Rc Global 2025 Review: Everything You Need to Know

The overall sentiment surrounding Rc Global is overwhelmingly negative, with multiple sources labeling it as an unregulated and potentially fraudulent broker. Despite offering the popular MetaTrader 4 platform, the lack of transparency regarding trading conditions and regulatory oversight raises significant concerns for prospective traders.

Note: It is important to consider the varying regulatory environments across different regions, as this can impact the safety and legitimacy of trading with brokers like Rc Global. This review aims for fairness and accuracy by synthesizing information from various credible sources.

Rating Overview

We score brokers based on a comprehensive analysis of user feedback, expert opinions, and factual data.

Broker Overview

Founded in 2018, Rc Global is a forex broker that claims to operate under the jurisdiction of Belize, holding an offshore license from the International Financial Services Commission (IFSC). However, numerous reviews suggest that this license is not sufficient to ensure trader safety, as the regulatory standards in Belize are considered lax. The broker primarily offers trading on the MetaTrader 4 platform, which is well-regarded in the industry for its functionality and user-friendly interface. However, Rc Global does not provide clear information on the types of accounts available, minimum deposit requirements, or the specific assets that can be traded.

Detailed Analysis

Regulatory Status

Rc Global is registered in Belize, which is known for its lenient regulatory framework. The broker has been reported to be in the process of surrendering its Belizean license, raising further red flags about its legitimacy. Additionally, the broker claims to have offices in multiple countries, including the USA and the UK, but does not hold licenses from any reputable regulatory bodies like the FCA or ASIC, which are crucial for ensuring client fund protection.

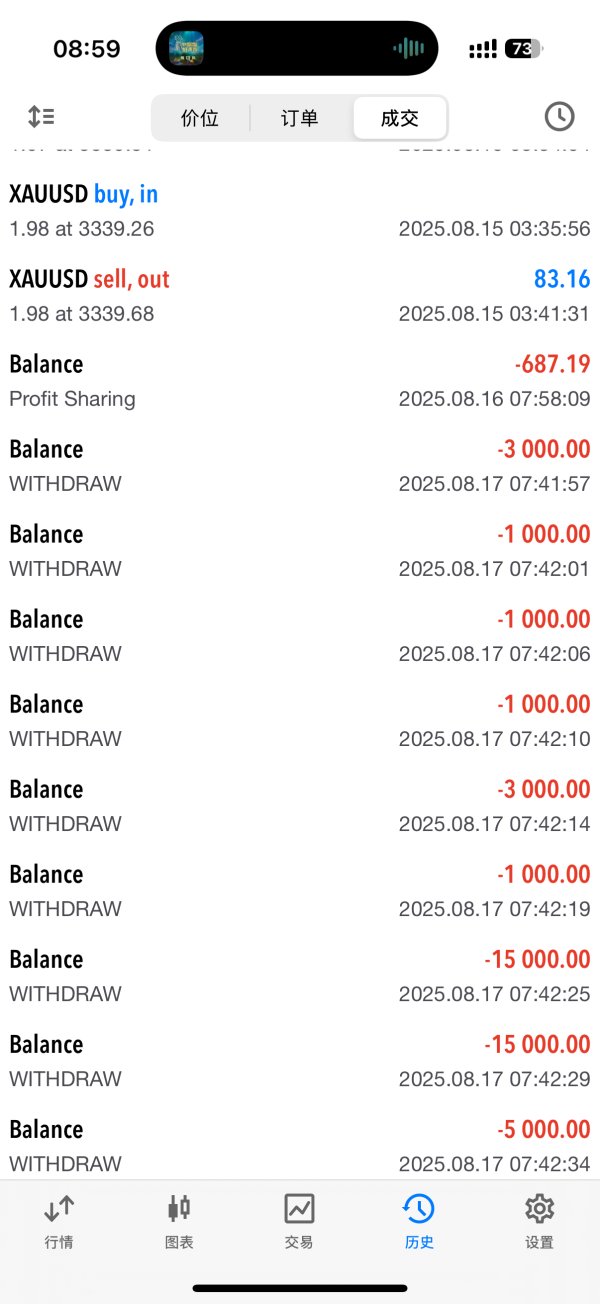

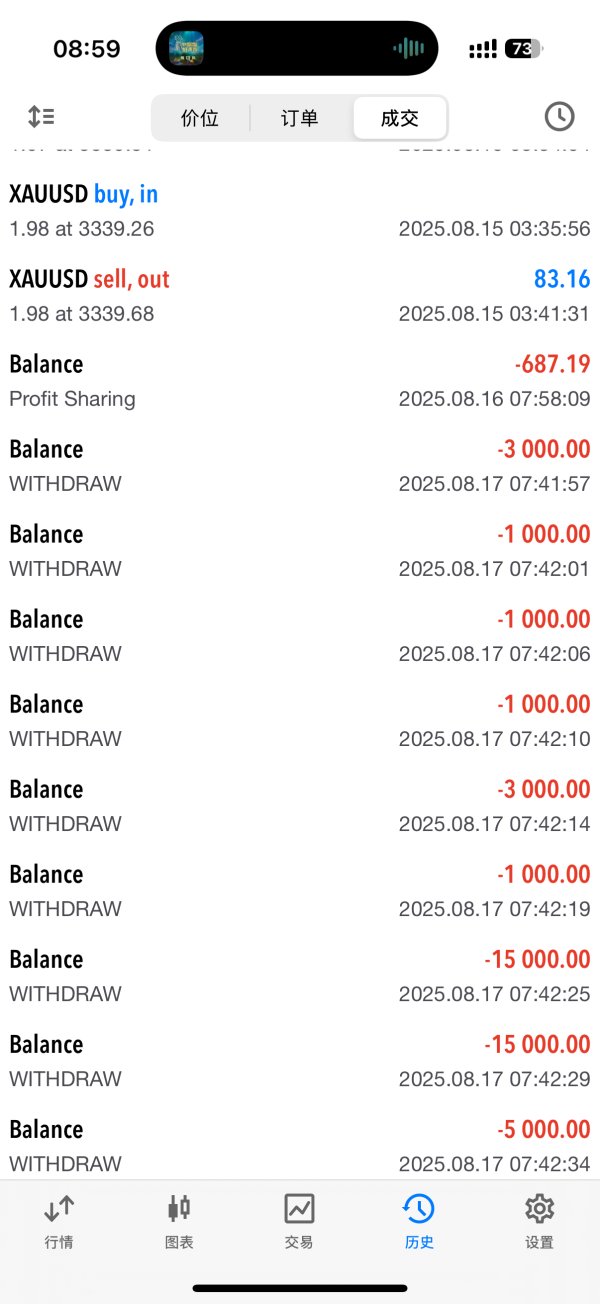

Deposit/Withdrawal Currencies

While specific information on deposit and withdrawal methods is scarce, it is crucial for potential clients to inquire directly with the broker. Many unregulated brokers often have convoluted withdrawal processes, which can be a significant barrier for traders looking to access their funds.

Minimum Deposit

The lack of transparency extends to the minimum deposit requirement, which is not clearly stated on the Rc Global website. This absence of information is a common concern among unregulated brokers, where traders often find themselves facing unexpected costs.

There is no clear information regarding bonuses or promotions offered by Rc Global. Many brokers use bonuses as a marketing tactic, but it is essential to read the terms carefully, especially with unregulated firms that may impose stringent conditions.

Tradable Asset Classes

The specific asset classes available for trading with Rc Global are not well-defined in the available reviews. This lack of clarity can deter potential traders who wish to diversify their portfolios.

Costs (Spreads, Fees, Commissions)

According to various sources, Rc Global offers spreads starting at 2 pips for major currency pairs like EUR/USD, which is considered high compared to industry standards. Many reputable brokers offer significantly lower spreads, making Rc Global less competitive.

Leverage

Information regarding the leverage offered by Rc Global is also absent, which is concerning for traders who rely on leverage to amplify their trading positions.

The only trading platform mentioned in relation to Rc Global is MetaTrader 4. While MT4 is a popular choice among traders, the lack of options may limit the trading experience for some users.

Restricted Regions

The reviews do not provide specific details on restricted regions, but the unregulated status of Rc Global suggests that traders from certain jurisdictions may face challenges when attempting to open accounts or withdraw funds.

Available Customer Support Languages

Customer support for Rc Global appears to be limited, with reports indicating difficulties in reaching their support team. The lack of reliable customer service is a significant drawback for any broker, especially for those dealing with unregulated entities.

Repeated Rating Overview

Detailed Breakdown

Account Conditions

The absence of clear information regarding account types and minimum deposits makes Rc Global a risky choice for traders. Potential clients should be cautious about engaging with brokers that lack transparency.

While the MT4 platform is a strong point, the overall lack of resources and educational materials limits the trading experience. Many reputable brokers offer comprehensive educational resources that are missing here.

Customer Service and Support

Multiple reviews indicate that customer service is lacking, with traders reporting difficulty in reaching support and receiving timely responses. This is critical for any trading platform, especially for those who may encounter issues.

Trading Setup (Experience)

The overall trading experience is marred by the lack of information and high spreads. Traders may find themselves at a disadvantage when competing against more established brokers.

Trustworthiness

The general consensus is that Rc Global is an unregulated broker with a high risk of fraud. This is a significant concern for any potential trader.

User Experience

The user experience is negatively impacted by the lack of information and questionable regulatory status. Traders are advised to proceed with caution.

In conclusion, based on the Rc Global review, it is highly recommended that potential traders avoid this broker due to its unregulated status and the significant risks involved.