Dtnet 2025 Review: Everything You Need to Know

Dtnet has emerged as a controversial player in the forex trading landscape, with numerous reviews pointing to significant concerns regarding its legitimacy and operational practices. Overall, the consensus among various sources is that Dtnet operates as an unregulated broker, raising red flags for potential investors. Key issues include a lack of transparency, absence of regulatory oversight, and numerous user complaints regarding withdrawal difficulties.

Note: It is crucial to recognize that Dtnet operates under different entities across regions, which can complicate the regulatory landscape. This review aims to provide a fair and accurate assessment based on the available information.

Ratings Overview

We assess brokers based on a combination of user feedback, expert opinions, and factual data.

Broker Overview

Dtnet, also known as Dtnet3650, claims to operate under the auspices of DingTian International Co., Ltd., which allegedly has its headquarters in London. However, multiple reviews highlight a lack of evidence supporting these claims, as no regulatory information can be found on the UK's Financial Conduct Authority (FCA) registry or any other recognized financial regulators. The broker offers trading through the popular MetaTrader 5 platform, primarily focusing on forex, CFDs, and ETFs. Unfortunately, the absence of a valid regulatory framework raises serious concerns about the safety of client funds.

Detailed Assessment

Regulatory Status

Dtnet is unregulated, which is a significant concern for potential investors. The lack of oversight means that traders have no recourse if issues arise, making it a risky choice for anyone looking to trade in the forex market. According to BrokersView, Dtnet's operational status is classified as a scam due to its unregulated nature.

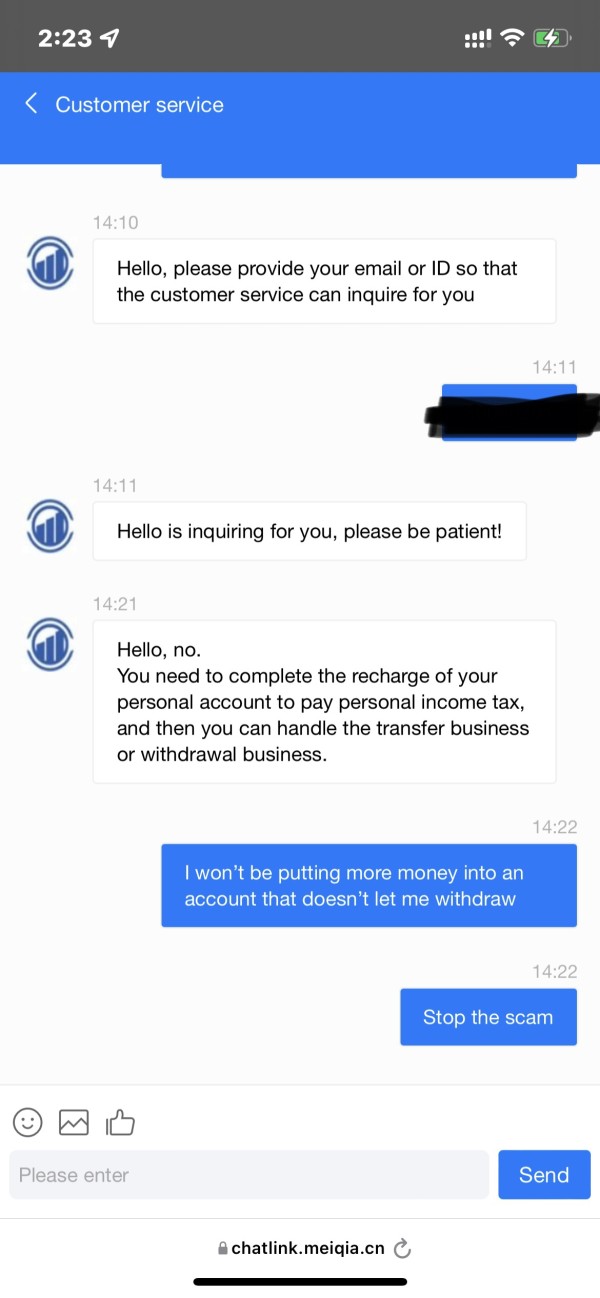

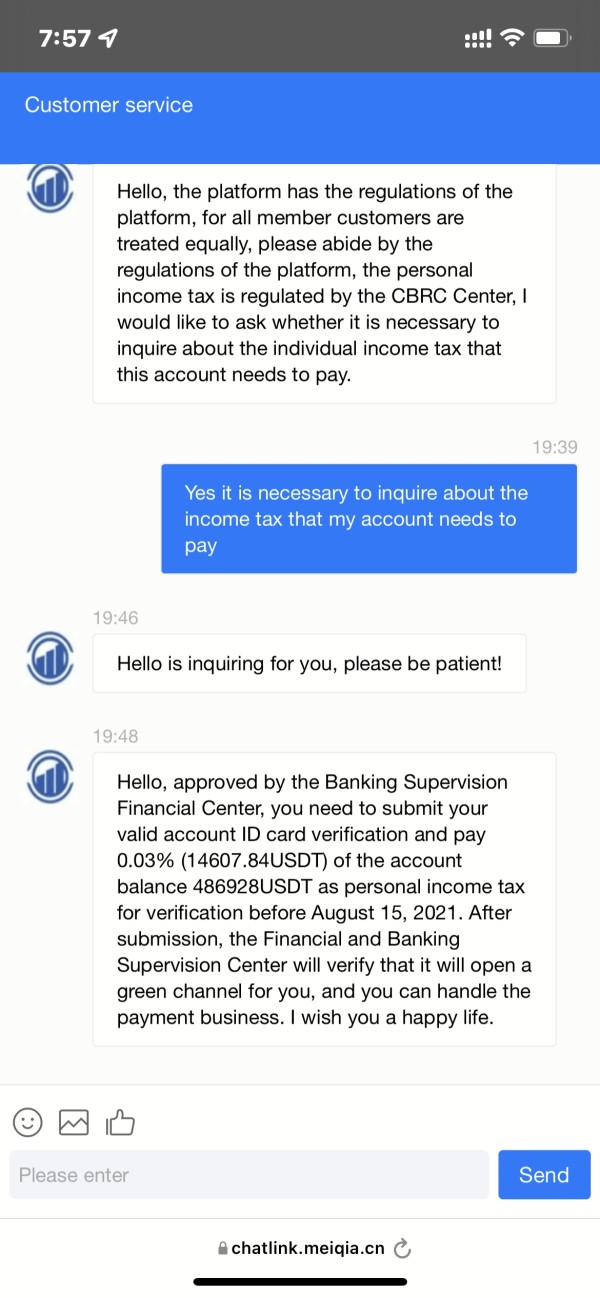

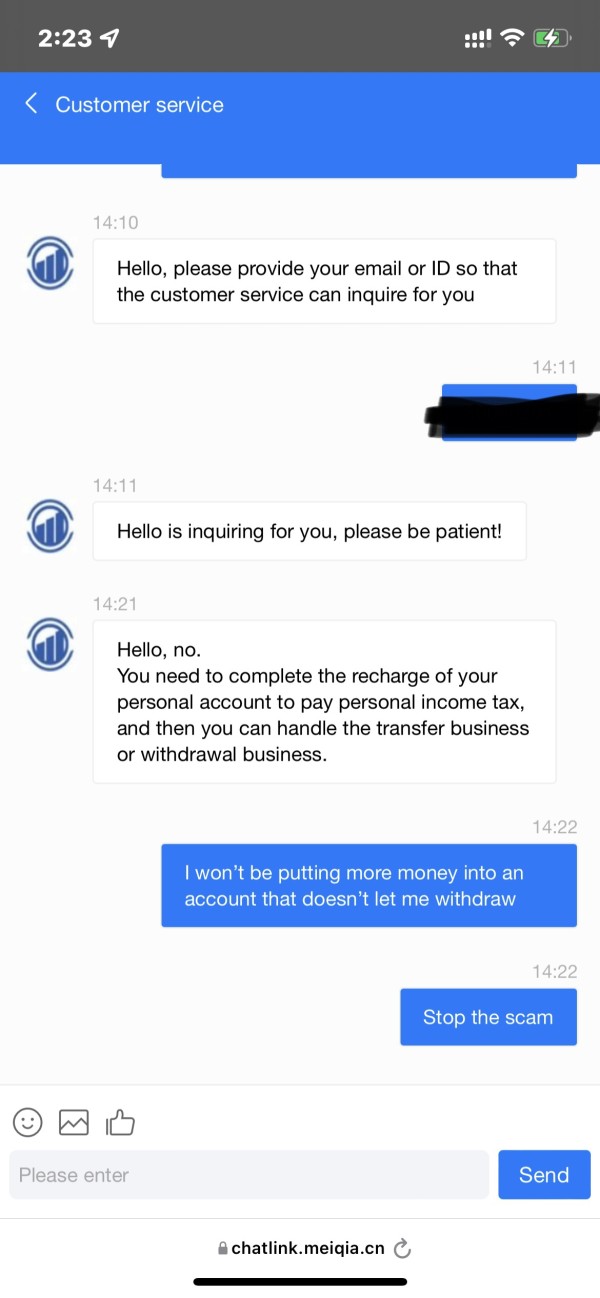

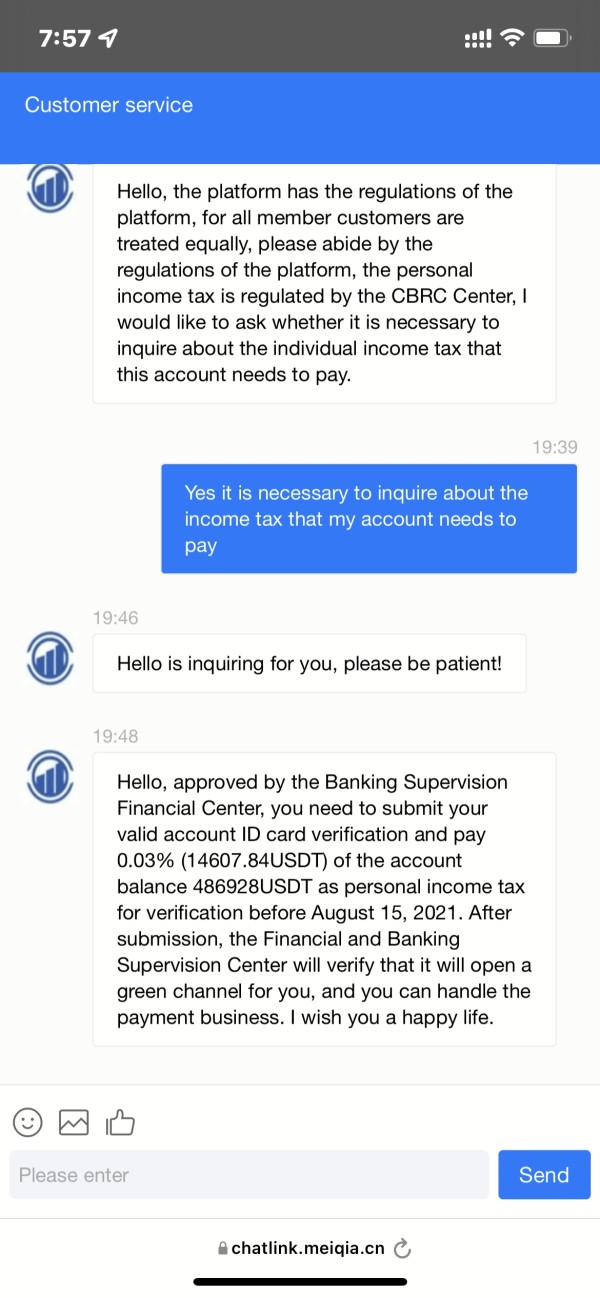

Deposit and Withdrawal Currencies

Information regarding the accepted deposit and withdrawal currencies is scarce. However, users have reported difficulties in withdrawing funds, with some citing requests for additional deposits before they could access their money. This aligns with common tactics used by fraudulent brokers, as noted in various reviews.

Minimum Deposit

Details about the minimum deposit requirements are not clearly stated on Dtnets website. This lack of transparency can be a red flag, as legitimate brokers typically provide clear information on account types and associated costs.

Dtnet appears to offer trading bonuses, but reviews suggest that these bonuses come with stringent conditions that make it nearly impossible for traders to withdraw their funds. This practice is often associated with scam brokers, as highlighted in ForexPeaceArmy.

Tradable Asset Classes

The broker claims to provide access to a variety of tradable assets, including forex pairs and CFDs. However, due to its unregulated status, the actual quality and execution of trades remain questionable.

Costs (Spreads, Fees, Commissions)

Specific details regarding spreads, fees, and commissions are not readily available. Reviews indicate that traders may face hidden fees, particularly when attempting to withdraw funds, which is a typical characteristic of untrustworthy brokers.

Leverage

Dtnet reportedly offers leverage of up to 1:200. While high leverage can be appealing, it also increases risk, especially when dealing with an unregulated broker.

Dtnet provides access to the MetaTrader 5 platform, a popular choice among traders. However, the lack of regulatory oversight raises questions about the platform's reliability and the safety of clients' trading data.

Restricted Regions

There is limited information on specific restricted regions, but the unregulated nature of Dtnet suggests that it may not be compliant with the laws of various jurisdictions, further complicating its operational legitimacy.

Available Customer Service Languages

Customer support appears to be minimal, with reports indicating difficulties in reaching the broker for assistance. This lack of support is a critical concern for anyone considering trading with Dtnet.

Final Ratings Overview

Detailed Breakdown

- Account Conditions: Dtnet lacks transparency regarding account types and minimum deposits, leading to a low rating.

- Tools and Resources: Limited tools and resources for traders were noted, contributing to a poor rating.

- Customer Service and Support: Users have reported significant difficulties in contacting customer support, leading to a minimal rating.

- Trading Setup (Experience): Traders have expressed concerns regarding the overall trading experience, particularly with execution and withdrawal processes.

- Trustworthiness: The unregulated status of Dtnet severely impacts its trustworthiness, resulting in a low score.

- User Experience: Overall user experiences have been negative, with many complaints about withdrawal issues and lack of transparency.

In conclusion, the Dtnet review points to a broker that operates with numerous red flags, particularly concerning its regulatory status and user experiences. Potential investors are strongly advised to exercise caution and consider regulated alternatives for their trading activities.