MYFX Markets Review 29

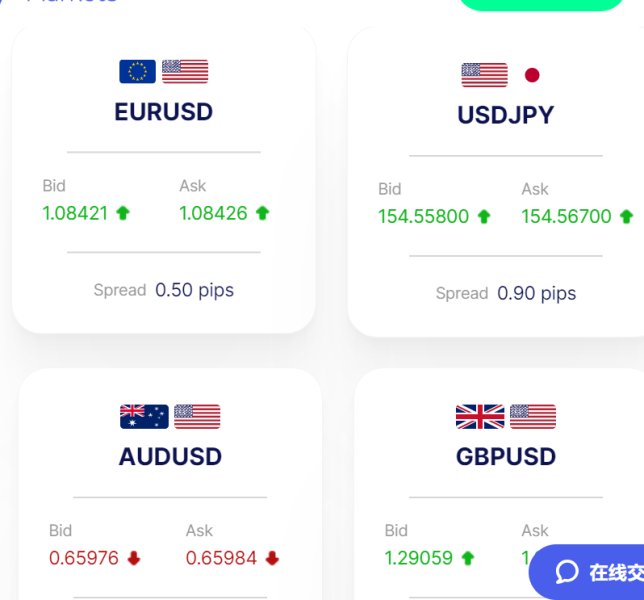

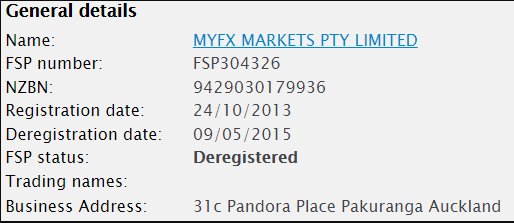

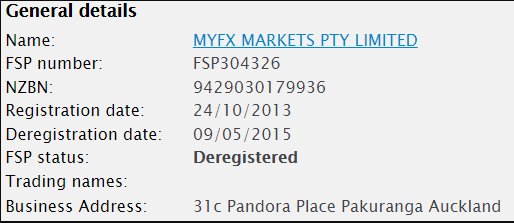

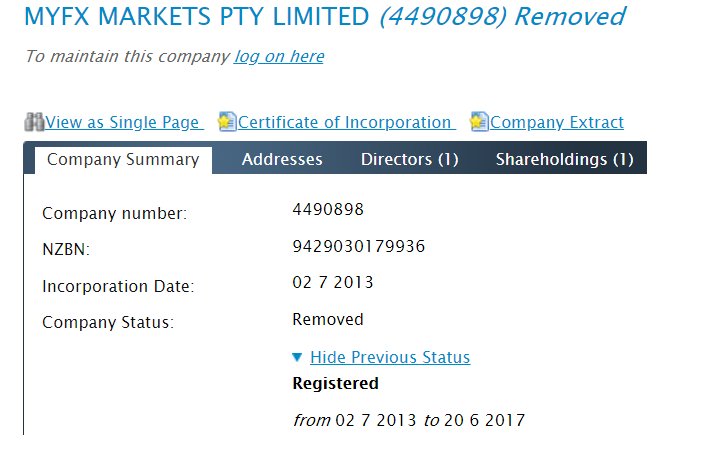

The contact information of the "Contact Us" section you want to spread is as follows. Address: 1a Wakeling Avenue, Te Atatu South, Auckland, 0610, New Zealand Tel: +64 9 889 4022 Email: customer.service@myfxmarkets.com The address is Auckland, New Zealand. Checking this address in Google Street View, it looks like a residential area, as shown in screen 1 below, but it is not very, but I think this address does not actually exist for foreign exchange traders. In addition, after checking the registration of New Zealand as a financial institution, it was found that the registration of the financial institution has been cancelled on the New Zealand Financial Service Provider Registration (FSPR) website. Registration was cancelled on May 9, 2015. Screen 2 If you check the legal person registration from here, it also seems to be considered deleted (registration cancelled). The deregistration time is June 20, 2017, which is more than two years after the deregistration of the financial institution. Screen 3 The reason for the cancellation of registration is not stated, but I think the contractor who received the cancellation of registration is not credible.

The customer service of Myfx Markets claimed that deposit and withdrawal is unlimited,while giving no access to withdrawal now.I traded in Myfx Markets and made profits,applying to withdraw money.But the customer service said that I was trading illegally.How could be?All my orders were operated by myself,held for several minutes at least several minutes.Just because I made a profit? I couldn’t log in my account because of invalid background.Hope you stay away and avoid being cheated.Hope WikiFX help me take back my hard-earned money.

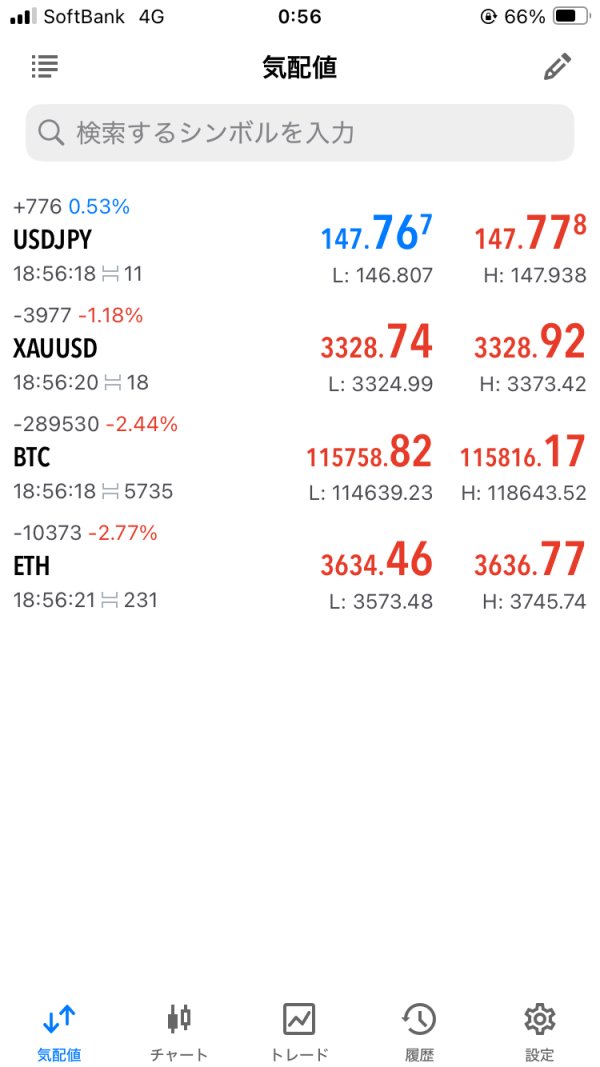

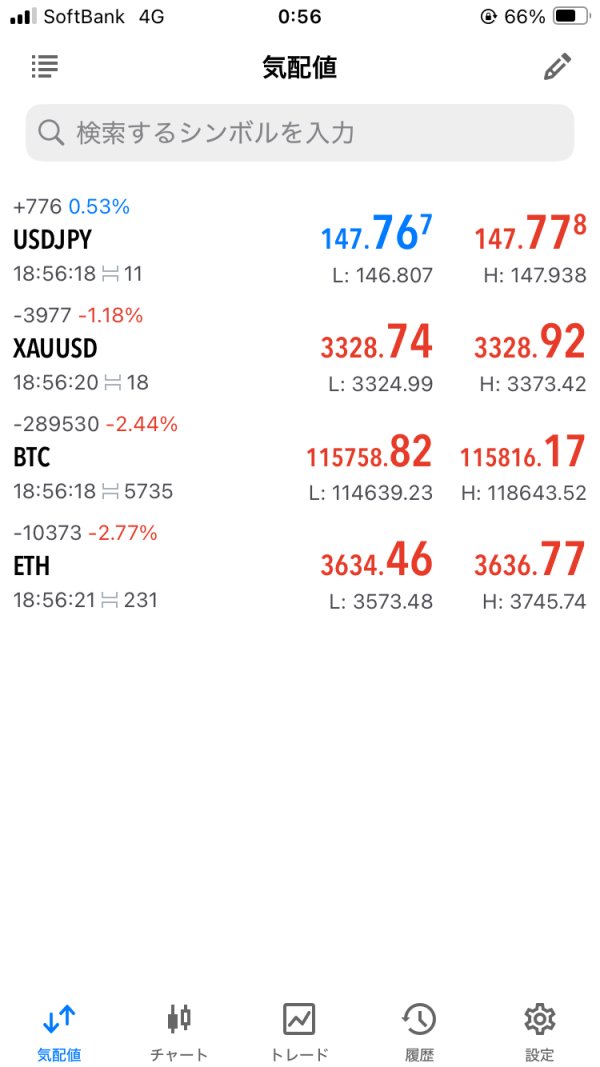

My MT4 account is 88000200. They said I violated their rules although all my orders were manual orders over several minutes. Obviously, this is a dealing-desk broker since they won’t let me withdraw and banned my account for no reason. Later they found more excuses to ask me to wait. At first when I was getting to know the platform, the customer manager said I can withdraw on Myfx Markets with no limits. I deposited $3000 and earned $5000. In Saturday, I applied for a withdrawal and the customer manager told me at Monday morning that the request is in process. However, at that very afternoon, I failed to log in to my MT4 terminal and found myself banned. I asked the customer manager and the service, who said I violated their rules and it is under checking which will take 1 or 2 weeks to give me reply. But the thing is, they banned my MT4 account and backstage account for no reason, saying that I violated their rules. Obviously they just didn’t want me to withdraw. They told me the head in office is in off hours when I asked them again. But they’ve got another office in Shanghai. Can I just call Shanghai police and let them arrest these people? I looked up online and found that actually Myfx Markets is a white label of FIXI, which has closed. I wonder if they rejected my withdrawal request as they are about to abscond. I called Shanghai police and reported to FCA them and their transaction channel. Here are the proofs. Stay away from this broker.

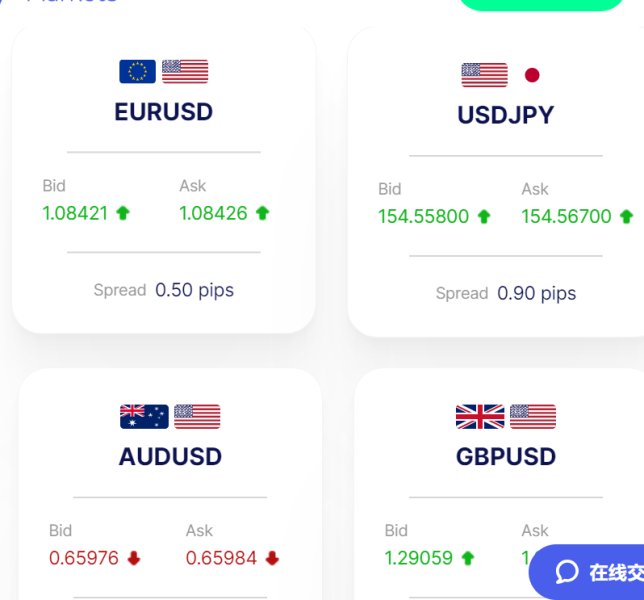

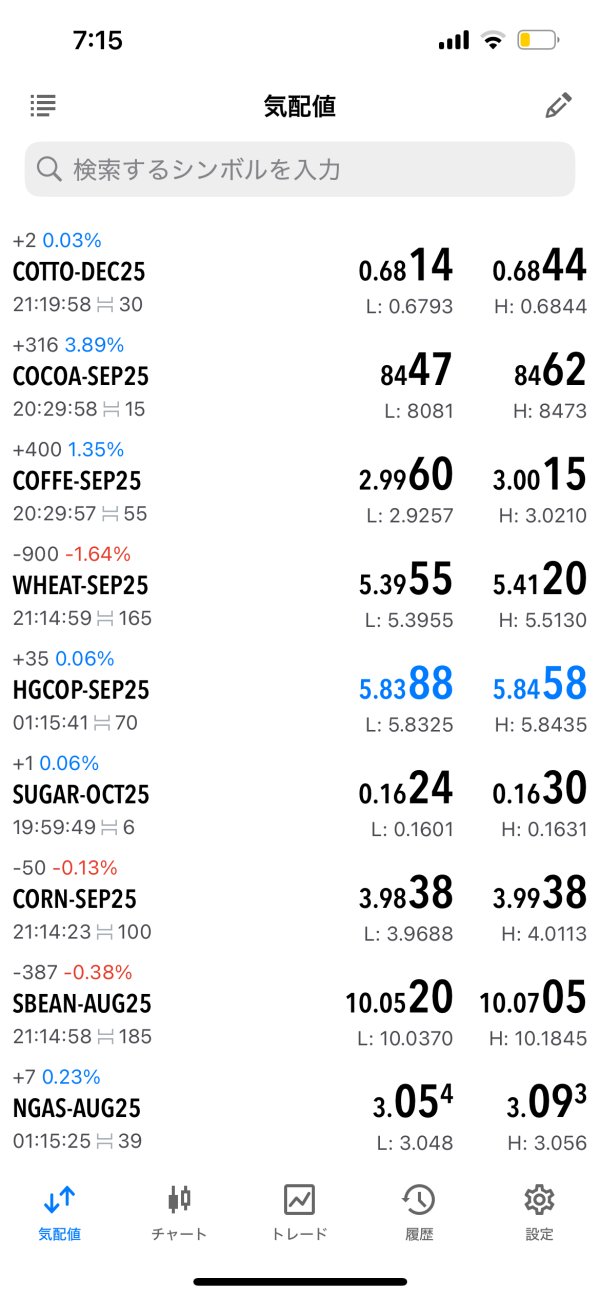

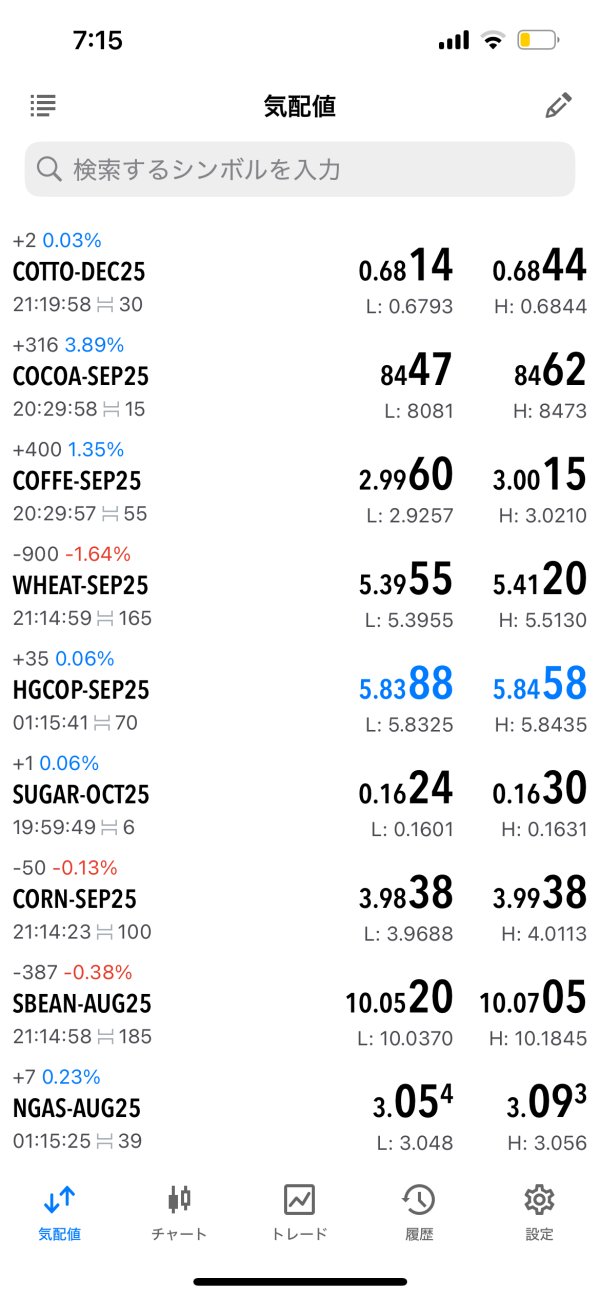

This broker isn't particularly outstanding, but I think their account opening bonuses and deposit bonuses aren't bad. Maybe the lack of a loyalty program is the reason... The spreads are decent, and I don't particularly have the impression that it's inconvenient to use. Still, whether I'd use it as my main account is questionable... That might be why it doesn't stand out much.

I use it sparingly, but it's neither good nor bad. The spreads for AUD-related pairs are relatively tight, making minor scalping easier. The frequent delays in deposits and withdrawals are the only drawback.

I received an account opening bonus and traded after depositing 20,000 yen. I submitted a withdrawal request without meeting the bonus withdrawal conditions, but the bonus and profits were not forfeited. After fulfilling the withdrawal requirements, I was able to withdraw without any issues.

There seem to be many campaigns. Deposits are also smooth.

MYFX Markets is the real deal! They offer tight spreads and generous leverage, giving traders like me the edge we need to succeed in the market.