Meksa 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Meksa, an unregulated Turkish forex broker, operates in a complex regulatory environment that raises substantial concerns for potential investors. Founded in 1990, this broker provides a variety of trading services, including access to foreign exchange, contracts for difference (CFDs), commodities, and indices. While Meksa may suit experienced traders comfortable with high-risk environments who seek a diverse array of instruments, it is less appropriate for novice traders. The lack of regulatory oversight and reports of withdrawal difficulties significantly exacerbate the risks associated with trading through Meksa. Potential investors must weigh the allure of multifaceted trading opportunities against the serious implications of operating within an unregulated space. Therefore, it is vital to approach Meksa with caution and a thorough understanding of the associated risks.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Trading with Meksa carries considerable risk due to its unregulated status and negative user experiences.

Potential Harms:

- Loss of Capital: Without regulatory protections, investments are at risk of total loss.

- Withdrawal Difficulties: Users have reported significant challenges in retrieving their funds.

- Hidden Fees: Cases of undisclosed fees further complicate the investor's landscape.

How to Self-Verify:

- Check Regulatory Agencies: Visit websites such as the UK's FCA, Australia's ASIC, or the American NFA. Use the search tools to check if Meksa is listed or reported.

- Read User Feedback: Check independent review platforms for feedback on Meksa, focusing on fund withdrawal experiences and customer service.

- Conduct a Domain Check: Use WHOIS lookup tools to investigate the previous ownership and registration details of Meksa's domain.

- Verify Financial Transactions: Look for documentation on deposit and withdrawal transactions to gauge responsiveness and clarity.

- Be Cautious of High Returns: If their offerings seem too good to be true, research thoroughly before proceeding.

Rating Framework

Broker Overview

Meksa, established in 1990 and headquartered in Istanbul, Turkey, has emerged in an evolving forex market but without the backing of major regulatory frameworks. It claims authorization through the Capital Markets Board of Turkey, yet lacks the robust regulation afforded by leading global financial authorities. This ambiguous regulatory status presents notable risks to potential clients, leading to extensive warnings from various financial oversight groups.

Core Business Overview

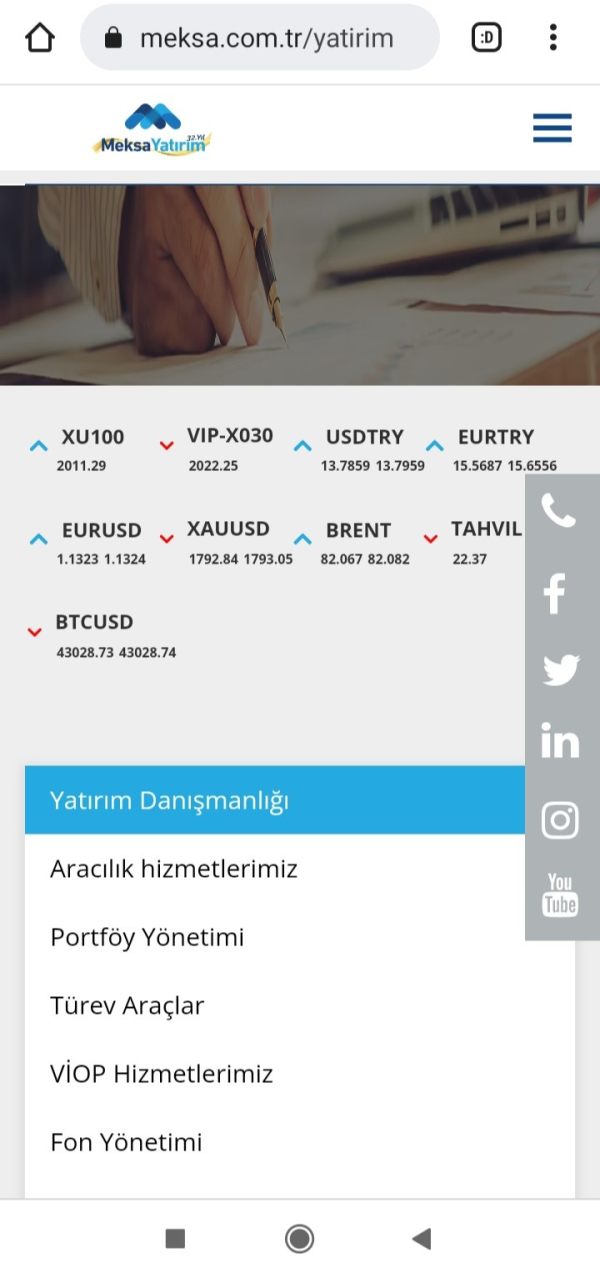

Meksa provides a range of trading services tailored mainly to experienced traders. Its offerings span traditional forex pairs, CFDs, commodities, and indices, with platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) providing the technological backbone for users. Despite these offerings, the broker's unregulated status raises flags about its operational legitimacy, further complicated by inconsistent reporting surrounding its compliance and regulatory transparency. The lack of reassurance for fund safety has led to skepticism among users and potential investors alike.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Meksas regulatory assertions are inconsistent, leading to considerable confusion regarding its legitimacy. Multiple reports indicate that the broker has not maintained valid regulations from recognized international authorities. This is particularly concerning as pitting regulatory bodies ensures the safety of investor funds and enforces market integrity.

- Assessment of Regulatory Information Conflicts

- Despite claiming to operate under the Capital Markets Board of Turkey, no concrete evidence delineates its regulatory authority. Reports from various review sites emphasize its lack of registration with robust entities such as ASIC, FCA, or the NFA. This void creates a breeding ground for unscrupulous practices, leaving clients vulnerable and exposed.