Price Action Forex 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Price Action Forex review shows major concerns about the broker's safety and legitimacy. Potential traders must think carefully about these issues before choosing this broker. Our analysis looked at 270 real customer reviews and market research to understand how Price Action Forex performs in the competitive forex trading world.

Some users say good things about customer support. They describe feeling informed, supported, and respected by the service team, which shows the company can provide decent help when needed. However, the overall assessment leans toward negative because of big questions about regulatory compliance and how transparent the company operates.

The broker seems to target users who want basic forex trading support. Our investigation suggests that traders should be very careful before putting money with this company, as several red flags appear throughout our research. The presence of 1-star reviews alongside legitimacy concerns creates a challenging environment for potential clients to navigate safely.

Despite some positive feedback about customer service interactions, the fundamental issues with regulatory clarity and safety protocols overshadow these limited advantages. This makes Price Action Forex a questionable choice for serious forex traders in 2025, especially when better alternatives exist in the market.

Important Notice

Regional Entity Differences: Price Action Forex's regulatory information stays hidden in available documentation. This suggests potential compliance variations across different jurisdictions that could affect trader safety and legal protections.

Traders should check the broker's regulatory status in their specific region before opening accounts. Regulatory frameworks and investor protections may differ significantly between territories, making independent verification essential for safety.

Review Methodology: This evaluation uses customer reviews and market research analysis. These sources may contain subjective biases and individual experiences that don't represent universal outcomes for all traders.

Readers should consider multiple sources and conduct independent research before making trading decisions. No single review should be the only factor in choosing a forex broker for your trading needs.

Rating Framework

Broker Overview

Price Action Forex operates in the competitive forex trading sector. However, specific details about its establishment date, founding year, and corporate background remain hidden in available source materials.

The company's business model and operational structure are not clearly defined in accessible documentation. This creates transparency challenges for potential clients seeking comprehensive broker information that most professional traders expect.

The broker's primary trading platform type, supported asset classes, and technological infrastructure details are not specified in current source materials. Additionally, information about the company's main regulatory authorities, licensing jurisdictions, and compliance frameworks remains unavailable.

This represents a significant concern for traders who prioritize regulatory oversight and investor protection measures. The absence of clear regulatory information can seriously impact trader confidence and safety when choosing a forex broker.

This Price Action Forex review highlights the importance of regulatory transparency in broker selection. The limited availability of fundamental company information suggests potential clients should seek additional verification before proceeding with account opening procedures.

Regulatory Regions: Specific regulatory jurisdictions and licensing authorities are not mentioned in available source materials. This creates uncertainty about compliance standards and legal protections for traders.

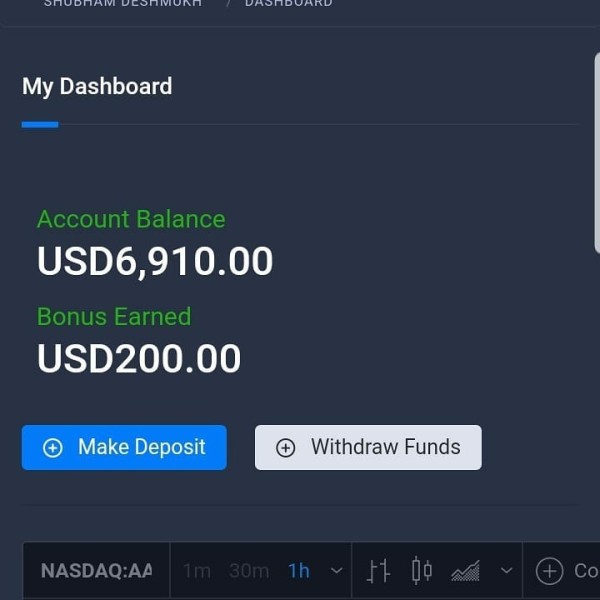

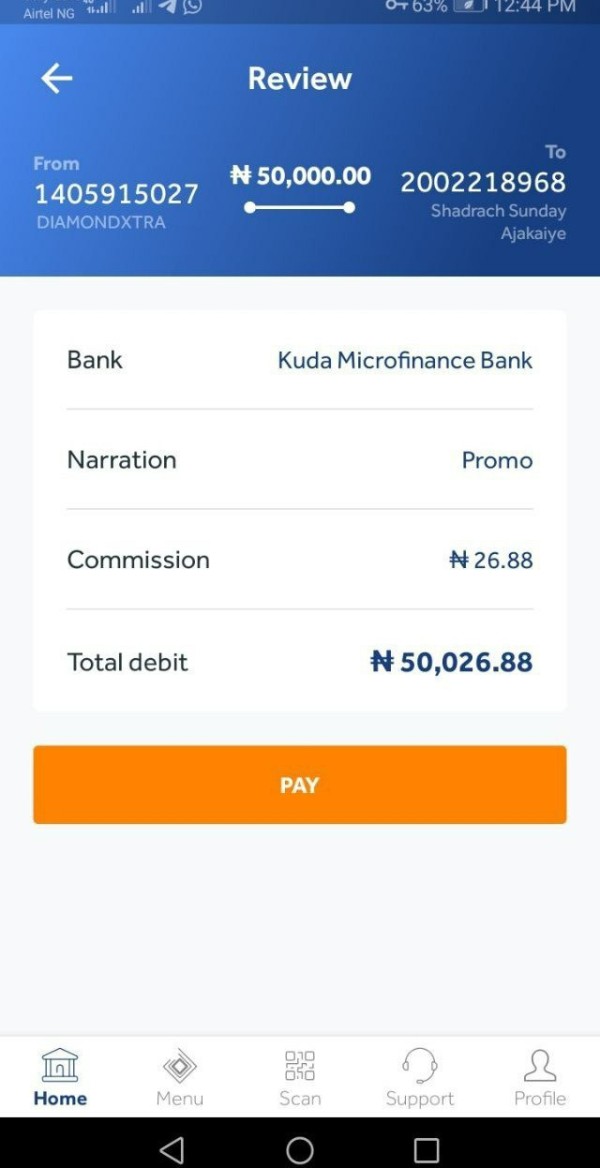

Deposit and Withdrawal Methods: Payment processing options and available funding methods are not detailed in accessible documentation.

Minimum Deposit Requirements: Entry-level deposit thresholds and account funding minimums are not specified in source materials. This makes it difficult for traders to plan their initial investment amounts.

Bonus and Promotional Offers: Current promotional campaigns, welcome bonuses, and incentive programs are not outlined in available information.

Tradeable Assets: The range of financial instruments, currency pairs, and investment products available for trading remains unspecified. This limits traders' ability to assess whether the broker meets their trading needs.

Cost Structure: Commission rates, spread information, overnight fees, and other trading costs are not detailed in source materials. This makes cost comparison with other brokers nearly impossible for potential clients.

Leverage Ratios: Maximum leverage offerings and margin requirements are not mentioned in available documentation.

Platform Options: Trading platform choices, software compatibility, and technological features are not specified in accessible materials. Modern traders typically need this information to evaluate platform suitability.

Geographic Restrictions: Regional limitations and country-specific access restrictions are not outlined in source information.

Customer Support Languages: Available language options for client support services are not mentioned in documentation. This could affect international traders who need support in their native language.

Our Price Action Forex review reveals significant information gaps that potential traders should consider. These gaps become especially important when evaluating this broker against competitors with more transparent operational details.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Price Action Forex's account conditions faces big limitations because of insufficient information in source materials. Account type varieties, their distinctive features, and specific characteristics remain unspecified.

This prevents a comprehensive assessment of the broker's offering structure. The absence of minimum deposit requirement details makes it impossible to evaluate the accessibility and reasonableness of entry-level investment thresholds for new traders.

Account opening procedures, verification processes, and documentation requirements are not outlined in available sources. This creates uncertainty about the onboarding experience that new clients can expect when joining the platform.

Special account features, including Islamic accounts, professional trader accounts, or VIP services, are not mentioned in accessible documentation. Many traders look for these specialized options when choosing a broker for their specific needs.

This lack of transparency about account conditions represents a significant concern for potential clients. Most traders rely on detailed information to make informed trading decisions in today's competitive market.

The missing account-related information in this Price Action Forex review suggests that prospective traders should directly contact the broker for comprehensive account details. However, the absence of such fundamental information in public materials raises questions about the company's commitment to transparency and professional standards.

The assessment of Price Action Forex's trading tools and resources encounters significant challenges. This happens because of the lack of detailed information in available source materials about what the broker actually offers.

Trading tool varieties, their quality standards, and functionality features are not specified. This prevents evaluation of the broker's technological capabilities and whether they meet modern trading standards.

Research and analysis resources, including market commentary, technical analysis tools, and fundamental research materials, remain undocumented in accessible sources. Most serious traders need these resources to make informed trading decisions in volatile forex markets.

Educational resources, which are crucial for trader development, are not mentioned in available documentation. The absence of information about webinars, tutorials, trading guides, or educational content suggests either limited educational support or poor transparency.

Automated trading support, including expert advisor compatibility, algorithmic trading features, and API access, is not detailed in source materials. Many advanced traders require these features for their trading strategies to work effectively.

The lack of specific information about tools and resources in available documentation prevents users from understanding the broker's commitment to trader education. This information gap represents a significant limitation for traders who prioritize comprehensive analytical tools and educational support in their broker selection process.

Customer Service and Support Analysis

Customer service evaluation reveals mixed signals based on available user feedback and limited operational information. According to user testimonials, some clients report feeling informed, supported, and respected by the customer service team.

These positive responses suggest that when functioning properly, the support system can meet basic client communication needs. The fact that some users feel respected indicates that staff training may include customer relations protocols.

However, the presence of 1-star reviews and customer complaints indicates inconsistent service quality and potential issues with problem resolution. This inconsistency suggests that service quality may depend on which representative handles your case.

The specific customer service channels, availability hours, and response time standards are not detailed in available source materials. This makes it difficult to assess the comprehensiveness of support infrastructure that traders can rely on.

Multi-language support capabilities and the breadth of communication options remain unspecified. International traders often need support in their native language to resolve complex account or trading issues effectively.

The mixed nature of customer feedback suggests that while some users experience satisfactory support, others encounter significant challenges. The lack of detailed information about service protocols, escalation procedures, and quality assurance measures raises concerns about the reliability and consistency of customer support operations.

Trading Experience Analysis

The evaluation of Price Action Forex's trading experience faces big limitations because of insufficient technical and operational information. Platform stability, execution speed, and system reliability metrics are not documented in available source materials.

This prevents assessment of the core trading infrastructure quality that determines whether traders can execute their strategies effectively. Order execution standards, including slippage rates, requote frequency, and fill quality, remain unspecified in accessible documentation.

Platform functionality completeness, including charting capabilities, technical indicators, and trading tools integration, is not detailed in available sources. Modern traders expect comprehensive charting tools and technical analysis capabilities for successful trading.

Mobile trading experience, application features, and cross-device synchronization capabilities are not mentioned. Mobile trading has become crucial for modern forex participants who need to monitor and manage positions while away from their computers.

Trading environment characteristics, such as market depth, liquidity provision, and execution models, are not outlined in source materials. These factors significantly affect trading costs and the ability to execute large orders without market impact.

The absence of specific trading experience information prevents potential clients from understanding the practical aspects of trading with Price Action Forex. This Price Action Forex review emphasizes that the lack of technical specifications and performance data represents a significant transparency gap that serious traders typically require for informed decision-making.

Trust and Reliability Analysis

Trust and reliability assessment reveals significant concerns that potential clients must carefully consider before committing funds. Major questions about the broker's legitimacy and safety create substantial red flags for trader confidence.

The absence of regulatory authority information in available source materials represents a critical transparency gap. This undermines trust-building efforts and raises serious questions about compliance standards that protect trader interests.

Fund safety measures, including client money segregation, deposit protection schemes, and regulatory safeguards, are not detailed in accessible documentation. These protections are essential for trader security and peace of mind when depositing funds.

Company transparency regarding ownership structure, financial statements, and operational procedures remains limited. This prevents thorough due diligence evaluation that professional traders typically conduct before choosing a broker.

Industry reputation indicators and third-party endorsements are not evident in available source materials. Most reputable brokers have industry recognition or regulatory awards that demonstrate their standing in the forex community.

The handling of negative events and customer complaints appears problematic based on the presence of serious legitimacy concerns. The combination of regulatory uncertainty and safety concerns creates a challenging environment for building trader confidence in the platform's reliability.

User Experience Analysis

User experience evaluation presents a complex picture based on the analysis of 270 customer reviews. These reviews demonstrate both positive and negative feedback patterns that suggest inconsistent service delivery across different client interactions.

Overall user satisfaction appears mixed, with some clients reporting positive interactions while others express significant dissatisfaction through 1-star ratings. This polarized feedback suggests that user experience quality may depend on individual circumstances or timing.

Interface design, usability standards, and platform navigation ease are not detailed in available source materials. This prevents assessment of the user interface quality that affects daily trading activities and overall satisfaction.

Registration and verification process efficiency, documentation requirements, and account activation procedures remain unspecified in accessible documentation. New users need to understand these processes to set realistic expectations for getting started.

Fund operation experiences, including deposit and withdrawal processes, are not outlined in available sources. These operations are crucial for trader satisfaction and confidence in the broker's operational capabilities.

Common user complaints appear to center around legitimacy concerns and service quality issues, as evidenced by negative reviews and safety questions. The presence of both satisfied and dissatisfied users suggests that user experience quality may vary significantly depending on specific interaction contexts and individual needs.

Conclusion

This comprehensive Price Action Forex review reveals a broker with significant legitimacy and safety concerns. These issues overshadow any potential positive aspects that some users have experienced with the platform.

While some customers report satisfactory customer service experiences and feeling supported during their interactions, these limited advantages cannot compensate for fundamental issues. The problems with regulatory transparency and operational clarity create serious concerns for trader safety.

The broker may suit users seeking basic forex trading support who are willing to accept higher risk levels. However, extreme caution is essential for any potential client considering this platform for their trading needs.

The absence of clear regulatory information, combined with legitimacy concerns and mixed user feedback, creates an environment where trader funds may not receive adequate protection. Most professional traders prioritize safety and regulatory oversight when choosing a forex broker.

The main advantages include occasional positive customer support interactions that some users have reported. However, significant disadvantages encompass regulatory uncertainty, safety concerns, and inconsistent service quality that affect the overall trading experience.

Based on our analysis, traders should prioritize brokers with stronger regulatory credentials and clearer operational transparency for their forex trading activities in 2025. Better alternatives exist in the market that offer more comprehensive protection and transparent operations for serious forex traders.