Seven Wonders 2025 Review: Everything You Need to Know

Executive Summary

This seven wonders review looks at a forex broker that works as a CFD provider in Hong Kong. Seven Wonders started in 2018 and tries to compete in the forex market by offering high leverage up to 1:500 and using the popular MT4 trading platform. Our detailed analysis shows big information gaps that make it hard to give a complete review.

The broker's main draw is its high leverage, which brings in traders who want bigger market exposure through CFD tools. Using MetaTrader 4 gives users a familiar and strong trading setup. But the lack of clear regulatory information, few details about account conditions, and no user feedback create big worries for potential clients.

Seven Wonders seems to target traders interested in leveraged CFD trading, especially those comfortable with higher risk. The lack of detailed operational information and regulatory clarity makes it very hard for us to give a clear recommendation. Potential users should be very careful and do thorough research before working with this broker.

Important Notice

This seven wonders review uses limited public information available as of 2024. Different regional users may face varying legal and regulatory environments, though specific regulatory details for Seven Wonders remain unclear in available documents. Our review method relies on accessible public information, but the absence of detailed user feedback, regulatory data, and operational transparency greatly impacts how complete this assessment can be.

Readers should know that broker services and conditions may vary a lot across different areas. This review should be considered alongside additional research and professional advice before making any trading decisions.

Rating Framework

Broker Overview

Seven Wonders entered the forex market in 2018. The company set up its headquarters in Hong Kong and operates mainly as a Bullion CFD provider, focusing on delivering contract for difference trading services to international clients. This business model puts the broker within the growing CFD trading sector, which appeals to traders seeking different investment opportunities without direct asset ownership.

The broker's Hong Kong base might provide access to Asian financial markets and regulatory frameworks, though specific regulatory details remain unclear in available documents. As a CFD specialist, Seven Wonders targets traders interested in leveraged trading across various financial tools, though the exact range of available assets needs further clarification.

This seven wonders review notes that the company's recent start in 2018 places it among newer market entrants. The broker's focus on CFD trading and high leverage offerings suggests targeting of active traders and those seeking significant market exposure. The use of MetaTrader 4 as the primary trading platform shows alignment with industry-standard trading technology, potentially providing users with familiar and reliable trading tools.

The company's business model as a Bullion CFD provider suggests specialization in precious metals trading. However, detailed asset coverage information remains limited in available sources.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Seven Wonders operations. This lack of regulatory transparency represents a major concern for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in accessible sources. This absence of payment method transparency may impact user convenience and accessibility.

Minimum Deposit Requirements: Current documents do not specify minimum deposit amounts required for account opening. This information gap prevents potential clients from understanding entry-level investment requirements.

Bonus and Promotions: No specific information regarding promotional offers, welcome bonuses, or ongoing trading incentives is available in current sources. The absence of promotional details may indicate either conservative marketing approaches or limited competitive offerings.

Tradeable Assets: While Seven Wonders operates as a CFD provider, specific details regarding available trading instruments, asset categories, and market coverage remain unclear in available documents. The broker's focus appears to be on precious metals trading based on its Bullion CFD provider designation.

Cost Structure: Critical information regarding spreads, commissions, overnight fees, and other trading costs is not specified in accessible sources. This represents a major information gap for cost-conscious traders.

Leverage Ratios: Seven Wonders offers leverage up to 1:500, representing one of the few clearly specified trading conditions available in current documents. This high leverage ratio attracts traders seeking amplified market exposure.

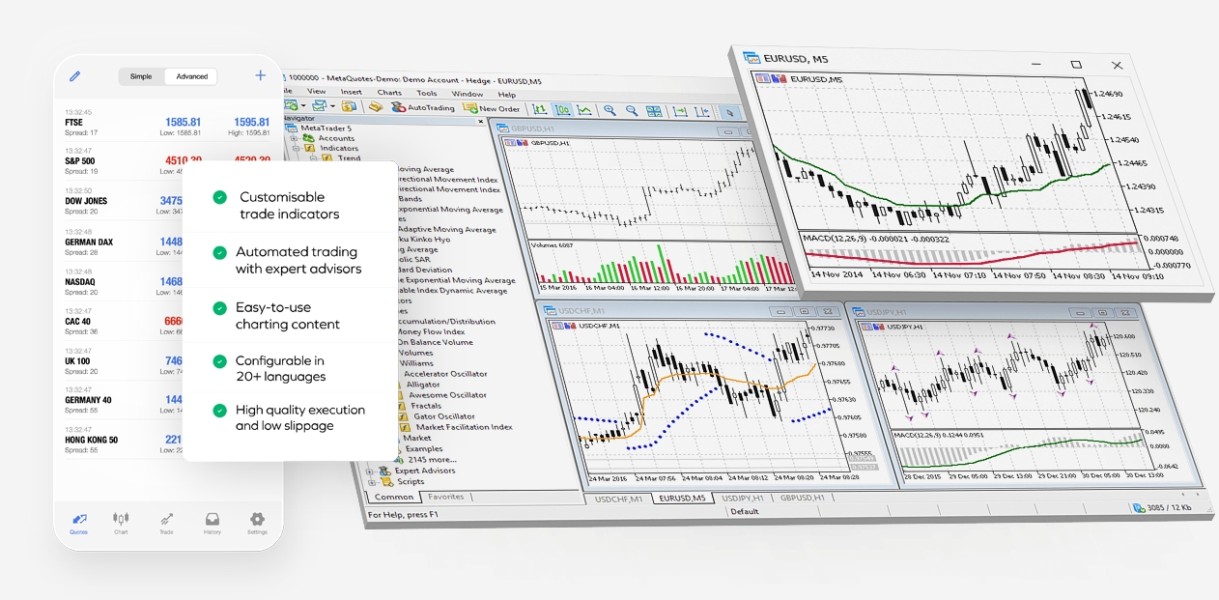

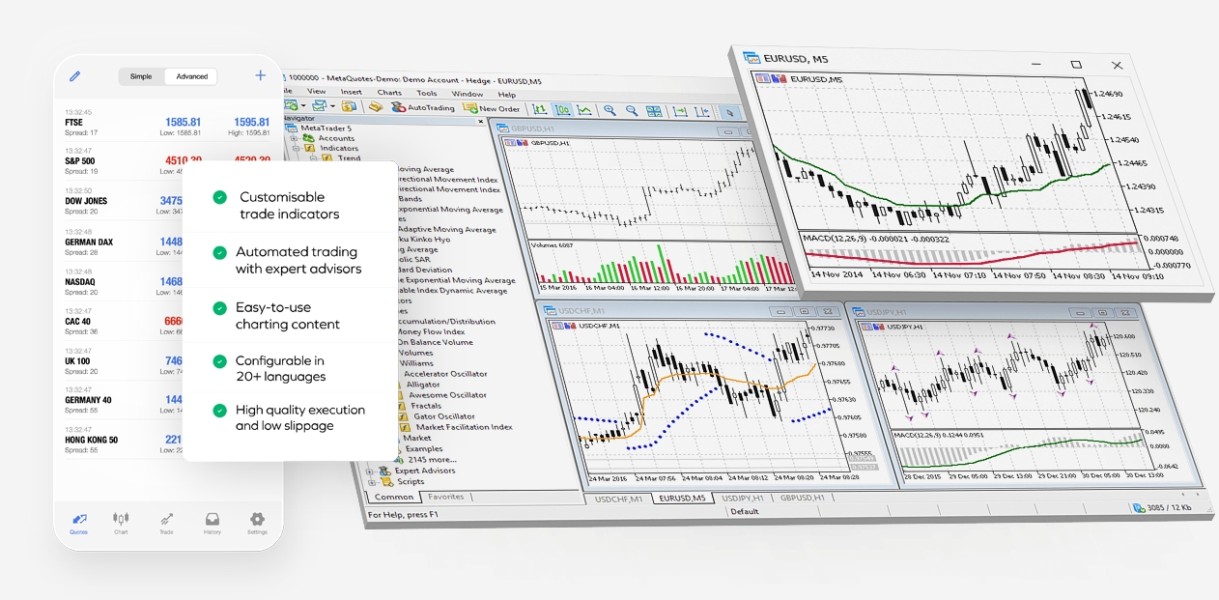

Platform Options: The broker provides MetaTrader 4 trading platform. This offers users access to popular and widely-used trading technology with detailed charting and analysis tools.

Geographic Restrictions: Specific information regarding restricted areas or geographic limitations is not available in current sources. Potential clients should verify their eligibility based on their location.

Customer Service Languages: Available documents do not specify supported languages for customer service communications. This may impact international clients' ability to receive assistance in their preferred languages.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The seven wonders review reveals major information gaps regarding account conditions, resulting in a neutral rating. Available sources do not provide details about account type varieties, their specific features, or different service levels. This absence of account structure information prevents potential clients from understanding available options and selecting appropriate account types for their trading needs.

Minimum deposit requirements remain unspecified. This makes it impossible to assess accessibility for different trader segments or evaluate the broker's positioning within the market. The lack of deposit information also prevents comparison with industry standards and competitor offerings.

Account opening procedures and verification processes are not detailed in available documents. This information gap impacts potential clients' ability to understand onboarding requirements, documentation needs, and timeline expectations for account activation.

Special account features are not mentioned in accessible sources. These might include Islamic accounts for Sharia-compliant trading, VIP accounts for high-volume traders, or demo accounts for practice trading. This absence of specialized account options may limit the broker's appeal to diverse trader segments with specific requirements.

Seven Wonders provides MetaTrader 4 as its primary trading platform. This represents a positive aspect of their service offering since MT4 is widely recognized for its detailed charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. This platform choice suggests alignment with industry standards and provides users with familiar trading environments.

Available information does not detail additional trading tools, market analysis resources, or educational materials provided by the broker. The absence of proprietary tools, market research, or analytical resources may limit the overall value proposition for traders seeking detailed trading support.

Educational resources are not mentioned in available documents. These might include webinars, tutorials, trading guides, or market analysis, which represents a major gap for newer traders who rely on broker-provided education to develop trading skills and market understanding.

Automated trading support through MT4's Expert Advisor functionality is likely available given the platform choice. However, specific broker policies regarding automated trading, restrictions, or additional support are not clarified in accessible sources.

Customer Service and Support Analysis (Score: 5/10)

Available documents provide no specific information regarding customer service channels, availability, or quality standards. This absence of customer support details represents a major concern for potential clients who prioritize responsive and accessible customer service.

Response time expectations, service level agreements, and problem resolution procedures are not specified in current sources. Without clear customer service standards, potential clients cannot evaluate the broker's commitment to client support and issue resolution.

Multilingual support capabilities remain unclear. This may impact international clients' ability to receive assistance in their preferred languages since the broker has a Hong Kong base and potential international client focus, making language support details particularly relevant.

Customer service hours, time zone coverage, and weekend availability are not detailed in accessible information. This lack of availability information may impact clients' ability to receive timely assistance during critical trading periods or urgent situations.

Trading Experience Analysis (Score: 6/10)

The use of MetaTrader 4 suggests a potentially solid trading experience. This is because the platform has a reputation for stability, functionality, and user-friendly interface, and MT4's detailed charting tools, technical indicators, and order management capabilities typically provide traders with strong trading environments.

This seven wonders review notes the absence of specific information regarding platform stability, execution speeds, or server reliability. Without performance data or user feedback, it's challenging to assess the actual trading experience quality beyond platform selection.

Order execution quality is not detailed in available sources. This includes fill rates, slippage rates, and execution speeds, which significantly impact trading experience and profitability, particularly for active traders and scalping strategies.

Mobile trading capabilities through MT4's mobile applications are likely available. However, broker-specific mobile features, customizations, or additional mobile tools are not specified in current documents.

Trust and Safety Analysis (Score: 4/10)

The absence of clear regulatory information represents the most major concern in this seven wonders review. Without specified regulatory oversight, clients cannot verify the broker's compliance with financial services regulations or assess available protections for client funds.

Fund safety measures are not detailed in available documents. These might include segregated client accounts, deposit insurance, or investor compensation schemes, and this lack of fund protection information raises serious concerns about client asset security.

Company transparency regarding ownership, financial statements, or corporate governance is not evident in accessible sources. This absence of transparency may impact client confidence and trust in the broker's operations.

Industry reputation, awards, or third-party recognitions are not mentioned in available information. Without external validation or industry acknowledgment, it's difficult to assess the broker's standing within the financial services community.

User Experience Analysis (Score: 5/10)

Available documents lack user feedback, testimonials, or satisfaction surveys that would provide insights into actual user experiences. This absence of user voice significantly limits our ability to assess real-world user satisfaction and identify common issues or strengths.

Interface design, platform customization options, and user-friendly features are not specifically detailed beyond the MT4 platform selection. While MT4 provides a standard interface, broker-specific customizations or additional user experience enhancements remain unclear.

Registration and verification processes are not described in accessible sources. This prevents assessment of onboarding convenience and efficiency since user-friendly account opening procedures significantly impact initial user experience and broker accessibility.

Funding operations are not detailed in available information. These include deposit processing times, withdrawal procedures, and transaction fees, which significantly impact ongoing user experience and satisfaction with broker services.

Conclusion

This detailed seven wonders review reveals a broker with limited transparent information available for thorough evaluation. Seven Wonders offers high leverage ratios up to 1:500 and uses the reputable MT4 trading platform, but major information gaps regarding regulatory status, account conditions, and operational details create substantial concerns.

The broker appears most suitable for experienced traders comfortable with higher risk profiles who prioritize leverage availability over regulatory transparency. The absence of clear regulatory oversight and limited operational transparency make Seven Wonders a questionable choice for risk-averse traders or those prioritizing fund safety and regulatory protection.

Primary advantages include high leverage availability and standard MT4 platform access. Major disadvantages include regulatory uncertainty, limited transparency, and absence of detailed service information. Potential clients should exercise considerable caution and seek additional information before engaging with this broker.