Is Smart Investment Capital safe?

Business

License

Is Smart Investment Capital A Scam?

Introduction

Smart Investment Capital is a forex broker that has recently gained attention in the online trading community. Founded in 2021 and registered in India, the company offers a diverse range of trading instruments, including forex currency pairs, commodities, precious metals, and indices. However, as the popularity of online trading grows, so does the need for traders to exercise caution when choosing their brokers. Evaluating the legitimacy of a forex broker is crucial for protecting ones investments and ensuring a safe trading environment. This article aims to provide a comprehensive analysis of Smart Investment Capital, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. Our findings are based on various sources, including user reviews, regulatory databases, and industry reports.

Regulatory and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. Smart Investment Capital operates without any valid regulatory oversight, which raises significant concerns about its reliability and adherence to industry standards. Below is a summary of the regulatory information for Smart Investment Capital:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | India | Unregulated |

The absence of regulation means that Smart Investment Capital is not subject to any external audits or compliance checks, leaving clients vulnerable to potential fraud or mismanagement. Regulatory bodies play a crucial role in ensuring that brokers adhere to strict guidelines, providing a level of protection for investors. The lack of oversight raises alarms, as unregulated brokers may engage in unethical practices without fear of repercussions. Historical compliance issues further complicate the broker's credibility, as there have been reports of scams associated with unregulated firms in the forex industry.

Company Background Investigation

Smart Investment Capital's company history and ownership structure provide further insight into its legitimacy. The broker was founded in 2021 and has been operating for a relatively short period. The lack of transparency surrounding its ownership and management team raises questions about its operational integrity. Details regarding the company's founders, their experience in the financial sector, and their previous ventures are scarce, making it difficult for potential clients to gauge the broker's credibility.

Transparency is a hallmark of trustworthy brokers, and the absence of clear information about Smart Investment Capital's operations is concerning. The company's website does not provide adequate details about its leadership team or their professional backgrounds, which is often indicative of a lack of accountability. In the forex trading landscape, where trust is paramount, such opacity can deter potential investors from engaging with the broker.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Smart Investment Capital presents a range of trading options, but the overall cost structure and fee policies warrant scrutiny. The broker claims to offer competitive spreads and zero commissions on trades, which may appear attractive at first glance. However, the lack of clarity regarding fees can lead to unexpected costs for traders.

Heres a comparison of Smart Investment Capital's core trading costs against industry averages:

| Fee Type | Smart Investment Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 1.5 pips | From 1.0 pips |

| Commission Model | Zero commissions | Varies |

| Overnight Interest Range | Unspecified | Varies |

The spreads offered by Smart Investment Capital are higher than the industry average, which could significantly impact profitability for traders, especially those engaging in high-frequency trading. Moreover, the absence of detailed information about overnight interest rates raises concerns about hidden fees that could affect trading outcomes. Traders must be vigilant and fully understand the cost implications before committing funds to this broker.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Smart Investment Capital claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's unregulated status.

The broker's website asserts that client funds are kept separate from company funds, which is a standard practice among reputable brokers. However, without regulatory oversight, there is no guarantee that these claims are upheld. The lack of independent verification raises concerns about the overall safety of funds deposited with Smart Investment Capital.

Additionally, there have been historical reports of fund mismanagement and withdrawal issues associated with unregulated brokers. If clients experience difficulties retrieving their funds, they may have limited recourse due to the lack of regulatory protection. Therefore, potential investors should carefully evaluate the security measures in place before deciding to trade with Smart Investment Capital.

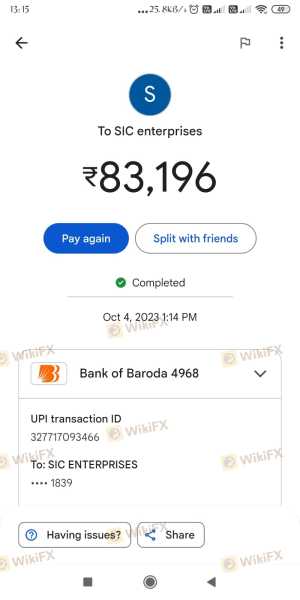

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. A thorough analysis of user experiences with Smart Investment Capital reveals a concerning trend of negative reviews and complaints. Many users have reported issues related to withdrawal delays, unresponsive customer support, and difficulties in accessing their accounts.

Here is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | High | Poor |

| Account Access Issues | Medium | Poor |

Several users have shared their experiences of being unable to withdraw funds, with some claiming that their accounts were suspended without explanation. Such patterns of complaints are significant red flags and point to potential operational deficiencies within the broker. The quality of customer support is crucial for traders who may need assistance, and Smart Investment Capital's lack of responsiveness could deter clients from engaging with the platform.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a successful trading experience. Smart Investment Capital offers the MetaTrader 5 (MT5) platform, which is well-regarded in the trading community. However, user experiences regarding platform stability and execution quality vary.

Traders have reported instances of slippage and order rejections during volatile market conditions, which can adversely impact trading outcomes. The absence of transparency regarding execution quality raises concerns about potential manipulation or unfair practices.

In evaluating the platform, it is essential to consider the overall user experience, including ease of navigation, speed of execution, and access to trading tools. While Smart Investment Capital claims to provide a robust trading environment, user feedback suggests that there may be shortcomings in platform performance that could affect traders' ability to execute strategies effectively.

Risk Assessment

Using Smart Investment Capital carries inherent risks that potential clients should be aware of. The combination of unregulated status, negative user feedback, and unclear trading conditions creates a precarious environment for traders.

Heres a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases vulnerability to fraud. |

| Financial Risk | High | Higher spreads and hidden fees can erode trading profits. |

| Operational Risk | Medium | Reports of withdrawal issues and poor customer support. |

| Platform Risk | Medium | Potential for poor execution and slippage during trades. |

To mitigate these risks, traders are advised to conduct thorough research, seek out regulated brokers, and consider starting with a demo account to test the platform before committing significant funds.

Conclusion and Recommendations

In conclusion, Smart Investment Capital raises several red flags that suggest it may not be a safe or reliable broker for forex trading. The lack of regulatory oversight, combined with negative user experiences and unclear trading conditions, makes it a potentially risky choice for traders.

For those considering trading with Smart Investment Capital, it is crucial to weigh the risks carefully and consider alternative, more reputable brokers that offer regulatory protection and transparent trading conditions. Some recommended alternatives include brokers regulated by top-tier authorities such as the FCA, ASIC, or CySEC, which provide a safer trading environment and greater peace of mind for investors.

In summary, while Smart Investment Capital may present attractive trading options, the evidence suggests that it is prudent for traders to exercise caution and seek out more secure alternatives.

Is Smart Investment Capital a scam, or is it legit?

The latest exposure and evaluation content of Smart Investment Capital brokers.

Smart Investment Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Smart Investment Capital latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.