IV Markets 2025 Review: Everything You Need to Know

Executive Summary

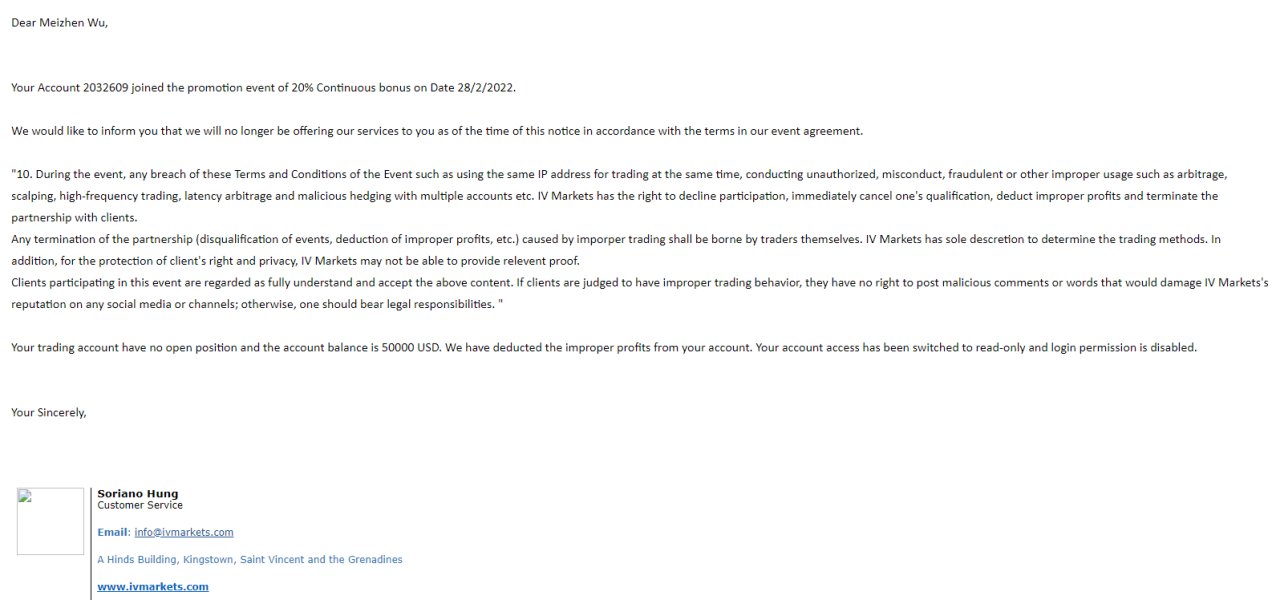

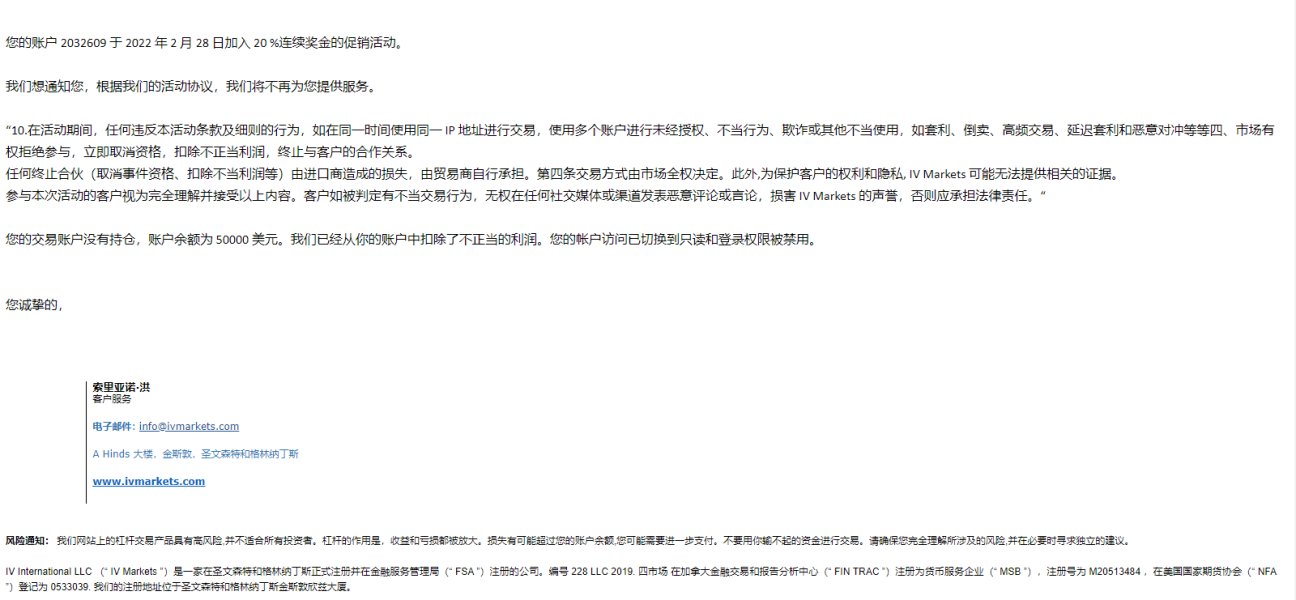

This comprehensive iv markets review examines a broker that presents a mixed profile in the competitive forex trading landscape. IV Markets was established in 2019 and operates as an online forex and CFD broker offering MetaTrader 4 and a proprietary web trading platform. While the broker provides access to advanced trading tools and automated trading capabilities, significant concerns exist regarding its regulatory standing and user trust levels.

The broker primarily targets intermediate to advanced traders seeking diversified trading instruments and asset classes. However, regulatory controversies and user skepticism cast shadows over its operations. IV Markets claims regulatory oversight from the Financial Services Authority in Seychelles, though questions remain about the robustness of this regulatory framework. The broker's offering includes forex and CFD trading with 24/5 customer support, but user feedback reveals mixed experiences that potential clients should carefully consider before making investment decisions.

Important Notice

Traders should be aware that IV Markets operates across multiple jurisdictions with varying regulatory frameworks. The primary regulatory oversight comes from the Financial Services Authority in Seychelles, which may offer different investor protections compared to more established regulatory bodies in major financial centers. Users must understand that regulatory differences across regions can significantly impact their trading experience and legal recourse options.

This review is based on comprehensive analysis of publicly available information and user feedback compiled from various sources. All assessments reflect the current available data and may change as new information becomes available.

Rating Framework

Broker Overview

IV Markets entered the forex brokerage scene in 2019 as an online trading platform specializing in foreign exchange and contracts for difference trading. The company positions itself as a technology-focused broker, emphasizing advanced trading tools and platform accessibility. Despite its relatively recent establishment, IV Markets has attempted to build a presence in the competitive online trading market through its multi-platform approach and diverse trading instrument offerings.

The broker operates primarily under a market maker model. According to available information, IV Markets offers trading through both the industry-standard MetaTrader 4 platform and its proprietary web-based trading interface. The company's business model focuses on serving traders who require sophisticated trading tools and automated trading capabilities, positioning itself as a solution for more experienced market participants rather than complete beginners.

Regulatory oversight for IV Markets comes primarily from the Financial Services Authority in Seychelles. The broker has made claims about ASIC authorization that require verification. The main asset classes available through the platform include major, minor, and exotic forex pairs, alongside various CFD instruments. This iv markets review notes that while the broker offers a reasonable selection of trading instruments, questions about regulatory transparency and operational clarity remain significant considerations for potential clients.

Regulatory Jurisdiction: IV Markets operates under the supervision of the Financial Services Authority in Seychelles. The broker claims additional regulatory connections, but verification of these claims requires careful investigation by potential clients.

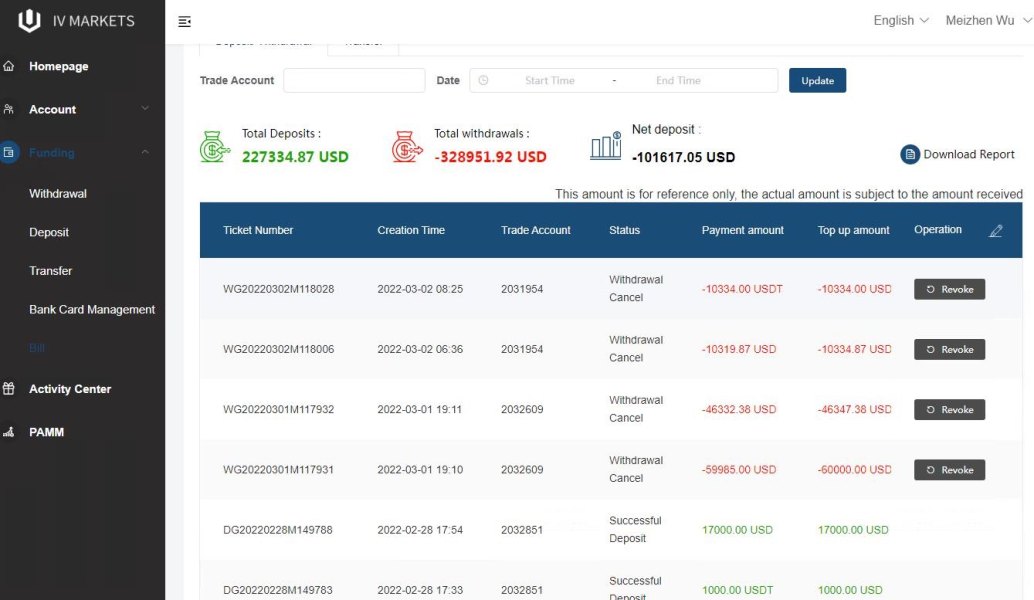

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available resources. This represents a transparency gap that traders should address directly with the broker.

Minimum Deposit Requirements: Minimum deposit requirements are not clearly specified in available documentation. This may indicate varying account tiers or lack of standardized entry requirements.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in available resources. This suggests either absence of such programs or limited marketing transparency.

Available Trading Assets: The platform primarily focuses on forex trading pairs and CFD instruments. It covers major currency pairs and derivative products across various market sectors.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not comprehensively detailed in available resources. This creates uncertainty about the total cost of trading with this broker.

Leverage Ratios: Leverage specifications are not clearly outlined in available documentation. This represents a significant information gap for risk management planning.

Platform Options: IV Markets supports MetaTrader 4 and offers its proprietary web-based trading platform. This provides traders with both industry-standard and custom trading environments.

Geographic Restrictions: Specific geographic limitations and service availability by region are not detailed in available resources.

Customer Support Languages: Language support options for customer service are not specifically outlined in available documentation.

This iv markets review emphasizes that the lack of detailed information in several key areas represents a significant concern for transparency. Potential clients should seek direct clarification from the broker before proceeding.

Account Conditions Analysis

The account conditions offered by IV Markets present several areas of concern due to limited transparency in available documentation. Without clear information about account types, minimum deposit requirements, or specific account features, potential traders face uncertainty about what to expect when opening an account with this broker. This lack of clarity stands in contrast to industry standards where reputable brokers typically provide comprehensive account specifications upfront.

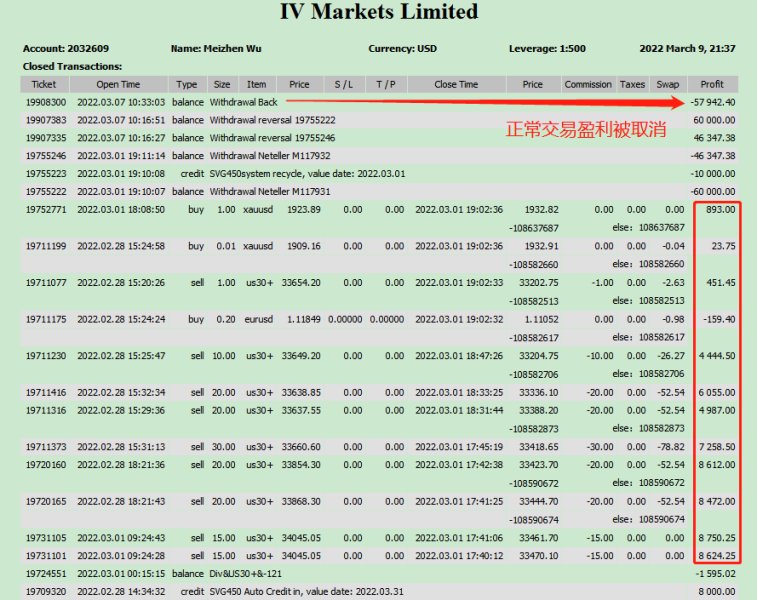

User feedback suggests mixed experiences with account setup and management processes. Some traders have raised questions about the clarity of terms and conditions, while others have expressed concerns about account verification procedures. The absence of detailed information about specialized account options, such as Islamic accounts for Shariah-compliant trading, further limits the broker's appeal to diverse trading communities.

The account opening process appears to follow standard industry practices. However, specific documentation requirements and verification timelines are not clearly specified. This uncertainty can be particularly problematic for traders who need quick account activation or have specific documentation constraints. Additionally, the lack of transparent information about account maintenance fees, inactivity charges, or other account-related costs creates potential for unexpected charges.

This iv markets review finds that the broker's approach to account condition transparency falls below industry standards. Potential clients should directly contact IV Markets to obtain comprehensive account information before making any commitment. The broker would benefit from providing more detailed and accessible account documentation to build trader confidence and meet market expectations for transparency.

IV Markets demonstrates notable strength in its trading tools and technology offerings. This represents one of the broker's more positive aspects. The platform provides access to MetaTrader 4, widely recognized as an industry standard for forex trading, alongside advanced trading tools and expert advisors that support automated trading strategies. This combination appeals particularly to intermediate and advanced traders who require sophisticated analytical and execution capabilities.

The broker's proprietary web trading platform complements the MT4 offering. It provides traders with alternative access methods and potentially unique features not available through standard platforms. The availability of numerous trading applications and automated trading support suggests a technology-focused approach that can benefit traders with algorithmic trading interests or those requiring advanced order management capabilities.

However, available information does not detail the quality or comprehensiveness of research and analysis resources, educational materials, or market commentary that many traders consider essential for informed decision-making. The absence of detailed information about economic calendars, market analysis, or educational content represents a potential gap in the overall trading support ecosystem.

User feedback indicates generally positive reception of the available trading tools. Some traders appreciate the automation capabilities and platform functionality. However, the effectiveness of these tools in real trading conditions and their reliability during volatile market periods requires further verification through extended use and testing.

Customer Service and Support Analysis

IV Markets provides customer support through multiple channels including online chat, email, and telephone support. It operates on a 24/5 schedule that covers most global trading hours. This availability aligns with industry standards and demonstrates recognition of the international nature of forex trading. The multi-channel approach provides traders with options for contacting support based on their preferences and urgency of issues.

However, user feedback reveals inconsistent experiences with customer service quality and responsiveness. While some traders report satisfactory interactions with support staff, others have expressed concerns about response times and the effectiveness of problem resolution. This variability in service quality suggests potential staffing or training issues that could impact trader satisfaction and confidence.

The absence of detailed information about multilingual support capabilities may limit accessibility for non-English speaking traders. In an increasingly global trading environment, comprehensive language support becomes crucial for effective customer service delivery. Additionally, specific information about support response time targets or service level commitments is not readily available.

User reviews indicate mixed satisfaction levels with customer service interactions. Particular concerns have been raised about the handling of account-related issues and withdrawal processes. These concerns, combined with general questions about the broker's transparency, suggest that customer service improvements could significantly enhance the overall trading experience and build greater user confidence in the platform.

Trading Experience Analysis

The trading experience with IV Markets appears to center around the availability of multiple platform options and trading tools. However, comprehensive data about execution quality and platform performance is limited. The combination of MetaTrader 4 and proprietary web platform provides traders with flexibility in choosing their preferred trading environment, which can be particularly valuable for traders with specific platform preferences or technical requirements.

Platform stability and execution speed data are not specifically detailed in available resources. This represents a significant gap in assessing the actual trading experience quality. For active traders, particularly those employing scalping or high-frequency strategies, execution quality and platform reliability are crucial factors that require verification through direct testing or more comprehensive performance data.

The availability of advanced trading tools and automated trading support suggests potential for sophisticated trading strategies. However, the practical effectiveness of these tools in live trading conditions requires validation. Mobile trading capabilities and cross-platform synchronization features are not specifically detailed, which may concern traders who require flexible access to their trading accounts.

User feedback about trading experience shows mixed results. Some traders express satisfaction with platform functionality while others have raised concerns about various aspects of the trading environment. This iv markets review notes that the lack of comprehensive performance data and mixed user feedback creates uncertainty about the actual trading experience quality that potential clients can expect.

Trust and Reliability Analysis

Trust and reliability represent perhaps the most concerning aspects of IV Markets' operations. Significant questions have been raised about regulatory oversight and operational transparency. The broker's primary regulation through the Financial Services Authority in Seychelles raises questions about the robustness of oversight compared to more established regulatory frameworks in major financial centers.

Claims about additional regulatory authorizations, including mentioned ASIC connections, require careful verification. Regulatory misrepresentation represents a serious concern in the forex industry. The lack of clear, verifiable regulatory information creates uncertainty about investor protections and recourse options in case of disputes or operational issues.

Fund safety measures and client money protection protocols are not clearly detailed in available documentation. This represents a significant transparency gap that affects trader confidence. Reputable brokers typically provide comprehensive information about client fund segregation, insurance coverage, and regulatory protections to build trust with potential clients.

User feedback includes notable concerns about the broker's credibility and operational practices. Some reviews question the legitimacy of certain aspects of the broker's operations. These concerns, combined with limited regulatory transparency, suggest that potential clients should exercise significant caution and conduct thorough due diligence before engaging with this broker. The broker's industry reputation appears to be developing, with mixed signals from various user experiences and review sources.

User Experience Analysis

Overall user satisfaction with IV Markets shows a polarized pattern. Experiences range from acceptable to concerning based on available feedback. The diversity in user experiences suggests inconsistent service delivery and potentially varying treatment of different client segments. This variability creates uncertainty for potential new clients about what level of service and support they can realistically expect.

Interface design and platform usability receive generally positive feedback, particularly regarding the MetaTrader 4 implementation and available trading tools. However, specific details about registration and verification processes, including required documentation and processing timelines, are not comprehensively detailed in available resources.

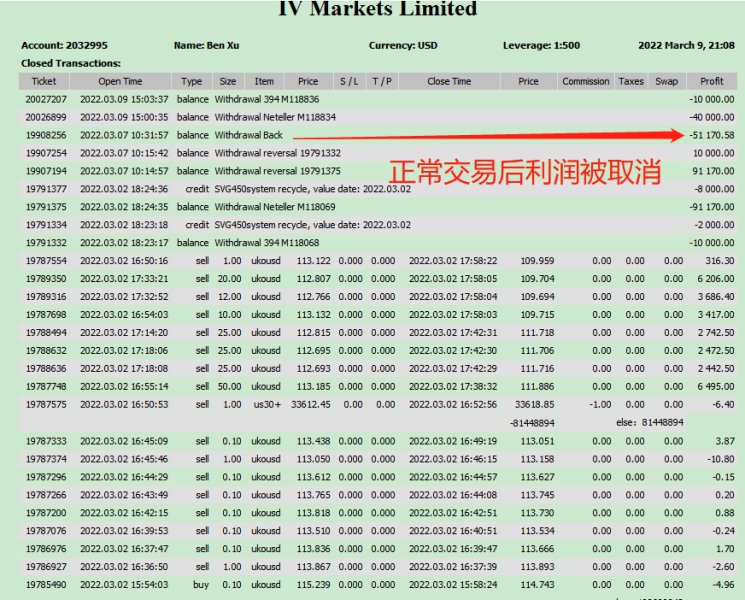

Fund operations experience, including deposit and withdrawal processes, represents an area of particular concern based on user feedback. Some traders have reported issues with withdrawal procedures and communication during fund transfer processes. These operational concerns can significantly impact the overall trading experience and trader confidence in the broker's reliability.

Common user complaints center on transparency issues, customer service consistency, and concerns about regulatory clarity. The broker appears to serve intermediate to advanced traders reasonably well in terms of platform functionality, but struggles with trust-building and operational transparency that affects overall user satisfaction.

Improvement recommendations for IV Markets include enhancing transparency in regulatory information, standardizing customer service quality, providing more comprehensive account and fee information, and addressing user concerns about fund operations. These improvements could significantly enhance user experience and build greater confidence in the broker's operations.

Conclusion

This comprehensive iv markets review reveals a broker with notable strengths in trading tools and platform technology. However, it also shows significant concerns regarding regulatory transparency and user trust. IV Markets offers sophisticated trading capabilities through MetaTrader 4 and proprietary platforms, making it potentially suitable for intermediate to advanced traders seeking diverse trading tools and automated trading capabilities.

However, the broker's regulatory standing and operational transparency present substantial concerns that potential clients must carefully consider. The primary regulation through Seychelles FSA, combined with user feedback questioning various operational aspects, suggests that traders should exercise considerable caution and conduct thorough due diligence before committing funds to this platform.

IV Markets may appeal to experienced traders who prioritize trading tools over regulatory robustness. However, the overall risk profile appears elevated compared to more established and transparently regulated alternatives in the competitive forex brokerage market.