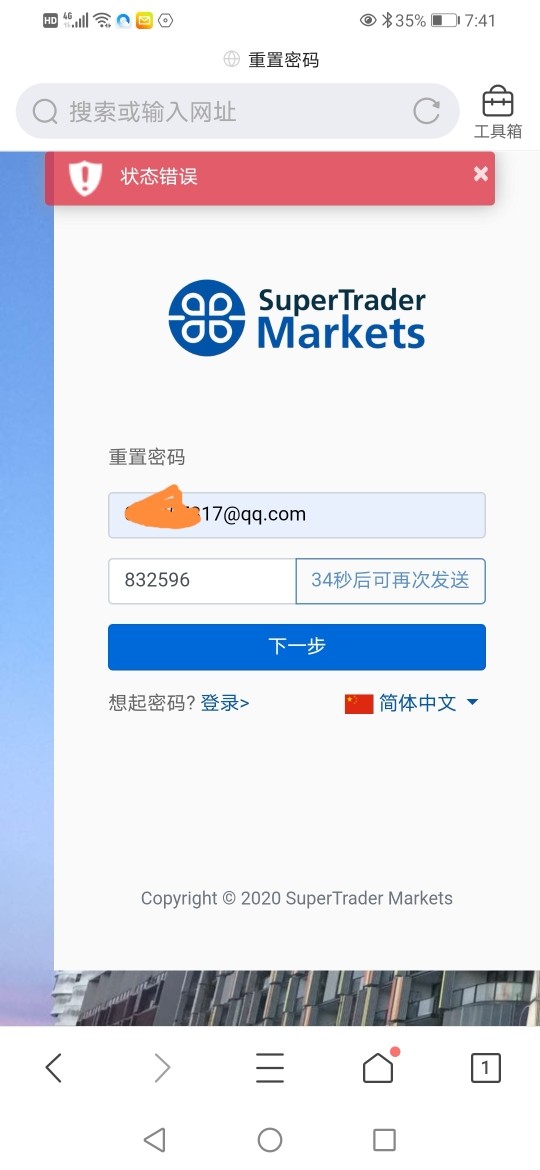

SuperTrader Markets 2025 Review: Everything You Need to Know

Executive Summary

SuperTrader Markets is a forex brokerage firm with established ties to Australia. The company has been operating in the foreign exchange market since it started. This SuperTrader Markets review reveals that the broker offers forex trading services with connections to the Australian financial market. However, specific regulatory details require further verification. The platform appears to cater primarily to forex traders seeking international market access. It puts particular emphasis on currency exchange and trading services.

Based on available information, SuperTrader Markets positions itself as a forex-focused brokerage. Comprehensive details about their service offerings, trading conditions, and regulatory status remain limited in current market documentation. The broker's Australian connections suggest potential regulatory oversight from regional financial authorities. Traders should verify current compliance status before engaging with the platform.

The target audience appears to be retail forex traders and those seeking currency exchange services. These traders are particularly interested in accessing Australian and international forex markets through a single platform.

Important Disclaimer

SuperTrader Markets operates as a forex brokerage with reported ties to Australia. Potential clients should independently verify the current regulatory status and licensing information before opening accounts. This review is based on publicly available information as of 2019-2025. Market conditions, regulations, and service offerings may have changed significantly.

Traders should conduct their own due diligence regarding the broker's current operational status, regulatory compliance, and service availability in their jurisdiction. The information presented in this review may not reflect the most current state of the broker's operations or regulatory standing.

Rating Framework

Broker Overview

SuperTrader Markets established its presence in the forex trading industry with a focus on providing currency exchange and trading services to retail clients. The broker has developed connections to the Australian financial market. This suggests potential regulatory oversight and compliance with regional financial standards. According to available information from TheForexReview, SuperTrader Markets operates as a forex brokerage that maintains ties to Australia's financial sector.

The company's business model appears centered on forex trading services. It puts particular emphasis on currency exchange operations. The broker's operational framework suggests a focus on providing access to major currency pairs and international forex markets. However, specific details about trading instruments and market access remain limited in current documentation.

This SuperTrader Markets review indicates that the broker positions itself within the competitive forex brokerage landscape by leveraging its Australian market connections. The platform appears designed to serve traders seeking reliable forex trading services. Comprehensive information about unique selling propositions and competitive advantages requires further investigation through direct broker contact.

Regulatory Status: SuperTrader Markets reports ties to Australia, suggesting potential oversight from Australian financial regulatory authorities. Specific licensing details are not extensively documented in available sources.

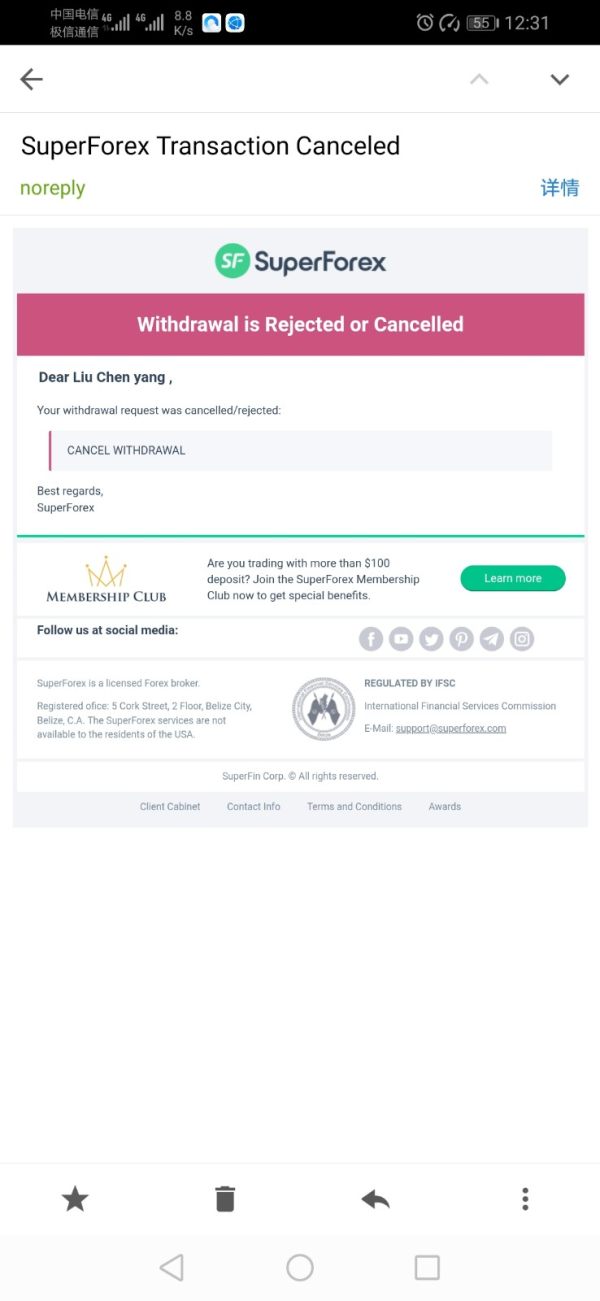

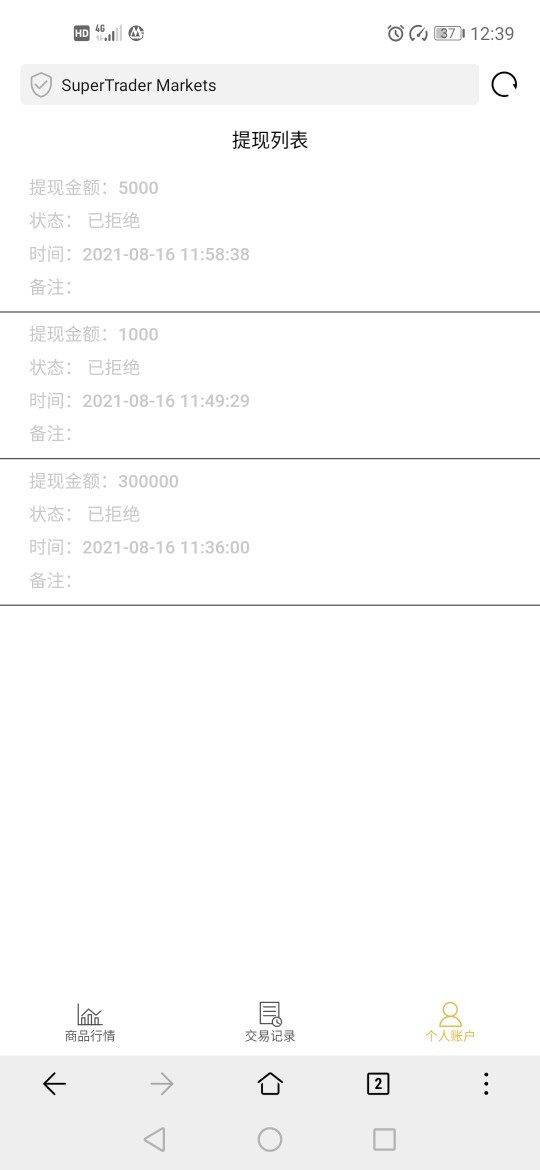

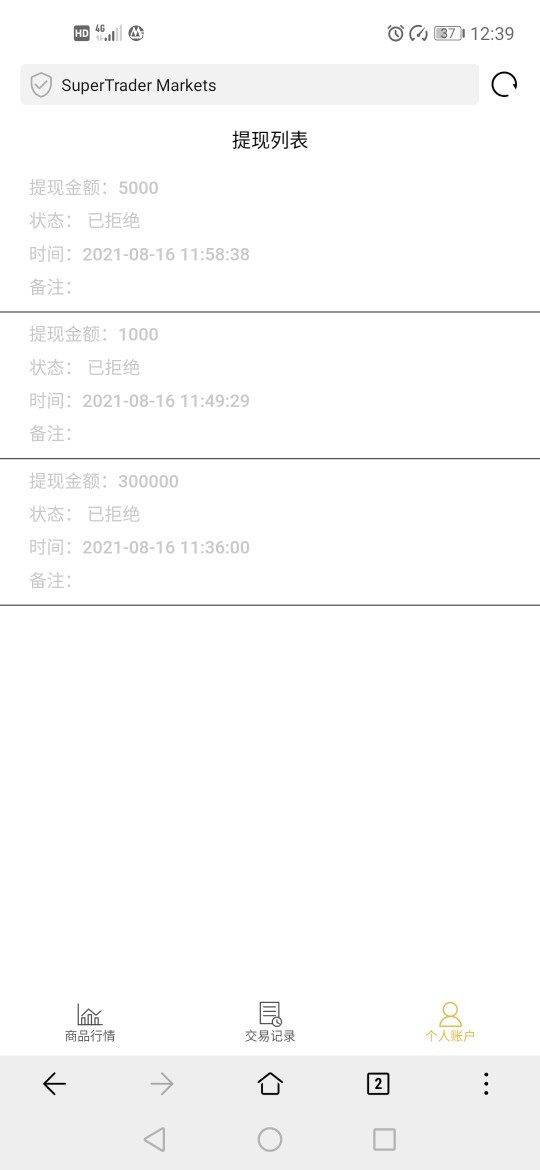

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in current market documentation. This would require direct verification with the broker.

Minimum Deposit Requirements: Minimum deposit information is not specified in available resources. It should be confirmed directly with SuperTrader Markets.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in available market documentation.

Tradeable Assets: The broker appears to focus primarily on forex trading, with emphasis on major currency pairs. The complete range of available trading instruments is not comprehensively documented.

Cost Structure: Specific information regarding spreads, commissions, and fee structures is not detailed in current available resources. This requires direct broker verification.

Leverage Options: Leverage information is not specifically detailed in available documentation. It should be confirmed with the broker directly.

Platform Options: Trading platform details are not extensively documented in current market resources. Standard forex trading platforms are typically expected.

Geographic Restrictions: Specific information about geographic restrictions and service availability is not detailed in current documentation.

Customer Service Languages: Supported languages for customer service are not specified in available resources.

This SuperTrader Markets review highlights the need for potential clients to contact the broker directly for comprehensive information about trading conditions and service specifications.

Account Conditions Analysis

The account conditions offered by SuperTrader Markets require direct verification as specific details are not comprehensively documented in current market resources. Based on available information, the broker appears to offer standard forex trading accounts. The variety of account types, minimum deposit requirements, and specific features remain unclear from publicly available documentation.

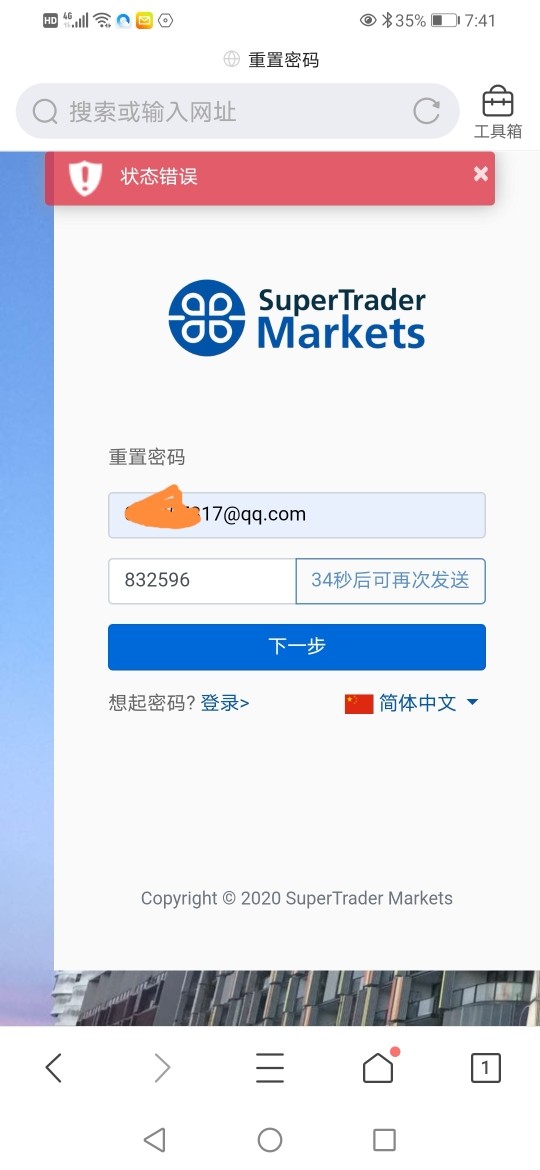

Account opening procedures and verification processes are not detailed in current sources. This makes it difficult to assess the ease and efficiency of the onboarding process. Potential traders would need to contact SuperTrader Markets directly to understand the complete account setup requirements and documentation needed for account activation.

Special account features such as Islamic accounts, professional trader accounts, or institutional services are not mentioned in available resources. The absence of detailed account information in this SuperTrader Markets review indicates that prospective clients should engage directly with the broker to understand the full range of account options and their respective benefits.

The lack of comprehensive account condition information in public documentation suggests that SuperTrader Markets may provide customized account solutions based on individual client needs. This would require direct confirmation with their customer service team.

SuperTrader Markets' trading tools and resources are not extensively detailed in current market documentation. This makes it challenging to provide a comprehensive assessment of their technological offerings. The broker appears to provide standard forex trading capabilities. Specific information about trading platforms, analytical tools, and research resources requires direct verification.

Educational resources and market analysis tools are not prominently featured in available information. This suggests that traders may need to rely on third-party resources or request specific educational materials directly from the broker. The absence of detailed tool descriptions limits the ability to assess the broker's commitment to trader education and market analysis support.

Automated trading support and algorithmic trading capabilities are not mentioned in current documentation. This may be a consideration for traders seeking advanced trading automation features. Technical analysis tools and platform functionality details would need to be confirmed through direct broker contact.

The limited information about trading tools and resources in available sources suggests that SuperTrader Markets may focus on providing essential trading functionality rather than comprehensive educational and analytical resources.

Customer Service and Support Analysis

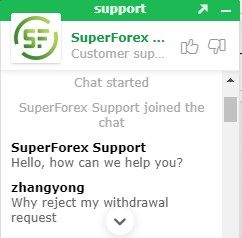

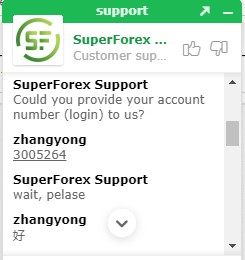

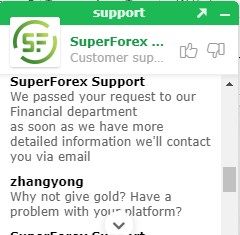

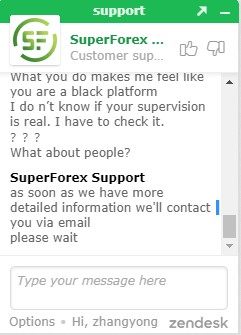

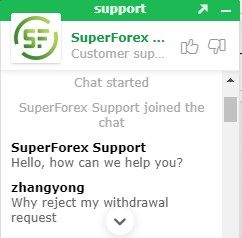

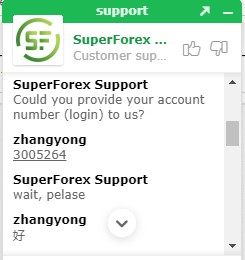

Customer service and support information for SuperTrader Markets is not extensively documented in available market resources. This makes it difficult to assess the quality and availability of client support services. The broker's customer service channels, response times, and support availability hours are not specified in current documentation.

Multilingual support capabilities and the range of communication channels available to clients remain unclear from publicly available information. This lack of detailed customer service information may be a concern for traders who prioritize responsive and accessible customer support.

Problem resolution processes and escalation procedures are not documented in available sources. This could impact traders' confidence in the broker's ability to address account issues or trading concerns effectively. The absence of customer service testimonials or case studies in current documentation limits the ability to assess support quality.

Response time expectations and service level commitments are not specified in available resources. Potential clients need to test customer service responsiveness through direct contact before committing to the platform.

Trading Experience Analysis

The trading experience offered by SuperTrader Markets is not comprehensively detailed in current market documentation. This makes it challenging to assess platform stability, execution quality, and overall trading environment. Available information suggests standard forex trading capabilities. Specific performance metrics and user experience data are not extensively documented.

Platform stability and execution speed information is not available in current sources. These are critical factors for active forex traders. Order execution quality and slippage data would need to be verified through direct testing or broker communication.

Mobile trading capabilities and cross-device synchronization features are not mentioned in available documentation. These are increasingly important for modern forex traders. Platform functionality and user interface design details require direct verification with the broker.

This SuperTrader Markets review indicates that potential clients should request demo accounts or trial access to properly evaluate the trading experience before committing to live trading accounts.

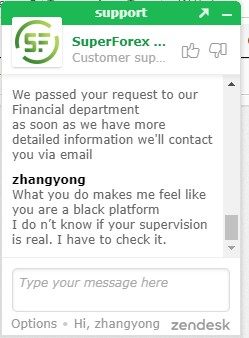

Trust and Reliability Analysis

SuperTrader Markets' trust and reliability profile is anchored by its reported ties to Australia. This suggests potential regulatory oversight from Australian financial authorities. However, specific regulatory license numbers, compliance certifications, and current regulatory status require direct verification and are not comprehensively documented in available sources.

Fund security measures and client money protection protocols are not detailed in current market documentation. These are crucial factors for trader confidence. The absence of specific information about segregated accounts, insurance coverage, or regulatory compensation schemes limits the ability to assess fund safety measures.

Company transparency regarding management, financial statements, and operational history is not extensively available in public documentation. Industry reputation and third-party ratings are not prominently featured in current sources. This requires independent research for comprehensive due diligence.

The broker's track record and any regulatory actions or industry recognition are not detailed in available resources. This makes it essential for potential clients to conduct independent verification of the company's regulatory standing and industry reputation.

User Experience Analysis

User experience feedback for SuperTrader Markets is limited in available market documentation. This makes it difficult to assess overall client satisfaction and platform usability. The absence of comprehensive user reviews and testimonials in current sources limits the ability to understand the typical trader experience.

Platform interface design and navigation ease are not detailed in available resources. These factors significantly impact daily trading activities. Registration and account verification processes are not described in current documentation. This makes it unclear how streamlined the onboarding experience may be.

Funding operation experiences, including deposit and withdrawal efficiency, are not documented in available sources. Common user complaints or praise are not featured in current market documentation. This requires potential clients to seek independent user feedback through trading forums and review platforms.

The limited user experience data in this review suggests that prospective traders should seek current user testimonials and possibly test the platform through demo accounts before making account funding decisions.

Conclusion

SuperTrader Markets presents as a forex brokerage with Australian market connections. Comprehensive information about their services, trading conditions, and regulatory status remains limited in current market documentation. This SuperTrader Markets review reveals that while the broker appears to offer standard forex trading services, potential clients would benefit from direct contact with the company to verify current offerings, regulatory compliance, and service specifications.

The broker may be suitable for traders seeking basic forex trading services. This is particularly true for those interested in Australian market connections. However, the limited publicly available information suggests that thorough due diligence and direct broker communication would be essential before account opening.

The main advantages appear to be the Australian market ties and focus on forex trading. The primary limitation is the lack of comprehensive public information about trading conditions, regulatory status, and service features. Potential clients should prioritize direct verification of all trading conditions and regulatory compliance before engaging with the platform.