IAL 2025 Review: Everything You Need to Know

In this comprehensive review of IAL, we delve into the key features, user experiences, and expert opinions surrounding this forex broker. Established in 2020, IAL operates without regulatory oversight, raising significant concerns about its trustworthiness and reliability. Users have reported issues with fund withdrawals and customer service, leading to a generally negative perception of the broker.

Note: It is vital to recognize that different entities may operate under the IAL name across various regions, which can complicate the regulatory landscape. This review aims to provide a fair and accurate assessment based on multiple sources.

Ratings Overview

We evaluate brokers based on user feedback, expert analysis, and factual data.

Broker Overview

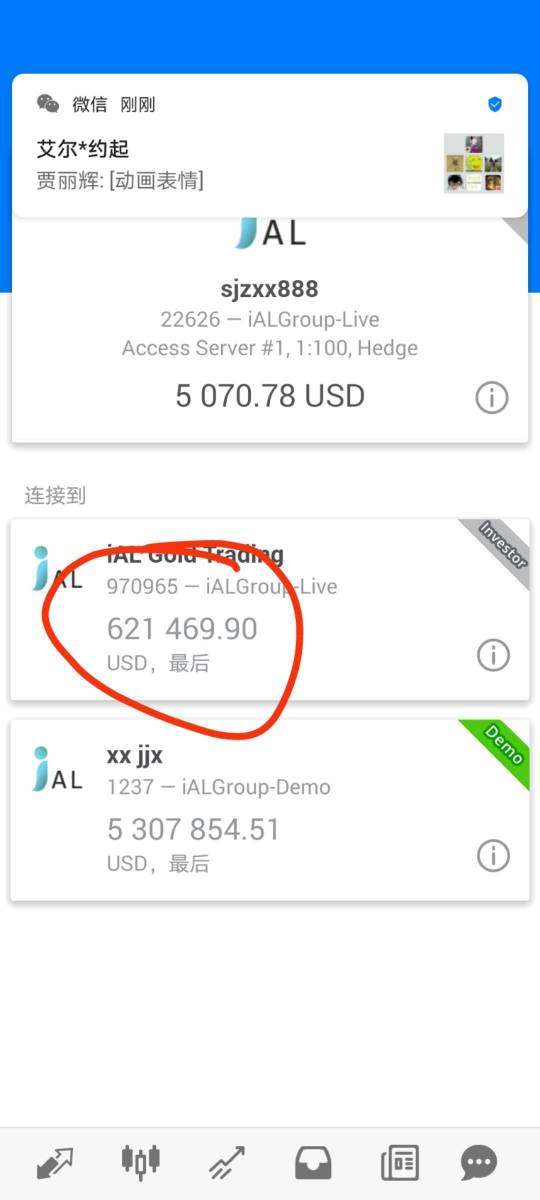

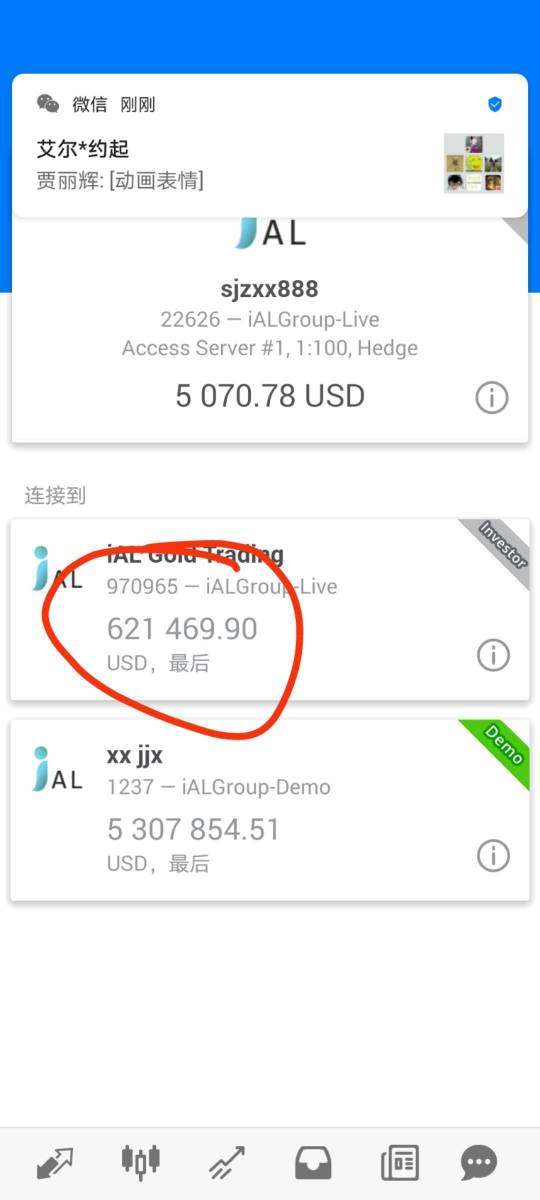

IAL, founded in 2020, is a forex broker based in Switzerland. The broker primarily operates on the MetaTrader 5 platform, which is renowned for its advanced trading tools and user-friendly interface. IAL offers a range of trading assets, including forex, stocks, and commodities. However, it is important to note that IAL is not regulated by any major financial authority, which raises significant concerns about the safety of funds and the overall trading environment.

Detailed Breakdown

Regulatory Environment

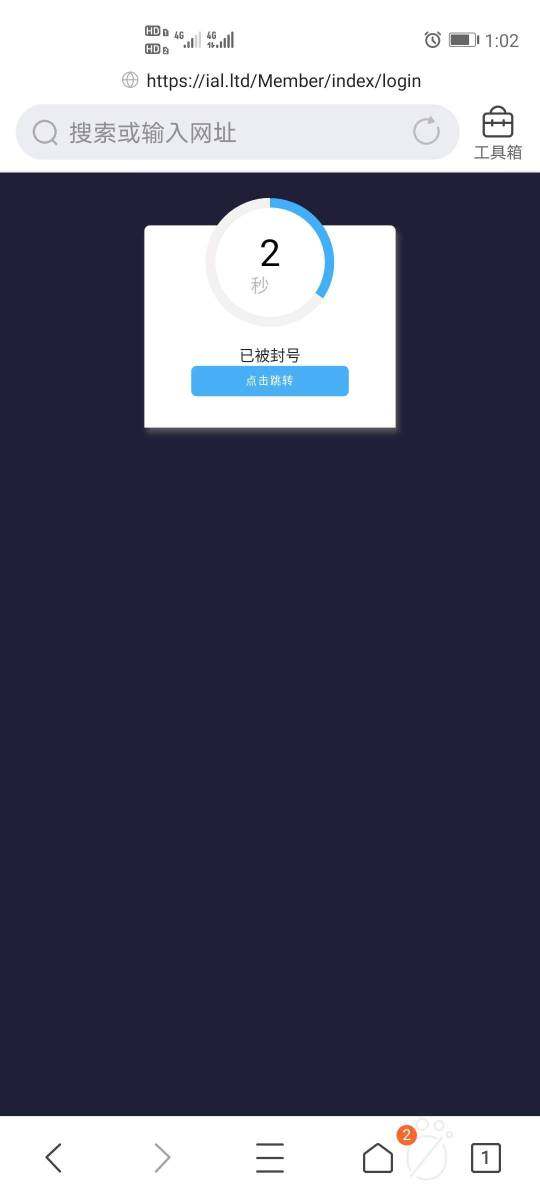

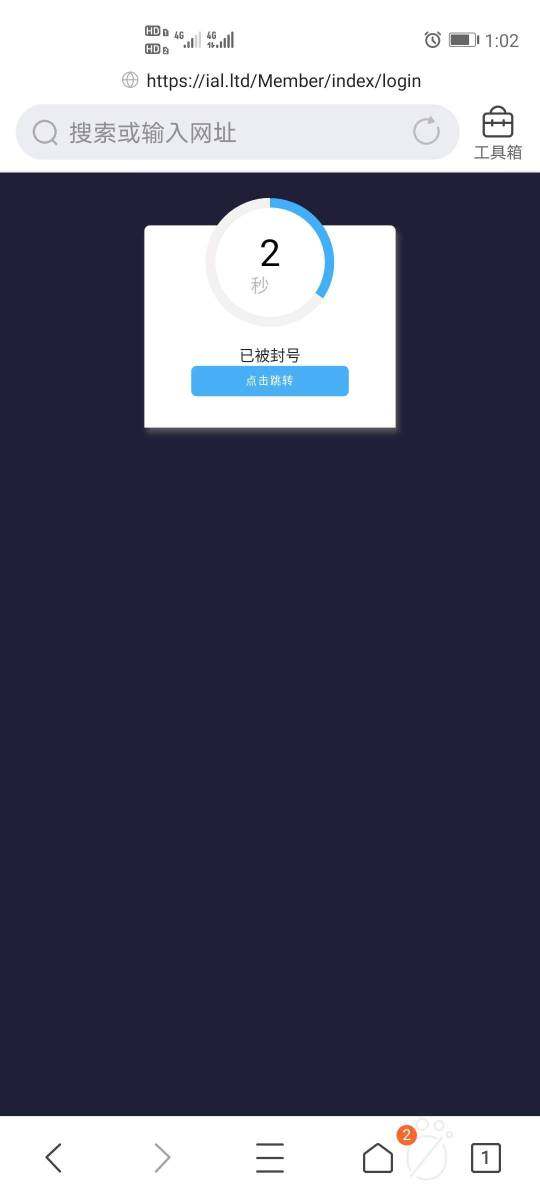

IAL operates without any regulatory oversight, which is a major red flag. According to the Swiss Financial Market Supervisory Authority (FINMA), IAL has been flagged for various compliance issues. This lack of regulation means that traders have very little recourse in case of disputes or problems with fund withdrawals.

Deposit and Withdrawal Methods

IAL appears to only accept bank transfers for both deposits and withdrawals, which may limit flexibility for some users. The minimum deposit requirement is reported to be $100, which is relatively standard in the industry.

There is little information available regarding bonuses or promotional offers from IAL. The absence of such incentives could be seen as a disadvantage when compared to other brokers that often provide bonuses to attract new clients.

Tradable Asset Classes

Users can trade a variety of assets on IAL, including forex pairs, stocks, and commodities. However, the limited range of assets compared to other brokers may deter some traders.

Cost Structure

IAL claims to offer competitive spreads starting from 0.7 pips on major currency pairs. However, without regulatory oversight, transparency regarding additional fees or commissions remains questionable.

Leverage

IAL offers a leverage ratio of up to 1:400, which is significantly higher than many competitors. While this may attract experienced traders, it poses considerable risks, especially for inexperienced ones who may not fully understand the implications of high leverage.

The primary trading platform for IAL is MetaTrader 5 (MT5), which is widely recognized for its robust features, including automated trading capabilities and a variety of technical indicators. However, the absence of a mobile app or support for other operating systems like iOS and Android is a significant limitation.

Restricted Regions

There is no clear information on specific regions where IAL operates or restricts trading. However, given its unregulated status, potential traders should exercise caution and conduct thorough research regarding local laws and regulations.

Customer Service Languages

IAL provides customer support in English, but users have reported long wait times and inadequate responses, contributing to a poor customer service experience.

Repeated Ratings Overview

Detailed Evaluation

-

Account Conditions: Users have reported issues with account management, including difficulties in withdrawing funds. The lack of regulation exacerbates these concerns, leading to a low score.

Tools and Resources: While MT5 is a powerful trading platform, the absence of mobile support and limited resources for beginners detracts from the overall offering.

Customer Service and Support: Customer service is a significant pain point for IAL. Users have described their experiences as frustrating, with long wait times and unhelpful responses.

Trading Experience: The trading experience is hindered by the lack of a mobile app and limited asset offerings. While MT5 provides advanced features, the outdated interface can be challenging for new traders.

Trustworthiness: The absence of regulatory oversight and multiple complaints about fund withdrawals contribute to a very low trust score.

User Experience: Overall user experience is marred by the issues mentioned above, leading to dissatisfaction among traders.

In conclusion, the IAL review highlights significant concerns regarding its regulatory status, customer service, and overall trustworthiness. Potential traders are advised to proceed with caution and consider more reputable alternatives that offer regulatory protection and better user experiences.