Invast Global 2025 Review: Everything You Need to Know

Invast Global is a prominent multi-asset broker based in Australia, established in 2013 as a division of a Japanese publicly listed company with over 60 years of experience. The broker is regulated by the Australian Securities and Investments Commission (ASIC) and offers a variety of trading platforms, including MT4, MT5, and IRESS. Overall, user feedback highlights the broker's competitive spreads and execution speeds, though some users have reported concerns about high minimum deposit requirements and limited educational resources.

Note: It is important to recognize that different entities operate under the Invast Global brand across various regions, which may affect the trading conditions and services available. This review aims to provide a balanced insight based on a thorough analysis of various sources.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user experiences, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

Invast Global was founded in 2013 and is headquartered in Sydney, Australia. It operates as a fully regulated broker under ASIC, providing services primarily to institutional and professional traders. The broker supports various trading platforms, including MT4 and MT5, catering to a wide range of financial instruments such as forex, commodities, indices, and CFDs.

Detailed Breakdown

Regulatory Regions

Invast Global is regulated by ASIC, which ensures that the broker adheres to strict guidelines regarding client fund protection and transparency. However, the broker does not accept clients from the United States, Japan, and several other countries.

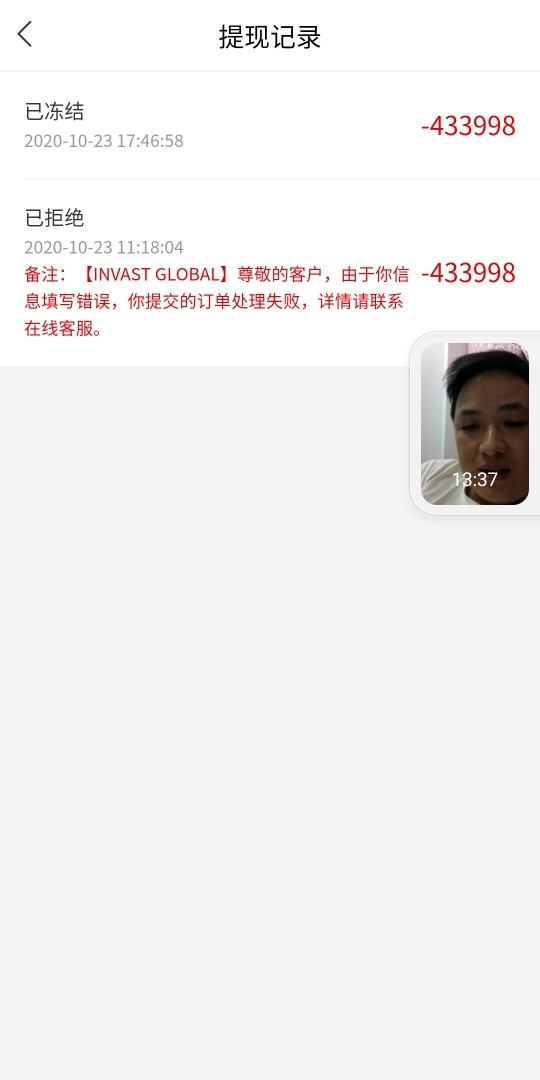

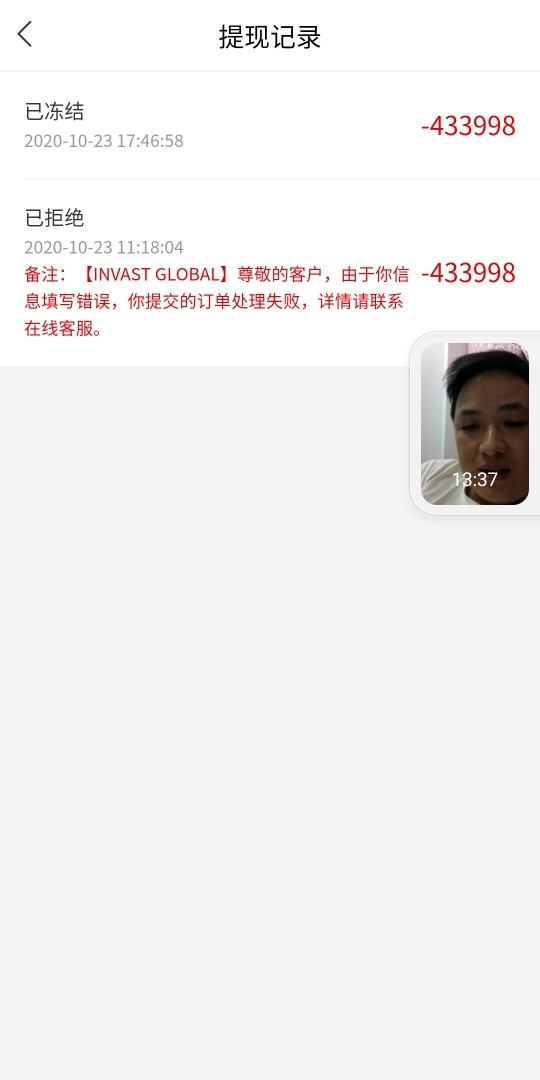

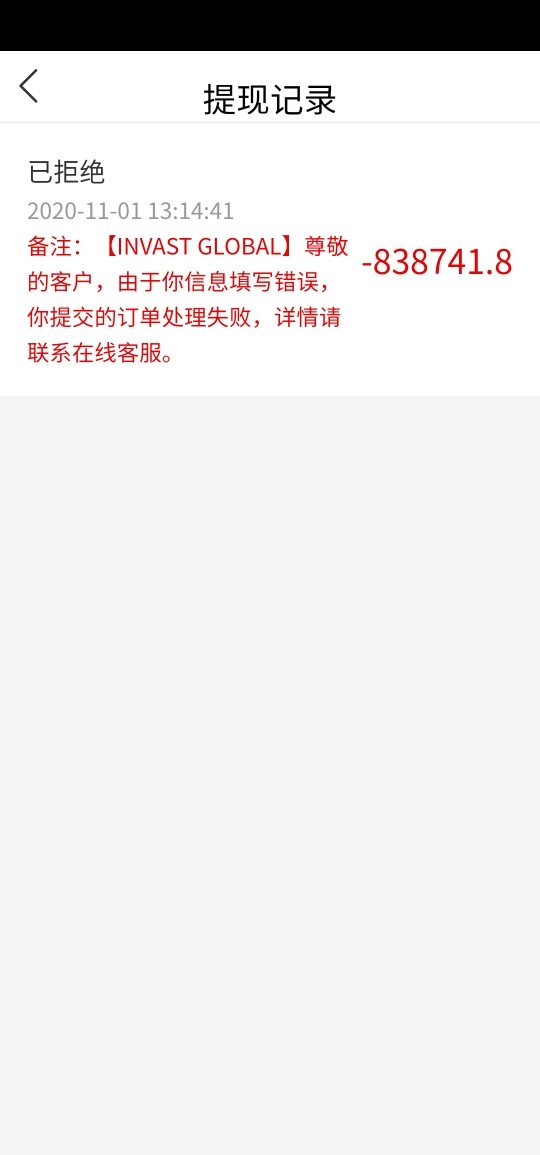

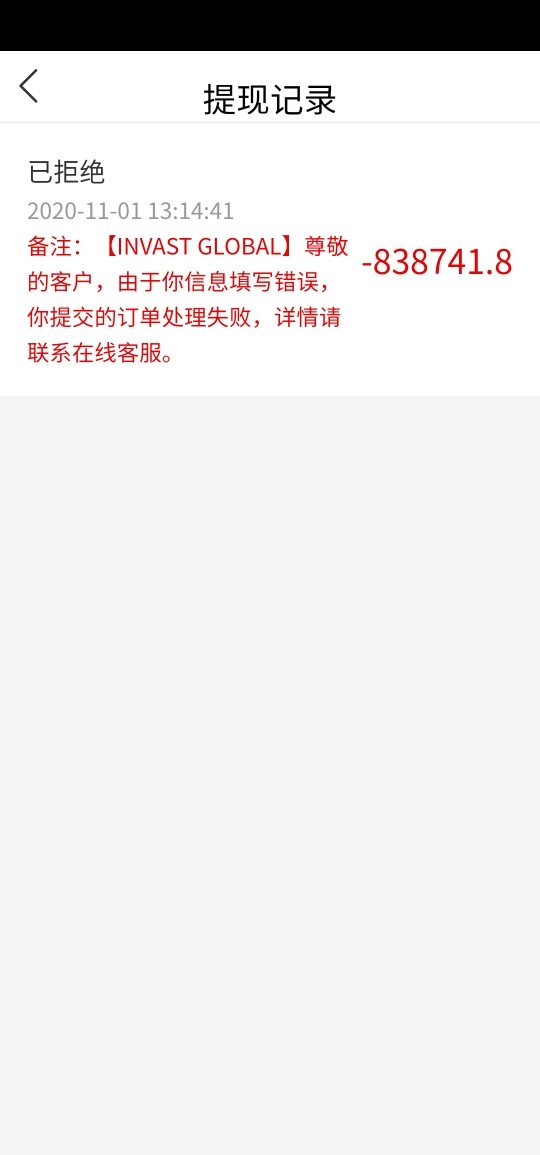

Deposit/Withdrawal Currencies and Methods

The broker primarily accepts bank wire transfers for both deposits and withdrawals. The minimum deposit required to open an account is AUD 5,000, which is considered high compared to many other brokers. There are no deposit fees, but withdrawal fees apply depending on the currency and location.

Currently, Invast Global does not offer any sign-up bonuses or promotional offers for new clients, which may limit its attractiveness to some traders looking for initial incentives.

Tradable Asset Classes

Traders can access a diverse range of assets, including forex pairs, single stock CFDs, ETFs, commodities, and futures. However, there are limitations, such as the absence of cryptocurrency trading options.

Costs (Spreads, Fees, Commissions)

Invast Global offers competitive trading conditions with average spreads starting from 0.2 pips for the EUR/USD pair. Commission fees are typically around AUD 4 per round turn, which is relatively low. However, traders should be aware of potential rollover fees for positions held overnight.

Leverage

The maximum leverage offered by Invast Global is 1:30 for Australian clients, in accordance with ASIC regulations. This leverage level allows traders to manage their capital effectively, but it also entails higher risk.

The broker provides access to several advanced trading platforms, including MT4, MT5, IRESS, and Bloomberg. These platforms are designed to cater to various trading strategies and preferences, ensuring that traders have the tools they need for effective trading.

Restricted Areas

As mentioned earlier, Invast Global does not accept clients from certain jurisdictions, particularly the United States and Japan, limiting its global reach.

Customer Service Languages

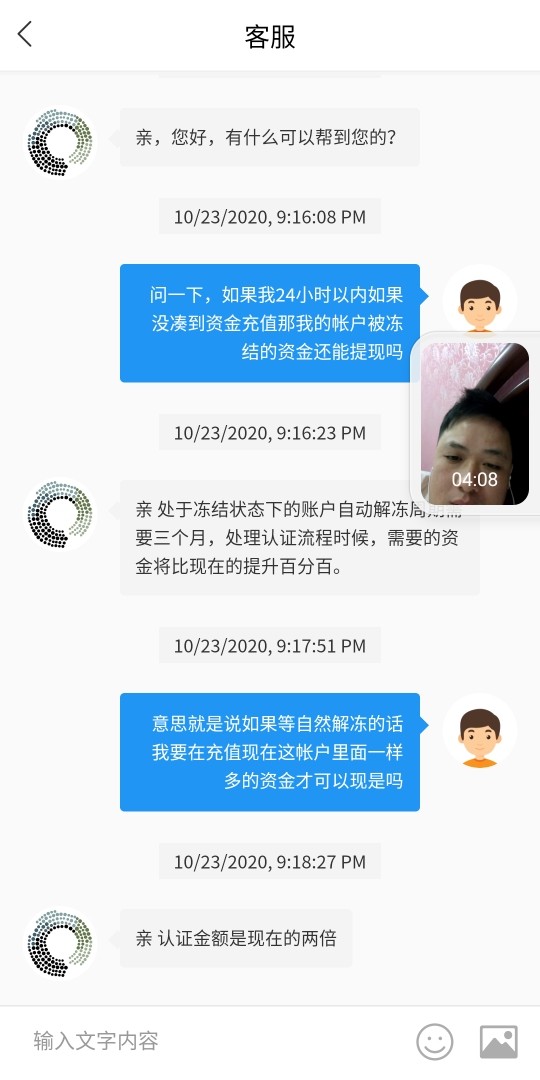

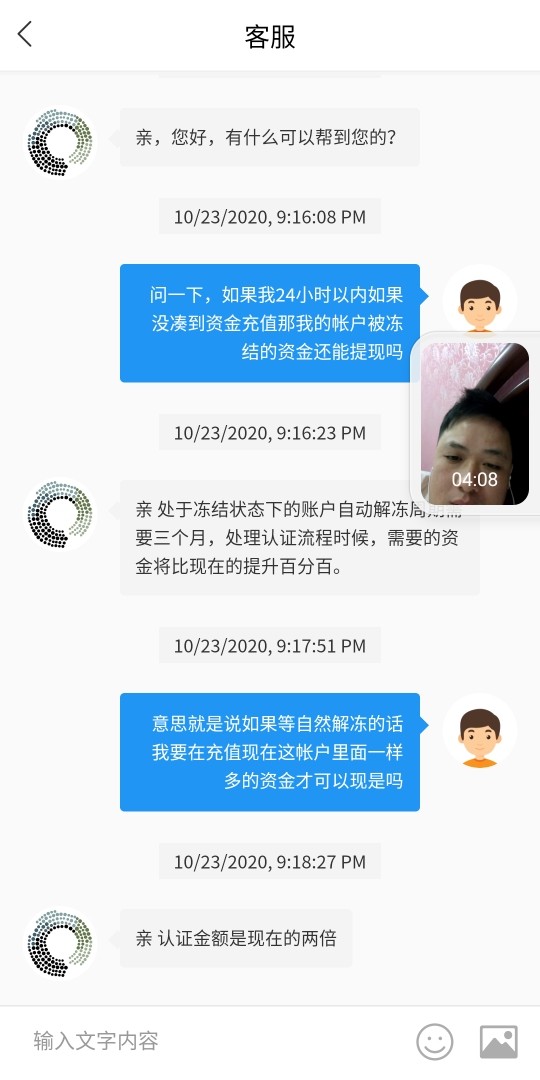

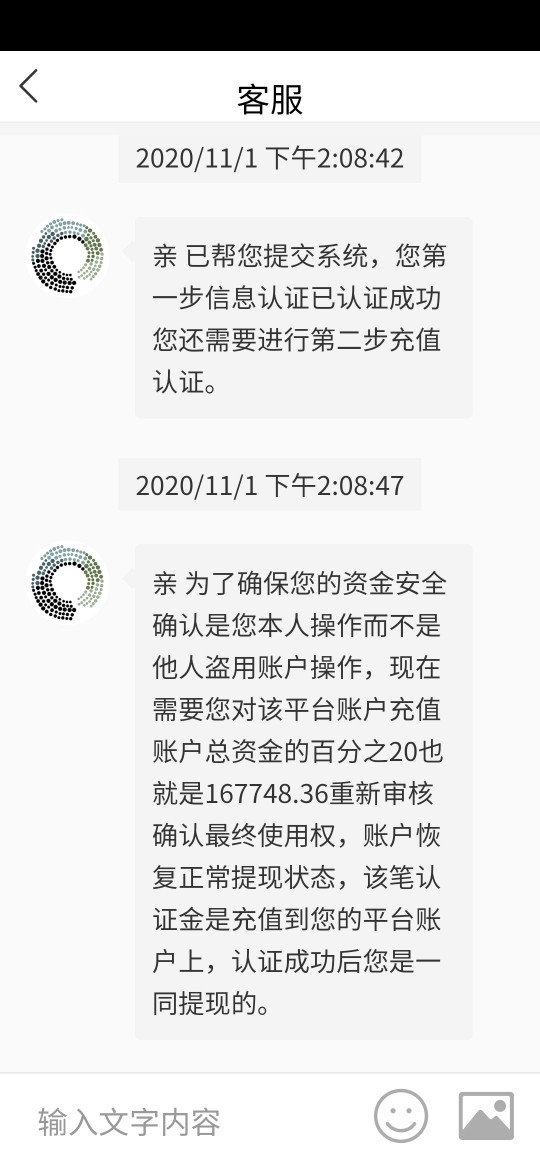

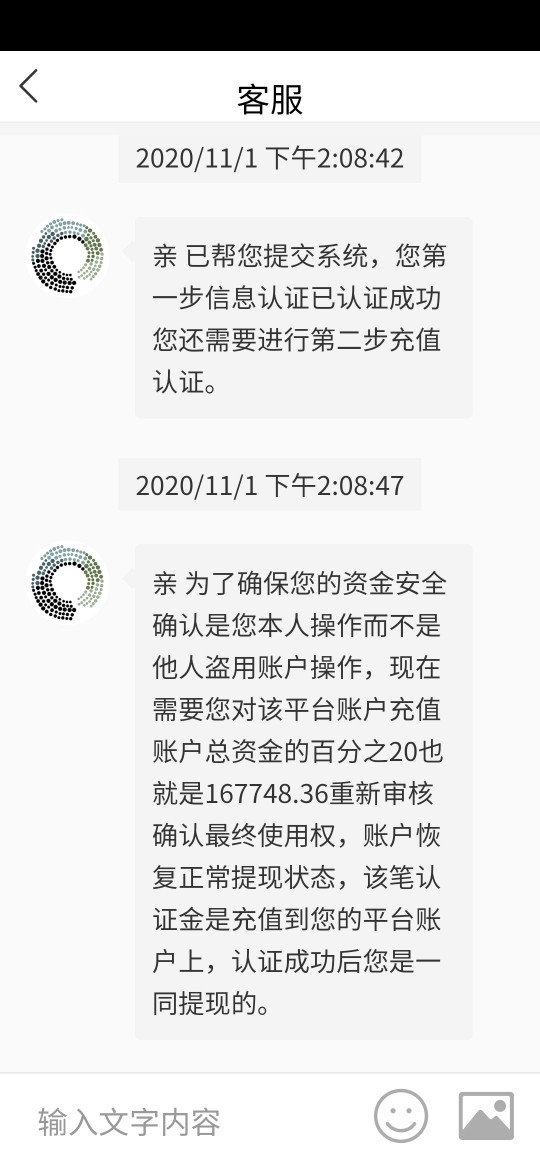

Invast Global offers customer support in multiple languages, including English and Mandarin, available 24/5 via email and phone. However, the absence of a live chat option may be a drawback for some users seeking immediate assistance.

Repeated Ratings Overview

Detailed Analysis of Ratings

-

Account Conditions (6/10): The high minimum deposit requirement of AUD 5,000 can be a barrier for smaller investors. The range of account types is limited, primarily catering to professional and institutional clients.

Tools and Resources (5/10): While Invast Global offers advanced trading platforms, educational resources are somewhat limited. Traders may find it challenging to access comprehensive training materials.

Customer Service and Support (6/10): The customer service is generally responsive, but the lack of 24/7 support and live chat can be a downside for traders needing immediate assistance.

Trading Setup (7/10): Users report positive experiences with execution speeds and spreads. The trading environment is considered competitive, especially for institutional traders.

Trust Level (8/10): Invast Global is regulated by ASIC, providing a sense of security for traders. The broker's long-standing history and reputation in the industry contribute to its trustworthiness.

User Experience (7/10): Overall, users have reported a satisfactory experience with the trading platform and services, although some express concerns about the high minimum deposit and limited educational resources.

In summary, Invast Global is a well-regarded broker for professional and institutional traders, offering competitive trading conditions and a trustworthy regulatory framework. However, potential clients should consider the high minimum deposit and the limited educational resources before opening an account.