Fxconnect Review 1

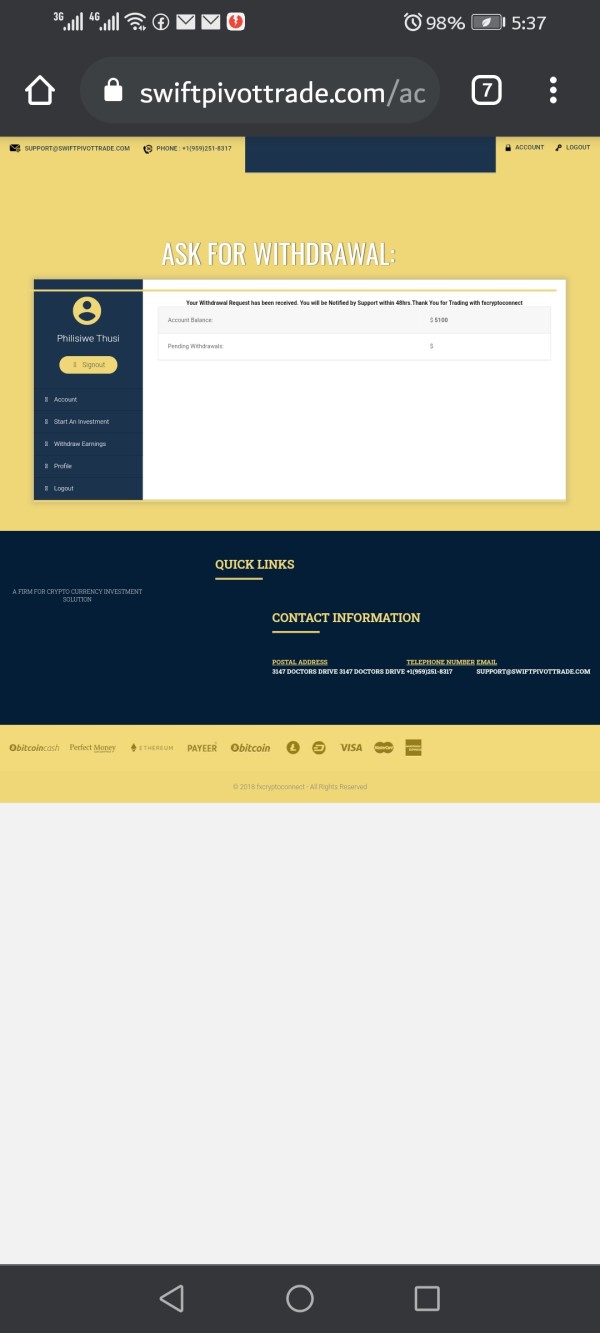

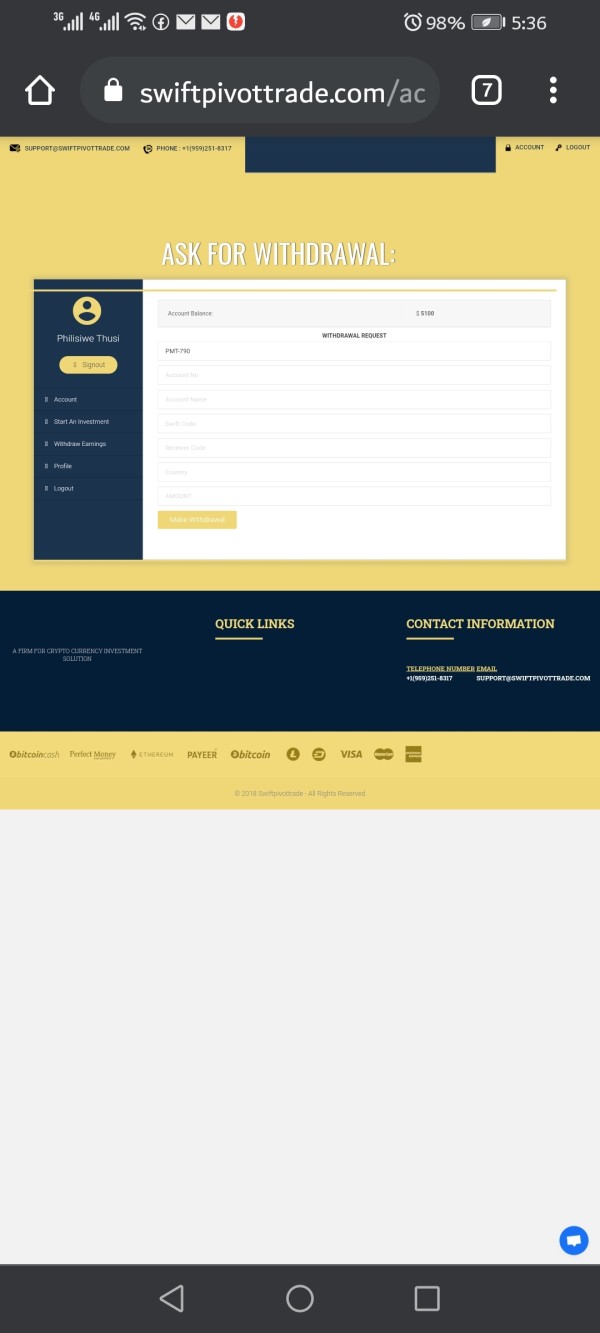

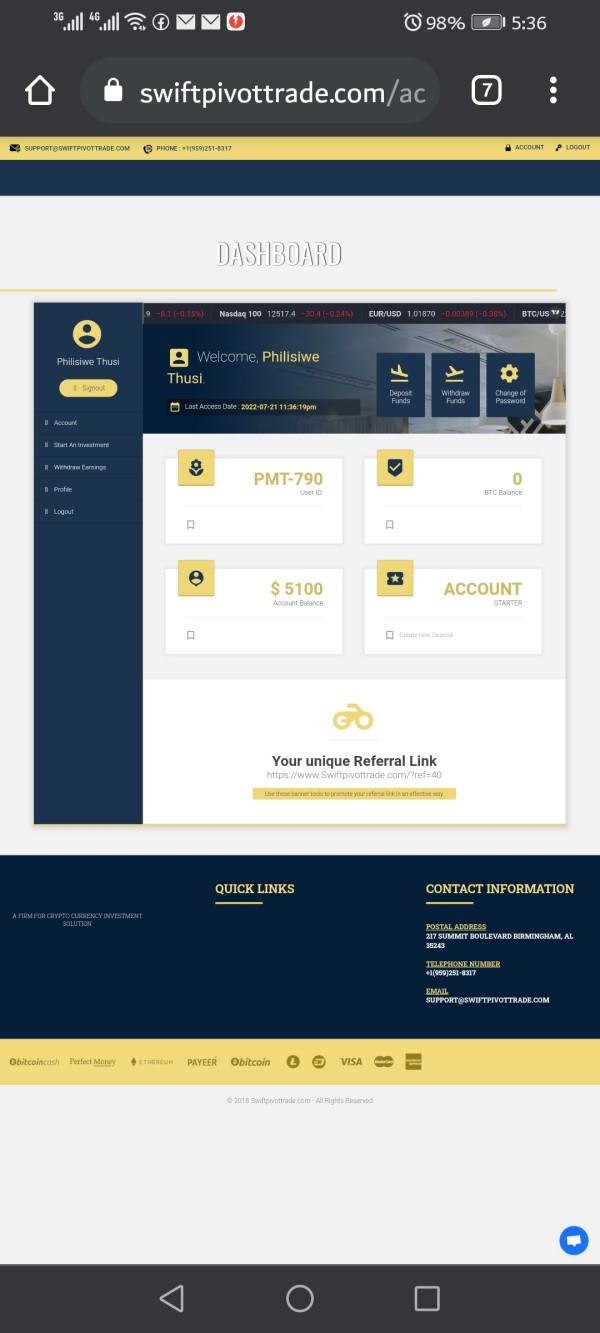

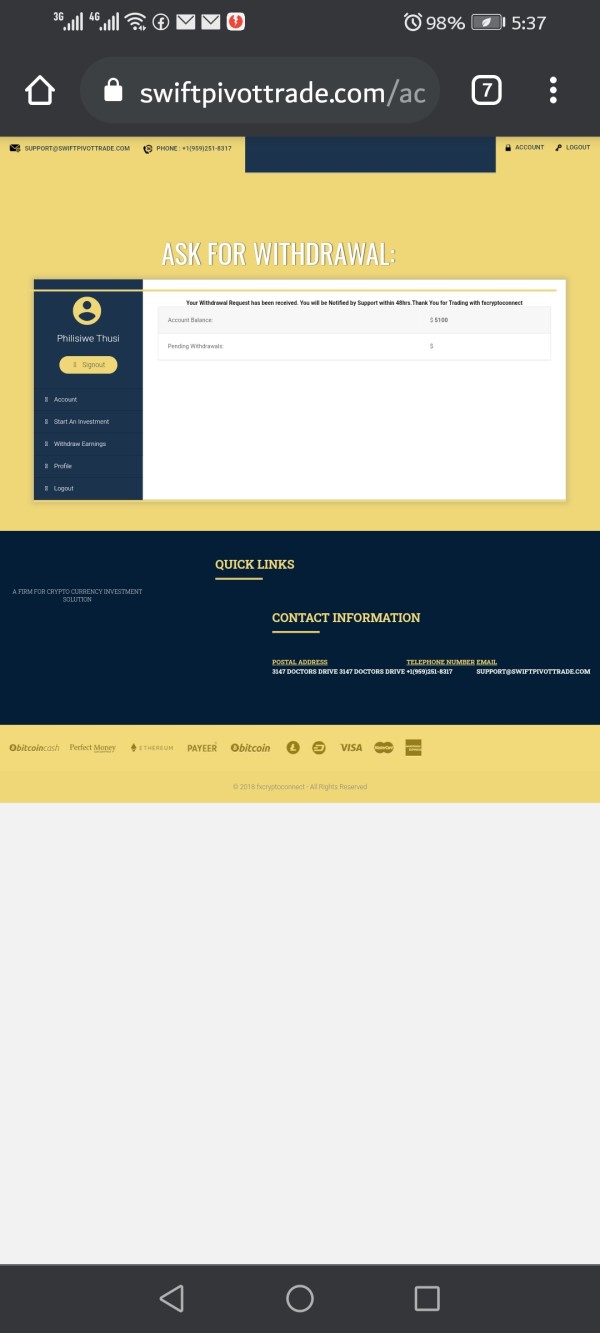

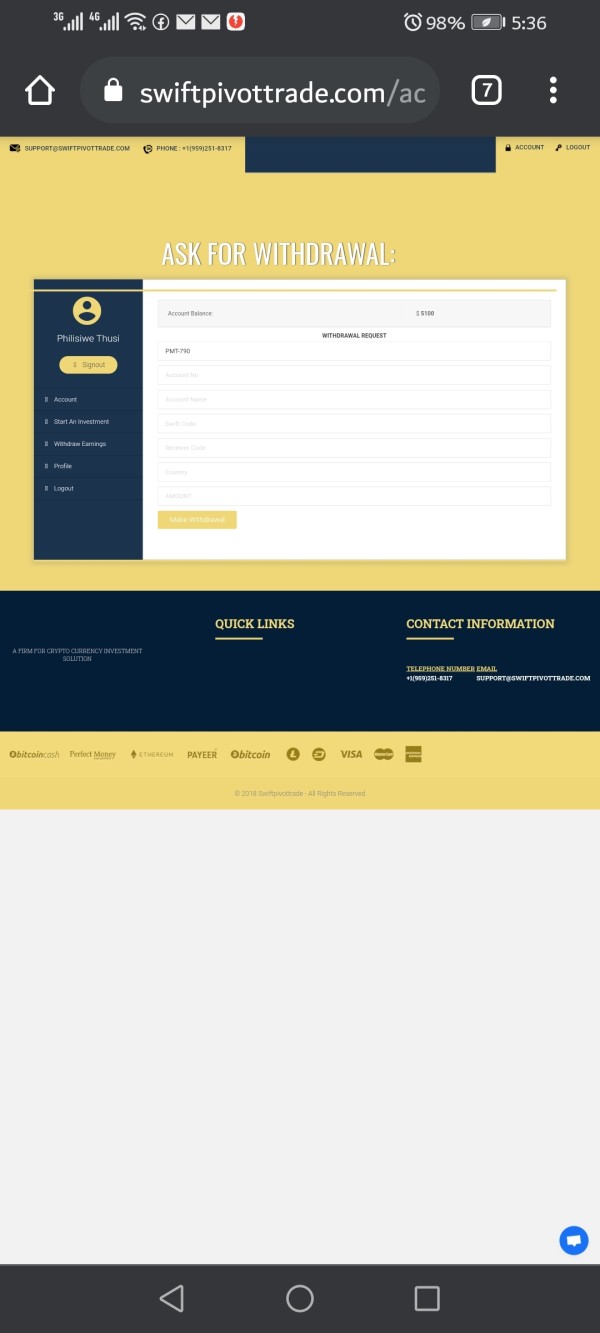

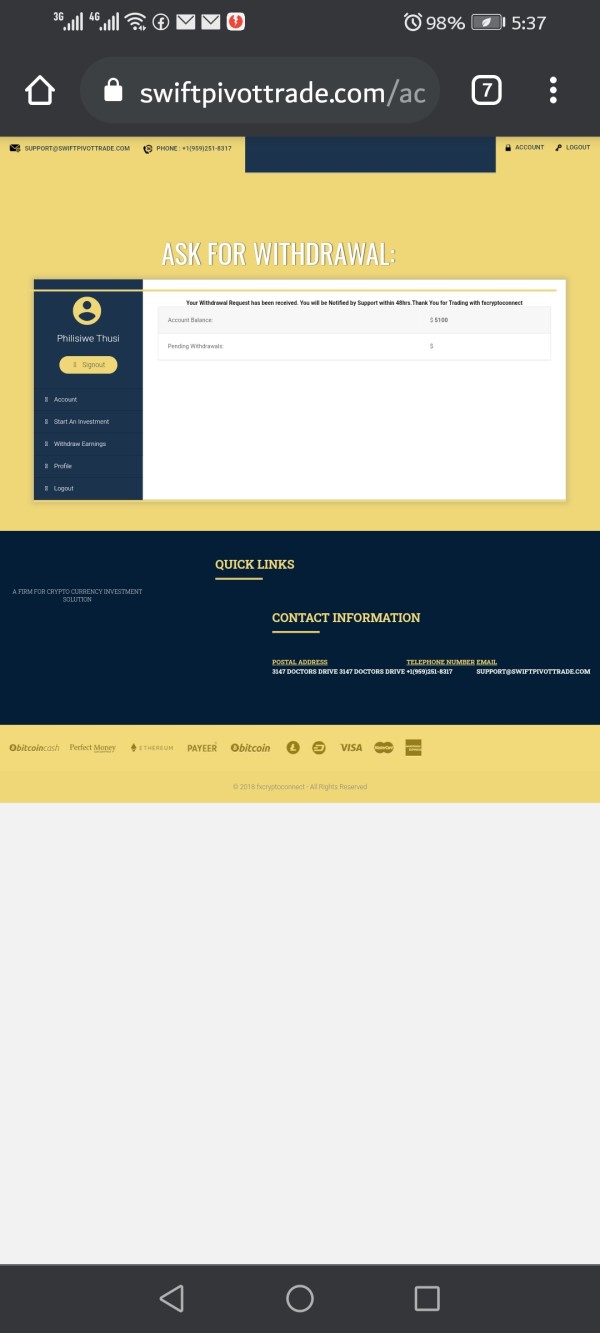

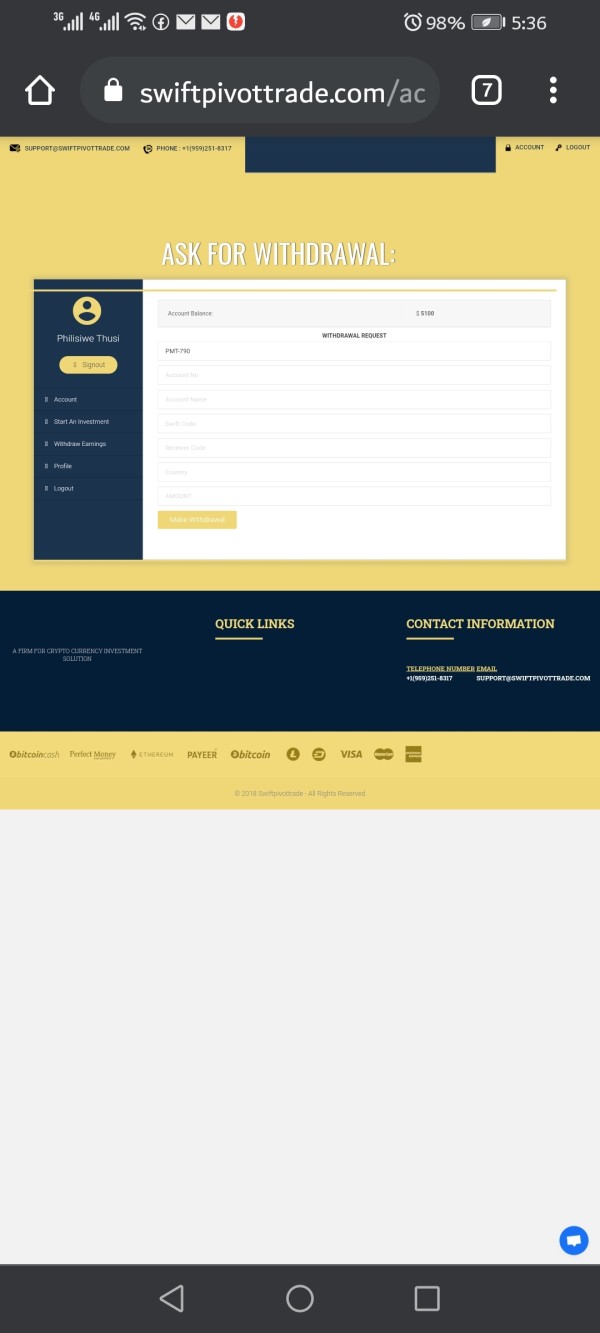

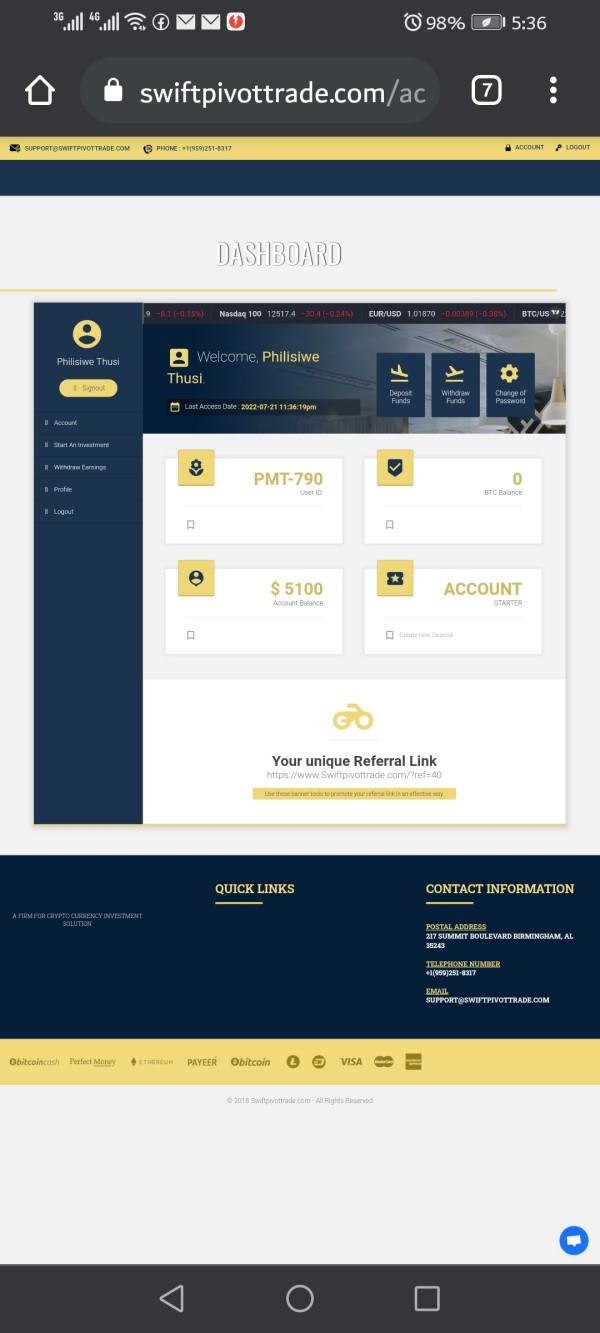

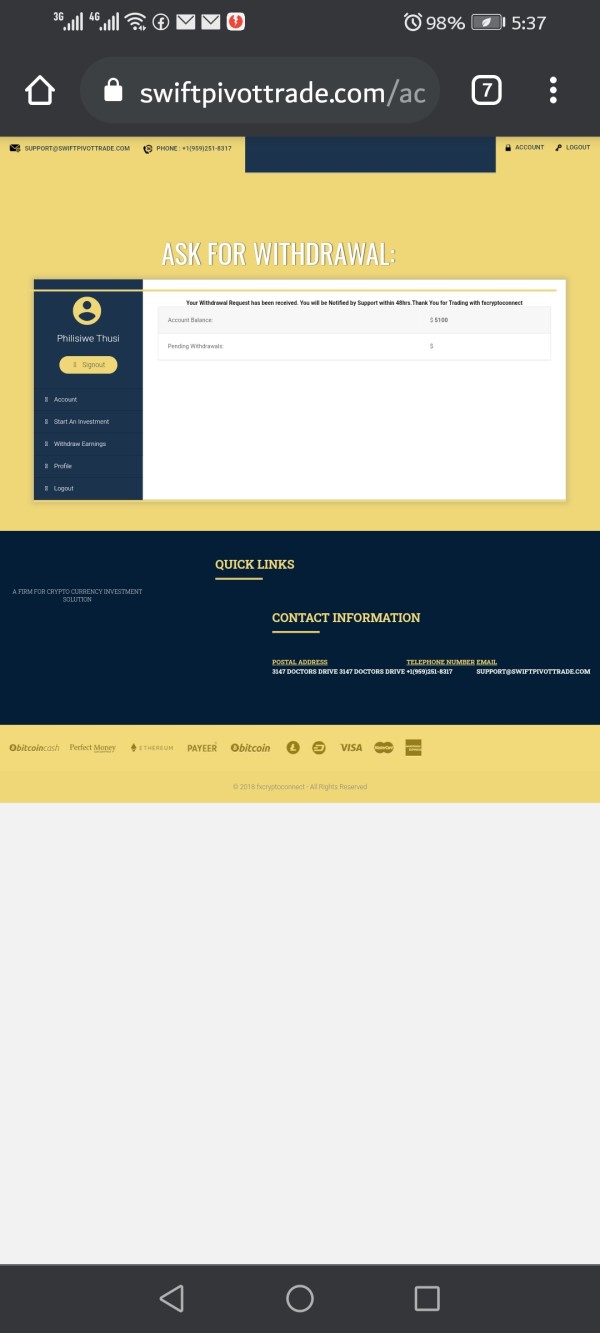

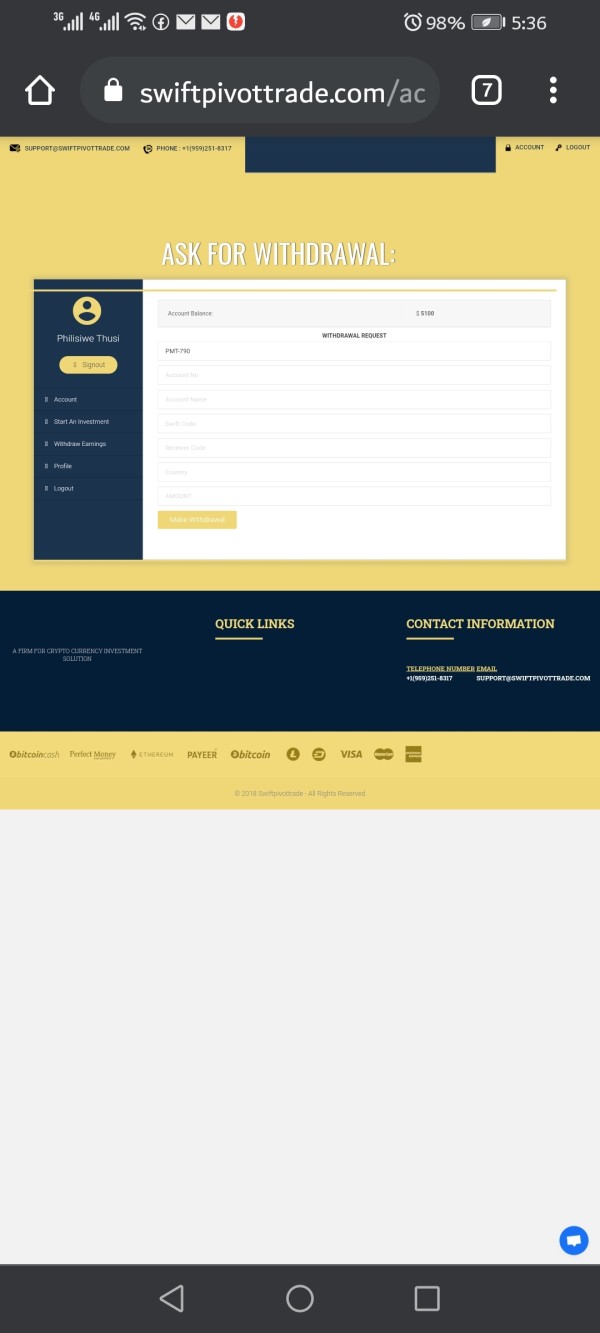

The woman called Elizabeth Khumola made me pay more than R5000 promised to pay my profits of $5100 if I pay for converting worth $1300. Till now she's still calling me to make that converting payment so she can release my profits.

Fxconnect Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The woman called Elizabeth Khumola made me pay more than R5000 promised to pay my profits of $5100 if I pay for converting worth $1300. Till now she's still calling me to make that converting payment so she can release my profits.

FX Connect presents itself as a market-leading platform for foreign exchange execution and portfolio management. It operates as part of State Street's GlobalLink suite of e-trading platforms. This Fxconnect review reveals a mixed picture of the broker's offerings and reliability.

The platform demonstrates technological sophistication in simplifying and automating the entire FX trading process from pre-trade through execution to post-trade settlement. However, significant concerns emerge regarding regulatory oversight and safety. The platform primarily targets professional traders and institutional investors.

It offers comprehensive technology and workflow solutions. However, multiple sources indicate that FX Connect operates without clear regulatory supervision, raising red flags about potential scam risks. Despite being described as a market-leading platform with transparent online trading facilities, the lack of regulatory information creates substantial uncertainty for potential users.

This evaluation maintains a neutral stance. It acknowledges both the platform's technological capabilities and the legitimate safety concerns raised by industry observers.

Users should be aware that FX Connect's regulatory status remains unclear across different jurisdictions. This potentially exposes traders to varying levels of legal and financial risk depending on their location. The absence of clear regulatory oversight means that standard investor protections may not apply.

Dispute resolution mechanisms could be limited. This review is based on publicly available information and user feedback from various sources. No direct testing or interviews with company representatives were conducted.

Readers should conduct their own due diligence and consider seeking independent financial advice before engaging with this platform.

| Dimension | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Specific account condition information not available in source materials |

| Tools and Resources | 8/10 | Comprehensive technology and workflow solutions covering entire trading process |

| Customer Service | N/A | Customer service details not specified in available information |

| Trading Experience | 7/10 | Platform offers transparent online trading facilities with good user feedback |

| Trust and Safety | 4/10 | Concerns about unregulated status and potential scam risks significantly impact trust |

| User Experience | N/A | Detailed user experience information not available in source materials |

FX Connect operates as part of State Street's GlobalLink suite. It positions itself as a sophisticated multi-bank foreign exchange execution platform. The platform's primary focus centers on simplifying and automating foreign exchange trading processes.

It targets professional traders and institutional investors who require advanced technological solutions for their trading operations. The company's business model revolves around providing comprehensive technology and workflow solutions that span the entire trading lifecycle. From pre-trade analysis through execution to post-trade settlement, FX Connect aims to streamline global operations for its users.

This approach suggests a focus on efficiency and automation. It appeals to traders who handle significant volumes and require reliable execution capabilities. FX Connect functions as a multi-bank foreign exchange execution platform.

It concentrates primarily on forex trading rather than diversified asset classes. The platform's integration with State Street's broader technology ecosystem suggests institutional-grade infrastructure. However, specific regulatory oversight details remain unclear in available documentation.

This Fxconnect review finds that while the technological foundation appears robust, the regulatory transparency requires improvement.

Regulatory Regions: Available information does not specify particular regulatory jurisdictions or oversight authorities governing FX Connect's operations. This raises significant compliance concerns.

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in the source materials. Users must make direct inquiry with the platform.

Minimum Deposit Requirements: The platform has not disclosed minimum deposit thresholds in publicly available information.

Bonuses and Promotions: No promotional offers or bonus structures are mentioned in the available documentation.

Tradeable Assets: The platform primarily focuses on foreign exchange trading. The scope of additional asset classes is not specified in source materials.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in the reviewed materials. Users must contact them directly for pricing details.

Leverage Ratios: Specific leverage offerings are not mentioned in the available information.

Platform Options: FX Connect operates as a multi-bank foreign exchange execution platform. Details about additional platform choices are not specified.

Regional Restrictions: Geographic limitations for platform access are not detailed in the source materials.

Customer Support Languages: Available customer service languages are not specified in the reviewed information.

This Fxconnect review highlights the need for greater transparency in these fundamental operational details.

The evaluation of FX Connect's account conditions proves challenging due to limited publicly available information. Standard account features such as account types, minimum deposit requirements, and opening procedures are not detailed in accessible documentation. This lack of transparency creates uncertainty for potential users who need to understand basic account parameters before making trading decisions.

Professional traders and institutional investors typically require clear information about account structures. They need details about any tiered offerings that might provide enhanced features or reduced costs based on trading volume. The absence of such details in FX Connect's public materials suggests that account information may only be available through direct consultation with their sales team.

Without specific account condition details, this Fxconnect review cannot provide meaningful comparison with industry standards or assess the competitiveness of their offerings. Potential users should directly contact the platform to obtain comprehensive account information before making any commitment. The lack of published account conditions also raises questions about transparency.

It may contribute to user concerns about the platform's legitimacy and regulatory compliance.

FX Connect demonstrates strength in technological offerings. It provides comprehensive technology and workflow solutions that address the complete trading process. The platform's integration with State Street's GlobalLink suite suggests access to institutional-grade technology infrastructure.

This could benefit professional traders requiring sophisticated execution capabilities. The platform's focus on automating and simplifying foreign exchange trading processes indicates substantial investment in technological development. This automation capability can be particularly valuable for high-volume traders and institutional investors who need efficient order management and execution systems.

However, specific details about research resources, analytical tools, and educational materials are not available in the reviewed information. Professional trading platforms typically offer market analysis, economic calendars, and educational resources to support trader decision-making. FX Connect's offerings in these areas remain unclear.

The absence of detailed tool descriptions makes it difficult to assess the platform's competitiveness against other professional trading solutions. While the technological foundation appears solid based on the State Street association, the lack of specific feature information limits the ability to evaluate practical utility for different trader types.

Customer service information for FX Connect remains largely unspecified in available documentation. Professional trading platforms typically provide multiple support channels, including phone, email, and live chat options. This is particularly important for institutional clients who may require immediate assistance during market hours.

The platform's target audience of professional traders and institutional investors generally demands high-quality customer support with rapid response times and knowledgeable staff capable of addressing complex trading and technical issues. However, without specific information about FX Connect's support infrastructure, potential users cannot assess whether the service level meets their requirements. Multilingual support capabilities, which are often crucial for international trading platforms, are not detailed in the available information.

Similarly, support availability hours and response time commitments are not specified. This creates uncertainty about service accessibility. The lack of published customer service information may indicate that support details are only provided to registered users or during the sales process.

This could be appropriate for institutional-focused platforms but limits transparency for evaluation purposes.

FX Connect's trading experience centers on its multi-bank foreign exchange execution platform. It aims to provide transparent online trading facilities. The platform's integration with State Street's technology suite suggests robust execution capabilities that could benefit professional traders requiring reliable order processing.

The emphasis on simplifying and automating the trading process indicates attention to user workflow efficiency. For institutional traders managing significant volumes, streamlined processes can translate to operational cost savings and reduced complexity in daily trading activities. However, specific performance metrics such as execution speeds, slippage rates, and platform uptime statistics are not available in the reviewed materials.

These technical performance indicators are crucial for professional traders who depend on consistent execution quality for their trading strategies. Mobile trading capabilities and platform accessibility across different devices are not detailed in available information. Modern professional traders often require flexible access to trading platforms.

This makes mobile functionality an important consideration that remains unclear in this Fxconnect review.

Trust and safety concerns represent the most significant challenge in this evaluation of FX Connect. Multiple sources indicate that the platform operates without clear regulatory oversight. This raises substantial questions about user protection and compliance with financial services standards.

The absence of specified regulatory authorities or compliance frameworks creates uncertainty about dispute resolution mechanisms, fund protection measures, and operational oversight. Professional traders and institutional investors typically require clear regulatory frameworks to ensure proper risk management and compliance with their own institutional requirements. While FX Connect is described as a market-leading platform, the lack of regulatory transparency conflicts with industry standards for financial services providers.

Legitimate forex platforms typically maintain clear regulatory status and provide detailed information about user fund protection and operational compliance. The potential classification as an unregulated broker significantly impacts the trust assessment. Regulatory oversight provides essential protections for traders and helps ensure fair dealing practices.

Without clear regulatory status, users may face increased risks regarding fund security and dispute resolution.

User experience evaluation for FX Connect proves challenging due to limited available feedback and interface information. The platform's focus on professional traders and institutional investors suggests a sophisticated user interface designed for experienced users rather than retail traders seeking simplified experiences. The integration with State Street's GlobalLink suite implies access to professional-grade trading tools and interfaces.

This could provide comprehensive functionality for experienced users. However, this sophistication might create complexity challenges for users seeking straightforward trading experiences. Registration and verification processes are not detailed in available information.

This makes it difficult to assess onboarding efficiency. Professional platforms often have more extensive verification requirements due to compliance obligations. The specific process for FX Connect remains unclear.

User satisfaction feedback from the available sources presents mixed signals. Concerns about regulatory status potentially impact overall user confidence despite positive comments about trading functionality. The lack of comprehensive user reviews limits the ability to assess typical user experiences and common satisfaction factors.

This Fxconnect review concludes with a neutral assessment of the platform. It recognizes both technological strengths and significant regulatory concerns. FX Connect demonstrates capabilities as a sophisticated multi-bank foreign exchange execution platform.

It is particularly suitable for professional traders and institutional investors who require advanced trading infrastructure. The platform's main advantages include its integration with State Street's technology ecosystem and focus on automating complex trading processes. However, the lack of clear regulatory oversight and limited transparency regarding operational details create substantial concerns that potential users must carefully consider.

Professional traders and institutional investors may find value in FX Connect's technological offerings. They should conduct thorough due diligence regarding regulatory compliance and risk management before engagement.

FX Broker Capital Trading Markets Review