Torque Marks 2025 Review: Everything You Need to Know

Executive Summary

This Torque Marks review shows big concerns about this broker's legitimacy and how openly it operates. Based on what we can find, Torque Marks seems to lack important regulatory oversight and detailed user feedback, which raises serious questions about whether we can trust it in the competitive forex market. The broker's website and promotional materials give limited concrete details about trading conditions, regulatory status, or how long it has been operating.

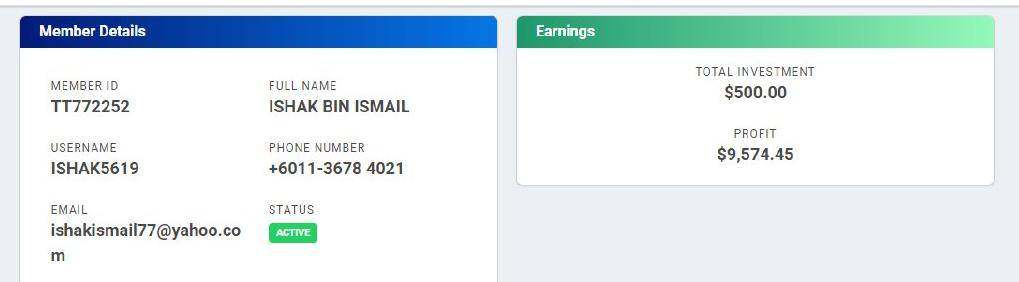

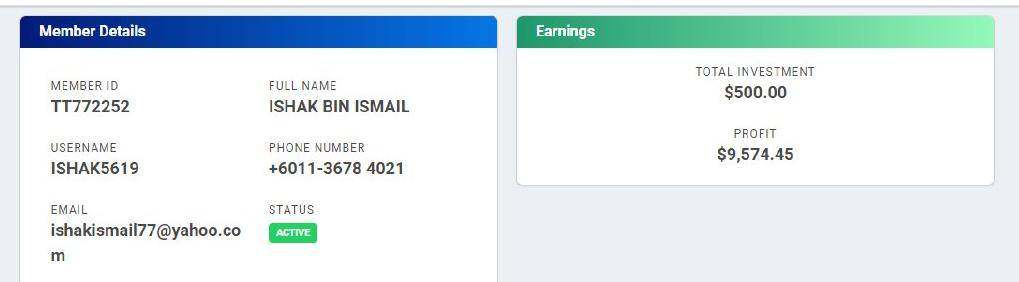

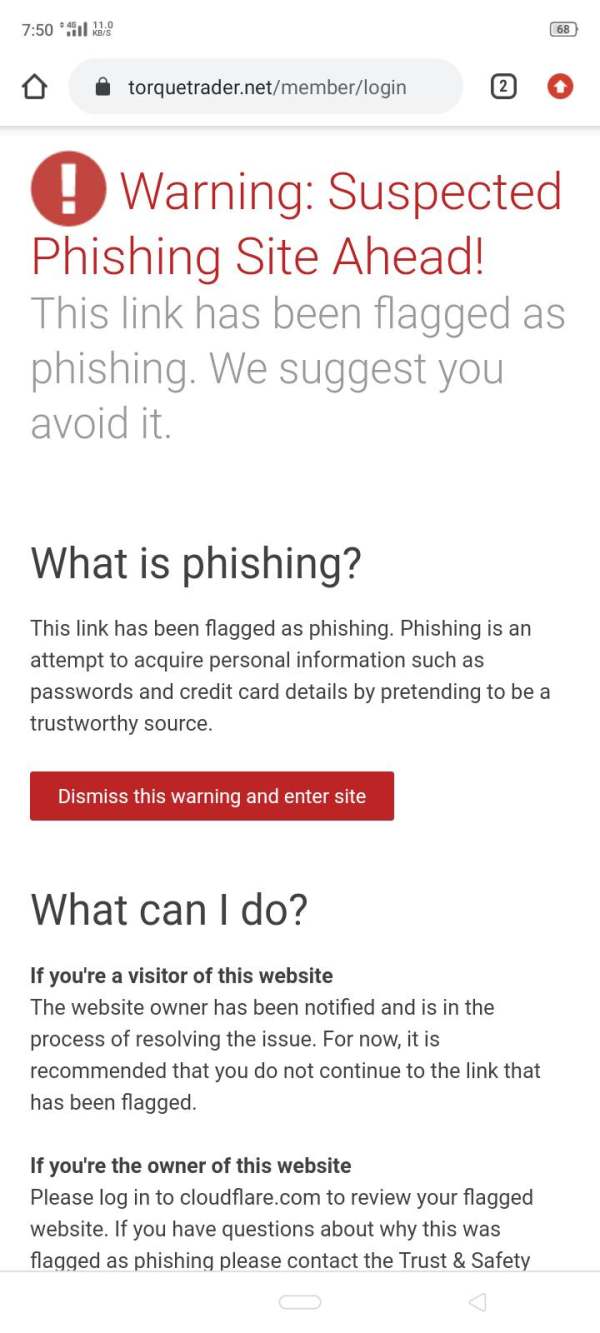

Key problem areas include no clear regulatory information, very few user testimonials, and not enough disclosure of trading terms and conditions. The data we have suggests that Torque Marks may not meet the standard transparency requirements we expect from established forex brokers. This Torque Marks review targets experienced traders who have the expertise to do thorough research and understand the risks that come with unregulated or poorly documented brokers.

Potential users should be extremely careful and consider more established, well-regulated alternatives. The lack of detailed information makes it hard to recommend Torque Marks to any trader category, especially newcomers to the forex market who need reliable, transparent, and well-supported trading environments.

Important Notice

This review uses publicly available information and should not be considered as investment advice. Different regional entities and regulatory jurisdictions may result in varying terms, conditions, and service offerings. Users should strongly verify all information independently, especially regarding regulatory status and trading conditions, before making any financial commitments.

The evaluation method used in this review relies on standard industry assessment criteria, though we did not conduct direct testing and verification of the platform. Market conditions and broker offerings may change, and readers should seek the most current information directly from official sources.

Rating Framework

The scoring reflects the significant information gaps and transparency concerns we found during this evaluation. The trustworthiness score is particularly low because there is no verifiable regulatory information and limited user feedback available.

Broker Overview

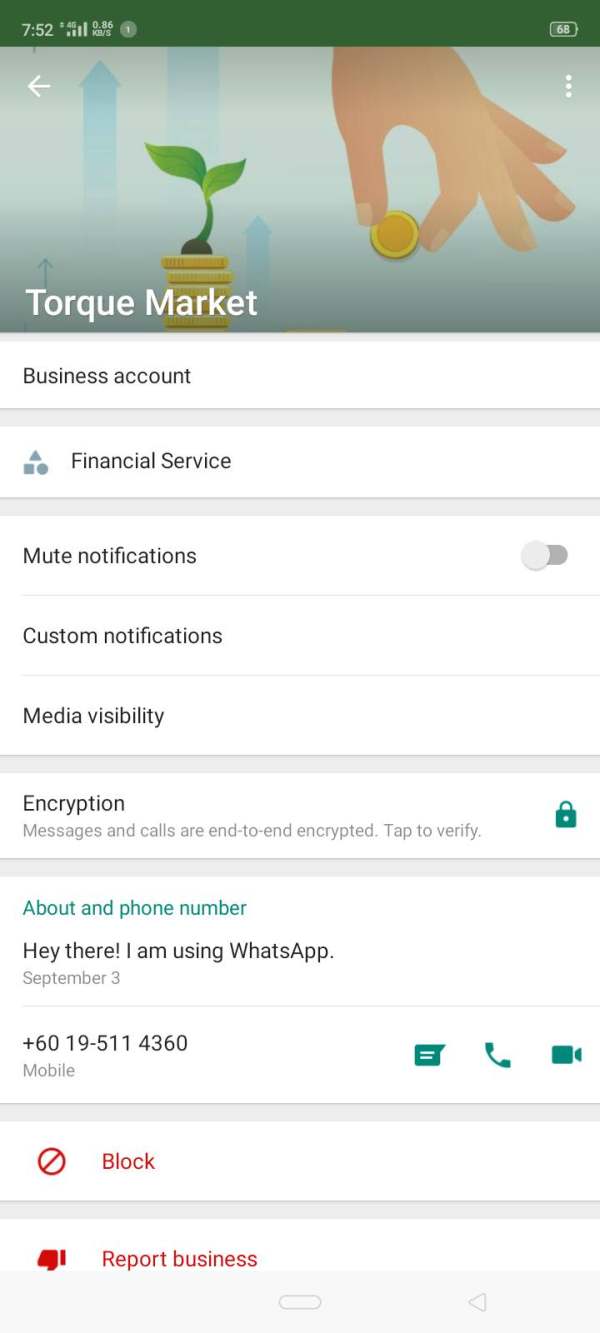

Torque Marks operates in the forex brokerage space. Specific details about when it was founded, its corporate structure, and operational history remain unclear from available sources. The company's background information is notably sparse, making it difficult to establish a complete profile of its business model and market positioning.

Unlike established brokers that typically provide detailed corporate histories and leadership information, Torque Marks maintains a relatively low profile in terms of public disclosure. The broker's business model and operational framework are not clearly defined in accessible materials. This lack of transparency extends to fundamental aspects such as market maker versus ECN execution, liquidity providers, and technological infrastructure.

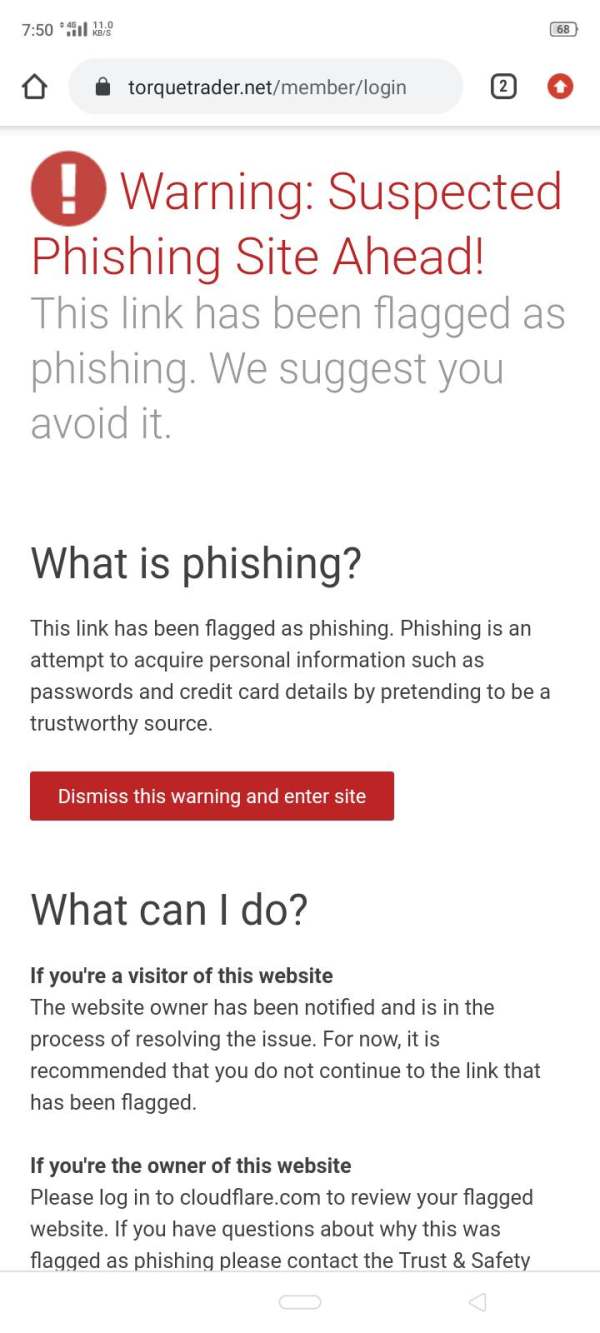

Such information gaps are concerning for potential clients seeking to understand how their trades will be processed and executed. Regarding trading platforms and asset offerings, specific information remains limited in available documentation. The regulatory landscape surrounding Torque Marks is particularly concerning, as no clear regulatory oversight or licensing information has been identified through standard verification channels.

This Torque Marks review emphasizes that regulatory compliance is a critical factor in broker selection, and the absence of such information represents a significant red flag for potential users.

Regulatory Status: Available information does not clearly identify specific regulatory authorities overseeing Torque Marks' operations. This represents a significant concern for trader protection and fund security.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees is not detailed in accessible materials.

Minimum Deposit Requirements: Concrete minimum deposit amounts for different account types are not specified in available documentation. This makes it difficult for potential clients to plan their initial investment.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not clearly outlined in accessible sources.

Tradeable Assets: The range of available instruments, including currency pairs, commodities, indices, and other financial products, lacks specific enumeration in available materials.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not detailed enough. This prevents accurate cost analysis for potential users.

Leverage Options: Maximum leverage ratios and margin requirements are not specifically stated in accessible documentation.

Platform Selection: Information about supported trading platforms, whether proprietary or third-party solutions like MetaTrader, is not clearly specified.

Geographic Restrictions: Details about service availability in different countries and jurisdictions are not explicitly outlined.

Customer Support Languages: Supported languages for customer service interactions are not clearly documented in available materials.

This Torque Marks review highlights the concerning lack of transparency across these fundamental operational areas.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions evaluation for Torque Marks reveals significant information gaps that substantially impact the scoring. Available materials do not provide clear details about different account tiers, their respective features, or minimum balance requirements. This lack of transparency makes it impossible for potential clients to make informed decisions about which account type might suit their trading needs and financial capacity.

The absence of detailed account opening procedures and requirements represents another area of concern. Established brokers typically provide detailed information about documentation needs, verification processes, and account activation timelines. The limited availability of such information from Torque Marks suggests either inadequate disclosure practices or potentially underdeveloped operational procedures.

Furthermore, special account features such as Islamic accounts, professional trader designations, or institutional offerings are not clearly documented. This Torque Marks review notes that the lack of detailed account information significantly impacts the user experience and raises questions about the broker's commitment to transparency and client service.

The evaluation methodology considered industry standards for account variety, accessibility, and feature disclosure. Torque Marks' performance in this category falls well below expectations for modern forex brokers.

The trading tools and resources assessment reveals substantial deficiencies in available information about Torque Marks' technological offerings. Standard trading tools such as technical analysis indicators, charting packages, and market research resources are not detailed in accessible materials. This absence of detailed tool descriptions makes it challenging for traders to assess whether the platform meets their analytical and trading requirements.

Educational resources, which are increasingly important for broker differentiation and client development, appear to be limited or poorly documented. Established brokers typically offer webinars, tutorials, market analysis, and educational content libraries. The lack of clear information about such resources suggests either minimal investment in client education or inadequate marketing of available materials.

Automated trading support, including expert advisors, copy trading, or algorithmic trading capabilities, is not clearly addressed in available documentation. Modern traders increasingly expect sophisticated automation options, and the absence of such information represents a competitive disadvantage.

Research and analysis resources, including market commentary, economic calendars, and fundamental analysis, are not prominently featured in accessible materials. These tools are essential for informed trading decisions and their absence or poor documentation negatively impacts the overall evaluation.

Customer Service and Support Analysis (5/10)

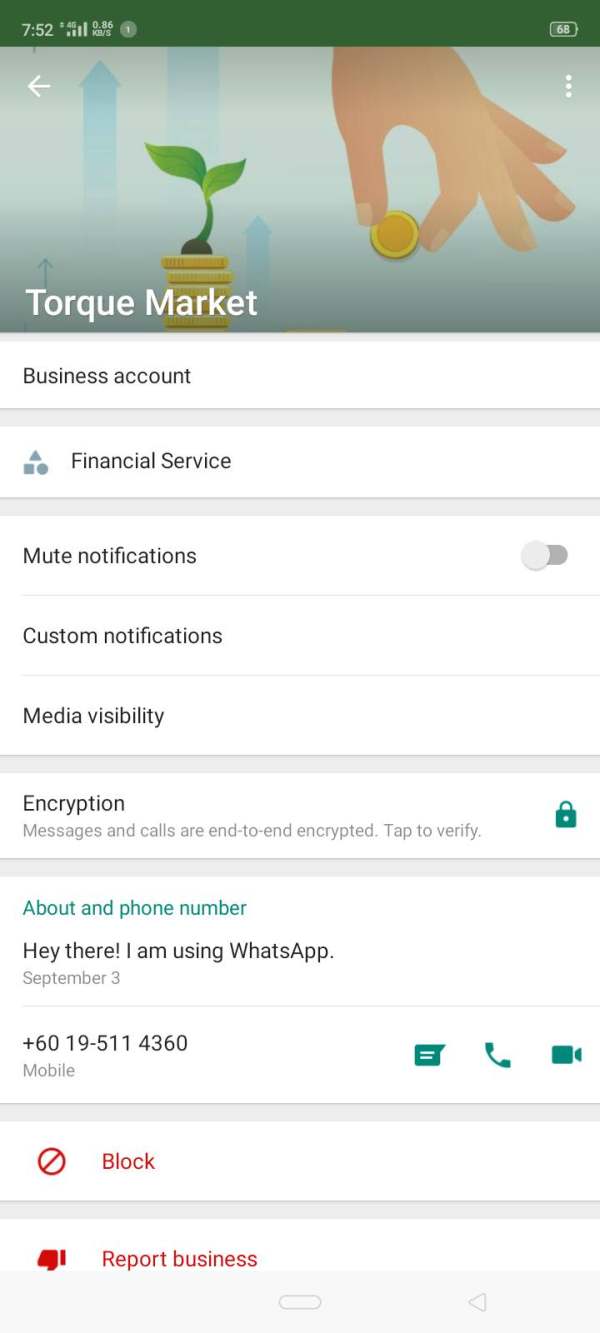

Customer service evaluation for Torque Marks is hampered by limited available information about support channels, response times, and service quality metrics. While some basic contact information may be available, detailed information about support availability, multilingual capabilities, and response time commitments are not clearly documented in accessible sources.

The availability of multiple communication channels, including live chat, phone support, email assistance, and potentially social media engagement, is not fully detailed. Modern traders expect 24/5 or 24/7 support availability, particularly for international markets, but specific service hours and availability are not clearly communicated.

Service quality indicators, such as average response times, customer satisfaction metrics, or support team expertise levels, are not publicly available. User feedback regarding support experiences is notably limited, making it difficult to assess real-world service performance.

The moderate scoring in this category reflects the general availability of basic contact methods while acknowledging the significant information gaps that prevent a more thorough evaluation of service quality and effectiveness.

Trading Experience Analysis (4/10)

The trading experience evaluation for Torque Marks faces significant challenges due to limited user feedback and platform information availability. Critical aspects such as execution speed, order processing quality, and platform stability are not well-documented in accessible sources. These factors are fundamental to trader satisfaction and success.

Platform functionality and user interface design details are not available, making it difficult to assess the overall trading environment quality. Modern traders expect intuitive interfaces, advanced charting capabilities, and seamless order management systems, but specific information about these features is lacking.

Mobile trading capabilities, which are increasingly crucial for contemporary traders, are not clearly detailed in available materials. The quality of mobile applications, feature parity with desktop platforms, and mobile-specific functionality are important considerations that cannot be adequately assessed.

Order execution quality, including slippage rates, requote frequency, and execution speed metrics, lacks documentation in accessible sources. This Torque Marks review emphasizes that execution quality is paramount for trading success, and the absence of such information is concerning for potential users.

Trustworthiness Analysis (2/10)

The trustworthiness evaluation reveals the most significant concerns about Torque Marks as a forex broker. The absence of clear regulatory oversight represents a fundamental issue that directly impacts trader protection and fund security. Established regulatory bodies such as the FCA, CySEC, ASIC, or other recognized authorities provide essential oversight and protection mechanisms.

Fund security measures, including segregated client accounts, deposit protection schemes, and third-party fund management, are not clearly documented in available materials. These protections are standard industry practices that help ensure client fund safety in case of broker financial difficulties.

Corporate transparency, including company registration details, ownership structure, and financial reporting, appears limited in publicly accessible information. Reputable brokers typically provide detailed corporate information that allows clients to verify business legitimacy and operational history.

Industry reputation and third-party evaluations are notably sparse, with limited independent assessments or industry recognition available. The absence of established industry relationships and recognition raises questions about the broker's standing within the professional forex community.

User Experience Analysis (3/10)

User experience evaluation for Torque Marks is significantly constrained by the limited availability of genuine user feedback and testimonials. User satisfaction metrics, which are typically available for established brokers through review platforms and industry surveys, are notably absent or limited for this broker.

Interface design and platform usability assessments cannot be thoroughly conducted without detailed platform information or substantial user feedback. Modern traders expect intuitive navigation, customizable interfaces, and streamlined workflows, but evaluation of these aspects is hampered by information limitations.

Registration and account verification processes are not clearly documented, making it difficult to assess the user onboarding experience. Efficient, secure, and user-friendly account opening procedures are important for initial user satisfaction and broker credibility.

Funding and withdrawal experiences, which significantly impact overall user satisfaction, lack detailed documentation regarding process efficiency, fee structures, and user satisfaction levels. The limited feedback available prevents a thorough assessment of these critical operational aspects.

Conclusion

This Torque Marks review reveals substantial concerns about the broker's transparency, regulatory status, and overall credibility within the forex industry. The significant information gaps across fundamental operational areas, combined with the absence of clear regulatory oversight, make it difficult to recommend Torque Marks to any category of trader.

The evaluation particularly highlights concerns for novice traders who require well-regulated, transparent, and supportive trading environments. Experienced traders who might consider less conventional brokers should exercise extreme caution and conduct thorough independent research before considering any engagement with Torque Marks.

The primary disadvantages include lack of regulatory transparency, insufficient operational information disclosure, and limited user feedback availability. Until these fundamental concerns are addressed through verifiable information and proper regulatory oversight, traders are advised to consider more established and transparent alternatives in the competitive forex brokerage market.