Gyd 2025 Review: Everything You Need to Know

Executive Summary

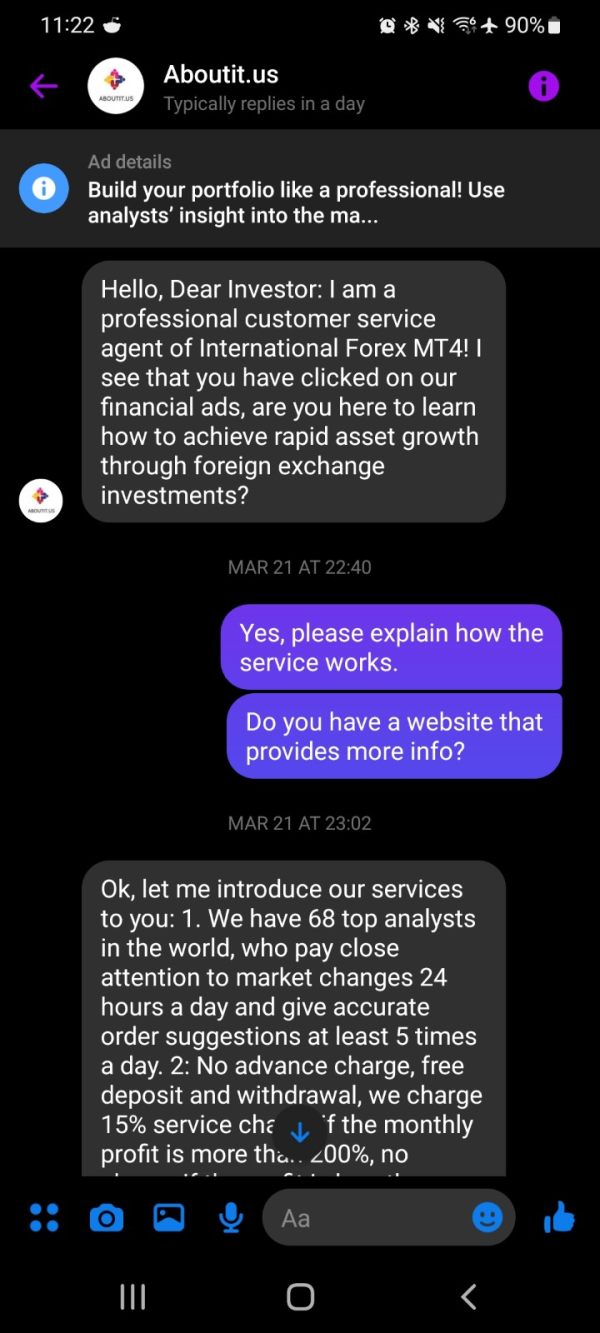

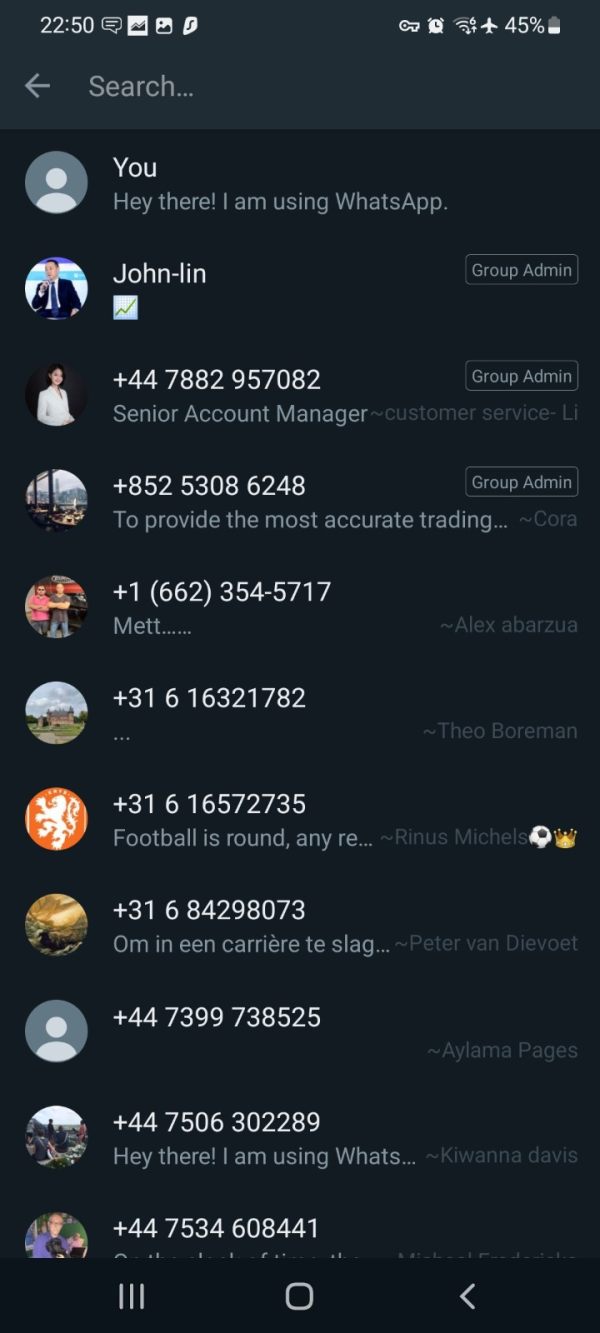

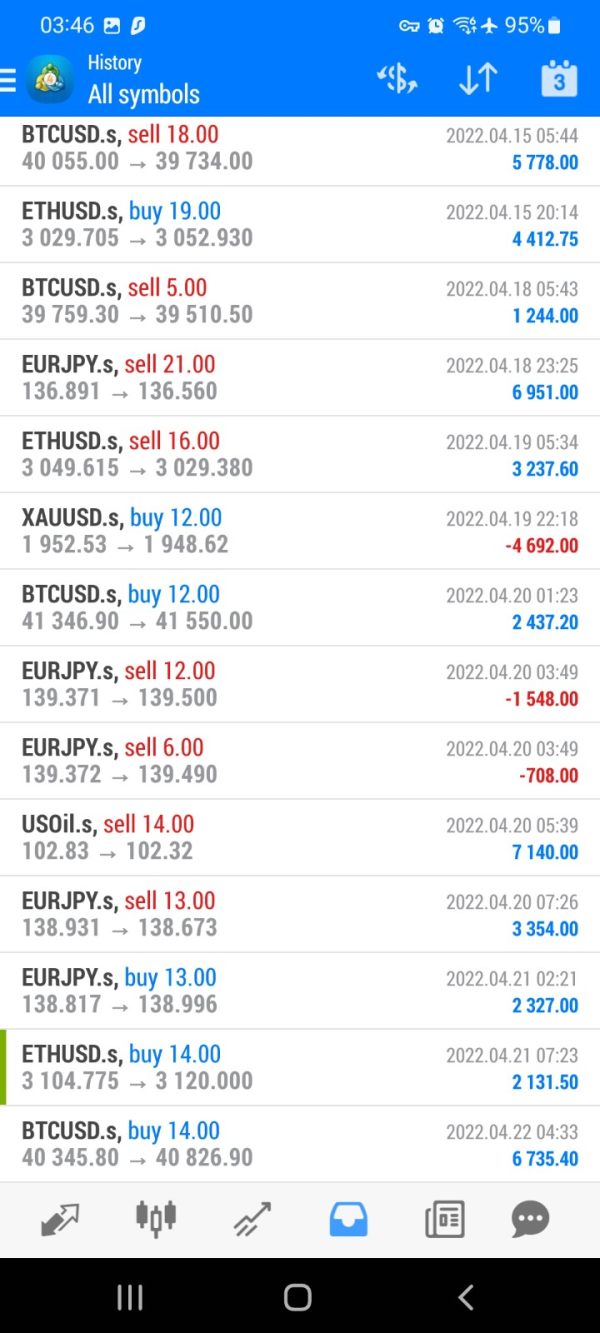

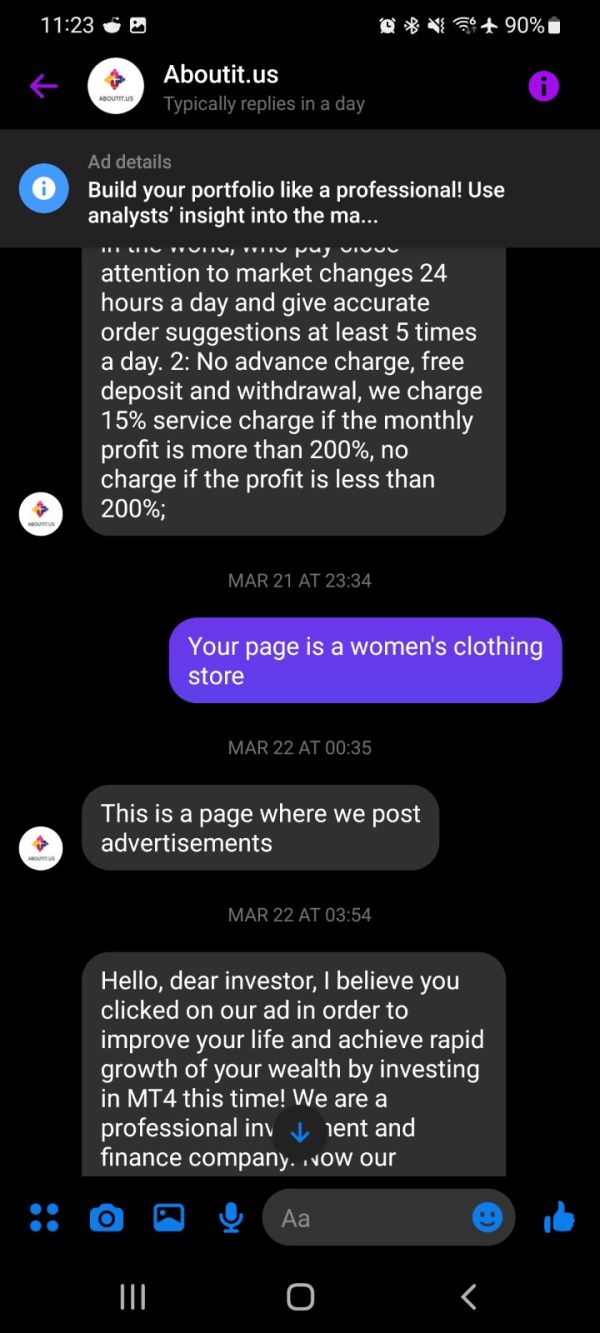

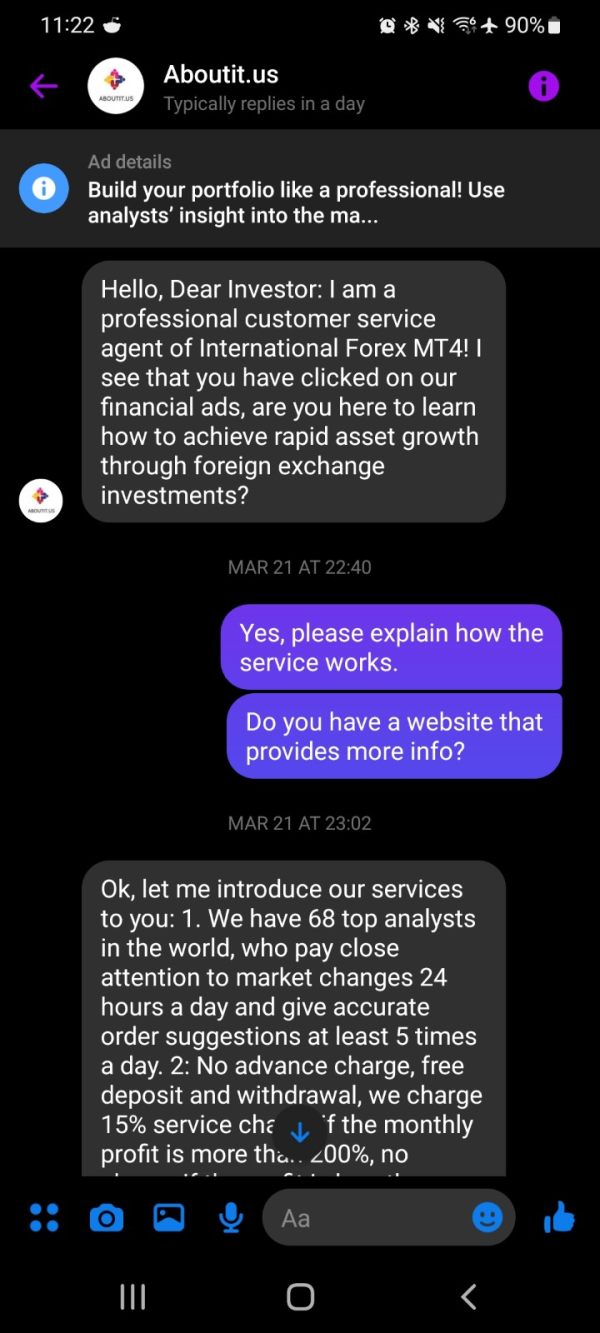

This comprehensive Gyd review reveals concerning findings about this forex broker that potential traders must understand before considering their services. Based on extensive research and user feedback analysis, Gyd appears to be operating as a fraudulent forex broker with extremely poor user ratings and questionable business practices. While the platform does offer legitimate trading software including MetaTrader 4 and MetaTrader 5, multiple sources indicate serious red flags regarding the broker's credibility and trustworthiness. The broker claims to provide forex and CFD trading services. However, user experiences suggest significant issues with service delivery and customer support. One employee review rated the company at -5 out of 5 stars, while Amazon customer reviews show 0 out of 5 stars for Gyd products, indicating widespread dissatisfaction. Given these concerning indicators, we strongly advise against using this platform for any trading activities. This review will examine all aspects of Gyd's operations to provide traders with the essential information needed to make informed decisions about their trading platform selection.

Important Disclaimers

This Gyd review is based on publicly available information, user feedback, and market analysis conducted in 2025. Readers should note that specific regulatory information and detailed operational procedures were not clearly disclosed in available sources, which itself raises concerns about transparency. Our evaluation methodology incorporates user testimonials, platform analysis, and industry standard comparisons to provide the most accurate assessment possible. The information presented reflects the current state of available data, and traders should conduct additional due diligence before making any financial decisions. Cross-regional entity differences were not specified in available documentation, which may indicate limited or unclear global operations.

Overall Rating Framework

Broker Overview

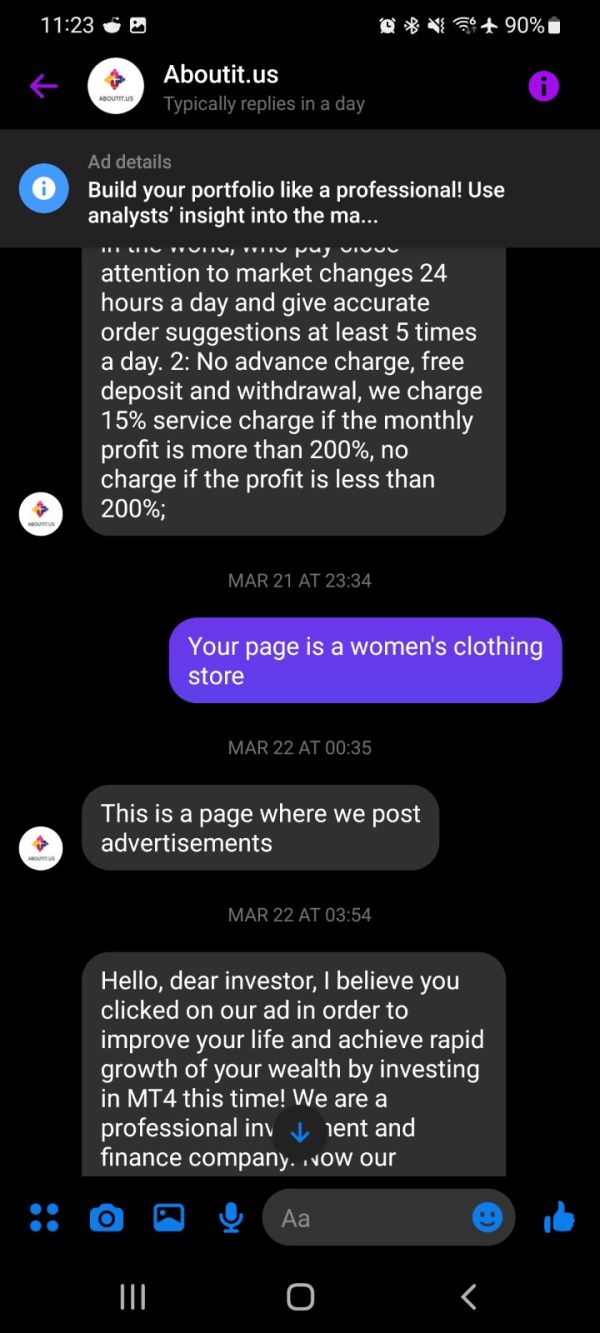

Gyd presents itself as a forex and CFD trading broker. Though specific information about its establishment date and corporate background remains unclear in available documentation, the lack of transparent company information raises immediate concerns about the broker's legitimacy and regulatory compliance. The platform's primary business model appears to focus on forex trading services, but multiple sources classify it as a potentially fraudulent operation rather than a legitimate financial services provider. The broker's operational structure and corporate governance details are notably absent from public records, which is highly unusual for legitimate financial service providers.

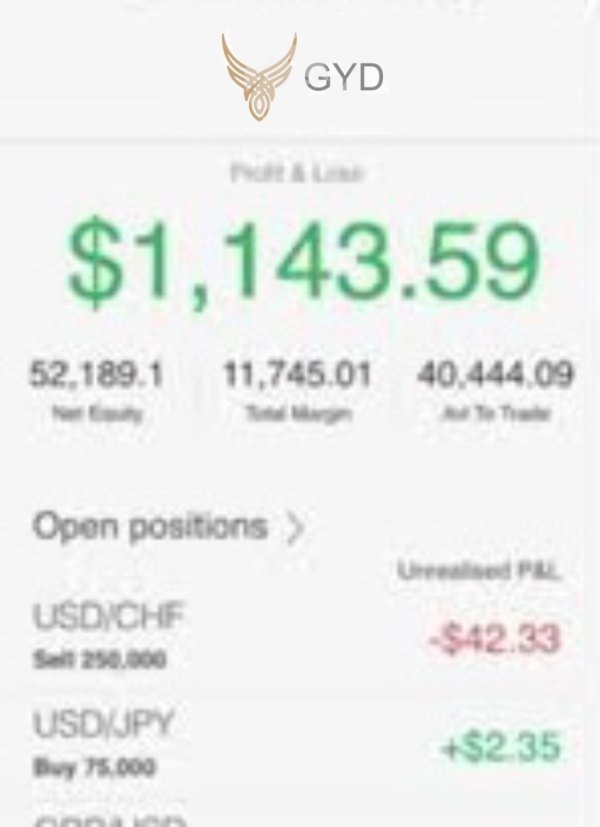

This opacity in corporate information, combined with poor user feedback, suggests significant issues with the broker's fundamental business practices and regulatory standing. The platform offers MetaTrader 4 and MetaTrader 5 as its primary trading platforms, which are industry-standard solutions used by many legitimate brokers. However, the availability of professional trading software does not compensate for the numerous red flags identified in user experiences and operational transparency. The broker claims to provide access to forex and CFD markets, though specific asset coverage and trading conditions remain poorly documented. Regulatory information for Gyd is notably absent from available sources, which represents a critical concern for potential traders.

Regulatory Status: Available sources do not provide specific information about Gyd's regulatory oversight or licensing. This is a significant red flag for potential traders seeking legitimate brokerage services.

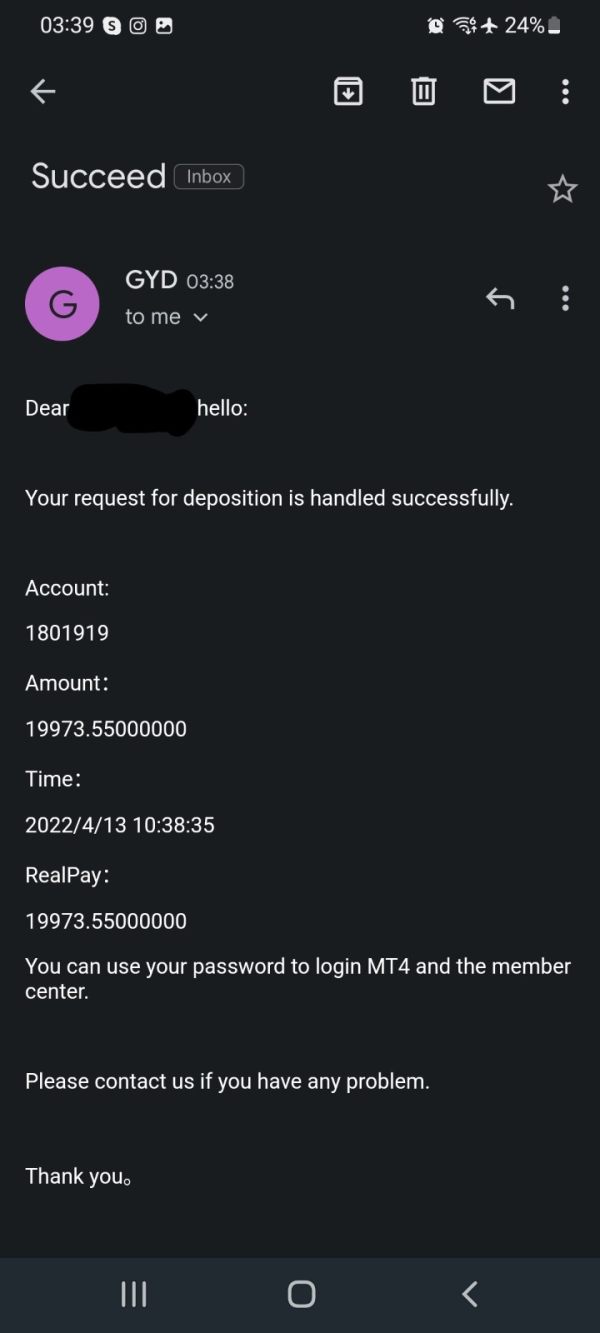

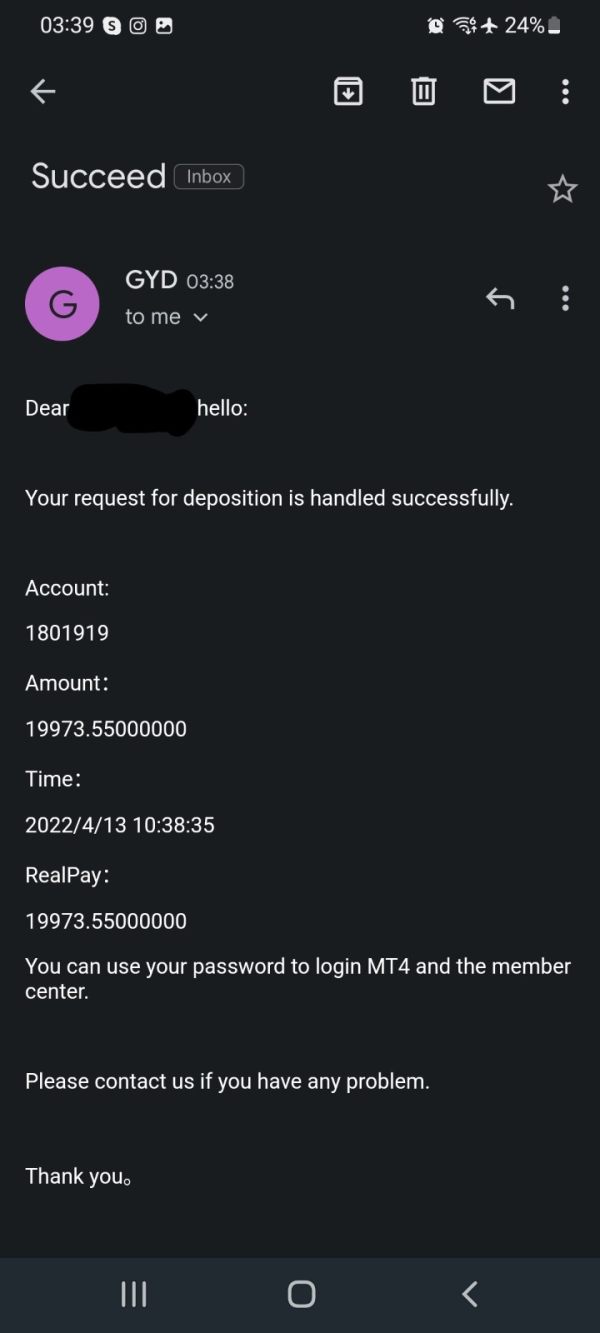

Deposit and Withdrawal Methods: Specific information regarding funding options and withdrawal procedures was not detailed in available documentation. This limits transparency about financial transactions.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available sources. This makes it difficult for potential traders to understand entry-level requirements.

Promotional Offers: No specific information about bonuses or promotional campaigns was found in available documentation. Though this may be due to the broker's questionable operational status.

Available Trading Assets: The platform focuses on forex and CFD trading. Though specific instrument coverage and market access details remain unclear in available sources.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not available in the sources reviewed. This limits transparency about true trading expenses.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available documentation. This prevents proper risk assessment for potential traders.

Platform Options: Gyd offers MetaTrader 4 and MetaTrader 5 platforms. Which are professional-grade trading solutions widely recognized in the industry.

Geographic Restrictions: Specific information about regional limitations or service availability was not detailed in available sources. Available documentation does not specify supported languages for customer service interactions.

This Gyd review highlights significant gaps in essential broker information that legitimate financial service providers typically disclose transparently.

Account Conditions Analysis

The account structure and conditions offered by Gyd remain largely undisclosed in available documentation. This represents a major concern for potential traders. Legitimate forex brokers typically provide detailed information about account types, features, and requirements to help traders make informed decisions. The absence of such fundamental information suggests either poor business practices or intentional opacity in operations. Available sources do not specify different account tiers, minimum balance requirements, or special features that might distinguish various account options.

This lack of clarity makes it impossible for traders to understand what they would be signing up for. Which is highly unusual in the competitive forex industry where transparency about account conditions is standard practice. The account opening process details are not described in available sources, though user feedback suggests significant issues with overall service delivery. One employee review rating the company at -5 out of 5 stars indicates serious internal operational problems that would likely affect account management and customer service quality. Without clear information about account conditions, trading requirements, or customer onboarding procedures, potential traders cannot properly evaluate whether Gyd's offerings meet their trading needs.

This information gap, combined with poor user ratings, strongly suggests avoiding this platform for any trading activities. The absence of detailed account information in this Gyd review reflects the broader transparency issues that characterize this broker's operations and contribute to its poor reputation among users and industry observers.

Gyd's trading infrastructure centers around MetaTrader 4 and MetaTrader 5 platforms. Which are industry-standard solutions that provide comprehensive charting, analysis, and automated trading capabilities. These platforms offer professional-grade tools including technical indicators, expert advisors, and advanced order management features that experienced traders expect from legitimate brokers. However, beyond the basic platform offering, available sources do not indicate additional proprietary tools, research resources, or enhanced trading features that might differentiate Gyd from other brokers.

The lack of supplementary resources such as market analysis, economic calendars, or educational materials suggests a limited commitment to trader support and development. Research and analysis resources appear to be minimal or non-existent based on available information. Legitimate brokers typically provide market commentary, economic analysis, and trading insights to support their clients' decision-making processes. The absence of such resources indicates either limited operational capabilities or poor service prioritization. Educational resources and trader development programs are not mentioned in available documentation, which represents a significant gap in service offering.

Professional forex brokers usually invest in comprehensive educational content to help traders improve their skills and understanding of market dynamics. While the MetaTrader platforms do support automated trading through expert advisors, there is no indication that Gyd provides additional support, custom solutions, or guidance for algorithmic trading implementation. This limited approach to tools and resources, combined with the platform's questionable reputation, makes it an unsuitable choice for traders seeking comprehensive trading support.

Customer Service and Support Analysis

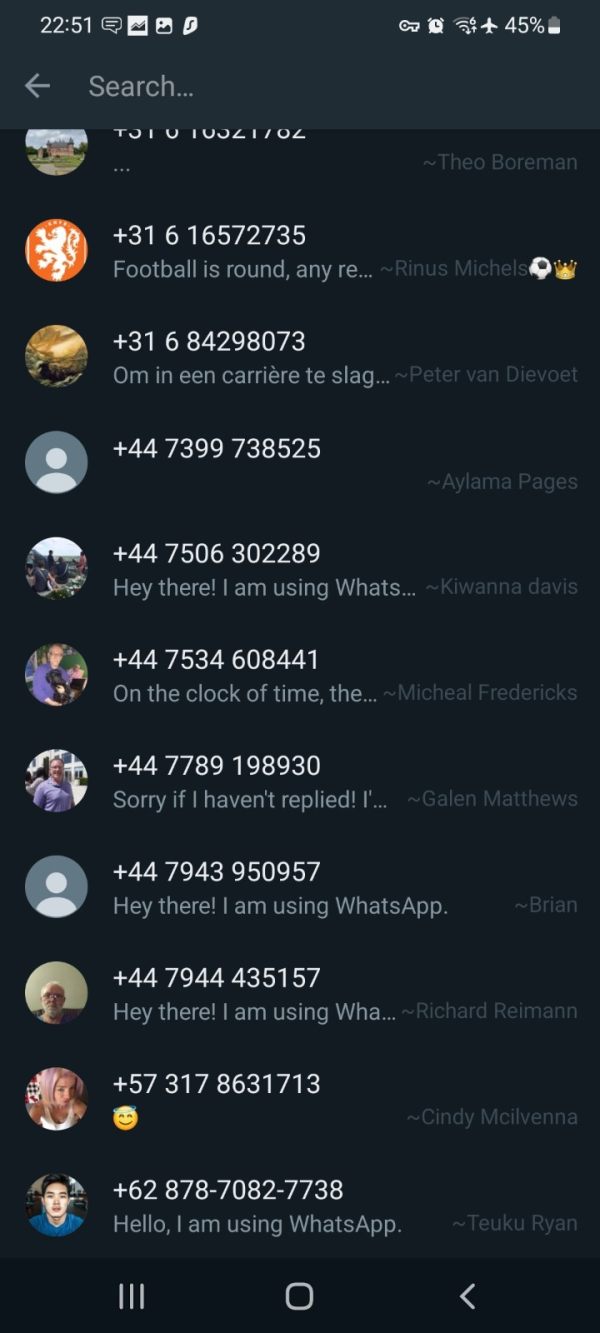

Customer service quality appears to be one of Gyd's most significant weaknesses based on available user feedback and ratings. The extremely poor user ratings, including an employee review of -5 out of 5 stars, suggest fundamental problems with customer support operations and service delivery standards. Available sources do not provide specific information about customer service channels, contact methods, or support availability hours. This lack of transparency about basic customer service infrastructure is concerning for potential traders who need reliable support for account issues, technical problems, or trading-related questions.

Response times and service quality metrics are not disclosed in available documentation. Though user feedback suggests significant dissatisfaction with support interactions. The consistently negative ratings indicate that when customers do manage to contact support, their experiences are frequently unsatisfactory and problems remain unresolved. Multi-language support capabilities are not specified in available sources, which may limit accessibility for international traders. Professional forex brokers typically provide comprehensive language support to serve their global customer base effectively.

The absence of detailed customer service information, combined with extremely poor user ratings, suggests that Gyd fails to meet basic standards for customer support in the forex industry. This deficiency represents a critical weakness that affects all aspects of the trading experience and contributes to the broker's poor overall reputation.

Trading Experience Analysis

The trading experience with Gyd appears to be severely compromised based on user feedback and available information. User ratings consistently indicate poor performance across multiple platforms, with Amazon reviews showing 0 out of 5 stars and employee feedback rating the company at -5 out of 5 stars, suggesting fundamental problems with service delivery and platform reliability. Platform stability and execution quality are critical factors for successful forex trading, but available feedback suggests significant issues in these areas. While Gyd offers MetaTrader 4 and MetaTrader 5 platforms, which are technically sound solutions, user experiences indicate problems that may stem from poor implementation, inadequate server infrastructure, or other operational deficiencies.

Order execution quality and trading environment details are not specifically documented in available sources. But the overwhelmingly negative user feedback suggests traders experience significant problems with trade processing, pricing, or platform functionality. These issues can severely impact trading performance and profitability. Mobile trading capabilities and cross-platform functionality are not detailed in available documentation, though MetaTrader platforms typically offer mobile solutions. However, given the poor overall user experience ratings, mobile trading performance is likely to be similarly compromised.

The trading environment appears to suffer from the same transparency and quality issues that affect other aspects of Gyd's operations. Without clear information about execution policies, trading conditions, or performance metrics, combined with consistently negative user feedback, the trading experience represents a significant risk for potential clients.

Trust and Security Analysis

Trust and security represent perhaps the most critical concerns in this Gyd review. With multiple sources identifying the broker as potentially fraudulent. The absence of clear regulatory information and licensing details raises immediate red flags about the broker's legitimacy and compliance with financial service standards. Regulatory oversight is fundamental to forex broker credibility, yet available sources do not provide any information about Gyd's regulatory status, licensing, or compliance with financial authorities. This absence of regulatory transparency is highly unusual for legitimate brokers and suggests either unlicensed operations or deliberate concealment of regulatory status.

Client fund security measures and segregation policies are not detailed in available documentation. Which represents a critical gap in essential safety information. Legitimate brokers typically provide clear information about how client funds are protected, segregated from company assets, and secured against operational risks. Corporate transparency and public disclosure practices appear to be minimal, with limited information available about company structure, management, or operational procedures. This opacity makes it impossible for potential clients to conduct proper due diligence about the broker's financial stability and business practices.

The combination of poor user ratings, absence of regulatory information, and lack of transparency about security measures creates a highly concerning profile that suggests significant risks for potential traders. Industry reputation appears to be severely damaged, with multiple sources recommending against using this platform for any trading activities.

User Experience Analysis

Overall user satisfaction with Gyd appears to be extremely poor based on available feedback across multiple platforms and review sources. The consistently negative ratings, including 0 out of 5 stars on Amazon and -5 out of 5 stars from an employee review, indicate widespread dissatisfaction with the broker's services and operations. Interface design and platform usability details are not specifically documented, though the use of MetaTrader platforms suggests access to professional-grade trading interfaces. However, user experience extends beyond platform functionality to include customer service, reliability, and overall service quality, areas where Gyd appears to perform poorly.

Registration and account verification processes are not detailed in available sources. But given the overall poor user feedback, these procedures likely suffer from the same quality and service issues that affect other aspects of the broker's operations. Financial transaction experiences, including deposits and withdrawals, are not specifically documented but represent critical aspects of user satisfaction. Poor ratings suggest potential issues with fund processing, transaction times, or accessibility of client funds. Common user complaints appear to center around poor service quality, reliability issues, and inadequate customer support, though specific details are limited in available sources.

The consistently negative feedback across different review platforms suggests systemic problems rather than isolated incidents. User demographics and suitability analysis clearly indicate that Gyd is not appropriate for any trader category, from beginners to experienced professionals, due to the fundamental issues with trust, transparency, and service quality identified throughout this review.

Conclusion

This comprehensive Gyd review reveals significant concerns that make this broker unsuitable for any trading activities. The combination of poor user ratings, lack of regulatory transparency, absence of detailed operational information, and identification as a potentially fraudulent broker creates an unacceptable risk profile for traders seeking legitimate forex services. While Gyd offers professional trading platforms through MetaTrader 4 and MetaTrader 5, the availability of quality software cannot compensate for the fundamental issues with trust, transparency, and service quality that characterize this broker's operations.

The consistently negative user feedback across multiple platforms indicates systemic problems that affect all aspects of the trading experience. We strongly recommend that traders avoid Gyd and instead seek properly regulated, transparent brokers with positive user feedback and clear operational standards. The forex industry offers numerous legitimate alternatives that provide the security, reliability, and professional service that successful trading requires.