SKY FINANCE GROUP Review 2

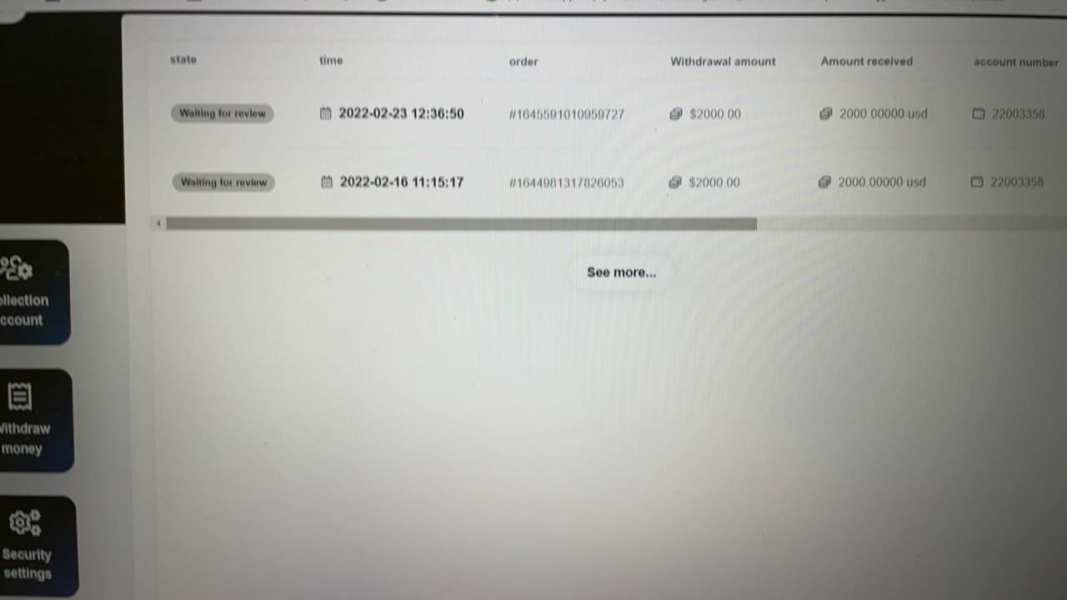

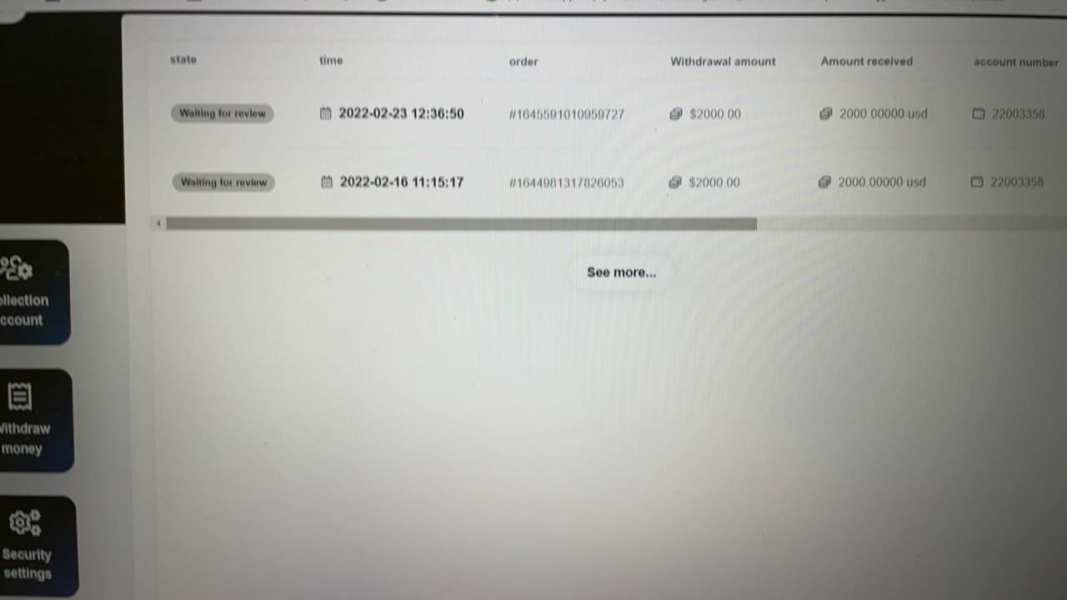

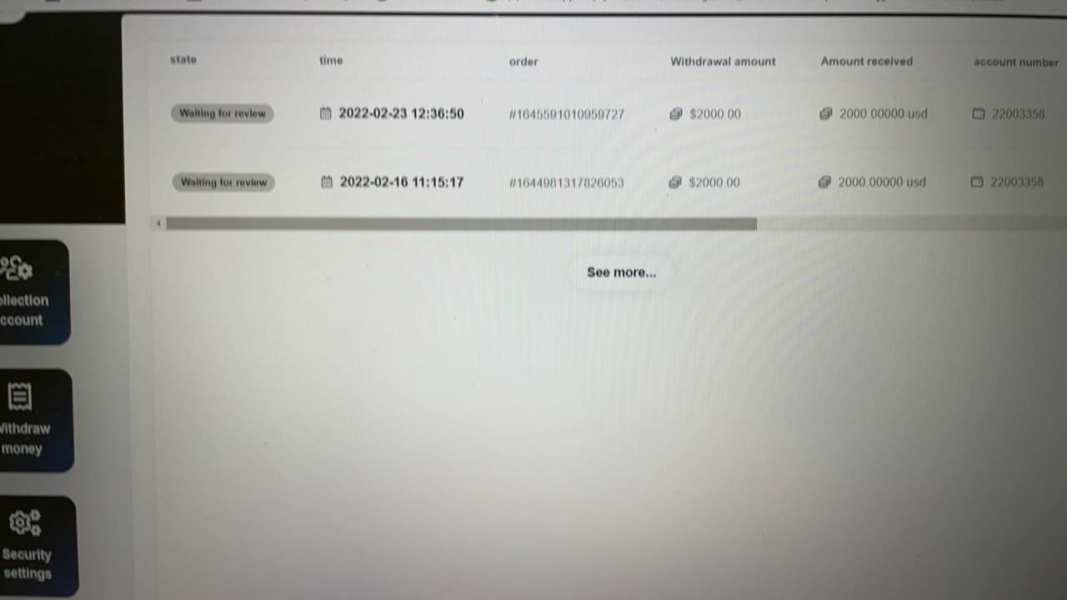

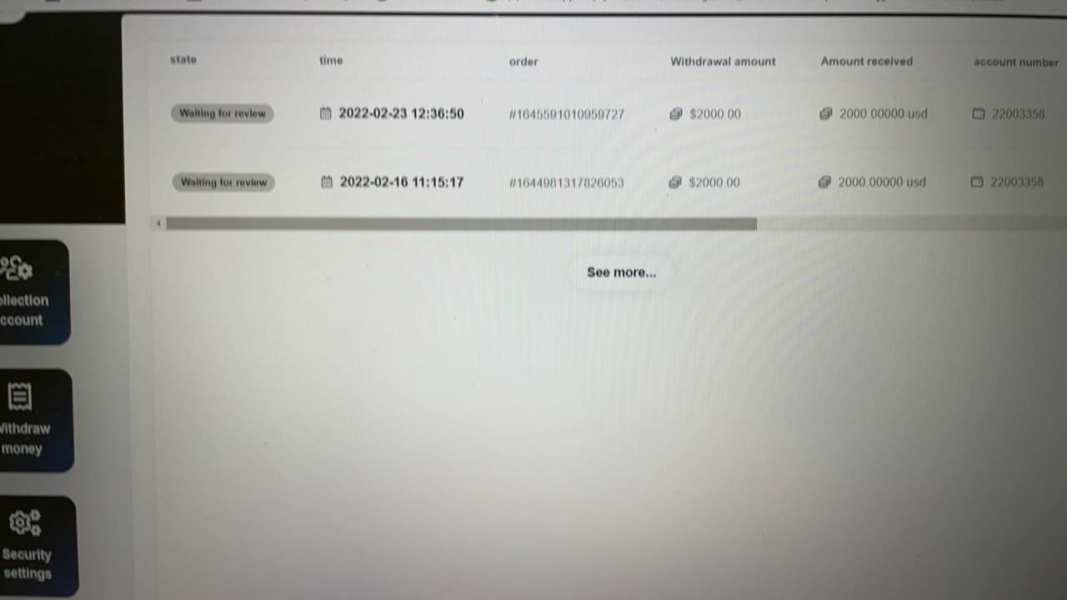

When opening an account, it said that the withdrawal will be approved within 2 hours, but the application for withdrawal has not been successful till now.

Cannot withdraw normally???? Need to operate mannually.

SKY FINANCE GROUP Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

When opening an account, it said that the withdrawal will be approved within 2 hours, but the application for withdrawal has not been successful till now.

Cannot withdraw normally???? Need to operate mannually.

Executive Summary

This comprehensive sky finance group review shows a complex picture of a multi-asset broker that needs careful thought before you start trading. Sky Finance Group started in 2016 and calls itself a global financial services provider that offers different trading products and services to clients around the world. The company has won various awards according to available data, which suggests it has some market presence and credibility.

However, our analysis shows big concerns that potential clients should think about carefully. Employee ratings on professional websites show a worrying 2.0 out of 5 rating, which means there might be internal problems that could hurt service quality. The company's regulatory status stays unclear with limited transparency about specific licensing and oversight systems.

Sky Finance Group mainly targets investors who want multi-asset trading opportunities, including forex and CFD products. The broker offers a range of financial instruments, but the lack of detailed information about trading conditions, platform details, and regulatory compliance raises questions about transparency and client protection measures that are essential in today's trading world.

Important Disclaimer

This sky finance group review uses publicly available information and user feedback from various sources. Readers should know that Wonderful Sky Financial Group and Sky Finance Group may be different legal entities that operate in separate areas. Our research shows potential registration in Hong Kong, though specific regulatory details need verification.

The evaluation method used in this review relies on accessible data, industry reports, and user testimonials. Some aspects of the broker's operations may not be fully shown in this analysis because comprehensive information is limited. Potential clients should strongly conduct independent research and verify all information directly with the broker before making any investment decisions.

Rating Framework

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 6/10 | Average |

| Customer Service and Support | 4/10 | Below Average |

| Trading Experience | 5/10 | Average |

| Trustworthiness | 5/10 | Average |

| User Experience | 5/10 | Average |

Broker Overview

Sky Finance Group started in the financial services sector in 2016 and became a global multi-asset broker focused on providing complete trading solutions to international clients. The company operates with a business model that centers on delivering different financial products, including foreign exchange and contracts for difference, to retail and institutional investors across multiple markets.

The broker's operational framework emphasizes access to various asset classes and positions itself as a one-stop solution for traders who want exposure to different financial instruments. Sky Finance Group has won industry recognition through awards according to available information, though specific details about these awards and their importance remain limited in public documentation.

From a regulatory perspective, available data suggests potential registration in Hong Kong, though comprehensive licensing information and supervisory oversight details are not clearly shown in accessible materials. This lack of regulatory transparency represents a big consideration for potential clients who are evaluating the broker's credibility and client protection measures. The company's relatively recent start in 2016 means it has about nine years of operational history, which is moderate compared to more established brokers in the competitive forex and CFD market landscape.

Detailed Information

Regulatory Status: Available information shows Sky Finance Group may operate under Hong Kong registration, though specific regulatory authority oversight and licensing numbers are not clearly shown in public materials. This lack of regulatory transparency requires careful consideration by potential clients.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and fees for deposits and withdrawals is not detailed in available documentation and requires direct inquiry with the broker.

Minimum Deposit Requirements: The broker's minimum deposit requirements across different account types are not specified in accessible materials and need direct contact for accurate information.

Bonus and Promotional Offers: Current promotional structures, welcome bonuses, or ongoing incentive programs are not detailed in available public information.

Tradeable Assets: Sky Finance Group offers multiple asset classes including foreign exchange pairs and contracts for difference according to available data, providing clients access to diverse market opportunities across various financial instruments.

Cost Structure: Specific information about spreads, commissions, overnight financing charges, and other trading costs is not comprehensively detailed in accessible documentation and requires direct verification with the broker.

Leverage Ratios: Maximum leverage offerings and margin requirements across different asset classes are not specified in available materials.

Platform Options: Details about trading platform types, whether MetaTrader 4, MetaTrader 5, or proprietary solutions, are not clearly outlined in accessible information.

Geographic Restrictions: Specific areas where services are restricted or unavailable are not detailed in available documentation.

Customer Support Languages: Information about multilingual support availability and specific languages offered is not specified in accessible materials.

This sky finance group review highlights the significant information gaps that potential clients should address through direct communication with the broker before making any trading decisions.

Account Conditions Analysis

The account conditions offered by Sky Finance Group present a challenging evaluation because of limited publicly available information. Sky Finance Group's account offerings lack transparency in accessible documentation unlike established brokers that typically provide comprehensive details about their account structures. This absence of clear information about account types, their specific features, and associated benefits creates uncertainty for potential clients who want to understand their trading options.

Minimum deposit requirements, which are basic considerations for retail traders, are not specified in available materials. This lack of clarity makes it difficult for potential clients to budget properly or compare Sky Finance Group's accessibility against industry competitors. Most reputable brokers clearly outline their entry-level requirements, making this information gap particularly concerning.

The account opening process details, including required documentation, verification procedures, and approval timeframes, are not comprehensively outlined in accessible sources. Specialized account features such as Islamic accounts for clients requiring Sharia-compliant trading conditions are not mentioned in available information. This sky finance group review must note that the absence of detailed account condition information significantly impacts the broker's transparency score and raises questions about client-focused service delivery.

Tools and Resources Analysis

Sky Finance Group's tools and resources portfolio shows mixed results based on available information. The broker claims to offer multiple trading products and services, but specific details about the quality and comprehensiveness of these offerings remain limited in accessible documentation. The company's positioning as a multi-asset broker suggests some level of tool diversity, though concrete information about analytical resources, charting capabilities, and research materials is not readily available.

Educational resources, which are increasingly important for retail trader development, are not detailed in public information. Modern brokers typically provide extensive learning materials, webinars, market analysis, and trading guides to support client success. The absence of clear educational resource information represents a significant gap in Sky Finance Group's service transparency.

Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, is not specified in available materials. Advanced trading tools such as economic calendars, market sentiment indicators, and technical analysis resources are not comprehensively outlined. The limited information availability about tools and resources contributes to the moderate rating in this category, as potential clients cannot adequately assess the broker's capability to support their trading strategies and development needs.

Customer Service and Support Analysis

Customer service quality represents one of Sky Finance Group's most concerning areas based on available data. Employee ratings on professional platforms show a troubling 2.0 out of 5 score, which suggests significant internal operational challenges that likely impact client service delivery. This low rating indicates potential issues with staff satisfaction, training, or company culture that could directly affect customer support quality.

Specific information about customer service channels, including live chat availability, telephone support, email response systems, and help desk operations, is not detailed in accessible documentation. Response time commitments, service level agreements, and support availability hours are similarly absent from public information, making it difficult to assess the broker's commitment to client assistance.

Multilingual support capabilities, which are essential for international brokers serving diverse client bases, are not specified in available materials. The lack of clear customer service information, combined with concerning employee satisfaction ratings, suggests potential challenges in getting timely and effective support when needed. This sky finance group review must highlight these service quality concerns as significant considerations for potential clients who value responsive and professional customer support in their trading experience.

Trading Experience Analysis

The trading experience evaluation for Sky Finance Group faces significant limitations because of insufficient publicly available information about platform performance and execution quality. Critical factors such as platform stability, server uptime, and connection reliability are not documented in accessible sources, making it challenging to assess the technical foundation of the trading environment.

Order execution quality, including fill rates, slippage statistics, and execution speed metrics, is not specified in available materials. These factors are crucial for active traders who require precise and timely order processing. Platform functionality details, including charting capabilities, technical indicators, and customization options, are not comprehensively outlined.

Mobile trading experience, which is increasingly important for modern traders requiring flexibility and accessibility, lacks detailed information about app functionality, feature parity with desktop platforms, and user interface design. The absence of specific platform type information makes the evaluation of trading experience quality more complicated.

Market access details, including available trading sessions, instrument availability, and market depth information, are not clearly specified. This sky finance group review must note that the limited trading experience information significantly impacts the ability to provide a comprehensive assessment of the broker's technical capabilities and trading environment quality.

Trustworthiness Analysis

Trustworthiness evaluation reveals several areas of concern that potential clients should carefully consider. The regulatory status of Sky Finance Group remains unclear with limited transparency about specific licensing authorities, regulatory compliance measures, and client protection frameworks. There are indications of potential Hong Kong registration, but comprehensive regulatory verification information is not readily accessible.

Client fund protection measures, including segregated account policies, deposit insurance coverage, and bankruptcy protection procedures, are not detailed in available documentation. These safeguards are fundamental for client security and represent standard industry practices among reputable brokers. The absence of clear fund protection information raises significant questions about client asset security.

Company transparency about ownership structure, financial statements, and operational disclosures is limited in accessible materials. Sky Finance Group has reportedly received industry awards, but specific details about these recognitions, their significance, and the awarding organizations are not comprehensively outlined. The concerning 2.0 out of 5 employee rating suggests potential internal operational challenges that could impact overall business integrity and client service delivery.

The company's relatively recent establishment in 2016 provides limited operational history for assessment, though this factor alone does not necessarily indicate trustworthiness concerns. The combination of regulatory uncertainty, limited transparency, and poor employee satisfaction creates a complex trustworthiness profile requiring careful evaluation.

User Experience Analysis

User experience assessment for Sky Finance Group presents challenges because of limited comprehensive user feedback and detailed interface information. The concerning 2.0 out of 5 employee rating suggests potential operational issues that could negatively impact overall user satisfaction and service delivery quality. This internal rating may reflect broader organizational challenges affecting client-facing operations.

Website design, navigation ease, and information accessibility appear limited based on the lack of detailed publicly available information about the broker's services and conditions. Modern users expect comprehensive online resources, clear service descriptions, and transparent operational details, which seem to be lacking in Sky Finance Group's public presence.

Account registration and verification processes are not detailed in accessible materials, making it difficult to assess the user-friendliness of onboarding procedures. Efficient and transparent account opening processes are crucial for positive initial user experiences and set expectations for ongoing service quality.

Fund management operations, including deposit and withdrawal user experience, processing efficiency, and fee transparency, lack detailed documentation. Users typically prioritize smooth financial transactions and clear cost structures, which cannot be adequately evaluated based on available information. The limited user experience information, combined with concerning employee satisfaction ratings, suggests potential challenges in delivering satisfactory client experiences that meet modern trading platform standards.

Conclusion

This comprehensive sky finance group review reveals a broker with significant transparency and operational concerns that potential clients should carefully evaluate. Sky Finance Group positions itself as a multi-asset trading provider with diverse product offerings, but the substantial information gaps and concerning employee ratings create notable red flags for potential clients.

The broker may be suitable for investors specifically seeking multi-asset trading opportunities and willing to accept higher risk levels associated with limited regulatory transparency. The 2.0 out of 5 employee rating, unclear regulatory status, and lack of detailed operational information suggest that most traders would benefit from considering more established alternatives with clearer regulatory oversight and better transparency records.

Key advantages include the company's multi-asset product range and industry award recognition, though specific details about these benefits remain limited. Significant disadvantages include poor employee satisfaction ratings, unclear regulatory compliance, limited customer service information, and insufficient transparency about trading conditions and costs. Potential clients should conduct thorough research and consider these factors carefully before engaging with Sky Finance Group's services.

FX Broker Capital Trading Markets Review