Hillhouse 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the vast landscape of online trading, Hillhouse presents itself as an option for experienced traders seeking low-cost trading environments through its familiar MetaTrader 4 platform. However, beneath this seemingly attractive façade lies a concerning lack of regulatory oversight, which raises significant red flags regarding fund safety and the reliability of withdrawals. Traders should be wary of the numerous negative user experiences reported, ranging from challenges in fund withdrawal to allegations of manipulative practices aimed at extracting further investments. Hence, while Hillhouse might lure skilled traders seeking budget-friendly alternatives, the high stakes of operating with an unregulated broker make it advisable to tread carefully before making a commitment.

⚠️ Important Risk Advisory & Verification Steps

Risk Advisory:

- Unregulated Status: Hillhouse operates entirely outside the purview of legitimate regulatory bodies, exposing users to substantial risks regarding the security of their investments.

- Withdrawal Challenges: Numerous reports detail serious obstacles faced by users while attempting to withdraw their funds.

Potential Harms:

- Complete loss of invested capital.

- Difficulty accessing and retrieving funds once deposited.

Self-Verification Steps:

- Research Legitimate Regulatory Information: Visit trusted regulatory sites like the FCA, ASIC, or NFA to verify the legitimacy of a broker's license.

- Check User Feedback: Use comprehensive platforms (e.g., WikiFX, Trustpilot) to assess the experiences of other traders.

- Examine the Broker's Official Website: Ensure the brokers official site is functional and provides adequate contact information.

- Engage with Community Forums: Participate in forums like Forex Factory or relevant Reddit threads to gather insights from other traders.

- Caution in Financial Commitments: Enter into any agreements cautiously, especially without verified information regarding the broker.

Rating Framework

Broker Overview

Company Background and Positioning

Founded between 2020 and 2023, Hillhouse has positioned itself as an online trading broker purportedly operating from the United Kingdom. Its ambition to offer cost-effective trading solutions is evident; however, the unregulated nature of its business casts a long shadow over its credibility. As a trading entity, it is crucial for brokers to adhere to strict guidelines to ensure the safety of their customers investments. Hillhouse, without any such oversight, raises several concerns which potential traders must consider.

Core Business Overview

Hillhouse primarily engages in forex trading and Contracts for Difference (CFDs), utilizing the widely known MetaTrader 4 platform for its operations. This platform is recognized for its analytical tools, functionality, and user-friendly interface, appealing particularly to traders who are already familiar with its features. The broker's website claims to offer a variety of trading assets, although the specifics are complicated by the issues regarding website accessibility and the absence of transparent regulation.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

A careful assessment of the regulatory information surrounding Hillhouse reveals significant contradictions. The absence of valid regulatory oversight raises questions about the brokers legitimacy and long-term viability in the trading market.

User Self-Verification Guide:

- Visit Regulatory Websites: Go to the FCA, ASIC, and other relevant sites.

- Search for Broker Licensing: Utilize these sites' search functions to input Hillhouse‘s operating name.

- Assess Current Status: Note if any licensing exists or if the broker is flagged as unregulated.

- Follow Up with User Alerts: Check for any community posts or alerts regarding Hillhouse’s performance.

- Confirm Contact Information: Ensure that the contact details provided by the broker are functional and responsive.

"This broker is running without any legitimate regulatory supervision, fostering doubts about its legitimacy and trustworthiness." (Source: WikiFX)

Overall, user feedback emphasizes the importance of self-verification as a critical step for managing uncertainty when considering investments with Hillhouse.

Trading Costs Analysis

Hillhouse claims to offer a competitive commission structure, which could appeal to cost-conscious advanced traders. The cost advantage, however, may be overshadowed by the potential for hefty withdrawal fees and other hidden costs.

Advantages in Commissions:

The initial low trading costs are attractive for high-frequency traders looking to maximize their profit margins.

The "Traps" of Non-Trading Fees:

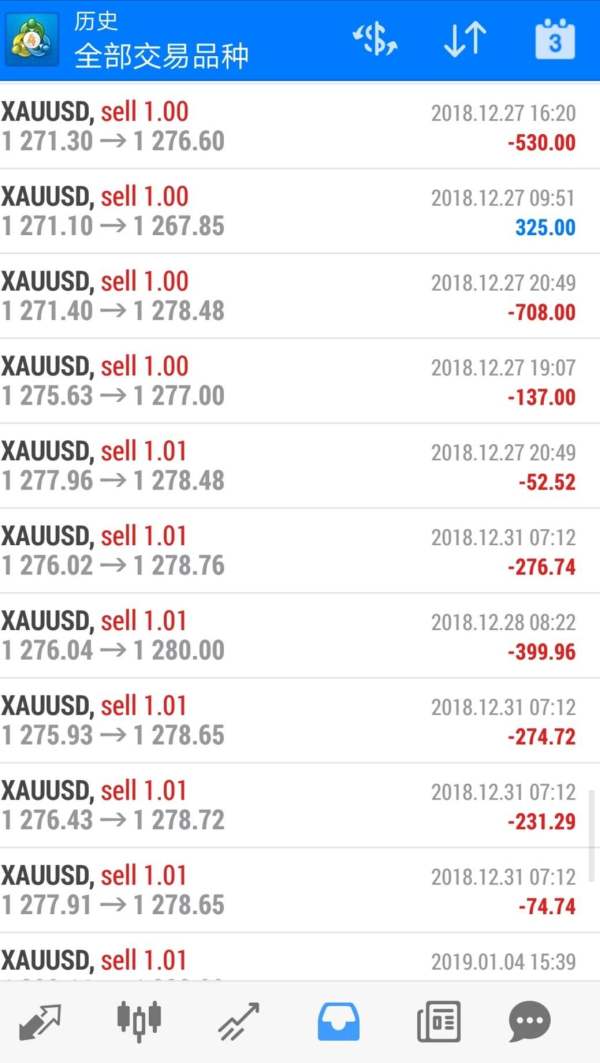

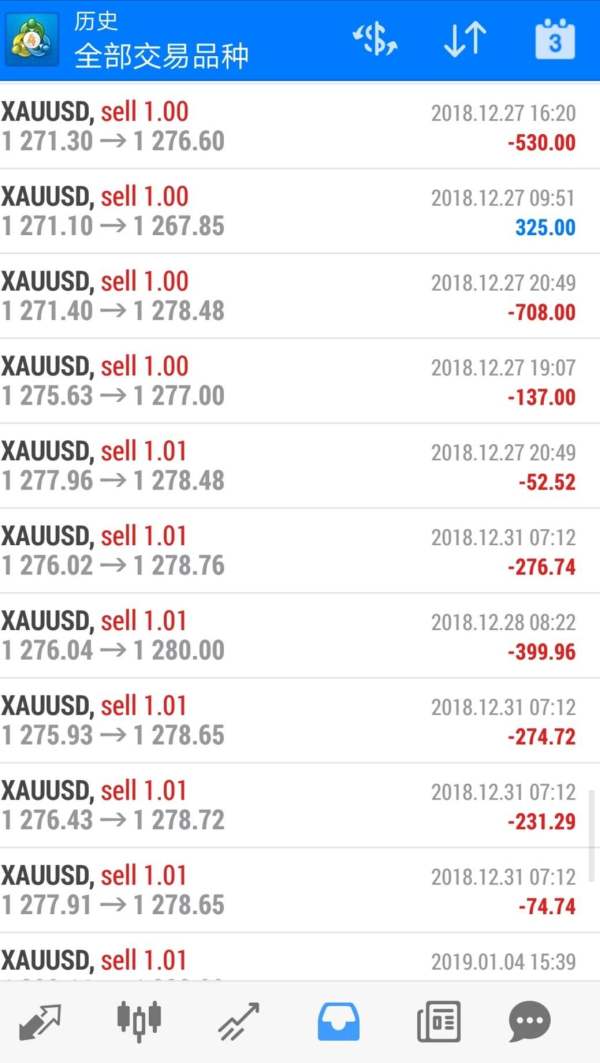

However, users have reported withdrawal fees that can reach up to $30, which are significant when compared to many regulated brokers who may offer free withdrawals.

"Their funds are doomed ending up with liquidation or unavailable withdrawal." (Source: WikiBit)

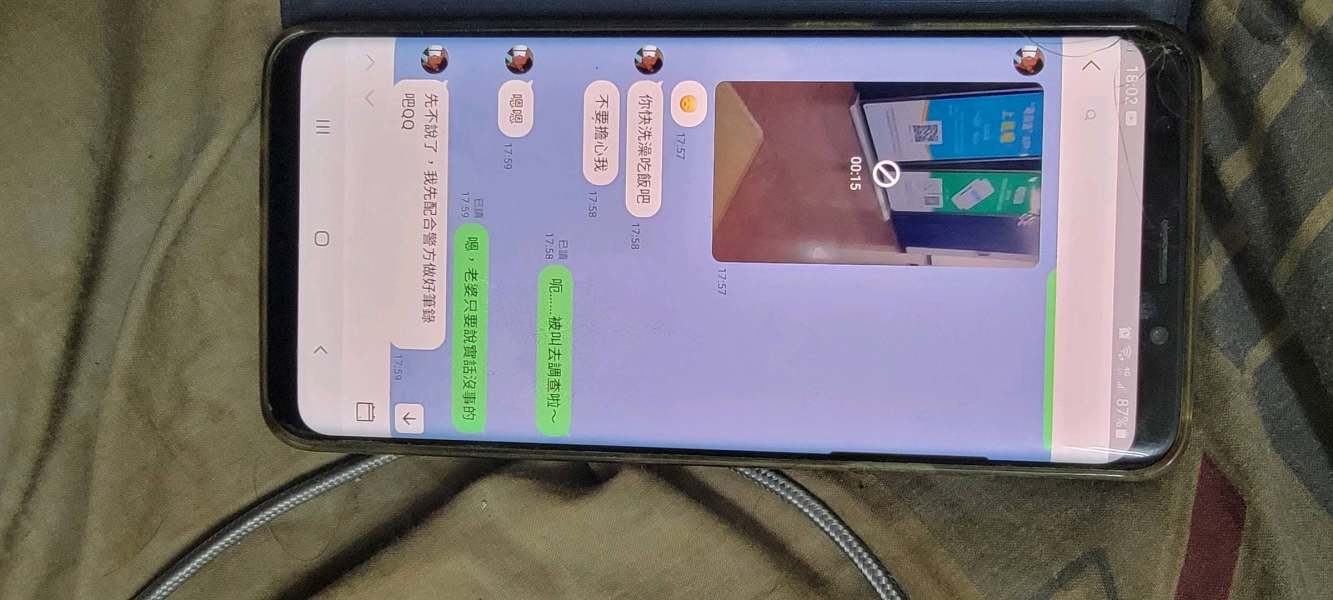

Hillhouses primary offering is the MetaTrader 4 platform, which is widely respected in the trading community for its robust feature set.

Platform Diversity:

MT4 includes various advanced charting tools and technical analysis options, as well as the ability to use automated trading strategies through Expert Advisors. This makes MT4 versatile for different trading strategies.

Quality of Tools and Resources:

The educational resources and customer support tools provided are, however, limited due to the broker's unregulated status.

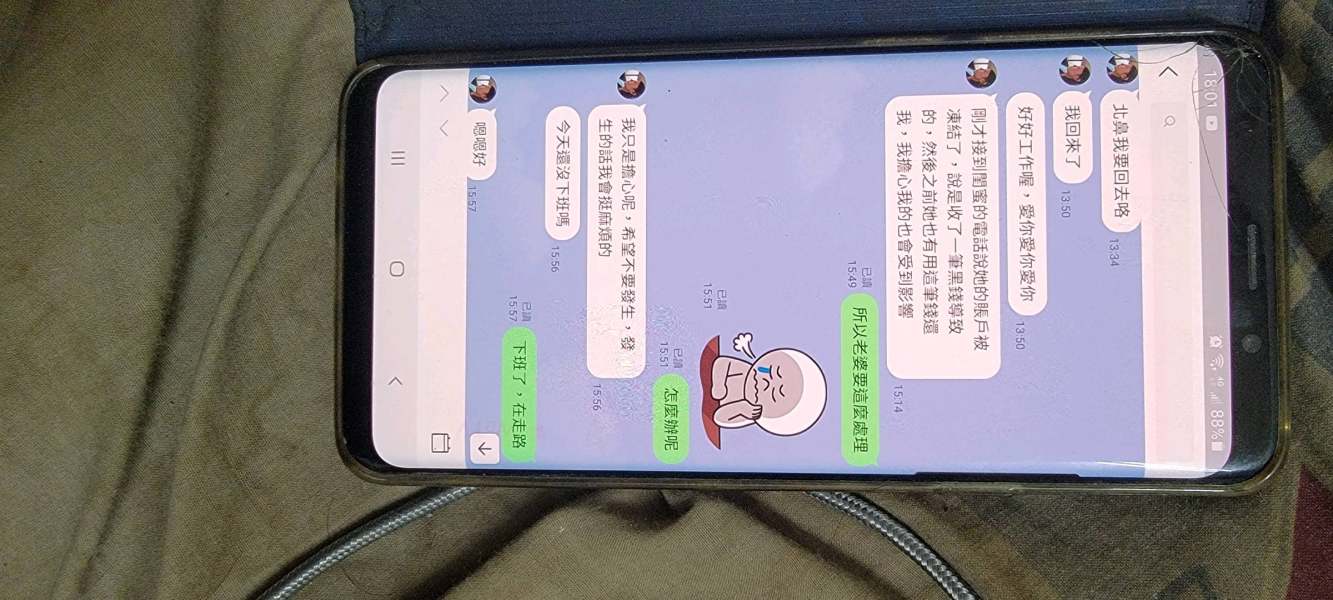

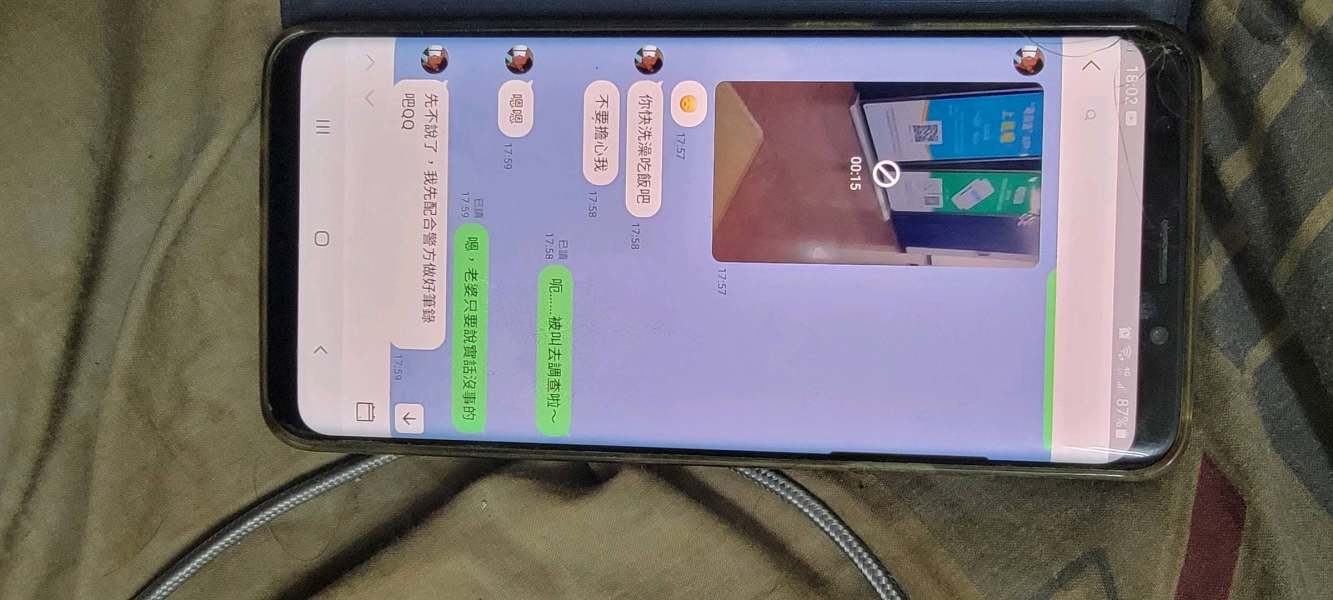

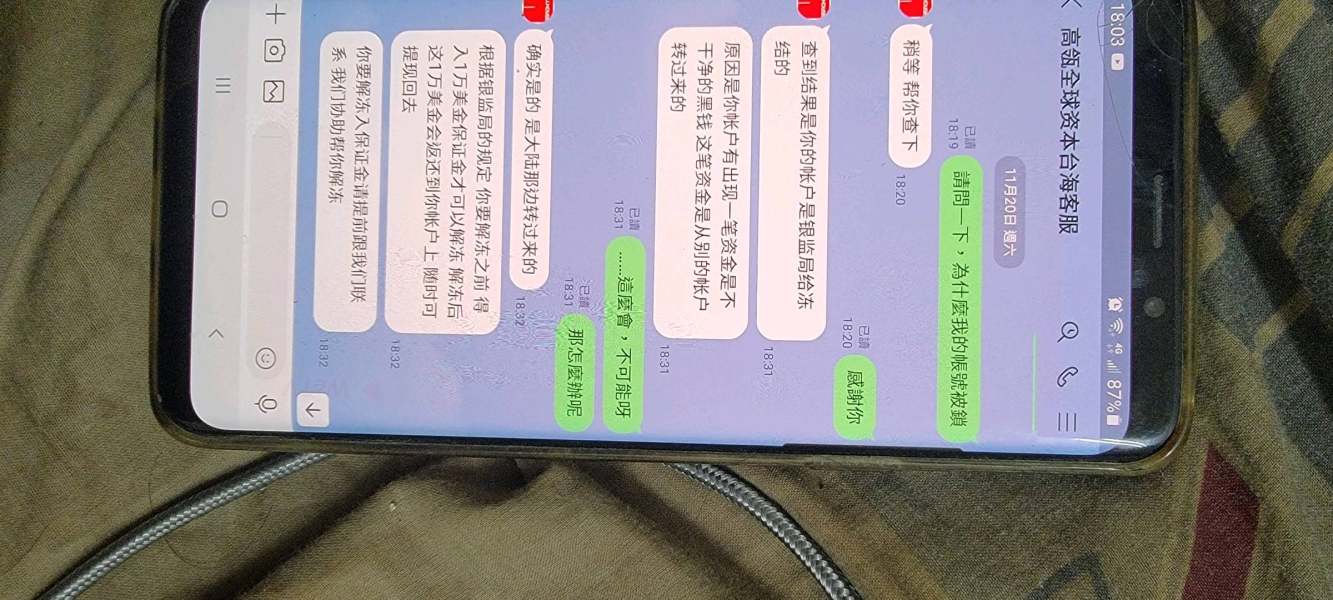

"The profit screenshots sent by the agent were fake." (Source: WikiBit)

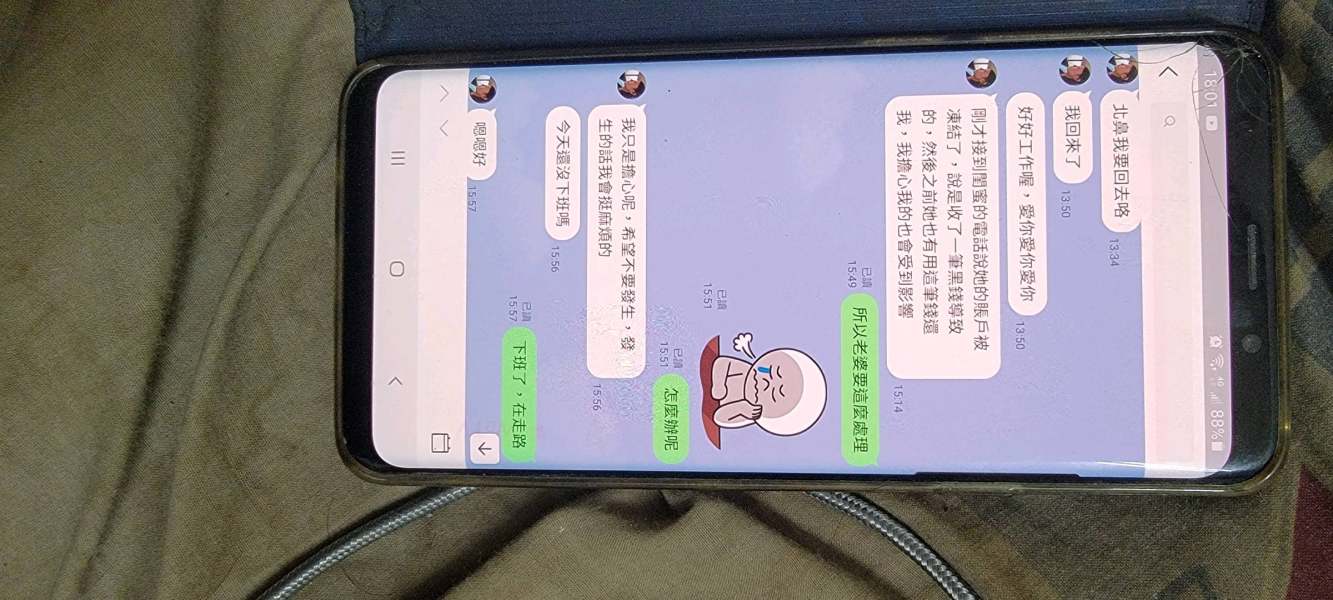

User Experience Analysis

Reviews of the user experience with Hillhouse paint a concerning picture, with many users consistently voicing dissatisfaction.

Positive User Experiences:

Some users have appreciated the features of the MT4 platform itself, as it allows for detailed analytics and trading.

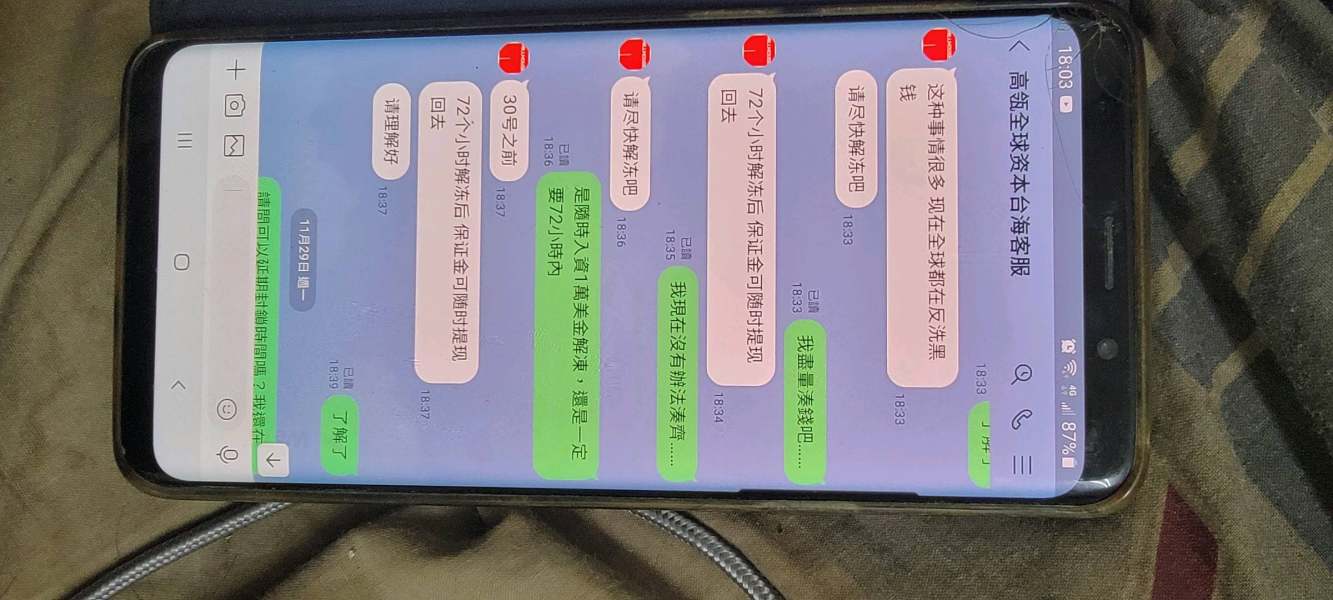

Negative User Experiences:

The overwhelming response, however, leans towards negative, with numerous complaints indicating emotional manipulation and fraud tactics that prevented users from withdrawing their funds.

Customer Support Analysis

Customer support options at Hillhouse include email and phone, offering limited ways to resolve issues.

Available Support Channels:

Users can only reach out via email or phone which can lead to delays in problem resolution.

User Feedback on Support:

Traders have indicated that responses to inquiries are often slow and sometimes unhelpful, exacerbating issues especially when dealing with fund withdrawals.

Account Conditions Analysis

Hillhouse provides a range of account types, yet the lack of clear regulatory backing makes it difficult to ascertain the genuine nature of these offerings.

Account Types Offered:

The accounts typically require a minimum deposit of $100, which aligns with many brokers catering to both novice and experienced traders.

Deposit and Withdrawal Processes:

Processes have been reported as cumbersome, particularly regarding withdrawals where users have found access difficult.

Conclusion

Hillhouse represents a precarious option within the trading landscape, offering a familiar trading platform without the safety net of regulation. The absence of legitimate oversight, accompanied by numerous user complaints regarding fund safety and withdrawal reliability, casts significant doubt on the broker's trustworthiness. Given the complexities and risks associated with trading through an unregulated broker, prospective traders are urged to prioritize platforms that meet rigorous regulatory standards.

Frequently Asked Questions (FAQs)

Q1: Is Hillhouse regulated?

- A1: No, it has been verified that this broker currently has no valid regulations.

Q2: Does Hillhouse offer the industry-leading MT4 & MT5?

- A2: Yes, Hillhouse offers the MT4 platform.

Q3: Is Hillhouse a good broker for beginners?

- A3: No, it is not a good choice for beginners due to its unregulated condition and negative feedback.

Risk Warning: Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Always ensure to understand the risks involved and regularly verify updated information directly with the company before making any decision.