Mandiri Investindo Futures Review 1

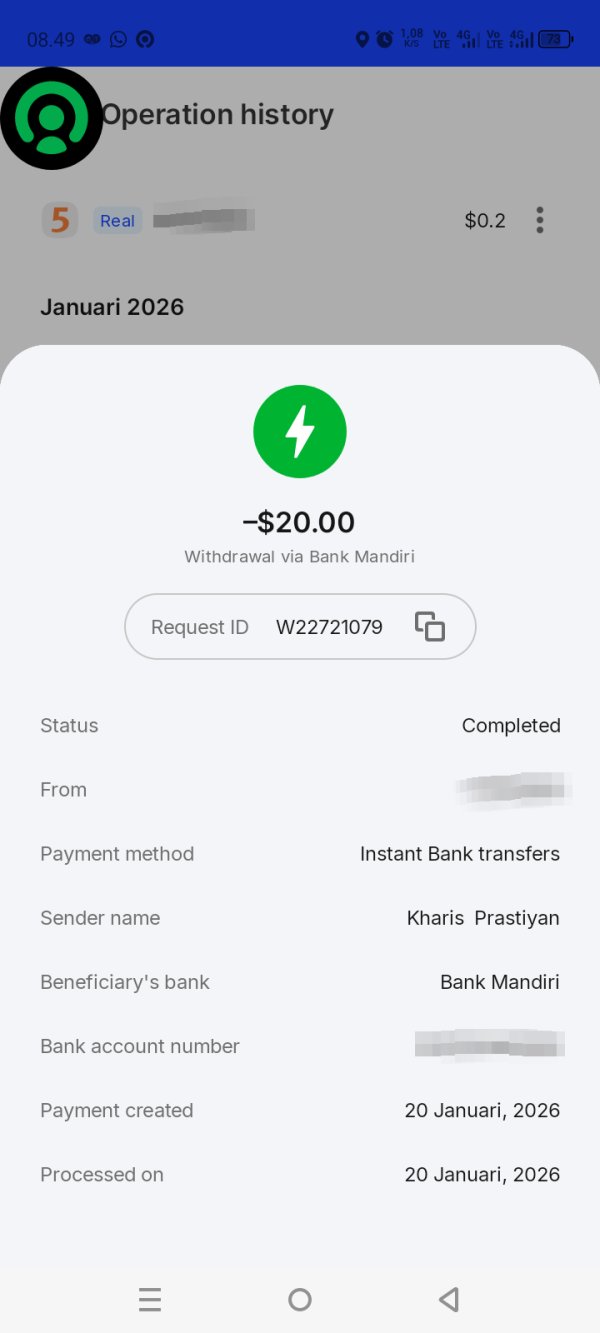

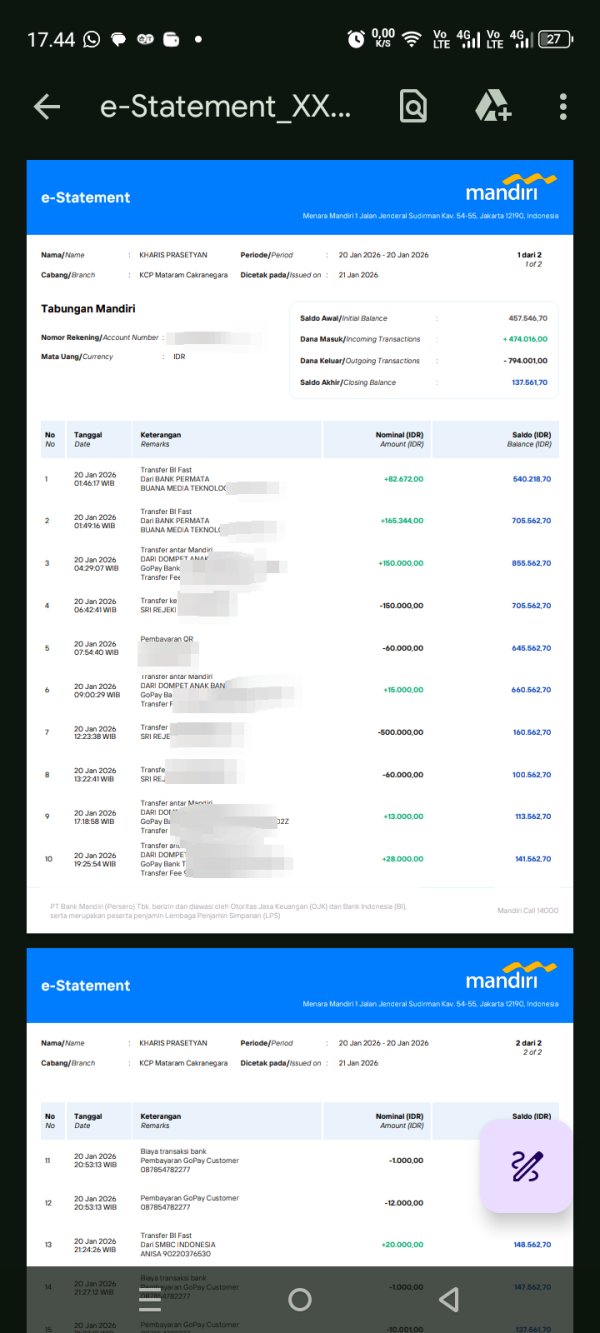

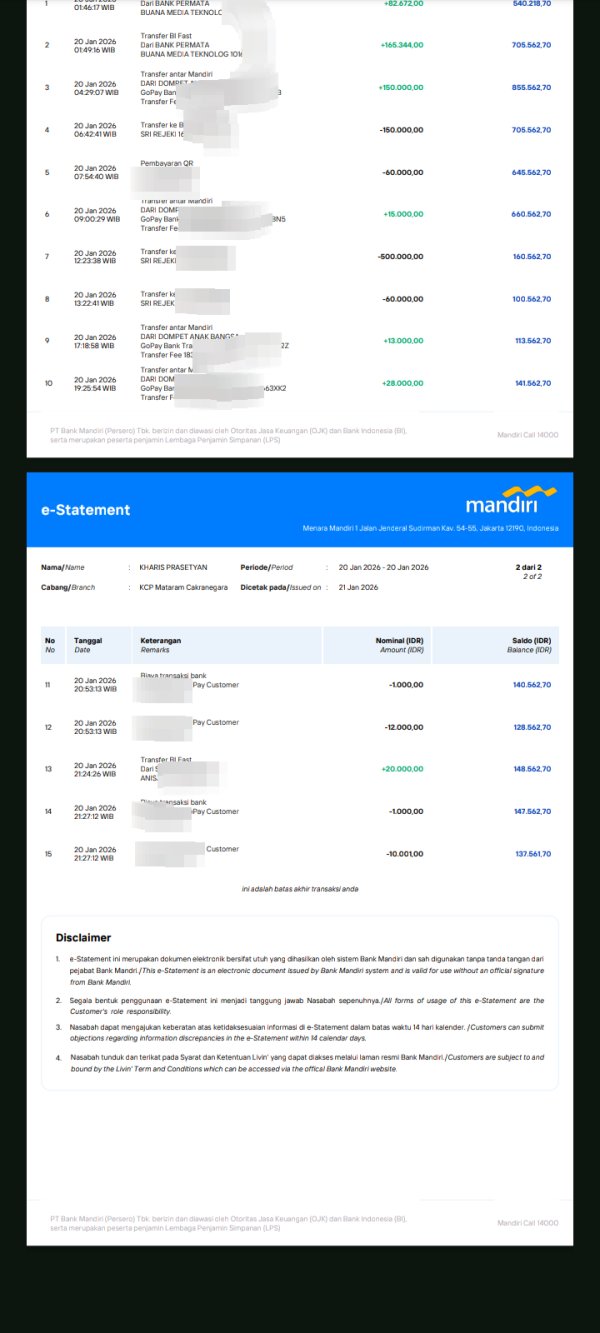

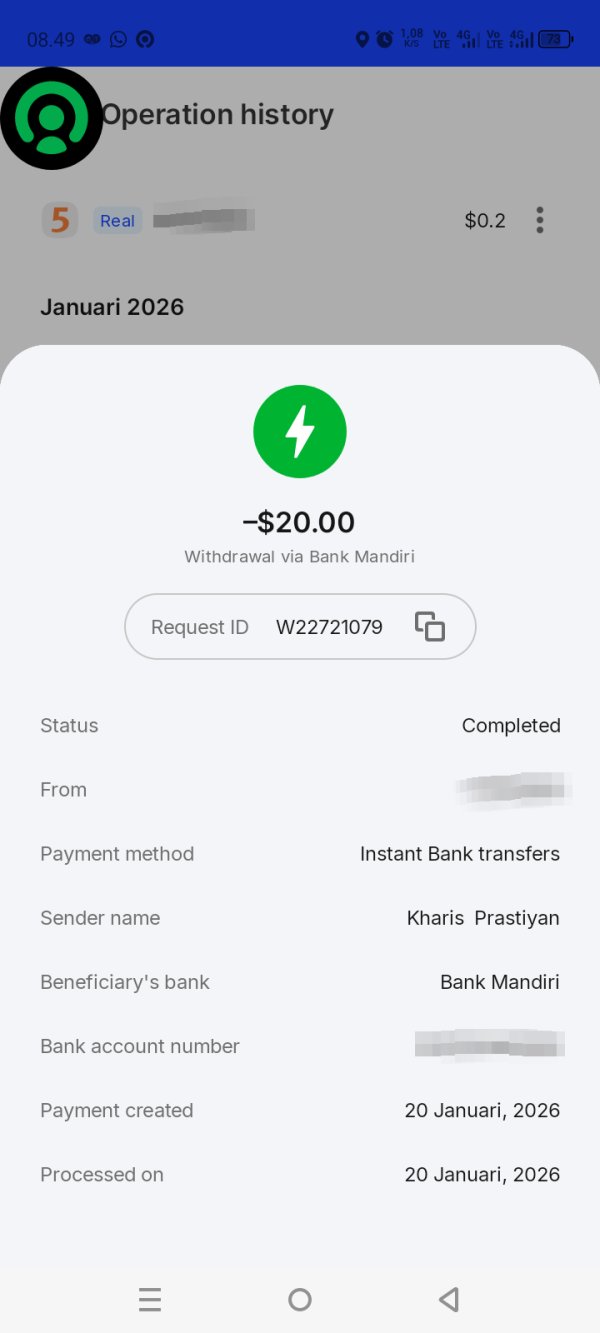

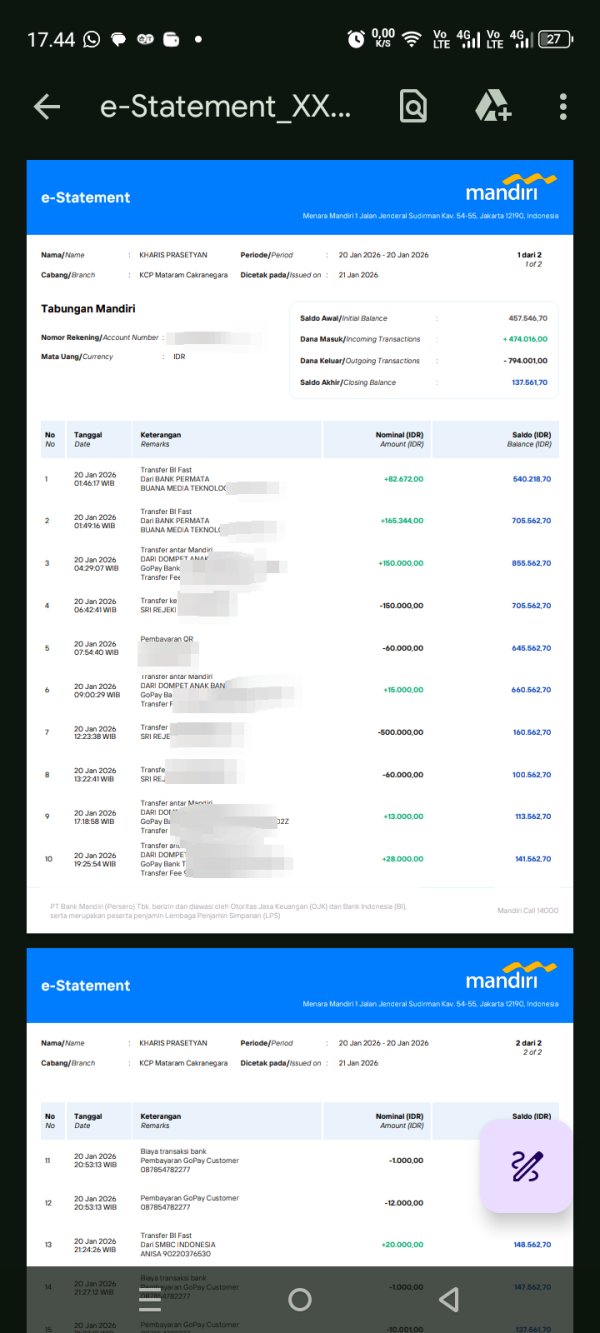

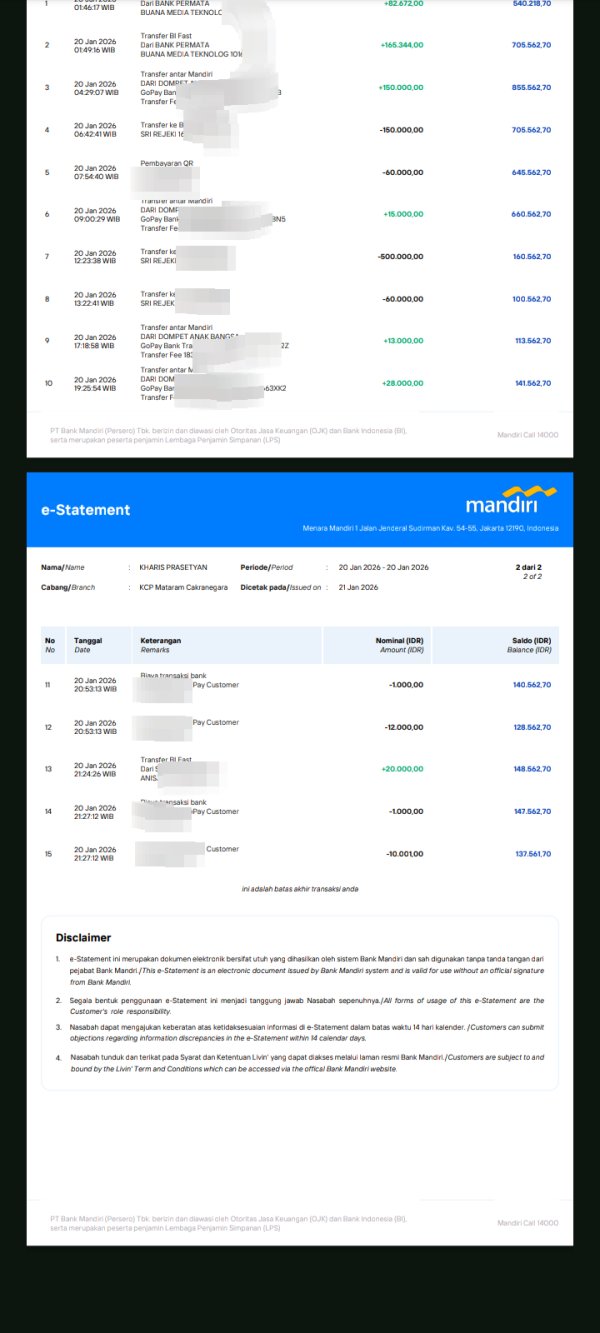

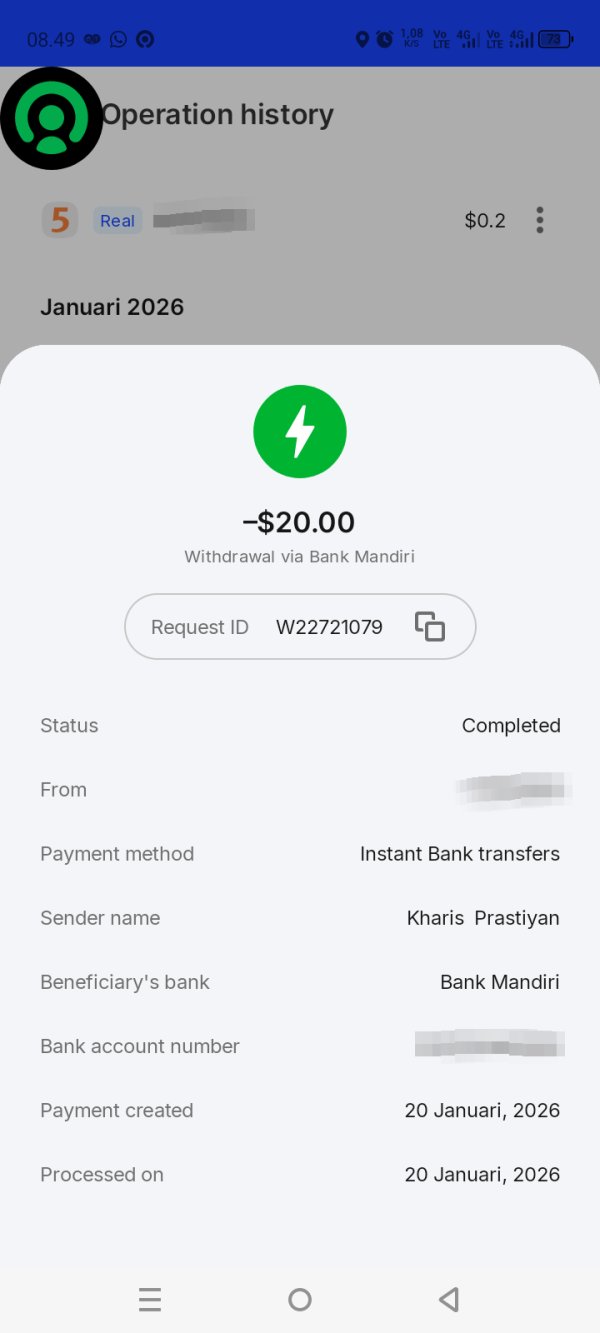

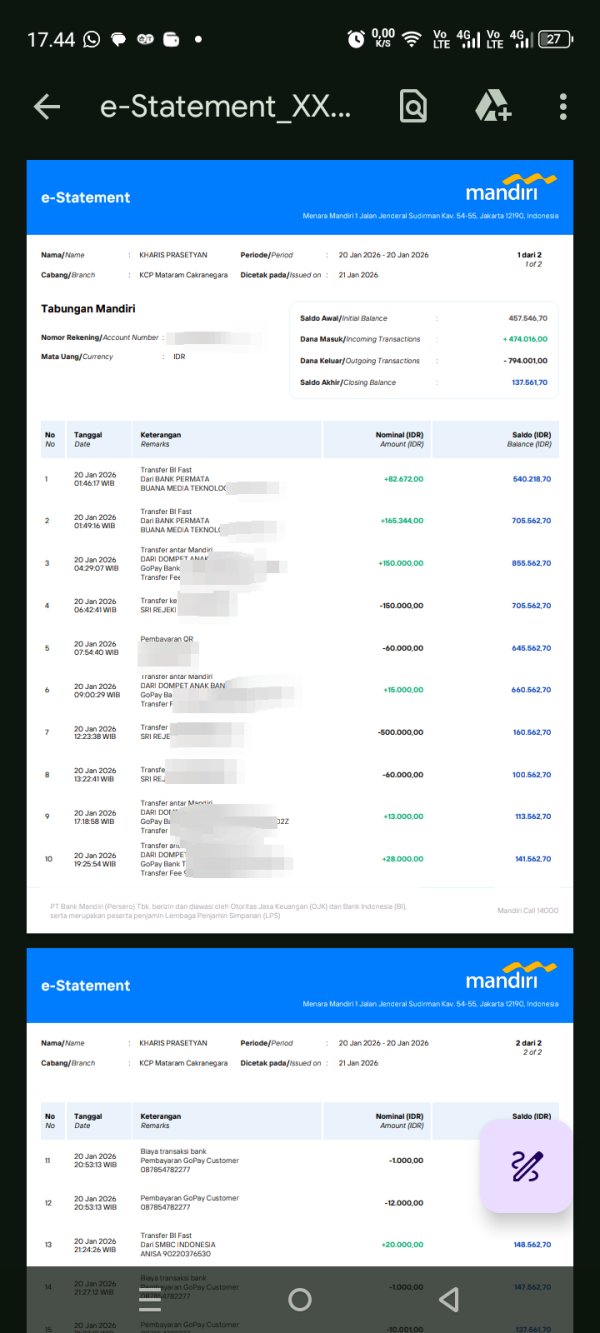

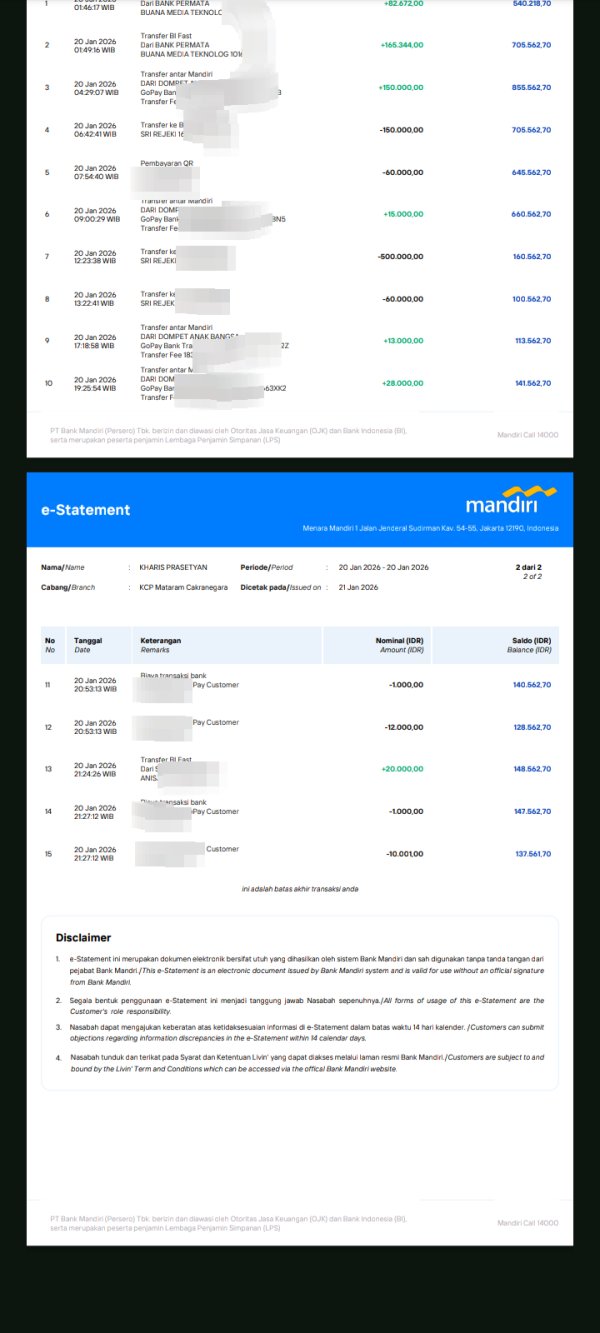

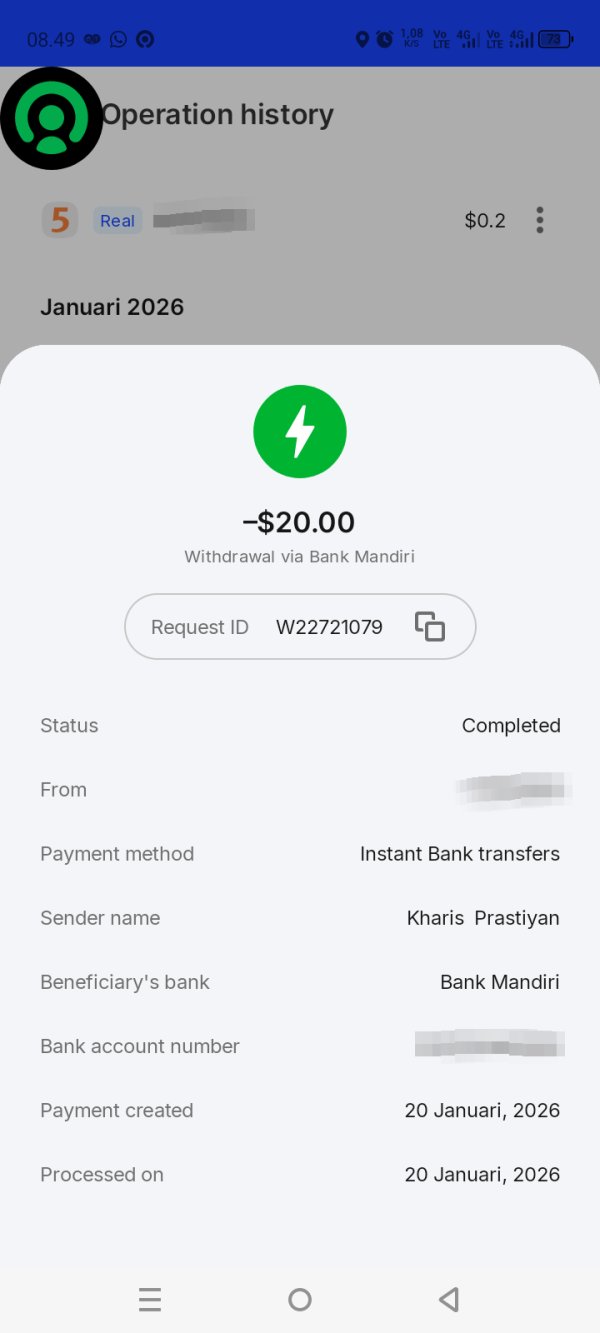

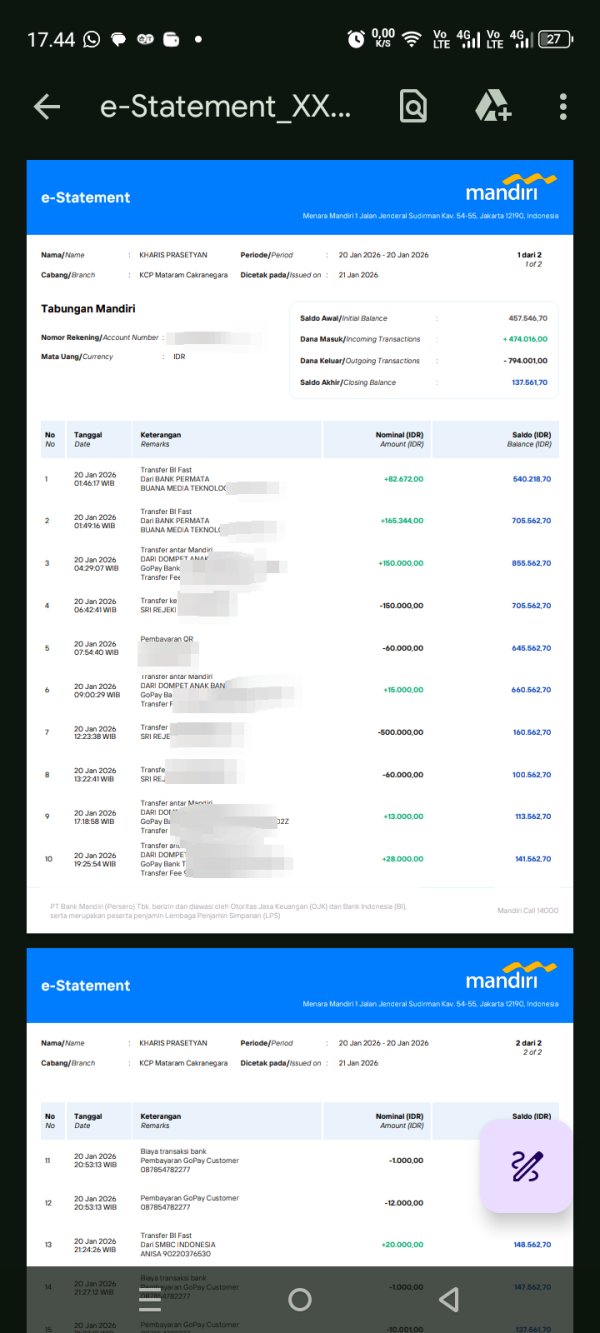

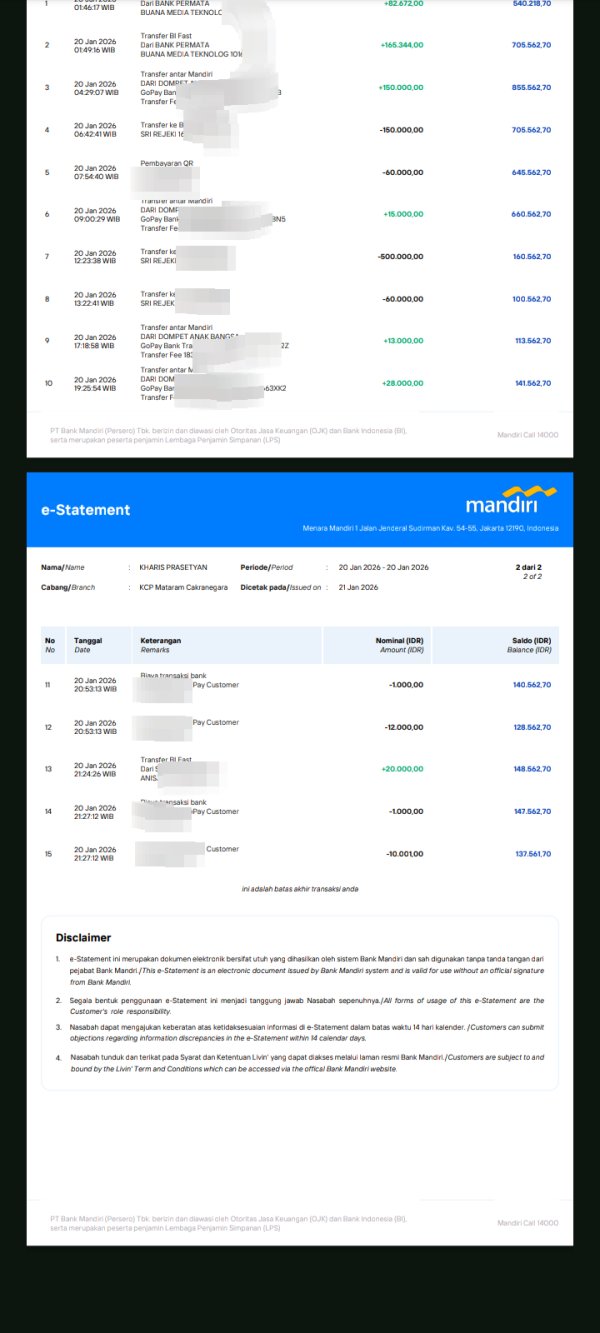

I made a withdrawal of 20 dollars on the 20th with a successful status in the application, but the money has not been credited to my account

Mandiri Investindo Futures Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I made a withdrawal of 20 dollars on the 20th with a successful status in the application, but the money has not been credited to my account

MIF Brokers, founded in October 2020 and based in Dubai, UAE, is a licensed brokerage firm that claims to offer specialized financial advisory services, particularly in mortgages, personal loans, and credit cards. Its mission statement emphasizes a commitment to transparency and comprehensive service aimed at simplifying complex financial processes for clients. The broker targets individuals and businesses in the UAE seeking personalized, clear financial solutions, particularly in the realm of mortgage advisory. However, MIF Brokers doubles as a cautionary tale, with significant scrutiny accompanying its operations due to concerns over regulatory compliance. The apparent lack of robust regulatory oversight raises essential questions regarding fund safety and the legitimacy of its claimed partnerships with various banks and financial institutions.

While MIF's attractive offerings may appeal to those looking for personalized service, the risks, particularly for risk-averse investors, cannot be overlooked. The absence of credible regulatory backing combined with multiple complaints regarding customer service reliability and withdrawal difficulties create a complex landscape for potential clients. Therefore, it becomes crucial for investors to weigh the benefits of tailored service against the potential pitfalls rooted in the broker's questionable regulatory compliance.

Be Aware of the Following Risks:

Self-Verification Guide:

| Dimension | Rating | Justification |

|---|---|---|

| Trustworthiness | 2 | Lack of regulation raises concerns. |

| Trading Costs | 3 | Competitive fees, but hidden costs exist. |

| Platforms & Tools | 4 | Offers a range of tools but lacks user-friendliness. |

| User Experience | 3 | Mixed reviews on support and service quality. |

| Customer Support | 2 | Frequent complaints about responsiveness. |

| Account Conditions | 3 | Standard offerings, but withdrawal issues noted. |

MIF Brokers is a licensed brokerage firm that made its debut in the UAE on October 13, 2020. Its headquarters in Dubai positions the company as a key player in the financial advisory scene, aiming to provide transparent financial solutions. The firm touts formal agreements with various leading banks in the UAE as a testament to its operational credibility. However, in light of the outlined risks associated with its non-regulatory status, investors are urged to exercise caution. The absence of necessary regulatory compliance not only endangers client funds but also raises questions about the legitimacy of its partnerships.

The company's primary service offerings include mortgages, credit cards, and personal loans. MIF Brokers claims to assist clients by delivering competitive rates in the market and guiding them through the entirety of the loan process, which can often be convoluted and time-consuming. By also providing financial planning and investment advice, MIF seeks to position itself as a multifaceted partner in the financial landscape. However, the strength of these services is shadowed by the lack of solid regulatory backing, culminating in a potential mismatch between service delivery and client expectations.

| Feature | Details |

|---|---|

| Regulation | None |

| Minimum Deposit | AED 10,000 |

| Leverage | 1:100 |

| Major Fees | Withdrawal fees may apply |

Understanding Regulatory Information Conflicts

The glaring absence of regulatory oversight is a fundamental concern. MIF Brokers does not display any valid regulatory credentials, raising alarms regarding investor safety and operational transparency. Without regulatory checks and balances, clients have few assurances regarding fund protection or the broker's operational legitimacy.

User Self-Verification Guide

Industry Reputation and Summary

User experiences have painted a troubling picture where multiple complaints highlight the risks associated with unregulated trading activities. Feedback is particularly critical regarding fund safety and the legitimacy of operations. Investors must prioritize self-verification to mitigate potential losses.

Competitive Commission Structure

MIF Brokers promotes a competitive commission structure that may attract traders. Their fees could be seen as viable alternatives when compared to other brokerage firms.

The "Traps" of Non-Trading Fees

However, hidden costs lurk in shadowy corners, particularly concerning withdrawal fees. Some users have reported experiencing issues such as significant withdrawal fees, notably **$30**, which compounds the costs of trading. These hidden charges can create an ineffable sense of mistrust.

Cost Structure Summary

For potential clients, understanding the fee structure is essential. While competitive trading costs may appeal to many, the existence of hidden fees presents challenges, particularly for frequent traders who might become burdened by unexpected withdrawal charges.

Platform Diversity

MIF Brokers presents various platforms, mainly focusing on mortgage-related transactions. These platforms often boast feature-rich environments conducive to experienced traders. However, the user-friendliness of these platforms remains questionable as user feedback often indicates a steep learning curve.

Quality of Tools and Resources

Charting tools and educational resources are available, yet mixed reviews suggest that the platform lacks commitment to appealing to novice traders. This might restrict broader market participation, ultimately limiting the potential client base.

Platform Experience Summary

Overall, while platforms offer depth, usability concerns could dissuade less experienced traders. Quotes from users highlight frustrations surrounding navigation and operational efficacy, which could undermine overall user satisfaction.

User-Focused Services

User experiences are a mixed bag, with several testimonials praising personalized service while others express concerns about the responsiveness of customer support and the transparency of processes. Some users have highlighted the seamless nature of obtaining mortgages, while others have noted significant hiccups in the support process, which could deter future clients.

Feedback Summary

This duality in user experience indicates a pressing need for MIF Brokers to standardize its service delivery to mitigate emerging discrepancies in user evaluations.

Complaints About Responsiveness

Customer support has been a significant bone of contention among users. Many complaints focus on inefficient responses during critical times, particularly regarding withdrawal issues, raising significant concerns about the firm's commitment to its clients.

Improvement Potential

Addressing these gaps in service delivery should be paramount as consumer feedback indicates that a lack of adequate support structures has frequently amplified frustrations among clients.

Standard Offerings

MIF Brokers presents various account conditions that reflect industry norms, including specific minimum deposit thresholds and withdrawal processes. However, concerns over withdrawal issues have emerged, leading to mixed experiences among users.

Account Conditions Feedback

A review of user feedback underscores the critical importance of transparency in account-related communications. Without clear guidelines and expectations, clients might find themselves facing unforeseen hurdles during their trading endeavors.

In summation, while MIF Brokers presents opportunities through personalized financial services and diverse offerings, significant risks arise due to its apparent lack of regulatory compliance and mixed user experiences. The balance between potential benefits and substantial pitfalls becomes a pivotal consideration for prospective clients. Prioritizing due diligence through self-verification and awareness of the pitfalls associated with unregulated brokers is crucial to navigate the complexities of engaging with MIF Brokers confidently.

FX Broker Capital Trading Markets Review