Executive Summary

Smart Investment Capital is a new company in the financial services sector. However, we don't have much public information about how it works as a forex broker. This smart investment capital review looks at what we know about this company based on the data we can find. The company seems to work in the investment business, but we need more details about its trading platforms, rules it follows, and what services it offers since this information is hard to find through normal industry sources.

The information we have suggests that Smart Investment Capital works in investment advice. We need to learn more about how much it offers forex and CFD trading services. People thinking about using this broker should know that we don't have clear details about trading conditions, platform features, and rule following from public sources. This review tries to give a fair assessment based on the limited information we can access right now, and it points out areas where more openness would help potential clients.

Forex brokers usually need to give complete information about spreads, leverage choices, platform abilities, and rule oversight because the industry is very competitive. Smart Investment Capital doesn't share much public information about what it offers in these areas, which is something potential clients should think about carefully.

Important Notice

This review uses publicly available information and industry standards analysis. We don't have detailed information about Smart Investment Capital's specific operations, regulatory status, and service offerings, so you should consider this assessment as preliminary. Potential clients should do their own research and ask for complete information directly from the company before making any investment decisions.

Different regions may have different rules, and services may change a lot across different areas. We don't have detailed regulatory information in public sources, which means that compliance standards and client protections may be different from established industry benchmarks. This review is not investment advice and should not be seen as an endorsement or recommendation.

Rating Framework

Broker Overview

Smart Investment Capital works in the financial services sector. However, we don't have much information about when it started, what rules it follows, and how big its operations are in sources that everyone can access. The company seems to focus on investments, but we can't easily find complete details about its forex broker services, trading platforms, and what it offers clients through normal industry channels.

We need to look more into the broker's market presence and operational history because typical industry databases and regulatory websites don't give us much information about Smart Investment Capital's specific credentials or service portfolio. This lack of easily available information is different from established brokers who usually keep transparent public profiles that detail their regulatory status, trading conditions, and platform specifications.

For potential clients looking at this smart investment capital review, it's important to know that not having detailed public information about trading spreads, leverage options, asset coverage, and platform capabilities is a big gap compared to industry standards. Established forex brokers usually provide complete disclosure about their services, regulatory compliance, and operational framework.

Regulatory Framework

We can't easily find specific regulatory information for Smart Investment Capital in standard industry sources. Most established forex brokers clearly show their regulatory credentials, including license numbers and supervising authorities. Since this information isn't available in public sources, potential clients should ask for detailed regulatory documentation directly from the company.

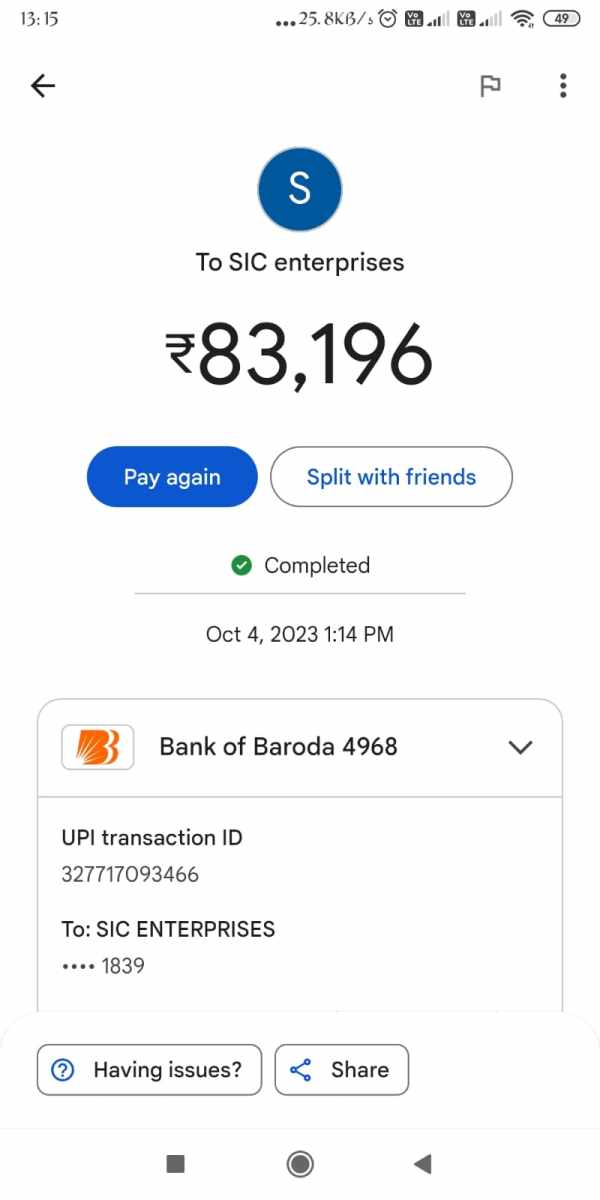

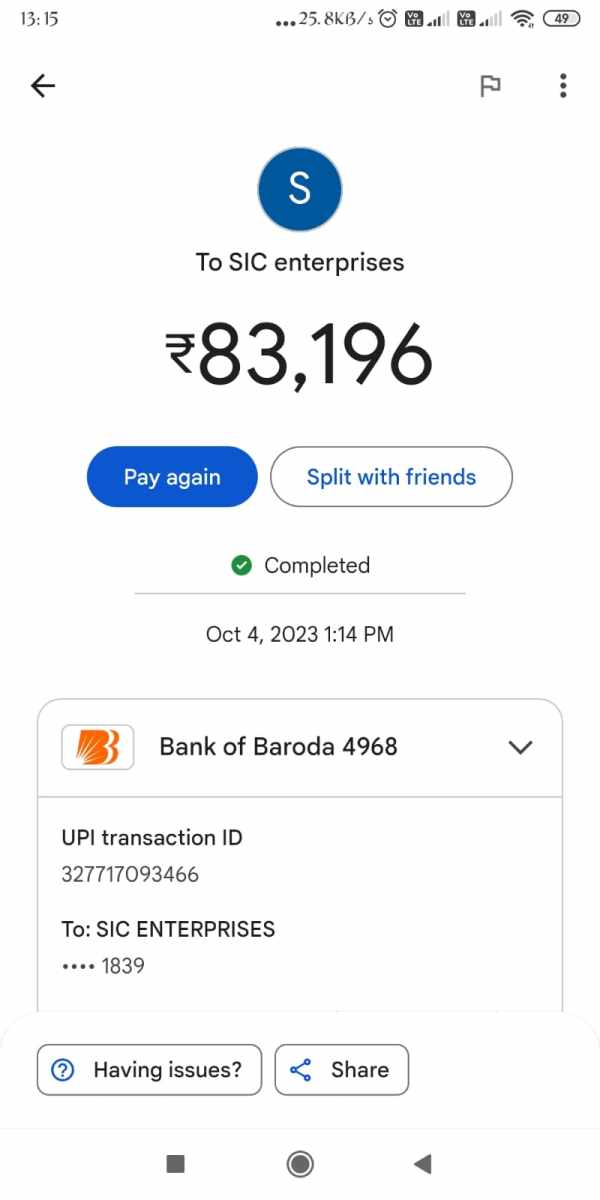

Deposit and Withdrawal Methods

Information about available payment methods, processing times, and fees isn't detailed in publicly accessible sources. Standard industry practice includes offering multiple funding options such as bank transfers, credit cards, and electronic wallets, along with transparent fee structures.

Minimum Deposit Requirements

We don't know the specific minimum deposit amounts for different account types from available information. Industry standards typically range from $100 to $500 for standard accounts, with premium accounts requiring higher initial deposits.

Details about welcome bonuses, trading incentives, or promotional programs aren't documented in publicly available sources. Established brokers typically offer transparent bonus structures with clear terms and conditions.

Tradeable Assets

The range of available trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, isn't specified in accessible information. Complete asset coverage is typically a key difference maker for forex brokers.

Cost Structure

We don't have specific information about spreads, commissions, overnight fees, and other trading costs in public sources. This smart investment capital review can't provide detailed cost analysis without access to the broker's fee schedule.

Leverage Options

Maximum leverage ratios for different asset classes and account types aren't specified in available information. Leverage options typically vary based on regulatory area and client classification.

Details about available trading platforms, including proprietary solutions or third-party options like MetaTrader, aren't documented in publicly accessible sources.

Geographic Restrictions

Information about service availability in different countries and areas isn't clearly specified in available sources.

Customer Support Languages

Available support languages and communication channels aren't detailed in publicly accessible information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Smart Investment Capital's account conditions has big limitations because we don't have detailed information in publicly available sources. Standard industry practice involves offering multiple account types made for different trader profiles, ranging from beginner-friendly accounts with educational support to advanced accounts with enhanced features and lower costs.

Forex brokers usually provide clear documentation about minimum deposit requirements, which can range from $10 for micro accounts to $25,000 or more for VIP accounts. The account opening process usually involves identity verification, address confirmation, and financial suitability assessment to follow Know Your Customer rules.

Without access to Smart Investment Capital's specific account documentation, this smart investment capital review can't provide detailed analysis of their account structure, minimum funding requirements, or special features such as Islamic accounts for clients requiring Sharia-compliant trading conditions. Not having this basic information is a big gap compared to industry transparency standards.

Established brokers typically offer account comparison tools, detailed fee schedules, and clear explanations of account benefits. The lack of easily available information about Smart Investment Capital's account conditions suggests potential clients should ask for complete documentation before moving forward with account opening.

The assessment of Smart Investment Capital's trading tools and educational resources is limited because we don't have detailed information in publicly accessible sources. Modern forex brokers typically provide complete analytical tools, including technical indicators, charting packages, economic calendars, and market research reports to support informed trading decisions.

Educational resources have become more important in broker evaluation, with leading firms offering webinars, video tutorials, e-books, and demo accounts to help clients develop trading skills. Advanced brokers often provide sophisticated tools such as algorithmic trading support, copy trading platforms, and social trading networks.

Research capabilities typically include daily market analysis, expert commentary, and fundamental research reports covering major currency pairs and market-moving events. Some brokers also offer premium research partnerships with established financial institutions or independent analysis providers.

Without specific information about Smart Investment Capital's tool offerings, this review can't assess the quality or completeness of their analytical resources. Not having detailed platform specifications and educational content descriptions is a big information gap for potential clients seeking to evaluate the broker's value proposition.

Customer Service and Support Analysis

Evaluating Smart Investment Capital's customer service capabilities is challenging because we have limited publicly available information about their support infrastructure. Industry-leading brokers typically offer multiple communication channels, including live chat, telephone support, email assistance, and complete FAQ sections to address client questions.

Response time standards vary across the industry, with top-tier brokers often providing 24/7 support during market hours and guaranteed response times for different inquiry types. Multi-language support has become more important as brokers expand their global reach, with leading firms offering assistance in 10 or more languages.

Service quality typically includes both technical support for platform issues and trading-related assistance for market questions. Some brokers assign dedicated account managers for higher-tier clients, while others focus on efficient ticket-based support systems for general inquiries.

Not having detailed information about Smart Investment Capital's customer service framework, including available contact methods, operating hours, and language support, makes it difficult to assess their commitment to client support. Potential clients should ask directly about service levels and support availability before committing to the platform.

Trading Experience Analysis

The evaluation of Smart Investment Capital's trading experience is significantly limited because we don't have detailed platform information in publicly available sources. Modern forex trading platforms are typically assessed based on execution speed, order processing reliability, interface design, and advanced trading features.

Platform stability is a critical factor, as traders need consistent access to markets and reliable order execution, particularly during high-volatility periods. Leading brokers invest heavily in server infrastructure and backup systems to minimize downtime and ensure optimal performance.

Mobile trading capabilities have become essential, with traders expecting full functionality across smartphone and tablet applications. Advanced features such as one-click trading, customizable charts, and push notifications for price alerts are now standard expectations rather than premium offerings.

This smart investment capital review can't provide specific assessment of platform performance, execution quality, or user interface design without access to detailed platform specifications or user feedback. Not having this information is a big gap for potential clients seeking to evaluate the broker's technical capabilities and trading environment quality.

Trust and Reliability Analysis

Assessing Smart Investment Capital's trustworthiness faces big challenges because we have limited publicly available information about regulatory compliance, company background, and industry standing. Trust evaluation typically centers on regulatory oversight, with established brokers proudly displaying their licenses from respected authorities such as the FCA, ASIC, or CySEC.

Client fund protection measures, including segregated accounts and investor compensation schemes, are fundamental trust indicators. Leading brokers typically provide detailed explanations of how client funds are protected and what recourse exists in unlikely scenarios of company failure.

Company transparency, including detailed company information, management team backgrounds, and operational history, contributes significantly to trust assessment. Established brokers typically maintain complete corporate websites with detailed company information and regulatory disclosures.

Not having easily available regulatory information, client protection details, and complete company background for Smart Investment Capital creates uncertainty regarding trust and reliability factors. Potential clients should prioritize getting detailed regulatory documentation and client protection information before proceeding with account opening.

User Experience Analysis

Evaluating Smart Investment Capital's overall user experience is limited because we don't have much client feedback and detailed platform information in publicly accessible sources. User experience assessment typically includes registration simplicity, platform ease of use, customer service responsiveness, and overall satisfaction levels.

The account opening process usually involves multiple steps, including application completion, document verification, and initial funding. Leading brokers make this process smoother while maintaining regulatory compliance, often completing verification within 24-48 hours for standard applications.

Platform usability includes both desktop and mobile interfaces, with modern traders expecting seamless transitions between devices and consistent functionality across all platforms. User interface design, customization options, and workflow efficiency significantly impact daily trading experience.

Without access to specific user feedback or detailed platform demonstrations, this review can't provide complete user experience assessment. Not having easily available client testimonials, platform reviews, or usability studies is a big information gap for potential clients seeking to understand the practical aspects of trading with Smart Investment Capital.

Conclusion

This smart investment capital review reveals big limitations in publicly available information about the broker's specific offerings, regulatory status, and operational framework. While Smart Investment Capital appears to operate within the financial services sector, not having detailed documentation about trading conditions, platform capabilities, and regulatory compliance creates substantial uncertainty for potential clients.

The lack of easily accessible information about fundamental aspects such as spreads, leverage options, platform specifications, and customer support infrastructure contrasts sharply with industry transparency standards. Established forex brokers typically provide complete public disclosure about their services, regulatory oversight, and operational capabilities.

For traders considering Smart Investment Capital, the primary recommendation is to conduct thorough research by asking for detailed information directly from the company about regulatory status, trading conditions, platform capabilities, and client protection measures. Not having this information in standard industry sources suggests additional caution and verification are needed before committing to the platform.