Summary: The Spring Information review reveals a concerning picture of this forex broker, which is largely regarded as unregulated and potentially fraudulent. Key findings indicate a lack of transparency regarding its licensing and operational practices, raising significant red flags for prospective traders.

Note: It is important to consider that Spring Information operates under various entities across regions, which may impact its legitimacy and trustworthiness. This review aggregates findings from multiple sources to ensure fairness and accuracy.

Rating Box

We base our ratings on a comprehensive analysis of user feedback and expert opinions.

Broker Overview

Spring Information, reportedly established within the last five years, is an online forex and CFD broker that claims to offer access to a variety of trading instruments through the MetaTrader 5 (MT5) platform. However, the broker lacks any credible regulatory oversight, with claims of being regulated by the non-existent Euro Finance Investigation & Security Organization (EFISO) being a major point of contention. This absence of regulation raises significant concerns regarding the safety and security of client funds.

Detailed Section

Regulatory Status

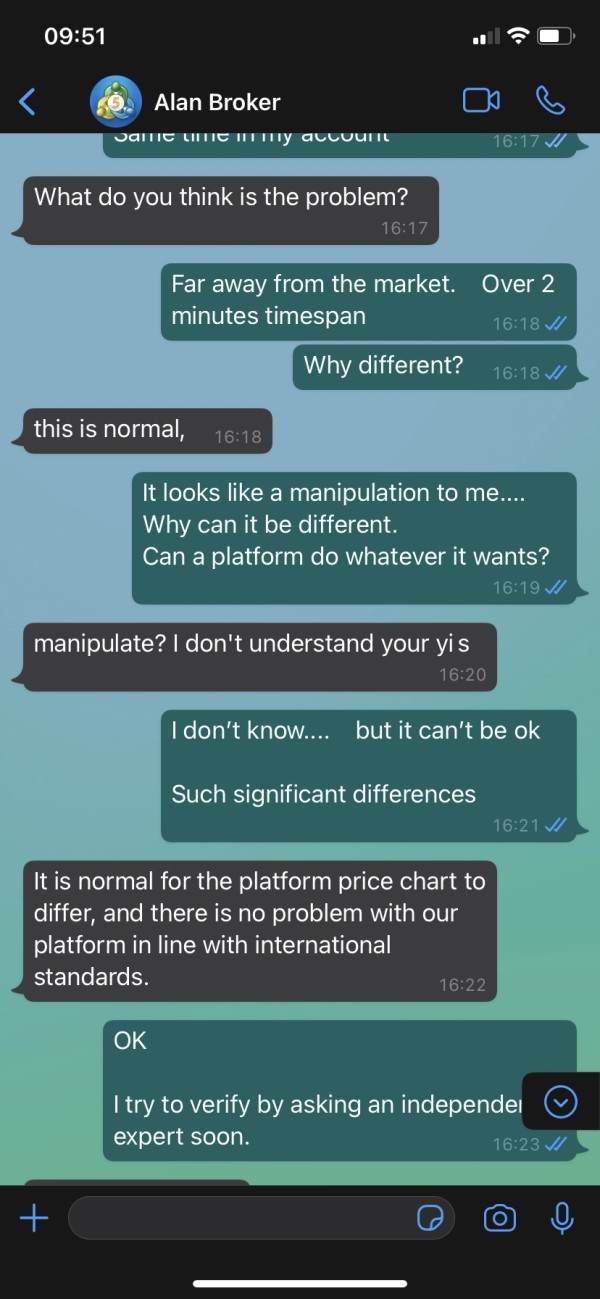

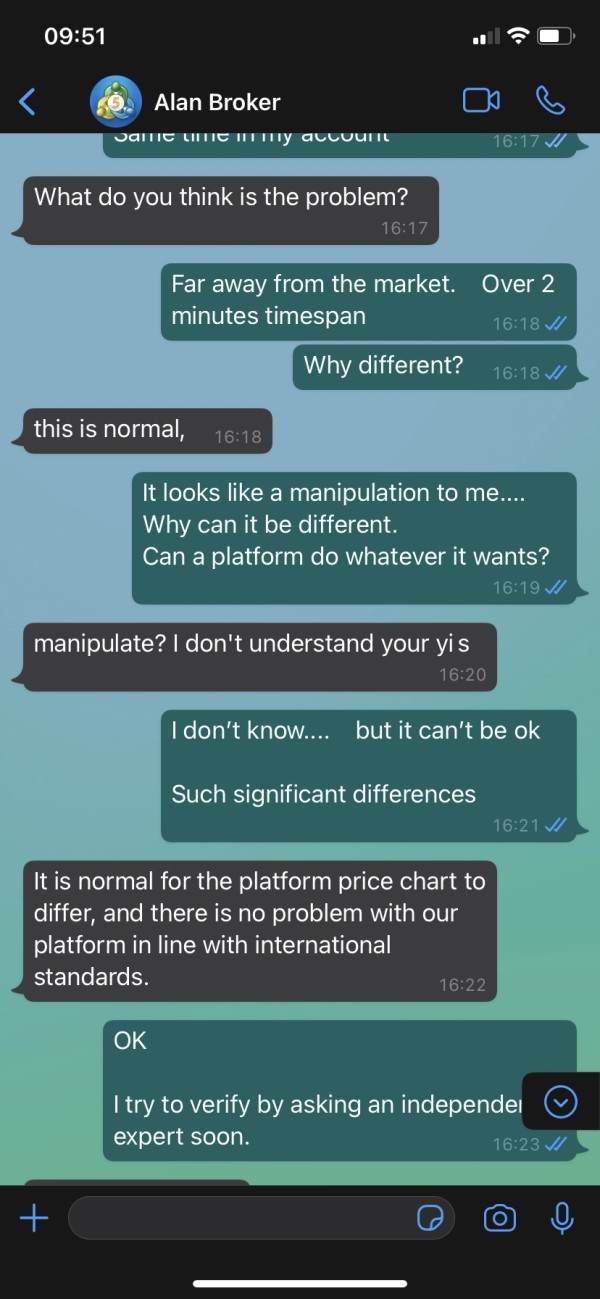

Spring Information is not regulated by any recognized financial authority. Numerous sources, including BrokersView, highlight that the broker operates without a valid license, which is a critical factor for traders when choosing a brokerage. The lack of oversight means that traders have little recourse in the event of disputes or issues with withdrawals.

Deposit and Withdrawal Methods

The broker does not provide clear information on its deposit and withdrawal methods, which is alarming. According to itisREVIEWED, many traders have reported difficulties in withdrawing their funds, indicating potential issues with the broker's financial practices. This lack of transparency in financial transactions is a significant risk factor for traders.

Minimum Deposit

The minimum deposit required to open an account with Spring Information is reported to be as low as $100, which may attract inexperienced traders. However, this low entry point is often a tactic used by unregulated brokers to lure in clients, as highlighted in multiple reviews.

Spring Information appears to offer various bonuses and promotions to entice new clients. However, these promotions often come with stringent withdrawal conditions that can trap traders into meeting high trading volumes before they can access their funds. This practice is common among unregulated brokers, as noted by WikiFX.

Tradable Asset Classes

The broker claims to provide access to a range of trading instruments, including forex pairs and CFDs. However, the lack of regulatory backing raises questions about the legitimacy of these claims. Traders should be cautious when considering the asset classes offered by Spring Information, as the actual trading conditions may not align with advertised offerings.

Costs (Spreads, Fees, Commissions)

Details regarding spreads, fees, and commissions are not clearly outlined by Spring Information, which is a common issue with unregulated brokers. The absence of transparent cost structures can lead to unexpected charges and losses for traders. According to WikiFX, the broker's costs are not competitive compared to regulated counterparts, further diminishing its appeal.

Leverage

Spring Information offers leverage up to 1:400, which is significantly higher than what is permitted by regulated brokers in many jurisdictions. While high leverage can amplify profits, it also increases the risk of substantial losses, especially for inexperienced traders. This high leverage is a common characteristic of unregulated brokers, as noted in the Spring Information review.

The primary trading platform offered by Spring Information is MT5, which is known for its advanced features and user-friendly interface. However, the lack of regulatory oversight raises concerns about the reliability and integrity of the trading environment provided by the broker.

Restricted Regions

While specific details on restricted regions are not readily available, the lack of regulation suggests that traders from certain jurisdictions may face challenges when dealing with Spring Information. Prospective traders should conduct thorough research to ensure compliance with local regulations.

Available Customer Support Languages

Customer support appears to be limited, with reports indicating that traders can only reach the broker through email, with no direct phone support available. This lack of accessible customer service is a significant drawback, as highlighted in various reviews, including Forex Peace Army.

Repeated Rating Box

Detailed Breakdown

- Account Conditions: The low minimum deposit is offset by the lack of transparency and high-risk environment.

- Tools and Resources: While MT5 is a robust platform, the overall lack of support and guidance diminishes its value.

- Customer Service & Support: Limited to email communication, with reports of unresponsive service.

- Trading Experience: High leverage and unclear costs can lead to a poor trading experience, especially for new traders.

- Trustworthiness: The absence of regulation and numerous negative reviews contribute to a very low trust rating.

- User Experience: Overall user experience is marred by operational issues and a lack of transparency.

In conclusion, the Spring Information review paints a troubling picture of a broker operating without proper oversight. Prospective traders are strongly advised to exercise caution and consider regulated alternatives to safeguard their investments.