ice fx 2025 Review: Everything You Need to Know

Abstract

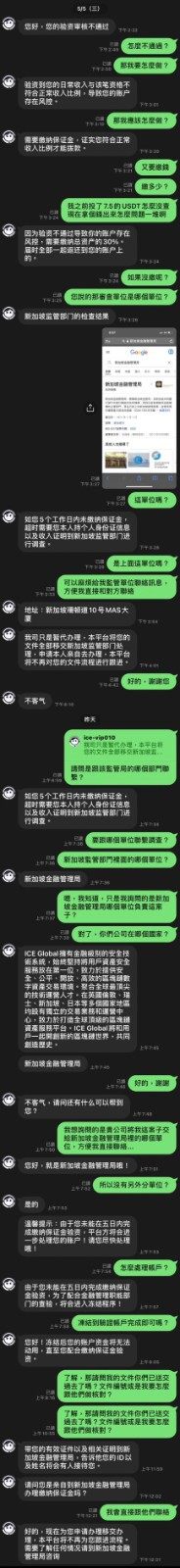

ICE FX is a forex broker that started in 2015. It operates from Labuan, Malaysia, and the Labuan Financial Services Authority regulates it. This broker offers clients a 100% A-book model where they hedge all client positions against external counterparties. The trading environment uses the popular MetaTrader 4 platform, which provides easy and flexible tools to trade over 94 instruments including forex, precious metals, cryptocurrencies, and CFD commodities. ICE FX offers attractive features like spreads as low as 0.0 and high leverage up to 1:500, making it appealing for traders who want diverse trading tools and high-leverage opportunities. However, concerns remain about its regulatory framework and customer support quality. User ratings average around 8/10, though some clients worry about the broker's transparency and risk management practices. This detailed ice fx review uses user feedback and public information to give you an objective analysis of what ICE FX offers and the potential challenges you might face when using this broker.

Important Disclaimers

ICE FX is regulated by the Labuan Financial Services Authority. The regulatory environment in Labuan is different from other regions, which may expose clients to higher risks compared to brokers under stricter international regulation. This review combines user feedback and publicly available data from various sources. Users should know that opinions on the broker's operational practices, customer service response, and trading conditions vary significantly. While this review aims to provide a balanced perspective, you should conduct personal research and consider your individual trading needs before engaging with ICE FX. Differences in user experiences may exist, and some reported details might have changed since the initial publication of the available information.

Score Framework

Broker Overview

ICE FX was founded in 2015 and has quickly become a notable player in the forex brokerage industry due to its commitment to a 100% A-book model. The broker is headquartered in Labuan, Malaysia, and hedges all client positions with external counterparties. This business model allows ICE FX to provide direct market access without conflict of interest, which sets it apart from brokers who operate on a B-book model. Despite being relatively new, ICE FX has found its place by focusing on transparency and offering competitive trading conditions, such as low spreads starting at 0.0 and a high maximum leverage of 1:500. However, potential clients should be mindful of the regulatory framework under which ICE FX operates, as being regulated by the Labuan Financial Services Authority may not give the same level of confidence as regulation from more established international bodies.

The broker supports the widely used MetaTrader 4 platform, which enhances its appeal among traders familiar with this user-friendly software. ICE FX offers a diverse range of 94 trading instruments spanning major, minor, and exotic currency pairs, as well as precious metals, cryptocurrencies, and CFDs on various assets. This extensive range serves both new and experienced traders looking for multiple trading opportunities. The combination of low spreads, high leverage, and a variety of asset classes forms the core appeal of ICE FX, yet the broker's operational details, such as its deposit and withdrawal policies and customer support quality, need careful consideration. This section of the ice fx review provides essential context and insights to help traders understand the advantages and limitations of choosing ICE FX as their trading partner.

ICE FX is regulated by the Labuan Financial Services Authority, which creates a regulatory framework that is more flexible than many other jurisdictions. This relatively lenient regulatory environment provides a more adaptable operational structure, although it may not meet the strict standards of other regulators. In terms of deposit and withdrawal methods, ICE FX offers multiple options for transactions; however, fees associated with these methods can be relatively high, and specific options are not fully detailed in the available information . The minimum deposit requirement is another area where details are limited, as such specifics have not been clearly outlined in any of the available information.

Bonus promotions or incentives are also not mentioned in the publicly available data, which adds uncertainty for traders looking for additional benefits beyond standard trading conditions. Regarding tradable assets, ICE FX provides an impressive menu of 94 instruments that span across forex pairs, precious metals, cryptocurrencies, and CFDs. The cost structure is competitive, with spreads as low as 0.0, although there is little clarity regarding commission fees or any hidden charges, leaving room for further inquiry. The broker offers a maximum leverage ratio of up to 1:500, which could appeal to traders seeking highly leveraged positions in volatile markets.

Platform selection centers around the MetaTrader 4 platform, known for its robust analytical tools, technical indicators, and charting capabilities. MT4 supports automated trading and a wide array of functions, making it a popular choice among global traders. Information on regional restrictions or on the languages in which customer support is offered has not been provided, potentially limiting accessibility for some clients. Overall, while ICE FX shows several attractive features, these gaps highlight the importance of due diligence for prospective users. This section of the ice fx review consolidates the available details to provide a comprehensive overview of the broker's operational parameters.

Detailed Score Analysis

2.6.1 Account Conditions Analysis

The account conditions provided by ICE FX reflect a mixed bag of advantages and unclear details. One of the major selling points is the broker's offering of spreads as low as 0.0, which is particularly attractive for active traders looking to reduce transaction costs. However, information regarding additional fees such as commissions or the minimum deposit amount remains unclear within the available data. The account opening process appears to be straightforward, with users reporting that the application and verification process is relatively simple. Despite this, specific account types and any additional account features—such as Islamic accounts—are not clearly stated in the available material. In comparison to other brokers, ICE FX's low spreads and the potential for high leverage stand out as competitive offerings. Yet, the absence of detailed information on deposit requirements and fee structures has led to different opinions among users, some of whom appreciate the low-cost trading environment while others feel uneasy about hidden costs. This balanced perspective is important in this ice fx review to ensure that traders are fully informed about the potential risks and benefits before opening an account.

ICE FX provides a diverse suite of trading instruments, boasting a total of 94 tradable assets that include currency pairs, precious metals, cryptocurrencies, and CFDs on various commodities. This broad range ensures that traders have access to multiple markets for diversified trading strategies. The quality and variety of the trading tools are rated highly by many users, who appreciate the flexibility and depth of the available instruments. However, while the platform supports a wide variety of instruments, details on the provision of research tools, educational resources, and advanced analysis modules are not clearly mentioned in the source material. The MetaTrader 4 platform itself comes equipped with comprehensive charting tools, numerous technical indicators, and the potential for automated trading, which are critical for both new and experienced traders. Although these features align with industry standards, the lack of additional educational support may be seen as a drawback for less experienced investors seeking guidance in a dynamic trading environment. Overall, despite some gaps in additional resources, ICE FX delivers substantial trading tools that meet the demands of a wide-ranging client base—a sentiment that is consistently noted in this ice fx review.

2.6.3 Customer Service and Support Analysis

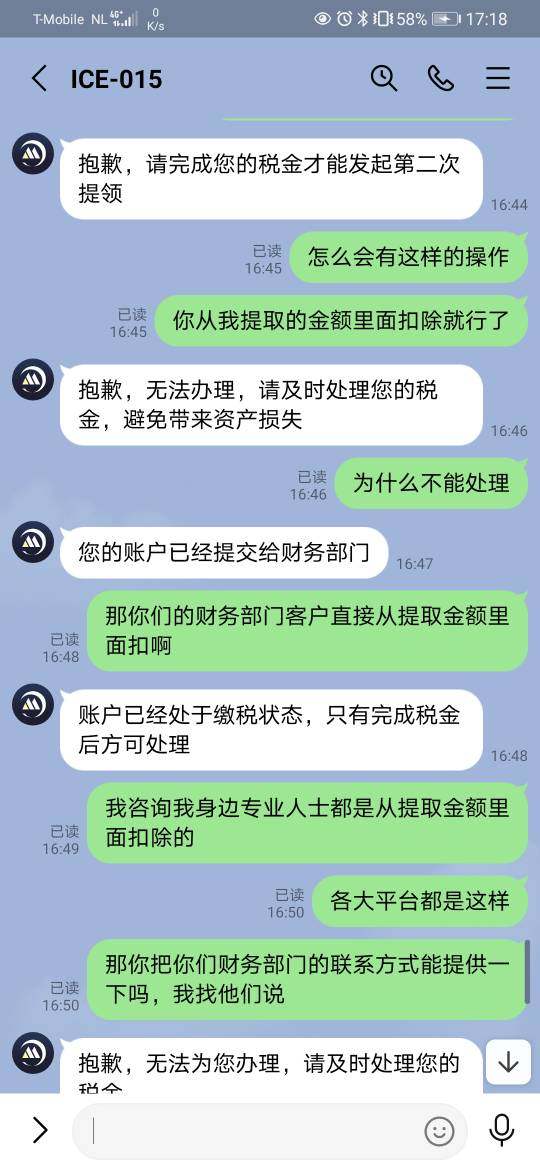

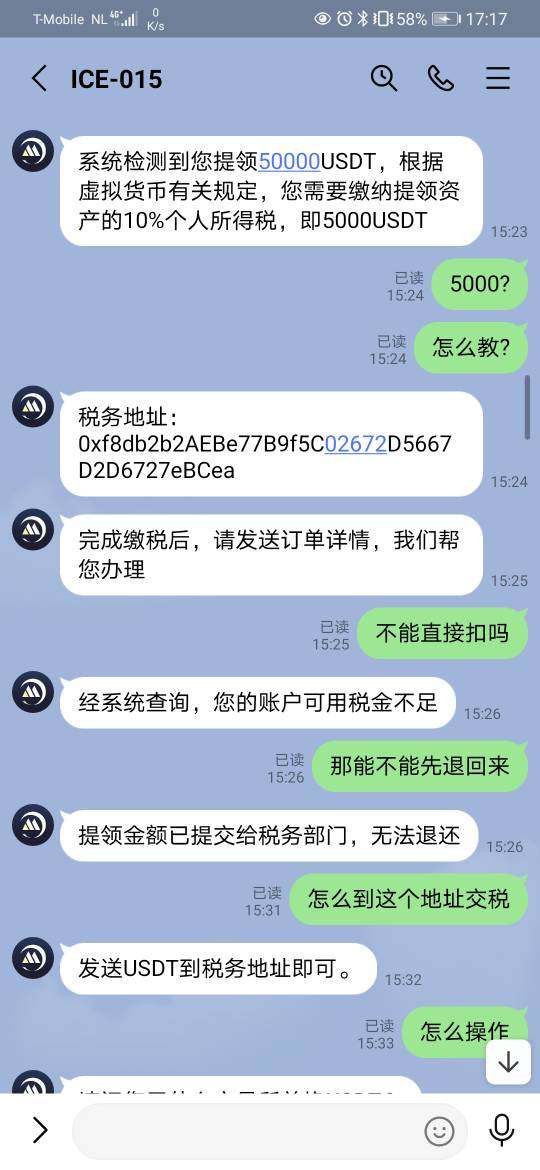

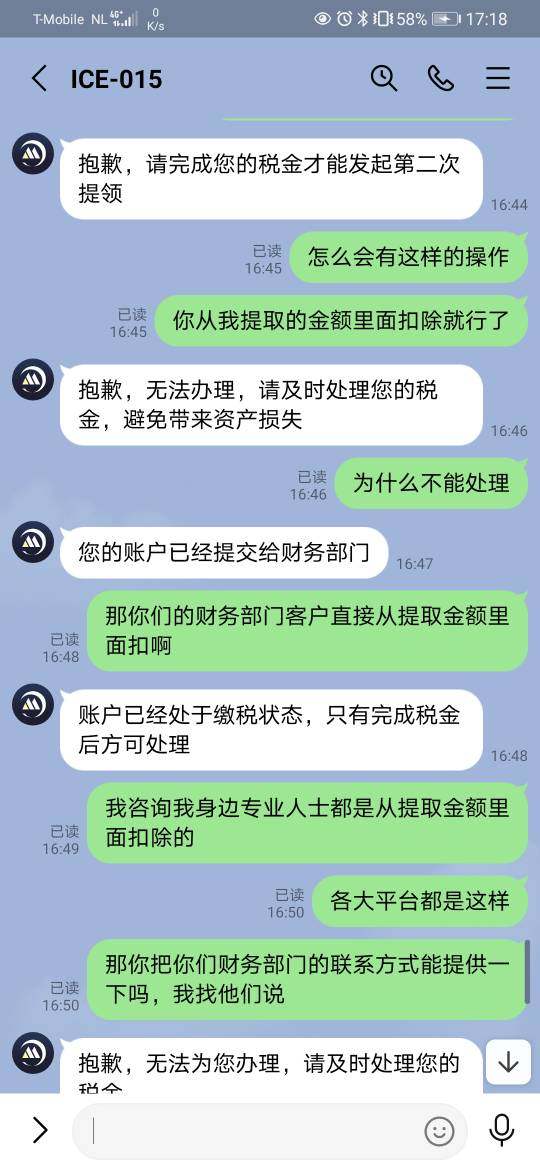

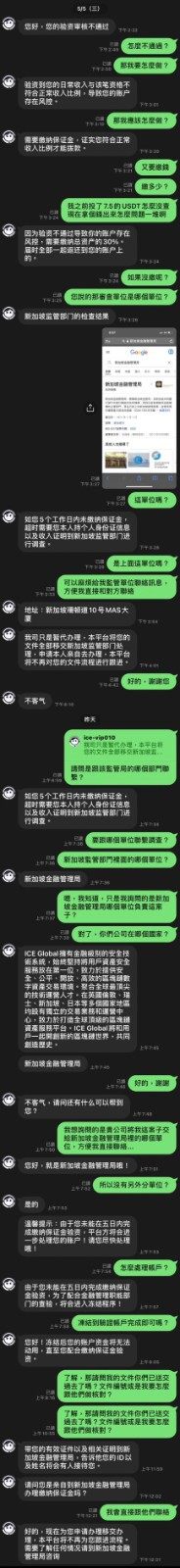

Customer service is a critical component of any trading platform, and the feedback on ICE FX's support team is notably mixed. While the broker offers multiple channels for communication, including phone and email, several users have reported dissatisfaction with response times and the quality of problem resolution. In many instances, clients have described delays and a perceived lack of proactive support in addressing their issues, which could be particularly harmful during volatile market conditions. Furthermore, there is a lack of clarity regarding the operational hours and the languages available for customer support, which poses challenges for non-English speaking traders or those in different time zones. Some users have expressed that while the representatives are generally polite, the overall efficiency and expertise seem inconsistent. These inconsistencies highlight the importance of having reliable customer service, particularly in an industry where rapid decision-making is essential. In this analysis, the mixed reviews, which include both positive and negative experiences, are presented to provide a balanced view—one that is crucial for any comprehensive ice fx review. It is recommended that prospective traders take these concerns into account when deciding on a broker that aligns with their support expectations.

2.6.4 Trading Experience Analysis

The trading experience on ICE FX is an essential point of analysis and generally reflects a moderately positive outlook among users. The broker's platform, powered by MetaTrader 4, is widely recognized for its intuitive interface and rich set of features, including multiple technical indicators and charting tools. Users have noted that the platform is stable under most market conditions and that order execution is generally smooth. However, some traders have reported occasional slippage, which can be a concern during periods of high volatility. Despite these occasional issues, the majority of feedback indicates that the platform's functionality supports a seamless trading experience, allowing for both manual and automated trading strategies. Additionally, the availability of diverse asset classes enables traders to implement varied risk management strategies. It is noteworthy that while most technical performance aspects are robust, improvements in execution speed and minimizing slippage could further improve the overall trading environment. This nuanced view, based on user experiences, is reflected here as part of our detailed ice fx review. Ultimately, while ICE FX provides a satisfactory trading experience, continuous improvements in execution quality would be beneficial for those trading high volumes or during peak market movements.

2.6.5 Trustworthiness Analysis

Trust and transparency are extremely important in selecting a forex broker. ICE FX is regulated by the Labuan Financial Services Authority, which provides a degree of oversight; however, this regulatory body is often viewed as more lenient compared to other major regulators. As a result, several users express concerns regarding the overall trustworthiness of the broker. There are noticeable gaps in the transparency of ICE FX's operational procedures, including the absence of detailed information about commission structures, the minimum deposit requirements, and specific funds protection measures. Additionally, questions remain about the disclosure of client fund segregation practices and company financials, elements that contribute directly to a broker's credibility. While some market participants take comfort in the relatively smooth trading experience and competitive spreads offered, others advise caution and recommend that additional due diligence be performed prior to account creation. The mixed user feedback and the absence of comprehensive security measures highlight potential vulnerabilities. Such issues are a critical component of this ice fx review, underscoring the need for traders to weigh the attractive trading conditions against the inherent regulatory and transparency limitations when deciding whether to proceed.

2.6.6 User Experience Analysis

User experience plays a vital role in evaluating any forex broker, and ICE FX presents a blend of strengths and areas for improvement. Most users praise the intuitive design of the MT4 trading platform, which is known for its clear layout and robust functionality. The registration and account verification processes are generally straightforward, contributing to an overall positive initial experience. However, concerns remain regarding the ease and efficiency of deposit and withdrawal procedures, with several clients reporting delays and higher-than-expected fees associated with these transactions. Additionally, while the platform's interface scores well in terms of design and ease-of-use, inconsistencies in customer support and the lack of detailed information on multilingual support have led some users to express frustration. The variability of experiences—where some traders enjoy a smooth operational flow and others face occasional technical or administrative hurdles—results in an overall user satisfaction rating that is moderate. This comprehensive account of user feedback serves as an essential part of our detailed ice fx review, offering insights that can help potential clients set realistic expectations and identify areas where the broker might enhance its service offering.

Conclusion

In summary, ICE FX presents a competitive environment for traders with its extensive range of 94 trading instruments, low spreads starting at 0.0, and high leverage up to 1:500. The broker's use of the robust MetaTrader 4 platform further enhances its appeal, especially for traders who value diversified trading tools. However, lingering concerns regarding its regulatory oversight, transparency, and inconsistent customer service quality cannot be overlooked. ICE FX is best suited for intermediate to advanced traders who can manage the inherent risks while leveraging the broker's high-leverage opportunities. This ice fx review encourages potential clients to conduct thorough due diligence and consider their unique trading needs before engaging with ICE FX.