OroTrader 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive orotrader review examines a broker that operates as an offshore entity with significant regulatory concerns. OroTrader has been flagged by financial authorities, particularly being blacklisted by Spanish financial regulators, which raises serious questions about its legitimacy and safety for traders. Despite offering attractive features such as up to 50% first deposit bonuses and one-on-one portfolio adjustment services, the broker's questionable regulatory status overshadows these benefits significantly.

The platform provides access to multiple asset classes including forex, stocks, indices, commodities, and cryptocurrencies through MetaTrader 4 and Sirix trading platforms. However, the lack of clear regulatory oversight and the blacklisting by Spanish authorities make it a high-risk choice for investors who value safety. While the broker advertises zero spreads and requires no minimum deposit, the absence of transparent information about commissions, leverage, and other crucial trading conditions further diminishes its credibility in the marketplace.

This review targets investors seeking diversified trading opportunities, but we strongly advise extreme caution due to the broker's compromised regulatory standing and potential risks to client funds.

Important Notice

Regional Entity Differences: OroTrader's regulatory status remains unclear across different jurisdictions, with the broker being specifically blacklisted by Spanish financial authorities. Potential investors should thoroughly evaluate the legal implications and regulatory compliance in their respective regions before considering any engagement with this platform or its services.

Review Methodology: This evaluation is based on publicly available information, regulatory warnings, and user feedback collected from various sources. We have not conducted direct testing of the platform's services, and all assessments are derived from external data and official regulatory communications from government authorities.

Rating Framework

Broker Overview

OroTrader operates as a forex and multi-asset broker in the offshore financial services sector. Specific information about its establishment date and corporate background remains undisclosed in available sources, which raises immediate transparency concerns. The company appears to follow a typical offshore brokerage model, targeting international clients while operating outside major regulatory frameworks that protect investors.

This operational structure, while common among certain brokers, has contributed to the regulatory scrutiny the company currently faces from financial authorities. The broker's business model centers on providing access to global financial markets through popular trading platforms, with particular emphasis on forex trading and diversified asset offerings that appeal to modern traders. However, the lack of transparent corporate information and verified regulatory credentials has led to significant concerns among financial authorities and potential clients who prioritize safety.

OroTrader provides trading services through MetaTrader 4 and Sirix platforms, offering access to forex, stocks, indices, commodities, and cryptocurrencies. The broker's asset portfolio appears comprehensive, catering to traders seeking diversified investment opportunities across multiple market sectors for portfolio balance. However, the company's regulatory status remains problematic, as it does not appear to be regulated by any recognized government authority and has been specifically blacklisted by Spanish financial regulators, severely impacting its credibility in the international trading community.

Regulatory Status: OroTrader lacks clear regulatory oversight from recognized financial authorities. Most concerning is its inclusion on the Spanish financial regulator's blacklist, indicating serious compliance issues and potential unauthorized operations within Spanish jurisdiction that could affect trader safety.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available sources. This creates uncertainty about fund transfer processes and potential restrictions that traders might face when managing their accounts.

Minimum Deposit Requirements: The broker advertises a zero minimum deposit requirement, which may appear attractive to new traders. However, this feature should be viewed cautiously given the overall regulatory concerns and potential hidden costs that may emerge later.

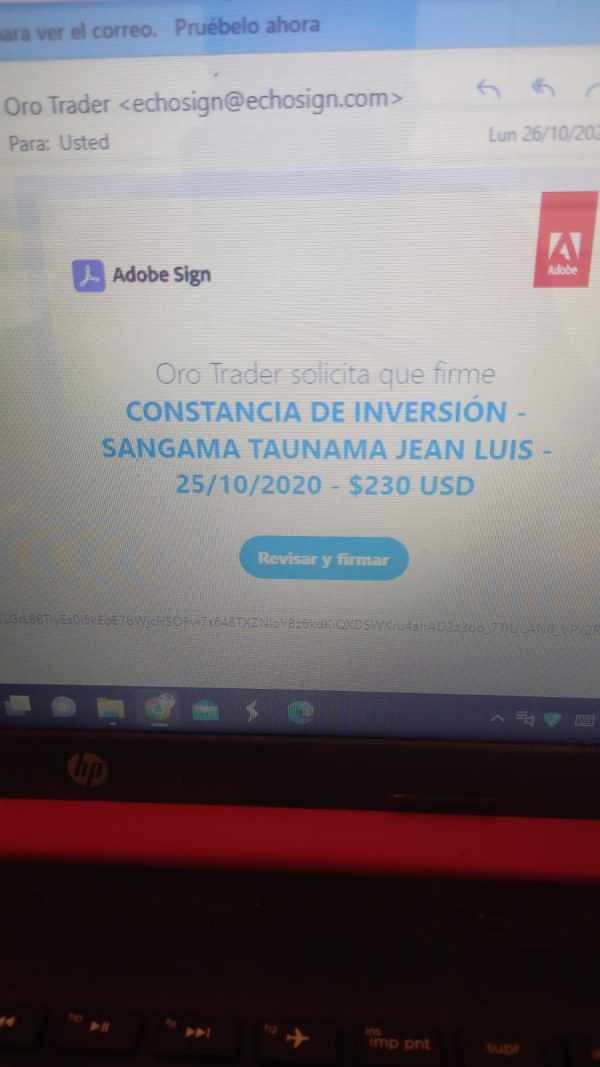

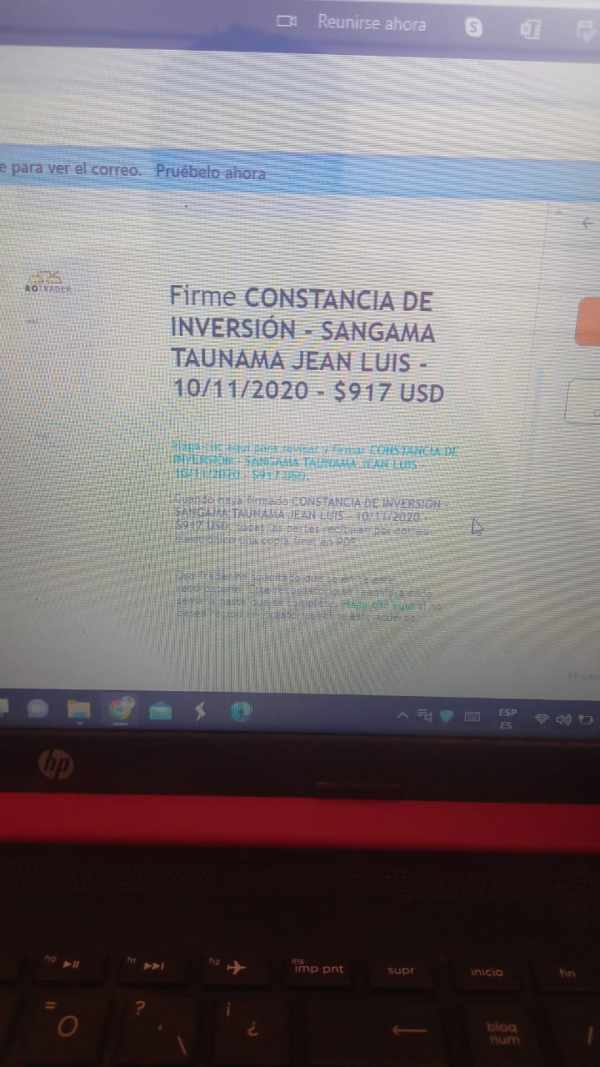

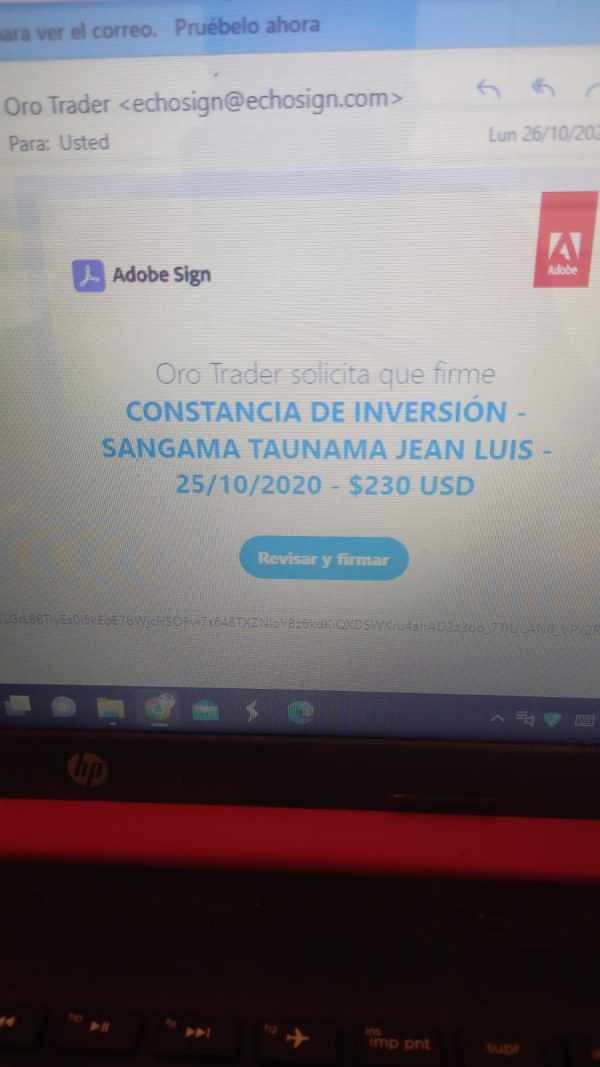

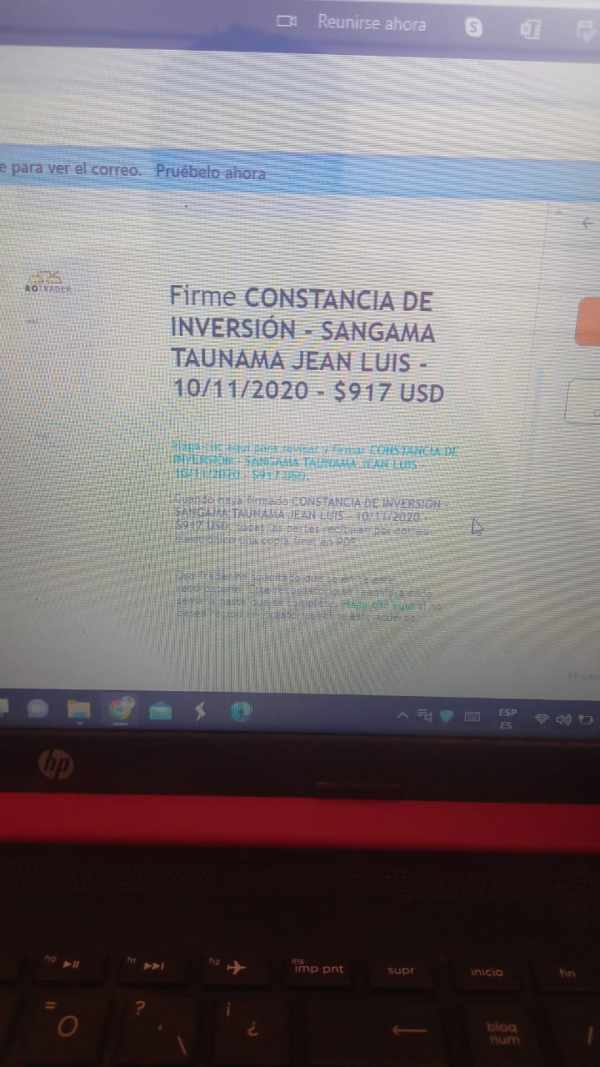

Bonus and Promotions: OroTrader offers up to 50% first deposit bonuses and promotes one-on-one portfolio adjustment services as key incentives for new clients. However, such promotional offers from unregulated brokers often come with restrictive terms and conditions that may limit withdrawal options or impose unrealistic trading requirements.

Trading Assets: The platform provides access to forex pairs, stocks, market indices, commodities, and cryptocurrencies. This offers a relatively comprehensive range of trading instruments across different asset classes that appeal to diverse trading strategies.

Cost Structure: While the broker advertises zero spreads, commission structures and other trading costs remain unclear. This creates transparency issues regarding the true cost of trading with the platform and potential hidden fees that could impact profitability.

Leverage Options: Specific leverage ratios and margin requirements are not disclosed in available information. This is concerning for traders needing to understand their risk exposure and potential losses from leveraged positions.

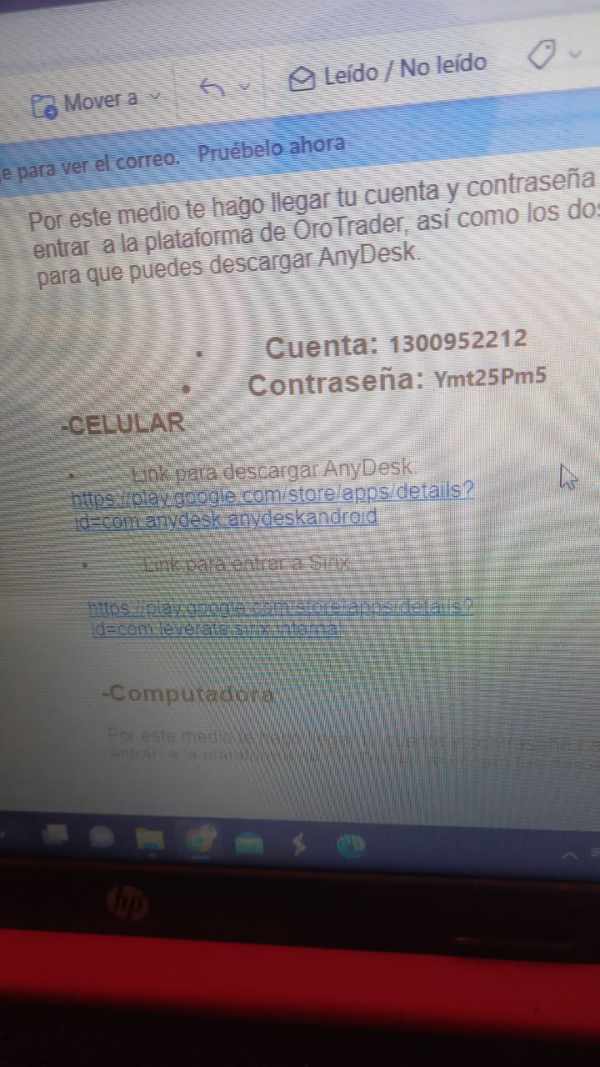

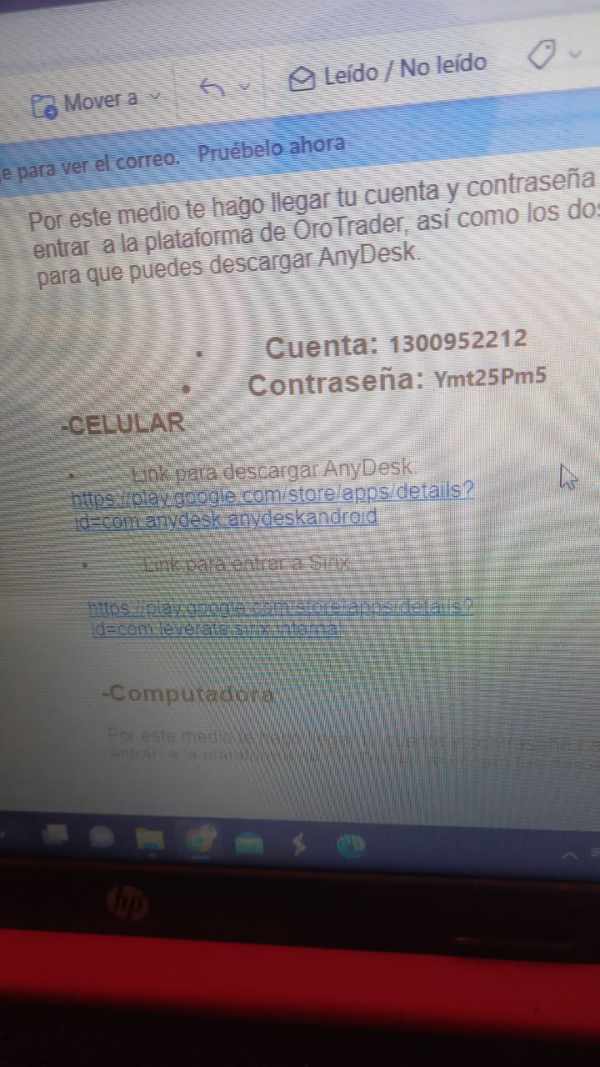

Platform Options: OroTrader supports MetaTrader 4 and Sirix trading platforms, both of which are established solutions in the forex industry. These platforms provide standard charting and analytical tools that most traders recognize and can use effectively.

Geographic Restrictions: Specific regional limitations and service availability are not clearly outlined in accessible documentation. This lack of clarity could lead to legal issues for traders in certain jurisdictions where the broker may not be authorized to operate.

Customer Support Languages: Information about supported languages for customer service is not specified in available sources. This creates uncertainty about communication capabilities for international clients who may need assistance in their native language.

Detailed Rating Analysis

Account Conditions Analysis

OroTrader's account structure lacks the transparency expected from reputable brokers in today's market. While the zero minimum deposit requirement may seem attractive to new traders, this feature alone cannot compensate for the significant gaps in account information that professional traders require. The absence of clear details about different account types, their specific features, and associated benefits creates uncertainty for potential clients trying to make informed decisions about their trading setup.

The account opening process is not well-documented in available sources. This raises questions about verification procedures, documentation requirements, and compliance with anti-money laundering standards that legitimate brokers must follow. Without proper regulatory oversight, there are concerns about whether the broker maintains adequate client protection measures and segregated account structures that protect trader funds from company operational risks.

Special account features such as Islamic accounts for Muslim traders are not mentioned in available information. This suggests limited accommodation for diverse client needs and religious requirements that modern brokers typically address. The overall lack of transparency in account conditions, combined with regulatory concerns, significantly impacts the broker's credibility in this crucial area of service delivery.

This orotrader review finds that while the zero deposit threshold might attract some traders, the overall account conditions framework lacks the comprehensive structure and transparency that characterize legitimate, regulated brokers in the contemporary forex market.

OroTrader provides access to MetaTrader 4 and Sirix platforms, both recognized solutions in the forex trading industry. MetaTrader 4 offers standard charting capabilities, technical indicators, and automated trading support through Expert Advisors, providing traders with familiar and functional trading tools that most professionals recognize. The Sirix platform adds social trading capabilities and additional analytical features to the broker's offering, potentially appealing to traders interested in copy trading strategies.

The diversity of available assets across forex, stocks, indices, commodities, and cryptocurrencies provides traders with opportunities for portfolio diversification and cross-market strategies. This multi-asset approach aligns with contemporary trading preferences for comprehensive market access through a single platform rather than maintaining multiple broker relationships. However, specific information about research and analysis resources, market commentary, economic calendars, and educational materials is not detailed in available sources, which limits the assessment of value-added services.

Quality brokers typically provide extensive research support, daily market analysis, and educational resources to help clients make informed trading decisions. The absence of detailed information about automated trading support, API access, and advanced trading tools suggests limitations in the broker's technological offerings that could impact serious traders. Without clear documentation of these features, traders cannot fully assess whether the platform meets their specific trading requirements and strategies for success.

Customer Service and Support Analysis

Information about OroTrader's customer service infrastructure is notably limited in available sources. This is concerning given the importance of reliable support in forex trading where technical issues or account problems can directly impact trading profitability. The lack of detailed information about available contact methods, response times, and service quality standards raises questions about the broker's commitment to client support and problem resolution.

Without clear documentation of customer service channels such as live chat, phone support, email ticketing systems, or support hours, potential clients cannot assess whether they would receive adequate assistance when needed. This is particularly problematic for active traders who may require immediate support during market hours or technical difficulties that could affect their trading positions. The absence of information about multilingual support capabilities suggests potential limitations for international clients, especially considering the broker's apparent focus on global markets and diverse trader demographics.

Professional brokers typically provide comprehensive language support to accommodate their diverse client base effectively. Given the regulatory concerns surrounding OroTrader, the limited customer service information compounds trust issues and creates additional uncertainty about service quality. Traders need confidence that they can reach responsive, knowledgeable support representatives when facing account issues, technical problems, or questions about trading conditions that affect their investment decisions.

Trading Experience Analysis

The trading environment at OroTrader presents mixed signals for potential clients seeking reliable execution and competitive conditions. The advertised zero spreads could provide attractive trading conditions, particularly for high-frequency traders and scalping strategies that depend on tight bid-ask spreads for profitability. However, the lack of information about execution quality, order processing speed, and slippage rates makes it difficult to assess the true trading experience that clients can expect.

Platform stability and performance data are not available in the sources reviewed. This creates uncertainty about system reliability during volatile market conditions when consistent platform performance becomes crucial for successful trading. Professional traders require consistent platform performance and reliable order execution, especially during news events and market stress periods when price movements can be rapid and significant.

The availability of MetaTrader 4 and Sirix platforms provides familiar trading environments for many forex traders. These platforms offer standard charting tools, technical analysis capabilities, and order management features that most traders expect from modern trading software in today's competitive marketplace. However, mobile trading experience details are not specified, which is increasingly important as traders demand seamless access across devices for flexibility and convenience.

Without clear information about mobile app functionality, offline capabilities, and cross-platform synchronization, traders cannot fully evaluate the platform's suitability for their trading style. This orotrader review notes that while some trading conditions appear favorable on the surface, the overall lack of transparency and detailed performance metrics significantly impacts the assessment of the actual trading experience quality that clients receive.

Trust and Safety Analysis

Trust and safety represent the most critical concerns with OroTrader, primarily due to its blacklisting by Spanish financial authorities. This regulatory action indicates serious compliance issues and suggests the broker may be operating without proper authorization in certain jurisdictions, creating legal and financial risks for clients. Such warnings from established financial regulators should be taken seriously by potential clients who value the security of their investment capital.

The absence of clear regulatory oversight from recognized authorities like the FCA, CySEC, ASIC, or other major financial regulators creates significant concerns about client fund protection. Legitimate brokers typically maintain client funds in segregated accounts with reputable banks and provide investor compensation scheme protection that safeguards client money in case of broker insolvency. Information about fund security measures, client money protection protocols, and operational transparency is not available in the sources reviewed, which raises serious red flags about capital safety.

Without these crucial safety elements, traders face elevated risks regarding the security of their deposits and potential recovery options in case of broker difficulties. The company's corporate structure, ownership details, and financial standing are not clearly disclosed, further diminishing transparency and accountability that professional traders expect from their broker relationships. Professional brokers typically provide comprehensive corporate information, regulatory documentation, and financial reports to demonstrate their legitimacy and stability in the marketplace.

User Experience Analysis

User experience assessment for OroTrader is challenging due to limited feedback and the overshadowing regulatory concerns that affect overall perception. While the broker offers multiple trading platforms and diverse asset classes that could appeal to various trader preferences, the overall user experience is significantly impacted by trust and transparency issues that create uncertainty. The registration and account verification processes are not well-documented, creating uncertainty about the user onboarding experience and potential delays in account activation.

Professional brokers typically provide clear, streamlined account opening procedures with transparent verification requirements and reasonable processing times. Interface design and platform usability depend largely on the MetaTrader 4 and Sirix platforms, both of which offer familiar user experiences for forex traders who have used these popular trading solutions. However, broker-specific customizations, additional features, and integration quality are not detailed in available information, making it difficult to assess the overall platform experience.

Fund management experience, including deposit and withdrawal processes, processing times, and potential restrictions, remains unclear due to limited documentation. This uncertainty significantly impacts the overall user experience assessment, as efficient fund operations are crucial for trader satisfaction and operational convenience in daily trading activities.

Conclusion

This orotrader review reveals a broker with significant regulatory and transparency concerns that overshadow any potential benefits it might offer. While OroTrader offers some attractive features such as zero spreads, diverse asset classes, and established trading platforms, the blacklisting by Spanish financial authorities and lack of clear regulatory oversight create substantial risks for potential clients who prioritize safety. The broker may appeal to traders seeking multi-asset trading opportunities and promotional bonuses, but the regulatory warnings and transparency issues make it unsuitable for investors prioritizing fund safety and regulatory protection in their broker selection.

The main advantages include access to popular trading platforms and competitive spread offerings that could benefit certain trading strategies. However, the primary disadvantages center on regulatory non-compliance, limited transparency, and elevated safety risks that could result in significant financial losses for traders. Traders should exercise extreme caution and consider regulated alternatives that provide proper client protection, transparent operations, and reliable regulatory oversight before engaging with OroTrader or similar offshore entities that operate without proper authorization.