Ventorus 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive ventorus review examines a new player in the forex and CFD brokerage world. Ventorus is an emerging online broker that launched in May 2023, and it wants to change how retail traders experience trading. The company's short operational history makes it hard to analyze its track record extensively, but early market signs show both promise and areas that need closer attention.

Ventorus operates under the regulation of the Mwali International Services Authority (MISA) with license number T2023290. This gives the broker a basic regulatory framework for its operations. The broker stands out by offering access to over 300 tradeable assets across multiple categories including forex, stocks, precious metals, cryptocurrencies, commodities, and indices. With a maximum leverage ratio of up to 1:400 and floating spreads starting from zero, Ventorus targets active traders who want high-leverage opportunities.

The platform mainly serves traders who value leverage flexibility and diverse asset selection. However, user feedback shows the broker has challenges with customer service response times and platform transparency. The company's Trustpilot rating shows mixed user experiences, with a 4-star average that includes some 1-star reviews pointing out service problems.

Since it recently entered the market and has limited operational history, this ventorus review finds the broker suitable mainly for experienced traders who are comfortable with higher-risk profiles. It also works for those willing to use a developing service infrastructure.

Important Notice

This evaluation recognizes that Ventorus operates under different regulatory frameworks across various locations. Traders must check their local regulatory requirements and make sure they follow applicable laws in their area. The Mwali International Services Authority (MISA) regulation may not provide the same level of protection as major financial regulatory bodies in established markets.

This review uses analysis of publicly available information, user feedback from multiple platforms, and official company communications. Since the broker was recently established, some operational aspects may change quickly, and traders should verify current conditions directly with the company. The assessment reflects conditions as of the review date and may not capture later changes in services, policies, or regulatory status.

Rating Framework

Broker Overview

Ventorus entered the competitive online trading world on May 8, 2023. The company established its headquarters in Saint Lucia. As a newcomer to the forex and CFD brokerage sector, the company positions itself as an innovative platform designed to change traditional trading experiences. The broker's business model focuses on providing comprehensive online trading services through its proprietary platform, and it emphasizes accessibility for both new and experienced traders.

The company's operational philosophy seems to focus on making access to global financial markets easier through technology-driven solutions. According to available information, Ventorus wants to bridge the gap between sophisticated trading tools and user-friendly interfaces, though we still need to evaluate how well this vision works in practice given the platform's short operational period.

Ventorus operates only through its proprietary trading platform. This sets it apart from brokers offering established platforms like MetaTrader 4 or 5. This proprietary approach allows for customized features and integrated analytical tools, though it also means traders must adapt to a less familiar interface. The platform supports both web-based and mobile trading, ensuring access across various devices and operating systems.

The broker's asset portfolio spans six major categories, offering over 300 trading instruments including traditional forex pairs, individual stocks, precious metals, cryptocurrencies, commodities, and major indices. This diversification strategy seems designed to attract traders with varied interests and risk appetites. Regulatory oversight comes from the Mwali International Services Authority (MISA) under license number T2023290, providing the basic compliance framework for the broker's operations.

Regulatory Jurisdiction: Ventorus operates under the supervision of the Mwali International Services Authority (MISA) with license number T2023290. This regulatory framework provides basic oversight for the broker's operations, though traders should note that MISA regulation may offer different protections compared to major financial regulatory authorities in established markets.

Deposit and Withdrawal Methods: Specific information about payment methods was not detailed in available materials. This represents an area where prospective clients would need to contact the broker directly for comprehensive information.

Minimum Deposit Requirements: The platform requires a minimum deposit of $250. This positions it as accessible to entry-level traders and those beginning their trading journey with modest capital allocation.

Bonus and Promotional Offers: Available information does not show specific bonus or promotional programs. This suggests the broker may focus on trading conditions rather than incentive-based marketing strategies.

Tradeable Assets: Ventorus provides access to over 300 CFD instruments across multiple asset classes. The selection includes forex currency pairs, individual equity stocks, precious metals including gold and silver, various cryptocurrencies, commodity futures, and major global indices, offering substantial diversification opportunities for traders.

Cost Structure: The broker uses a floating spread model beginning from zero spreads. However, specific commission structures and additional fees were not detailed in available materials. Traders should verify complete cost information including overnight financing charges and withdrawal fees before starting trading activities.

Leverage Ratios: Maximum leverage reaches 1:400, catering to traders seeking significant position sizing relative to account capital. This high leverage ratio appeals to active traders but also increases risk exposure substantially.

Platform Options: Trading occurs only through Ventorus's proprietary platform. This does not include popular third-party options like MetaTrader platforms. The proprietary system emphasizes integrated analytical tools and customized features.

Geographic Restrictions: Specific information about restricted locations was not provided in available materials.

Customer Support Languages: Details about multilingual support capabilities were not specified in accessible information sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Ventorus shows competitive account accessibility through its $250 minimum deposit requirement. This is significantly lower than many established brokers demanding $500 or higher initial deposits. This threshold makes the platform approachable for beginning traders and those testing new strategies with limited capital exposure. The 1:400 maximum leverage ratio provides substantial position-sizing flexibility, particularly attractive to active traders and scalping strategies.

However, available information lacks detail about account type variations. This suggests the broker may operate a single account structure rather than tiered offerings common among established competitors. This simplicity could benefit traders preferring straightforward conditions but may limit options for clients seeking specialized account features like reduced spreads for high-volume trading or Islamic-compliant accounts.

The floating spread structure starting from zero presents potentially attractive trading costs. However, the absence of detailed commission information prevents complete cost assessment. According to user feedback, the low minimum deposit proves accessible, but some traders want more account customization options and clearer fee structures.

Compared to industry standards, Ventorus's account conditions show promise through low barriers to entry and high leverage availability. However, the limited account variety and unclear fee transparency somewhat limit the overall offering. This ventorus review finds the account conditions suitable for straightforward trading approaches but potentially limiting for sophisticated strategies requiring specialized account features.

The broker's strength lies in providing access to over 300 tradeable instruments across six major asset categories. This offers substantial diversification opportunities within a single platform. This extensive selection compares favorably with many brokers focusing on narrower asset ranges, particularly beneficial for traders seeking exposure across multiple markets without maintaining multiple brokerage relationships.

However, detailed information about research and analytical resources remains limited in available materials. While the proprietary platform emphasizes integrated analytical tools, specific capabilities such as economic calendars, market research reports, technical analysis tools, or educational resources were not comprehensively detailed. This information gap represents a significant limitation for traders relying on broker-provided research and analysis.

Educational resources appear notably absent from available information. This potentially disadvantages beginning traders who typically benefit from structured learning materials, webinars, and market analysis guidance. The lack of detailed tool descriptions also makes it difficult to assess the platform's suitability for different trading styles, from basic chart analysis to advanced algorithmic trading support.

User feedback suggests appreciation for the diverse asset selection but shows desire for more comprehensive analytical resources and educational materials. The platform's proprietary nature means traders cannot leverage familiar third-party tools and indicators commonly available on established platforms like MetaTrader, potentially requiring adaptation time and limiting strategy implementation options.

Customer Service and Support Analysis (Score: 5/10)

Customer service represents a notable challenge area for Ventorus based on available user feedback and review analysis. Multiple sources show concerns about response times and resolution efficiency, with some users reporting extended delays in receiving support for account-related inquiries and technical issues. This pattern suggests potential understaffing or process inefficiencies in the customer service department.

The specific channels available for customer contact were not detailed in accessible information. Basic support appears available through standard communication methods. However, the absence of detailed information about support hours, multilingual capabilities, and specialized support for different account types or trading issues represents a transparency concern for prospective clients.

User reviews on platforms like Trustpilot include complaints about customer service professionalism and problem-solving effectiveness. Some traders report difficulty reaching knowledgeable representatives capable of addressing technical trading questions or account management concerns promptly. The 48% trust score mentioned in available materials reflects these service challenges and suggests inconsistent user experiences.

The lack of comprehensive support information also extends to educational assistance. There is limited evidence of dedicated customer education programs or trading guidance services. For a broker targeting both novice and experienced traders, this support gap potentially limits user satisfaction and platform adoption, particularly among traders requiring guidance during their initial platform experience.

Trading Experience Analysis (Score: 6/10)

The proprietary platform approach offers both advantages and limitations for the overall trading experience. While custom-built platforms can provide optimized performance and integrated features, they also require traders to adapt to unfamiliar interfaces and may lack the extensive customization options available on established platforms like MetaTrader 4 or 5.

Platform stability and execution speed data were not specifically detailed in available materials. This makes it difficult to assess critical performance metrics such as order execution times, slippage rates, or system uptime statistics. These factors significantly impact trading success, particularly for active traders and scalping strategies that depend on precise timing and minimal execution delays.

The emphasis on integrated analytical tools suggests attention to trader workflow efficiency. However, specific capabilities and customization options remain unclear. Mobile trading support addresses the growing demand for on-the-go trading access, essential for active traders monitoring positions throughout trading sessions. However, the mobile platform's functionality compared to the web-based version was not detailed.

User feedback shows mixed experiences with platform performance. Some traders express confidence in basic stability while others request additional functionality and improved execution reliability. The absence of detailed technical specifications and performance benchmarks makes it challenging for prospective users to assess platform suitability for their specific trading requirements and strategies.

This ventorus review finds the trading experience adequate for basic trading needs. However, it may be limiting for advanced strategies requiring sophisticated platform capabilities or integration with third-party tools and analysis software.

Trust and Reliability Analysis (Score: 5/10)

Ventorus operates under MISA regulation (license T2023290), providing basic regulatory oversight. However, this potentially offers different protections compared to major financial authorities like the FCA, ASIC, or CySEC. The Mwali International Services Authority represents a legitimate regulatory body, but traders should understand the varying levels of protection and recourse available under different jurisdictional frameworks.

Fund security measures were not specifically detailed in available materials. This represents a significant transparency gap for risk-conscious traders. Information about client fund segregation, deposit insurance, negative balance protection, or compensation schemes remains unclear, making it difficult for traders to assess their financial protection levels.

The company's brief operational history since May 2023 limits track record evaluation. This is natural for any new market entrant. However, the combination of recent establishment and limited transparency about security measures may concern conservative traders prioritizing established operational histories and comprehensive protection frameworks.

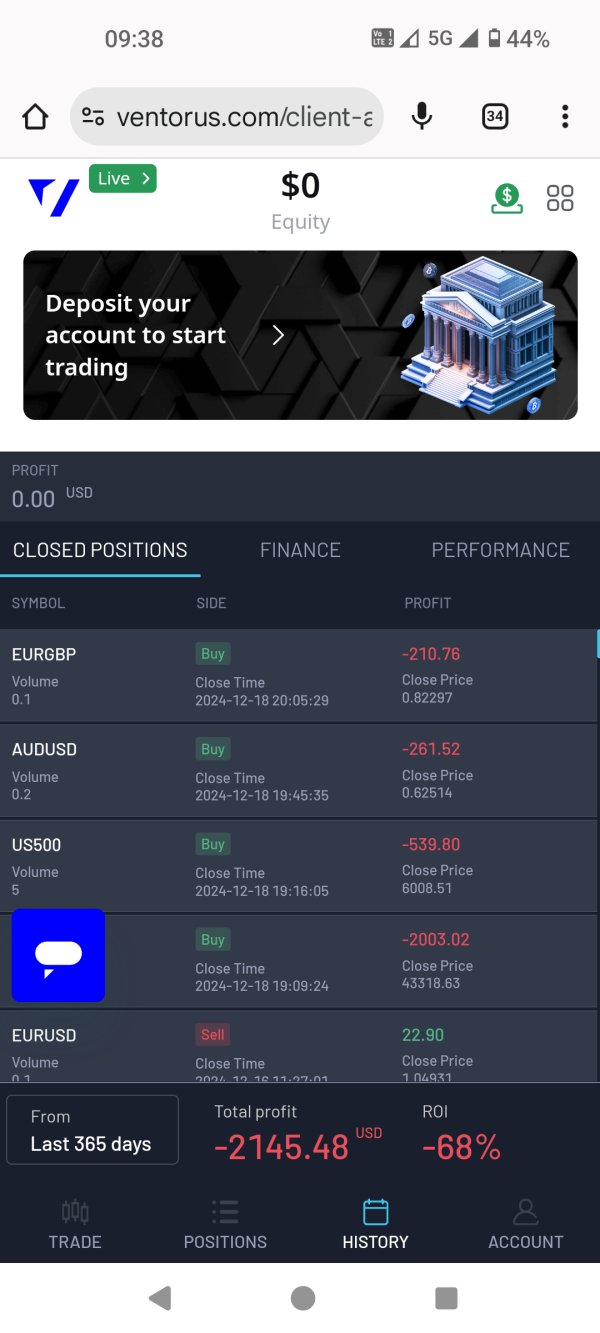

Third-party review platforms show mixed results. Trustpilot displays a 4-star average that includes notable 1-star reviews highlighting various service concerns. This mixed feedback pattern suggests inconsistent user experiences and potential service delivery challenges that impact overall reliability perceptions.

The absence of detailed financial reporting, management team information, or parent company details further limits transparency assessment. While not unusual for smaller brokers, this information gap may concern traders seeking comprehensive due diligence information before committing significant trading capital.

User Experience Analysis (Score: 6/10)

Overall user satisfaction appears moderate based on available feedback. Experiences vary significantly among different trader types and expectations. The 4-star Trustpilot average suggests generally positive experiences for many users, though the presence of 1-star reviews indicates notable dissatisfaction among some clients, particularly regarding customer service and platform functionality.

Interface design and usability details were not comprehensively covered in available materials. The proprietary platform's emphasis on integrated tools suggests attention to workflow efficiency. However, the absence of detailed interface descriptions makes it difficult to assess ease of use for traders with varying experience levels and technical comfort.

Registration and account verification processes were not specifically detailed. This represents an important user experience component that affects initial platform adoption. Streamlined onboarding processes significantly impact user satisfaction, particularly for beginning traders who may find complex procedures discouraging.

Fund operation experiences, including deposit and withdrawal processes, timeframes, and associated fees, lack detailed coverage in available information. These operational aspects critically impact user satisfaction and platform viability for active traders requiring reliable fund access and transparent processing procedures.

Common user complaints appear centered on customer service responsiveness and platform transparency rather than fundamental trading functionality. This pattern suggests the core trading experience may be adequate while support infrastructure requires development. The broker's suitability appears strongest for self-sufficient traders comfortable with limited support interaction and willing to work with developing service infrastructure.

Conclusion

This comprehensive ventorus review reveals a broker with both promising features and notable limitations. Ventorus shows competitive positioning through its low $250 minimum deposit, high 1:400 leverage availability, and extensive asset selection exceeding 300 instruments. These characteristics make it potentially attractive for active traders seeking leverage flexibility and diversified market access within a single platform.

However, significant areas require improvement, particularly customer service responsiveness, platform transparency, and educational resource availability. The mixed user feedback and moderate trust scores indicate inconsistent service delivery that may impact trader satisfaction and platform reliability perceptions.

Ventorus appears most suitable for experienced, self-sufficient traders comfortable with proprietary platforms. It also works for those willing to use developing service infrastructure. The broker's high leverage and diverse asset selection benefit active trading strategies, while the low minimum deposit accommodates traders with modest initial capital requirements. However, beginning traders or those requiring extensive support and educational resources may find better-suited alternatives among more established brokers with comprehensive service offerings.