FCMB Review 1

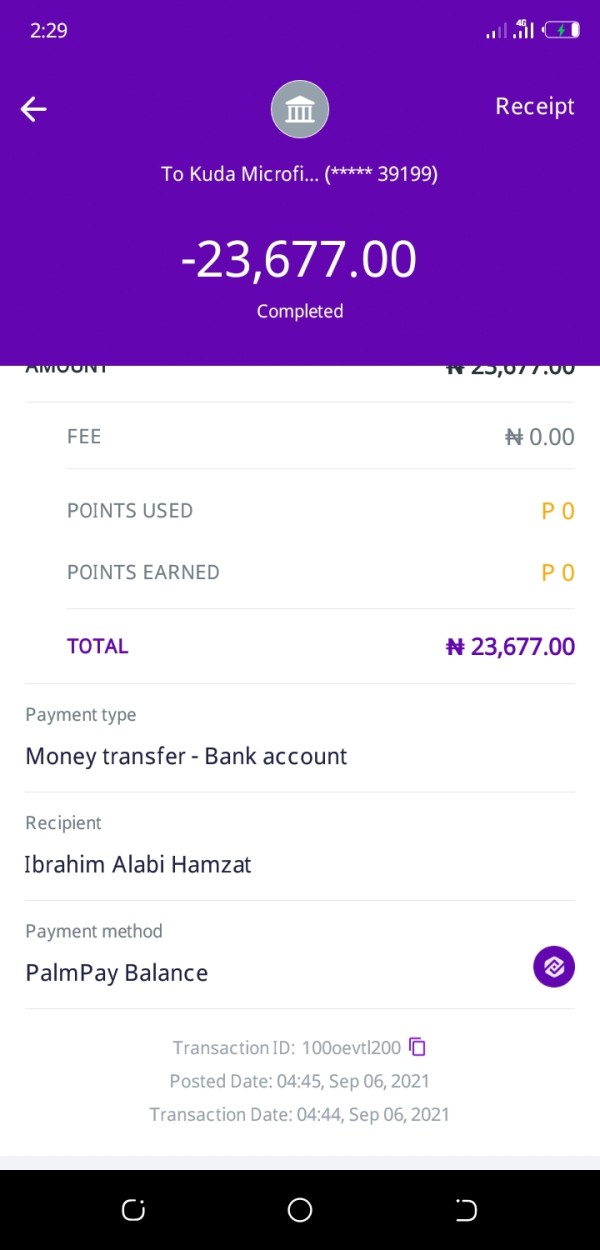

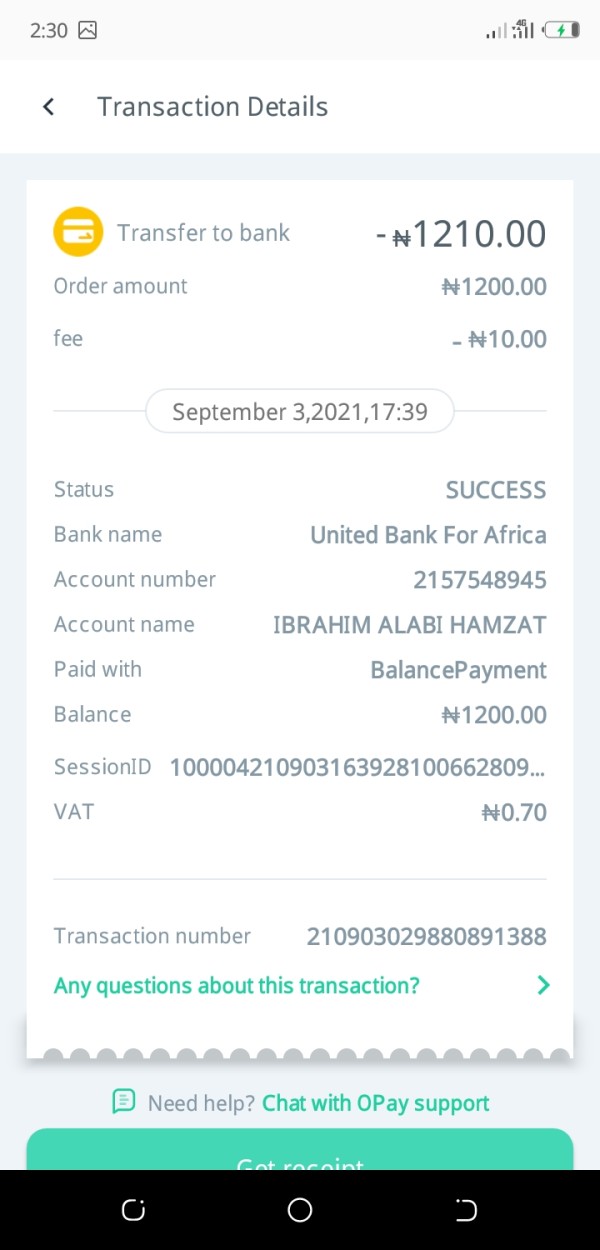

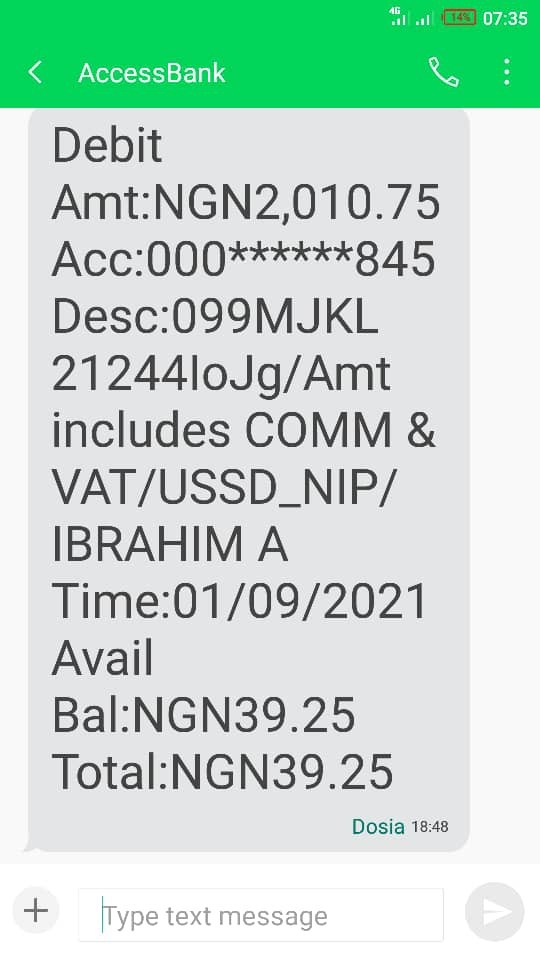

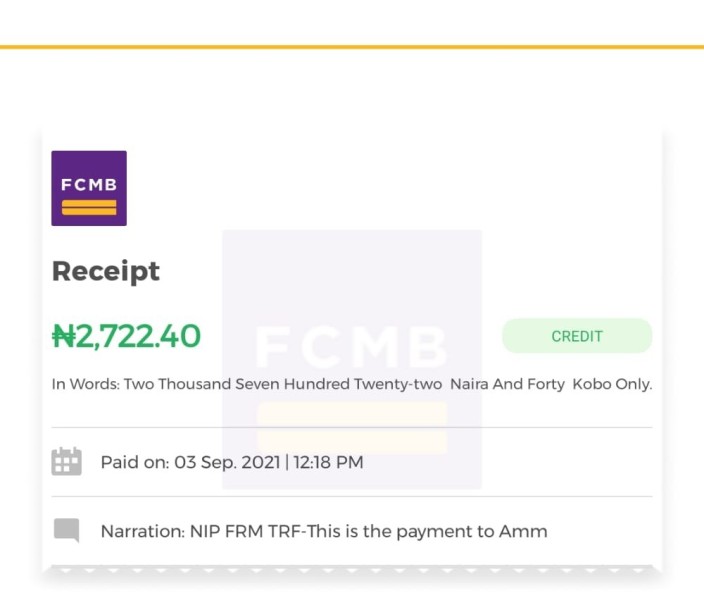

am unable to withdraw after making transfer deposit

FCMB Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

am unable to withdraw after making transfer deposit

FCMB stands for First City Merchant Bank. This Nigerian bank started in 1982 and has over forty years of experience in banking and financial services. However, our detailed fcmb review shows major problems with how happy customers are with their service.

The bank's performance numbers show worrying trends. User ratings lean heavily toward being unhappy with the service. The data shows that 38% of users give FCMB just 1 star, while only 25% give it the highest 5-star rating.

This split feedback means service quality changes a lot between different types of customers. FCMB Group PLC works through several smaller companies, including CSL Stockbrokers Limited, which handles investment management and wealth advice. The company tries to help investors who want complete financial solutions beyond regular banking.

Even though FCMB has been around for decades, it struggles to keep customers happy. The bank works best for investors who want long-term relationships with established banks, but new clients should think carefully about the mixed reviews before signing up.

This review uses public information and user feedback data. FCMB works through different smaller companies and regional offices, which may follow different rules and service standards. We could not find detailed regulatory information in available sources, so potential clients should check current regulatory status on their own.

Our review method combines number-based user rating analysis with quality-based feedback evaluation. Since we found limited technical trading information, this review focuses mainly on overall service quality and customer experience rather than specific trading conditions or platform features.

| Dimension | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Information not available in source materials |

| Tools and Resources | N/A | Specific trading tools not detailed in available data |

| Customer Service | 4/10 | Mixed user feedback with 38% giving 1-star ratings |

| Trading Experience | N/A | Trading platform details not specified in sources |

| Trustworthiness | N/A | Regulatory information not comprehensively detailed |

| User Experience | 5/10 | Polarized ratings suggest inconsistent service delivery |

FCMB started in 1982 when First City Merchant Bank got its license. This was a big deal because it was Nigeria's first locally established bank without government backing. This innovative approach made the institution a leader in the Nigerian financial sector.

Over the next forty years, FCMB grew into a complete financial services group. The bank expanded beyond traditional banking into investment management and wealth advisory services. The main structure centers around FCMB Group PLC, which includes multiple specialized smaller companies.

CSL Stockbrokers Limited is one important subsidiary that handles investment management and provides wealth management solutions to different client groups. This varied approach lets the group serve different market areas while keeping operations efficient across business lines. However, our fcmb review shows that expansion and variety have not led to consistent customer satisfaction.

The available user feedback shows significant room for improvement in service delivery. Nearly four out of ten users express strong unhappiness with their experience.

Regulatory Framework: Available sources do not give complete details about FCMB's regulatory oversight, though as a Nigerian financial institution, it likely operates under Central Bank of Nigeria supervision.

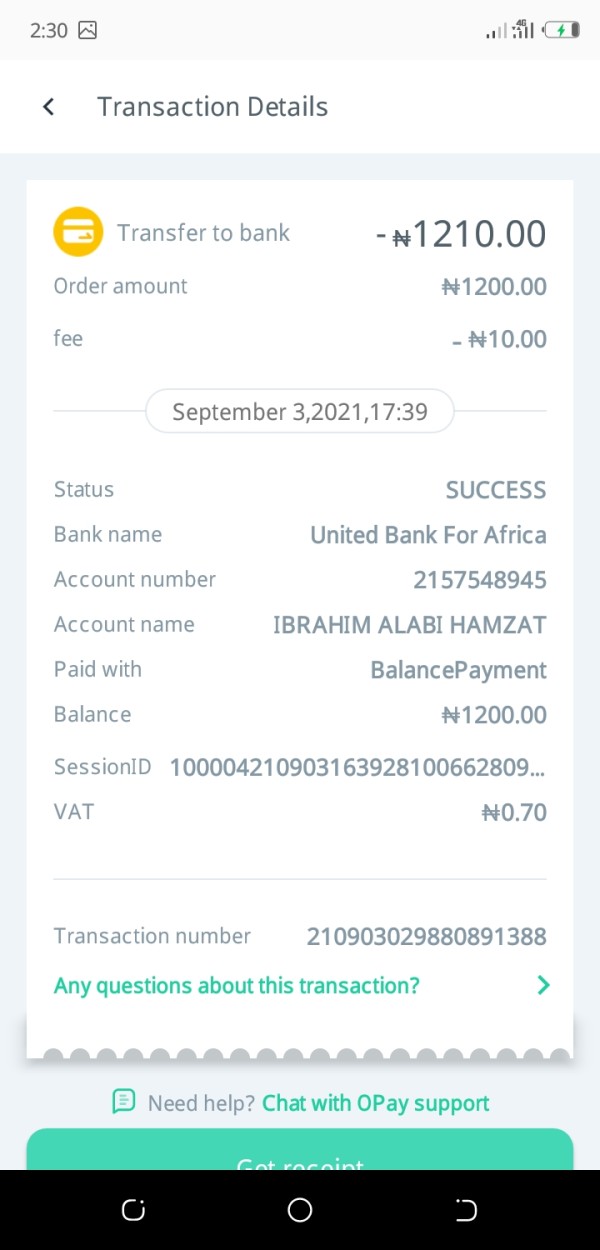

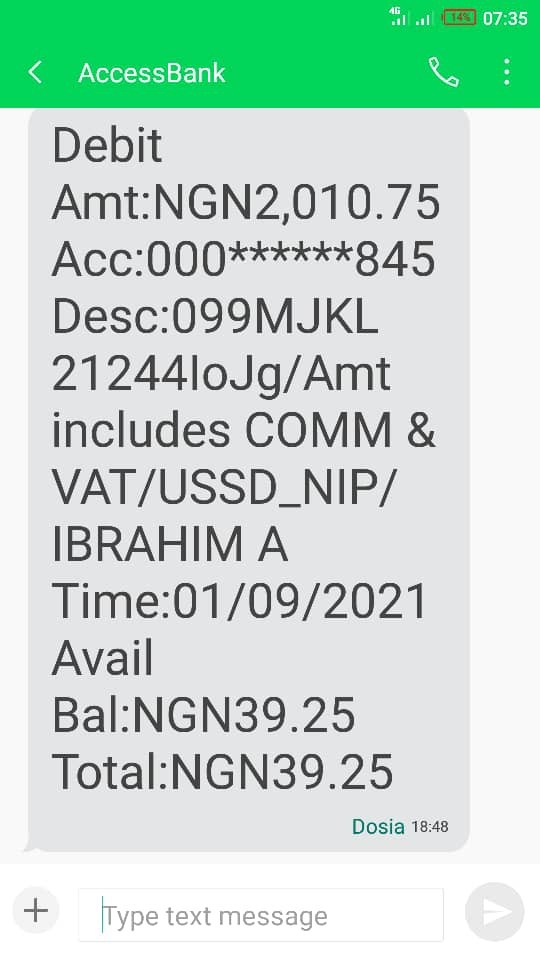

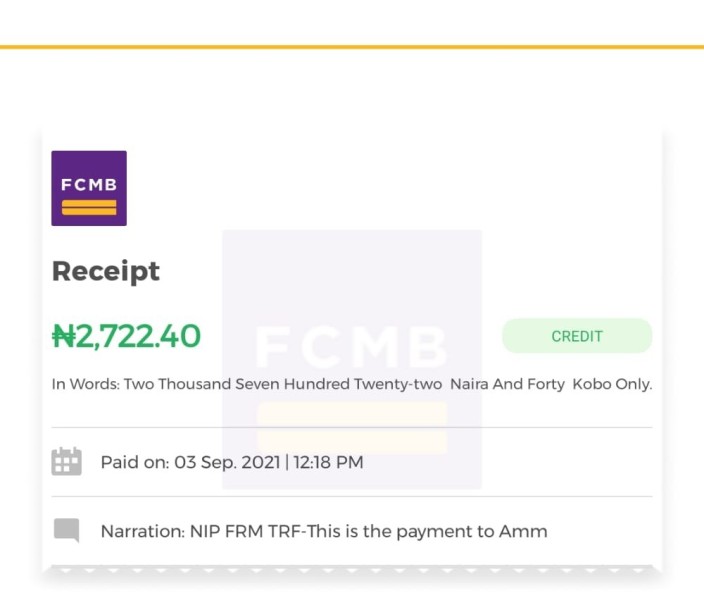

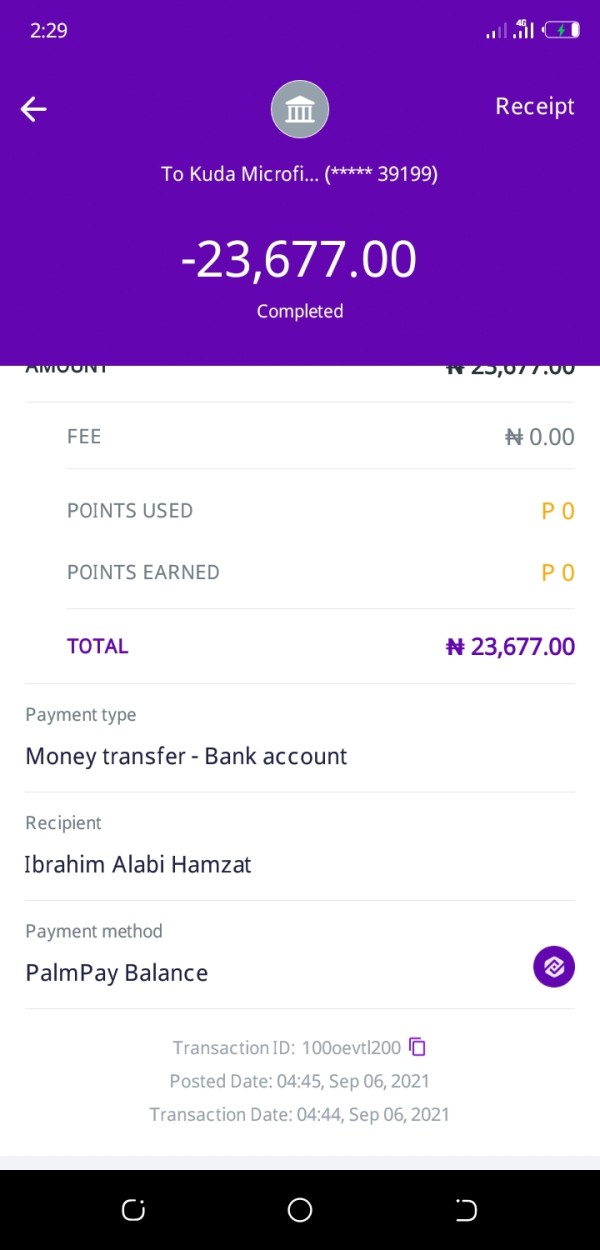

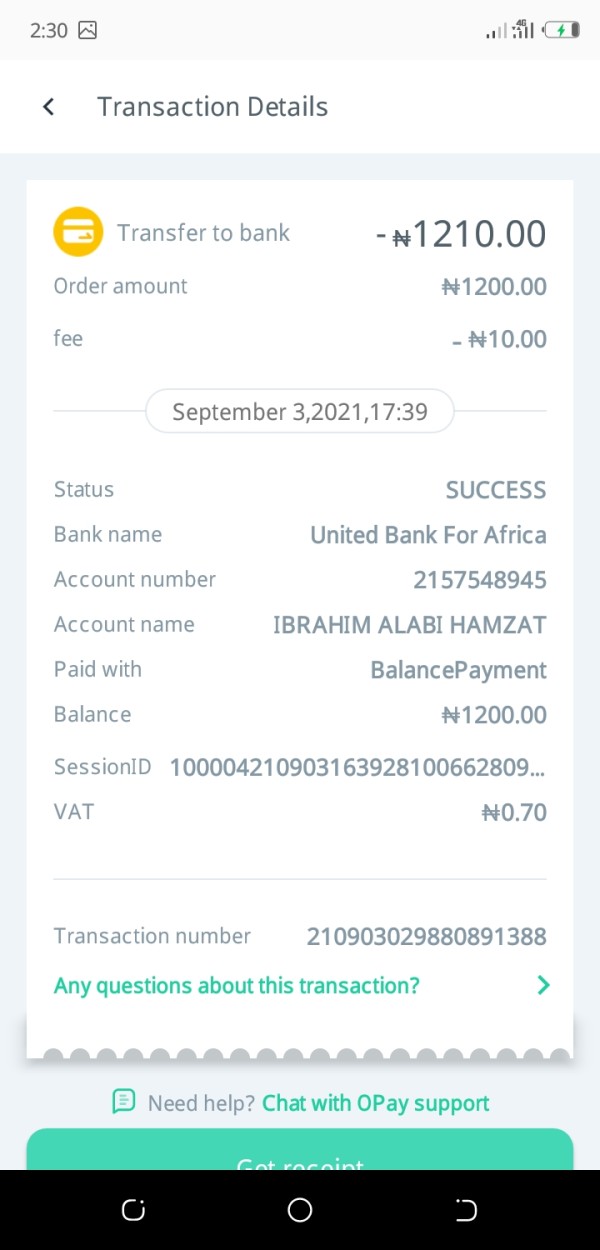

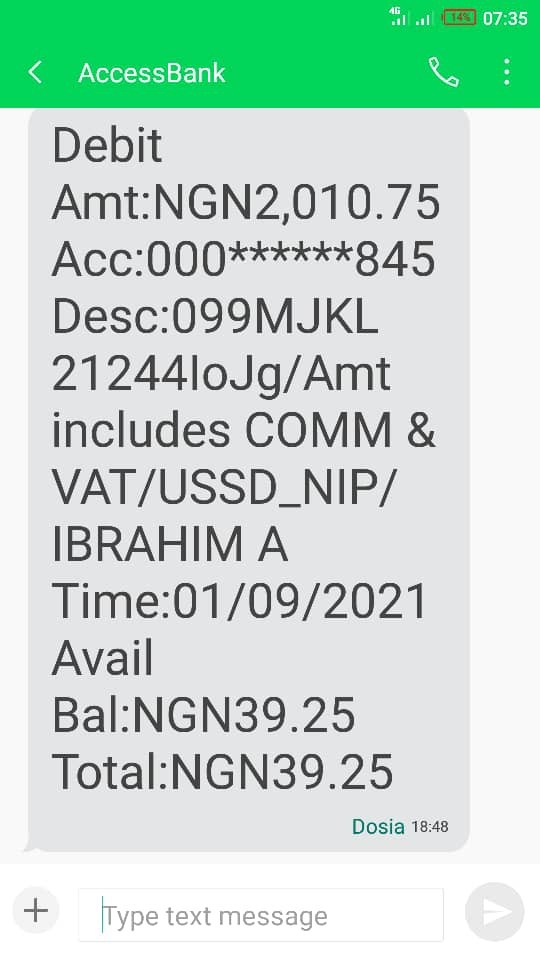

Deposit and Withdrawal Methods: We could not find specific information about funding options and withdrawal procedures in the available materials. This means potential clients should contact the institution directly for current offerings.

Minimum Deposit Requirements: Entry-level investment amounts are not specified in the source materials. These may vary by service type or account category.

Promotional Offers: No specific bonus structures or promotional campaigns were mentioned in the available information. Such offerings may exist through direct institutional channels.

Available Assets: The range of tradeable instruments and investment products is not fully detailed in source materials. The presence of CSL Stockbrokers suggests equity market access.

Cost Structure: Fee schedules and commission rates are not specified in available information. This requires direct inquiry for current pricing models.

Leverage Options: Margin trading capabilities and leverage ratios are not detailed in the source materials.

Platform Selection: We could not find specific trading platforms and technological infrastructure details in available sources. This fcmb review highlights the need for more transparent information disclosure regarding trading conditions and service specifications.

The lack of detailed account information in available sources creates a significant transparency gap for potential clients. Traditional financial institutions like FCMB typically offer tiered account structures ranging from basic retail accounts to premium wealth management services. However, specific details about FCMB's current offerings remain unclear.

Account opening procedures and documentation requirements are standard considerations for any financial institution. The available materials do not outline FCMB's current processes. This lack of readily available information may indicate either limited online presence or a preference for direct client consultation rather than public disclosure.

Minimum balance requirements and account maintenance fees are crucial factors for potential clients. These specifics are not detailed in the source materials. The institutional focus on investment management through subsidiaries like CSL Stockbrokers suggests that account structures may vary significantly between different service lines.

Our fcmb review indicates that prospective clients should expect to engage directly with FCMB representatives to understand current account options. Publicly available information does not provide comprehensive coverage of these essential details.

The analytical tools and research resources available to FCMB clients remain largely unspecified in available source materials. For an institution with over four decades of market experience, the absence of detailed information about research capabilities and analytical support represents a notable gap in public disclosure.

Investment management operations through CSL Stockbrokers suggest some level of market analysis and research capability. However, the specific tools, platforms, and resources available to different client segments are not clearly outlined. Modern financial institutions typically provide various analytical tools, from basic market data to sophisticated research reports.

FCMB's current offerings in this area require direct inquiry. Educational resources and client development programs are increasingly important differentiators in the financial services sector. However, the available information does not detail any specific educational initiatives or client training programs that FCMB may offer.

The technology infrastructure supporting client services is not comprehensively described in source materials. References to online banking platforms suggest some digital capability exists within the organization.

Customer service emerges as a critical concern in our fcmb review. User feedback reveals significant inconsistencies in service quality. The stark contrast between positive and negative reviews suggests that customer experience varies dramatically depending on specific circumstances or service representatives encountered.

Positive feedback highlights instances of swift response times and effective complaint resolution. User testimonials mention appreciating email-based customer contact systems that eliminate waiting times and provide prompt responses to queries. Some customers specifically praise FCMB staff quality, indicating that when service standards are met, client satisfaction can be quite high.

However, the substantial 38% of users awarding only 1-star ratings indicates systemic issues in service delivery consistency. This polarization suggests that while some clients receive excellent service, a significant portion encounters problems that severely impact their overall experience with the institution. Response time variability appears to be a key factor, with some users experiencing rapid resolution while others face delays.

The availability of multiple contact channels, including email support, provides options for client communication. The effectiveness of these channels appears inconsistent based on user feedback patterns.

Trading experience evaluation is constrained by limited available information about FCMB's specific trading platforms and execution capabilities. The presence of CSL Stockbrokers within the FCMB Group suggests equity trading capabilities. However, detailed platform specifications and execution quality metrics are not provided in source materials.

Platform stability and execution speed are critical factors for any trading environment. Specific performance data or user feedback about trading platform reliability is not available in the reviewed sources. This absence of technical performance information makes it difficult to assess FCMB's competitiveness in the trading services sector.

Order execution quality and slippage characteristics are essential considerations for active traders. Such technical details are not specified in available materials. The institutional structure suggests capability for handling various order types and market conditions, though specifics require direct verification with the provider.

Mobile trading capabilities and cross-platform synchronization are increasingly important features. Information about FCMB's mobile trading solutions is not detailed in the source materials. Our comprehensive fcmb review indicates that potential trading clients should conduct thorough due diligence regarding platform capabilities before committing to the service.

Evaluating FCMB's trustworthiness presents challenges due to limited regulatory transparency in available sources. As a financial institution operating since 1982, FCMB has demonstrated longevity in the Nigerian market. This suggests some level of regulatory compliance and operational stability over time.

The institutional structure through FCMB Group PLC with multiple subsidiaries indicates a formal corporate framework. Specific regulatory oversight details are not comprehensively provided in source materials. For potential clients, this lack of readily available regulatory information may raise questions about transparency standards.

Fund security measures and client protection protocols are not detailed in the available information. This represents a significant gap for risk-conscious investors. Modern financial institutions typically provide clear information about deposit protection, segregation of client funds, and regulatory compliance measures.

The mixed user feedback, with 38% negative ratings, raises questions about operational consistency and client treatment standards. While negative reviews don't necessarily indicate regulatory issues, they do suggest areas where institutional performance may not meet client expectations consistently.

User experience represents the most concerning aspect of our fcmb review. Rating distribution shows significant polarization between satisfied and dissatisfied clients. The 38% of users awarding 1-star ratings indicates widespread dissatisfaction with various aspects of service delivery, while the 25% giving 5-star ratings suggests that positive experiences are achievable but not consistently delivered.

The substantial gap between positive and negative experiences suggests systemic inconsistencies in service standards across different touchpoints or departments within the organization. This variability may reflect differences in staff training, process standardization, or resource allocation across different service areas. Interface design and digital experience details are not comprehensively covered in available sources, though references to online banking platforms suggest some level of digital service capability.

User feedback about digital platform quality and ease of use is not specifically detailed in the reviewed materials. The customer demographic appears to include users seeking comprehensive financial services beyond basic banking, which aligns with FCMB's positioning as a diversified financial services provider. However, the mixed satisfaction levels suggest that service delivery may not consistently meet the expectations of this target market segment.

FCMB presents a complex profile in the financial services landscape. The institution has significant strengths in longevity and market experience, but concerning patterns in customer satisfaction offset these advantages. While the institution's four-decade operational history demonstrates stability and market presence, the substantial proportion of dissatisfied users indicates serious challenges in service delivery consistency.

The broker appears most suitable for investors seeking established institutional relationships and comprehensive financial services. These clients should be particularly willing to invest time in direct consultation to understand current offerings. However, potential clients should carefully weigh the mixed user feedback and limited transparency in publicly available information.

Primary advantages include institutional stability and diversified service capabilities through multiple subsidiaries. Key disadvantages center on inconsistent customer satisfaction levels and limited transparency regarding specific service terms and conditions.

FX Broker Capital Trading Markets Review