Ids International 2025 Review: Everything You Need to Know

Executive Summary

This Ids International review looks at a broker with a moderate standing in forex trading. The company gets a user rating of 3.66 out of 5, and about 66% of employees would recommend it as a workplace. However, user trust stays low because the broker lacks strict financial oversight.

The broker offers over 30 forex currency pairs, CFDs, indices, and precious metals trading. Trading happens through the well-known MT4 platform and MT Mobile app, giving traders familiar tools they can trust. The platform works best for traders who want different trading options and high-leverage chances.

Even though Ids International offers many trading assets, it struggles to build strong user confidence. The lack of solid rules and limited transparency about trading conditions creates mixed user experiences. The moderate employee rating shows the company runs smoothly inside, but outside feedback shows they need to improve service and trustworthiness.

Important Notice

Potential traders should know that Ids International works without strict financial oversight. This means trading security and investor protection can vary by region. Users in different places may get different levels of protection and help with disputes.

This review uses public information and user feedback from various sources. The assessment doesn't check with all possible regulatory bodies, so traders should do their own research before using this broker. The review focuses on facts rather than promotion and stays objective in all assessments.

Rating Framework

Broker Overview

Ids International works as a forex and CFD broker, though details about when it started and its company background are unclear. The company focuses on giving access to foreign exchange markets, contracts for difference, indices, and precious metals trading. Their business model centers on offering diverse trading tools to retail traders who want exposure to global financial markets.

The platform keeps its market presence through technology that supports multiple asset classes. While detailed company history isn't well documented, the broker has built systems that support international trading activities. The company's approach emphasizes access to various financial tools rather than focusing on specific market areas.

Trading infrastructure at Ids International uses the MetaTrader 4 platform and MT Mobile app, giving traders industry-standard trading environments. The asset list includes over 30 forex currency pairs, various CFD instruments, major global indices, and precious metals trading opportunities. However, specific regulatory oversight details aren't disclosed in available materials, which affects this Ids International review assessment about compliance and oversight standards.

The broker targets traders interested in building diverse portfolios and using high-leverage trading strategies. While the company can handle international clients, specific regional restrictions and compliance frameworks aren't clearly outlined in accessible documentation, so potential users need to ask the broker directly for clarification.

Regulatory Status: Available information doesn't specify which regulatory bodies govern Ids International's operations. This lack of clear regulatory framework is a major consideration for potential traders evaluating platform safety and compliance standards.

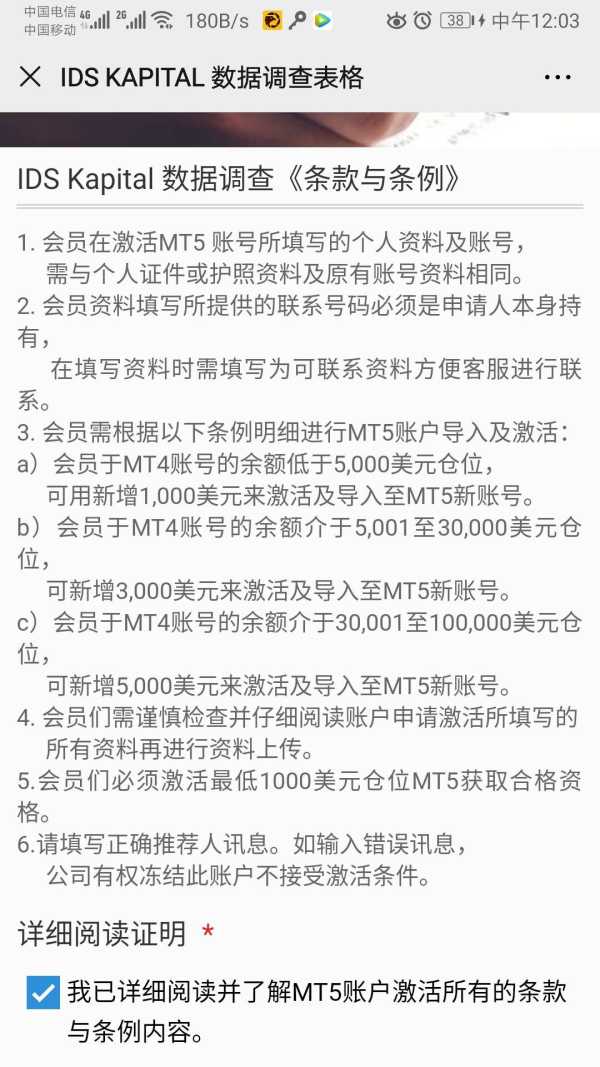

Deposit and Withdrawal Methods: Specific information about available funding methods, processing times, and fees isn't detailed in current documentation. Traders should ask directly about available payment processors and transaction procedures.

Minimum Deposit Requirements: Exact minimum deposit amounts aren't specified in available materials. This makes it hard for potential users to assess entry-level requirements for opening accounts.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs aren't outlined in accessible documentation.

Trading Assets: The platform provides access to over 30 forex currency pairs, covering major, minor, and exotic currency combinations. Additionally, traders can access CFD instruments across various sectors, global indices tracking major economies, and precious metals including gold and silver trading opportunities.

Cost Structure: Specific information about spreads, commission structures, overnight funding costs, and additional fees isn't comprehensively detailed in available sources.

Leverage Ratios: While high leverage options are mentioned, exact maximum leverage ratios and margin requirements aren't specified in current documentation.

Platform Options: Trading happens through MetaTrader 4 and MT Mobile applications. These provide access to standard charting tools, technical indicators, and order management systems.

Geographic Restrictions: Specific countries or regions where services are restricted aren't clearly outlined in available information.

Customer Support Languages: Available customer service language options aren't specified in current documentation.

This Ids International review section highlights the limited transparency about specific trading conditions and operational details.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for Ids International shows significant information gaps that affect the overall assessment. Available documentation doesn't specify different account types, their features, or targeted user groups. This lack of transparency makes it hard for potential traders to understand what account structures are available and which might suit their trading needs.

Minimum deposit requirements stay unspecified, preventing accurate assessment of accessibility for different trader groups. Without clear entry-level requirements, traders can't effectively plan their initial capital or compare accessibility with other market participants. The absence of detailed account opening procedures also raises questions about verification requirements and timeline expectations.

The moderate user rating of 3.66 suggests mixed experiences with account-related services, though specific feedback about account setup, maintenance, or upgrade processes isn't available in current documentation. This Ids International review finds that the lack of comprehensive account condition information significantly hurts the platform's transparency and user confidence.

Special account features, such as Islamic accounts, professional trader classifications, or institutional services, aren't mentioned in available materials. The absence of tiered account structures or progressive benefits based on trading volume or deposit levels suggests a simplified approach, though without confirmation, this remains unclear.

Ids International's tools and resources offering centers mainly around the MetaTrader 4 platform and MT Mobile application. MT4 gives traders industry-standard charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. The platform includes comprehensive order management systems and real-time market data access across supported instruments.

However, available information doesn't detail additional proprietary tools, advanced analytics platforms, or supplementary research resources. The absence of mentioned economic calendars, market analysis reports, or trading signal services suggests limited value-added resources beyond basic platform functionality. Educational resources, including webinars, tutorials, or trading guides, aren't referenced in current documentation.

Research and analysis capabilities appear limited to standard MT4 functionality, without evidence of dedicated research teams, daily market commentary, or institutional-grade analysis tools. The lack of mentioned social trading features, copy trading systems, or community-based trading tools indicates a more traditional approach to platform development.

Automated trading support through MT4's Expert Advisor functionality provides some advanced trading capabilities, though specific information about proprietary algorithms, trading robots, or automated strategy development tools isn't available. The mobile trading experience through MT Mobile offers basic functionality, but specific feature sets and mobile-optimized tools aren't detailed in accessible materials.

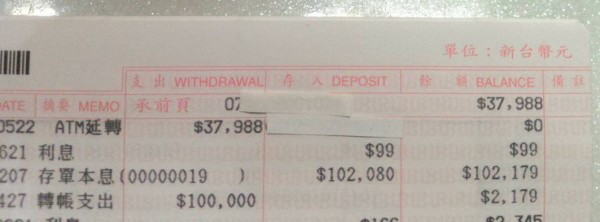

Customer Service and Support Analysis

The customer service evaluation for Ids International faces significant limitations due to insufficient information about support infrastructure and service quality metrics. Available documentation doesn't specify customer service channels, such as live chat availability, telephone support hours, or email response protocols. This information gap makes it impossible to assess accessibility and convenience of customer support services.

Response time benchmarks, service quality standards, and customer satisfaction metrics specific to support interactions aren't available in current materials. The overall user rating of 3.66 may reflect support experiences, but without specific customer service feedback, it's difficult to separate support quality from other platform aspects.

Multilingual support capabilities remain unspecified, which is particularly relevant for an international trading platform. The absence of information about support team expertise, problem resolution procedures, or escalation processes raises questions about service reliability and effectiveness. Support availability hours, timezone coverage, and weekend or holiday service provisions aren't outlined.

The lack of mentioned self-service resources, such as comprehensive FAQ sections, video tutorials, or troubleshooting guides, suggests limited emphasis on customer empowerment and problem prevention. Without evidence of dedicated account managers, relationship management services, or personalized support for higher-tier clients, the service model appears to lack differentiation based on client value or needs.

Trading Experience Analysis

The trading experience assessment focuses mainly on the MetaTrader 4 platform and MT Mobile application capabilities. MT4 provides a stable and familiar trading environment with proven reliability across global markets. The platform supports standard order types, including market, limit, and stop orders, with real-time execution capabilities across the supported instrument range.

However, specific performance metrics such as average execution speeds, slippage rates, or uptime statistics aren't available in current documentation. Without concrete performance data, it's challenging to assess the technical quality of trade execution or platform reliability during high-volatility periods. The absence of mentioned liquidity providers or execution models limits understanding of the trading environment structure.

Mobile trading through MT Mobile provides basic functionality for position management and market monitoring, though specific mobile-optimized features or unique capabilities aren't detailed. The Ids International review finds that while standard MT4 functionality is reliable, the lack of platform customization or proprietary enhancements may limit the differentiated trading experience.

Order execution quality, including fill rates, requote frequency, and price improvement statistics, aren't specified in available materials. Advanced trading features such as one-click trading, advanced charting tools, or institutional-grade execution algorithms aren't mentioned, suggesting a focus on standard retail trading functionality rather than advanced trader requirements.

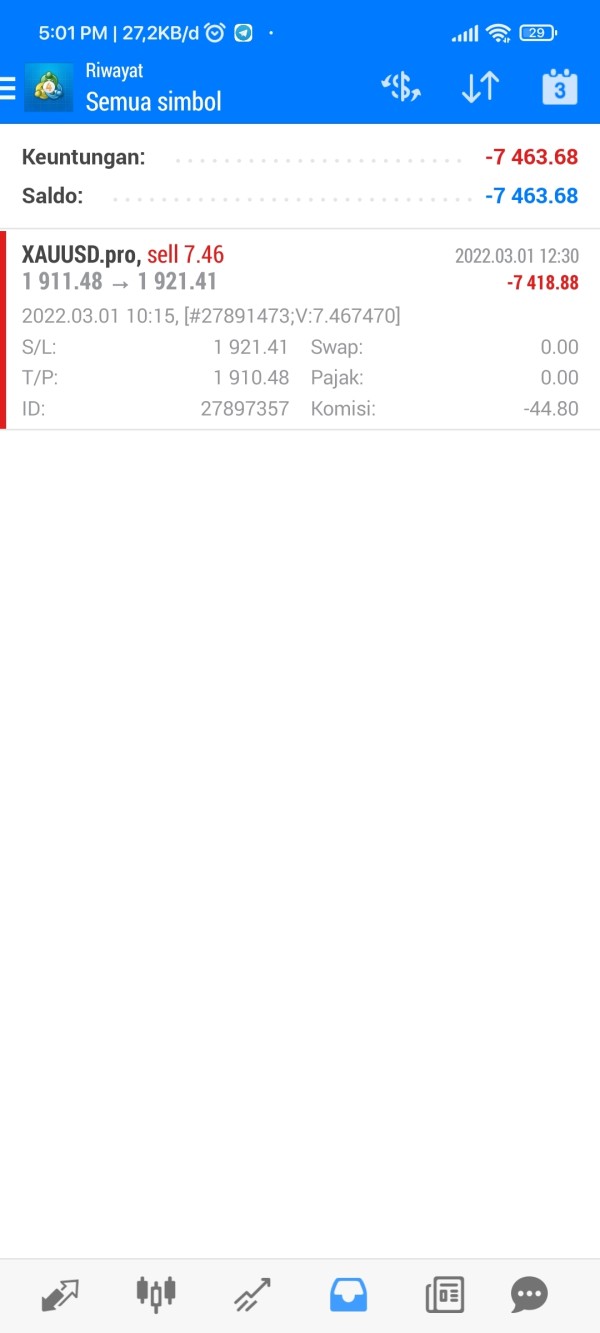

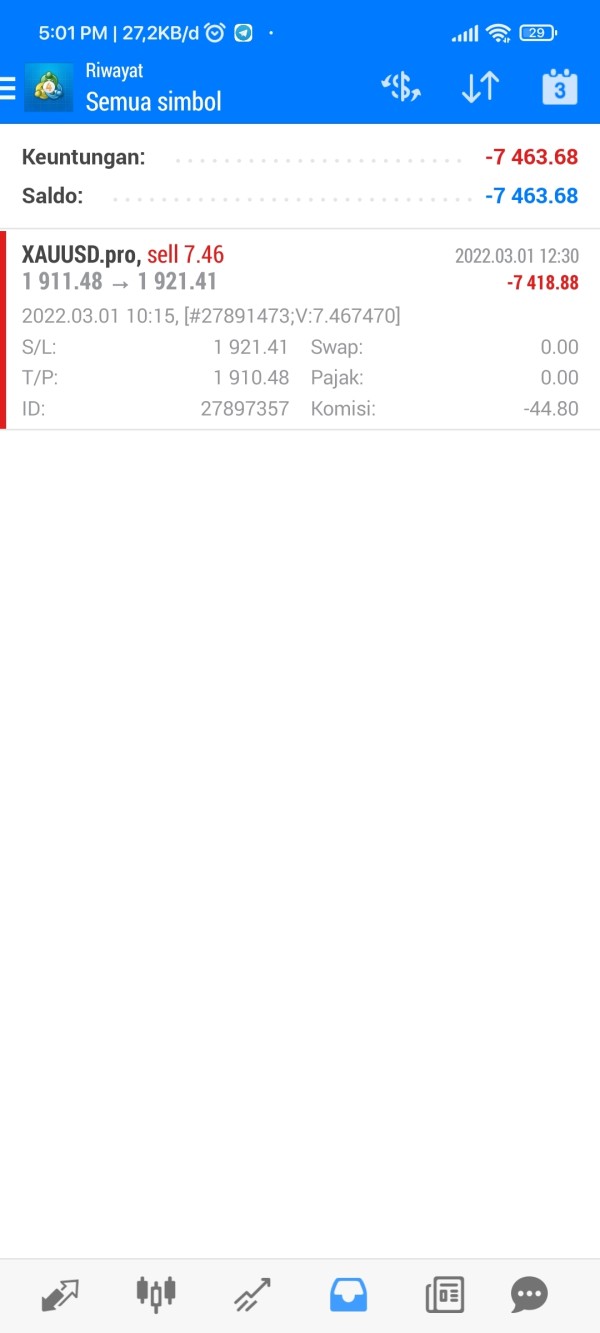

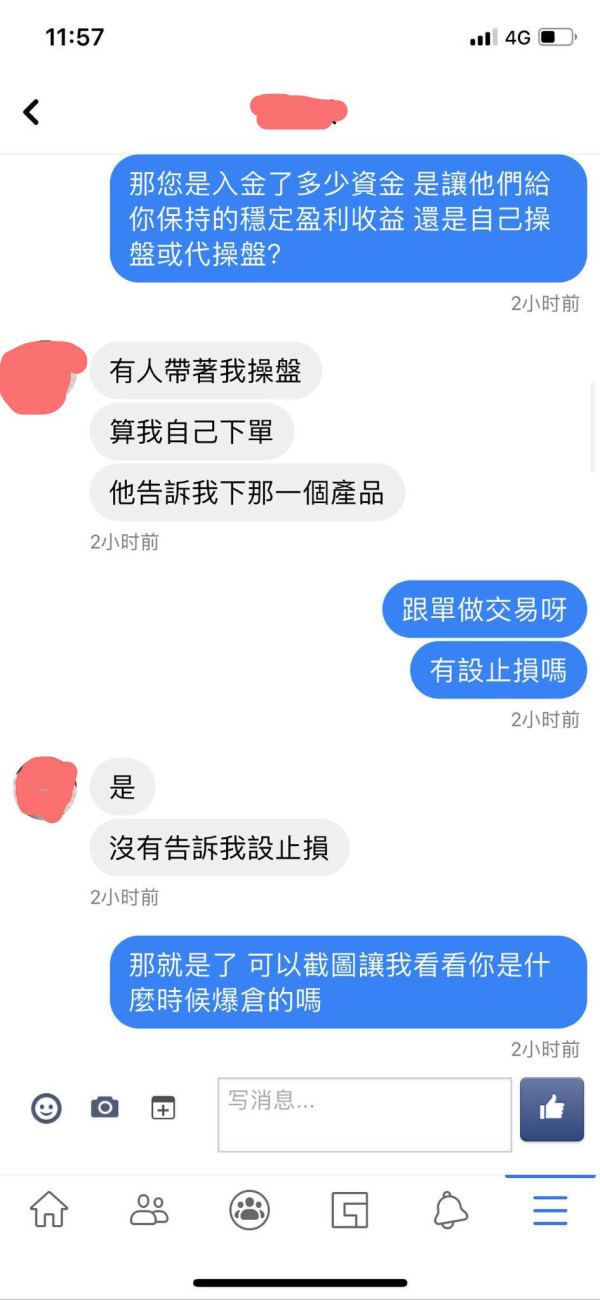

Trust and Reliability Analysis

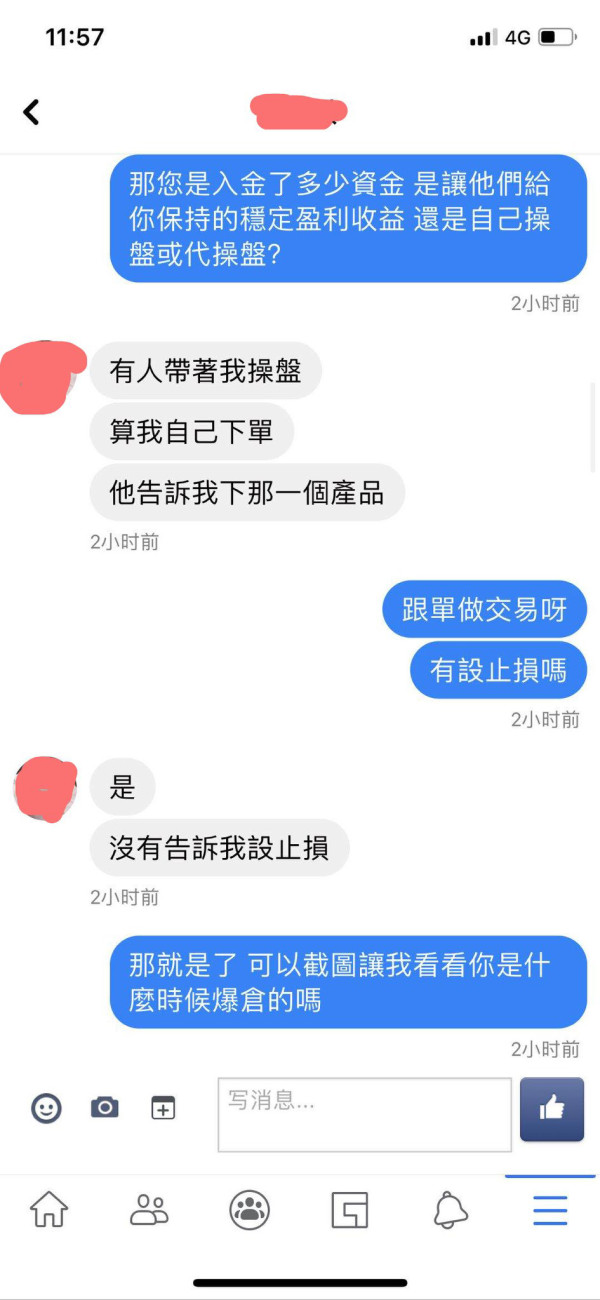

The trust and reliability assessment reveals significant concerns about Ids International's regulatory oversight and transparency standards. Available information indicates that the broker operates without strict financial regulatory supervision, which substantially impacts investor protection and dispute resolution mechanisms. This regulatory gap represents the most significant trust-related concern for potential users.

Fund security measures, including segregated client accounts, deposit protection schemes, or insurance coverage, aren't specified in current documentation. The absence of clear fund protection protocols raises questions about client capital safety and recovery procedures in adverse scenarios. Without regulatory oversight, standard investor protection mechanisms may not apply.

Company transparency about ownership structure, financial reporting, or operational procedures appears limited based on available information. The lack of detailed corporate information, regulatory compliance updates, or public financial disclosures contributes to reduced transparency standards. User trust levels are reportedly low, which aligns with the regulatory and transparency concerns identified.

Industry reputation and third-party evaluations aren't extensively documented, limiting independent verification of service quality and reliability. The absence of mentioned industry awards, regulatory recognition, or professional certifications suggests limited external validation of operational standards. Negative event handling procedures and crisis management protocols aren't outlined in available materials.

User Experience Analysis

User experience evaluation is based mainly on the reported user rating of 3.66, indicating moderate satisfaction levels with mixed feedback across different service aspects. This rating suggests that while some users find acceptable value, significant improvement opportunities exist across various platform dimensions.

Interface design and usability assessment is limited to standard MT4 functionality, which provides familiar navigation for experienced traders but may present learning curves for newcomers. The absence of mentioned platform customization options or user interface enhancements suggests reliance on standard MetaTrader design without proprietary improvements.

Registration and verification processes aren't detailed in available documentation, making it difficult to assess onboarding efficiency or user-friendliness. Account funding and withdrawal experiences lack specific user feedback or performance metrics, limiting understanding of operational smoothness and user satisfaction with financial transactions.

Common user complaints or recurring issues aren't specifically documented, though the moderate overall rating suggests mixed experiences across different platform aspects. The user demographic appears to focus on traders seeking diverse instrument access and high-leverage opportunities, though specific user profiling data isn't available. Improvement opportunities likely exist across transparency, customer service, and regulatory compliance dimensions based on the overall assessment framework.

Conclusion

This comprehensive Ids International review reveals a broker with moderate capabilities but significant limitations in key areas affecting trader confidence and security. The platform offers reasonable asset diversity with over 30 forex pairs, CFDs, indices, and precious metals, supported by the reliable MT4 and MT Mobile trading infrastructure. However, the absence of strict regulatory oversight represents a fundamental concern that substantially impacts the overall assessment.

The broker appears most suitable for experienced traders who prioritize instrument diversity and high-leverage opportunities while accepting higher regulatory risk. The moderate user rating of 3.66 and 66% employee recommendation rate suggest operational competency, but trust issues stemming from limited regulatory compliance and transparency significantly constrain broader market appeal.

Key advantages include diverse trading instruments and proven platform technology, while primary disadvantages encompass regulatory uncertainty, limited transparency regarding trading conditions, and insufficient customer service information. Potential users should carefully consider these factors against their individual risk tolerance and trading requirements before engagement.