Prolio Review 1

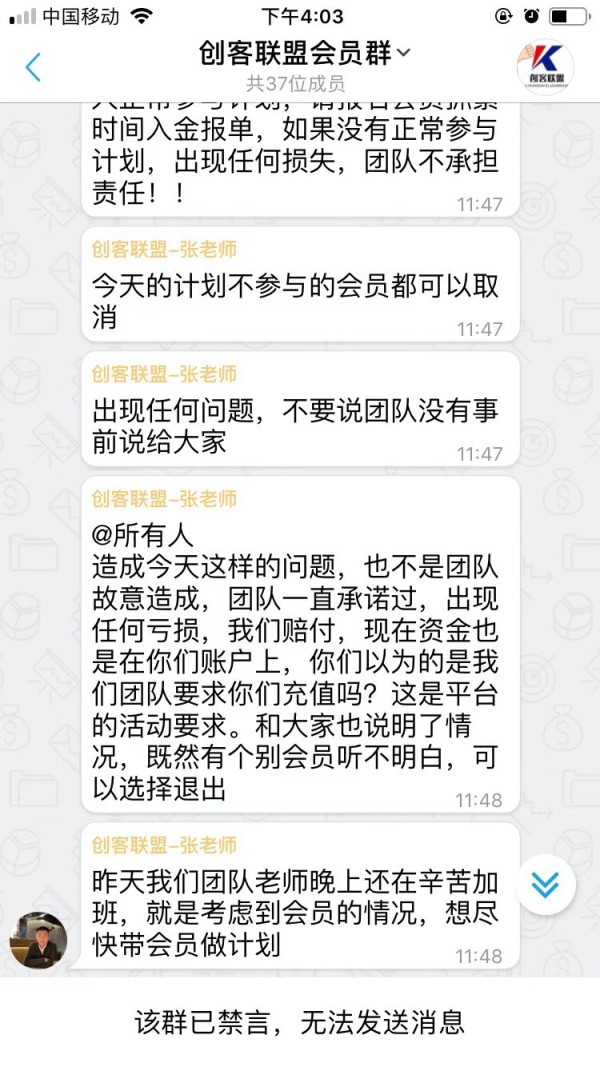

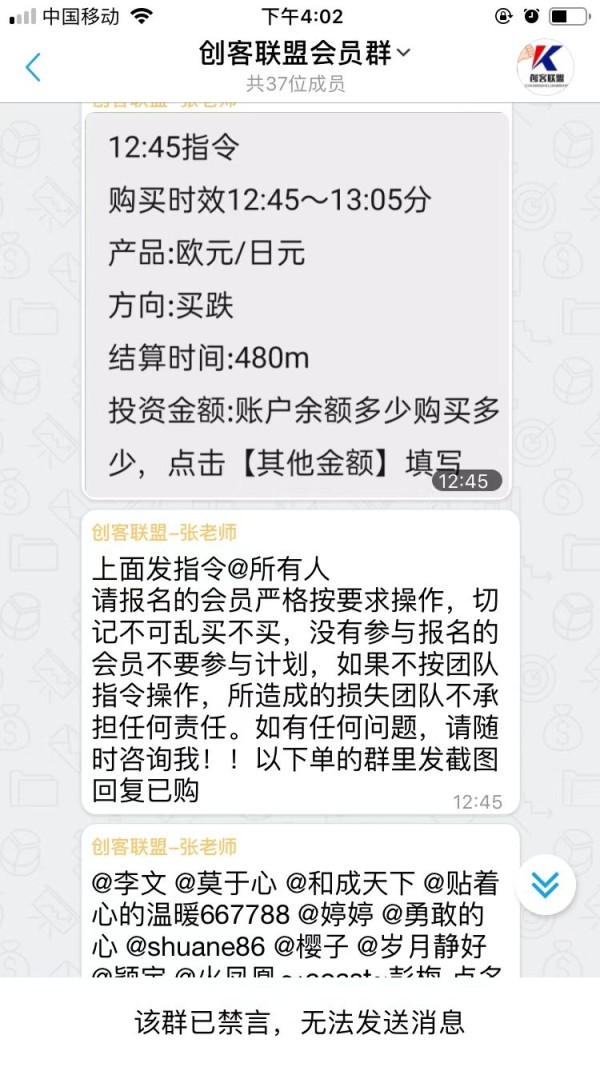

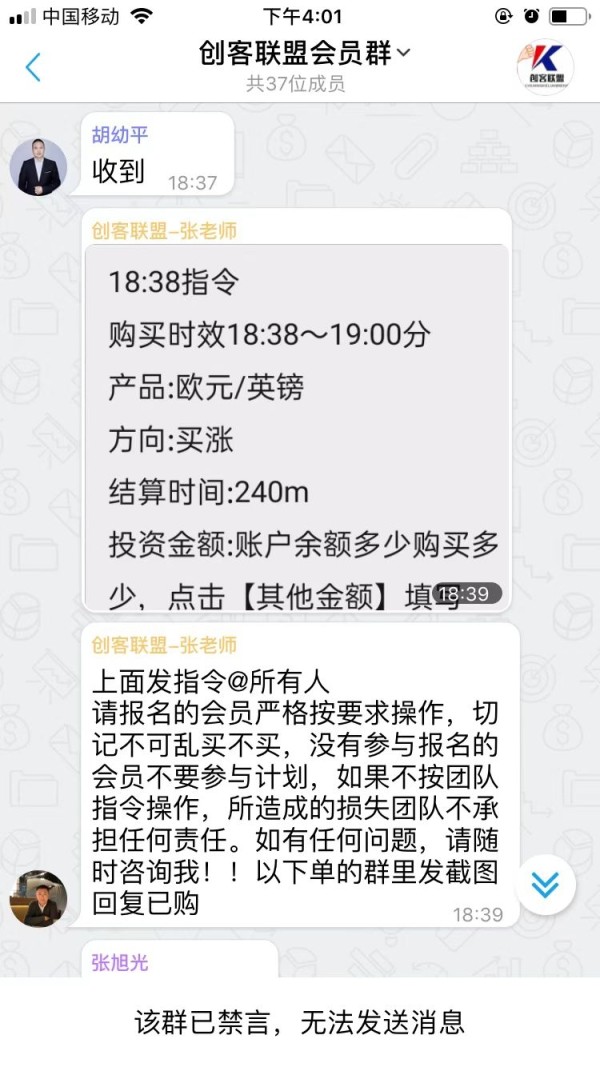

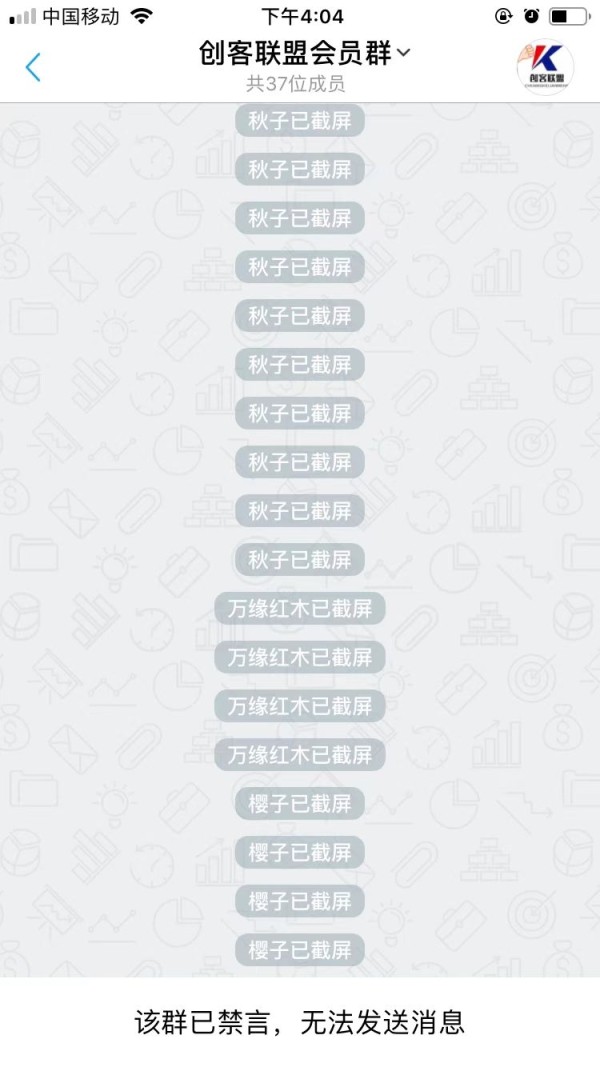

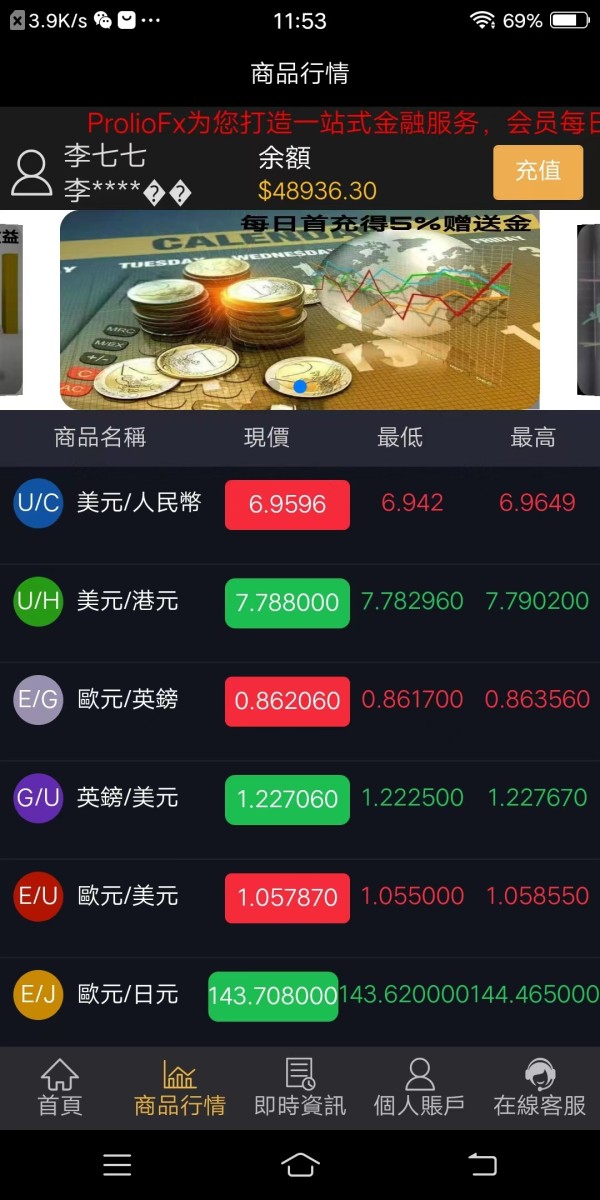

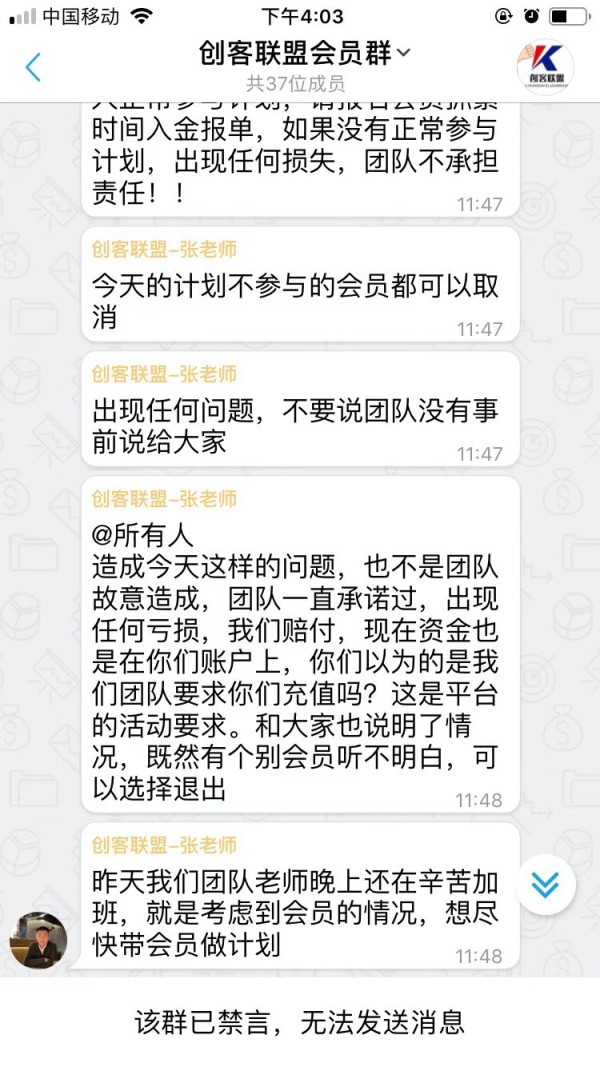

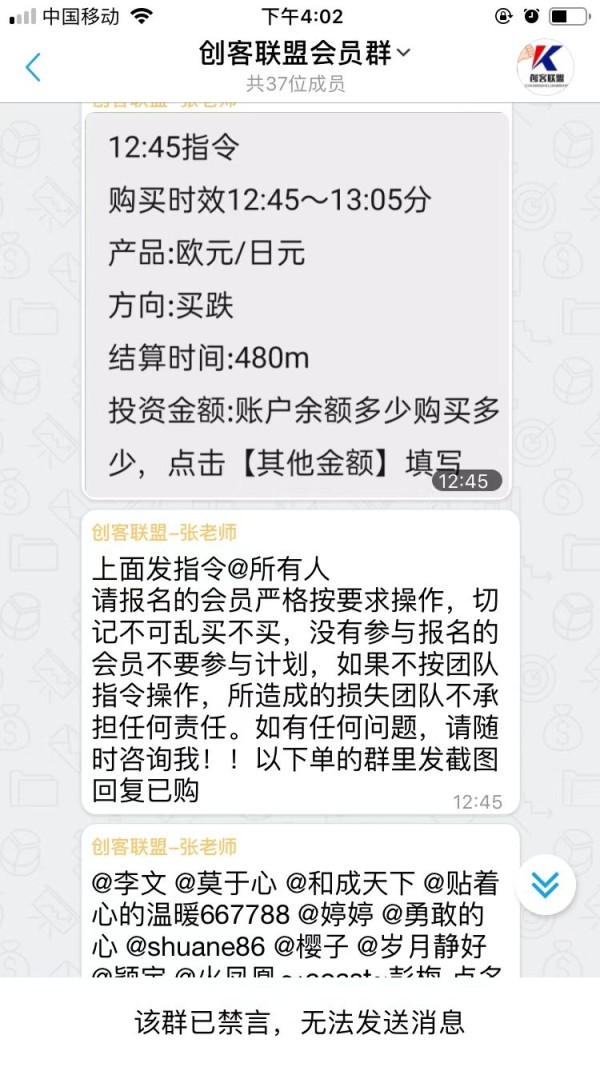

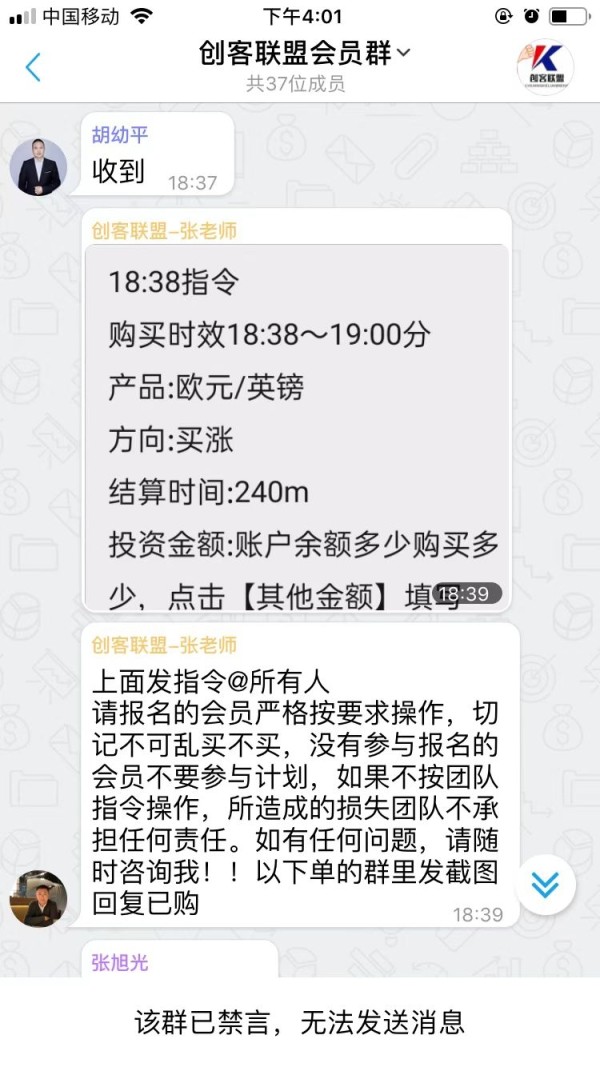

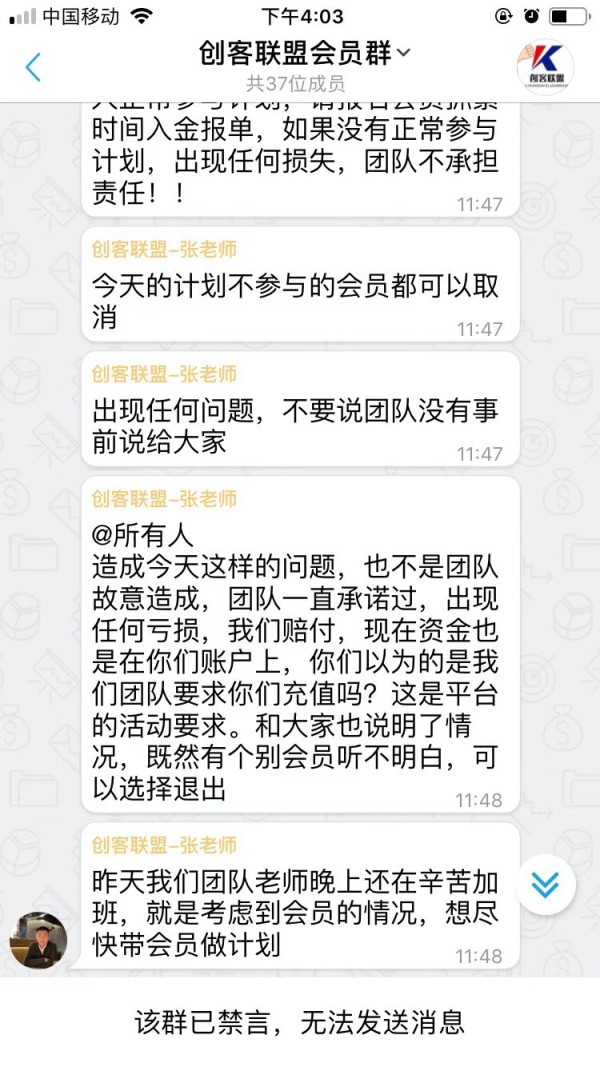

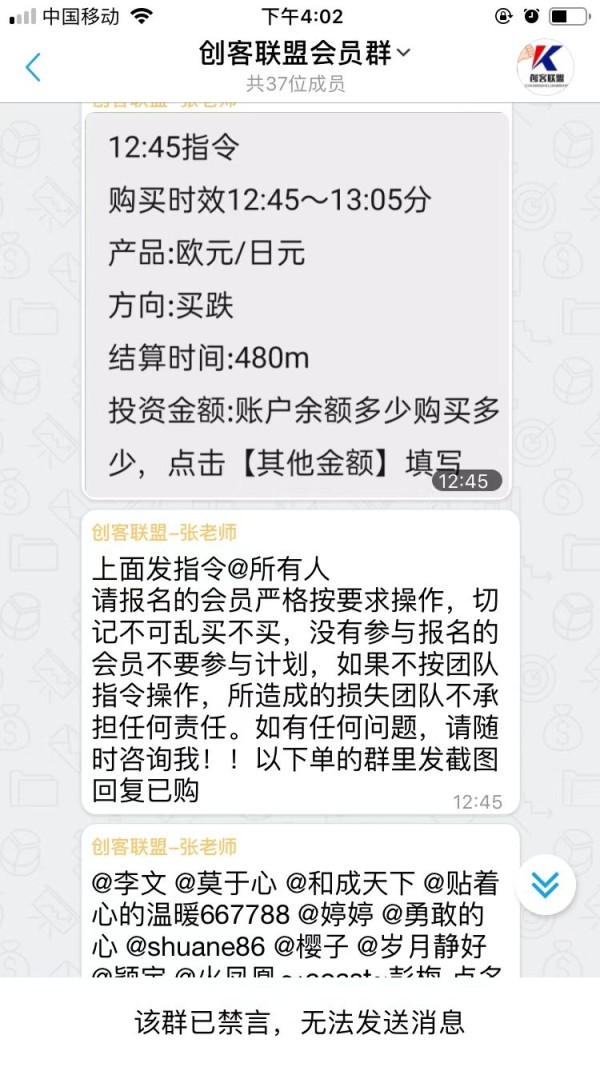

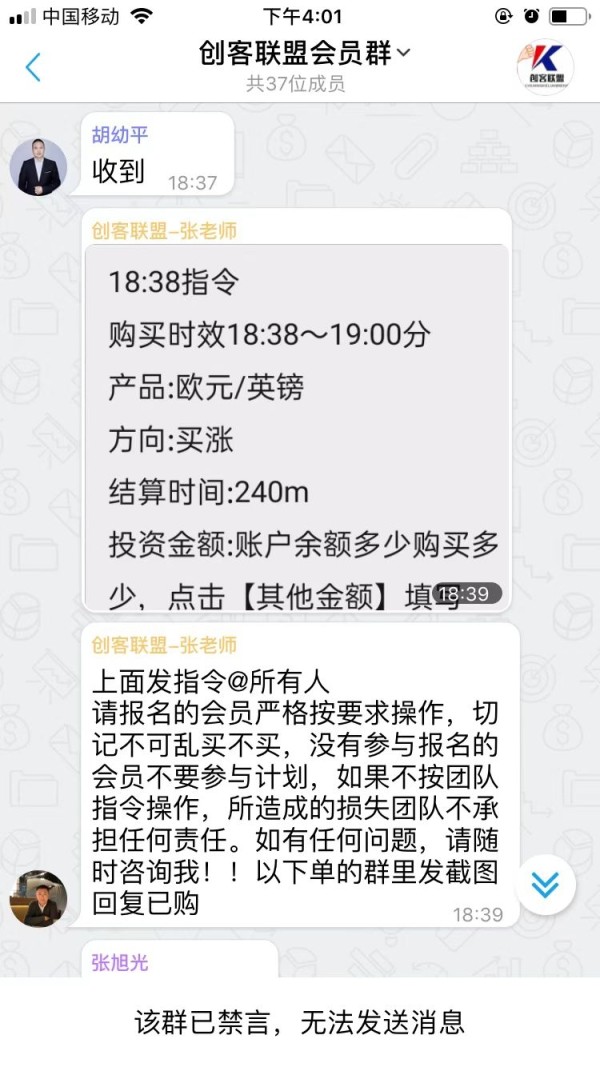

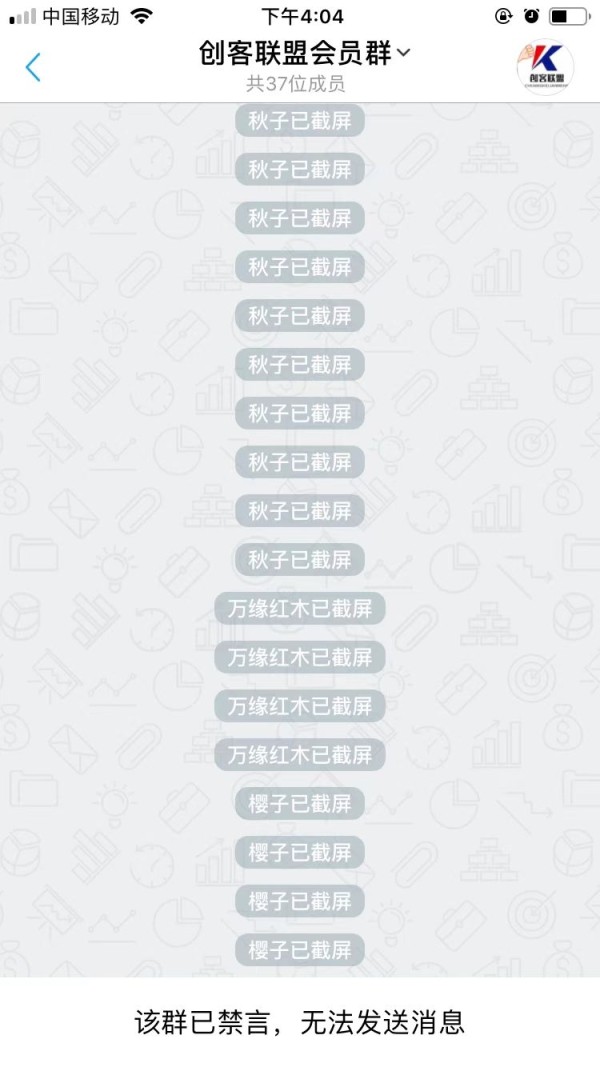

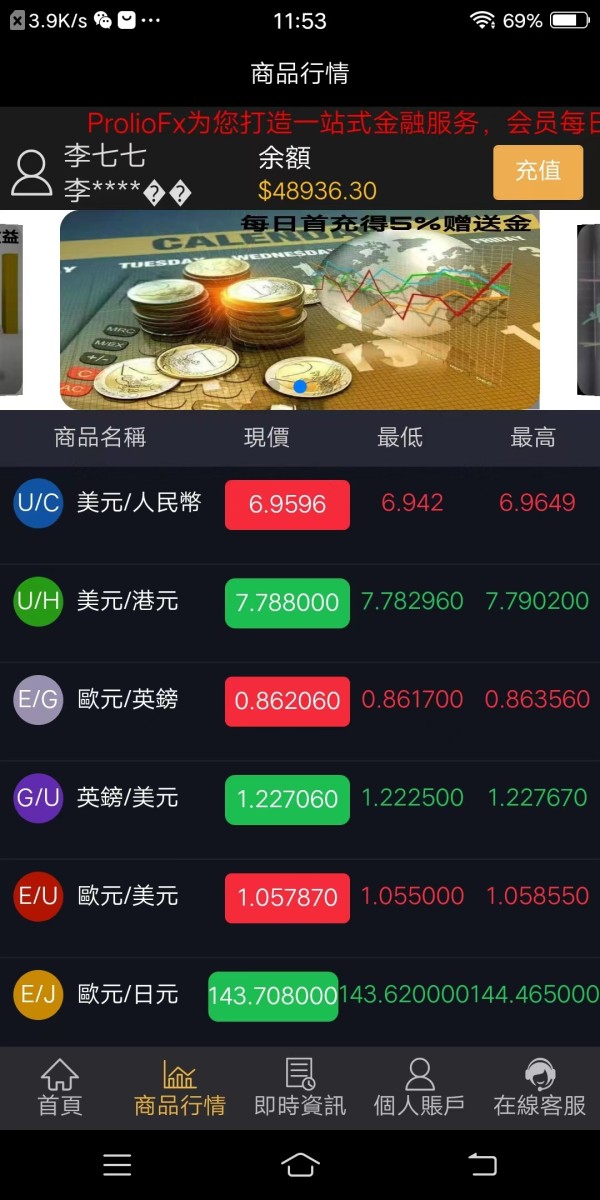

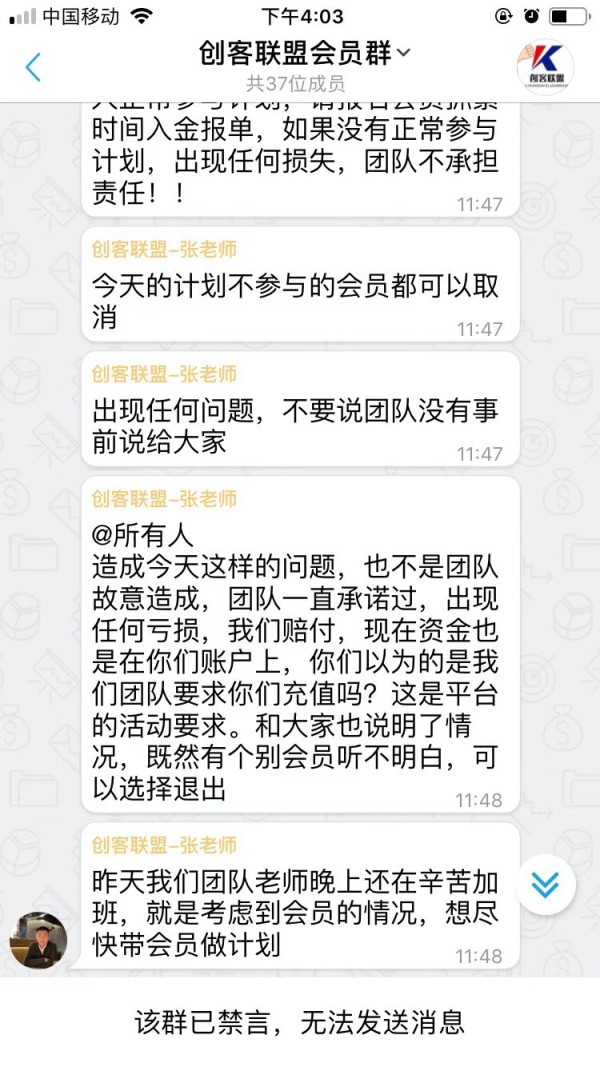

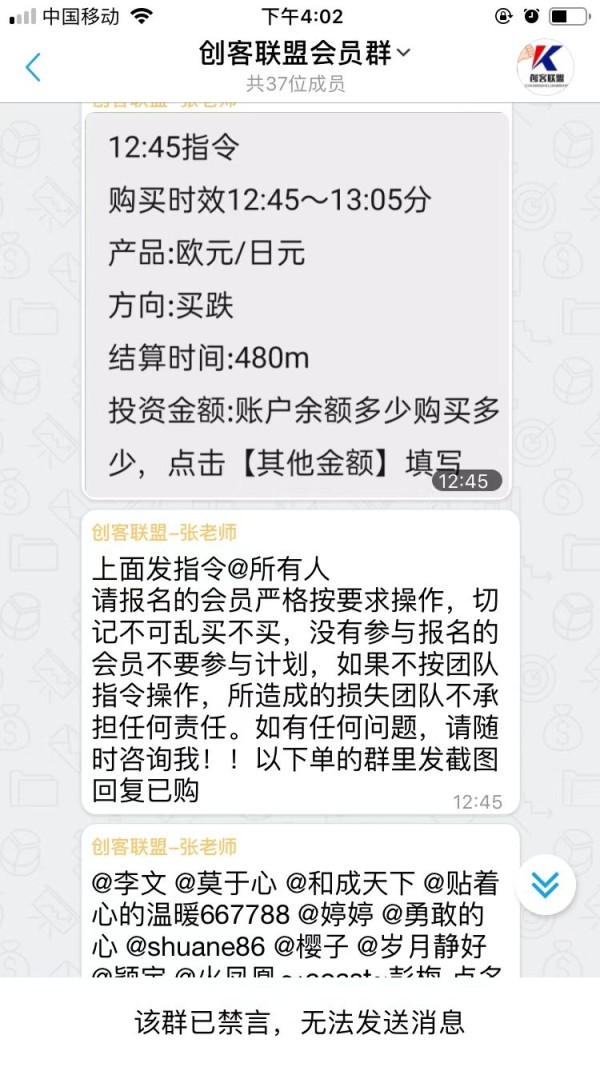

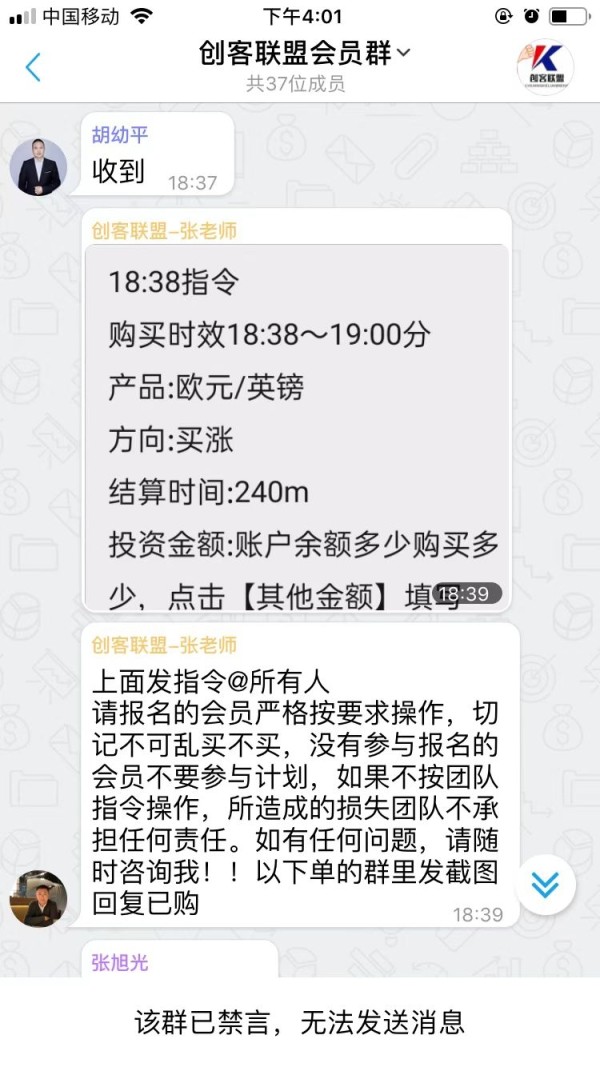

ProlioFX is a scam. Everyone be careful. Attatch the screenshot

Prolio Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

ProlioFX is a scam. Everyone be careful. Attatch the screenshot

Prolio works as a forex broker. It offers zero spread trading conditions and ultra-fast execution speeds, positioning itself primarily for high-frequency traders and cost-conscious market participants. This Prolio review examines a broker that claims an average trading speed of 0ms and zero spread costs. These are attractive features for active traders seeking minimal transaction expenses.

However, our analysis reveals significant concerns regarding transparency and regulatory oversight. With a user rating of 2.9 out of 10 based on 375 reviews, Prolio faces substantial credibility challenges. The lack of clear regulatory information and company background details raises questions. These questions concern the broker's legitimacy and long-term viability.

The platform appears to target traders who prioritize low trading costs over comprehensive regulatory protection. While the technical specifications suggest competitive execution capabilities, the absence of detailed information about account conditions, trading platforms, and customer support infrastructure indicates potential gaps in service delivery. Our neutral assessment reflects the mixed nature of Prolio's offering.

Technically competitive trading conditions are overshadowed by transparency concerns and poor user feedback. Prospective clients should exercise considerable caution and conduct thorough due diligence before engaging with this broker.

This review is based on available user feedback and publicly accessible trading conditions. Traders should note that Prolio operates with limited regulatory transparency. Users must carefully consider the legal and regulatory requirements in their respective jurisdictions before opening accounts.

The information presented in this analysis may vary across different regions. Potential clients should verify all details directly with the broker. Our evaluation methodology incorporates user reviews, technical specifications, and industry standard comparisons where data is available.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 3/10 | Poor |

| Tools and Resources | 2/10 | Very Poor |

| Customer Service and Support | 2/10 | Very Poor |

| Trading Experience | 4/10 | Below Average |

| Trust and Reliability | 2/10 | Very Poor |

| User Experience | 3/10 | Poor |

Prolio presents itself as a forex broker in the competitive online trading landscape. Specific details about its establishment date and corporate history remain unclear from available sources. The broker's business model appears focused on providing low-cost trading solutions. It particularly emphasizes zero spread conditions and rapid execution speeds that appeal to scalpers and high-frequency trading strategies.

The company's operational structure and geographical presence lack detailed documentation in publicly available materials. This absence of comprehensive corporate information represents a significant transparency gap. Potential clients should consider this gap when evaluating the broker's credibility and long-term stability.

Prolio's primary service offering centers on forex trading. The platform advertises technical capabilities that include instantaneous trade execution and zero spread costs. However, the limited information available about additional asset classes, trading platforms, and comprehensive service offerings suggests a narrow focus. This focus may not meet the needs of diversified trading strategies.

The regulatory framework governing Prolio's operations remains unclear from available documentation. This regulatory ambiguity, combined with the low user satisfaction ratings, indicates potential challenges in client protection and dispute resolution mechanisms. These mechanisms are typically associated with well-regulated brokers.

Regulatory Status: Available documentation does not specify particular regulatory authorities overseeing Prolio's operations. This represents a significant concern for trader protection and fund security.

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in current available sources. This limits transparency about financial transaction capabilities.

Minimum Deposit Requirements: The minimum account funding threshold is not specified in accessible documentation. This makes it difficult for potential clients to assess entry barriers.

Bonus and Promotional Offers: Current promotional programs and bonus structures are not detailed in available materials. This suggests limited marketing incentives for new clients.

Tradeable Assets: Based on Prolio's identification as a forex broker, currency pairs appear to be the primary trading instruments. The complete range of available assets requires direct verification with the broker.

Cost Structure: The most prominent feature is the advertised zero spread cost. Additional fees, commissions, and overnight charges are not comprehensively detailed in this Prolio review.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in current documentation. This is crucial information for risk management planning.

Platform Selection: Trading platform options and technological infrastructure details are not comprehensively covered in available sources.

Regional Restrictions: Geographic limitations and country-specific access restrictions are not clearly outlined in accessible materials.

Customer Service Languages: Multi-language support capabilities and communication options are not detailed in current documentation.

The evaluation of Prolio's account conditions faces significant limitations due to insufficient publicly available information. Standard account types, their specific features, and differentiation between various service levels are not clearly documented. This makes it challenging for potential clients to understand what services they would receive.

Minimum deposit requirements, which are fundamental for account planning, remain unspecified in available sources. This lack of transparency extends to account opening procedures, verification requirements, and the timeline for account activation. All of these are essential considerations for prospective traders.

Special account features such as Islamic accounts for Sharia-compliant trading, VIP services for high-volume traders, or demo accounts for strategy testing are not mentioned in current documentation. This absence suggests either limited service diversity or poor communication of available options. The scoring of 3/10 for account conditions reflects these transparency gaps and the lack of comprehensive information that traders typically expect when evaluating broker services.

Without clear account structures and requirements, clients cannot make informed decisions about their trading setup. This Prolio review emphasizes the need for direct broker contact to clarify these fundamental account details.

Prolio's trading tools and educational resources receive a concerning 2/10 rating. This is due to the complete absence of information about analytical capabilities, research materials, and trader education programs. Modern forex trading requires sophisticated analytical tools, market research, and educational support. None of these are documented in available sources.

Trading platforms, charting capabilities, technical indicators, and automated trading support remain unspecified. These tools are essential for effective market analysis and strategy implementation. Their absence from available documentation suggests either limited offerings or poor marketing communication.

Research and analysis resources, including market commentary, economic calendars, and expert insights, are not mentioned in current materials. Professional traders rely heavily on these resources for informed decision-making. Their unavailability would significantly impact trading effectiveness.

Educational materials such as webinars, tutorials, trading guides, and strategy resources are not documented. This is particularly concerning for newer traders who require comprehensive learning support. The lack of educational infrastructure suggests limited commitment to client development and success.

Customer service evaluation proves challenging due to the absence of detailed information about support channels, availability, and service quality. Contact methods, response times, and support availability are not specified in current documentation. This earns a 2/10 rating for this critical service area.

Multi-language support capabilities, which are essential for international brokers, are not documented. This limitation could significantly impact non-English speaking clients who require native language assistance for complex trading or account issues. Support availability hours, emergency contact procedures, and escalation processes for dispute resolution are not outlined in available materials.

These service elements are crucial for maintaining client confidence and ensuring prompt issue resolution. The low user rating of 2.9 out of 10 suggests significant customer service challenges. Specific feedback about support experiences is not detailed in current sources.

This poor rating indicates potential systematic issues with client satisfaction and service delivery.

Prolio's trading experience receives a 4/10 rating. The primary positive element is the advertised average trading speed of 0ms. This suggests competitive execution capabilities for high-frequency trading strategies.

This technical specification, if accurate, would provide advantages for scalping and rapid-fire trading approaches. However, critical trading metrics such as slippage rates, requote frequency, and order rejection statistics are not provided in available documentation. These factors significantly impact actual trading costs and execution quality. This makes it impossible to fully assess the trading environment's effectiveness.

Platform stability, uptime statistics, and technical reliability information are not documented. These factors are crucial for consistent trading performance. Server locations, redundancy systems, and technical infrastructure details that support the claimed execution speeds are not specified.

Mobile trading capabilities, platform compatibility, and cross-device synchronization features are not detailed in current sources. Modern traders require seamless multi-platform access. The absence of this information suggests potential limitations in trading flexibility. This Prolio review highlights the need for comprehensive technical verification before committing to the platform.

Trust and reliability represent Prolio's most significant weakness. They earn a 2/10 rating due to fundamental transparency issues and regulatory concerns. The absence of clear regulatory information, including specific licensing authorities and regulatory numbers, creates substantial uncertainty about client protection and fund security.

Company background, ownership structure, and operational history are not documented in available sources. This makes it impossible to assess the broker's stability and long-term viability. Established brokers typically provide comprehensive corporate information to build client confidence.

Fund protection mechanisms, such as segregated client accounts, investor compensation schemes, and insurance coverage, are not detailed in current documentation. These protections are essential for client fund security. They are typically highlighted by reputable brokers.

The user rating of 2.9 out of 10 based on 375 reviews indicates significant trust issues among actual clients. This poor rating suggests systematic problems with service delivery, transparency, or client satisfaction. Potential traders should carefully consider these issues.

User experience receives a 3/10 rating. It is primarily influenced by the poor overall user satisfaction score of 2.9 out of 10 from 375 reviews. This low rating indicates widespread dissatisfaction among actual clients. It suggests significant issues with service quality or platform functionality.

Interface design, platform usability, and navigation efficiency are not detailed in available documentation. This makes it difficult to assess the practical aspects of using Prolio's services. User-friendly design is crucial for effective trading, particularly for newer market participants.

Account registration and verification processes are not described in current sources. These procedures significantly impact the initial client experience. Streamlined onboarding processes are essential for client satisfaction and platform adoption.

The predominance of negative feedback, as reflected in the low user rating, suggests systematic issues. These may include poor customer service, technical problems, or transparency concerns. Potential clients should carefully investigate these user experience issues before committing to the platform.

This Prolio review reveals a broker with mixed characteristics. Technically competitive trading conditions are overshadowed by significant transparency and reliability concerns. While the zero spread costs and rapid execution speeds may appeal to cost-conscious high-frequency traders, the absence of regulatory clarity and poor user ratings present substantial risks.

The broker appears most suitable for experienced traders who prioritize low transaction costs over comprehensive regulatory protection. These traders are comfortable with higher risk tolerance. However, the lack of detailed information about essential services and poor user feedback suggest considerable caution is warranted.

Primary advantages include zero spread costs and fast execution speeds. Significant disadvantages encompass regulatory uncertainty, limited transparency, poor user ratings, and insufficient documentation of essential services. Prospective clients should conduct thorough due diligence and consider alternative brokers with stronger regulatory credentials and better user satisfaction records.

FX Broker Capital Trading Markets Review