Is IDS International safe?

Pros

Cons

Is IDS International Safe or Scam?

Introduction

In the ever-evolving landscape of the forex market, IDS International has emerged as a player, attracting the attention of both novice and experienced traders. As an offshore broker, it positions itself as a gateway to various trading opportunities. However, the nature of offshore brokers often raises red flags, making it imperative for traders to exercise caution. This article aims to provide a comprehensive analysis of IDS International, exploring its regulatory standing, company background, trading conditions, and customer experiences. The assessment is based on a thorough review of available information, including user feedback and expert opinions, ensuring a balanced perspective on whether IDS International is safe or potentially a scam.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is crucial in determining its legitimacy and the safety of client funds. IDS International claims to operate from Saint Vincent and the Grenadines, a jurisdiction notorious for its lack of stringent regulations in the financial sector. This raises concerns about the broker's accountability and operational transparency.

The following table summarizes the core regulatory information for IDS International:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of a regulatory license signifies a significant risk for traders. Legitimate brokers are usually overseen by reputable regulatory bodies, which enforce compliance with financial standards and provide a safety net for investors. In the case of IDS International, the lack of regulation means that clients have no recourse in the event of disputes or financial mishaps. This absence of oversight is a major indicator that IDS International is not safe for trading.

Company Background Investigation

Founded in 2019, IDS International operates under the ownership of IDS International Ltd., which is registered in Saint Vincent and the Grenadines. The company's history is relatively short, and it lacks the established reputation that many traders seek in a broker. The management team behind IDS International remains largely anonymous, with limited information available about their backgrounds and expertise in the financial industry.

Transparency is a critical factor for trust in any financial service provider, and the lack of detailed information regarding the management team raises questions about the broker's credibility. Without knowing who is at the helm, traders are left vulnerable to potential fraud or mismanagement. Given these factors, it is prudent to conclude that IDS International is not a safe choice for traders seeking a reliable and transparent trading environment.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. IDS International offers a range of trading instruments, including forex pairs, commodities, and indices, but the specifics of their trading costs are not clearly defined. The broker advertises competitive spreads and leverage options, yet lacks transparency regarding their fee structures and potential hidden costs.

The following table compares the core trading costs associated with IDS International against the industry average:

| Cost Type | IDS International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.5% |

The spread for major currency pairs at 2.5 pips is notably higher than the industry average, which may eat into traders' profits. Additionally, the absence of a clear commission structure raises concerns about potential hidden fees that could be levied on trades. Such discrepancies in trading conditions suggest that IDS International may not be a safe broker for those looking to maximize their trading efficiency.

Client Fund Security

The security of client funds is paramount when assessing a forex broker. IDS International does not provide clear information regarding its fund safety measures. There are no indications of segregated accounts, which are essential for protecting client deposits from being misused by the broker. Furthermore, the lack of investor protection schemes in Saint Vincent and the Grenadines leaves traders exposed to the risk of losing their funds without any means of recovery.

The absence of negative balance protection is another critical issue. This policy is designed to prevent traders from losing more than their initial investment, a safeguard that reputable brokers typically offer. Without such protections, clients of IDS International could face significant financial risks, leading to the conclusion that IDS International is not safe for trading.

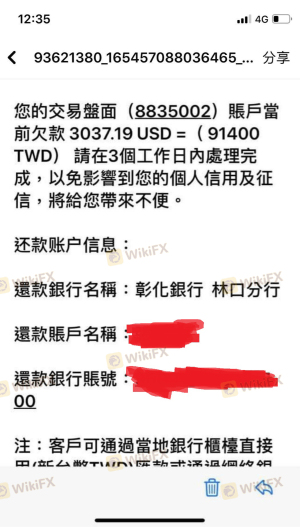

Customer Experience and Complaints

Customer feedback is a vital component in evaluating the reliability of a broker. A review of user experiences with IDS International reveals a troubling pattern of complaints. Many traders have reported difficulties in withdrawing funds, with claims that the broker has delayed or denied withdrawal requests.

The following table highlights the primary complaint types and their severity ratings:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

Case studies from users indicate that traders have experienced significant frustration when attempting to access their funds, leading to allegations of potential scams. These recurring issues suggest that IDS International may not be a safe option for traders who prioritize reliable customer service and prompt access to their investments.

Platform and Trade Execution

The trading platform offered by IDS International is MetaTrader 4 (MT4), a widely recognized platform known for its robust features and user-friendly interface. However, the overall performance and execution quality provided by IDS International remain questionable. Reports from users indicate potential issues with trade execution, including slippage and rejections, which can severely impact trading outcomes.

Moreover, the lack of transparency regarding order execution policies raises concerns about possible platform manipulation. Traders expect fair and efficient execution, and any signs of irregularities could indicate that IDS International is not a safe broker for serious traders.

Risk Assessment

Using IDS International carries an array of risks that potential traders must consider. The lack of regulation, transparency, and security measures significantly heightens the overall risk profile associated with this broker.

The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection from regulatory authorities. |

| Fund Safety Risk | High | Lack of segregated accounts and investor protection. |

| Customer Support Risk | Medium | Poor response times and unresolved complaints. |

| Execution Risk | High | Reports of slippage and execution issues. |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and avoid investing significant sums until they can verify the safety and reliability of the platform.

Conclusion and Recommendations

In conclusion, the evidence suggests that IDS International is not a safe broker for forex trading. The lack of regulation, transparency issues, and numerous customer complaints indicate a high risk of potential fraud. Traders should exercise extreme caution when considering this broker and explore alternative options that provide robust regulatory oversight and a proven track record of reliability.

For those seeking safer trading environments, it is advisable to choose brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically offer better protection for client funds, transparent fee structures, and reliable customer support, ensuring a more secure trading experience.

Is IDS International a scam, or is it legit?

The latest exposure and evaluation content of IDS International brokers.

IDS International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IDS International latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.