Investments 2025 Review: Everything You Need to Know

Executive Summary

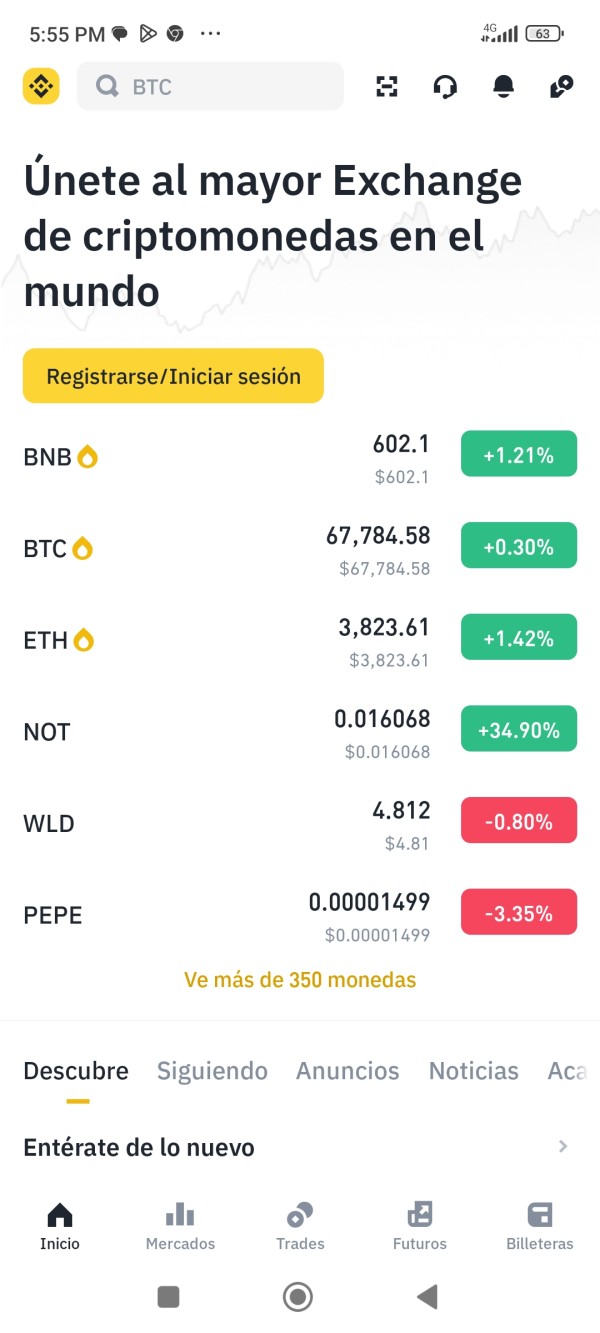

This investments review looks at the current investment opportunities available in 2025. The investment sector offers many different opportunities including high-yield savings accounts, CDs, bonds, funds, stocks, and gold investments based on market analysis. The platform focuses on providing multiple investment options rather than traditional brokerage services, which puts it in a similar position to discount brokers in the market.

The key highlights include a wide range of investment products designed to help investors handle market ups and downs through smart diversification strategies. The investment approach emphasizes proven, diversified investments that can help investors manage market highs and lows effectively according to available information. This investments review shows that the platform works well for investors seeking long-term investment strategies and those looking to reduce how market volatility affects their portfolio performance.

However, this review takes a neutral stance due to limited information about specific regulatory oversight and detailed trading conditions. The platform seems most appropriate for investors who value investment diversity and feel comfortable making their own investment decisions.

Important Notice

This investments review uses publicly available information and market analysis. Specific regulatory information was not detailed in available sources, which may cause different user experiences and regulatory compliance across different regions.

The evaluation method used in this review relies on accessible market data and does not include direct user testimonials or complete regulatory verification. Potential investors should do additional research, especially regarding regulatory status and specific terms of service in their area.

Rating Framework

Broker Overview

The investment platform works as a diversified investment provider, offering multiple investment options to help investors build complete portfolios. The platform provides access to high-yield savings accounts, certificates of deposit, bonds, mutual funds, stocks, and gold investments according to market analysis. This approach matches discount brokerage models similar to established firms like Charles Schwab and Fidelity Investments.

The business model focuses on letting investors access various asset classes through a single platform, emphasizing how important diversification is in managing market volatility. The platform's investment philosophy centers on proven, diversified investment strategies that can help investors handle market changes effectively. This complete approach to investment options suggests a focus on serving investors who prefer to maintain control over their investment decisions while having access to multiple asset classes.

The platform's position in the market appears to target self-directed investors who value investment diversity over full-service brokerage features. The service model emphasizes providing access to various investment types rather than offering complete advisory services based on available information. This investments review shows that the platform serves investors who feel comfortable making independent investment decisions while benefiting from access to diversified investment options.

Regulatory Oversight: Specific regulatory information was not mentioned in available source materials, which may impact investor protection and oversight standards.

Deposit and Withdrawal Methods: Payment processing and fund transfer methods were not detailed in the available information, requiring potential users to verify these details independently.

Minimum Deposit Requirements: Specific minimum deposit amounts were not specified in source materials, suggesting investors should ask directly about account opening requirements.

Promotional Offers: Bonus structures and promotional incentives were not mentioned in available information, indicating the platform may not emphasize promotional marketing.

Available Assets: The platform provides access to stocks, ETFs, and mutual funds according to market analysis, along with traditional investment vehicles like bonds and savings products.

Cost Structure: Detailed fee information and commission structures were not specified in available source materials, requiring investors to request complete fee schedules.

Leverage Options: Margin trading and leverage capabilities were not mentioned in available information.

Platform Options: Specific trading platform details and technology offerings were not detailed in source materials.

Regional Restrictions: Geographic limitations and availability were not specified in available information.

Customer Support Languages: Multi-language support capabilities were not mentioned in available data.

This investments review highlights the need for potential investors to conduct thorough research regarding specific terms and conditions.

Detailed Rating Analysis

Account Conditions Analysis

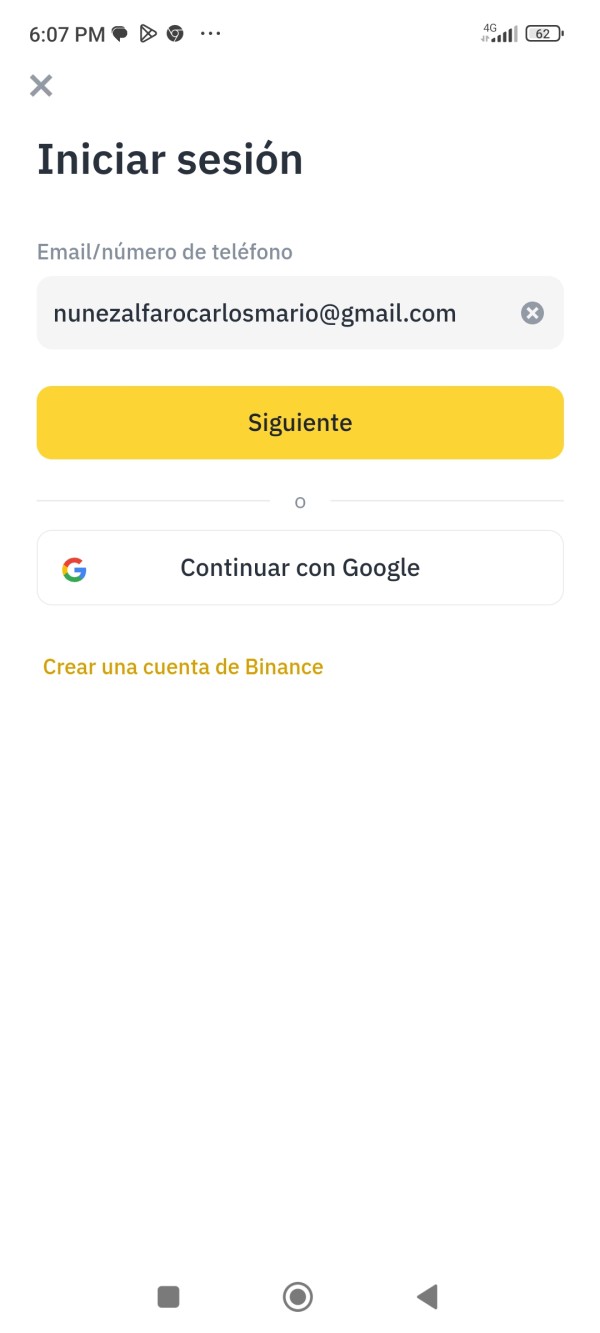

The account conditions evaluation for this platform faces significant limitations due to insufficient information in available source materials. Account type varieties and their specific features were not detailed, making it challenging to assess how complete the account offerings are.

The absence of minimum deposit requirement information prevents evaluation of accessibility for different investor segments. Account opening procedures and verification processes were not described in available materials, which is concerning for potential users who need to understand onboarding requirements. Special account features, such as retirement accounts or tax-advantaged options, were not mentioned in the source information, limiting the assessment of the platform's ability to serve diverse investor needs.

The lack of detailed account condition information suggests that this investments review cannot provide a complete evaluation of this critical aspect. Potential investors would need to contact the platform directly to understand account structures, requirements, and available features. This information gap represents a significant limitation in evaluating the platform's overall value proposition for different types of investors.

Without specific user feedback regarding account opening experiences or account management features, this review cannot assess user satisfaction with account conditions. The absence of comparative information also prevents evaluation of how the platform's account offerings compare against industry standards.

The evaluation of trading tools and resources faces substantial limitations due to the absence of specific information in available source materials. Research and analysis capabilities, which are crucial for informed investment decisions, were not detailed in the available information.

This lack of transparency regarding analytical tools makes it difficult to assess the platform's value for investors who rely on complete market research. Educational resources and learning materials were not mentioned in source materials, preventing assessment of the platform's commitment to investor education. For many investors, particularly those new to investing, educational support represents a critical factor in platform selection.

The absence of information about educational offerings limits this investments review's ability to evaluate the platform's suitability for learning-oriented investors. Automated trading support and algorithmic trading capabilities were not addressed in available information. Modern investors often seek platforms that offer automation features to help manage portfolios efficiently.

The lack of detail regarding these technological capabilities suggests potential limitations in the platform's technological sophistication. Market analysis tools, portfolio tracking features, and performance reporting capabilities were not described in source materials. These tools are essential for effective investment management and portfolio optimization.

Customer Service and Support Analysis

Customer service evaluation proves challenging due to the complete absence of support-related information in available source materials. Communication channels, availability hours, and response time standards were not detailed, preventing assessment of the platform's commitment to customer support.

This information gap is particularly concerning given the importance of reliable customer service in financial services. Service quality indicators, such as resolution rates or customer satisfaction scores, were not mentioned in available information. The absence of multi-language support details also limits understanding of the platform's ability to serve diverse, international user bases.

For investors who may need assistance in languages other than English, this represents a significant information gap. Customer service accessibility during market hours and emergency support availability were not addressed in source materials. Given that financial markets operate across multiple time zones and investors may need urgent assistance during volatile market conditions, the lack of support availability information represents a notable limitation in this investments review.

User feedback regarding customer service experiences was not available in source materials, preventing inclusion of real-world service quality assessments. Without testimonials or user reviews about support interactions, potential investors cannot gauge the practical effectiveness of the platform's customer service capabilities.

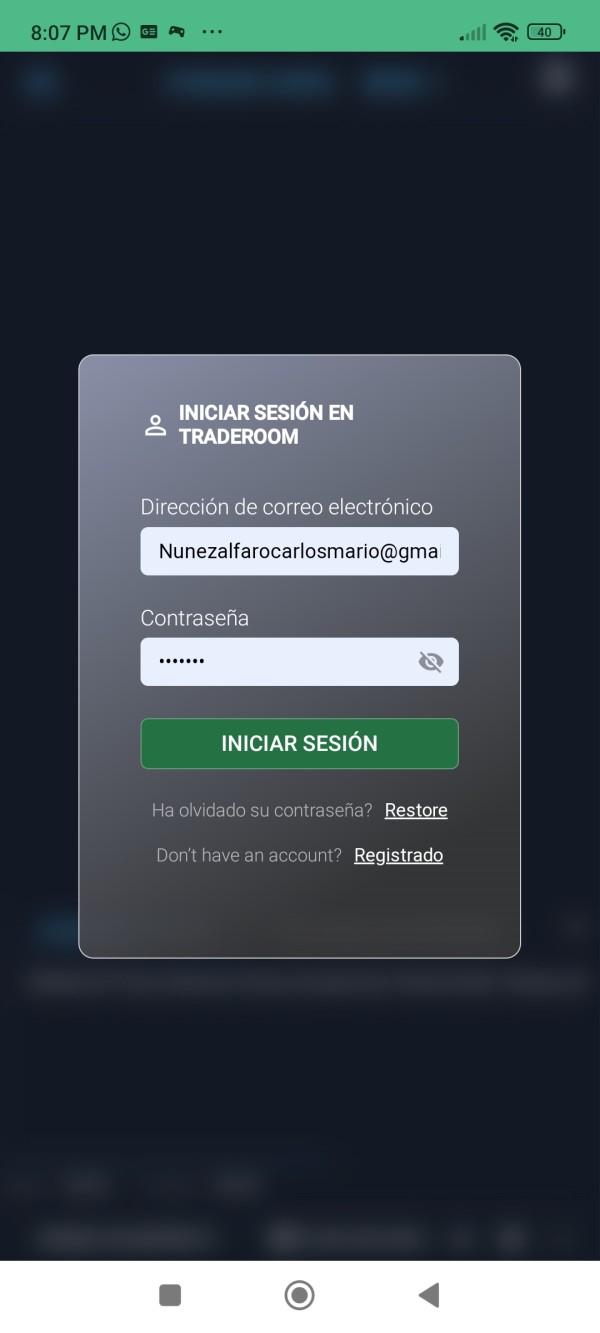

Trading Experience Analysis

Platform stability and execution speed information was not provided in available source materials, making it impossible to assess the technical reliability of the trading environment. Order execution quality, which directly impacts investment performance, was not detailed in available information.

This represents a critical information gap for investors who prioritize efficient trade execution. Platform functionality and feature completeness were not described in source materials, preventing evaluation of the trading interface's sophistication and user-friendliness. Mobile trading capabilities, increasingly important for modern investors, were not mentioned in available information.

This limits assessment of the platform's ability to serve investors who prefer mobile-first trading experiences. Trading environment characteristics, such as real-time data availability, charting capabilities, and order types, were not detailed in available materials. These features significantly impact the trading experience and investment decision-making process.

The absence of this information in this investments review highlights the need for potential users to conduct independent platform demonstrations. Performance metrics and technical specifications were not provided in source materials, preventing objective evaluation of the platform's trading capabilities. Without user feedback about actual trading experiences, this review cannot assess practical usability or identify potential technical limitations that might affect investment activities.

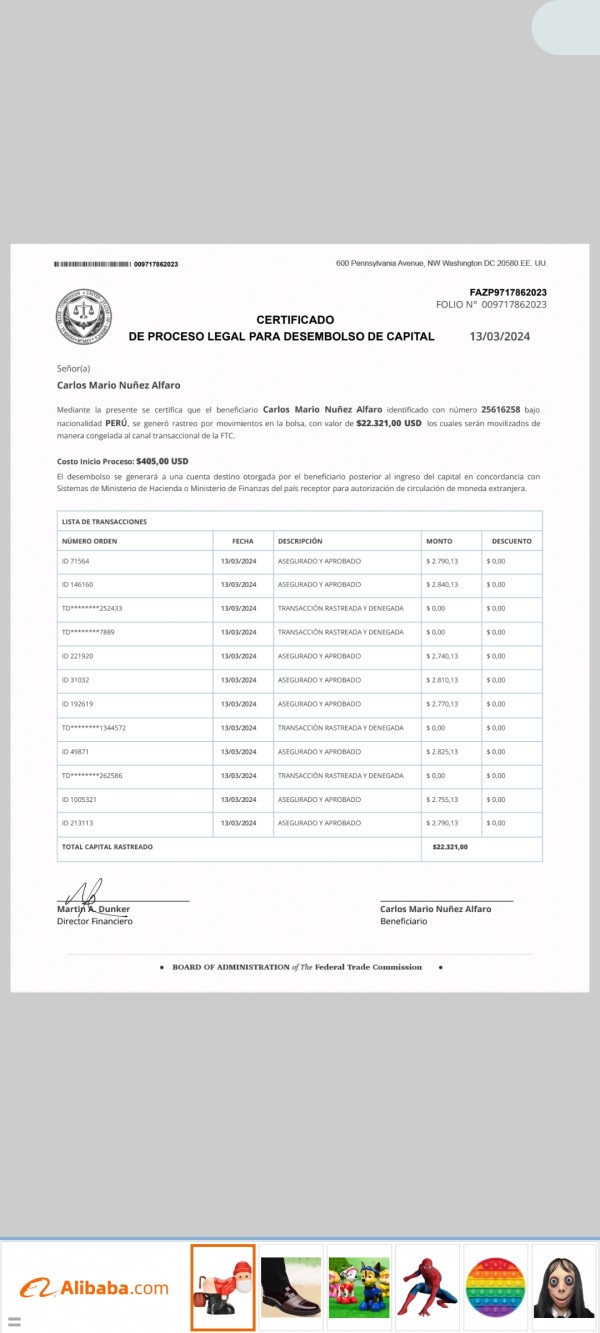

Trust and Security Analysis

Regulatory credentials and oversight information were not mentioned in available source materials, representing a significant concern for investor protection assessment. The absence of regulatory details makes it impossible to verify the platform's compliance with financial services standards and investor protection requirements.

This information gap is particularly important for investors prioritizing security and regulatory oversight. Fund safety measures and client asset protection protocols were not detailed in available information. Insurance coverage, segregation of client funds, and other security measures that protect investor assets were not described.

Without this crucial information, investors cannot adequately assess the safety of their investments on the platform. Company transparency regarding ownership, financial stability, and operational practices was not addressed in source materials. Industry reputation and third-party assessments were not mentioned, limiting the ability to gauge the platform's standing within the investment community.

The absence of information about regulatory actions or compliance history further complicates trust assessment. User trust feedback and security-related testimonials were not available in source materials, preventing inclusion of real-world security experiences. Without independent verification of security practices or regulatory compliance, potential investors face significant uncertainty regarding the platform's trustworthiness and reliability.

User Experience Analysis

Overall user satisfaction data was not available in source materials, preventing complete assessment of the platform's ability to meet investor expectations. Interface design and usability information were not detailed, making it impossible to evaluate the platform's accessibility for users with varying levels of technical expertise.

This represents a significant limitation in assessing the platform's practical usability. Registration and account verification processes were not described in available information, preventing evaluation of the onboarding experience. Fund management and transaction processes were not detailed, limiting understanding of how users interact with their investments on the platform.

These operational aspects significantly impact overall user satisfaction. Common user complaints and areas for improvement were not identified in available source materials. Without feedback about user pain points or frequently requested features, this investments review cannot provide insights into the platform's practical limitations or areas where user experience might be enhanced.

User demographic analysis and satisfaction surveys were not referenced in available information, preventing assessment of how well the platform serves different types of investors. Without complete user experience data, potential investors cannot adequately evaluate whether the platform aligns with their preferences and requirements.

Conclusion

This investments review reveals significant information limitations that prevent a complete evaluation of the platform's capabilities and suitability. The platform appears to offer diverse investment options including stocks, bonds, funds, and alternative investments, but the absence of detailed information about regulatory oversight, trading conditions, and user experiences requires a cautious approach.

The platform may be suitable for investors seeking diversified investment opportunities and those comfortable with self-directed investment strategies. However, the lack of transparency regarding regulatory compliance, customer support, and specific terms of service represents notable concerns for potential users.

Investors considering this platform should conduct extensive research, particularly regarding regulatory status, fee structures, and customer protection measures before committing funds.