Regarding the legitimacy of MMIG forex brokers, it provides FSPR, ASIC and WikiBit, (also has a graphic survey regarding security).

Is MMIG safe?

Pros

Cons

Is MMIG markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

MMIG NZ LIMITED

Effective Date:

2016-08-26Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2018-04-05Address of Licensed Institution:

111 Bridge Street Nelson NelsonPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

DBG MARKETS (AUSTRALIA) PTY LTD

Effective Date: Change Record

2004-03-10Email Address of Licensed Institution:

compliance@dbgmarket.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 14 L 11 65 YORK ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0426281215Licensed Institution Certified Documents:

Is Mmig Safe or a Scam?

Introduction

Mmig, also known as Market Maker International Group, is a broker based in New Zealand that has been operational since 2017. It positions itself in the foreign exchange market by offering a range of financial products, including forex, precious metals, and indices. However, the rise of online trading has led to an influx of brokers, making it crucial for traders to carefully evaluate the legitimacy and safety of their chosen trading platforms. This article aims to provide an objective assessment of Mmig by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The analysis is based on data gathered from various reputable sources, including regulatory databases and user reviews.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. Mmig claims to be registered with the Financial Service Providers Register (FSPR) in New Zealand; however, recent evaluations indicate that its license has been revoked. This raises significant concerns about its legitimacy and operational authority. The following table summarizes the key regulatory information related to Mmig:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Service Providers Register (FSPR) | 511666 | New Zealand | Revoked |

| Australia Securities & Investments Commission (ASIC) | N/A | Australia | Suspicious Clone |

| National Futures Association (NFA) | N/A | United States | Suspicious Clone |

The revocation of the FSPR license indicates that Mmig is no longer recognized as a legitimate financial service provider. Moreover, being labeled as a suspicious clone by both ASIC and NFA suggests that there may be fraudulent activities associated with this broker. Regulatory oversight is paramount for investor protection, and the lack of a valid license significantly undermines Mmig's credibility. Traders should be wary of engaging with brokers that lack proper regulatory backing, as it exposes them to potential scams and financial losses.

Company Background Investigation

Mmig was established in 2017 and claims to provide a variety of financial services. However, little information is available regarding its ownership structure and management team. A transparent company background is essential for establishing trust, and the absence of detailed information raises red flags. The management teams experience and qualifications play a vital role in the operational integrity of a brokerage. Unfortunately, Mmig does not provide adequate information about its leadership, which hinders the ability to assess its professionalism and expertise.

Furthermore, the transparency of a broker's operations is critical for building trust among clients. Investors should have access to information regarding the company's history, ownership, and operational practices. Given the lack of information available about Mmig, potential clients may find it challenging to ascertain the broker's reliability. This absence of transparency, coupled with the revocation of its license, leads to a concerning conclusion regarding the broker's legitimacy.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the trading conditions they offer. Mmig employs the MetaTrader 4 and MetaTrader 5 platforms, which are widely recognized in the trading community for their user-friendly interfaces and advanced features. However, the overall cost structure and potential hidden fees associated with trading on this platform warrant scrutiny.

The following table outlines the core trading costs associated with Mmig:

| Fee Type | Mmig | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Varies (not specified) | 1.0 - 1.5 pips |

| Commission Structure | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | Varies by broker |

The absence of specific information regarding spreads, commissions, and overnight interest rates is concerning. Traders should be cautious of brokers that do not transparently disclose their trading fees, as this may indicate an attempt to mask unfavorable conditions. The lack of clarity surrounding these costs could lead to unexpected expenses for traders, further complicating their trading experience.

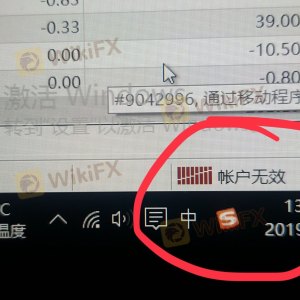

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Reliable brokers typically implement strict measures to protect client funds, including segregated accounts, investor protection schemes, and negative balance protection policies. However, Mmigs practices in this area are questionable.

The broker's lack of a valid regulatory license raises concerns about the safety of client deposits. Without proper oversight, there is no guarantee that client funds are held securely or that they are protected in the event of financial difficulties. Furthermore, historical complaints against Mmig suggest that clients have faced challenges when attempting to withdraw their funds, indicating potential issues with fund accessibility.

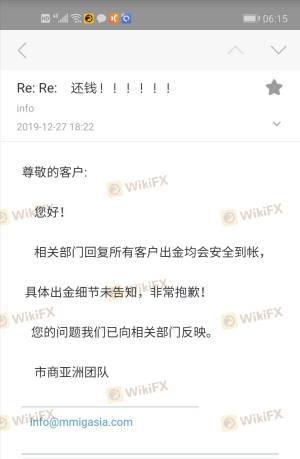

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reputation and reliability. Reviews and testimonials from users can provide insight into the level of service provided by a broker. Unfortunately, Mmig has received numerous complaints over the past few months, highlighting significant issues with customer service and fund withdrawals.

The following table summarizes the main types of complaints against Mmig:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Poor |

| Account Access Problems | High | Poor |

Common complaints include difficulties in withdrawing funds and inadequate customer service responses, which are critical factors for any trading platform. One notable case involved a user who was unable to withdraw their funds for over a year, with customer service continuously deflecting responsibility. Such experiences raise serious concerns about the broker's operational integrity and reliability.

Platform and Trade Execution

The performance and stability of a trading platform are crucial for a positive trading experience. Mmig utilizes the MetaTrader platforms, which are generally well-regarded. However, the execution quality, slippage rates, and any indications of platform manipulation should also be assessed.

Traders have reported issues with order execution on Mmig's platform, including delays and slippage, which can significantly affect trading outcomes. Consistent and reliable execution is essential for traders, and any signs of manipulation or poor performance should be taken seriously. The lack of transparency regarding execution quality further complicates the assessment of Mmig's overall reliability.

Risk Assessment

Engaging with Mmig presents various risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid licensing raises concerns. |

| Fund Security Risk | High | No clear measures for fund protection. |

| Customer Service Risk | Medium | Numerous complaints about service responsiveness. |

| Execution Risk | Medium | Reports of slippage and execution delays. |

To mitigate these risks, potential traders should conduct thorough research and consider alternative brokers with solid regulatory backing and positive customer feedback. It is essential to prioritize safety and reliability when selecting a trading platform.

Conclusion and Recommendations

In conclusion, the evidence suggests that Mmig may not be a safe choice for traders. The revocation of its regulatory license, numerous customer complaints, and lack of transparency surrounding its operations raise significant concerns about its legitimacy. Traders should exercise extreme caution when considering Mmig as a trading platform.

For those seeking reliable alternatives, it is advisable to consider brokers that are regulated by top-tier authorities, such as the FCA, ASIC, or SEC. These brokers typically provide a more secure trading environment, transparent fee structures, and better customer service. Ultimately, protecting your investments should be the top priority, and selecting a reputable broker is a crucial step in achieving that goal.

Is MMIG a scam, or is it legit?

The latest exposure and evaluation content of MMIG brokers.

MMIG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MMIG latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.