SI Review 3

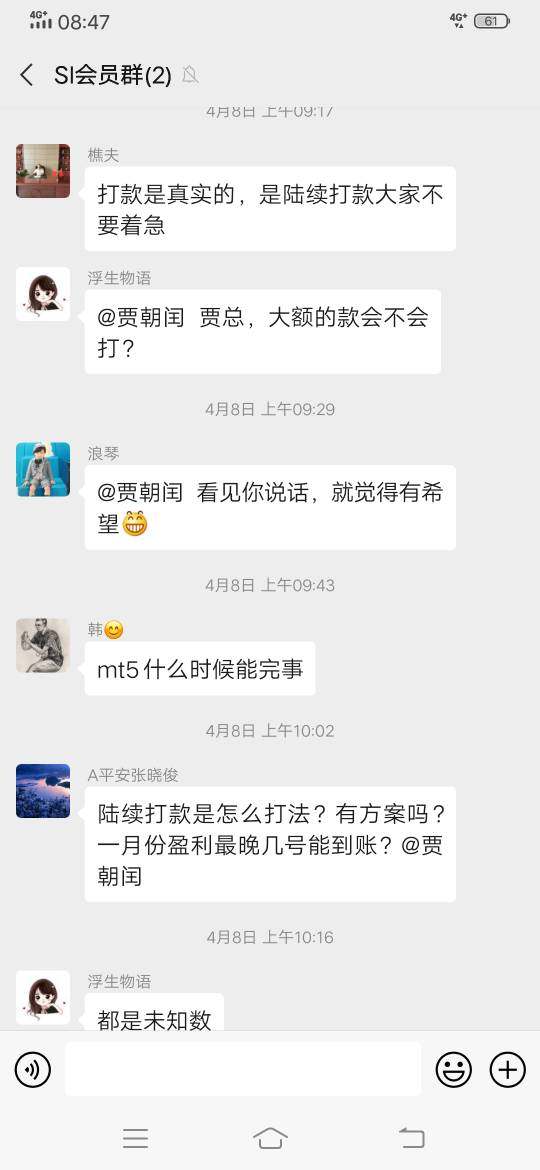

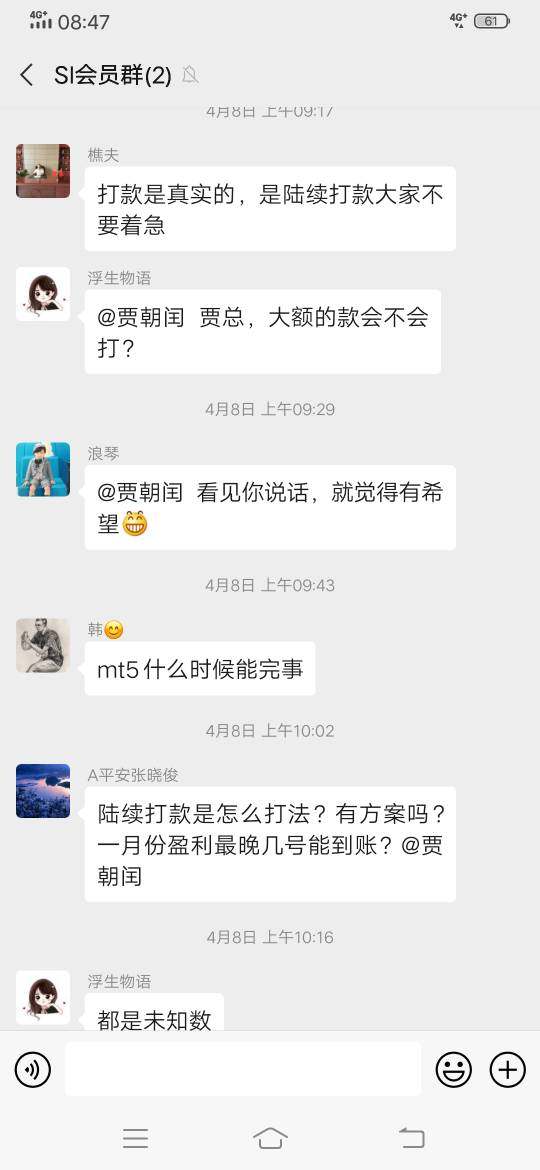

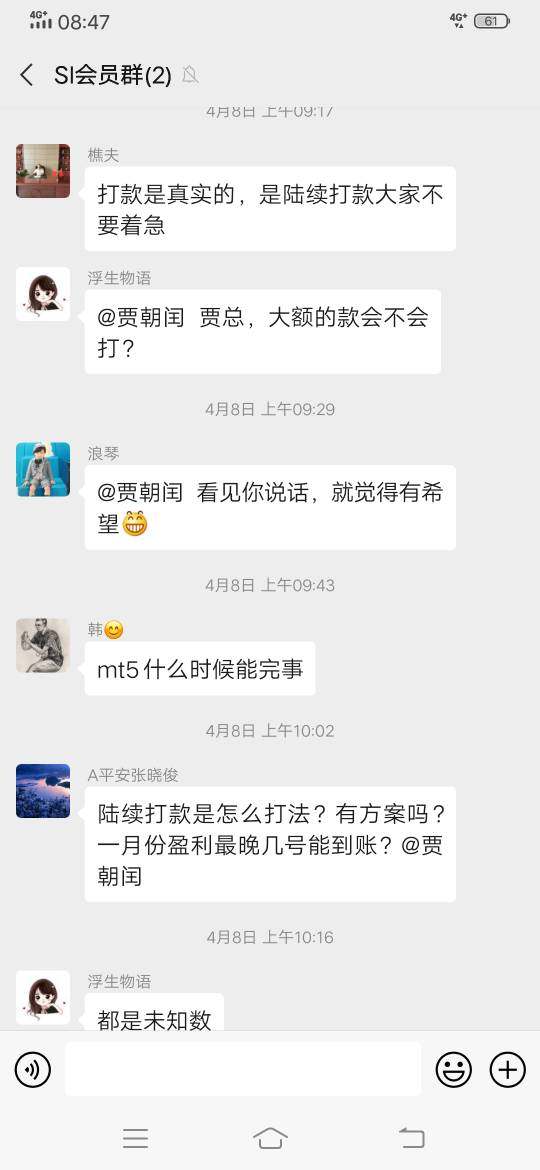

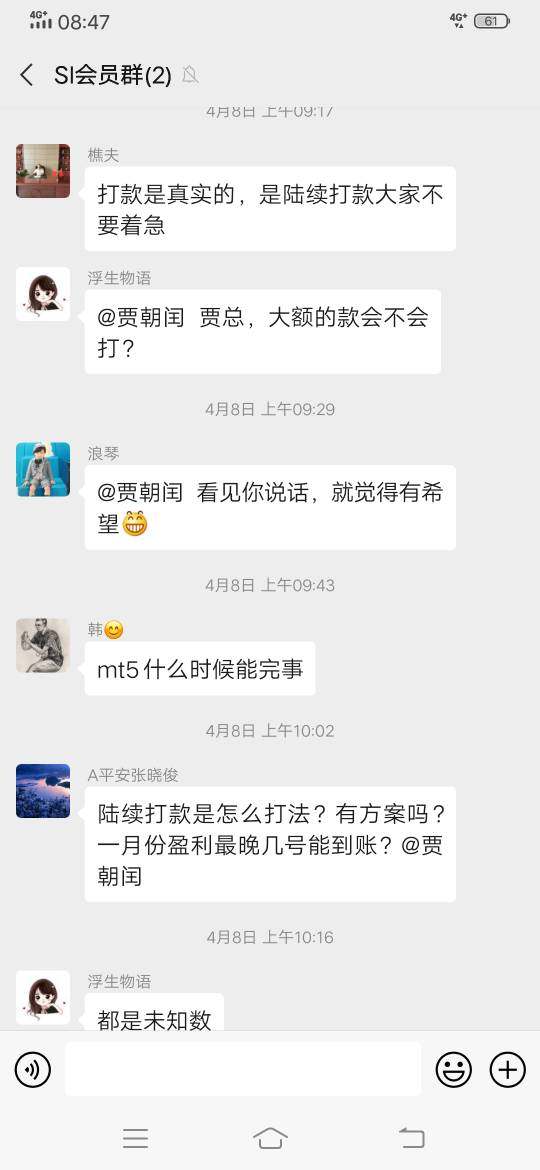

The leader of SI, Jia Haitao, masqueraded clients.

The withdrawal is unavailable. But the bald leader Jia Haitao is still cheating us.

Scrupulous SI is still conning clients to deposit.

SI Forex Broker provides real users with * positive reviews, * neutral reviews and 3 exposure review!

The leader of SI, Jia Haitao, masqueraded clients.

The withdrawal is unavailable. But the bald leader Jia Haitao is still cheating us.

Scrupulous SI is still conning clients to deposit.

This si review looks at SI as a trading platform for 2025. The information we found shows big problems with how clear they are about their business and rules they follow. SI works in financial services and focuses on insurance solutions and consulting. However, we don't know much about their forex trading, who watches over them, or what their trading conditions are like.

The platform gives personal services, especially for insurance and consulting. Their team has experience in insurance and reinsurance work. Some sources hint they offer trading services, but we can't find solid details about their trading platforms, what you can trade, or if they follow the rules. This lack of openness is a big red flag for traders who want a reliable broker.

If you're thinking about using SI, the missing regulatory info and unclear fees make it hard to recommend them. This si review shows why you need to do your homework when picking any financial services company.

Regional Entity Variations: We don't have enough regulatory information to check if their operations differ by region. You should check their regulatory status in your area before using any SI services.

Review Methodology: We based this review on public information and company materials we could access. The lack of complete data about trading services, rule compliance, and user experiences limits what we can tell you. You should do more research and check things yourself.

| Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | 3/10 | Limited information available about account types and conditions |

| Tools and Resources | 2/10 | Insufficient data on trading tools and educational resources |

| Customer Service | 2/10 | No detailed information on support channels or quality |

| Trading Experience | 2/10 | Trading platform details not clearly specified |

| Trust and Regulation | 1/10 | Regulatory information not adequately disclosed |

| User Experience | 2/10 | Limited user feedback and experience data available |

SI works as a consulting company that focuses mainly on insurance solutions rather than forex trading. The company was started by professionals who know insurance and reinsurance work, which means they understand risk management and financial consulting better than retail trading services.

The company likes to give personal service, especially for insurance and consulting. But we can't figure out how their insurance services connect to forex trading from the public information available. This confusion makes us question whether the company really belongs in the retail trading market.

SI's setup looks more like traditional insurance and consulting services than full forex trading offerings. The missing information about trading platforms, what you can trade, and regulatory oversight suggests you should carefully check if the company actually provides trading services before you commit to anything.

Regulatory Status: We can't find clear details about who oversees them or if they have licenses for forex trading services. This is a big concern for traders who want regulated broker services.

Deposit and Withdrawal Methods: We don't have specific information about how to fund your account, how long it takes, and what fees you'll pay, making it hard to judge if their financial transactions are convenient and cost-effective.

Minimum Deposit Requirements: Some sources say they have competitive deposit requirements, but we don't know the exact amounts or account structures.

Promotional Offerings: We can't find information about welcome bonuses, trading rewards, or promotional programs in public sources, so we can't assess what extra benefits new clients might get.

Tradeable Assets: While they might offer forex trading, we don't have a complete list of currency pairs, CFD offerings, and other instruments you can trade.

Cost Structure: We don't have detailed information about spreads, commissions, overnight fees, and other trading costs, making it hard for potential clients to compare costs.

Leverage Options: We don't know the specific leverage ratios and margin requirements, so we can't assess trading flexibility.

Platform Selection: We don't have clear information about trading platform options, whether they use their own system or third-party solutions like MetaTrader.

This si review shows big information gaps that potential traders should address by talking directly with the company.

We can't properly assess SI's account conditions because there isn't enough public information available. The company seems to offer personal services, which might mean flexible account structures, but we don't have clear documentation of standard accounts, premium benefits, or specific trading conditions.

Without detailed information about account types, minimum balances, and account features, potential clients can't figure out if the available options meet their trading needs and experience levels. The missing information about how to open accounts, what verification you need, and what documentation is required creates additional concerns.

Professional traders need to understand account setup processes, funding requirements, and any restrictions on their trading activities clearly. We also don't know about specialized features like Islamic accounts, corporate accounts, or managed account services from the available materials.

This si review emphasizes that you need to talk directly with SI representatives to clarify account details before making any commitments.

We can't properly evaluate SI's trading tools and resources because there's limited information in public sources. Most brokers offer market analysis tools, economic calendars, trading signals, and educational resources, but we don't know what SI specifically provides in these areas.

Research and analysis tools help traders make informed decisions. However, we don't know if SI provides market research, technical analysis tools, or fundamental analysis resources, and we can't find information about charting capabilities, available indicators, and analytical features.

Educational resources help traders develop their skills, especially newer market participants. We can't find information about webinars, trading guides, market tutorials, or educational partnerships in accessible sources, which limits our assessment of SI's commitment to client education and skill development.

Automated trading support, including Expert Advisor compatibility, algorithmic trading capabilities, and API access, is increasingly important for modern traders. But we don't have specific information about these advanced trading tools in available documentation.

We can't properly assess SI's customer service because there isn't enough information in public sources. Good customer support is critical when choosing a broker, including response times, communication channels, and service quality standards.

We don't have clear details about support channels like live chat, phone support, email help, or ticket systems. The missing information about support hours, multilingual capabilities, and regional coverage makes it hard to evaluate service accessibility for international clients.

We don't know about response time expectations and service quality standards from accessible sources. Professional traders need quick resolution of technical issues, account questions, and trading concerns, but without clear service commitments or performance metrics, potential clients can't assess support reliability.

We don't know if they offer specialized support for different client segments, including VIP services for high-volume traders or dedicated account managers. We also can't find information about support team expertise, training standards, and escalation procedures in public documentation.

We can't properly evaluate SI's trading experience because there's limited information about platform specifications and trading environment characteristics. Key trading experience factors include platform stability, execution speed, order management capabilities, and overall user interface design.

We don't have clear documentation about platform reliability and uptime statistics. Professional traders need stable platforms with minimal downtime and consistent performance during high-volatility market conditions, but without specific information about infrastructure capabilities and performance monitoring, potential clients can't assess platform reliability.

Order execution quality, including fill rates, slippage statistics, and execution speed metrics, is crucial for trading success. However, we don't have detailed data about execution performance or order processing capabilities.

Mobile trading capabilities and cross-platform synchronization features are increasingly important for modern traders. We don't have clear information about mobile app availability, feature parity between desktop and mobile platforms, and offline capabilities in accessible sources.

We don't have comprehensive details about advanced trading features such as one-click trading, advanced order types, and risk management tools in available documentation. This si review highlights the need for direct platform testing or detailed discussions with SI representatives to properly evaluate trading experience quality.

Our assessment of SI's trustworthiness and regulatory compliance reveals significant concerns because of limited transparency in available information. Regulatory oversight provides the fundamental basis for broker trustworthiness, offering client protection, operational standards, and dispute resolution mechanisms.

We can't find clear information about specific regulatory licenses, oversight authorities, or compliance frameworks. This lack of regulatory transparency raises substantial concerns about client fund protection, operational oversight, and adherence to industry standards, and professional traders typically require clear regulatory credentials before engaging with any financial services provider.

We don't have clear details about fund security measures, including segregated account policies, insurance coverage, and investor compensation schemes in accessible documentation. Without specific information about client fund protection mechanisms, potential traders can't adequately assess the security of their capital investments.

Company transparency regarding ownership structure, financial statements, and operational history isn't readily available in public sources. The lack of comprehensive corporate information limits the ability to assess company stability, track record, and long-term viability in the competitive brokerage industry.

We can't find clear documentation about third-party audits, compliance certifications, and industry recognition in available materials.

We can't properly evaluate SI's user experience because there's insufficient user feedback and detailed interface information in available sources. User experience includes platform usability, registration processes, navigation efficiency, and overall client satisfaction levels.

We don't have comprehensive documentation about interface design and usability factors in accessible materials. Modern trading platforms require intuitive navigation, customizable layouts, and efficient workflow design to support effective trading activities, but without specific information about user interface characteristics, potential clients can't assess platform suitability for their preferences and experience levels.

We don't have clear details about registration and account verification processes in available sources. Streamlined onboarding procedures with reasonable verification requirements represent important factors in overall user experience, but the absence of clear information about documentation requirements and processing timeframes limits assessment of account setup efficiency.

We don't specifically address funding and withdrawal experiences, including processing speeds, fee transparency, and available payment methods in accessible documentation. These operational aspects significantly impact overall user satisfaction and platform convenience.

We can't readily find common user concerns, satisfaction ratings, and improvement feedback in public sources.

This comprehensive si review reveals significant information gaps that prevent a definitive recommendation for SI as a forex trading platform. The company appears to operate in financial services with insurance and consulting expertise, but the lack of transparent information about trading services, regulatory oversight, and platform capabilities raises substantial concerns for potential traders.

The absence of clear regulatory credentials, detailed trading conditions, and comprehensive platform specifications makes SI unsuitable for traders seeking transparent, well-regulated brokerage services. Professional traders should prioritize platforms with clear regulatory oversight, transparent fee structures, and comprehensive service documentation.

If you're considering SI, you would need extensive due diligence and direct communication with company representatives to clarify service offerings, regulatory status, and trading conditions. However, the current lack of transparency suggests that alternative, more established brokers with clear regulatory credentials and comprehensive service documentation would better serve most trading requirements.

FX Broker Capital Trading Markets Review