Executive Summary

This hui tong international review looks at a forex broker that has caused major concerns in the trading community since 2019. Hui Tong International currently holds a very low user rating of 1.00, according to WikiBit data, and traders have filed 21 complaints against them. WikiFX gives them a rating of 1.46 out of 10 and warns users to be extremely careful to avoid potential fraud.

The broker's poor performance and high number of complaints show serious problems that potential clients should think about carefully. The company says it serves investors who want to trade forex, but the negative feedback shows that traders should be very skeptical about this broker. The lack of clear regulatory information and transparent details makes things worse, so Hui Tong International is a high-risk choice for forex traders who want reliable services.

Important Notice

This review uses publicly available information and user feedback from sources like WikiBit and WikiFX platforms. The information does not include specific details about differences between regions or regulatory variations that may exist. Traders should do their own research and check all information independently before making investment decisions, especially given the concerning ratings and complaint history of this broker.

Rating Framework

Broker Overview

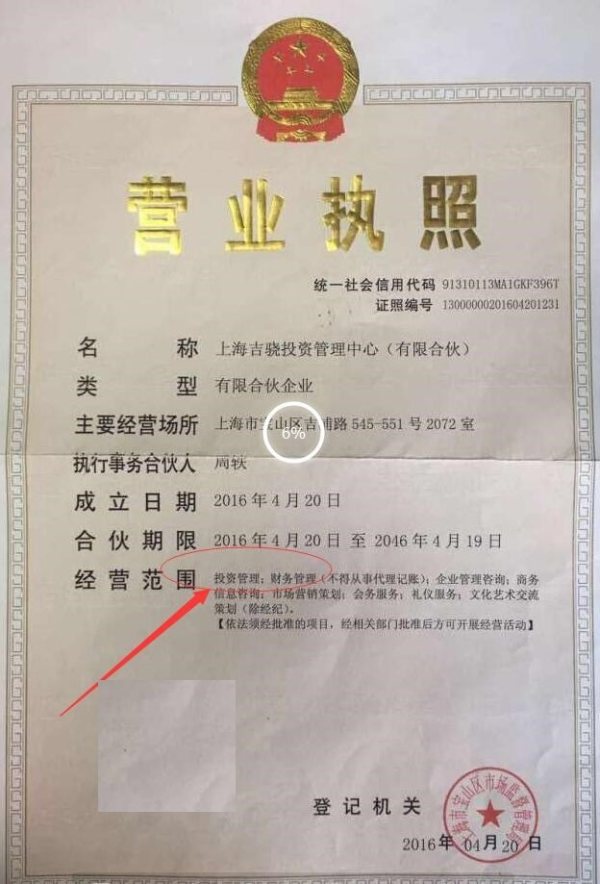

Hui Tong International started offering forex trading services in 2019. The broker has quickly built up a concerning track record that raises serious questions about how well it operates and the quality of its services, despite being relatively new. The company focuses on forex trading services, but specific details about its corporate structure, ownership, and background remain unclear in public information.

The broker's short history and poor performance show significant operational problems. Hui tong international review data from multiple platforms consistently points to major issues with service delivery, customer satisfaction, and overall reliability. The lack of detailed company background information, combined with alarming user feedback, shows a broker that fails to meet industry standards for transparency and service quality. This lack of corporate disclosure is especially concerning in an industry where trust and transparency are essential for protecting clients.

Regulatory Status: Available information does not specify which regulatory authorities oversee Hui Tong International's operations. This represents a significant red flag for potential traders seeking regulated forex services.

Deposit and Withdrawal Methods: The information does not detail specific funding options, processing times, or fees for deposits and withdrawals. This limits traders' ability to assess convenience and cost-effectiveness.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in available sources. This prevents potential clients from understanding the financial commitment required to begin trading.

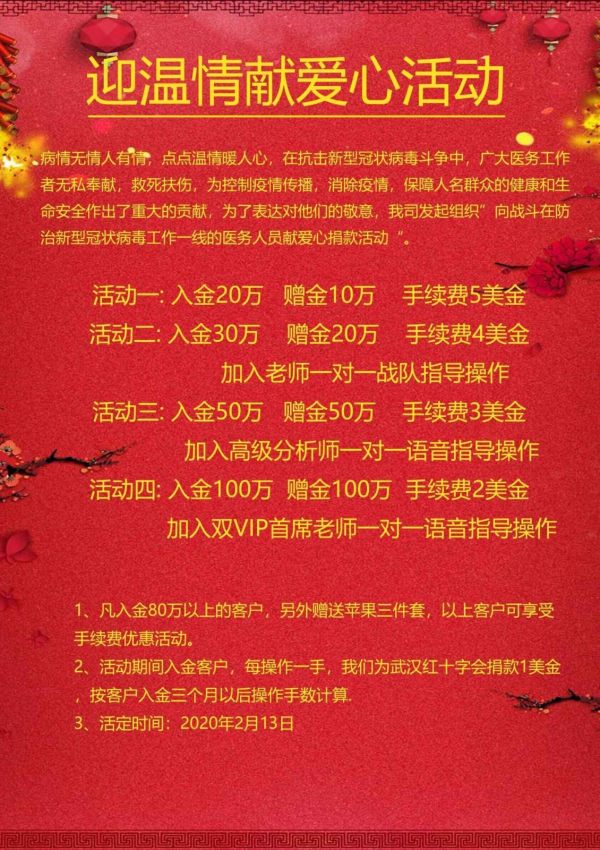

Promotional Offers: No information about bonuses, promotional campaigns, or special offers is available in the sources. This suggests limited marketing initiatives or poor disclosure practices.

Available Trading Assets: The broker appears to focus on forex trading, but the information does not specify the range of currency pairs, CFDs, or other financial instruments available. Traders cannot assess the variety of trading opportunities offered.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed in available sources. This makes cost comparison impossible.

Leverage Ratios: Specific leverage offerings are not mentioned. This prevents traders from assessing risk management options and trading flexibility.

Platform Options: Trading platform specifications, compatibility, and features are not detailed in the available information. This limits assessment of technological capabilities.

Geographic Restrictions: Information about regional limitations or restricted countries is not provided in the source materials.

Customer Support Languages: Available language options for customer service are not specified in the hui tong international review materials examined.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Hui Tong International's account conditions shows a concerning lack of transparency and detail. Available sources do not provide information about account types, their specific features, or the benefits offered to different trader categories. This absence of basic account information represents a significant problem, as reputable brokers typically offer clear descriptions of various account tiers, their minimum deposit requirements, and associated benefits.

The lack of information about account opening procedures, verification requirements, and special account features shows the broker's poor disclosure practices. Professional forex brokers typically provide comprehensive account documentation, including detailed terms and conditions, fee structures, and account-specific benefits. The absence of such fundamental information in this hui tong international review suggests either poor operational organization or deliberate lack of transparency.

Potential traders cannot make informed decisions about whether the broker's offerings align with their trading needs, risk tolerance, or investment goals without clear account condition details. This information gap, combined with the extremely low user ratings, indicates that the broker fails to meet basic industry standards for account condition transparency and client communication.

The assessment of trading tools and resources reveals another area where Hui Tong International falls short of industry expectations. Available information does not specify the types of trading tools, analytical resources, or educational materials provided to clients. Modern forex brokers typically offer comprehensive suites of trading tools including technical analysis indicators, economic calendars, market research, and automated trading capabilities.

The absence of detailed information about research and analysis resources is particularly concerning. These tools are essential for informed trading decisions. Professional brokers usually provide daily market analysis, economic forecasts, and expert commentary to support their clients' trading activities. The lack of such information suggests either minimal tool offerings or poor communication about available resources.

Educational resources represent another critical gap in available information. Reputable brokers typically offer extensive educational materials including webinars, tutorials, trading guides, and market analysis training. The absence of information about educational support indicates limited commitment to client development and success. No information is available about automated trading support, API access, or advanced trading tools that experienced traders often require.

Customer Service and Support Analysis

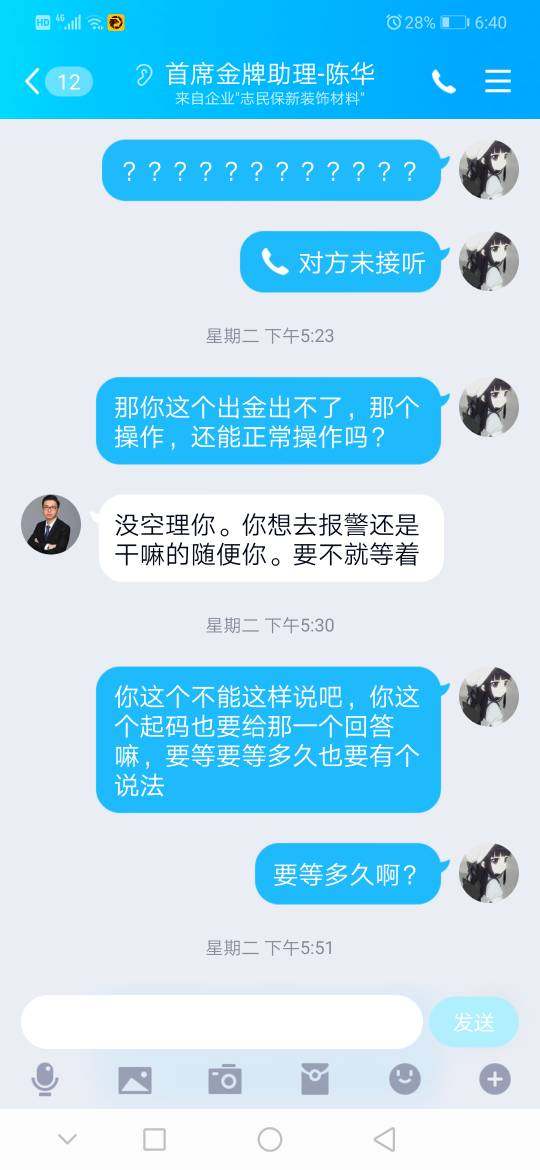

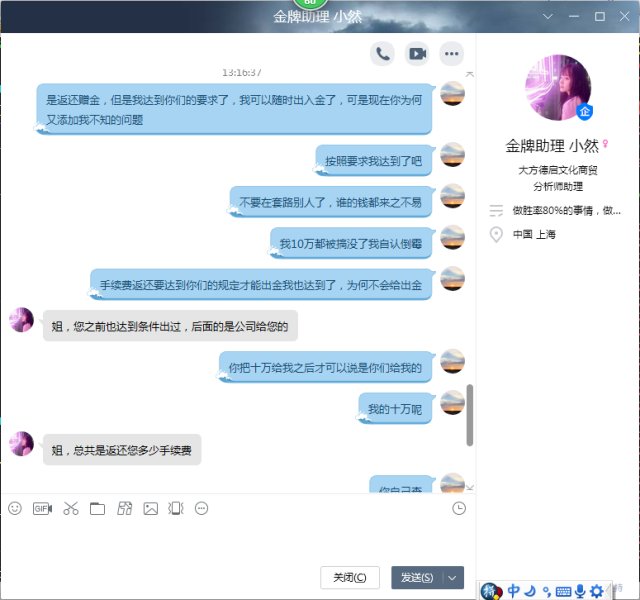

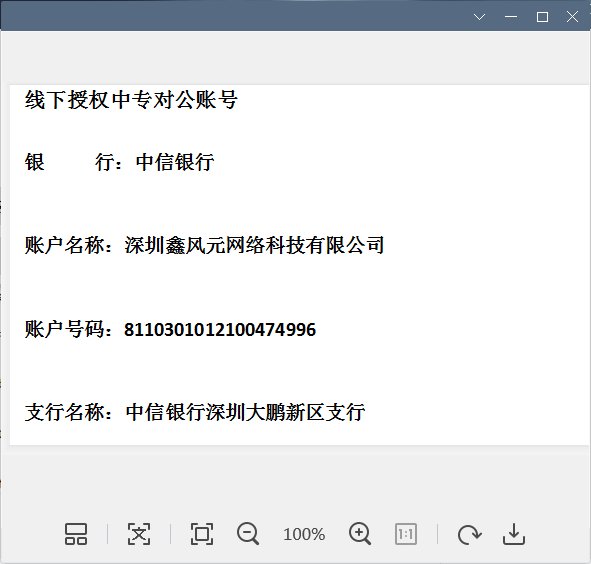

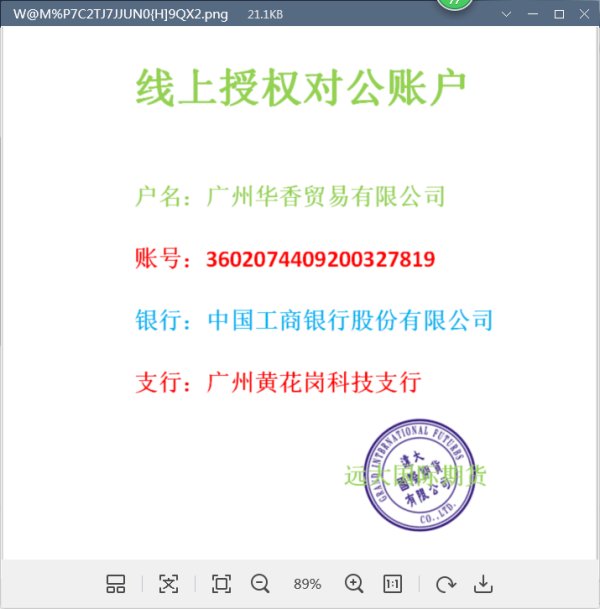

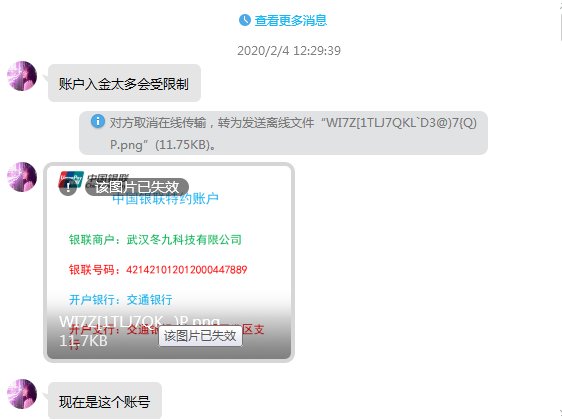

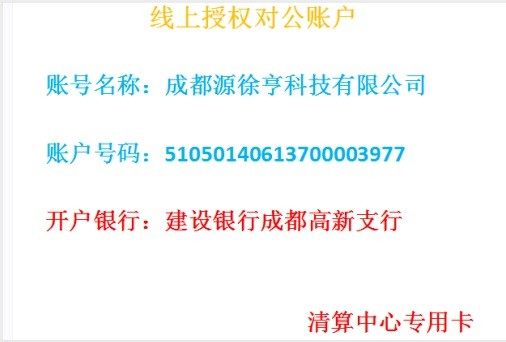

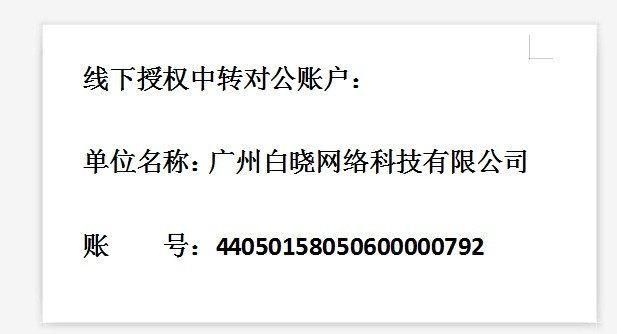

Customer service evaluation reveals significant concerns based on the high volume of recorded complaints. With 21 documented complaints against the broker, there are clear indications of systemic customer service issues that potential clients should carefully consider. This complaint volume suggests recurring problems with service delivery, dispute resolution, or client communication, while not necessarily representing the total client base.

The available information does not specify customer service channels, availability hours, or response time commitments. This makes it impossible to assess the accessibility and efficiency of support services. Professional forex brokers typically offer multiple communication channels including live chat, email, phone support, and often provide 24/5 or 24/7 availability to accommodate global trading schedules.

The absence of information about multilingual support capabilities is another concern, particularly for international clients who may require assistance in their native languages. Quality customer service is crucial in forex trading, where technical issues, account problems, or trading disputes require prompt and professional resolution. The combination of high complaint volume and lack of detailed service information suggests that Hui Tong International may not provide the level of customer support that serious traders require.

Trading Experience Analysis

The trading experience evaluation reveals the most concerning aspect of Hui Tong International's operations. With a user rating of 1.00 out of 10, the broker demonstrates a fundamental failure to provide satisfactory trading conditions for its clients. This extremely low rating typically indicates severe problems with platform stability, order execution, pricing accuracy, or overall service reliability.

Available information does not provide specific details about platform performance, execution speeds, or technical reliability. However, the user rating suggests significant deficiencies in these critical areas. Professional forex trading requires stable platforms, accurate pricing, and reliable order execution, particularly during volatile market conditions. The poor rating indicates that hui tong international review feedback consistently highlights problems in these fundamental areas.

The absence of information about mobile trading capabilities, platform features, and trading environment specifics further compounds concerns about the overall trading experience. Modern traders expect responsive, feature-rich platforms that provide real-time data, advanced charting capabilities, and seamless order management. The combination of extremely poor user ratings and lack of detailed platform information suggests that the broker fails to meet contemporary trading standards and client expectations.

Trust and Security Analysis

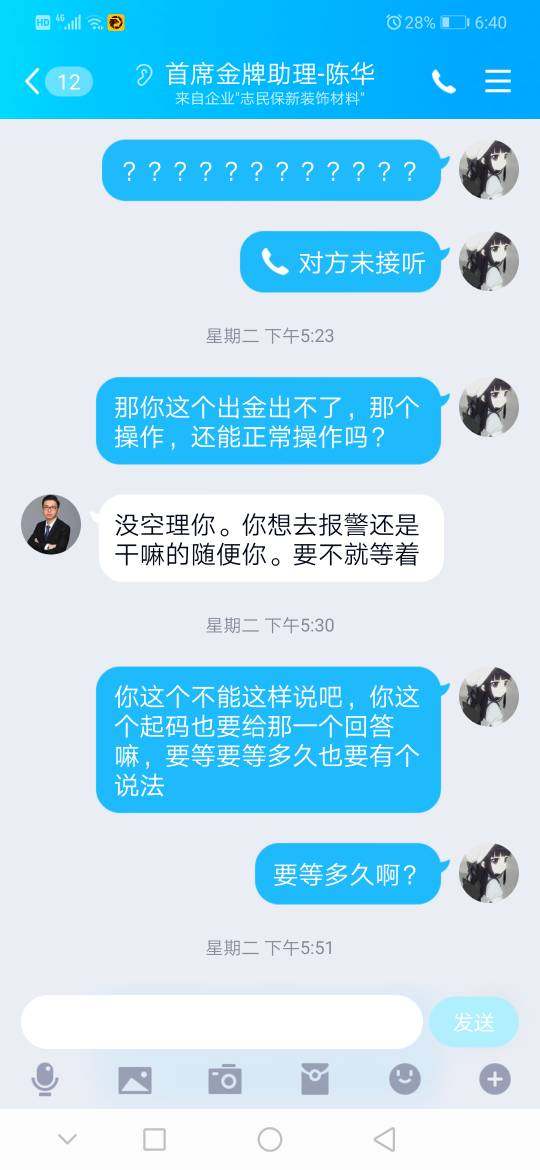

Trust and security represent perhaps the most critical concerns in this evaluation. WikiFX's rating of 1.46 out of 10, accompanied by explicit warnings about potential fraud risks, raises serious questions about the broker's operational integrity and client fund security. Such warnings from established evaluation platforms should be considered significant red flags for potential clients.

The absence of clear regulatory information compounds these security concerns. Reputable forex brokers typically operate under strict regulatory oversight from recognized financial authorities, providing client fund protection, operational transparency, and dispute resolution mechanisms. The lack of specified regulatory credentials suggests that Hui Tong International may operate without proper oversight, potentially exposing clients to significant risks.

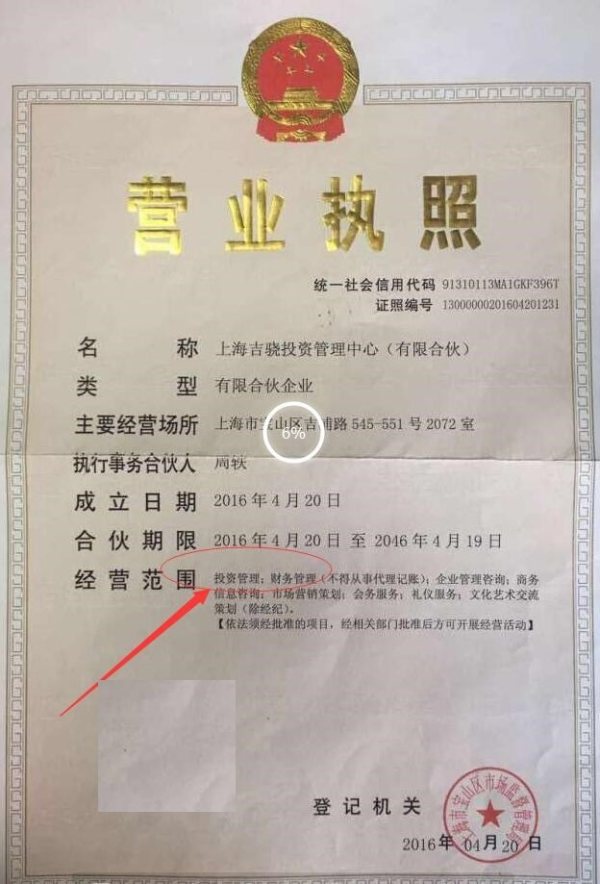

The 21 recorded complaints further indicate ongoing issues with client relations, fund handling, or service delivery that have escalated to formal complaint procedures. While isolated complaints are normal in any service industry, the volume and the accompanying poor ratings suggest systemic problems rather than isolated incidents. The combination of fraud warnings, poor ratings, and multiple complaints creates a concerning picture of operational reliability and client fund security.

User Experience Analysis

User experience analysis reveals comprehensive dissatisfaction among Hui Tong International's client base. The 1.00 user rating represents near-universal negative feedback, indicating fundamental failures in service delivery, platform functionality, or client relations. Such uniformly poor ratings typically result from serious operational problems that affect the majority of users rather than isolated issues.

The 21 recorded complaints provide additional evidence of widespread user dissatisfaction. This suggests that problems are not limited to a small subset of clients but represent broader operational failures. These complaints likely reflect issues with fund withdrawals, platform functionality, customer service responsiveness, or trading condition disputes that have significantly impacted user experience.

Available information does not provide specific details about user interface design, registration processes, or account management features. However, the overwhelmingly negative feedback suggests deficiencies across multiple user interaction points. Professional forex brokers typically maintain user satisfaction through intuitive interfaces, streamlined processes, and responsive support systems. The poor user experience ratings indicate that Hui Tong International fails to meet these basic service expectations, making it unsuitable for traders seeking reliable, professional forex trading services.

Conclusion

This comprehensive evaluation reveals that Hui Tong International presents significant risks and concerns that potential traders should carefully consider. The broker's extremely poor ratings across multiple evaluation platforms, combined with substantial complaint volumes and fraud warnings, indicate fundamental operational problems that make it unsuitable for serious forex trading activities.

The lack of transparent information about regulatory oversight, trading conditions, and operational details further compounds these concerns. Professional traders seeking reliable forex services should prioritize brokers with strong regulatory credentials, transparent operations, and positive user feedback. Based on available evidence, Hui Tong International fails to meet these basic requirements and should be avoided by prudent investors seeking secure and reliable trading environments.