Regarding the legitimacy of SuperTrader Markets forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is SuperTrader Markets safe?

Business

License

Is SuperTrader Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

AW FINTECH PTY LTD

Effective Date: Change Record

2013-11-12Email Address of Licensed Institution:

mark.li@awfintech.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

'THE ZENITH TOWER' SE 902 B 821 PACIFIC HWY CHATSWOOD NSW 2067Phone Number of Licensed Institution:

0414386029Licensed Institution Certified Documents:

Is SuperTrader Markets Safe or Scam?

Introduction

SuperTrader Markets, also known as SuperTraderFX, positions itself as a forex and CFD broker offering a range of trading services, including access to various currency pairs, commodities, and indices. In an industry rife with scams and unregulated entities, it is crucial for traders to conduct thorough evaluations of any broker they consider for trading. This article aims to provide a comprehensive analysis of SuperTrader Markets, assessing its legitimacy, regulatory compliance, trading conditions, and overall safety for investors. Our investigation draws from multiple credible sources, including user reviews, regulatory databases, and expert analyses, to ensure a balanced and informative overview.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors that determine its safety and reliability. SuperTrader Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). However, there are significant concerns regarding the authenticity of these claims, with many sources labeling SuperTrader Markets as a "suspicious clone" of legitimate firms.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 443886 | Australia | Suspicious Clone |

| VFSC | 41698 | Vanuatu | Suspicious Clone |

The lack of a solid regulatory framework raises red flags about the broker's operational legitimacy. ASIC is known for its stringent regulatory standards, and any broker claiming to be regulated by this authority must adhere to strict compliance measures. However, reports indicate that SuperTrader Markets may not meet these requirements, leading to questions about its operational integrity. Investors should be wary of engaging with a broker that lacks transparent regulatory oversight, as this is often a hallmark of fraudulent operations.

Company Background Investigation

SuperTrader Markets was established in 2018, with its headquarters reportedly located in Australia. However, the companys ownership structure and management team lack transparency, which is concerning for potential investors. The absence of detailed information about the company's history, ownership, and the professional backgrounds of its management team creates a significant barrier to assessing its trustworthiness.

Moreover, the company's website and promotional materials do not provide sufficient insights into its operational history or track record. This lack of transparency is a common trait among fraudulent brokers, who often operate with minimal oversight and accountability. In light of these factors, it is prudent for traders to approach SuperTrader Markets with caution, as the company's opacity may indicate underlying issues that could jeopardize the safety of their funds.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and commissions, is essential. SuperTrader Markets presents a range of trading instruments, but its fee structure raises some concerns. The broker claims to offer competitive spreads and leverage options, but the specifics are often vague and not clearly outlined.

| Fee Type | SuperTrader Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Starting from 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | Varies by account type | Typically fixed or variable |

| Overnight Interest Range | Not clearly specified | 0.5% - 2.0% |

The spreads offered by SuperTrader Markets are reportedly higher than the industry average, which could significantly impact traders' profitability. Additionally, the lack of clarity regarding commissions and overnight interest rates is concerning. Traders should be cautious of any broker that does not provide transparent information about its fee structure, as hidden costs can erode trading profits and lead to unexpected financial burdens.

Client Fund Security

The safety of client funds is paramount when choosing a broker. SuperTrader Markets claims to implement various security measures, including the segregation of client funds. However, there is limited information available regarding the specifics of these measures. Without clear evidence of fund protection protocols, such as participation in compensation schemes or insurance for client deposits, traders should be skeptical about the safety of their investments.

Furthermore, there have been reports of clients experiencing difficulties with fund withdrawals, a common issue associated with fraudulent brokers. If a broker fails to facilitate timely withdrawals, it suggests potential liquidity issues or a lack of transparency in their operations. Investors should prioritize brokers that provide clear assurances regarding fund safety and have a proven track record of honoring withdrawal requests.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding a broker's reputation. User reviews of SuperTrader Markets reveal a concerning trend of complaints, particularly regarding withdrawal issues and poor customer service. Many users have reported being unable to withdraw their funds, which raises significant alarms about the broker's operational practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Customer Support | Medium | Inadequate |

| Misleading Information | High | Ignored complaints |

Several users have shared experiences of being pressured to deposit more funds without receiving satisfactory responses to their withdrawal requests. This pattern of behavior is often indicative of a broker that may be engaging in fraudulent practices, as they attempt to retain client funds while avoiding payouts. Such complaints should serve as a warning to potential investors, emphasizing the importance of selecting brokers with a solid reputation for customer service and fund management.

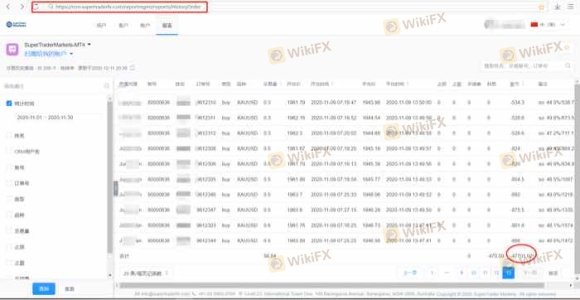

Platform and Trade Execution

The performance of the trading platform is another crucial factor in assessing a broker's reliability. SuperTrader Markets offers the MetaTrader 4 platform, which is widely regarded for its user-friendly interface and robust features. However, there have been reports of platform instability and issues with order execution, including slippage and rejected orders.

Traders should be cautious of any broker that does not provide a seamless trading experience, as this can lead to significant financial losses. If a broker's platform is prone to technical issues, it can hinder traders' ability to execute trades effectively and capitalize on market opportunities. The presence of such issues raises questions about the broker's overall reliability and commitment to providing a secure trading environment.

Risk Assessment

Engaging with SuperTrader Markets presents various risks that potential traders should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone of regulated entities |

| Fund Safety | High | Unclear fund protection measures |

| Customer Support | Medium | Slow response times and unresolved complaints |

| Platform Stability | High | Reports of technical issues and order execution problems |

To mitigate these risks, traders should conduct thorough research before engaging with SuperTrader Markets. It is advisable to prioritize brokers with strong regulatory oversight, transparent fee structures, and positive customer reviews. Additionally, traders should only invest amounts they can afford to lose, especially when dealing with brokers that exhibit red flags.

Conclusion and Recommendations

In conclusion, the evidence suggests that SuperTrader Markets is not a safe option for traders. The brokers dubious regulatory status, coupled with numerous complaints regarding withdrawal issues and customer support, raises significant concerns about its legitimacy. Furthermore, the lack of transparency in its operations and fee structures further complicates the decision for potential investors.

For those seeking reliable trading options, it is advisable to consider alternative brokers that are well-regulated and have established a positive reputation in the industry. Brokers such as AvaTrade, IG Markets, and Forex.com offer robust regulatory frameworks, transparent fee structures, and positive user experiences, making them safer choices for traders.

In light of the findings, potential investors should exercise extreme caution and conduct thorough due diligence before engaging with SuperTrader Markets. Ensuring the safety of your investments should always be the top priority in the forex market.

Is SuperTrader Markets a scam, or is it legit?

The latest exposure and evaluation content of SuperTrader Markets brokers.

SuperTrader Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SuperTrader Markets latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.