SuperForex 2025 Review: Everything You Need to Know

Summary

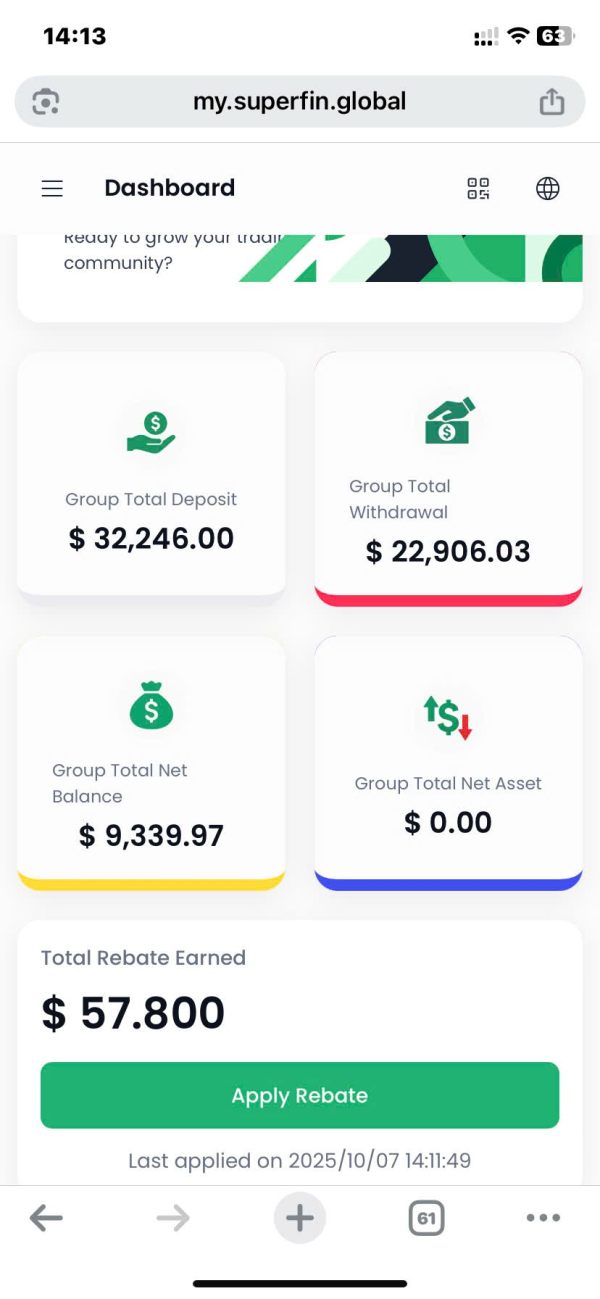

This super forex review looks at one of the more controversial brokers in the foreign exchange market. SuperForex has earned a concerning 2-star rating from traders, which mainly shows significant user problems with withdrawals and customer service. While the broker offers good market conditions with low fees and spreads that first attract traders who want cost-effective forex trading, the overwhelming user feedback shows serious problems that overshadow these benefits.

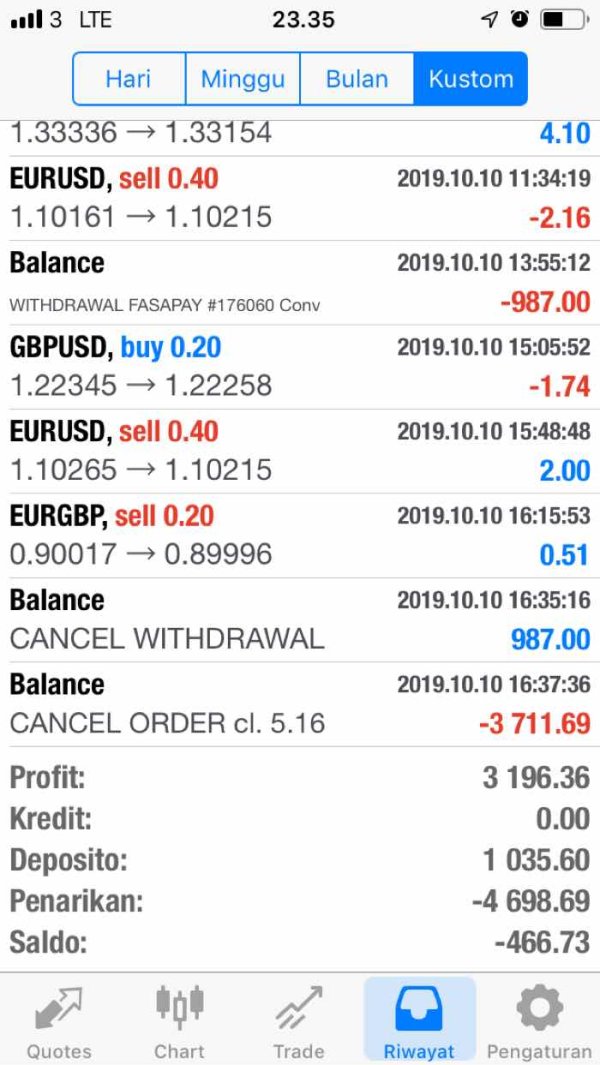

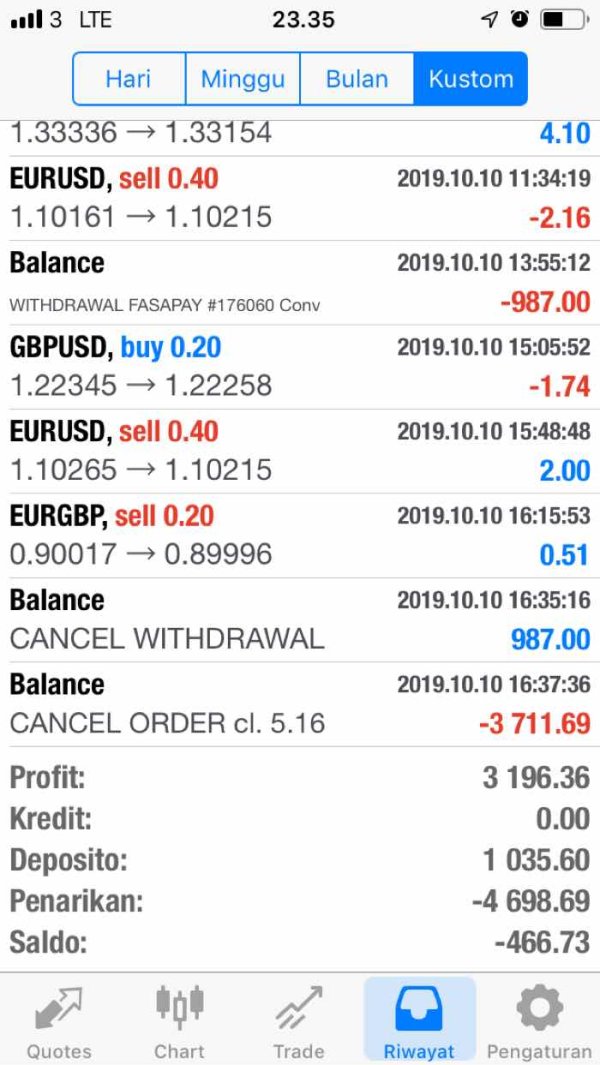

The broker seems to target investors looking for low-spread forex trading opportunities, especially those interested in algorithmic trading strategies. However, many trader reports show that SuperForex cannot process withdrawals well, which has created major trust issues within the trading community. Users always report that while putting in funds and accessing trading conditions stays easy, taking out profits becomes hard, which raises red flags about the broker's operational integrity.

Despite offering what looks like good trading environments, the ongoing withdrawal complaints suggest that SuperForex may not work for serious traders who prioritize reliable fund access and professional customer support.

Important Notice

This SuperForex evaluation is based on available user feedback and publicly accessible information. Traders should note that SuperForex's regulatory status and operational details across different jurisdictions remain unclear from available sources. The broker's licensing information and compliance standards vary by region, and potential clients must conduct independent verification of regulatory standing in their specific location.

Our assessment methodology relies primarily on user experiences, trading condition reports, and publicly available broker information. This review does not constitute investment advice, and traders should perform their own due diligence before engaging with any forex broker, particularly given the concerning feedback patterns identified in this analysis.

Rating Framework

Broker Overview

SuperForex operates in the competitive foreign exchange market, though specific details about its founding date and corporate background remain limited in available documentation. The broker positions itself as a provider of forex and CFD trading services, targeting traders who seek competitive spreads and flexible trading conditions. However, the lack of transparent corporate information raises questions about the company's operational history and management structure.

The broker's business model seems focused on offering low-cost trading access across major currency pairs and contracts for difference. According to available information, SuperForex provides access to forex markets and CFD instruments, though complete details about asset coverage, trading platforms, and specific service offerings are not well documented in current sources. This super forex review finds that while the broker markets itself as a competitive option for cost-conscious traders, the absence of detailed operational transparency contributes to user uncertainty and trust issues reported across trading communities.

Regulatory Status: Available information does not specify SuperForex's regulatory jurisdictions or licensing authorities, creating uncertainty about oversight and compliance standards.

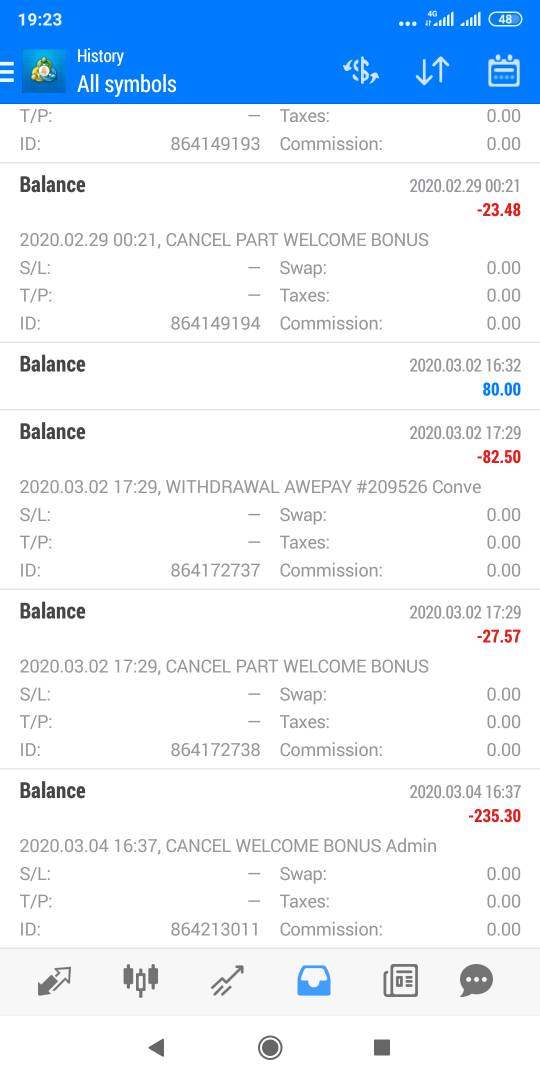

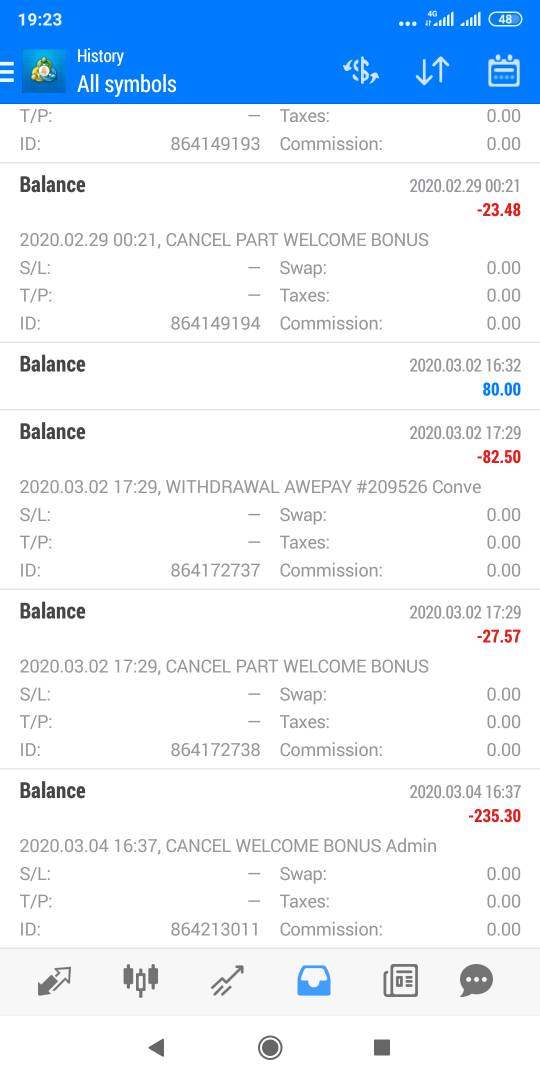

Deposit and Withdrawal Methods: Specific payment methods and processing procedures are not detailed in current documentation, though user reports consistently highlight withdrawal processing difficulties.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available sources, limiting clarity for prospective account holders.

Promotional Offers: Current bonus structures and promotional campaigns are not documented in accessible materials.

Tradeable Assets: SuperForex offers forex currency pairs and CFD instruments, though the complete range of available markets remains undocumented.

Cost Structure: Users report low fees and competitive spreads, though specific numerical values and commission structures are not detailed in available information.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in current documentation.

Platform Selection: Trading platform options and software capabilities are not well detailed in available sources.

Geographic Restrictions: Service availability by region and jurisdictional limitations are not clearly documented.

This super forex review notes that the lack of detailed operational information contributes to user uncertainty and complicates informed decision-making for potential clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

SuperForex's account conditions receive a poor rating mainly due to insufficient transparency and user dissatisfaction. Available information lacks specific details about account types, tier structures, and associated benefits, making it difficult for traders to understand what services they can expect. The absence of clear minimum deposit requirements and account opening procedures creates uncertainty for prospective clients.

User feedback consistently indicates problems with account management, particularly regarding fund withdrawals. According to trader reports, while opening accounts appears straightforward, the subsequent account experience deteriorates significantly when users attempt to access their funds. The lack of documented special account features, such as Islamic accounts or professional trader options, further limits the broker's appeal to diverse trading demographics.

The account verification process and documentation requirements remain undocumented, contributing to user confusion and operational difficulties. This super forex review finds that SuperForex's account conditions fail to meet industry standards for transparency and user satisfaction, resulting in a below-average rating that reflects the documented user experience challenges.

SuperForex receives a below-average rating for tools and resources due to limited documentation of available trading tools and educational materials. Current sources do not specify the range of technical analysis tools, research capabilities, or market analysis resources provided to traders. This lack of information suggests either insufficient tool offerings or poor communication about available resources.

The absence of documented educational materials, webinars, or training programs indicates limited support for trader development. Modern forex brokers typically provide comprehensive research tools, market analysis, and educational content to support trader success, but SuperForex's offerings in these areas remain unclear from available information.

Automated trading support and algorithmic trading capabilities are not detailed, despite user reports mentioning algorithmic trading activities. The lack of clear information about API access, expert advisor support, or automated trading infrastructure limits the broker's appeal to sophisticated trading strategies. Without documented tool specifications and resource availability, traders cannot adequately assess whether SuperForex meets their analytical and educational needs.

Customer Service and Support Analysis (Score: 2/10)

SuperForex's customer service receives a very poor rating based on consistent user complaints about support quality and responsiveness. User feedback reveals significant problems with customer service effectiveness, particularly regarding withdrawal requests and account resolution issues. Traders report difficulties in receiving adequate support when attempting to access their funds.

Available information does not specify customer service channels, operating hours, or response time commitments, suggesting limited support infrastructure. The absence of documented multilingual support options or regional customer service capabilities further restricts service accessibility for international clients.

According to user reports, customer service representatives appear unable or unwilling to resolve withdrawal-related issues effectively. This pattern of inadequate support has contributed to the broker's poor reputation and low user satisfaction ratings. The lack of documented escalation procedures or complaint resolution processes compounds these service quality problems, leaving users with limited recourse when encountering difficulties.

Trading Experience Analysis (Score: 5/10)

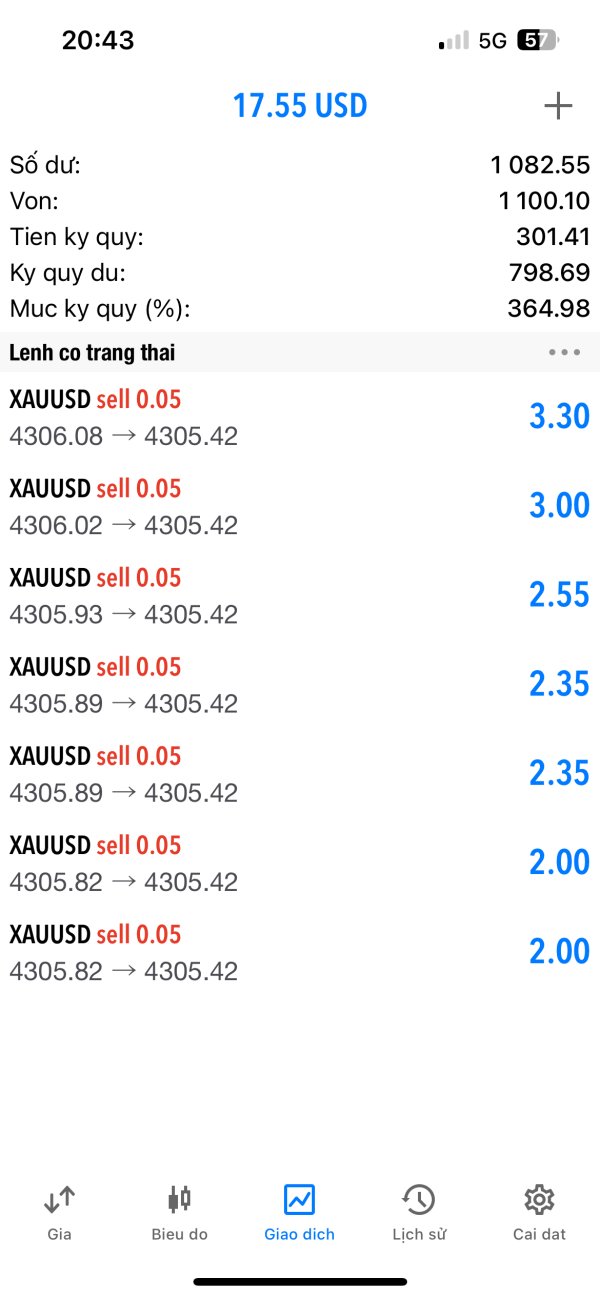

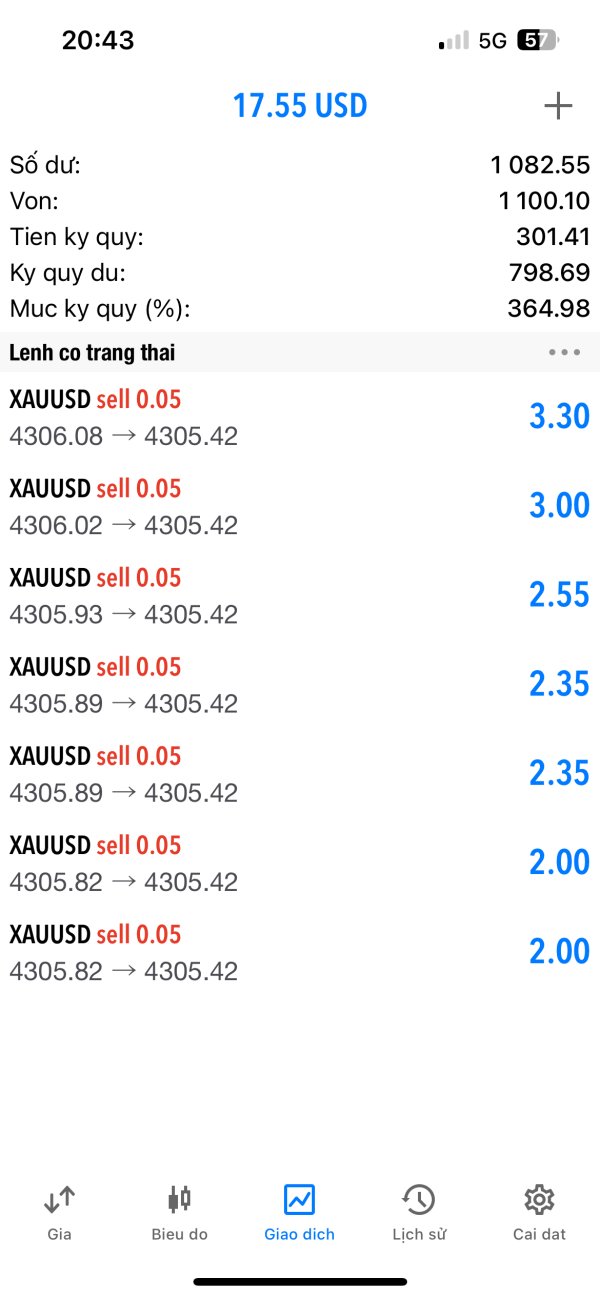

SuperForex's trading experience receives an average rating, reflecting mixed user feedback about platform performance and market access. Users report that the broker provides good market conditions with competitive spreads, suggesting adequate trade execution and pricing. However, the overall trading experience is significantly impacted by withdrawal difficulties and operational concerns.

Platform stability and execution speed are not well documented, though users have not reported major technical issues with trading functionality. The trading environment appears suitable for basic forex and CFD trading, though advanced features and platform capabilities remain undocumented.

Mobile trading capabilities and platform accessibility across devices are not specified in available information. While users appreciate the market conditions for trading activities, the inability to reliably withdraw profits severely undermines the overall trading experience. This super forex review finds that despite potentially adequate trading conditions, operational problems prevent SuperForex from achieving a higher rating in trader experience satisfaction.

Trust and Reliability Analysis (Score: 2/10)

SuperForex receives a very poor trust and reliability rating due to significant concerns about operational integrity and regulatory transparency. The absence of clear regulatory information and licensing details creates uncertainty about oversight and compliance standards. Users cannot verify the broker's regulatory status or confirm investor protection measures.

Fund security measures and segregation policies are not documented, raising concerns about client asset protection. The consistent user reports of withdrawal difficulties suggest potential issues with fund management and operational reliability. These problems directly impact trader confidence and create substantial trust concerns.

The broker's transparency regarding corporate structure, management, and operational procedures remains limited. Without clear information about regulatory compliance, fund protection measures, and corporate accountability, traders face significant uncertainty about the safety of their investments. The pattern of withdrawal complaints further undermines confidence in the broker's operational integrity.

User Experience Analysis (Score: 3/10)

SuperForex's user experience receives a poor rating, mainly driven by the documented 2-star user satisfaction score and widespread complaints about withdrawal processing. While the initial trading experience may meet basic expectations, the overall user journey is severely compromised by operational difficulties and poor customer support.

User feedback consistently highlights withdrawal problems as the primary source of dissatisfaction. Traders report that while depositing funds and accessing trading conditions proceeds smoothly, attempting to withdraw profits becomes problematic. This creates a frustrating user experience that undermines confidence in the broker's services.

The absence of documented user interface features, platform usability improvements, or user experience enhancements suggests limited focus on client satisfaction. Registration and verification processes are not clearly outlined, contributing to user uncertainty. Common user complaints center on fund access difficulties and inadequate customer support responses, indicating systemic problems with the overall service delivery model.

Conclusion

This super forex review reveals a broker with mixed characteristics that ultimately fails to meet acceptable industry standards. While SuperForex may offer competitive market conditions and low spreads that initially attract traders, the overwhelming pattern of withdrawal difficulties and poor customer service creates significant concerns about operational reliability.

SuperForex might appeal to traders specifically seeking low-spread forex trading opportunities, but the documented withdrawal problems make it unsuitable for serious traders who require reliable fund access. The broker's lack of regulatory transparency and limited operational documentation further compound these concerns.

The primary advantages appear to be competitive trading conditions and low fees, but these benefits are overshadowed by critical disadvantages including withdrawal difficulties, poor customer service quality, and insufficient operational transparency. Based on available evidence and user feedback, traders should exercise extreme caution when considering SuperForex and may be better served by more established and transparent forex brokers.