Paxful Financials 2025 Review: Everything You Need to Know

Executive Summary

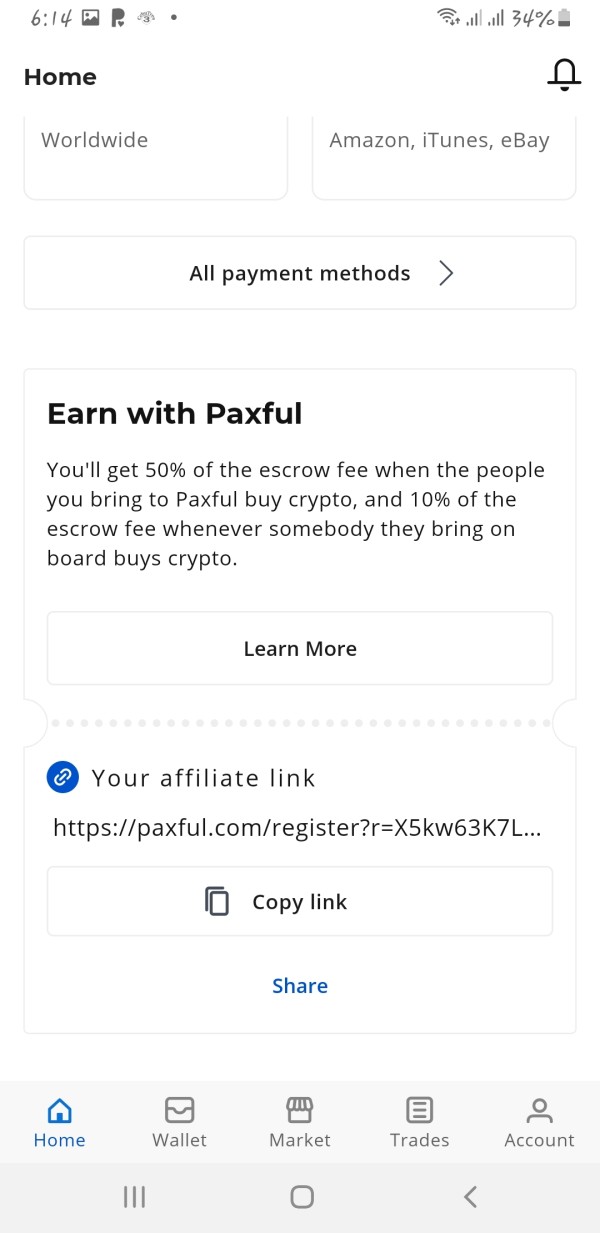

This paxful financials review looks at the platform's place in cryptocurrency trading. Paxful works as a peer-to-peer cryptocurrency marketplace that builds a secure, fast, and reliable financial system without borders. The platform gets attention for its great customer service, with users always reporting good experiences with support staff who respond quickly and solve problems well.

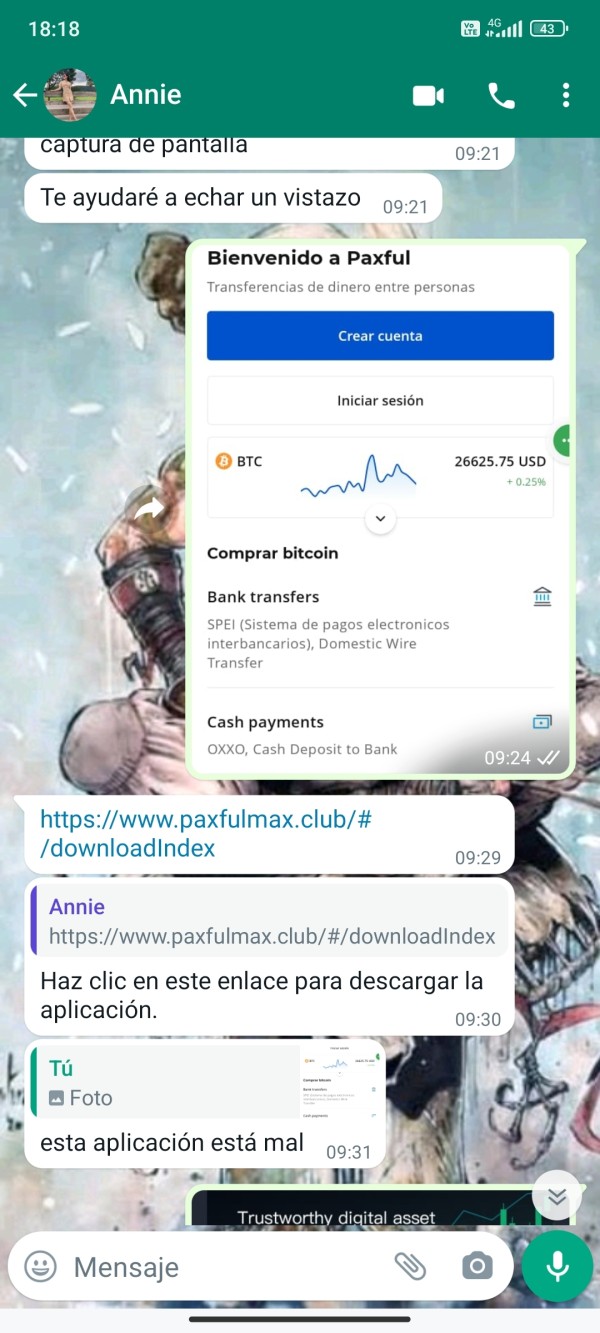

The platform's main strength is its focus on customers and the easy way it handles Bitcoin and other cryptocurrency trades. Paxful helps users trade directly with each other, unlike traditional exchanges that control everything. This creates a marketplace that appeals to people who want different ways to trade. The platform targets users who like peer-to-peer cryptocurrency trading instead of regular exchange methods, offering something unique in the digital money space.

User feedback always points to customer service quality as the best feature. Many traders feel happy with the platform's support system. This focus on user experience has made Paxful a notable player in peer-to-peer cryptocurrency trading, though detailed regulatory and operational information stays limited in public records.

Important Notice

Users should know that specific regulatory information and differences between jurisdictions for Paxful are not well explained in public documents. This lack of detailed regulatory information may create legal and compliance risks that users should think about carefully before using the platform.

This review comes from detailed analysis of user feedback, available market information, and public platform data. Since cryptocurrency regulation changes around the world, users should do their own research about legal rules in their countries before using Paxful's services.

Rating Framework

Broker Overview

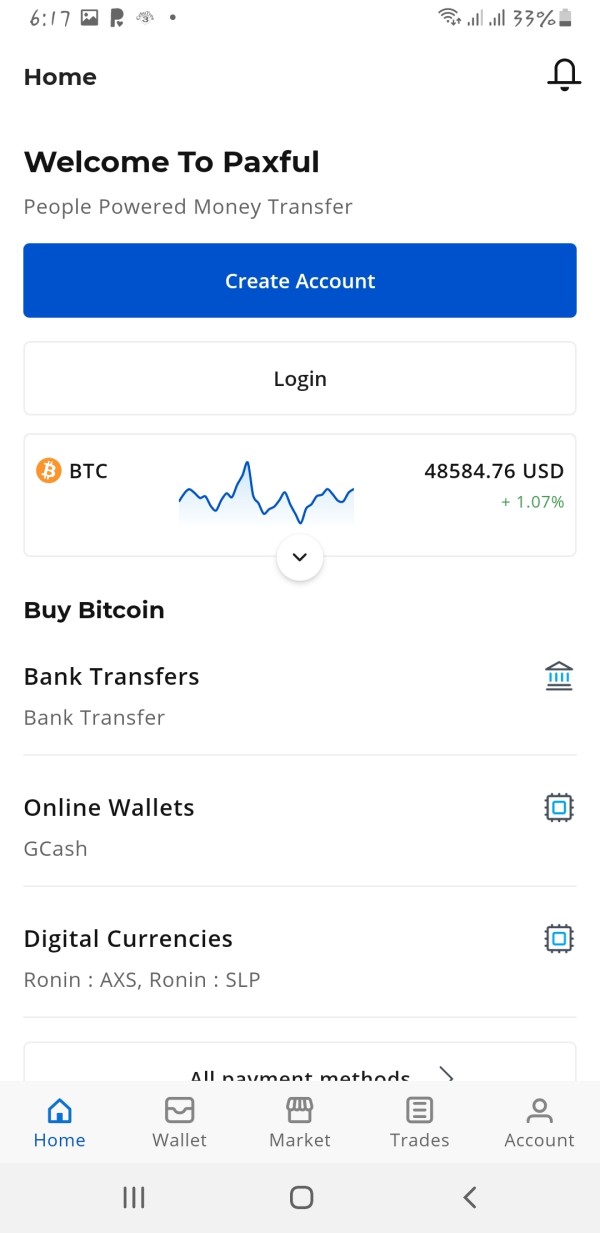

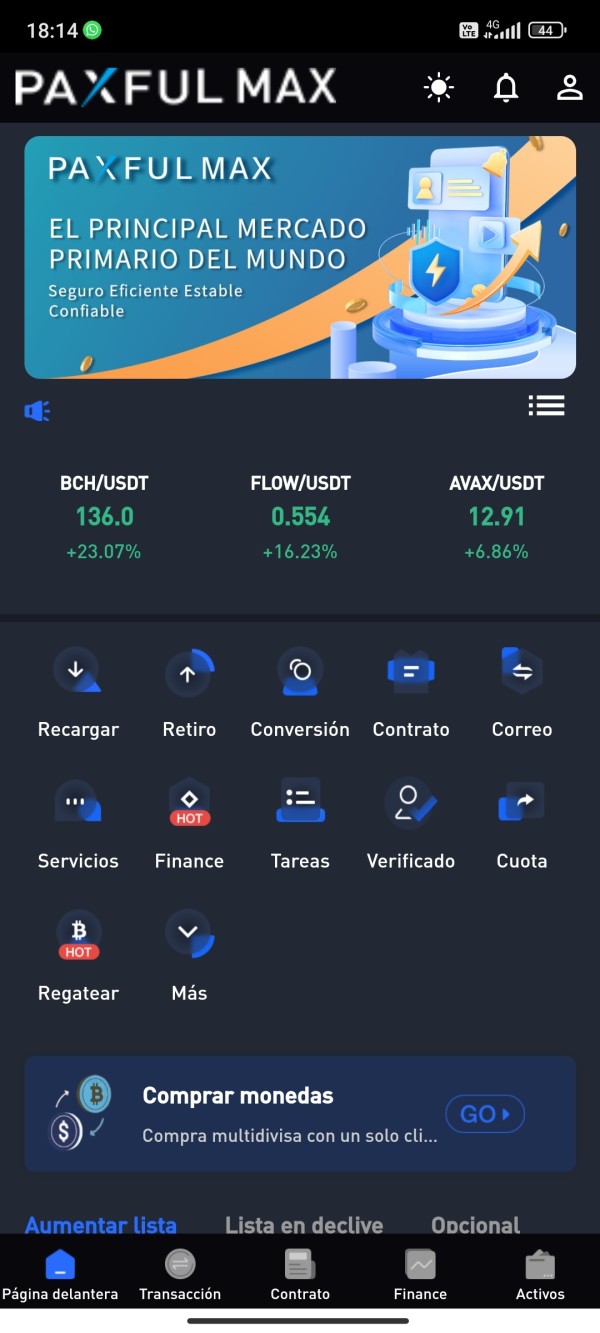

Paxful sees itself as a revolutionary force in cryptocurrency trading. The platform has a clear mission to build a secure, fast, and reliable financial system without borders. While the specific founding year is not detailed in available information, the platform has become a major player in peer-to-peer cryptocurrency markets. The company's business model focuses on helping direct peer-to-peer transactions, removing traditional middlemen and creating a more democratic trading environment.

The platform works differently from regular cryptocurrency exchanges by letting users trade directly with each other. This peer-to-peer model allows more flexibility in payment methods and trading terms, serving users who want alternatives to standard exchange rules. Paxful's commitment to building a borderless financial system reflects the broader cryptocurrency industry's vision of financial inclusion and accessibility.

As a peer-to-peer cryptocurrency marketplace, Paxful operates differently from traditional forex trading platforms. It focuses only on digital asset transactions. The platform mainly helps with trading Bitcoin and other cryptocurrencies, giving users a marketplace environment rather than a regular brokerage structure. While specific regulatory oversight details are not well documented in available sources, the platform continues to serve users seeking peer-to-peer cryptocurrency trading solutions.

Regulatory Jurisdiction: Specific regulatory authority information is not detailed in available documentation. This may require users to check compliance requirements on their own.

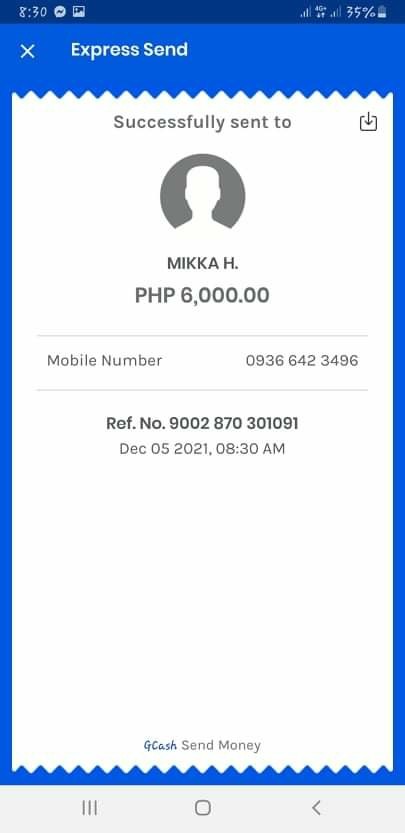

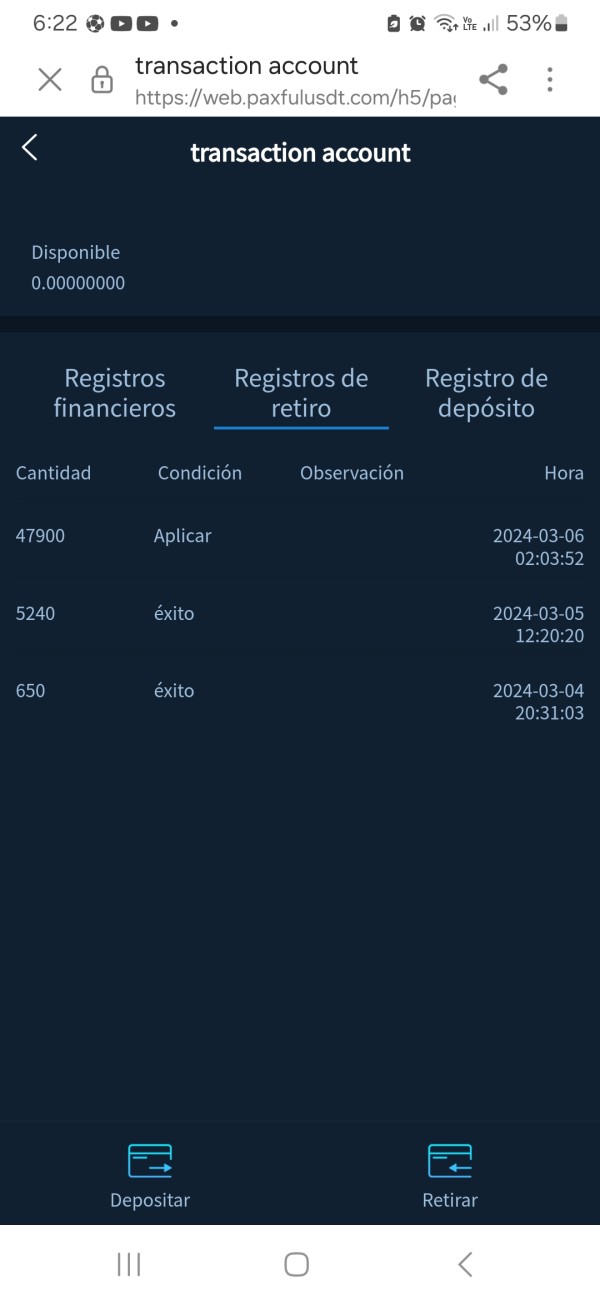

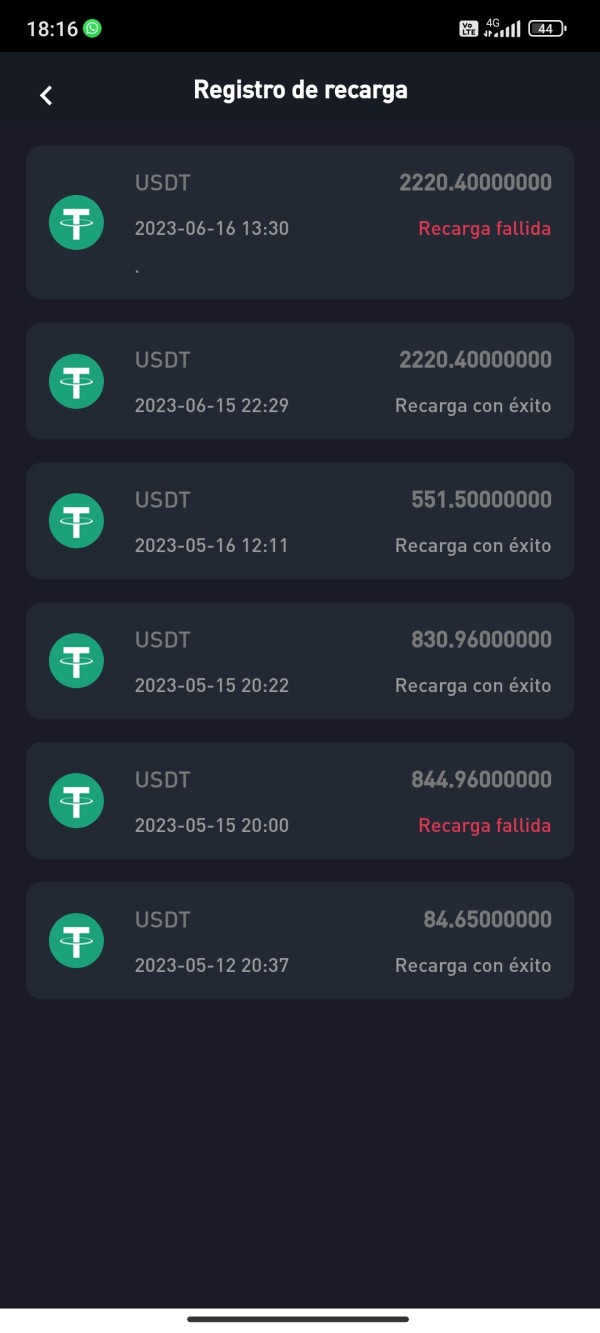

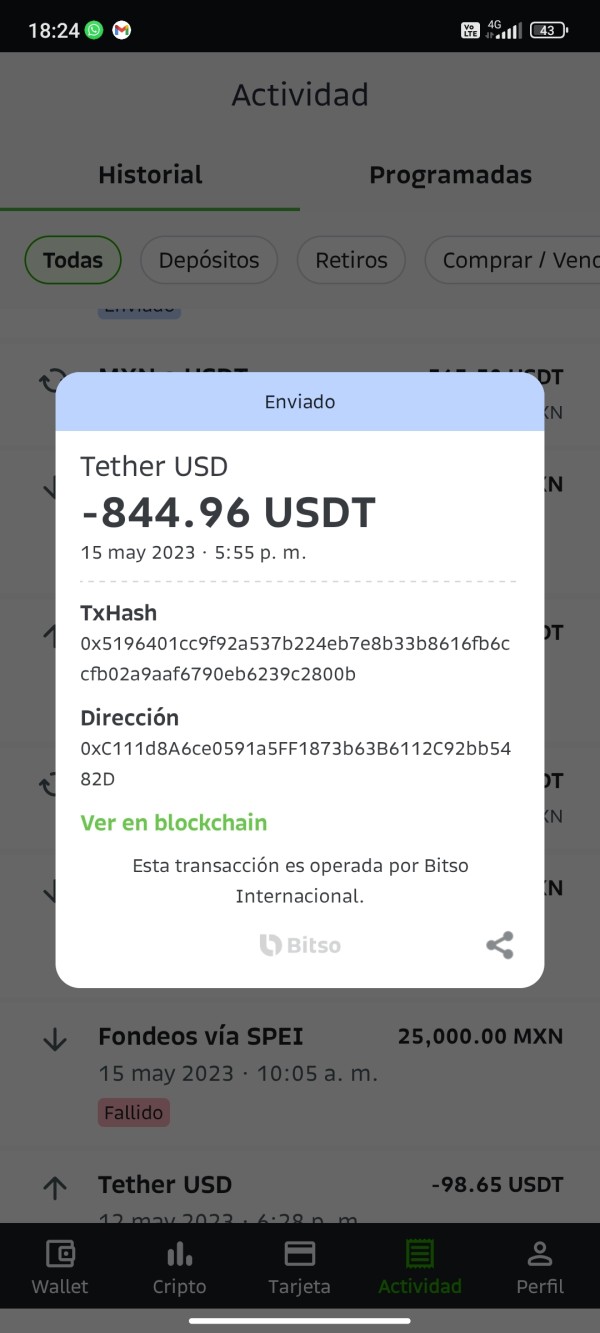

Deposit and Withdrawal Methods: Complete information about supported deposit and withdrawal methods is not specified in current available materials.

Minimum Deposit Requirements: Specific minimum deposit amounts are not documented in accessible platform information.

Promotional Offers: Details about bonuses, promotional campaigns, or special offers are not outlined in current information sources.

Tradable Assets: The platform mainly focuses on Bitcoin and other cryptocurrency transactions. It operates within the digital asset ecosystem rather than traditional forex or commodity markets.

Cost Structure: Specific information about spreads, commissions, and fee structures is not well detailed in available documentation. Users need to contact the platform directly for current pricing.

Leverage Options: Leverage ratio information is not specified in current available platform materials.

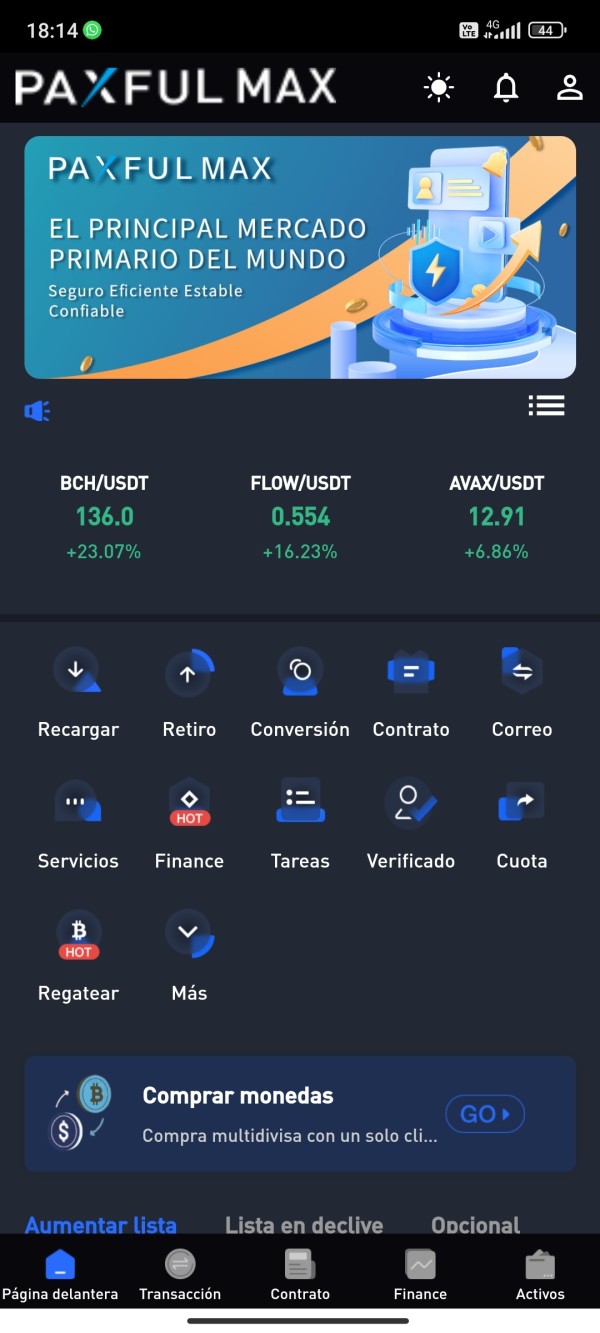

Platform Selection: Paxful operates as a specialized peer-to-peer cryptocurrency marketplace. It is very different from traditional forex trading platforms in both structure and function.

Geographic Restrictions: Specific regional limitations or geographic restrictions are not detailed in current information sources.

Customer Support Languages: Supported languages for customer service are not specified in available documentation.

This paxful financials review shows that while the platform has strong customer service capabilities, many operational details require direct platform consultation for complete information.

Detailed Rating Analysis

Account Conditions Analysis

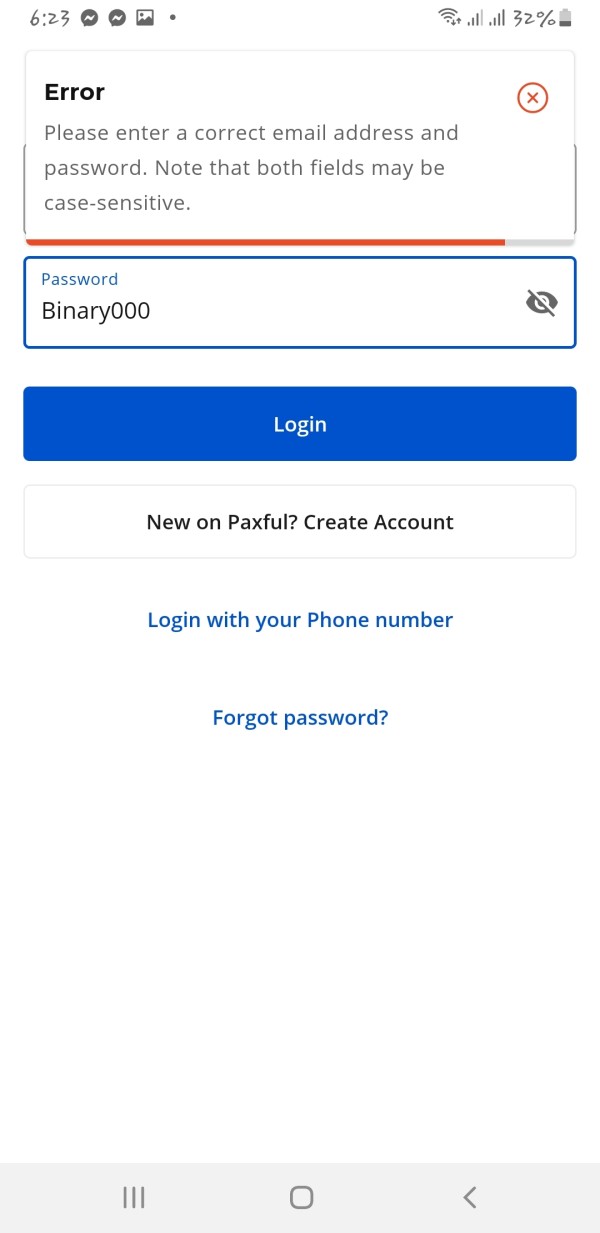

The account conditions for Paxful remain mostly undocumented in publicly available information. This creates a big information gap for potential users. Without specific details about account types, tier structures, or minimum balance requirements, users cannot fully judge if the platform fits their trading needs. The absence of clear account opening process documentation makes it hard to evaluate the user onboarding experience.

Traditional cryptocurrency platforms typically offer various account levels with different verification requirements and trading limits. However, as a peer-to-peer marketplace, Paxful may operate under different structural principles that don't match conventional account categorization systems. The lack of publicly available information about account features, special functions, or tier-based benefits suggests that users must contact the platform directly to understand available options.

The minimum deposit requirements are crucial for accessibility assessment, but they are not specified in current documentation. This information gap extends to account maintenance fees, inactivity charges, or other account-related costs that could impact user experience. Without complete account condition details, this paxful financials review cannot provide clear guidance on account suitability for different user types.

The availability and quality of trading tools and resources on Paxful are not well documented in accessible information sources. For a peer-to-peer cryptocurrency marketplace, the tool requirements differ a lot from traditional forex platforms, focusing more on user matching, transaction security, and communication features rather than technical analysis tools.

Research and analytical resources, which are standard offerings on regular trading platforms, may not apply to Paxful's peer-to-peer model. Instead, the platform likely emphasizes user verification systems, transaction tracking tools, and peer communication features. However, without specific documentation, users cannot assess how sophisticated or effective the available tools are.

Educational resources play a crucial role in cryptocurrency trading platforms, especially for users new to peer-to-peer transactions. The absence of detailed information about educational materials, tutorials, or guidance resources represents a big knowledge gap. Automated trading support, while common in traditional forex platforms, may not be relevant to Paxful's peer-to-peer transaction model, though specific confirmation of this assumption is not available in current documentation.

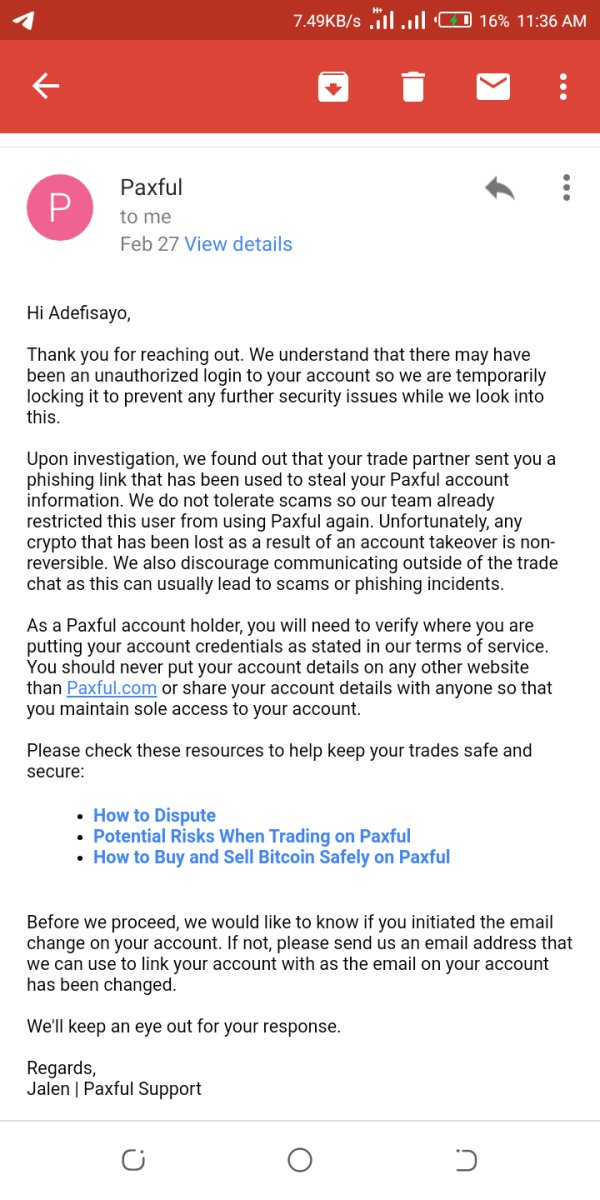

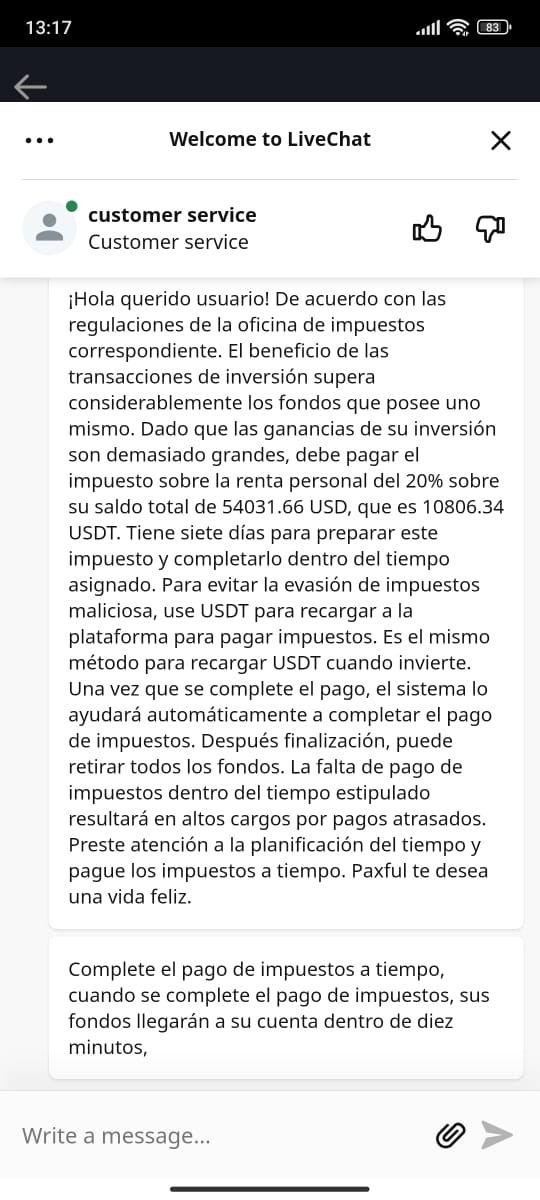

Customer Service and Support Analysis

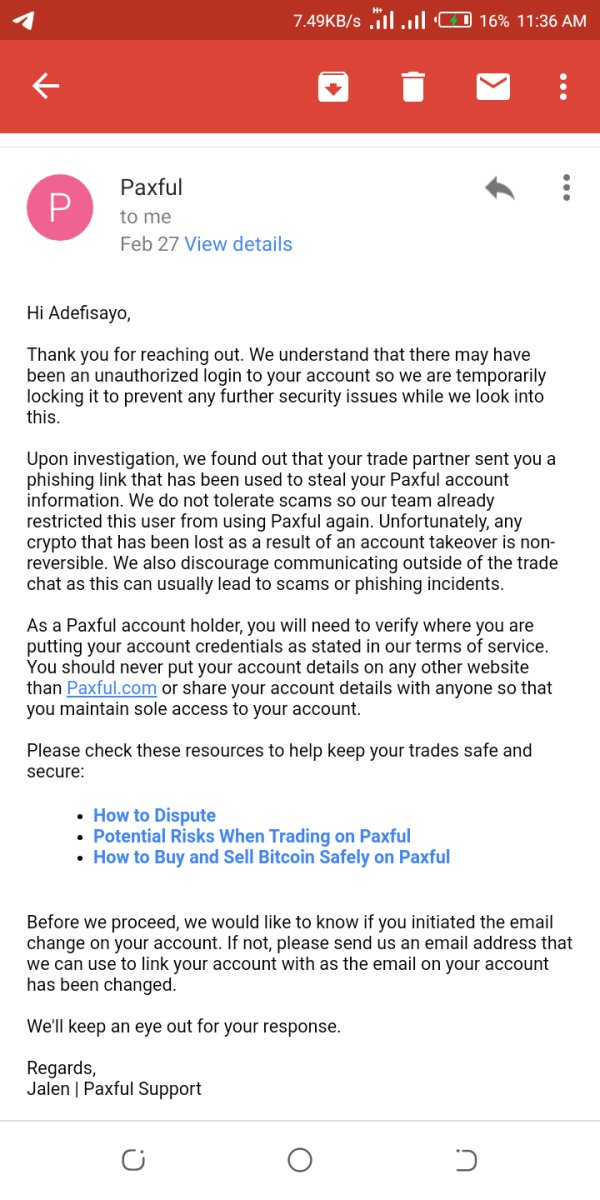

Customer service emerges as Paxful's strongest documented feature. User feedback consistently highlights the quality and responsiveness of support staff. Users report positive experiences with customer service representatives who show both knowledge and commitment to problem resolution. This strength appears to be a core difference for the platform in the competitive cryptocurrency marketplace.

The ability to provide timely help for user issues has generated significant positive feedback. This suggests that Paxful has invested heavily in building strong customer support infrastructure. Users express satisfaction with the problem-solving capabilities of support staff, indicating that the platform prioritizes user experience through effective customer service delivery.

However, specific details about customer service channels, availability hours, response time metrics, and multilingual support capabilities are not documented in available information. While user satisfaction appears high, the absence of operational details about support infrastructure limits the ability to provide complete assessment. The lack of documented customer service protocols or escalation procedures represents an information gap that potential users should address through direct platform inquiry.

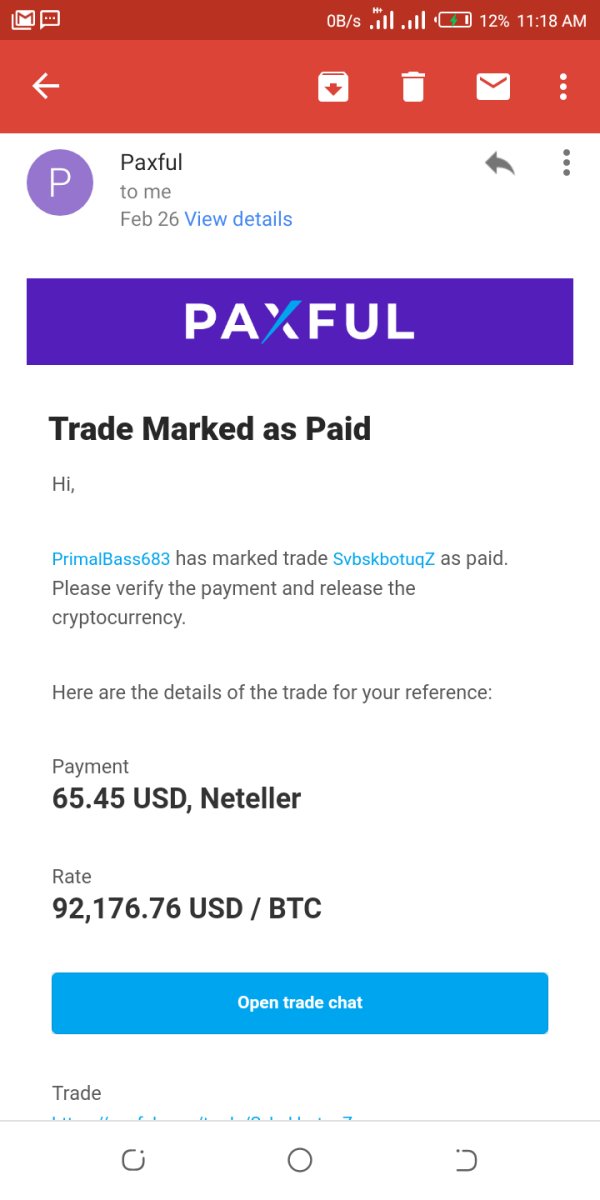

Trading Experience Analysis

The trading experience on Paxful cannot be completely evaluated due to limited available information about platform performance metrics, execution quality, and user interface functionality. As a peer-to-peer marketplace, the trading experience differs fundamentally from traditional exchange environments, focusing on peer matching and transaction facilitation rather than market making or order book management.

Platform stability and transaction processing speed are crucial factors for cryptocurrency trading platforms, but specific performance data is not documented in accessible sources. The quality of peer matching algorithms, transaction security protocols, and dispute resolution mechanisms would significantly impact user experience, yet these technical aspects remain undocumented in available materials.

Mobile platform functionality, which is increasingly important for cryptocurrency traders, is not detailed in current information sources. The absence of user interface descriptions, feature availability comparisons, or platform capability assessments limits the ability to evaluate the overall trading environment. This paxful financials review cannot provide clear guidance on trading experience quality without access to complete platform performance data.

Trust and Security Analysis

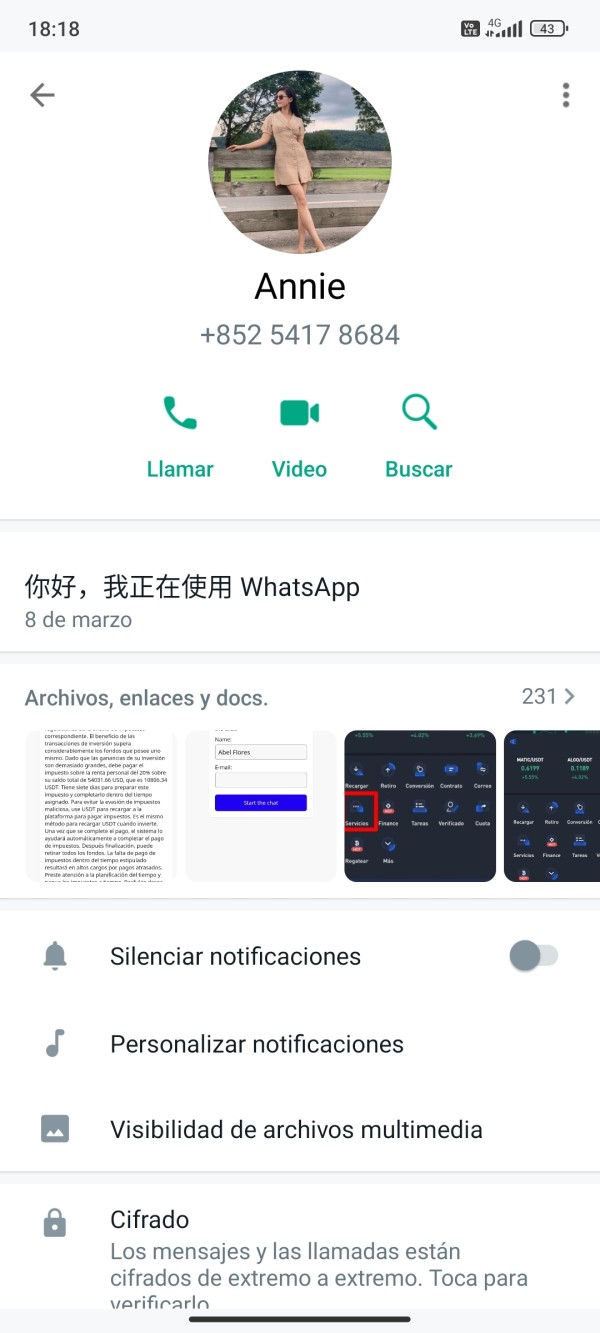

Trust and security assessment for Paxful faces big limitations due to the absence of detailed regulatory and security information in available documentation. The platform's regulatory status, licensing jurisdictions, and compliance frameworks are not well outlined, creating uncertainty about oversight and consumer protection measures.

Fund security protocols, encryption standards, and user asset protection mechanisms are not detailed in accessible information sources. For cryptocurrency platforms, security infrastructure represents a critical factor in user trust, yet specific security measures, audit results, or third-party security assessments are not documented in available materials.

Company transparency, corporate structure details, and operational disclosure practices remain unclear from available information. The absence of documented negative incident handling procedures or crisis management protocols further complicates trust assessment. Without complete regulatory verification or third-party security evaluations, users must rely primarily on peer feedback and personal research for trust evaluation.

User Experience Analysis

User experience assessment reveals positive feedback about customer service satisfaction, though complete user experience metrics are not available in current documentation. The limited feedback suggests that users appreciate the customer support quality, indicating that Paxful has succeeded in creating positive service interactions.

Interface design, navigation efficiency, and platform usability details are not documented in accessible sources, limiting the ability to assess overall user experience quality. The registration and verification processes, which significantly impact initial user impressions, are not described in available materials, creating an information gap for potential users.

Fund operation experiences, transaction completion rates, and common user challenges are not documented in current information sources. The absence of user satisfaction surveys, complaint resolution statistics, or improvement feedback limits complete user experience evaluation. While customer service satisfaction appears positive, broader user experience assessment requires additional information not currently available in accessible documentation.

Conclusion

This paxful financials review reveals a platform that shows strength in customer service delivery while facing significant information transparency challenges. Paxful appears well-suited for users seeking peer-to-peer cryptocurrency trading alternatives, particularly those who value responsive customer support and personalized service experiences.

The platform's primary strength lies in its customer service excellence, with users consistently reporting positive support interactions and effective problem resolution. However, the lack of complete information about regulatory status, account conditions, security measures, and operational details represents a significant limitation for potential users seeking complete platform assessment.

Paxful appears most appropriate for cryptocurrency traders who prioritize customer service quality and are comfortable with peer-to-peer trading models. Users should conduct independent research about regulatory compliance and security measures before engaging with the platform.