Is Intan safe?

Pros

Cons

Is Intan Safe or a Scam?

Introduction

Intan is a forex broker that has emerged in the competitive landscape of online trading, targeting both novice and experienced traders. With the proliferation of online trading platforms, it becomes imperative for traders to exercise caution and conduct thorough evaluations of forex brokers. This is due to the inherent risks associated with trading, including potential fraud, lack of regulatory oversight, and questionable business practices. In this article, we will investigate the legitimacy of Intan by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our research is based on a comprehensive review of available online resources and user feedback to provide an objective assessment of whether Intan is safe for traders.

Regulation and Legitimacy

The regulatory framework surrounding a broker is a critical factor in determining its legitimacy and safety for traders. A well-regulated broker is often seen as more trustworthy due to the oversight provided by financial authorities. In the case of Intan, our research shows a concerning lack of regulation:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Intan does not appear to be regulated by any recognized financial authority, which raises significant red flags. The absence of regulatory oversight means that there are fewer safeguards in place to protect traders' interests. Regulatory bodies typically enforce strict compliance standards, ensuring that brokers operate transparently and ethically. Without such oversight, the risk of encountering fraudulent practices increases substantially. Historical compliance records of brokers in the forex industry suggest that those lacking regulation often engage in dubious activities, leading to potential losses for traders. Therefore, based on the available information, it is evident that Intan is not safe due to its unregulated status.

Company Background Investigation

A thorough investigation into the company's background can provide insights into its reliability. Intan is operated by Investment Management Co. Pty Ltd, which is registered in China. However, specific details about the company's history, ownership structure, and operational practices remain vague and unverified.

The management team behind Intan has not been prominently featured in credible sources, raising questions about their experience and expertise in the financial sector. A transparent company typically provides detailed information about its leadership, including their qualifications and track records. The lack of such transparency suggests a potential risk factor for traders considering this broker. Furthermore, a company's willingness to disclose its operational practices and history is often indicative of its legitimacy. In this case, the insufficient information surrounding Intan's management and operational history contributes to the conclusion that Intan is potentially unsafe for traders.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for traders looking to maximize their profitability. Intan presents a range of trading options, but the specifics of its fee structure and trading conditions are not readily available. This lack of transparency can be detrimental to traders who rely on clear and upfront information to make informed decisions.

| Fee Type | Intan | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not Disclosed | 1.5 - 2.0 pips |

| Commission Structure | Not Disclosed | $5 - $10 per lot |

| Overnight Interest Range | Not Disclosed | 2% - 5% |

The absence of clear information regarding spreads, commissions, and overnight interest rates makes it difficult to assess the overall cost of trading with Intan. Traders may unknowingly incur higher costs that could eat into their profits, particularly if the broker employs hidden fees or unfavorable trading conditions. Additionally, the lack of transparency in fee structures often correlates with a higher risk of exploitation, further emphasizing the need for caution. Thus, the vague trading conditions contribute to the assessment that Intan is not a safe choice for traders.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Brokers that prioritize fund security typically implement measures such as segregated accounts, investor protection schemes, and negative balance protection. However, in the case of Intan, there is no available information indicating that such safety measures are in place.

A broker that does not segregate client funds from its operational funds poses a significant risk to traders. In the event of insolvency or mismanagement, traders could potentially lose their investments. Furthermore, the absence of investor protection schemes means that traders have little recourse in the event of fraud or malpractice. Historical data indicates that brokers with poor fund safety records have faced numerous complaints and legal actions from dissatisfied clients. Therefore, the lack of information regarding Intan's fund safety measures reinforces the conclusion that Intan is not a safe option for traders.

Customer Experience and Complaints

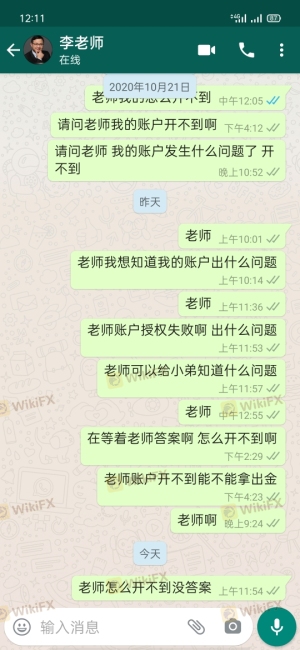

Customer feedback plays a crucial role in evaluating a broker's reliability. Analyzing user experiences can reveal common complaints and the broker's responsiveness to issues. In the case of Intan, there are limited reviews available, but the feedback suggests a concerning trend of dissatisfaction among users.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Average |

| Misleading Information | High | Poor |

Many users have reported difficulties in withdrawing their funds, which is a major red flag in the forex brokerage industry. A broker that complicates or delays withdrawals is often perceived as untrustworthy. Additionally, the quality of customer support is a critical factor in determining a broker's reliability. Intan's reported lack of responsiveness to customer inquiries further exacerbates concerns about its legitimacy. Cases of clients being unable to access their funds or receiving vague responses to their complaints suggest that Intan poses a significant risk to traders.

Platform and Execution

The performance of a trading platform is essential for successful trading. A reliable platform should offer stability, fast execution, and a user-friendly interface. However, there is limited information available regarding Intan's trading platform, which raises concerns about its performance and reliability.

Traders have reported issues related to order execution quality, including slippage and rejections. Such problems can severely impact trading outcomes, leading to unexpected losses. Furthermore, any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, would indicate unethical practices by the broker. The lack of transparency regarding platform performance and execution quality contributes to the assessment that Intan is not a safe trading environment.

Risk Assessment

Using Intan presents various risks that traders should be aware of. The lack of regulation, transparency, and customer support are significant factors that contribute to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Poor platform performance |

To mitigate these risks, traders should consider the following suggestions:

- Avoid depositing large sums until a thorough evaluation of the broker is completed.

- Research alternative brokers that are well-regulated and have a proven track record of reliability.

- Start with a demo account to test the platform's functionality before committing real funds.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Intan is not a safe forex broker. The lack of regulatory oversight, transparency in trading conditions, and poor customer feedback indicate significant risks for traders. Those considering trading with Intan should exercise extreme caution and thoroughly evaluate their options. For traders seeking reliable alternatives, it is advisable to explore brokers that are regulated by reputable financial authorities and have a solid reputation for customer service and fund safety. Brokers such as [insert trusted broker names] may provide a safer trading environment and better overall experience.

Is Intan a scam, or is it legit?

The latest exposure and evaluation content of Intan brokers.

Intan Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Intan latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.