Regarding the legitimacy of MONEY MALL forex brokers, it provides JFX, BAPPEBTI and WikiBit, .

Is MONEY MALL safe?

Pros

Cons

Is MONEY MALL markets regulated?

The regulatory license is the strongest proof.

JFX Derivatives Trading License (AGN)

Jakarta Futures Exchange

Jakarta Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Gatra Mega Berjangka

Effective Date:

--Email Address of Licensed Institution:

sekretaris.gmb@moneymallfutures.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Jl. Untung Suropati No. 63 Surabaya 60246Phone Number of Licensed Institution:

031-5027188Licensed Institution Certified Documents:

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. GATRA MEGA BERJANGKA

Effective Date:

--Email Address of Licensed Institution:

info@moneymallfutures.comSharing Status:

No SharingWebsite of Licensed Institution:

www.moneymallfutures.comExpiration Time:

--Address of Licensed Institution:

CENTRAL POINT BUILDING LT. 2, Jl. Ngagel No. 137 - 141, Surabaya 60246Phone Number of Licensed Institution:

031 - 502 7188Licensed Institution Certified Documents:

Is MoneyMall A Scam?

Introduction

MoneyMall is a forex broker that claims to offer a wide range of trading services and platforms, including the popular MetaTrader 4 (MT4). Established in the United States, it positions itself as a viable option for traders seeking to navigate the complexities of the forex market. However, the legitimacy of MoneyMall has come under scrutiny, prompting potential investors to exercise caution. In the highly volatile world of forex trading, assessing the reliability of brokers is crucial, as many traders have fallen victim to scams. This article aims to provide a comprehensive analysis of MoneyMall, evaluating its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation is based on multiple sources, including reviews, regulatory databases, and user feedback, to present a balanced view of whether MoneyMall is safe or a scam.

Regulatory Status and Legitimacy

The regulatory framework within which a forex broker operates is pivotal for ensuring investor protection. MoneyMall claims to be regulated by the National Futures Association (NFA) under license number 0506478. However, investigations reveal that this license is unauthorized, raising significant red flags regarding the broker's legitimacy. The absence of valid regulatory oversight means that there is no governing body to protect traders' interests or enforce compliance with industry standards.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0506478 | United States | Unauthorized |

The lack of credible regulation is alarming, as it exposes traders to potential fraud and exploitation. Reports indicate that MoneyMall has been classified as an illegal broker, with expired licenses and allegations of operating as a Ponzi scheme. The absence of regulatory oversight not only diminishes trust but also raises concerns about the broker's operational practices and the safety of client funds. Therefore, it is crucial for traders to consider the regulatory status of MoneyMall before engaging in any trading activities.

Company Background Investigation

MoneyMall was established in 2017 and claims to operate from the United States. However, the details regarding its ownership structure and management team are murky at best. The lack of transparency surrounding the company's history and operations raises concerns about its credibility. A reputable broker typically provides clear information about its founders, management team, and business model, fostering trust among potential clients.

The management team's background is another critical aspect to consider. Unfortunately, there is limited information available regarding their qualifications and experience in the financial industry. A lack of experienced leadership may indicate a lack of professionalism and expertise, which are essential for navigating the complexities of forex trading. Furthermore, the opacity surrounding the company's operations can deter potential investors who seek transparency and accountability.

In summary, the insufficient information regarding MoneyMall's background, ownership, and management team contributes to a growing suspicion about its legitimacy. The absence of a well-documented history and the lack of transparency are significant indicators that lead us to question whether MoneyMall is safe for traders.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for making informed investment decisions. MoneyMall claims to provide competitive trading conditions; however, reports suggest otherwise. The overall fee structure and trading costs associated with MoneyMall appear to be ambiguous, which can pose a challenge for traders seeking clarity.

| Fee Type | MoneyMall | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (Typically 1-2 pips) |

| Commission Structure | N/A | Varies (Typically $0-$10 per lot) |

| Overnight Interest Range | N/A | Varies (Typically 2-5%) |

The lack of clear information regarding spreads, commissions, and overnight interest rates raises concerns about the broker's transparency. Traders may find themselves facing unexpected costs, which can significantly impact their profitability. Furthermore, the absence of a demo account option limits the ability of potential clients to test the trading environment before committing real funds.

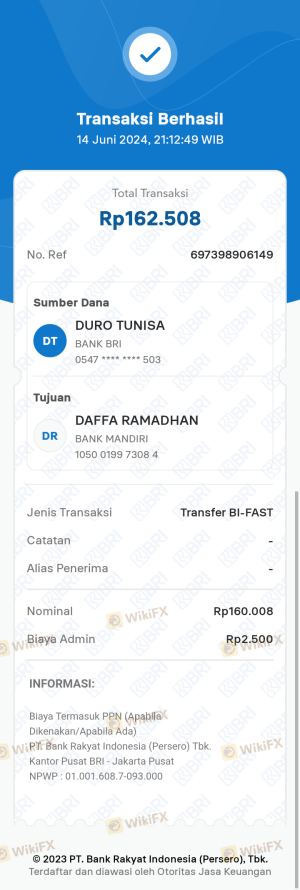

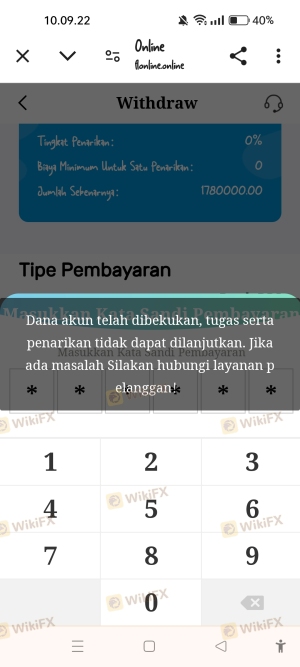

Moreover, negative reports from users regarding withdrawal difficulties further exacerbate concerns about the broker's trading conditions. Many traders have reported being unable to withdraw their funds, suggesting potential issues with the broker's operational integrity. Such experiences can lead to a lack of trust and may indicate that MoneyMall is not a safe option for traders.

Customer Fund Security

The safety of customer funds is paramount when evaluating a forex broker. MoneyMall's claims regarding fund security measures warrant careful scrutiny. Effective fund protection mechanisms include fund segregation, investor protection schemes, and negative balance protection policies. Unfortunately, there is little evidence to suggest that MoneyMall implements these essential safety measures.

Traders must be particularly cautious when dealing with brokers that lack robust fund protection policies. The absence of fund segregation means that client funds may not be held in separate accounts, which increases the risk of loss in the event of the broker's insolvency. Additionally, the lack of investor protection schemes leaves traders vulnerable to potential fraud and mismanagement.

Moreover, historical accounts of fund security issues raise further alarms. Reports of clients facing withdrawal challenges and difficulties in accessing their funds indicate a lack of operational integrity. Such incidents not only jeopardize the safety of traders' investments but also highlight the potential risks associated with using MoneyMall.

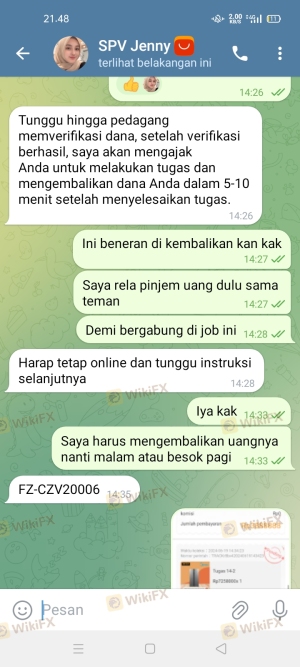

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience of traders with a broker. Unfortunately, MoneyMall has garnered a significant number of complaints, primarily centered around withdrawal issues and unresponsive customer service. Many users have reported being unable to withdraw their funds, leading to frustrations and concerns about the broker's legitimacy.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service | Medium | Delayed Response |

The prevalence of withdrawal complaints suggests a systemic issue within MoneyMall's operations. Clients have expressed dissatisfaction with the company's responsiveness to their concerns, further eroding trust in the broker. In some cases, traders reported being pressured to deposit additional funds to access their existing balances, a tactic often associated with fraudulent schemes.

Typical case studies illustrate the severity of these complaints. For instance, one user reported that after investing a considerable amount, they faced repeated delays in withdrawing their funds. Despite multiple attempts to contact customer support, their requests went unanswered, leading them to question the broker's legitimacy.

Given the concerning feedback from clients and the pattern of complaints, it is evident that MoneyMall may not provide a satisfactory trading experience. The lack of effective communication and resolution of issues raises significant concerns about the broker's reliability and whether it is safe for traders to invest their money.

Platform and Trade Execution

The performance of a trading platform is a critical factor in determining a broker's reliability. MoneyMall claims to offer the MT4 platform, known for its user-friendly interface and advanced trading features. However, user experiences suggest that the platform may not perform as expected, with reports of slippage and order rejections.

Traders often rely on the platform's stability and execution quality to make timely decisions. Unfortunately, complaints about slow execution times and high slippage rates have emerged, indicating potential inefficiencies within MoneyMall's trading environment. Such issues can lead to missed trading opportunities and financial losses, raising questions about the broker's operational integrity.

Additionally, any signs of platform manipulation should be taken seriously. Traders have reported instances where their orders were rejected or executed at unfavorable prices, suggesting possible manipulation tactics. These practices not only undermine the trading experience but also pose significant risks to traders' capital.

In conclusion, while MoneyMall may offer a recognizable trading platform, the concerns surrounding its execution quality and potential manipulation raise serious doubts about its reliability. Traders must carefully consider these factors before deciding to engage with the broker.

Risk Assessment

Using MoneyMall presents a variety of risks that traders must be aware of. The absence of regulatory oversight, coupled with numerous complaints regarding fund withdrawals and customer service, creates a high-risk environment for potential investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation, unauthorized NFA license. |

| Operational Risk | High | Reports of withdrawal issues and unresponsive support. |

| Financial Risk | High | Potential for loss of funds due to lack of protection measures. |

Given the high-risk assessment across various categories, it is essential for traders to approach MoneyMall with caution. To mitigate these risks, potential investors should conduct thorough research, seek alternative brokers with a strong regulatory framework, and avoid investing significant amounts until they can verify the broker's legitimacy.

Conclusion and Recommendations

In light of the evidence presented, it is clear that MoneyMall raises numerous red flags that suggest it may not be a safe option for traders. The lack of valid regulation, coupled with a history of complaints regarding fund withdrawals and poor customer service, indicates a troubling operational environment.

For traders considering their options, it is advisable to steer clear of MoneyMall and seek out more reputable alternatives that are well-regulated and have a proven track record of reliability. Brokers such as Eightcap, Tera FX, and GVD Markets offer safer trading environments backed by credible regulatory oversight.

In conclusion, the consensus surrounding MoneyMall points towards significant risks, and it is crucial for traders to prioritize their safety and conduct thorough due diligence when selecting a forex broker. Always ask yourself, is MoneyMall safe? Based on the evidence, the answer appears to be no.

Is MONEY MALL a scam, or is it legit?

The latest exposure and evaluation content of MONEY MALL brokers.

MONEY MALL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MONEY MALL latest industry rating score is 7.21, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.21 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.