Ramon 2025 Review: Everything You Need to Know

Summary

This Ramon review looks at a service with mixed features. It combines elements that suggest both film-related content and potential brokerage services, creating an interesting but unclear profile. Based on available information, Ramon presents a neutral profile with limited regulatory transparency and diverse user feedback that ranges from very positive to somewhat critical. The service appears to cater primarily to audiences interested in cinematic content, potentially targeting younger demographics who seek alternatives to mainstream entertainment options.

User reviews range from highly positive experiences praising the content quality to more critical assessments highlighting areas for improvement. The absence of clear regulatory information and limited transparency regarding operational details raises questions about the service's positioning in the financial services sector, making it difficult for potential users to fully understand what they're getting into. This comprehensive evaluation aims to provide potential users with essential insights into Ramon's offerings, limitations, and overall value proposition in 2025.

Important Notice

Due to the absence of comprehensive regulatory information in available sources, potential users should be aware that legal compliance may vary across different jurisdictions. This ramon review is based on user feedback and publicly available information, without independent verification of all operational claims, which means some details might not be completely accurate or up-to-date. Readers should exercise due diligence and consider consulting with financial advisors before making any service-related decisions.

The evaluation presented here reflects information available at the time of writing and may not capture all recent developments or changes in service offerings. Users should always do their own research before committing to any service, especially when regulatory information is limited or unclear.

Rating Framework

Broker Overview

Ramon operates under the leadership of Ramon Sanchez-Vinas, who serves as the chief broker for TCI Group. The organization focuses on commercial brokerage and insurance brokerage activities, though specific establishment dates and detailed company history remain undisclosed in available materials, creating some uncertainty about the company's background and experience level.

The service structure suggests a hybrid approach that may include both traditional brokerage services and content-related offerings, particularly in the entertainment sector. The operational model appears to emphasize accessibility and user engagement, as evidenced by the diverse range of user feedback received from various demographic groups.

However, the lack of detailed information regarding trading platforms, asset categories, and regulatory oversight creates uncertainty about the service's primary focus and target market positioning. Without clear disclosure of regulatory authorities or compliance frameworks, potential users face challenges in assessing the service's legitimacy and operational standards within the financial services industry, which is a significant concern for anyone considering using their services.

Regulatory Jurisdiction: Available sources do not specify particular regulatory authorities overseeing Ramon's operations. This creates uncertainty about compliance standards and investor protection measures that users might expect from financial service providers.

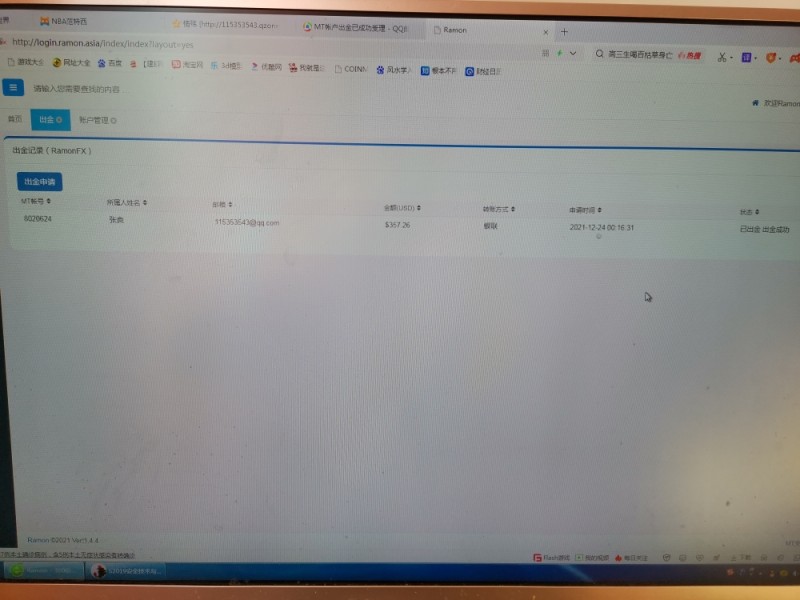

Deposit and Withdrawal Methods: Specific information regarding funding options, processing times, and associated fees is not detailed in available documentation.

Minimum Deposit Requirements: Exact minimum deposit amounts and account funding thresholds are not specified in current information sources. This makes it difficult for potential users to plan their initial investment or understand entry barriers to the service.

Bonuses and Promotions: Details about promotional offers, welcome bonuses, or ongoing incentive programs are not mentioned in available materials.

Tradeable Assets: The range of available instruments, markets, and investment options remains unspecified in this ramon review based on current information. Users cannot determine what types of investments or trading opportunities might be available through the platform.

Cost Structure: Commission rates, spread information, overnight fees, and other trading costs are not detailed in accessible sources.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in available documentation. This information is typically crucial for traders who want to understand their potential exposure and risk levels.

Platform Options: Information about trading platforms, software compatibility, and technical specifications is not provided in current sources.

Regional Restrictions: Specific geographical limitations or service availability constraints are not mentioned in available materials. Users from different countries cannot determine if the service is available in their region or what restrictions might apply.

Customer Support Languages: Available language options for customer service communications are not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for Ramon reflects significant information gaps that prevent a comprehensive assessment. Without detailed specifications about account types, minimum deposit requirements, or opening procedures, potential users face uncertainty about basic service parameters that are typically clearly outlined by reputable financial service providers.

The absence of information regarding special account features, such as Islamic accounts or professional trader options, limits the service's apparent accessibility to diverse user groups. Account opening processes and verification requirements remain unspecified, making it difficult for prospective users to understand onboarding expectations and prepare necessary documentation.

The lack of transparent fee structures and account maintenance costs further complicates decision-making for potential clients. Compared to established industry standards, the limited disclosure of account conditions represents a significant disadvantage in this ramon review, as users typically expect clear information about account tiers, benefits, and associated costs when evaluating financial service providers.

The evaluation of trading tools and resources reveals substantial information deficiencies that impact the overall assessment. Available sources do not detail the types of analytical tools, charting capabilities, or research resources provided to users, which are typically essential components of any serious trading platform.

Educational materials, market analysis, and learning resources that are typically essential for user development and success remain unspecified in current documentation. Automated trading support, algorithm compatibility, and third-party tool integration possibilities are not addressed in available information, leaving users uncertain about advanced functionality.

The absence of details about mobile applications, desktop platforms, or web-based interfaces creates uncertainty about technological capabilities. Professional traders and experienced users typically require sophisticated tools and comprehensive resources, which cannot be evaluated based on current information availability, significantly impacting the service's competitiveness in the modern financial services landscape.

Customer Service and Support Analysis (5/10)

Customer service evaluation reveals limited information about support infrastructure and service quality standards. Available contact methods, response time commitments, and service availability hours are not specified in accessible documentation, making it difficult for users to understand what level of support they can expect.

Multilingual support options and regional service variations remain unspecified, potentially limiting accessibility for international users. User feedback regarding customer service experiences is not detailed in available sources, preventing assessment of satisfaction levels and service effectiveness that would help potential users set appropriate expectations.

Professional support for complex issues, technical assistance, and account management services are not described in current materials. The absence of clear service level agreements and support guarantees creates uncertainty about user experience expectations and service reliability standards, which is particularly concerning for users who might need immediate assistance with time-sensitive trading decisions.

Trading Experience Analysis (5/10)

The trading experience assessment faces significant challenges due to limited information about platform performance and functionality. Platform stability, execution speed, and order processing capabilities are not detailed in available sources, which are crucial factors for anyone considering active trading through the platform.

User interface design, navigation efficiency, and overall usability cannot be evaluated based on current documentation. Mobile trading capabilities, cross-platform synchronization, and offline functionality remain unspecified in this ramon review, leaving users uncertain about accessibility and convenience features.

Advanced trading features, order types, and execution options that experienced traders typically require are not described in accessible materials. Market access, instrument availability, and trading hours are not detailed in current information sources, making it impossible for users to determine if the platform meets their specific trading needs and preferences.

Trust and Security Analysis (3/10)

The trust and security evaluation reveals concerning information gaps that significantly impact confidence levels. The absence of regulatory oversight details, compliance certifications, and industry authorizations creates substantial uncertainty about operational legitimacy that would concern any prudent investor or user.

Company transparency regarding ownership structure, financial statements, and operational history remains limited in accessible sources. Industry reputation, peer recognition, and third-party validations are not detailed in current materials, making it difficult to verify the company's standing within the financial services community.

The handling of negative events, dispute resolution procedures, and customer protection measures cannot be assessed based on available information. Without clear regulatory backing and transparency measures, users face elevated risks when considering service engagement, which is particularly problematic in the financial services sector where trust and security are paramount concerns.

User Experience Analysis (6/10)

User experience evaluation benefits from available feedback indicating mixed but generally positive reception among certain user segments. Reviews suggest that the service appeals particularly to audiences interested in cinematic content, with several users expressing satisfaction with the overall experience quality and content delivery.

Positive feedback highlights the service's ability to provide engaging, family-friendly content that differs positively from mainstream alternatives. The user base appears to appreciate the non-vulgar, feel-good nature of the content provided, suggesting successful targeting of specific demographic preferences and market positioning.

However, some users have expressed disappointment with certain aspects of the service, indicating areas for potential improvement. Interface design and navigation ease cannot be fully assessed due to limited technical information, but user satisfaction indicators suggest reasonable usability standards that meet basic expectations.

The service appears to successfully differentiate itself from competitors in certain aspects, contributing to positive user perception among its target audience. This differentiation seems to be particularly effective in the entertainment content space, where users value alternatives to mainstream offerings.

Conclusion

This ramon review presents a mixed assessment of a service that operates with limited transparency and unclear regulatory positioning. While user feedback indicates positive experiences among certain demographics, particularly those interested in entertainment content, the absence of comprehensive operational information raises significant concerns for potential users seeking traditional financial services.

The service appears best suited for audiences interested in cinematic content and entertainment experiences rather than professional trading or investment activities. Key advantages include diverse user appeal and positive content quality feedback, while major disadvantages encompass regulatory uncertainty and limited disclosure of essential service parameters that users typically expect from financial service providers.