Poia 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Poia review examines a forex broker that has generated mixed reactions from the trading community. Based on available information and user feedback, Poia presents itself as a trading platform with certain features that may appeal to specific trader segments, though significant transparency concerns exist. The broker's most notable characteristics include offering high leverage trading opportunities and utilizing the MetaTrader 4 platform.

However, our analysis reveals substantial gaps in regulatory transparency and public information disclosure that potential clients should carefully consider. This Poia review primarily targets traders who are specifically interested in high leverage trading opportunities. We recommend thorough due diligence given the limited transparency regarding regulatory oversight and operational details.

User feedback suggests a generally neutral experience, with responses typically described as "meh," indicating neither exceptional satisfaction nor significant dissatisfaction among the trading community.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. Readers should note that regulatory requirements and broker offerings may vary significantly across different jurisdictions, and specific services may not be available in all regions. Our evaluation methodology focuses on accessible public information, user testimonials, and industry-standard assessment criteria.

Given the limited transparency of certain operational aspects, some sections of this analysis rely on general industry practices and available user experiences rather than detailed official documentation.

Rating Framework

Broker Overview

Poia Global Limited operates as a forex broker that has been present in the trading industry since 2008. According to available information, the company positions itself within the competitive forex brokerage landscape, though it has been characterized by industry observers as maintaining relatively low transparency regarding its operational structure and regulatory framework. The broker claims to provide access to MetaTrader 4 trading platform, which represents one of the most widely recognized trading interfaces in the forex industry.

This platform selection suggests an attempt to cater to traders familiar with standard industry tools and functionalities. From a business model perspective, this Poia review finds that the company's operational approach appears to focus on providing trading services with particular emphasis on high leverage opportunities. However, the lack of detailed public information about specific business practices, regulatory compliance measures, and operational transparency raises questions that potential clients should carefully evaluate before engaging with the platform.

The broker's market positioning appears to target traders seeking access to leveraged forex trading, though the limited availability of comprehensive information about asset classes, trading conditions, and regulatory oversight suggests a more cautious approach may be warranted for potential clients.

Regulatory Framework: Specific regulatory information is not detailed in available materials, which represents a significant concern for traders prioritizing regulatory oversight and consumer protection measures.

Deposit and Withdrawal Methods: Concrete information about supported payment methods and processing procedures is not specified in available documentation.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in publicly available information.

Promotional Offers: Details regarding bonus structures or promotional campaigns are not mentioned in available materials.

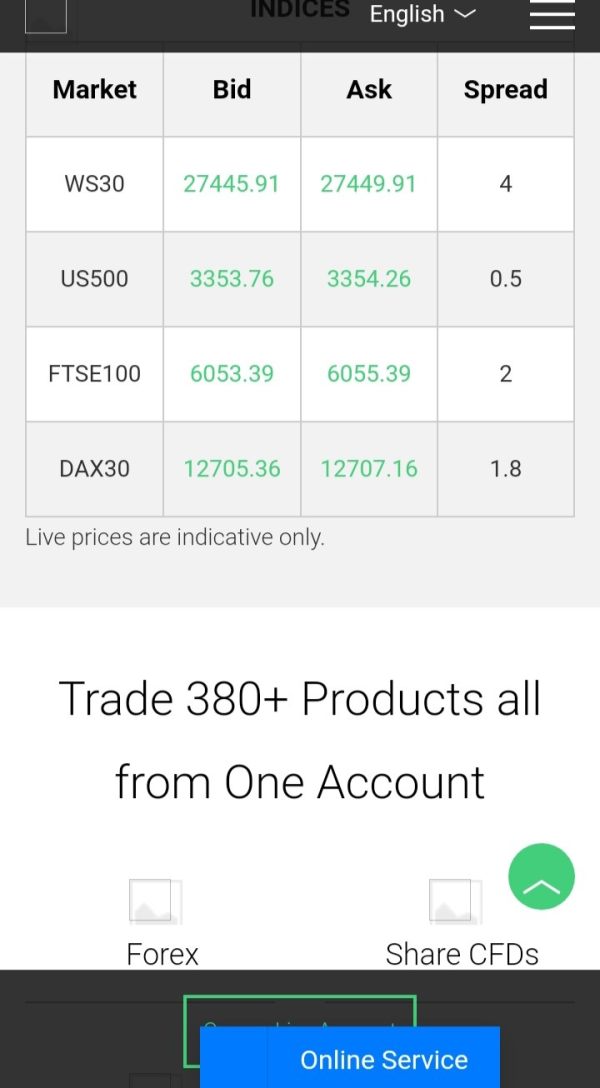

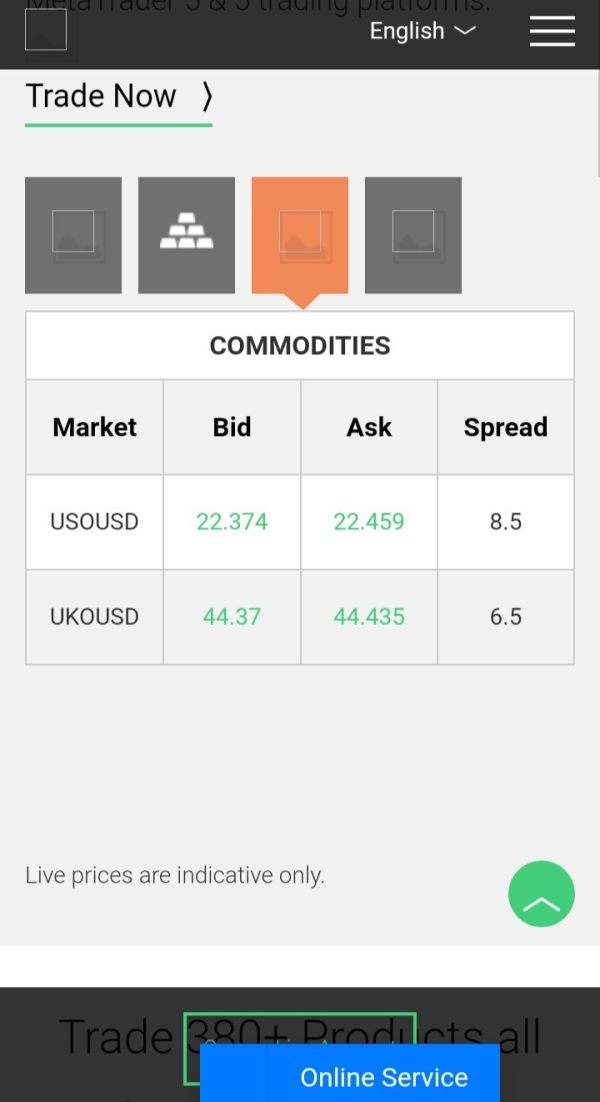

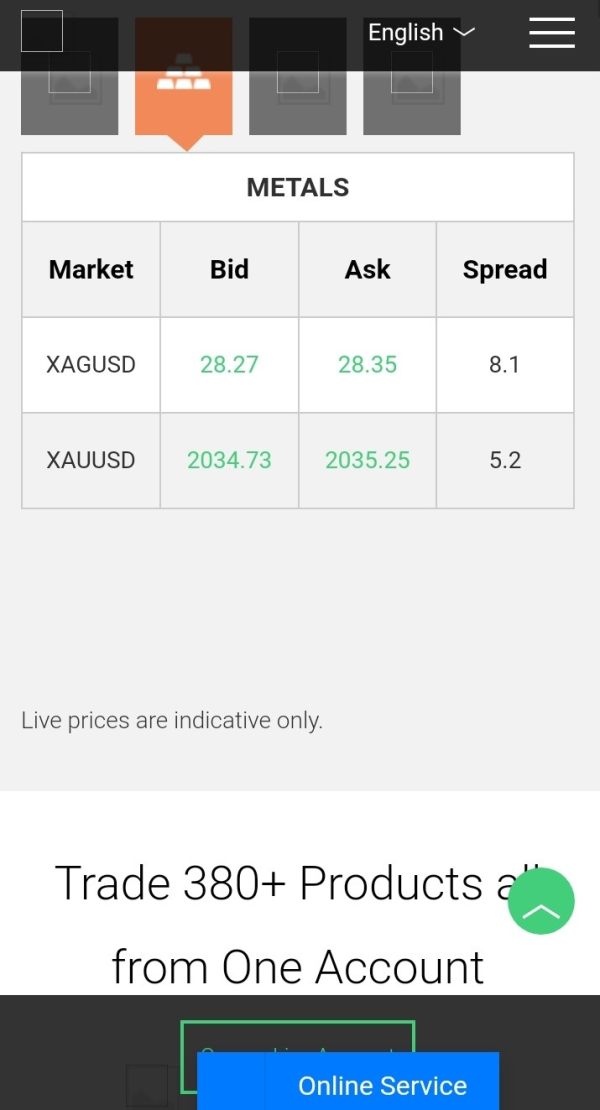

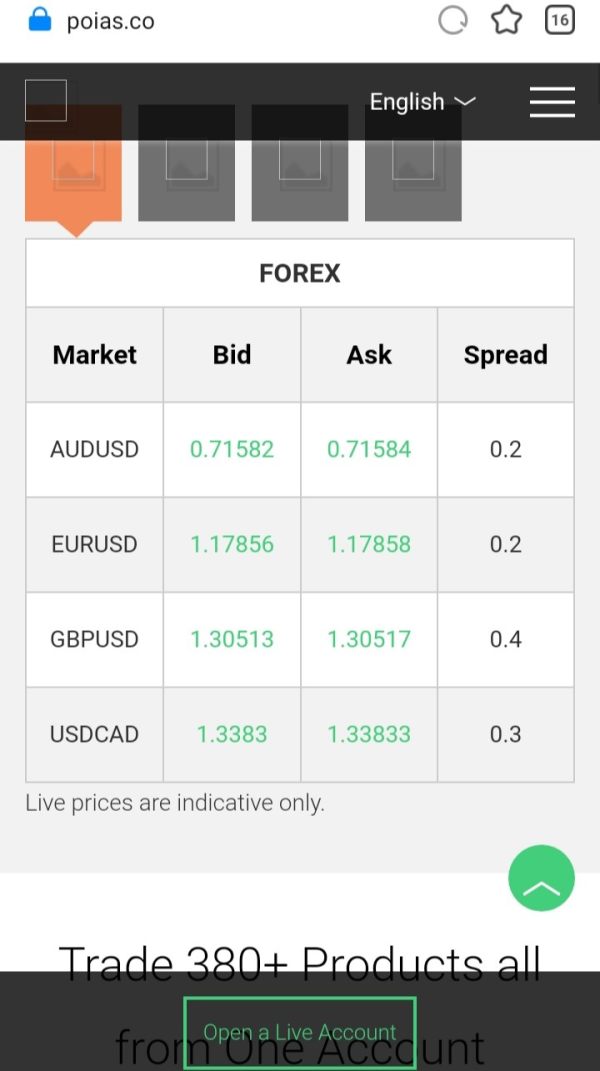

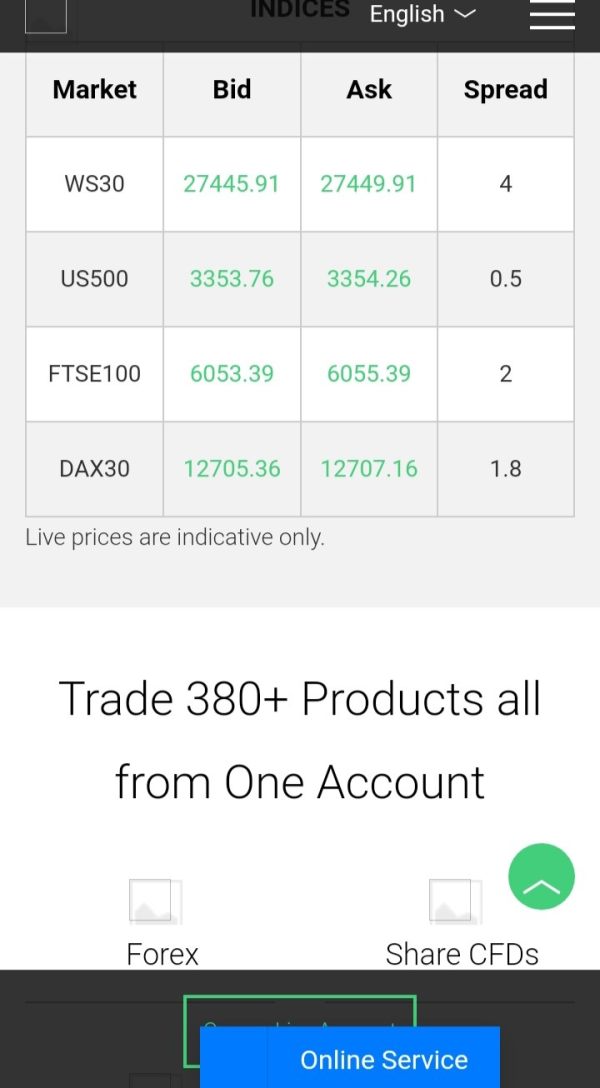

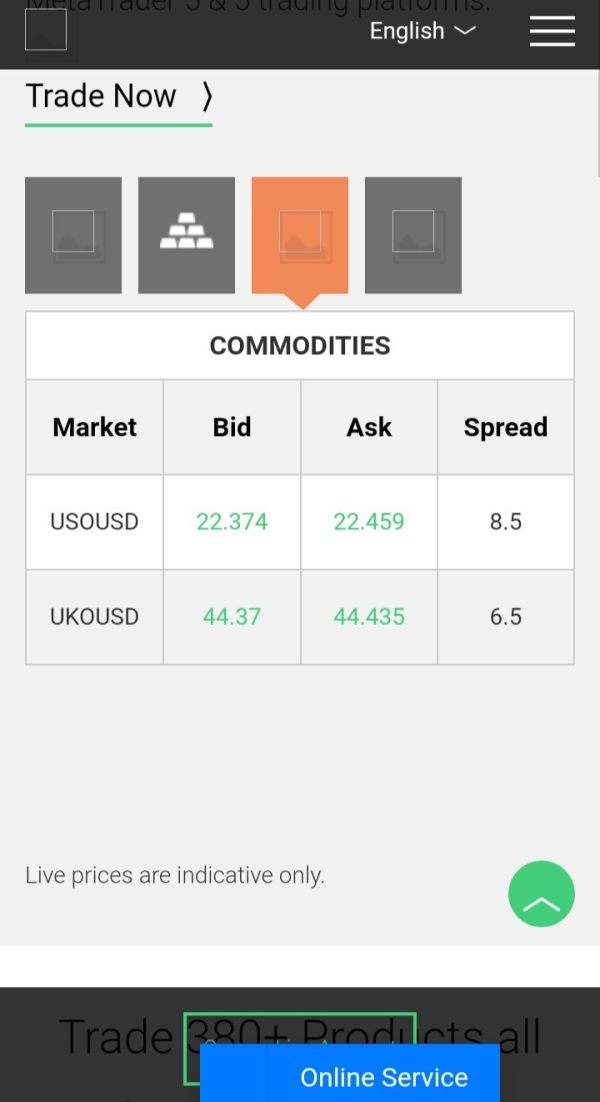

Tradeable Assets: Specific information about available currency pairs, commodities, indices, or other tradeable instruments is not detailed in accessible documentation.

Cost Structure: Comprehensive information about spreads, commissions, and other trading costs is not available in public materials, which limits traders' ability to make informed cost comparisons.

Leverage Options: High leverage trading is mentioned as a key feature, though specific ratios and conditions are not detailed in this Poia review's source materials.

Platform Selection: MetaTrader 4 availability is confirmed, representing a standard industry platform choice.

Geographic Restrictions: Specific information about regional limitations or restricted jurisdictions is not available in accessible documentation.

Customer Support Languages: Details about multilingual support options are not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions evaluation for this Poia review reveals significant information gaps that impact the overall assessment. Without clear details about account types, minimum deposit requirements, or specific account features, potential traders face uncertainty when attempting to evaluate whether the broker's offerings align with their trading needs and financial capabilities. The absence of publicly available information about account opening procedures, verification requirements, and account management features represents a substantial limitation.

Industry-standard practice typically involves transparent disclosure of account conditions, fee structures, and operational requirements, which appears to be lacking in Poia's public documentation. Furthermore, the lack of detailed information about different account tiers, if they exist, makes it challenging for traders to understand potential progression paths or premium features that might be available with higher deposit levels. This opacity in account condition disclosure contributes to the lower rating in this category and suggests potential clients should seek direct communication with the broker for specific details.

This Poia review notes that the limited transparency regarding account conditions may particularly concern experienced traders who typically conduct thorough due diligence before committing to a new trading platform.

The tools and resources assessment focuses primarily on the confirmed availability of the MetaTrader 4 platform, which represents a positive aspect of the broker's offering. MetaTrader 4 is widely recognized as a robust trading platform that provides essential charting tools, technical analysis capabilities, and automated trading support through Expert Advisors. However, beyond the platform confirmation, specific information about additional trading tools, research resources, or educational materials is not detailed in available documentation.

Modern traders often expect comprehensive market analysis, economic calendars, trading signals, and educational content to support their trading decisions and skill development. The absence of information about proprietary tools, third-party integrations, or specialized trading resources limits the overall assessment in this category. Additionally, details about mobile trading capabilities, web-based platform access, or platform customization options are not specified in available materials.

While MetaTrader 4 provides a solid foundation for trading activities, the lack of information about supplementary resources and tools prevents a higher rating in this evaluation category. Traders seeking comprehensive analytical and educational support may need to inquire directly about additional resource availability.

Customer Service and Support Analysis (Score: 5/10)

The customer service evaluation presents challenges due to limited specific information about support infrastructure, response times, and service quality measures. Without concrete user feedback regarding customer service experiences, this assessment relies on general observations and industry standard expectations. Effective customer support typically includes multiple communication channels such as live chat, email support, and telephone assistance, along with reasonable response times and knowledgeable support staff.

However, specific details about Poia's customer service structure, available support hours, and multilingual capabilities are not detailed in accessible documentation. The absence of user testimonials specifically addressing customer service experiences means this evaluation cannot provide insights into actual support quality, problem resolution effectiveness, or overall client satisfaction with service interactions. This information gap represents a significant limitation for potential clients who prioritize responsive and effective customer support.

Additionally, without information about dedicated account management services, educational support, or technical assistance availability, traders cannot adequately assess whether the broker's support infrastructure meets their expected service levels and requirements.

Trading Experience Analysis (Score: 5/10)

The trading experience assessment encounters limitations due to insufficient specific information about execution quality, platform performance, and overall trading environment characteristics. While MetaTrader 4 platform availability suggests access to standard trading functionalities, concrete details about execution speeds, slippage rates, and order processing quality are not available. Platform stability and reliability represent crucial factors for trading success, yet specific performance metrics, uptime statistics, or technical infrastructure details are not disclosed in available materials.

This information gap makes it challenging for traders to evaluate whether the platform can support their trading strategies effectively, particularly for high-frequency or scalping approaches. Mobile trading capabilities, while likely available through standard MetaTrader 4 applications, lack specific confirmation or details about mobile-optimized features. Additionally, information about trading environment characteristics such as dealing desk versus no dealing desk execution, market depth visibility, or advanced order types is not specified.

This Poia review notes that the limited concrete information about trading experience factors contributes to the neutral rating, as potential clients cannot adequately assess execution quality or platform performance based on available documentation.

Trust and Reliability Analysis (Score: 3/10)

The trust and reliability assessment reveals significant concerns primarily related to transparency and regulatory disclosure limitations. The characterization of the broker as maintaining low transparency represents a substantial issue for traders who prioritize regulatory oversight and operational clarity. Regulatory compliance and licensing information typically serve as fundamental trust indicators for forex brokers.

The absence of clear regulatory details, licensing information, or supervisory authority disclosure creates uncertainty about consumer protection measures and operational oversight standards. Additionally, limited information about fund segregation practices, insurance coverage, or other client protection measures raises questions about financial security and risk management protocols. Industry best practices typically involve transparent disclosure of these protective measures to build client confidence and demonstrate regulatory compliance.

The lack of detailed company information, management team disclosure, or operational transparency further contributes to trust concerns. Without comprehensive information about corporate structure, regulatory relationships, and operational practices, potential clients face uncertainty about the broker's reliability and long-term stability.

User Experience Analysis (Score: 4/10)

User experience evaluation reveals mixed signals based on available feedback, with user responses typically characterized as "meh," indicating neither strong satisfaction nor significant dissatisfaction. This neutral-to-negative feedback suggests that while the platform may function adequately, it may not provide exceptional user satisfaction or standout features. The absence of detailed user interface design information, registration process descriptions, or account management system details limits the comprehensive assessment of user experience factors.

Modern traders often expect intuitive interfaces, streamlined processes, and user-friendly navigation throughout their trading journey. Without specific information about the registration and verification procedures, fund management processes, or platform navigation characteristics, potential users cannot adequately assess whether the broker's systems align with their expectations for ease of use and operational efficiency. The limited positive user feedback combined with transparency concerns suggests that user experience may be impacted by uncertainty and limited information access.

Traders who value comprehensive information disclosure and transparent operational practices may find the current level of transparency insufficient for their preferences and requirements.

Conclusion

This comprehensive Poia review reveals a broker with mixed characteristics that require careful consideration by potential clients. While the platform offers certain features such as MetaTrader 4 access and high leverage opportunities, significant transparency and information disclosure limitations present substantial concerns. The broker may be suitable for traders specifically seeking high leverage trading opportunities and who are comfortable with limited regulatory transparency.

However, the lack of comprehensive information about operational practices, regulatory oversight, and detailed trading conditions suggests that thorough due diligence and direct communication with the broker would be essential before account opening. The primary advantages include high leverage availability and access to the widely-recognized MetaTrader 4 platform. However, these benefits are overshadowed by significant disadvantages including limited regulatory transparency, insufficient operational information disclosure, and neutral user feedback that suggests room for improvement in overall service delivery.