Redimax 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Redimax review presents a thorough analysis of a forex broker that has gained attention in 2025. Unfortunately, this attention is not for positive reasons. Based on available user feedback and regulatory information, Redimax operates under the supervision of the Dubai Financial Services Authority. This provides some level of regulatory oversight, but the broker faces major concerns about safety, legitimacy, and user satisfaction.

The platform targets forex traders who want international trading opportunities. However, potential clients should be extremely careful when considering this broker. According to WikiFX monitoring data, Redimax has received mixed reviews from users, with a concerning pattern of negative feedback and safety warnings showing up repeatedly. The broker's website has reportedly triggered security warnings for some visitors. This raises immediate red flags about the platform's reliability and trustworthiness.

While Redimax positions itself as an international forex trading platform, the lack of comprehensive information about its services significantly undermines its credibility. The missing details about trading conditions and operational transparency make it hard to trust this broker in the competitive forex market.

Important Notice

This Redimax review is based on publicly available information and user feedback collected from various sources as of 2025. Readers should note that regulatory frameworks and broker services may vary significantly across different jurisdictions. The Dubai Financial Services Authority regulation mentioned applies specifically to certain operational aspects. However, it may not extend comprehensive protection to all international clients.

Our evaluation methodology incorporates user reviews, regulatory status verification, and available operational data. Given the limited transparency from the broker itself, some assessments are based on the absence of information rather than comprehensive disclosure. Potential traders are strongly advised to conduct independent research and consider multiple sources before making any trading decisions.

Rating Framework

Broker Overview

Redimax presents itself as an international forex trading platform. However, comprehensive background information about the company's establishment date and founding history remains notably absent from public records. The broker operates in the competitive foreign exchange market, attempting to serve traders seeking access to currency pair trading opportunities. The lack of detailed company information and transparent operational history raises immediate concerns about the platform's legitimacy and long-term stability.

The broker's business model appears to focus primarily on forex trading services. However, specific details about their operational approach, technology infrastructure, and market-making versus ECN execution remain unclear. This lack of transparency is particularly concerning in an industry where operational clarity is essential for trader confidence and regulatory compliance.

From a regulatory perspective, Redimax claims supervision under the Dubai Financial Services Authority. This provides some level of oversight, but the extent of this regulation and its practical implications for international traders require careful consideration. The DFSA regulation may not offer the same level of protection that traders might expect from more established regulatory jurisdictions such as the FCA, ASIC, or CySEC. This Redimax review emphasizes the importance of understanding these regulatory limitations before engagement.

Regulatory Jurisdiction: Redimax operates under Dubai Financial Services Authority supervision. However, the specific license details and regulatory protections remain unclear from available public information.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been disclosed in readily available sources. This represents a significant transparency concern for potential traders.

Minimum Deposit Requirements: The broker has not clearly communicated minimum deposit requirements. This makes it difficult for potential clients to understand entry-level investment requirements.

Promotional Offers: Details about bonuses, promotions, or incentive programs are not readily available. This suggests either limited promotional activities or poor communication of available offers.

Available Trading Assets: The platform appears to focus primarily on forex trading. However, the specific range of currency pairs, exotic options, and additional asset classes remains undisclosed.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs has not been transparently communicated. This makes cost comparison with other brokers impossible.

Leverage Ratios: Specific leverage offerings and their variations across different account types and asset classes remain undisclosed in available documentation.

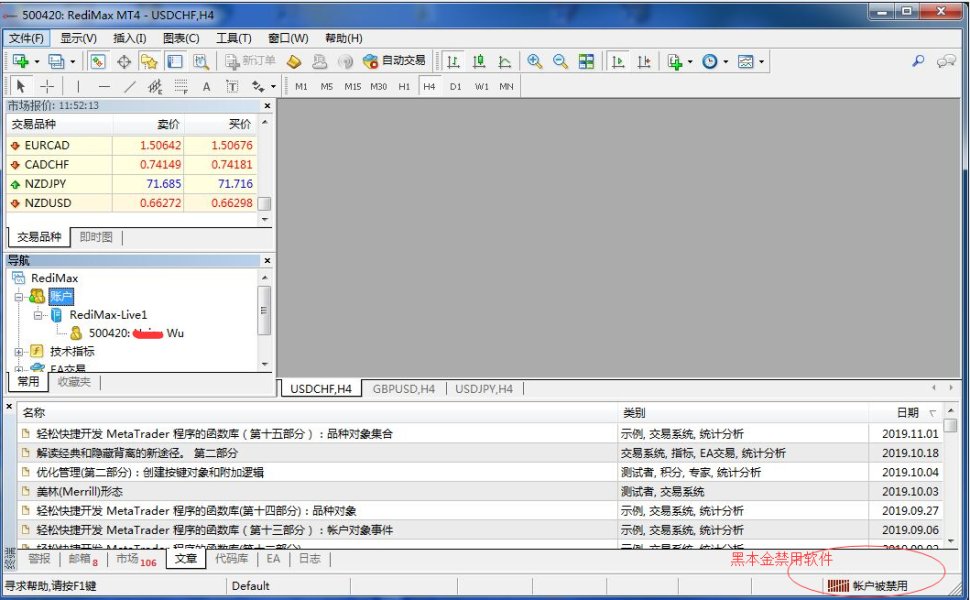

Platform Options: Information about available trading platforms, including MetaTrader integration, proprietary platforms, or mobile applications, is notably absent from public sources.

Geographic Restrictions: The broker has not clearly outlined which jurisdictions are restricted or accepted for account opening and trading activities.

Customer Support Languages: Available language support for customer service has not been specified in accessible materials. This Redimax review highlights the concerning lack of basic operational transparency that potential traders should expect from legitimate brokers.

Detailed Rating Analysis

Account Conditions Analysis (1/10)

The account conditions offered by Redimax represent one of the most concerning aspects of this broker's service offering. The complete absence of detailed information about account types, minimum deposit requirements, and specific trading conditions immediately raises red flags about the platform's transparency and professionalism. Legitimate forex brokers typically provide comprehensive account specifications, including various account tiers, minimum funding requirements, and clear terms of service.

The lack of information about account opening procedures, verification requirements, and documentation standards suggests either poor operational organization or deliberate hiding of important trading conditions. Professional traders require detailed understanding of account specifications to make informed decisions about broker selection. Redimax's failure to provide this basic information represents a significant operational deficiency.

Furthermore, the absence of information about special account features, such as Islamic accounts, professional trader classifications, or institutional service offerings, indicates limited service sophistication. Modern forex brokers typically offer diverse account structures to accommodate different trading styles and regulatory requirements. Redimax's apparent lack of such offerings suggests limited operational capabilities.

User feedback regarding account conditions has been predominantly negative, with reports suggesting difficulty in obtaining clear information about trading terms and conditions. This Redimax review emphasizes that the lack of transparent account information should be considered a major warning sign for potential traders considering this platform.

The trading tools and resources available through Redimax represent another area of significant concern for potential traders. The broker has failed to provide comprehensive information about available analytical tools, research resources, or educational materials that modern traders expect from professional forex platforms. This absence of detailed tool specifications suggests either limited technological capabilities or poor communication of available services.

Professional forex trading requires access to sophisticated analytical tools, including technical indicators, charting capabilities, economic calendars, and market research. The lack of information about these essential trading resources indicates that Redimax may not offer the comprehensive toolkit necessary for serious forex trading activities. Additionally, the absence of educational resources, such as webinars, tutorials, or market analysis, suggests limited commitment to trader development and success.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, remains completely unspecified. Modern forex traders increasingly rely on automated strategies. The lack of information about such capabilities represents a significant limitation for advanced trading approaches.

The absence of mobile trading applications or comprehensive platform specifications further undermines the broker's technological credibility. In today's trading environment, mobile accessibility and cross-platform synchronization are essential features that professional brokers must provide to remain competitive.

Customer Service and Support Analysis (1/10)

Customer service and support capabilities represent critical factors in forex broker evaluation, and Redimax's performance in this area raises substantial concerns. The broker has not provided clear information about available customer support channels, response times, or service quality standards that traders can expect when requiring assistance.

Professional forex brokers typically offer multiple communication channels, including live chat, telephone support, email assistance, and comprehensive FAQ resources. The absence of detailed information about these support options suggests either limited customer service capabilities or poor communication of available services. Additionally, the lack of specified operating hours and multilingual support options indicates potential limitations in serving international client bases.

Response time commitments and service level agreements remain completely unspecified. This makes it impossible for potential traders to understand what level of support they can expect when encountering trading issues or requiring account assistance. This lack of service transparency represents a significant operational concern for traders who may require timely assistance during volatile market conditions.

User feedback regarding customer service has been notably negative, with reports suggesting difficulty in reaching support representatives and obtaining satisfactory resolution of trading issues. The absence of clear escalation procedures and complaint resolution processes further undermines confidence in the broker's customer service capabilities.

Trading Experience Analysis (1/10)

The trading experience offered by Redimax appears to fall significantly short of industry standards based on available information and user feedback. Platform stability, execution speed, and overall trading environment quality remain largely unspecified. This creates substantial uncertainty about the actual trading conditions that clients can expect.

Order execution quality represents a critical factor in forex trading success, and the absence of detailed information about execution speeds, slippage rates, and order processing capabilities raises immediate concerns about trading performance. Professional traders require reliable execution during volatile market conditions. Redimax's failure to provide transparent execution statistics suggests potential limitations in trading infrastructure.

Platform functionality and user interface quality remain completely undocumented. This makes it impossible to assess the broker's technological capabilities. Modern forex trading requires sophisticated platform features, including advanced charting, multiple order types, and seamless trade management tools. The lack of platform specifications indicates either limited technological development or poor communication of available features.

Mobile trading capabilities and cross-device synchronization have not been addressed in available materials, representing a significant limitation in today's mobile-first trading environment. Additionally, the absence of information about trading environment features such as one-click trading, partial position closing, and advanced order management suggests limited platform sophistication. This Redimax review emphasizes that the poor trading experience indicators should be carefully considered by potential traders.

Trustworthiness Analysis (1/10)

Trustworthiness represents perhaps the most critical concern in this Redimax review, with multiple factors contributing to significant doubts about the broker's reliability and legitimacy. While the broker claims regulation under the Dubai Financial Services Authority, the specific license details, regulatory protections, and compliance standards remain unclear from publicly available information.

The regulatory framework provided by DFSA may not offer the same level of trader protection that clients might expect from more established regulatory jurisdictions. Additionally, the lack of transparent information about client fund segregation, deposit insurance, and regulatory compliance procedures raises substantial concerns about financial security and operational integrity.

Company transparency represents another significant concern, with limited information available about corporate structure, ownership, management team, and operational history. Legitimate forex brokers typically provide comprehensive corporate information to build client confidence and demonstrate operational credibility. Redimax's failure to provide such transparency suggests potential concerns about corporate legitimacy.

User feedback and third-party reviews have highlighted safety concerns, with some reports indicating that the broker's website triggers security warnings for visitors. These technical security issues, combined with negative user experiences, contribute to substantial doubts about the platform's overall trustworthiness and operational integrity. The absence of positive industry recognition or awards further undermines confidence in the broker's reputation and standing within the forex community.

User Experience Analysis (1/10)

User experience represents the culmination of all operational aspects, and Redimax's performance in this area reflects the cumulative impact of the various deficiencies identified throughout this review. Overall user satisfaction appears to be extremely low based on available feedback and rating information. Predominant negative experiences have been reported across multiple review platforms.

Interface design and platform usability remain largely undocumented, though user feedback suggests significant challenges in navigation and platform functionality. Modern forex traders expect intuitive, responsive, and feature-rich trading interfaces that facilitate efficient trade execution and portfolio management. The apparent limitations in platform design and functionality contribute to poor overall user satisfaction.

Registration and account verification processes have reportedly been problematic for users, with unclear requirements and extended processing times creating frustration and delays. Professional forex brokers typically maintain streamlined onboarding processes with clear documentation requirements and reasonable processing timeframes.

Fund management experiences, including deposit and withdrawal processes, appear to be particularly problematic based on user feedback. Traders require reliable, efficient, and transparent fund management capabilities. The reported difficulties in these areas represent serious operational deficiencies.

Common user complaints center around platform reliability, customer service responsiveness, and overall transparency concerns. The pattern of negative feedback suggests systemic operational issues rather than isolated incidents. This indicates fundamental problems with the broker's service delivery capabilities.

Conclusion

This comprehensive Redimax review reveals significant concerns across all evaluated aspects of the broker's operations. With consistently low ratings across account conditions, tools and resources, customer service, trading experience, trustworthiness, and user experience, Redimax fails to meet the standards expected from professional forex brokers in 2025.

While the broker claims regulatory supervision under the Dubai Financial Services Authority, the lack of transparency, poor user feedback, and numerous operational deficiencies suggest that potential traders should exercise extreme caution when considering this platform. The absence of detailed information about trading conditions, platform capabilities, and corporate structure represents fundamental transparency failures. These failures undermine confidence in the broker's legitimacy and operational integrity.

For traders seeking reliable forex trading opportunities, numerous alternative brokers offer superior transparency, regulatory protection, and operational capabilities. The significant concerns identified in this review suggest that Redimax may not provide the secure, professional trading environment that serious forex traders require for successful market participation.