Byds 2025 Review: Everything You Need to Know

Executive Summary

This Byds review shows a detailed analysis of what seems to be a broken entity with limited available information for traditional forex broker evaluation. Based on available data, Byds works mainly in the automotive sector, specifically focusing on electric vehicle technology and BYD automotive products. The company shows technological advancement in the electric vehicle market. It positions itself as a competitor to established players like Tesla, particularly with products such as the BYD Seal challenging the Model 3 market segment.

The primary user base appears to be consumers interested in electric vehicle technology and automotive innovation rather than traditional forex trading services. According to available reports, BYD's lane-keeping assist functionality shows improvement over previous versions. However, technical challenges remain in maintaining consistent lane positioning. The overall assessment remains neutral due to insufficient information regarding traditional brokerage services, trading conditions, and regulatory compliance typically expected in forex broker evaluations.

Important Notice

This evaluation is conducted based on available market information and public data analysis. The assessment method relies on accessible information sources, though comprehensive details about traditional forex brokerage operations remain limited in available materials. Traders and potential clients should exercise caution and conduct additional due diligence before making any financial commitments. This is particularly important given the absence of clear regulatory information in the summary materials provided.

Rating Framework

Broker Overview

Byds operates within a complex business environment that appears to span multiple sectors. It has primary focus on automotive technology and electric vehicle manufacturing. The company's background centers around battery technology and electric vehicle production, with the BYD Seal representing a significant market offering positioned as direct competition to Tesla's Model 3. The business model emphasizes technological innovation in the electric vehicle sector. However, specific establishment dates and comprehensive company history remain unclear in available documentation.

The operational framework suggests involvement in commercial trading support and brokerage services. Some sources indicate specialization in diversified project buying and selling. However, traditional forex trading platform types, comprehensive asset class offerings, and primary regulatory oversight details are not clearly specified in available materials. This Byds review must therefore acknowledge significant information gaps that prevent comprehensive evaluation using standard forex broker assessment criteria.

Regulatory Jurisdictions: Specific regulatory information is not detailed in available source materials. This presents a significant concern for potential traders seeking regulated brokerage services.

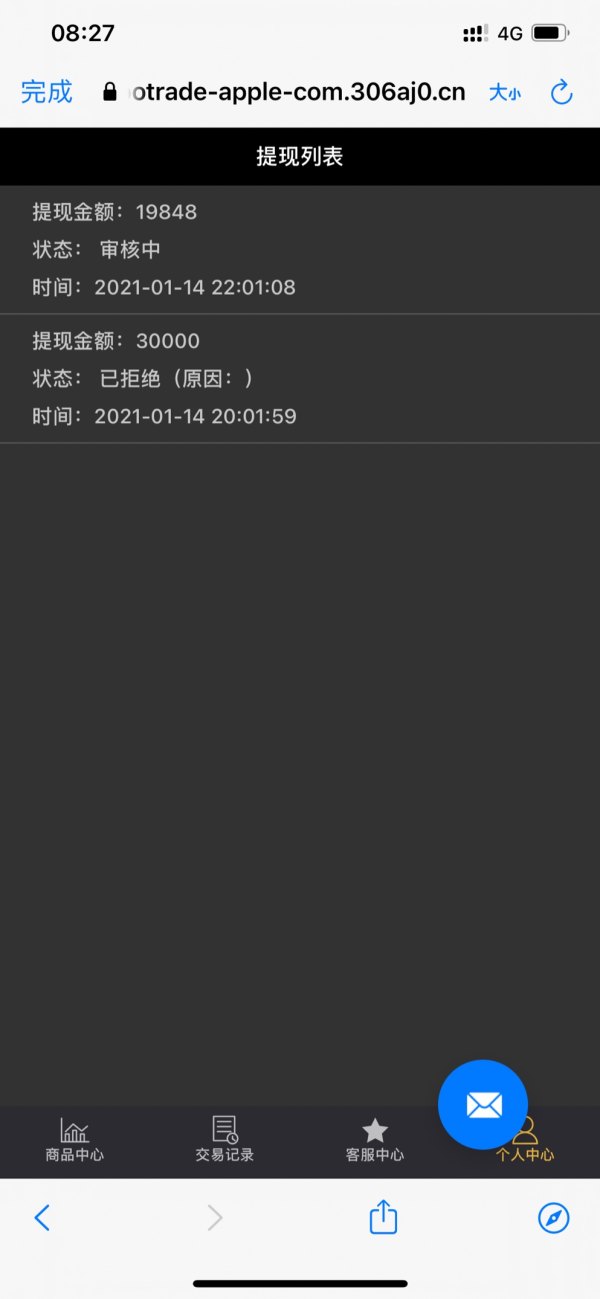

Deposit and Withdrawal Methods: Available documentation does not provide specific information about accepted payment methods or processing procedures for client funds.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in the source materials reviewed for this assessment.

Bonus and Promotional Offers: No information regarding trading bonuses or promotional campaigns is available in the provided documentation.

Tradeable Assets: While automotive sector involvement is evident, specific financial instruments and asset classes available for trading are not detailed in source materials.

Cost Structure: Comprehensive fee schedules, spread information, and commission structures are not available in the reviewed materials. This makes cost comparison impossible.

Leverage Ratios: Specific leverage offerings and margin requirements are not mentioned in available documentation.

Platform Options: Trading platform specifications and software options are not detailed in the source materials for this Byds review.

Geographic Restrictions: Specific regional limitations or service availability constraints are not clearly outlined in available information.

Customer Support Languages: Multi-language support capabilities are not specified in the reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of account conditions for Byds presents significant challenges due to the absence of specific information in available source materials. Traditional forex broker evaluation requires detailed analysis of account types, ranging from basic retail accounts to professional and institutional offerings. Yet such specifications remain unavailable. The lack of minimum deposit requirement information prevents evaluation of accessibility for different trader segments, from beginners to high-volume professionals.

Account opening procedures and verification processes are not documented in available materials. This creates uncertainty about client onboarding efficiency and regulatory compliance measures. Special account features such as Islamic accounts for Shariah-compliant trading, VIP account benefits, or institutional account advantages cannot be evaluated due to information gaps. This Byds review must therefore conclude that account condition assessment requires additional information gathering from direct company sources or alternative documentation not currently available.

The evaluation of trading tools and resources proves challenging given the limited information available about Byds' specific offerings in this area. Traditional forex broker assessment requires analysis of charting packages, technical analysis tools, economic calendars, and market research provisions. Yet such details are not present in available documentation. The absence of information about research and analysis resources prevents evaluation of the company's commitment to trader education and market insight provision.

Educational resource availability, including webinars, tutorials, market analysis, and trading guides, cannot be assessed based on current information. Automated trading support capabilities, including Expert Advisor compatibility, API access, and algorithmic trading infrastructure, remain unspecified in available materials. Without user feedback regarding tool effectiveness or expert evaluations of resource quality, this analysis must remain incomplete pending additional information availability.

Customer Service and Support Analysis

Customer service evaluation for Byds encounters significant information limitations that prevent comprehensive assessment of support quality and availability. Traditional broker evaluation requires analysis of multiple communication channels including live chat, telephone support, email responsiveness, and help desk efficiency. Yet specific details about these services are not available in source materials. Response time metrics and service quality indicators cannot be evaluated without access to user feedback or company performance data.

Multi-language support capabilities remain unspecified, preventing assessment of international client service provision. Operating hours and time zone coverage for customer support cannot be determined from available information. Problem resolution effectiveness and escalation procedures are not documented in accessible materials. Without specific user testimonials or case studies demonstrating customer service interactions, this evaluation must acknowledge incomplete assessment capabilities pending additional information sources.

Trading Experience Analysis

The trading experience assessment for Byds faces substantial information gaps that prevent standard forex broker evaluation procedures. Platform stability metrics, execution speed data, and order processing quality indicators are not available in source materials. This makes performance assessment impossible. Trading environment characteristics, including spread consistency, slippage rates, and execution reliability, cannot be evaluated without specific technical performance data.

Mobile trading application functionality and cross-platform synchronization capabilities remain unspecified in available documentation. User interface design quality, navigation efficiency, and feature accessibility cannot be assessed without direct platform access or user feedback compilation. Advanced trading features such as one-click trading, automated order management, and risk management tools are not detailed in current information sources. This Byds review must therefore acknowledge that trading experience evaluation requires additional technical analysis and user feedback collection.

Trust and Reliability Analysis

Trust assessment for Byds encounters significant challenges due to the absence of regulatory qualification information in available source materials. Traditional forex broker evaluation relies heavily on regulatory oversight verification, license authenticity confirmation, and compliance history analysis. Yet such details are not accessible through current documentation. Fund security measures, including segregated account provisions, insurance coverage, and client fund protection protocols, cannot be evaluated without specific regulatory filing information.

Company transparency regarding ownership structure, financial reporting, and operational procedures remains unclear based on available materials. Industry reputation assessment requires access to regulatory actions, peer reviews, and professional standing indicators that are not present in current information sources. The handling of negative events, dispute resolution procedures, and customer complaint management cannot be evaluated without access to regulatory databases or industry reporting systems.

User Experience Analysis

User experience evaluation for Byds proves challenging given the limited availability of direct user feedback and interface assessment data in source materials. Overall user satisfaction metrics, including retention rates, user ratings, and recommendation scores, are not available through current information sources. Interface design quality and navigation efficiency cannot be assessed without direct platform interaction or comprehensive user testimonials.

Registration and verification process efficiency remains unspecified, preventing evaluation of client onboarding experience quality. Fund operation procedures, including deposit processing, withdrawal efficiency, and account management functionality, are not detailed in available documentation. Common user concerns and complaint patterns cannot be identified without access to customer feedback databases or support ticket analysis. Potential user demographic analysis and trader type suitability assessments require additional market research and user base data not currently available.

Conclusion

This comprehensive Byds review concludes with a neutral assessment primarily due to insufficient information availability regarding traditional forex brokerage operations and services. The evaluation reveals a company with apparent focus on automotive sector activities, particularly electric vehicle technology, rather than conventional financial services provision. While technological advancement appears evident in their automotive offerings, the absence of detailed trading conditions, regulatory compliance information, and user feedback prevents standard broker assessment completion.

The analysis suggests potential suitability for consumers interested in automotive technology and electric vehicle innovation rather than traditional forex trading services. Primary advantages appear centered on technological advancement and market innovation. However, significant disadvantages include information transparency limitations and unclear regulatory positioning within the financial services sector.