KPF 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive kpf review examines a trading entity that has drawn significant attention in the forex market. KPF operates under regulation from the National Futures Association with license number 0514414, which provides some level of regulatory oversight for traders. However, the broker's reputation has been significantly impacted by multiple complaints and concerns raised by users in the trading community.

KPF primarily targets forex traders seeking access to currency markets. The broker faces substantial challenges regarding information transparency and accessibility. One of the most concerning issues identified is that the company's website has been reported as inaccessible, which raises serious questions about operational continuity and customer service capabilities.

This lack of web presence significantly hampers potential clients' ability to access essential trading information, account management tools, and customer support services. The broker's overall evaluation tends toward the negative side due to these transparency issues and user complaints. While the NFA regulation provides some regulatory foundation, the combination of accessibility problems and user concerns suggests that traders should exercise considerable caution when considering KPF as their trading partner.

Important Notice

Users should be aware that KPF operates under United States regulation through the National Futures Association. This means traders from different jurisdictions may face varying legal frameworks and risk exposures when engaging with this broker. Cross-border trading activities may be subject to additional regulatory requirements and restrictions depending on the trader's country of residence.

This review is based on publicly available information and user feedback collected from various sources. Due to the reported website accessibility issues, some information may be limited or outdated. Traders should conduct their own due diligence and verify current operational status before making any trading decisions.

Rating Framework

Broker Overview

KPF operates as a forex trading broker. Comprehensive details about the company's establishment date and corporate background remain limited in available documentation. The broker's primary business model focuses on providing forex trading services to retail and potentially institutional clients, though the scope of their target market remains unclear due to information accessibility challenges.

The company operates under the regulatory framework of the National Futures Association. It holds license number 0514414, which indicates compliance with United States financial regulations for futures and forex trading activities. However, beyond this regulatory information, specific details about the company's trading platform technology, operational infrastructure, and business development history are not readily available through standard information channels.

This kpf review reveals that the broker's business model centers around forex trading services. The specific asset classes, trading instruments, and market access options remain poorly documented. The lack of accessible information raises questions about the broker's commitment to transparency and customer communication, which are essential elements for building trust in the competitive forex trading industry.

Regulatory Jurisdiction: KPF operates under the supervision of the United States National Futures Association with license number 0514414. This provides regulatory oversight for forex trading activities.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not available in accessible documentation. This poses significant concerns for potential traders.

Minimum Deposit Requirements: The minimum deposit requirements for opening trading accounts with KPF are not specified in available sources.

Bonus and Promotional Offers: Details regarding bonus programs, promotional offers, or incentive structures are not documented in accessible information.

Tradeable Assets: KPF primarily focuses on forex trading services. The specific currency pairs and trading instruments available are not clearly documented.

Cost Structure: Information about spreads, commissions, overnight fees, and other trading costs is not available in accessible sources. This makes it difficult for traders to evaluate the broker's competitiveness.

Leverage Ratios: Specific leverage options and margin requirements are not detailed in available documentation.

Platform Options: The trading platforms offered by KPF are not specified in accessible information sources.

Geographic Restrictions: Regional limitations and country-specific restrictions are not clearly outlined in available documentation.

Customer Service Languages: The languages supported by KPF's customer service team are not specified in accessible sources.

This kpf review highlights the significant information gaps that potential traders face when evaluating this broker. These gaps represent a major concern for transparency and customer service standards.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of KPF's account conditions faces significant limitations due to the lack of accessible information about account types, features, and requirements. Without access to the broker's website or comprehensive documentation, it becomes impossible to assess the variety of account options available to traders. It also becomes impossible to determine whether the broker offers different account tiers based on deposit amounts or trading volume, and what specific features each account type might include.

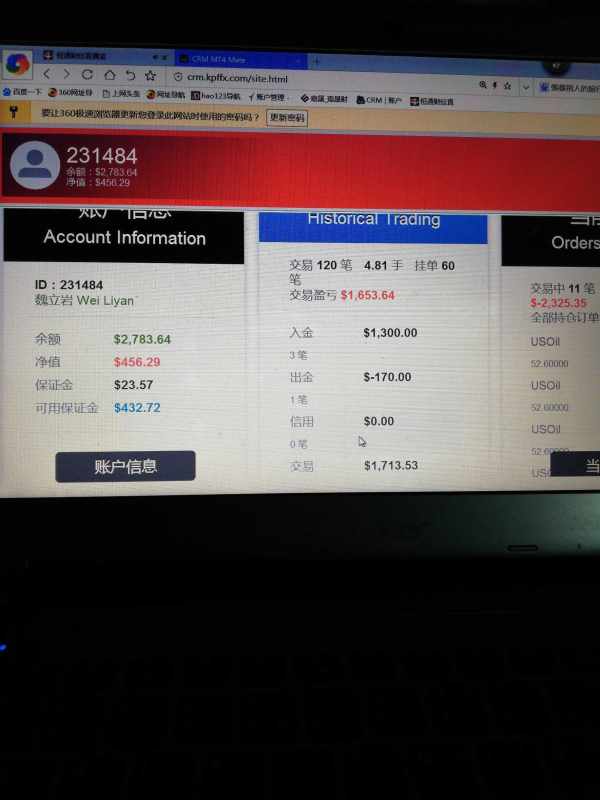

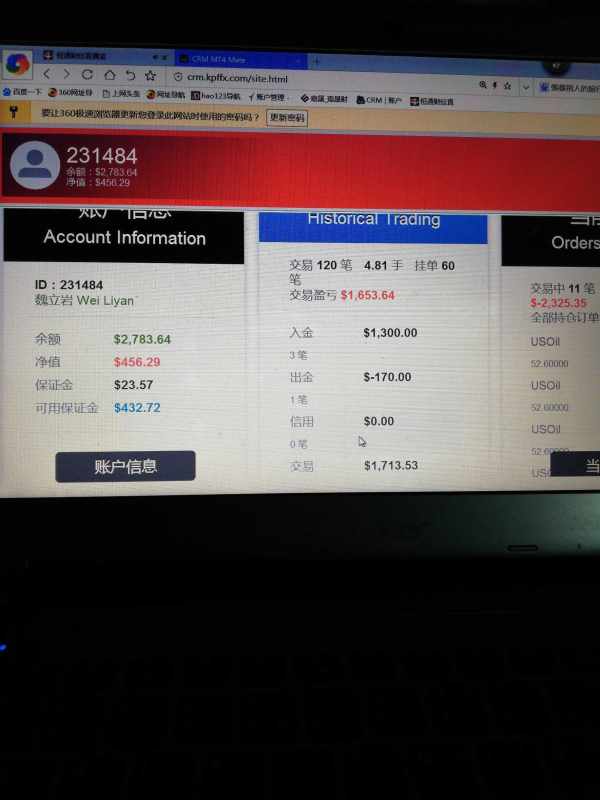

The absence of information about minimum deposit requirements makes it particularly challenging for potential traders to determine whether KPF's services align with their budget and trading goals. Additionally, the account opening process, required documentation, verification procedures, and timeline for account activation remain unclear. This could significantly impact the user experience for new clients.

Special account features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or professional accounts for experienced traders are not documented in available sources. This kpf review cannot provide meaningful analysis of account conditions without access to fundamental information about the broker's service structure and client onboarding processes.

The assessment of KPF's trading tools and resources is severely hampered by the lack of accessible information about the broker's platform capabilities and analytical offerings. Without clear documentation about the trading tools available to clients, it becomes impossible to evaluate whether the broker provides essential features. These features include technical analysis indicators, charting capabilities, automated trading options, or risk management tools.

Educational resources, which are crucial for trader development and success, cannot be evaluated due to information accessibility issues. Many reputable brokers provide comprehensive educational materials including webinars, tutorials, market analysis, and trading guides. However, KPF's offerings in this area remain unknown.

Research and analysis resources, such as daily market commentary, economic calendars, news feeds, and expert analysis, are not documented in available sources. The absence of information about these tools makes it difficult for traders to determine whether KPF can support their analytical needs and trading strategies effectively.

Customer Service and Support Analysis

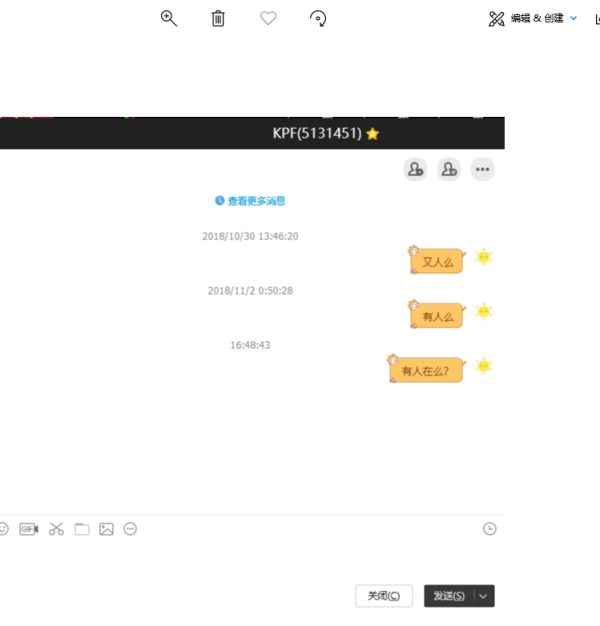

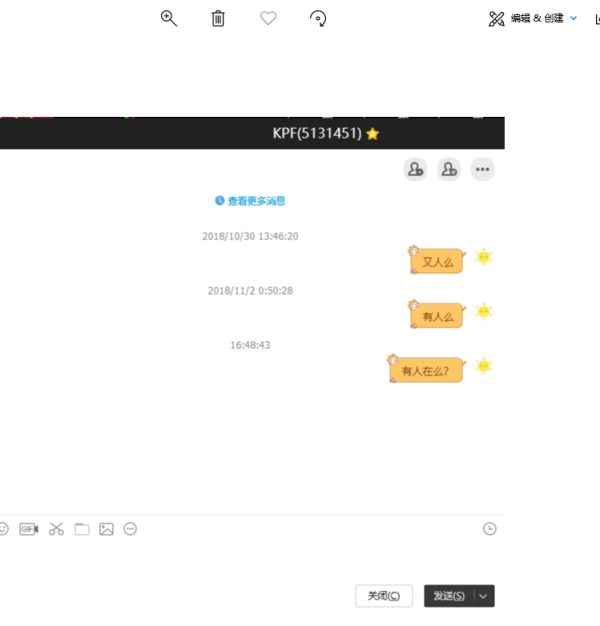

Customer service evaluation for KPF faces substantial challenges due to the reported website accessibility issues and lack of documented support channels. The inability to access the broker's primary communication platform raises serious concerns. These concerns relate to how existing clients can reach customer support when they encounter trading issues, account problems, or technical difficulties.

Response times, service quality, and problem resolution capabilities cannot be assessed without access to customer service information or user testimonials about support experiences. The availability of multiple communication channels such as live chat, email support, telephone assistance, and social media engagement remains unclear.

Multilingual support capabilities, which are essential for international forex brokers, are not documented in available sources. The operating hours of customer service, timezone coverage, and availability during market hours cannot be determined from accessible information. This represents a significant concern for traders who may need assistance during active trading sessions.

Trading Experience Analysis

The evaluation of trading experience with KPF is significantly limited by the lack of accessible information about platform performance, execution quality, and overall trading environment. Without access to the broker's trading platform or user testimonials about trading conditions, it becomes impossible to assess critical factors. These factors include order execution speed, slippage rates, and platform stability during volatile market conditions.

Platform functionality, including the availability of advanced order types, one-click trading options, mobile trading capabilities, and platform customization features, cannot be evaluated due to information accessibility constraints. The trading environment, including factors such as requotes, execution delays, and platform downtime, remains undocumented.

Mobile trading experience, which has become increasingly important for modern forex traders, cannot be assessed without access to information about mobile applications, responsive web platforms, or mobile-specific features. This kpf review cannot provide meaningful insights into the practical aspects of trading with KPF due to these information limitations.

Trustworthiness Analysis

KPF's trustworthiness presents a mixed picture based on available information. The broker's regulation by the National Futures Association with license number 0514414 provides some level of credibility and regulatory oversight, which is positive for trader protection. NFA regulation includes requirements for financial reporting, customer fund segregation, and compliance with trading practices standards.

However, the broker's trustworthiness is significantly undermined by user complaints and concerns that have been reported in the trading community. These negative feedback reports, combined with the reported website accessibility issues, raise serious questions about the broker's operational reliability and commitment to customer service.

The lack of transparency regarding company information, trading conditions, and operational details further impacts the trustworthiness assessment. Reputable brokers typically maintain comprehensive websites with detailed information about their services, which helps build confidence among potential clients. KPF's information accessibility problems represent a significant red flag for transparency and professional standards.

Company transparency, including information about corporate structure, management team, financial statements, and business operations, is not readily available. This makes it difficult for traders to make informed decisions about the broker's reliability and long-term viability.

User Experience Analysis

User experience with KPF appears to be significantly compromised based on available feedback and accessibility issues. The reported website inaccessibility represents a fundamental problem for user experience. Traders rely on broker websites for account management, trading platform access, market information, and customer support.

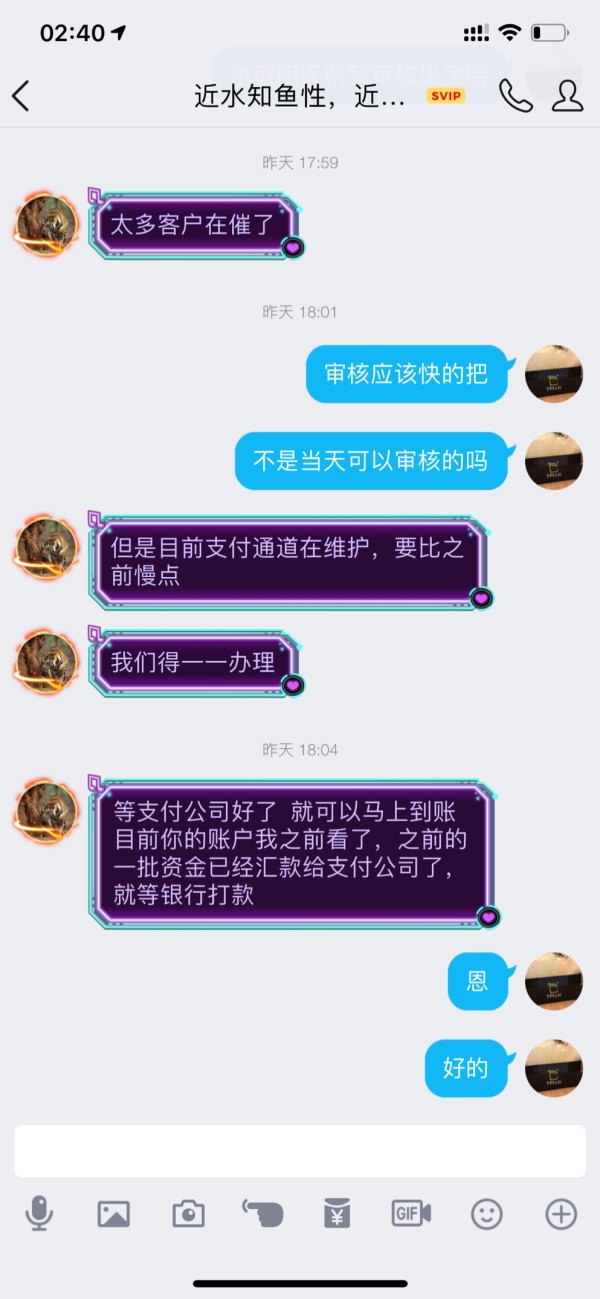

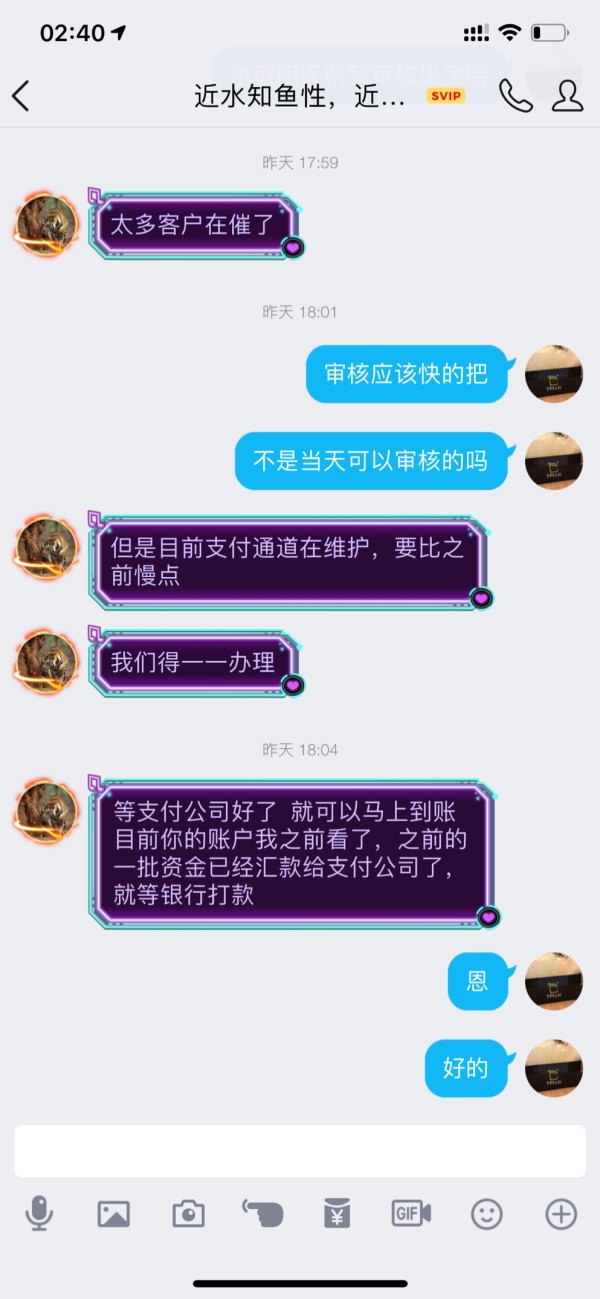

User complaints and concerns mentioned in community feedback suggest that the overall satisfaction level with KPF's services is below industry standards. These negative experiences, combined with the lack of accessible information about services and support, indicate that users may face significant challenges when attempting to trade with this broker.

The registration and verification process cannot be evaluated due to website accessibility issues. This means potential clients cannot even begin the account opening process through standard channels. Fund management operations, including deposits, withdrawals, and account monitoring, become problematic when the primary service platform is inaccessible.

Common user complaints appear to center around accessibility issues and service quality concerns. Specific details about these problems are not comprehensively documented. The accumulation of negative feedback suggests that KPF may need to address fundamental operational and customer service issues to improve user satisfaction and market reputation.

Conclusion

This comprehensive kpf review reveals significant concerns about the broker's operational transparency, accessibility, and overall service quality. While KPF maintains regulatory status through the National Futures Association, the combination of website accessibility problems, user complaints, and lack of transparent information creates substantial red flags for potential traders.

The broker is not recommended for risk-averse traders or those who prioritize transparency and reliable customer service. The primary advantage of NFA regulation is overshadowed by the numerous operational and communication challenges that appear to impact the user experience significantly.

Traders considering KPF should exercise extreme caution and thoroughly investigate the broker's current operational status before committing funds or opening accounts. The lack of accessible information makes it impossible to conduct proper due diligence. This represents an unacceptable risk for serious forex traders.