Trader Team Malaysia Review 1

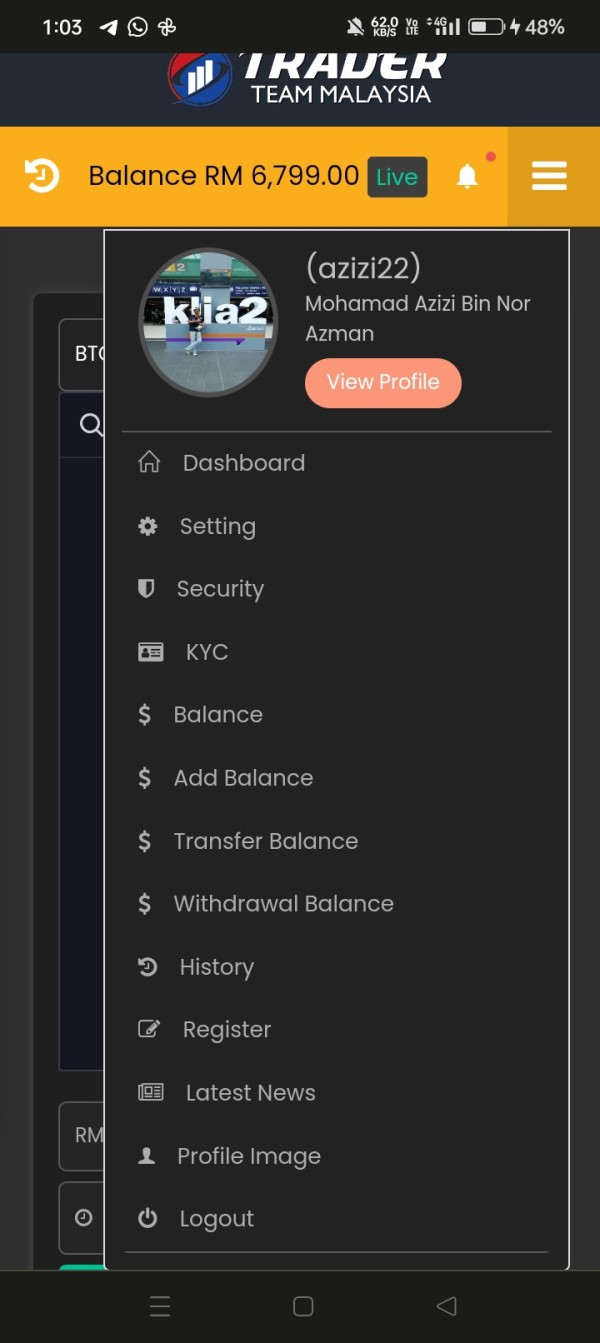

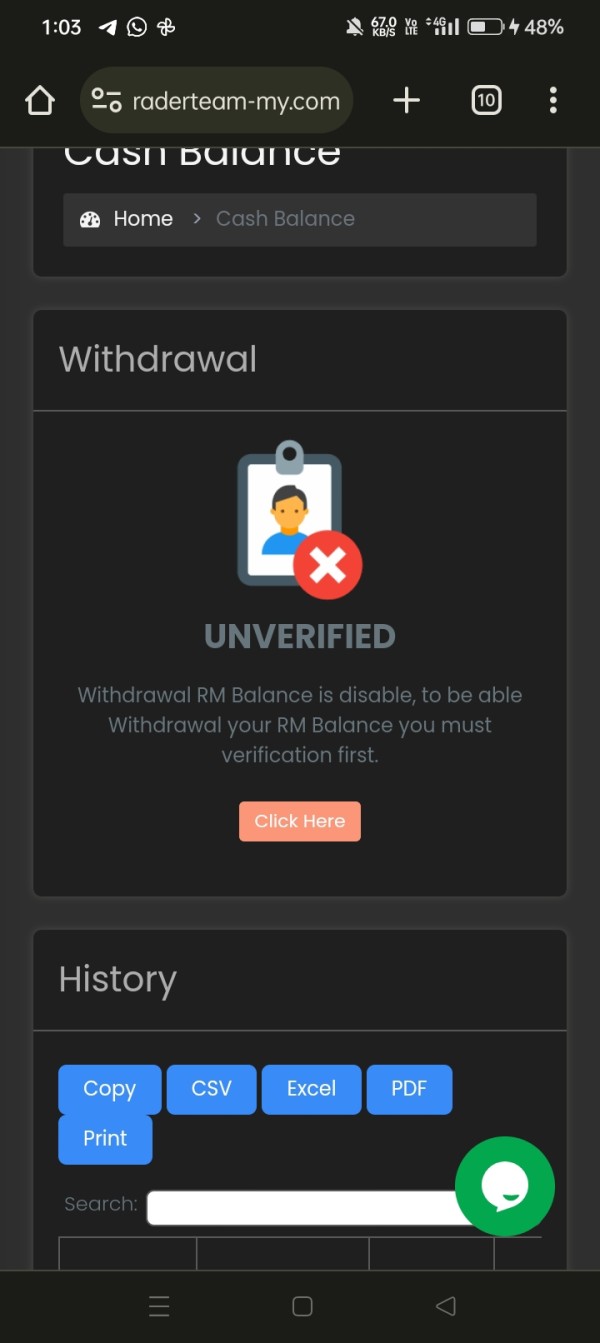

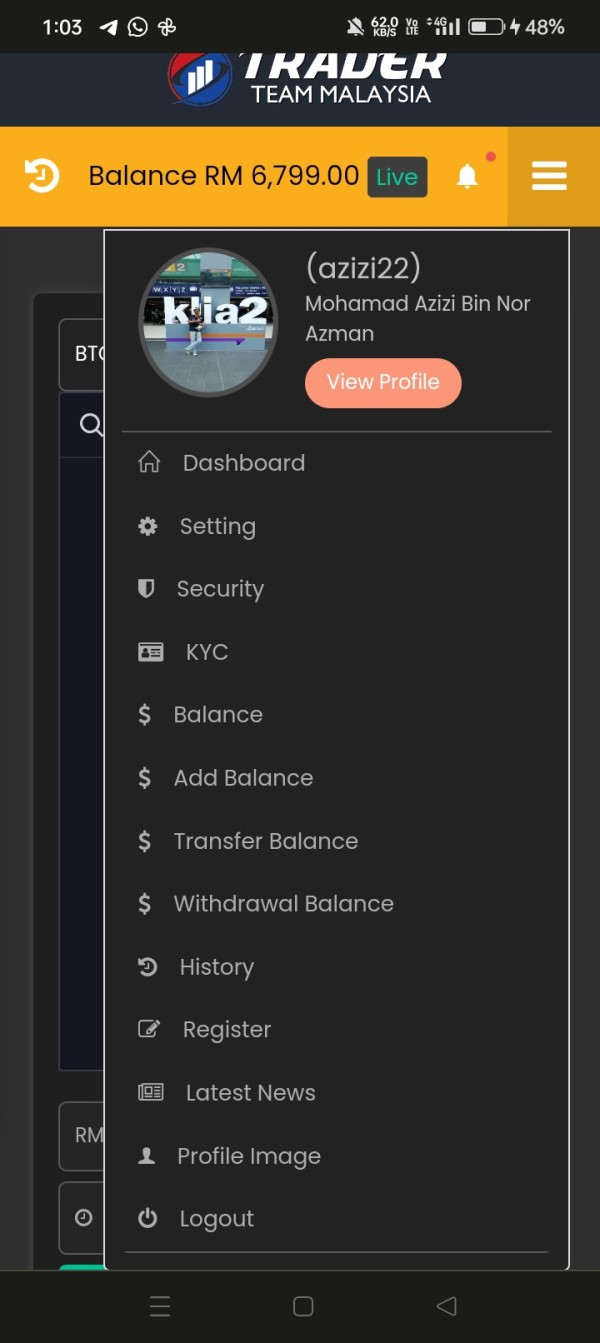

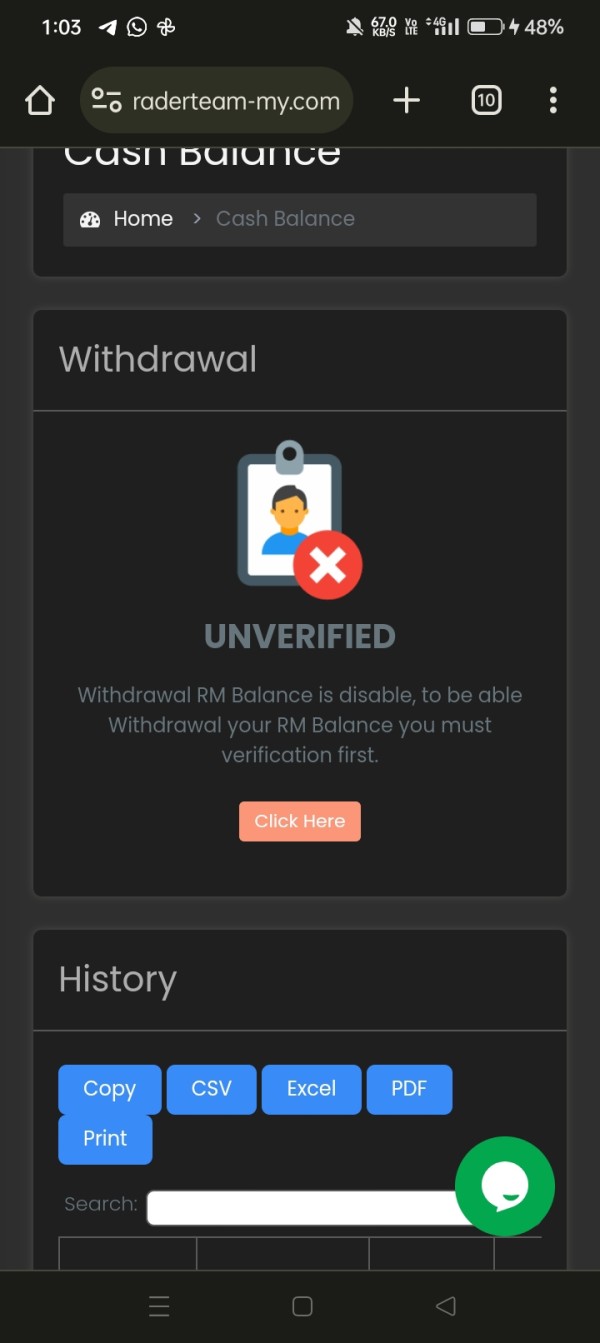

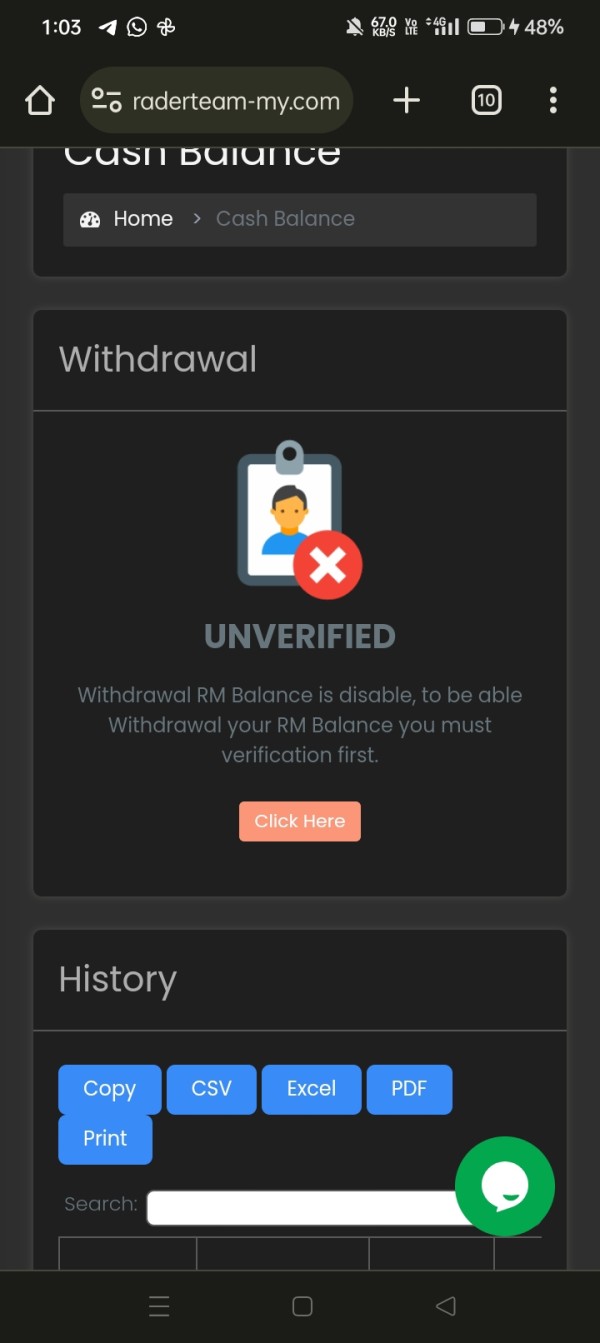

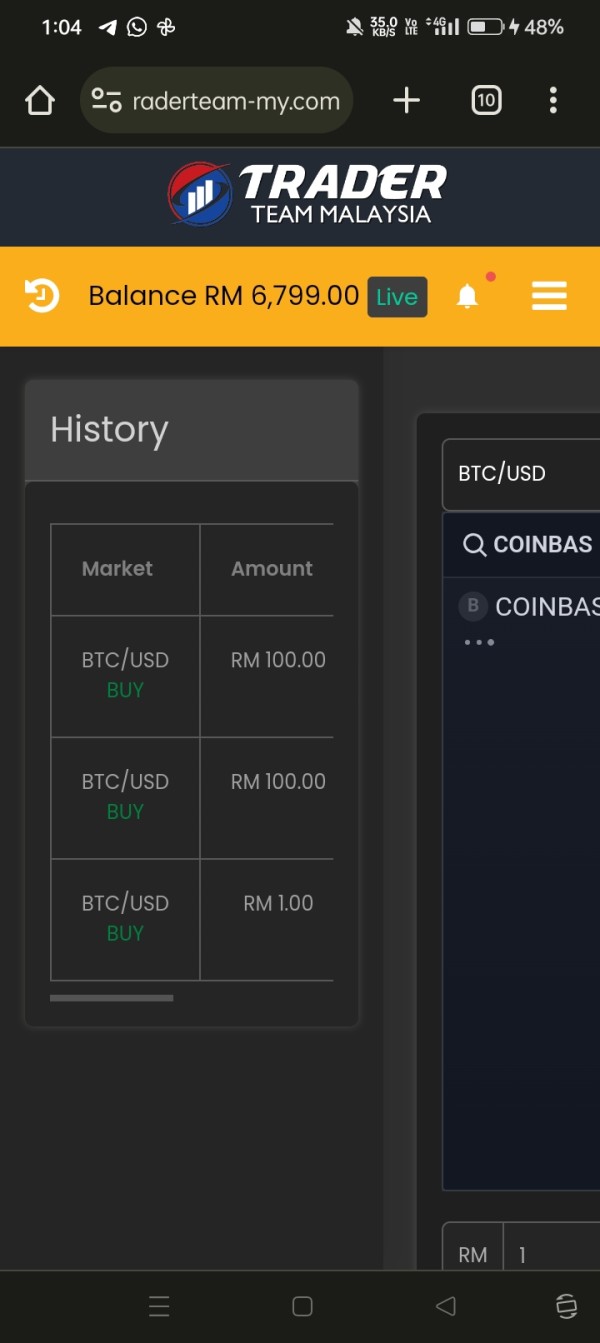

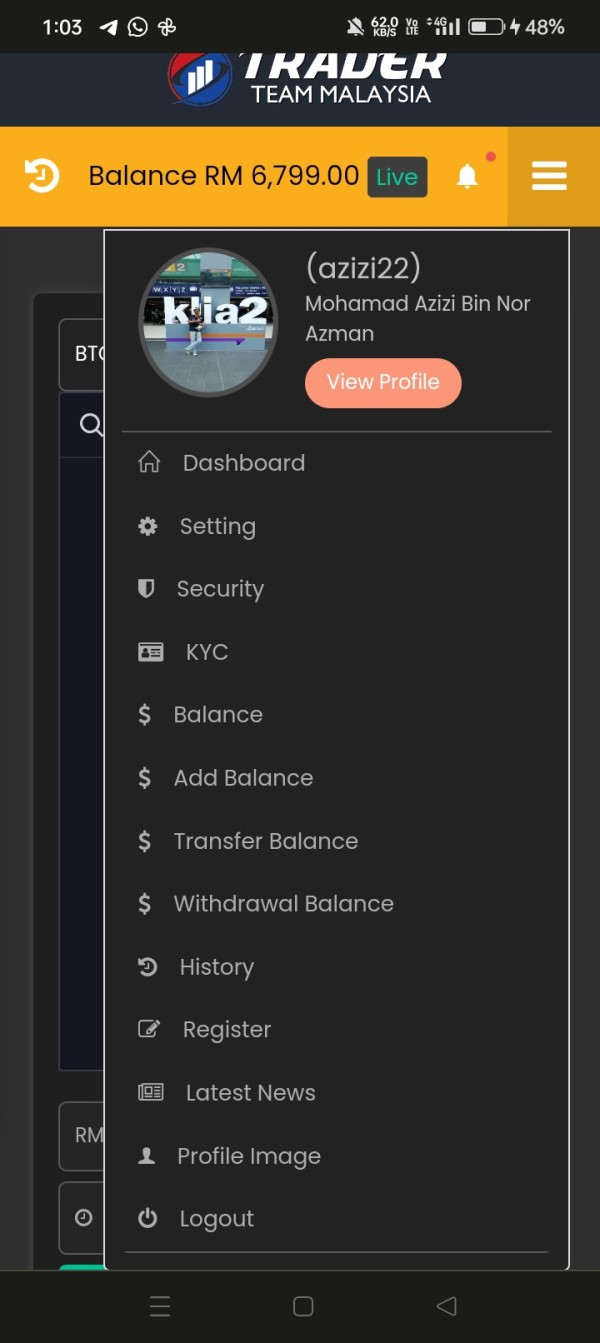

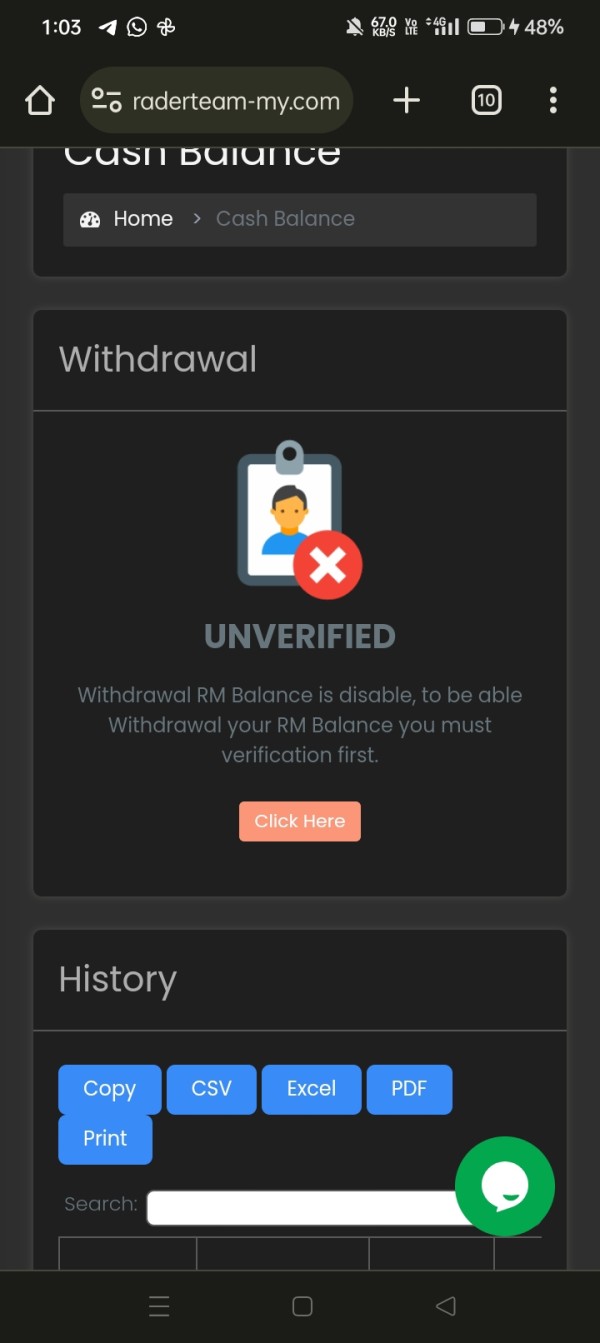

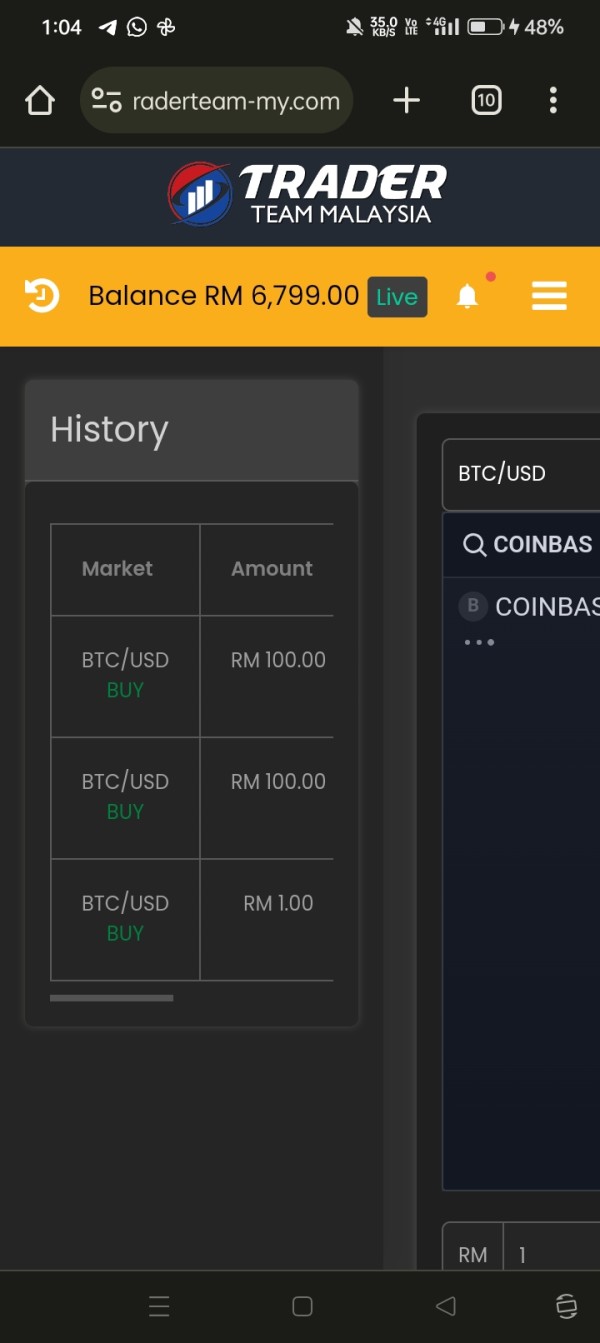

i cant withdraw my acc, idont know why..it also cant verify my id (KYC) please help me..idont know how to do..ijust want to withdraw the money..thats all

Trader Team Malaysia Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

i cant withdraw my acc, idont know why..it also cant verify my id (KYC) please help me..idont know how to do..ijust want to withdraw the money..thats all

This trader team malaysia review shows big concerns about this Malaysian binary trading company. Trader Team Malaysia started in 2022 and operates without regulation, which has led to warnings from the Malaysian Securities Commission. The company lacks authorization from any regulatory body. This raises serious questions about investor protection and fund security.

Trader Team Malaysia is new to the market but has already received investor complaints and regulatory attention. The platform targets people interested in binary trading, especially those who want quick investment opportunities. However, potential investors should be very careful because there is no proper regulatory oversight and growing concerns about the company's legitimacy.

The company lacks transparency about trading conditions, platform features, and client protection measures. This makes the risks even worse for people who might use this broker. Our detailed analysis shows that Trader Team Malaysia fails to meet basic standards expected from a real financial services provider. This makes it unsuitable for serious traders and investors.

This review looks specifically at Trader Team Malaysia's operations within Malaysia. The company operates without authorization from the Malaysian Securities Commission. The SC has issued official warnings about this entity. This highlights the risks of working with unregulated financial service providers.

Our evaluation uses available public information, regulatory notices, and user feedback collected through independent research. We maintain strict editorial independence and do not receive compensation from the broker under review. Readers should do their own research before making any investment decisions.

| Evaluation Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | 1/10 | No information available about account types or conditions |

| Tools and Resources | 1/10 | No trading tools or educational resources mentioned |

| Customer Service | 1/10 | Customer support information not provided |

| Trading Experience | 2/10 | Users express doubts about legitimacy |

| Trustworthiness | 1/10 | Unregulated status with regulatory warnings |

| User Experience | 1/10 | Users question the company's legitimacy |

Trader Team Malaysia appeared in the binary trading space in 2022. The company positions itself as an online trading platform for Malaysian investors. The company's short operational history and lack of established track record immediately raise red flags for potential clients seeking reliable trading services.

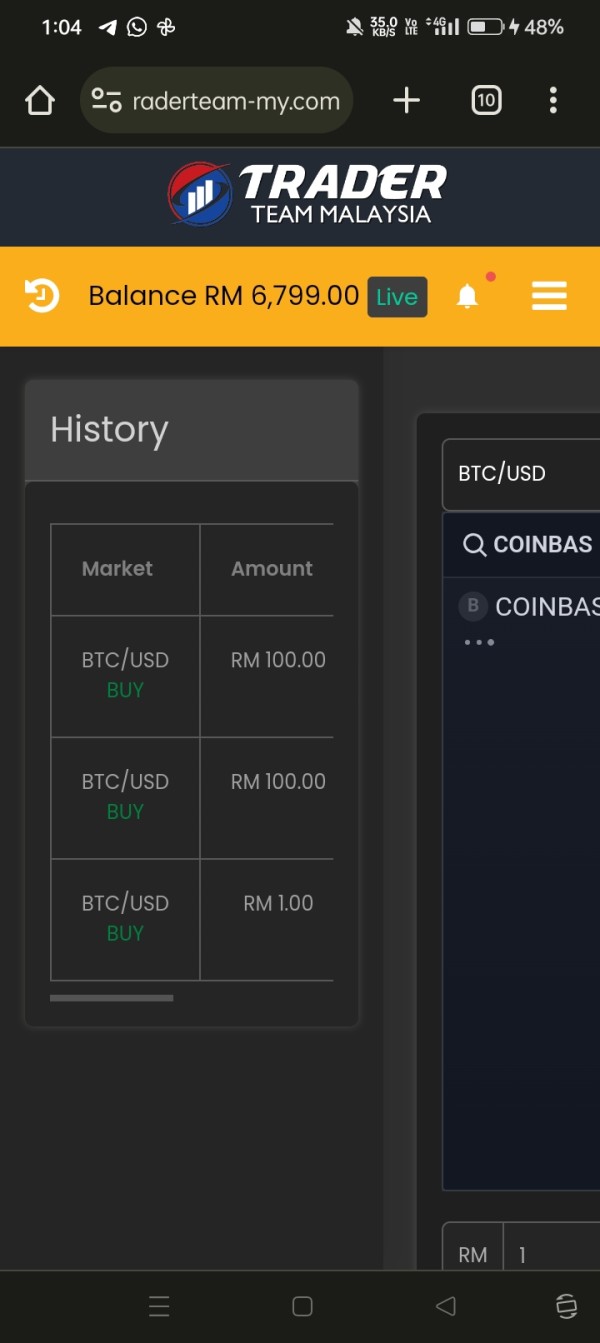

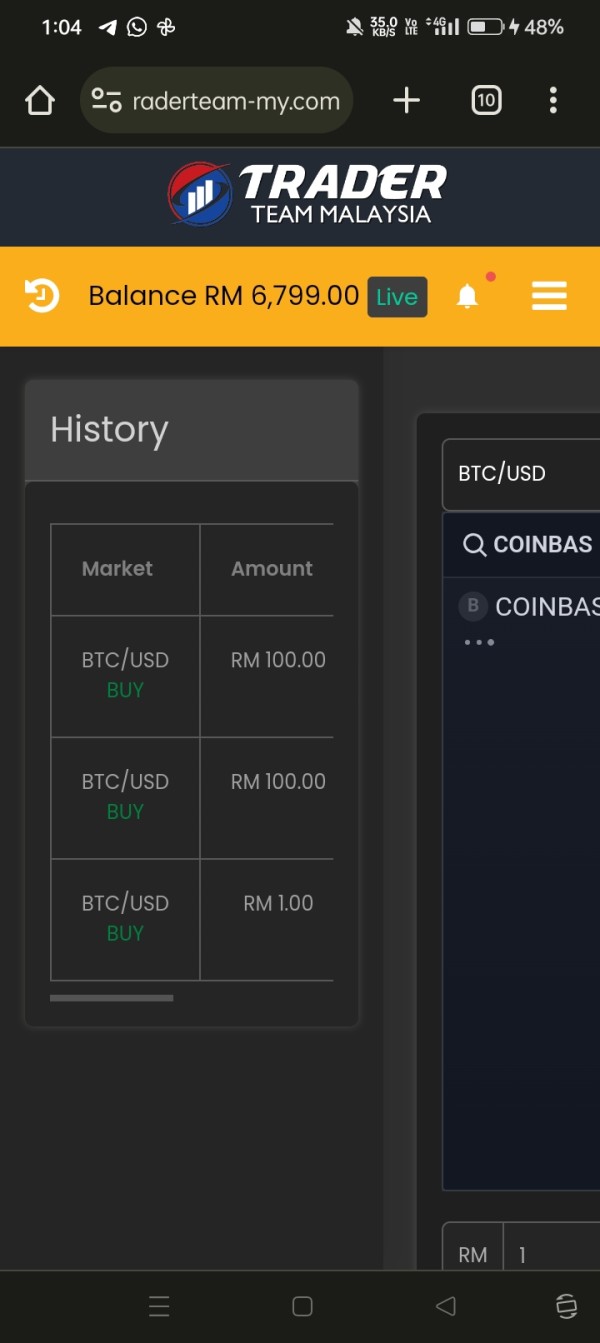

According to available information, the platform focuses mainly on binary trading options. However, specific details about their trading instruments remain unclear. The company's business model appears to target retail investors looking for alternative investment opportunities in the binary options market.

The absence of detailed information about their services, trading conditions, and operational framework suggests a lack of transparency that is concerning for any financial services provider. The Malaysian Securities Commission's warning about this entity further shows the risks of using their services. This trader team malaysia review must emphasize that the company operates without proper regulatory authorization. This means clients have limited options in case of disputes or fund recovery issues.

The lack of oversight from established financial regulators creates an environment where investor protection is minimal at best.

Trader Team Malaysia operates without authorization from any recognized financial regulatory body. The Malaysian Securities Commission has specifically issued warnings about this entity and advises investors to exercise caution. This unregulated status means the company is not subject to standard financial service provider requirements. These include capital adequacy, client fund segregation, or dispute resolution mechanisms.

Information about deposit and withdrawal methods is not available in public sources. This itself is a significant concern for potential clients seeking transparency about fund management procedures.

The company has not disclosed minimum deposit requirements. This makes it impossible for potential clients to assess the accessibility of their services or plan their investment strategy accordingly.

No information is available about bonus structures or promotional offers. This may indicate either a lack of such programs or poor communication about available incentives.

Specific details about tradeable assets are not provided in available sources. The company appears to focus on binary trading options based on limited available information.

The fee structure and trading costs remain undisclosed. This prevents potential clients from making informed decisions about the total cost of trading with this platform.

Information about leverage offerings is not available in public sources. This is concerning given the importance of understanding leverage risks in trading.

Details about trading platforms are not specified in available documentation. This includes web-based or mobile applications.

This trader team malaysia review highlights the concerning lack of transparency across all operational aspects of the company.

The absence of clear information about account types and conditions represents a fundamental failure in transparency. Legitimate brokers typically provide this information. Standard financial service providers offer detailed information about different account tiers, minimum deposit requirements, and account-specific benefits.

Trader Team Malaysia's failure to provide such basic information suggests either poor communication practices or deliberate opacity. Legitimate brokers typically offer multiple account types catering to different trader profiles, from beginners to professional traders. These usually include demo accounts for practice, standard accounts for retail traders, and premium accounts with enhanced features.

The lack of such information makes it impossible for potential clients to understand what services they would receive. The presence of investor complaints, as noted by regulatory authorities, indicates that users who have engaged with the platform have experienced issues with account conditions or service delivery. Without proper regulatory oversight, resolving such complaints becomes significantly more challenging for affected investors.

This trader team malaysia review cannot recommend engaging with a broker that fails to provide basic account information. This represents a fundamental breach of industry standards and client communication expectations.

Professional trading platforms typically provide comprehensive trading tools. These include technical analysis indicators, charting capabilities, market research, and educational resources. The absence of any information about such tools suggests either a lack of professional-grade trading infrastructure or poor communication about available features.

Educational resources are particularly important for binary trading, given the complexity and risks involved. Legitimate brokers invest significantly in client education to ensure informed trading decisions. The lack of mentioned educational resources raises questions about the company's commitment to client success and responsible trading practices.

Research and analysis tools are essential for making informed trading decisions. Professional brokers typically provide market analysis, economic calendars, and trading signals to support client decision-making. The absence of such resources suggests a potentially inadequate trading environment.

User feedback indicating doubts about legitimacy directly impacts the perceived value of any tools or resources the platform might offer. Clients cannot trust the reliability or accuracy of services from an unregulated provider.

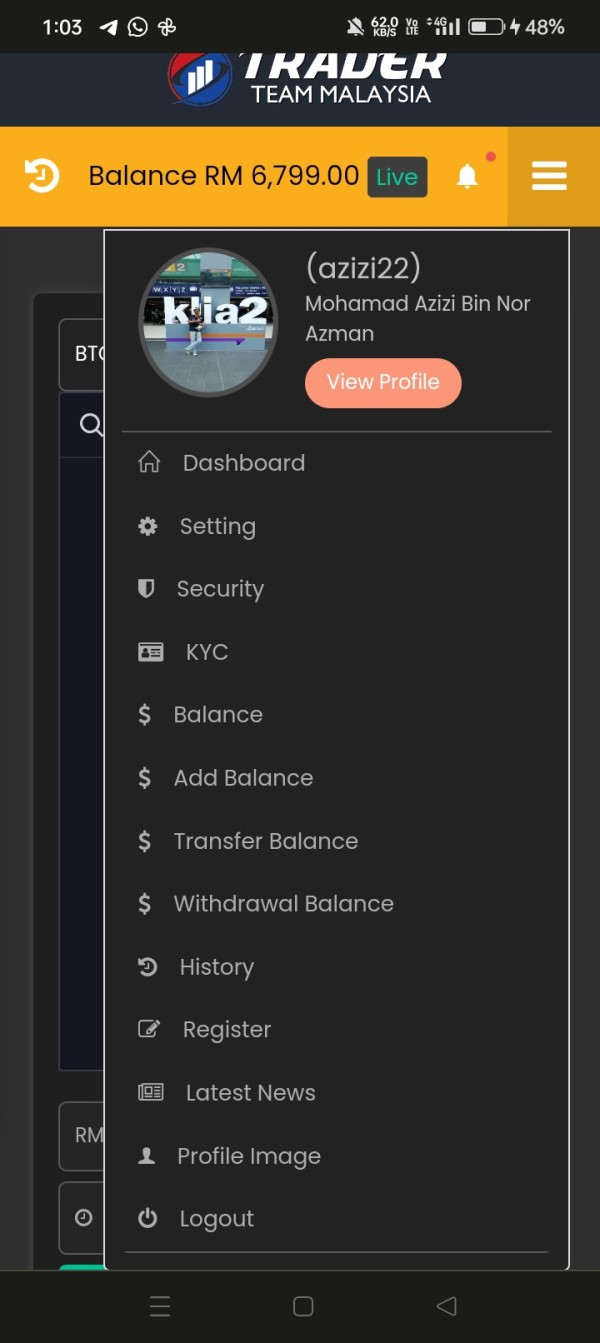

Effective customer service is crucial for any financial services provider. This is particularly true for addressing technical issues, account problems, and trading-related queries. The lack of available information about customer support channels, response times, or service quality is deeply concerning for potential clients.

Professional brokers typically offer multiple contact methods including live chat, email support, phone assistance, and comprehensive FAQ sections. They also provide support in local languages and maintain reasonable response times for client inquiries. The absence of such information suggests inadequate customer service infrastructure.

Given the regulatory warnings and investor complaints, the quality of customer service becomes even more critical. Clients experiencing issues need reliable support channels to resolve problems quickly and effectively. Without proper customer service, minor issues can escalate into significant problems for traders.

The unregulated status of the company means that customer service quality is not subject to regulatory standards or oversight. This potentially results in inconsistent or inadequate support for clients facing difficulties.

The trading experience encompasses platform stability, execution quality, user interface design, and overall functionality. User expressions of doubt about the company's legitimacy directly impact confidence in the trading environment and platform reliability.

Platform stability is crucial for successful trading, particularly in binary options where timing can significantly impact outcomes. Without information about platform performance, uptime statistics, or technical infrastructure, potential clients cannot assess the reliability of the trading environment. Order execution quality affects trading outcomes and client profitability.

Professional brokers provide transparent information about execution speeds, slippage rates, and order processing procedures. The absence of such information prevents informed evaluation of the trading experience quality. This trader team malaysia review notes that user skepticism about legitimacy creates an environment where even potentially positive trading features cannot be trusted.

Clients question whether the platform will honor trading outcomes or process withdrawals reliably.

Trustworthiness in financial services relies heavily on regulatory oversight, transparent operations, and established track records. Trader Team Malaysia's unregulated status immediately undermines trust, as clients have no regulatory protection or recourse mechanisms.

The Malaysian Securities Commission's warning represents official recognition of concerns about this entity. Regulatory warnings are typically issued when authorities identify potential risks to investors. This makes this a significant red flag for potential clients.

The presence of investor complaints, combined with the lack of regulatory oversight, suggests that clients have experienced problems without adequate resolution mechanisms. This pattern indicates systemic issues with the company's operations and client treatment. Company transparency is essential for building trust, yet Trader Team Malaysia fails to provide basic information about operations, management, financial standing, or business practices.

This opacity is inconsistent with legitimate financial service providers who prioritize transparency to build client confidence.

User experience encompasses all aspects of client interaction with the broker. This includes everything from initial registration through ongoing trading activities. User expressions of doubt about legitimacy indicate fundamental problems with the overall experience and company credibility.

The registration and account verification process is typically the first point of client interaction with a broker. Professional platforms provide clear, efficient procedures with appropriate security measures. The lack of information about these processes suggests potential problems with user onboarding.

Interface design and usability directly impact trading effectiveness and client satisfaction. Modern trading platforms invest heavily in user experience design to ensure intuitive navigation and efficient trading execution. Without information about platform design or user feedback, it's impossible to assess this crucial aspect.

The presence of investor complaints indicates that users who have engaged with the platform have experienced significant problems. Combined with the lack of regulatory protection, this creates an environment where user experience issues cannot be adequately addressed or resolved. This leads to client frustration and potential financial losses.

This trader team malaysia review concludes with a strong recommendation against engaging with this unregulated entity. The combination of regulatory warnings, lack of transparency, and investor complaints creates an unacceptable risk profile for potential clients. The company's failure to provide basic information about trading conditions, customer service, or operational procedures represents a fundamental breach of industry standards.

The platform is unsuitable for any type of investor, whether novice or experienced. This is due to the absence of regulatory protection and the mounting concerns about legitimacy. The only potential positive aspect - being a recently established company - is far outweighed by the numerous red flags and regulatory concerns.

Potential investors should seek regulated alternatives that provide transparent operations, proper oversight, and adequate client protection. The risks associated with Trader Team Malaysia far exceed any potential benefits. This makes it an unsuitable choice for serious trading activities.

FX Broker Capital Trading Markets Review