LunoTrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive lunotrade review reveals significant concerns about the broker's legitimacy and safety for potential traders. LunoTrade started in 2019 and operates as an online trading platform with headquarters in Nigeria, primarily targeting forex traders in Nigeria and surrounding regions. However, our analysis uncovers troubling red flags that potential clients must consider before making any decisions.

WikiFX reports show that LunoTrade currently holds an alarming score of just 1.48 out of 10. This indicates severe deficiencies in multiple operational areas. The platform has received 36 user complaints, with numerous traders warning that LunoTrade may operate as a Ponzi scheme. Most critically, the broker lacks proper regulatory oversight from any recognized financial authority, raising substantial questions about fund security and operational legitimacy.

The broker's business model centers on providing online forex and CFD trading services. However, the absence of transparent information about account conditions, trading costs, and platform features creates additional uncertainty. User feedback consistently highlights concerns about withdrawal difficulties and questionable business practices. This makes LunoTrade unsuitable for serious forex trading activities.

Important Notice

This review focuses specifically on LunoTrade's operations based in Nigeria. The company does not appear to maintain regulated entities in other jurisdictions. This significantly limits legal protections for international clients. Traders should be aware that LunoTrade's lack of regulatory oversight means standard investor protection schemes do not apply to their funds or trading activities.

Our evaluation methodology relies on available public information, user feedback from various sources, and third-party assessment platforms. Given the limited transparency from LunoTrade itself, potential clients should exercise extreme caution and conduct additional due diligence before considering any engagement with this platform.

Rating Framework

Broker Overview

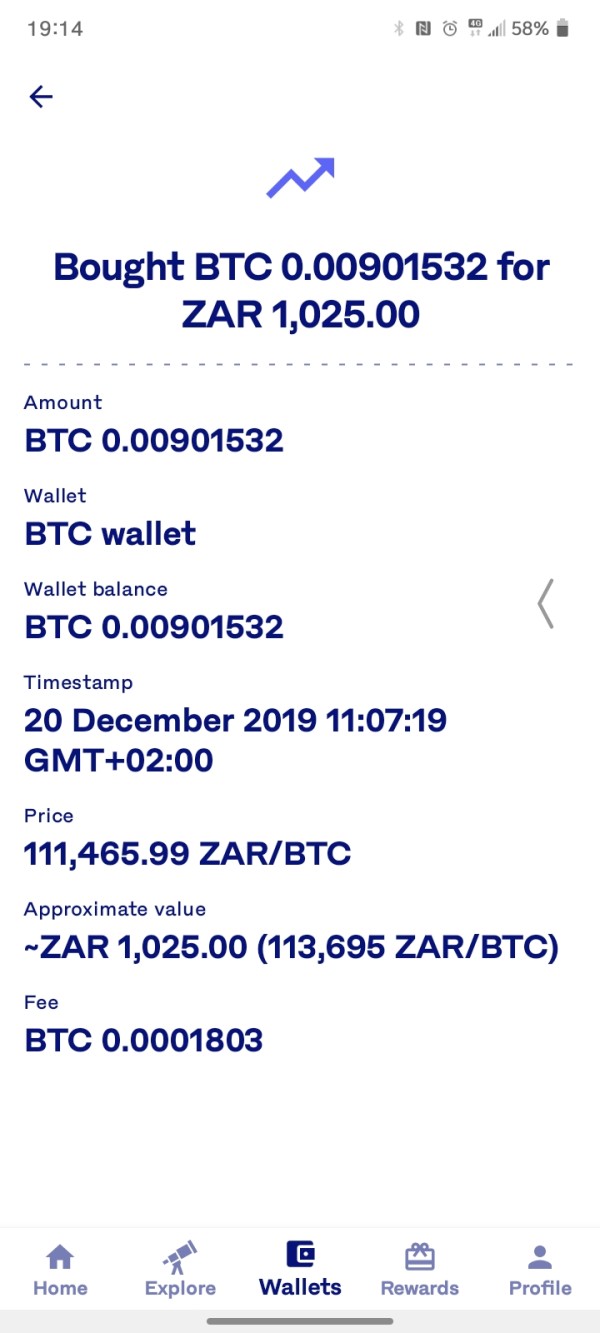

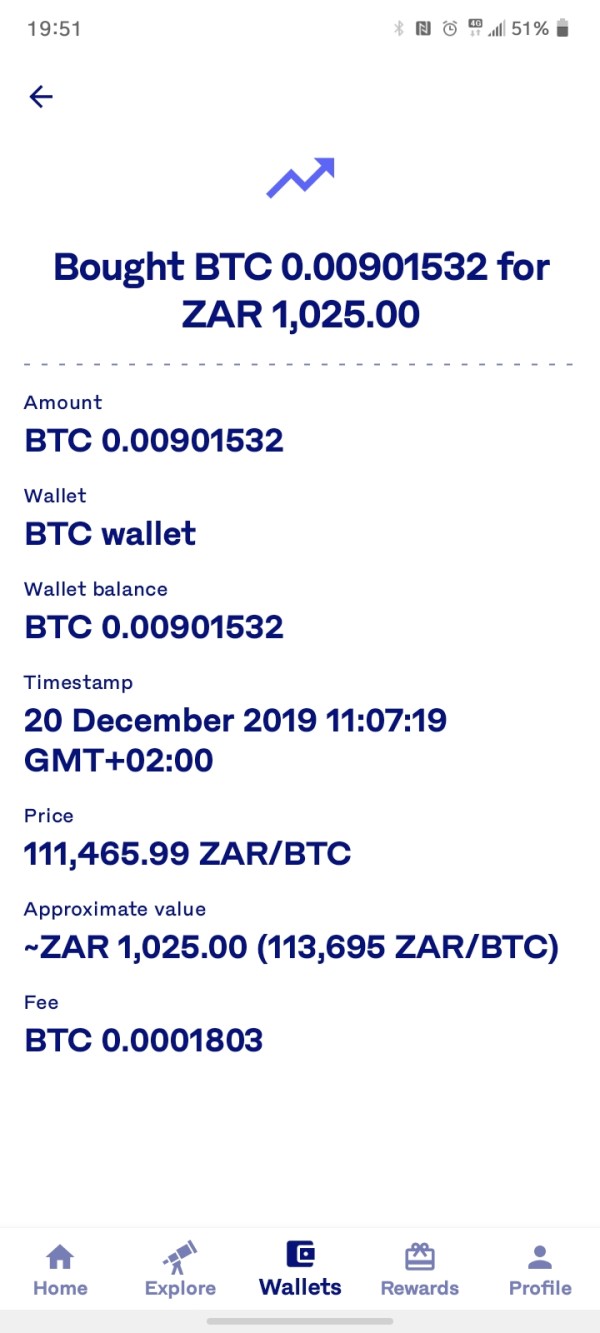

LunoTrade emerged in the online trading landscape in 2019. The company positioned itself as a forex and financial derivatives trading platform. Based in Nigeria, the company attempts to serve the growing demand for online trading services in West Africa and beyond. The broker claims to offer access to various financial markets, though specific details about their service offerings remain notably sparse in publicly available materials.

The platform's business model appears to follow the standard online brokerage approach. It provides retail traders with access to forex markets and potentially other financial instruments through their proprietary trading system. However, unlike established brokers, LunoTrade operates without the safety net of regulatory oversight. This immediately raises concerns about operational standards and client fund protection.

Our lunotrade review investigation reveals that the company maintains a relatively low profile in the broader forex industry. The company has limited presence in major financial publications or industry recognition. This lack of visibility, combined with concerning user feedback, suggests potential clients should approach with significant caution when considering LunoTrade for their trading activities.

Regulatory Status: LunoTrade operates without oversight from any recognized financial regulatory authority. This absence of regulation means clients lack standard protections typically available through regulated brokers.

Deposit and Withdrawal Methods: Available information does not specify the payment methods supported by LunoTrade. The lack of transparent information about funding options raises additional concerns about operational legitimacy.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available materials. This makes it difficult for potential clients to assess accessibility.

Promotional Offers: No information about bonus programs or promotional offers is available in current public materials about LunoTrade's services.

Available Assets: The platform appears to focus on forex trading. However, the complete range of available trading instruments remains unclear from publicly available information.

Cost Structure: Critical information about spreads, commissions, and other trading costs is not transparently disclosed. This makes cost comparison with legitimate brokers impossible.

Leverage Ratios: Specific leverage offerings are not mentioned in available materials. This leaves potential clients without crucial risk management information.

Platform Options: The trading platform technology and features used by LunoTrade are not clearly specified in available documentation.

Geographic Restrictions: Information about regional trading restrictions or availability limitations is not provided in accessible materials.

Customer Support Languages: Available support languages and communication channels are not specified in current public information.

This lunotrade review highlights the concerning lack of transparency across fundamental operational areas that legitimate brokers typically disclose prominently.

Detailed Rating Analysis

Account Conditions Analysis

LunoTrade's account conditions receive the lowest possible rating due to complete lack of transparency about account types, features, and requirements. Legitimate forex brokers typically offer detailed information about different account tiers, minimum deposit requirements, and specific features available to different client segments.

The absence of clear account structure information makes it impossible for potential clients to understand what services they would receive. It also prevents them from knowing how their trading relationship would be managed. Standard industry practice includes providing comprehensive details about account opening procedures, verification requirements, and ongoing account management features.

Without transparent information about account conditions, traders cannot make informed decisions about whether LunoTrade's offerings align with their trading needs and experience levels. This opacity contrasts sharply with regulated brokers who must provide clear, accessible information about all account features and requirements.

The lack of account condition transparency in this lunotrade review represents a significant red flag. Potential clients should carefully consider this before proceeding with any account opening process.

The tools and resources offered by LunoTrade receive the minimum rating due to the complete absence of information about trading tools, analytical resources, or educational materials. Professional forex brokers typically provide comprehensive suites of trading tools, market analysis, and educational content to support client success.

Available information does not indicate whether LunoTrade offers essential trading tools such as technical analysis indicators, economic calendars, market news feeds, or research reports. The lack of educational resources is particularly concerning, as legitimate brokers invest significantly in client education and market analysis.

Modern trading platforms typically integrate advanced charting capabilities, automated trading support, and real-time market data feeds. Without clear information about these fundamental features, potential clients cannot assess whether LunoTrade's platform meets basic trading requirements.

The absence of tool and resource information suggests either inadequate platform development or deliberate opacity about platform capabilities. Both of these possibilities raise serious concerns about the broker's commitment to client success.

Customer Service and Support Analysis

Customer service receives a minimal rating due to the lack of clear information about support channels, availability, and service quality. Professional brokers typically provide multiple communication channels including phone, email, live chat, and comprehensive FAQ sections.

Available information does not specify LunoTrade's customer support hours, response time commitments, or available communication languages. The absence of transparent support information makes it difficult for potential clients to understand how issues or questions would be addressed.

User feedback available through third-party platforms suggests concerning experiences with customer service responsiveness and problem resolution. The low WikiFX score partially reflects user dissatisfaction with support quality and accessibility.

Without reliable customer service information and given the negative user feedback patterns, potential clients face significant uncertainty. They cannot be sure about receiving adequate support for their trading activities or resolving potential account issues.

Trading Experience Analysis

The trading experience evaluation receives the lowest rating due to insufficient information about platform stability, execution quality, and overall trading environment. Professional trading platforms typically provide detailed specifications about order execution speeds, platform uptime, and trading infrastructure.

Available materials do not describe LunoTrade's trading platform features, mobile application capabilities, or order execution methodology. The absence of technical performance data makes it impossible to assess whether the platform meets modern trading standards.

User feedback suggests potential issues with platform reliability and trade execution. However, specific details about trading experience problems are limited in available sources. The concerning overall user ratings indicate systemic issues with the trading environment.

Without transparent information about trading infrastructure and given the negative user feedback patterns, potential clients cannot confidently assess the platform. They cannot determine whether LunoTrade provides a suitable trading environment for their activities.

Trust and Safety Analysis

Trust and safety receive the minimum possible rating due to LunoTrade's complete lack of regulatory oversight and concerning user feedback patterns. The absence of regulation from recognized financial authorities means standard investor protections do not apply to client funds or trading activities.

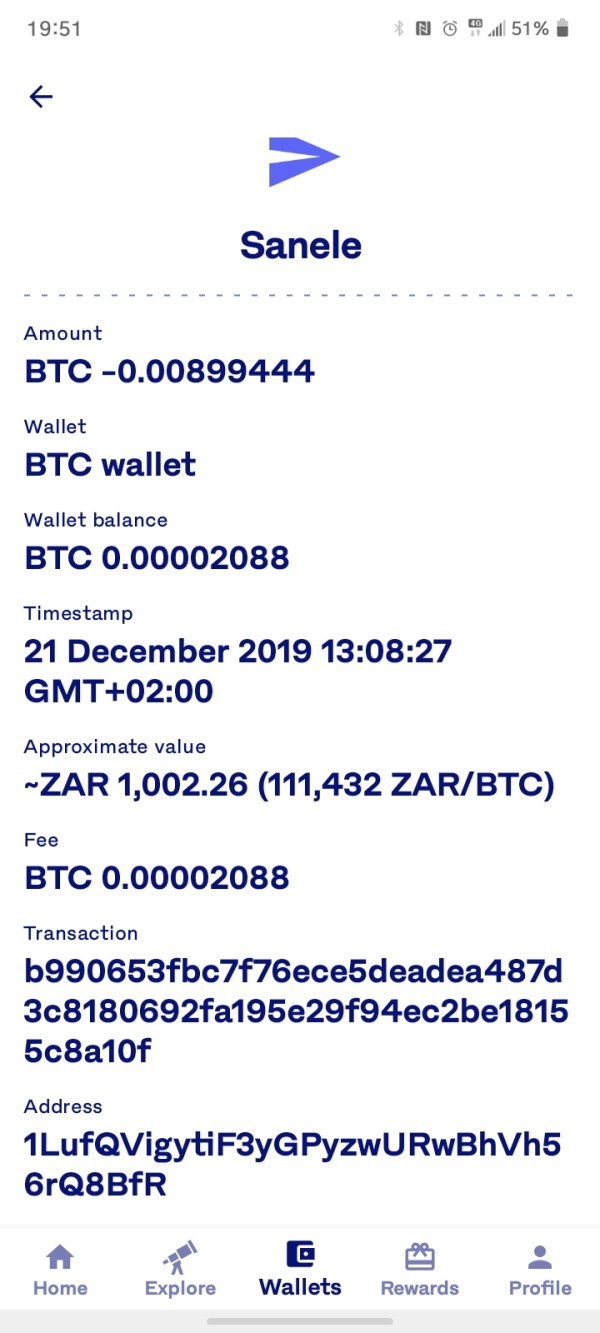

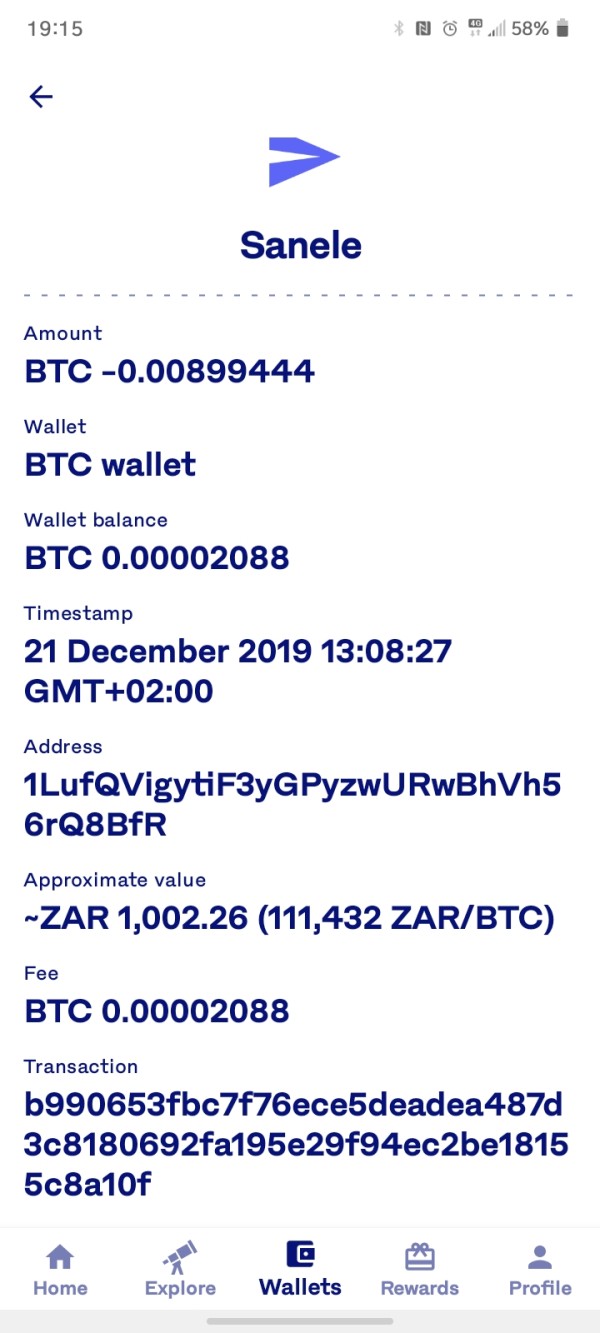

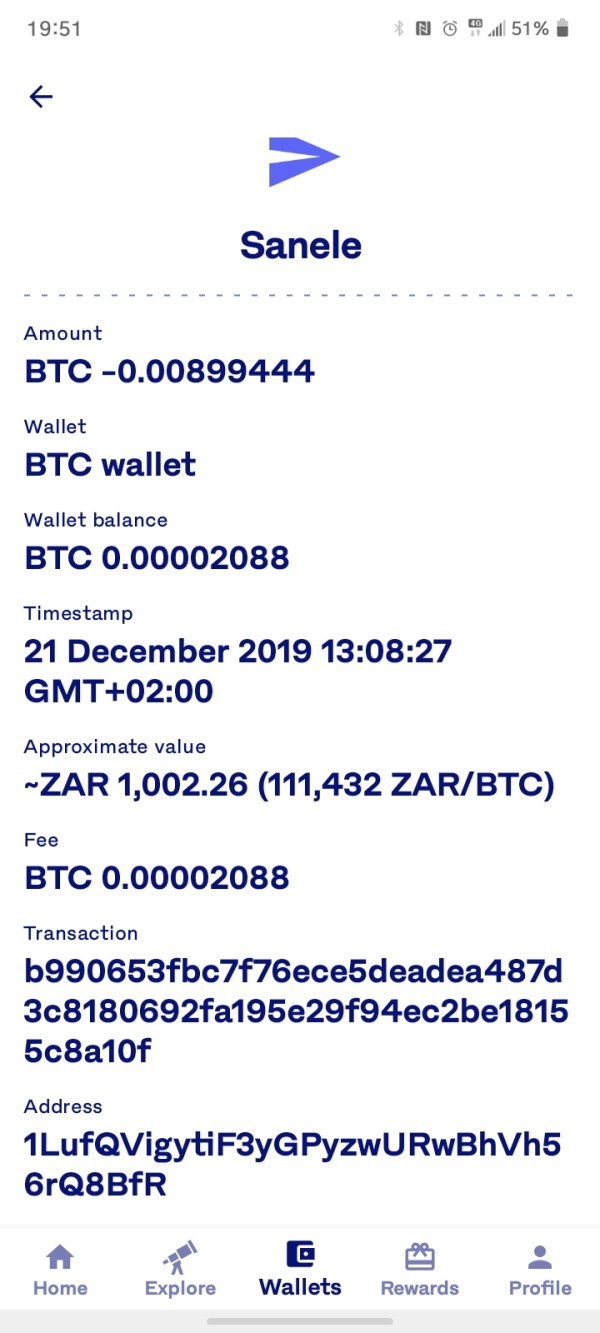

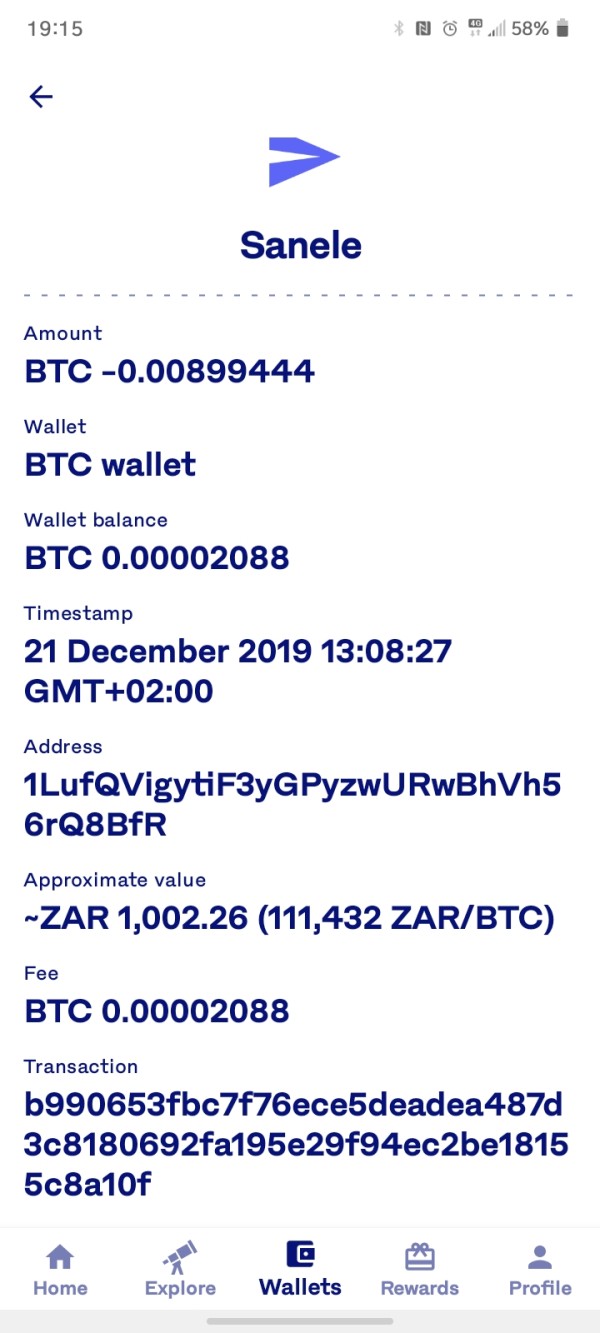

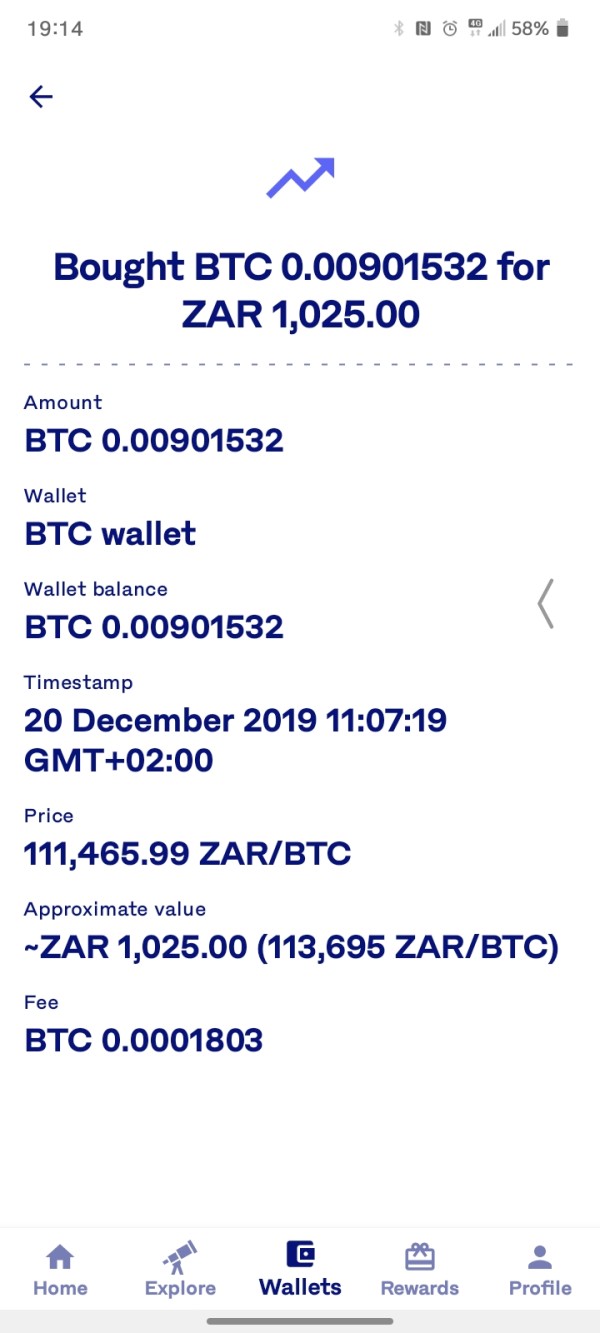

WikiFX reports indicate a score of just 1.48 out of 10. This reflects serious concerns about the broker's legitimacy and operational standards. The platform has accumulated 36 user complaints, with some users specifically warning about potential Ponzi scheme characteristics.

The lack of regulatory oversight means LunoTrade is not subject to standard financial industry requirements for client fund segregation, capital adequacy, or operational transparency. This creates significant risks for client fund security and operational continuity.

User warnings about potential fraudulent activity, combined with the absence of regulatory protection, create an extremely high-risk environment. Legitimate traders should avoid this situation.

User Experience Analysis

Overall user experience receives the lowest rating based on the extremely poor WikiFX score of 1.48 and multiple user complaints. This score indicates widespread user dissatisfaction across multiple operational areas and suggests systemic problems with LunoTrade's service delivery.

The 36 user complaints reported through WikiFX indicate ongoing problems with various aspects of the trading experience. These range from account management to fund withdrawal processes. User feedback patterns suggest significant difficulties in accessing funds and resolving account issues.

The absence of positive user testimonials or reviews contrasts sharply with legitimate brokers. Established brokers typically maintain strong user satisfaction ratings and positive community feedback. The overwhelmingly negative user sentiment indicates serious operational deficiencies.

Based on available user feedback and third-party assessments, LunoTrade appears to provide a poor overall experience. This falls far short of industry standards for professional forex trading services.

Conclusion

This comprehensive lunotrade review reveals significant concerns that make LunoTrade unsuitable for serious forex trading activities. The broker's lack of regulatory oversight, extremely poor user ratings, and absence of transparent operational information create an unacceptably high-risk environment for potential clients.

With a WikiFX score of just 1.48 and multiple user warnings about potential fraudulent activity, LunoTrade does not meet basic standards for legitimate forex brokerage services. The complete absence of regulatory protection means clients have no recourse if problems arise with their accounts or funds.

Key Disadvantages: No regulatory oversight, poor user ratings, lack of operational transparency, user warnings about potential fraud, absence of clear account conditions, and inadequate customer support information. Notable Advantages: None identified in available materials.

Potential traders should avoid LunoTrade and instead consider regulated brokers. These brokers provide transparent operations, proper oversight, and proven track records of client satisfaction and fund security.