City Credit Capital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive city credit capital review examines a UK-based forex broker. City Credit Capital has been operating in the financial services industry since 2001. The company positions itself as a provider of online trading services, specifically focusing on retail derivatives trading for a diverse client base including private investors, institutions, banks, and other brokers.

Based on available user feedback data, City Credit Capital demonstrates mixed performance metrics. The company has an employee rating of 3.0 out of 5 based on 37 reviews, and an overall rating of 3.4 from 47 anonymous user reviews. The broker's primary offerings include forex and CFD trading through their proprietary MarketsTrader platform. They target traders seeking access to derivative markets.

The company's headquarters in London's financial district suggests a focus on serving the European market. However, specific regulatory details and comprehensive service information remain limited in publicly available sources. This positioning indicates City Credit Capital's attempt to establish credibility within the competitive UK forex brokerage landscape.

Important Notice

This city credit capital review is based on available public information and user feedback data. Potential traders should note that specific regulatory information, detailed account conditions, and comprehensive service specifications were not extensively detailed in available sources at the time of this review. The evaluation methodology relies primarily on user testimonials, company background information, and publicly accessible data.

Readers should be aware that forex trading involves significant risk. Different regulatory entities may apply varying standards across jurisdictions. We recommend conducting independent research and verifying current regulatory status before making any trading decisions.

Rating Framework

Note: Ratings marked as N/A indicate insufficient information was available in source materials to provide accurate scoring.

Broker Overview

Company Background and Establishment

City Credit Capital was established in 2001. This marks over two decades of operation in the forex and derivatives trading sector. The company maintains its headquarters in London's financial district, positioning itself strategically within one of the world's leading financial centers. This location choice reflects the broker's intention to serve both retail and institutional clients seeking exposure to international derivative markets.

The broker's business model centers on providing online trading services specifically tailored for retail derivatives trading. Their target clientele encompasses private investors looking for individual trading opportunities, institutional clients requiring professional-grade services, banks seeking trading partnerships, and other brokers who may utilize their services for white-label or partnership arrangements.

Trading Platform and Asset Classes

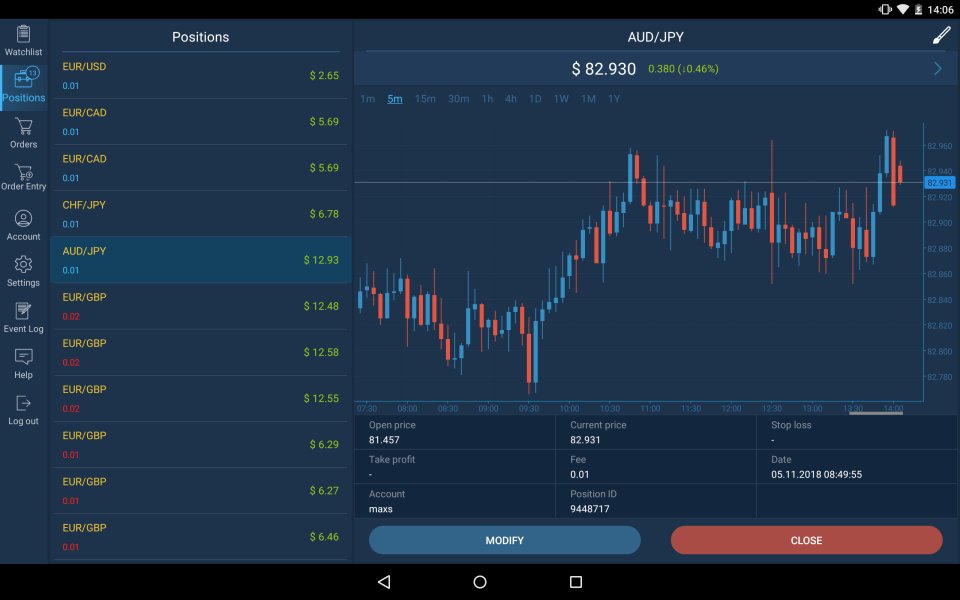

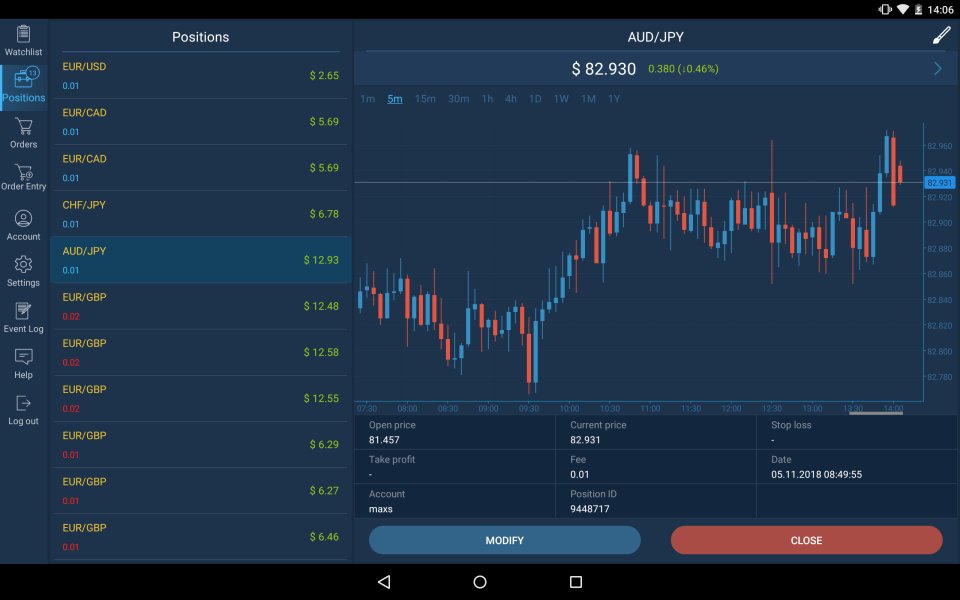

City Credit Capital operates through its proprietary trading platform called MarketsTrader. This platform serves as the primary interface for client trading activities. The platform facilitates access to two main asset classes: foreign exchange markets and contracts for difference. This focus on derivative instruments aligns with the broker's stated specialization in retail derivatives trading.

The forex offerings presumably include major, minor, and exotic currency pairs. However, specific details regarding the number of available instruments were not detailed in available source materials. Similarly, the CFD selection likely covers various underlying assets such as indices, commodities, and potentially individual stocks. Comprehensive asset lists were not specified in the reviewed information.

This city credit capital review notes that while the broker offers these core trading categories, detailed specifications regarding spreads, execution methods, and platform-specific features require further investigation through direct broker contact.

Regulatory Environment

Available source materials did not provide specific details regarding City Credit Capital's regulatory status or oversight bodies. Given the company's UK headquarters, potential regulatory frameworks may include Financial Conduct Authority oversight. However, this requires independent verification.

Deposit and Withdrawal Methods

Specific information regarding available deposit and withdrawal methods was not detailed in the source materials reviewed for this evaluation. Traders interested in account funding options should contact the broker directly for current payment processing information.

Minimum Deposit Requirements

The minimum deposit requirements for opening accounts with City Credit Capital were not specified in available documentation. This indicates the need for direct broker consultation to determine account opening thresholds.

Promotional Offers

Details regarding bonus structures, promotional offers, or incentive programs were not included in the source materials reviewed for this city credit capital review.

Available Trading Assets

The broker focuses on forex and CFD trading. This provides access to currency markets and derivative instruments. However, specific instrument counts, exotic pairs availability, and CFD underlying asset categories were not comprehensively detailed in available sources.

Cost Structure Analysis

Detailed information regarding spread structures, commission rates, overnight financing costs, and additional fees was not specified in the reviewed materials. This requires direct broker inquiry for comprehensive cost analysis.

Leverage Specifications

Leverage ratios and margin requirements were not detailed in available source documentation.

Platform Options

The primary trading platform is MarketsTrader. Additional platform options or mobile trading capabilities were not extensively described in source materials.

Geographic Restrictions

Specific information regarding geographic trading restrictions or country limitations was not detailed in available sources.

Customer Support Languages

Available customer service languages were not specified in the reviewed documentation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of City Credit Capital's account conditions faces significant limitations due to insufficient detailed information in available source materials. Traditional account analysis typically examines multiple account tiers, minimum deposit requirements, account-specific benefits, and specialized offerings such as Islamic accounts for Shariah-compliant trading.

Without comprehensive account specification data, this city credit capital review cannot provide definitive assessment of account opening procedures, verification requirements, or tier-based benefit structures. Potential traders seeking detailed account information should engage directly with the broker to understand available account types, associated costs, and specific terms and conditions.

The absence of detailed account information in public sources may indicate either limited marketing transparency or a focus on direct client consultation rather than public specification disclosure. This approach could benefit traders preferring personalized account setup discussions but may disadvantage those seeking immediate comparison data.

Industry standard account conditions typically include demo account availability, cent account options for beginners, and premium accounts for high-volume traders. The specific availability of these options with City Credit Capital requires direct verification through broker contact.

Assessment of City Credit Capital's trading tools and educational resources encounters limitations due to sparse detailed information in available sources. Modern forex brokers typically provide comprehensive analytical tools, market research, economic calendars, and educational materials to support trader decision-making.

The MarketsTrader platform presumably includes standard charting capabilities, technical indicators, and order management tools. However, specific feature sets were not detailed in reviewed materials. Advanced trading tools such as automated trading support, custom indicator capabilities, and algorithmic trading options require direct platform investigation.

Educational resource availability, including webinars, tutorials, market analysis, and trading guides, was not specified in source materials. Many brokers provide extensive educational libraries to support trader development, but City Credit Capital's specific offerings in this area remain unclear from available documentation.

Research and analysis resources, such as daily market commentary, fundamental analysis reports, and economic event coverage, were not detailed in the reviewed information. These resources typically play crucial roles in trader education and market awareness development.

Customer Service and Support Analysis

Customer service evaluation for City Credit Capital faces constraints due to limited specific information regarding support channels, availability, and service quality metrics in reviewed source materials. Effective customer support typically encompasses multiple contact methods, extended availability hours, and multilingual assistance capabilities.

Standard customer service channels usually include live chat, email support, telephone assistance, and potentially social media support options. The specific availability and operating hours for these channels with City Credit Capital were not detailed in available sources.

Response time expectations, service quality standards, and problem resolution procedures were not specified in the reviewed materials. User feedback data showing overall ratings of 3.4 from 47 reviews suggests mixed customer experiences, though specific service-related comments were not detailed in available sources.

Multilingual support capabilities, particularly important for international brokers, were not specified in the documentation reviewed. Given the broker's London headquarters, English language support is presumed, though additional language availability requires verification.

Trading Experience Analysis

Evaluation of the trading experience with City Credit Capital encounters limitations due to insufficient technical performance data and platform-specific information in available sources. Trading experience assessment typically examines platform stability, execution speed, order fulfillment quality, and overall user interface effectiveness.

The MarketsTrader platform serves as the primary trading interface. However, detailed performance metrics, system uptime statistics, and execution quality data were not provided in reviewed materials. Platform reliability and speed directly impact trading effectiveness, particularly for active traders and scalping strategies.

Order execution quality, including slippage rates, requote frequency, and execution speed measurements, was not detailed in available sources. These factors significantly influence trading costs and strategy effectiveness, making them crucial considerations for potential users.

Mobile trading capabilities and cross-device synchronization features were not comprehensively detailed in the reviewed information. Modern traders increasingly rely on mobile platforms for market monitoring and trade management, making mobile functionality assessment important.

Trust Factor Analysis

Trust factor evaluation for City Credit Capital faces significant constraints due to limited regulatory information and transparency details in available source materials. Trust assessment typically examines regulatory oversight, fund security measures, company transparency, and industry reputation factors.

Regulatory status verification represents a crucial trust component. Yet specific regulatory body oversight and license numbers were not detailed in reviewed sources. UK-based brokers typically operate under Financial Conduct Authority oversight, though City Credit Capital's specific regulatory status requires independent verification.

Fund security measures, including segregated account policies, deposit insurance coverage, and client fund protection protocols, were not specified in available documentation. These protections serve as fundamental trust indicators for forex brokers.

Company transparency regarding ownership, financial statements, and operational procedures was not extensively detailed in reviewed materials. Transparency levels often correlate with regulatory compliance and operational integrity.

Industry reputation factors, including regulatory violations, customer complaints, and third-party evaluations, were not comprehensively covered in available sources. This limits comprehensive trust assessment capabilities.

User Experience Analysis

User experience evaluation for City Credit Capital benefits from available rating data showing an overall score of 3.4 from 47 anonymous reviews and an employee rating of 3.0 based on 37 reviews. These moderate ratings suggest mixed user experiences with room for improvement across various service aspects.

The 3.4 overall rating indicates that while some users find acceptable service levels, others may experience challenges or limitations. This moderate scoring suggests neither exceptional performance nor significant service failures, positioning the broker in a neutral performance category.

Interface design and platform usability assessment requires direct platform interaction, as specific user interface details were not comprehensively described in available sources. User-friendly design significantly impacts trading efficiency and overall satisfaction levels.

Account registration and verification processes were not detailed in reviewed materials. However, these procedures directly affect initial user experiences. Streamlined onboarding processes typically correlate with positive user feedback and higher satisfaction ratings.

The mixed rating data suggests potential areas for service improvement. However, specific user complaint categories or praise areas were not detailed in available sources, limiting targeted user experience analysis.

Conclusion

This city credit capital review reveals a forex broker with over two decades of operational history but limited publicly available detailed information regarding specific service offerings and regulatory status. The moderate user ratings of 3.4 overall and 3.0 employee satisfaction suggest neutral market positioning with mixed customer experiences.

City Credit Capital appears most suitable for traders seeking basic forex and CFD trading services who prefer direct broker consultation over extensive public information research. The broker's London headquarters and focus on derivatives trading may appeal to European traders and those seeking institutional-style service approaches.

The primary advantages include established operational history since 2001 and focus on retail derivatives trading through the MarketsTrader platform. However, significant limitations include insufficient public information regarding regulatory status, detailed account conditions, cost structures, and comprehensive service specifications. Potential traders should conduct thorough due diligence and direct broker consultation before account opening decisions.