NeoProFx 2025 Review: Everything You Need to Know

Executive Summary

NeoProFx operates as an unregulated forex broker. The company has generated mixed reactions from the trading community since its establishment approximately 2-5 years ago. According to multiple sources including WikiBit and various review platforms, this neoprofx review reveals significant concerns about the broker's legitimacy and regulatory status. The broker primarily targets forex market participants but lacks the fundamental regulatory oversight that experienced traders typically seek.

User feedback presents a polarized picture. Some traders question the broker's authenticity while others report varying experiences with the platform. The absence of clear regulatory compliance raises red flags for potential investors, particularly those prioritizing fund security and transparent business practices. NeoProFx appears to position itself toward beginner and intermediate traders exploring forex markets. However, the controversial nature of user reviews suggests caution is warranted.

The broker's relatively short operational history, combined with unverified regulatory status, places it in the high-risk category for potential clients. This comprehensive analysis examines all available information to provide traders with essential insights for informed decision-making.

Important Notice

Due to NeoProFx's unregulated status, traders across different jurisdictions should exercise extreme caution. They should thoroughly evaluate their local legal frameworks before considering this broker. Regulatory requirements vary significantly between regions, and the absence of proper oversight may expose traders to unnecessary risks.

This evaluation is based on available information from April 2023 and August 2024 user feedback, market observations, and publicly accessible sources. Given the limited transparency surrounding NeoProFx's operations, prospective clients should conduct additional due diligence and consider regulated alternatives that offer greater consumer protection and operational transparency.

Rating Framework

Broker Overview

NeoProFx entered the online trading landscape approximately 2-5 years ago. The company positions itself as a forex and CFD trading service provider. According to available sources from WikiBit and other review platforms, the company operates with limited transparency regarding its corporate structure, management team, and business operations. The broker's relatively recent establishment in the competitive forex market coincides with increasing scrutiny from traders seeking reliable and regulated trading environments.

The company's business model appears centered on providing access to foreign exchange markets. However, specific details about their trading infrastructure, liquidity providers, and operational procedures remain unclear from available documentation. This lack of transparency extends to fundamental business information that established brokers typically make readily available to potential clients.

Regarding regulatory oversight, neoprofx review sources consistently indicate that the broker operates without proper regulatory authorization from recognized financial authorities. This unregulated status significantly impacts the broker's credibility and raises concerns about client fund protection, dispute resolution mechanisms, and adherence to industry standards. The absence of regulatory compliance represents a critical consideration for traders evaluating NeoProFx against established, regulated alternatives in the forex market.

Regulatory Status: NeoProFx operates without regulation from recognized financial authorities. This creates potential risks for client fund protection and dispute resolution.

Deposit and Withdrawal Methods: Available sources do not provide specific information about supported payment methods, processing times, or associated fees for fund transfers.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in available documentation. This requires direct inquiry with the broker.

Bonuses and Promotions: No information about promotional offers, welcome bonuses, or trading incentives appears in current source materials.

Tradeable Assets: The broker primarily focuses on forex markets. However, specific details about available currency pairs, exotic options, and CFD instruments remain unspecified.

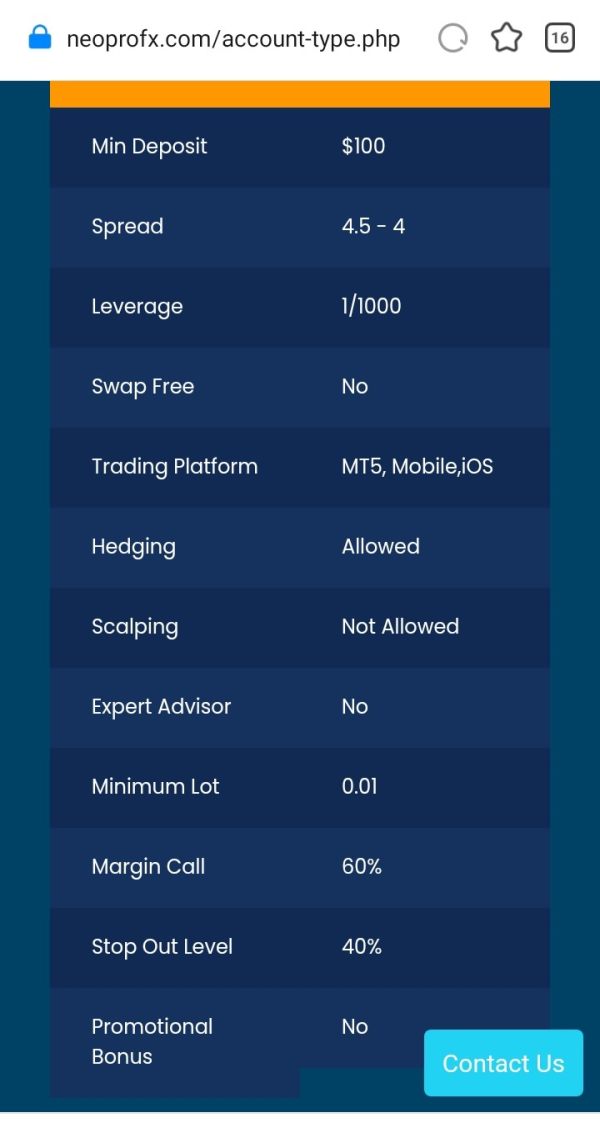

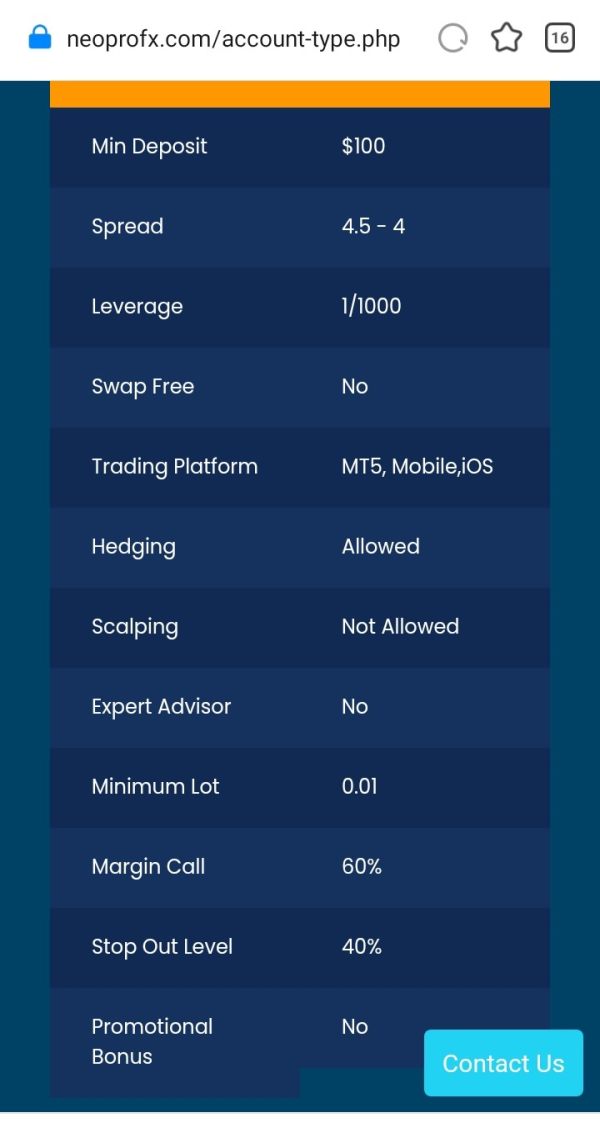

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not available in current documentation. This represents a significant transparency gap.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in available sources.

Platform Options: Trading platform specifications, including software type, mobile applications, and technical features, are not clearly outlined in accessible materials.

Geographic Restrictions: Information about restricted countries or regional limitations is not specified in current documentation.

Customer Support Languages: Available support languages and communication channels are not detailed in source materials.

This neoprofx review highlights the substantial information gaps that potential clients encounter when evaluating the broker's services and operational framework.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

NeoProFx's account structure lacks the transparency and detailed specifications that characterize reputable forex brokers. Available sources do not provide comprehensive information about account types, tier structures, or specific features that differentiate various account offerings. This absence of clear account documentation makes it difficult for potential traders to understand what services they would receive and how different account levels might serve their trading objectives.

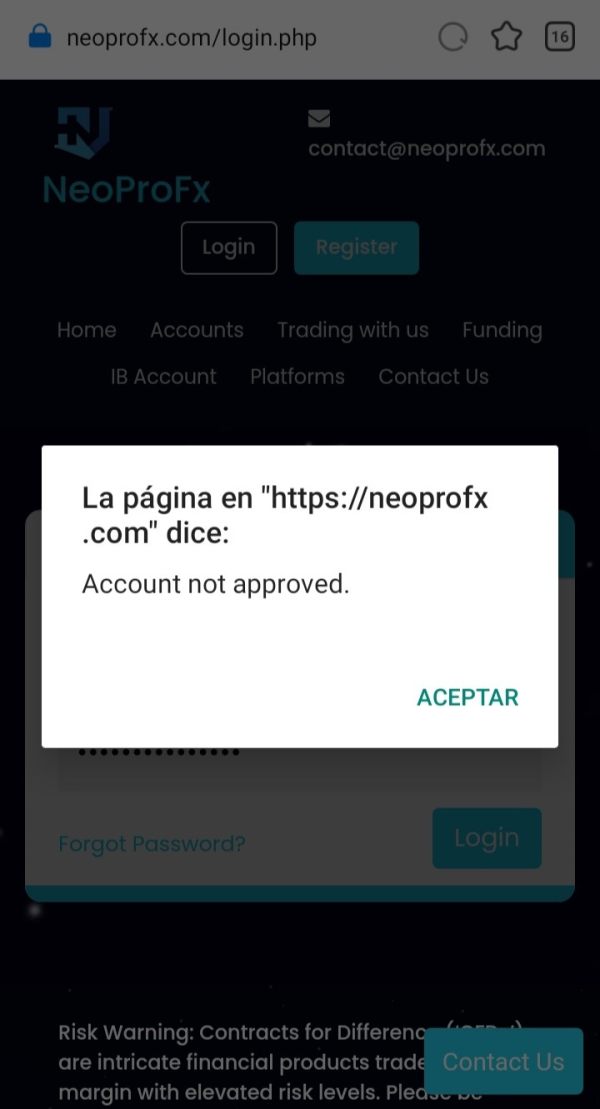

The minimum deposit requirements remain unspecified in available materials. This prevents traders from properly budgeting for account opening and comparing costs against regulated competitors. Without clear information about account opening procedures, verification requirements, and approval timelines, prospective clients cannot adequately prepare for the onboarding process.

Special account features, such as Islamic accounts for Sharia-compliant trading, VIP services, or institutional offerings, are not detailed in accessible documentation. This lack of specificity suggests either limited account variety or poor communication of available options.

The overall account conditions evaluation reflects these significant information gaps and the challenges they create for informed decision-making. Neoprofx review sources consistently highlight these transparency concerns as major drawbacks for potential clients seeking clear, comprehensive account information.

The trading tools and analytical resources offered by NeoProFx remain largely undocumented in available source materials. This creates significant uncertainty about the broker's technical capabilities. Established forex brokers typically provide detailed information about charting software, technical indicators, automated trading support, and analytical tools that enhance trading effectiveness.

Research and market analysis resources, including economic calendars, market commentary, daily analysis, and educational content, are not specified in current documentation. These resources are considered essential by many traders for making informed decisions and developing trading strategies.

Educational materials, such as webinars, tutorials, trading guides, and market education programs, appear absent from available information. The lack of educational support particularly impacts beginner traders who rely on broker-provided learning resources to develop their skills and market understanding.

Automated trading capabilities, including Expert Advisor support, algorithmic trading options, and API access for advanced users, are not detailed in accessible materials. This absence of information about automation features may concern traders who depend on systematic trading approaches.

The limited information about tools and resources significantly impacts the broker's appeal to serious traders who require comprehensive analytical and educational support for effective market participation.

Customer Service and Support Analysis (4/10)

Customer service information for NeoProFx presents significant gaps that raise concerns about support accessibility and quality. Available sources do not provide clear details about customer service channels, including telephone support, live chat availability, email response systems, or help desk operations.

Response times and service quality metrics are not documented in available materials. This makes it impossible to assess the broker's commitment to timely problem resolution and client support. Established brokers typically publish service level agreements and response time commitments that help clients understand what support they can expect.

Multi-language support capabilities remain unspecified. This potentially limits accessibility for international traders who require assistance in their native languages. The absence of clear language support information may indicate limited international service capabilities.

Operating hours for customer support services are not detailed in available documentation. This creates uncertainty about when clients can access assistance for urgent trading or account issues. The lack of clarity about support availability represents a significant service gap.

The overall customer service evaluation reflects these substantial information deficits and the potential challenges they create for clients requiring reliable support services during their trading activities.

Trading Experience Analysis (5/10)

The trading experience offered by NeoProFx remains difficult to assess due to limited available information about platform performance, execution quality, and technical capabilities. User feedback from various sources presents mixed perspectives, though specific performance data and detailed user experiences are not comprehensively documented.

Platform stability and execution speed represent critical factors for forex trading success. Yet available sources do not provide concrete information about server uptime, connection reliability, or order processing performance. The absence of technical performance metrics makes it challenging to evaluate the broker's infrastructure quality.

Order execution quality, including slippage rates, requote frequency, and fill rates, is not detailed in accessible documentation. These factors significantly impact trading profitability and user satisfaction, making their absence a notable information gap.

Mobile trading capabilities and platform functionality across different devices are not specified in available materials. Modern traders increasingly rely on mobile access for market monitoring and trade management, making mobile platform quality an important consideration.

The neoprofx review indicates that while some users report acceptable trading experiences, the lack of detailed performance information and mixed user feedback contributes to uncertainty about the overall trading environment quality.

Trust and Security Analysis (2/10)

Trust and security represent the most concerning aspects of NeoProFx's operations. This is primarily due to the broker's unregulated status and associated risks. The absence of regulatory oversight from recognized financial authorities eliminates crucial consumer protections that regulated brokers must provide.

Fund security measures, including client money segregation, deposit insurance, and bankruptcy protection, are not detailed in available documentation. Regulated brokers typically maintain client funds in segregated accounts and provide clear information about fund protection mechanisms.

Corporate transparency issues include limited information about company ownership, management structure, financial reporting, and business operations. This lack of transparency makes it difficult for clients to assess the company's stability and operational integrity.

Industry reputation concerns arise from user reviews questioning the broker's legitimacy and various sources highlighting potential risks associated with unregulated operations. The presence of scam-related discussions in review platforms raises significant red flags about the broker's credibility.

Negative event handling and dispute resolution mechanisms are not clearly established. This leaves clients without clear recourse options if problems arise. The combination of unregulated status and limited transparency creates substantial trust and security concerns for potential clients.

User Experience Analysis (4/10)

User experience feedback for NeoProFx presents a mixed picture. Available sources indicate varying levels of satisfaction among traders who have engaged with the platform. The diversity of user opinions suggests inconsistent service delivery and potentially problematic operational aspects.

Interface design and usability information is not comprehensively available in source materials. However, user feedback indicates varying experiences with platform navigation and functionality. Modern trading platforms require intuitive design and efficient workflow management for effective user experience.

Registration and account verification processes are not detailed in available documentation. This creates uncertainty about onboarding efficiency and requirements. Streamlined account opening procedures are essential for positive initial user experiences.

Fund management experiences, including deposit and withdrawal processes, processing times, and associated challenges, are not clearly documented in available sources. Efficient fund operations represent crucial components of overall user satisfaction.

Common user complaints appear to center around transparency concerns and questions about the broker's legitimacy. However, specific operational issues are not comprehensively detailed in accessible materials. The target user base of beginner and intermediate traders may find the lack of clear information and mixed reviews particularly challenging when making platform decisions.

Conclusion

NeoProFx presents significant challenges for traders seeking a reliable and transparent forex trading environment. While the broker offers access to forex markets, the combination of unregulated status, limited operational transparency, and mixed user feedback creates substantial concerns for potential clients. The absence of regulatory oversight eliminates crucial consumer protections and dispute resolution mechanisms that regulated brokers provide.

The broker may appeal to traders interested in exploring forex markets, particularly beginners and intermediate-level participants. However, the lack of comprehensive information about trading conditions, costs, and operational procedures makes informed decision-making difficult. The primary advantages appear to be platform accessibility, while significant disadvantages include regulatory absence and transparency concerns.

Prospective clients should carefully consider these factors and explore regulated alternatives that offer greater transparency, consumer protection, and operational accountability before committing funds to NeoProFx.