fxmills 2025 Review: Everything You Need to Know

1. Abstract

The fxmills review gives a fair look at this brokerage. It shows both good and bad feedback from users. FXMills offers strong features for traders with more experience, including a low spread of 0.5 on the Elite Plus account and many ways to deposit money like credit cards, debit cards, and e-wallets. But some traders worry about high minimum deposits and changes in how well trades work. The VIP account needs at least $10,000 to start, which makes this broker better for experienced investors than beginners. Many users like the mix of low spreads and different payment choices, but some don't like the strict account rules and missing details about regulations. This review looks at how well the platform works, account rules, and customer support to help potential users decide if FXMills is right for them.

2. Disclaimer

This FXMills review uses mainly user feedback and information from the platform. We don't have detailed regulatory information, which might affect how much users trust the broker in different areas. Our review method used public reviews and data from the platform, while thinking about possible differences across regions. Details about which regulatory body watches FXMills operations are not shared and might be different depending on location. So the information in this review should be understood with these things in mind, and readers should do more research before opening an account.

3. Rating Framework

The following table presents the evaluation scores for FXMills across six key dimensions. These scores come from looking at user feedback and available platform data:

4. Broker Overview

FXMills started in 2020 and has its main office in St. Vincent and the Grenadines. The broker has worked to create a complete trading platform that gives access to many different financial products since it began. FXMills lets people trade forex, indices, stocks, commodities, and cryptocurrencies, which covers many market interests. Their business focuses on giving advanced trading tools to clients with more money and experience, which you can see from the premium features in their VIP and Elite Plus accounts. FXMills has made a place for itself as a broker that focuses on low-cost trading through competitive spreads, especially on its Elite Plus account—a key draw for experienced traders who want minimal transaction costs.

FXMills also gives access to standard trading platforms, MetaTrader 4 and MetaTrader 5. The broker's asset range includes many financial instruments, like forex pairs, major indices, leading stocks, commodities, and some digital currencies, so clients have lots of market exposure. But it's important to know that clear regulatory oversight details are not given in the available reviews, which might worry some people. Even with this issue, FXMills keeps focusing on giving a strong and efficient trading environment, while serving clients who are okay with higher initial deposit requirements and expect premium service.

In this section, we look deeper into the specific operations and products of FXMills.

Regulatory Presence:

FXMills does not give detailed regulatory framework information based on available data. This lack of clear regulatory information may hurt user trust across different regions, as different areas have different regulatory requirements.

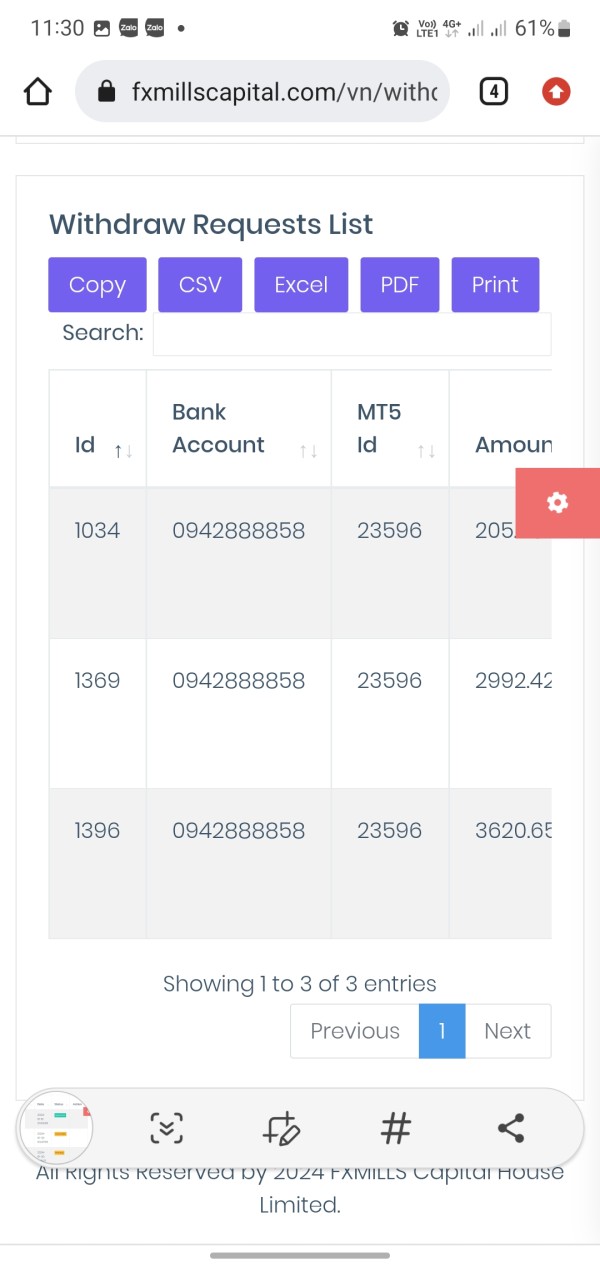

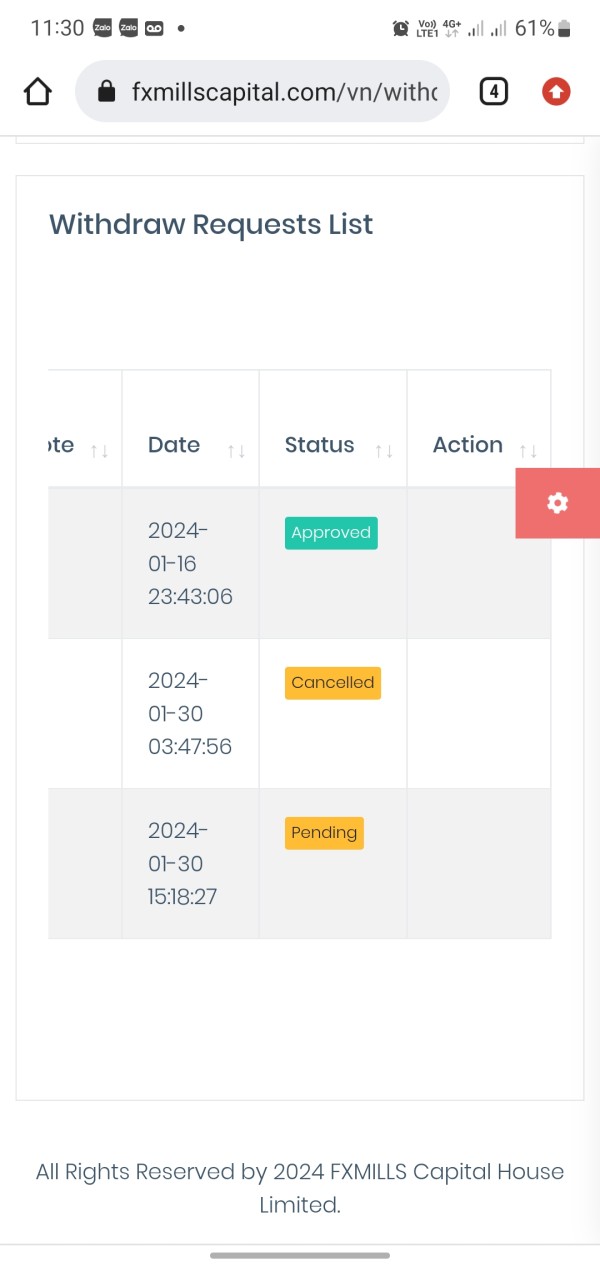

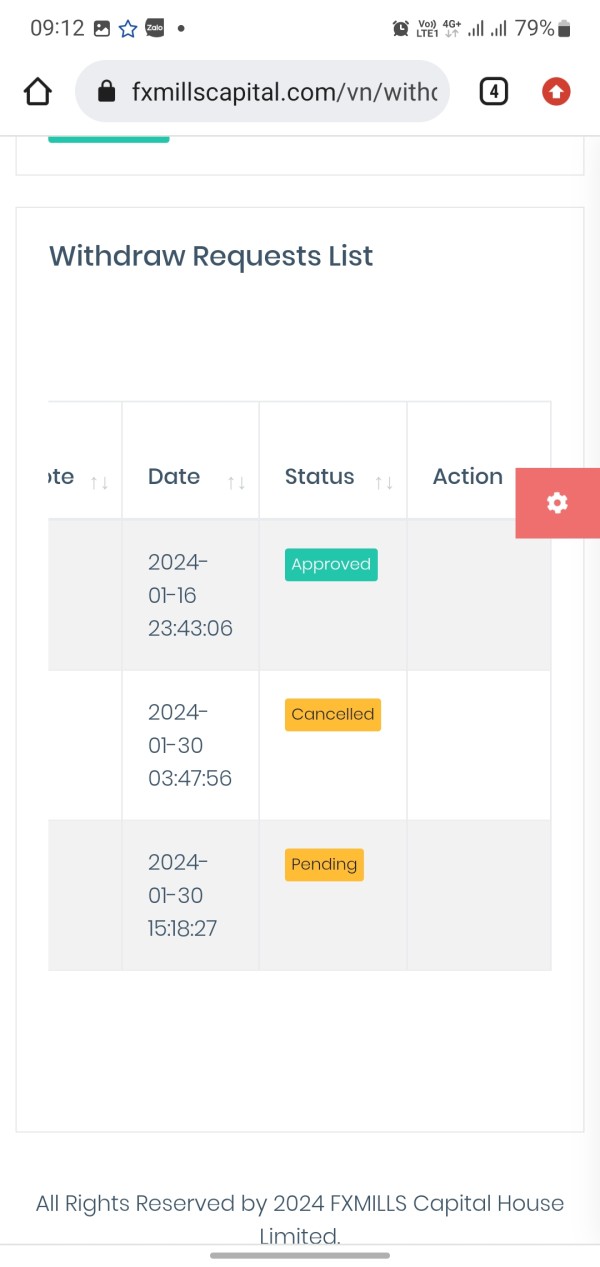

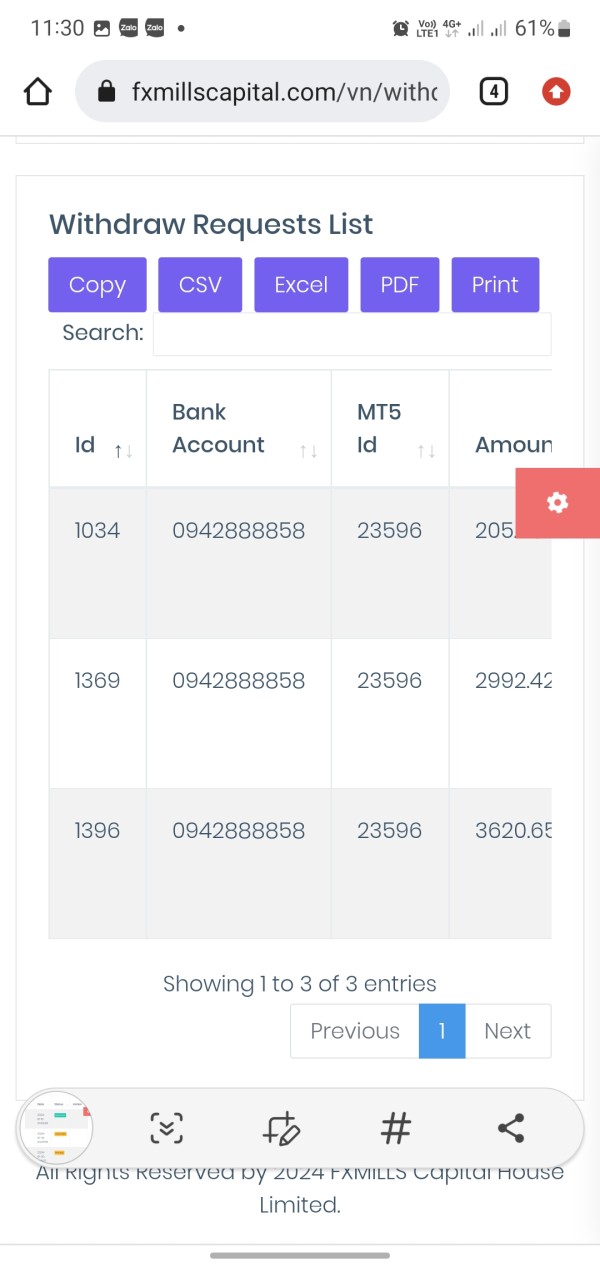

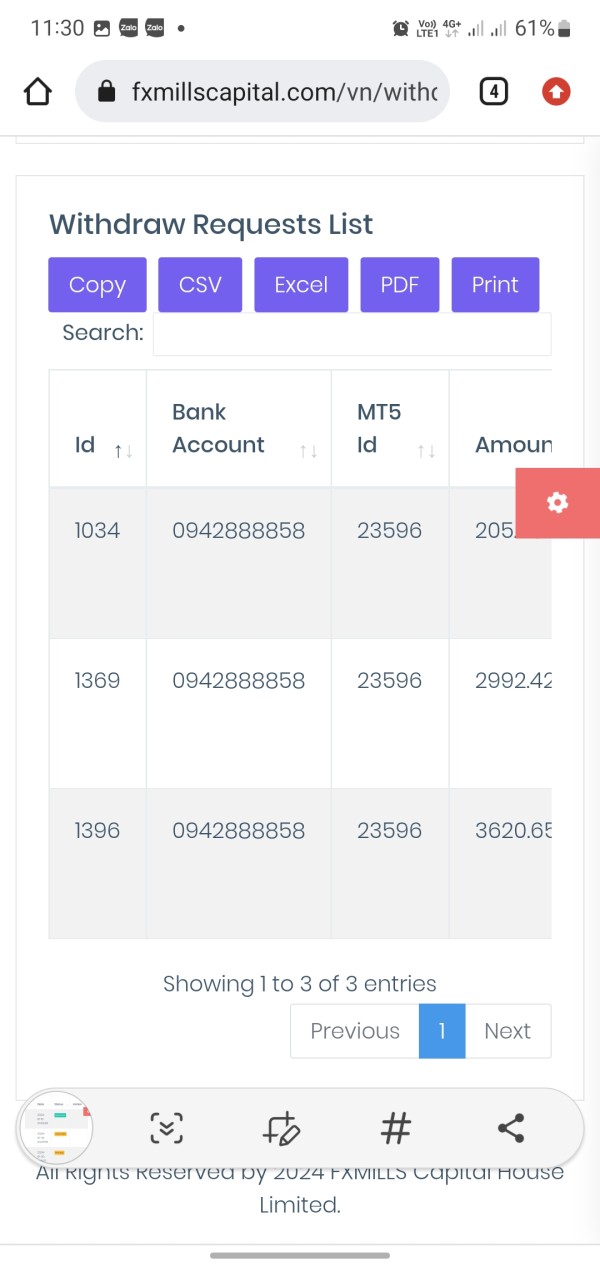

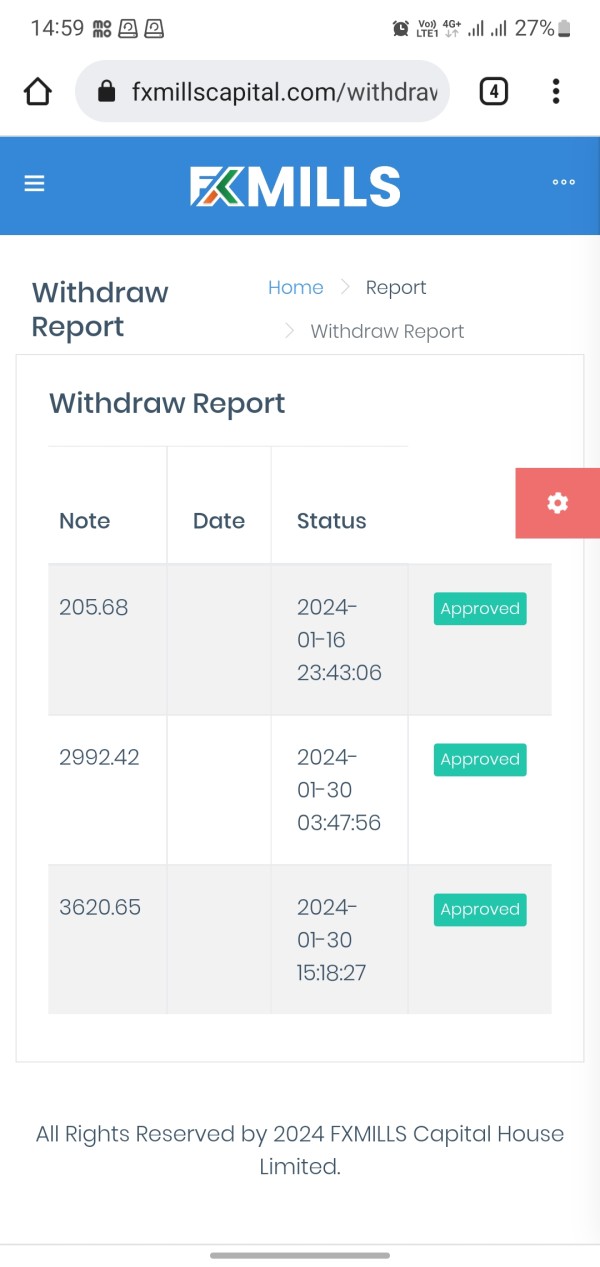

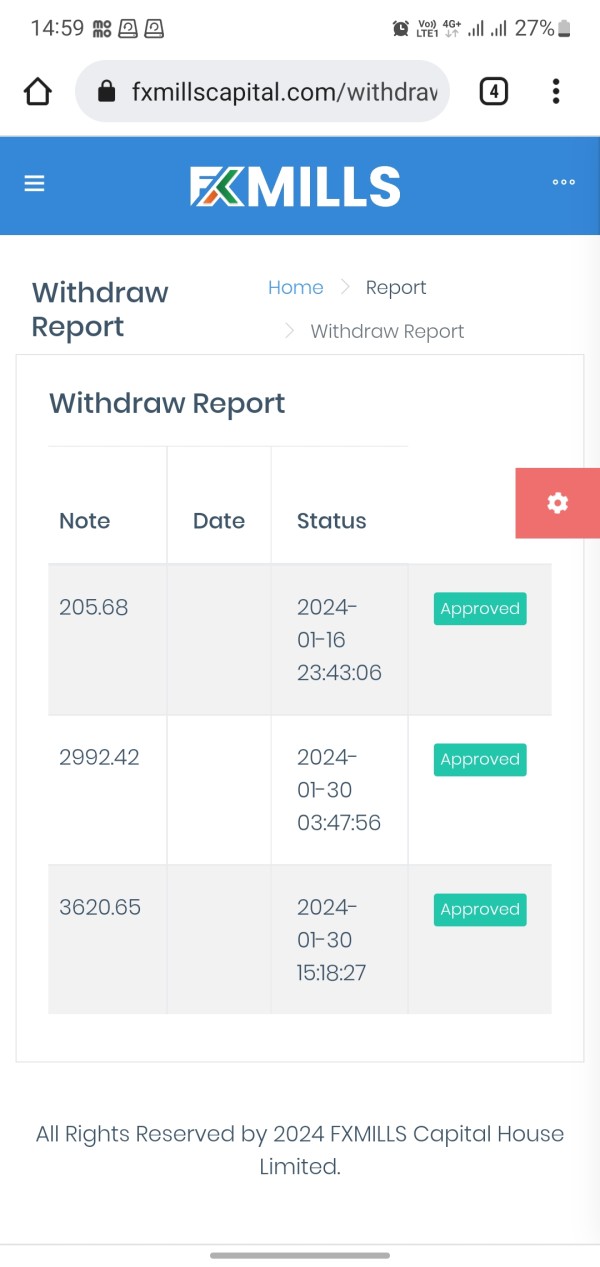

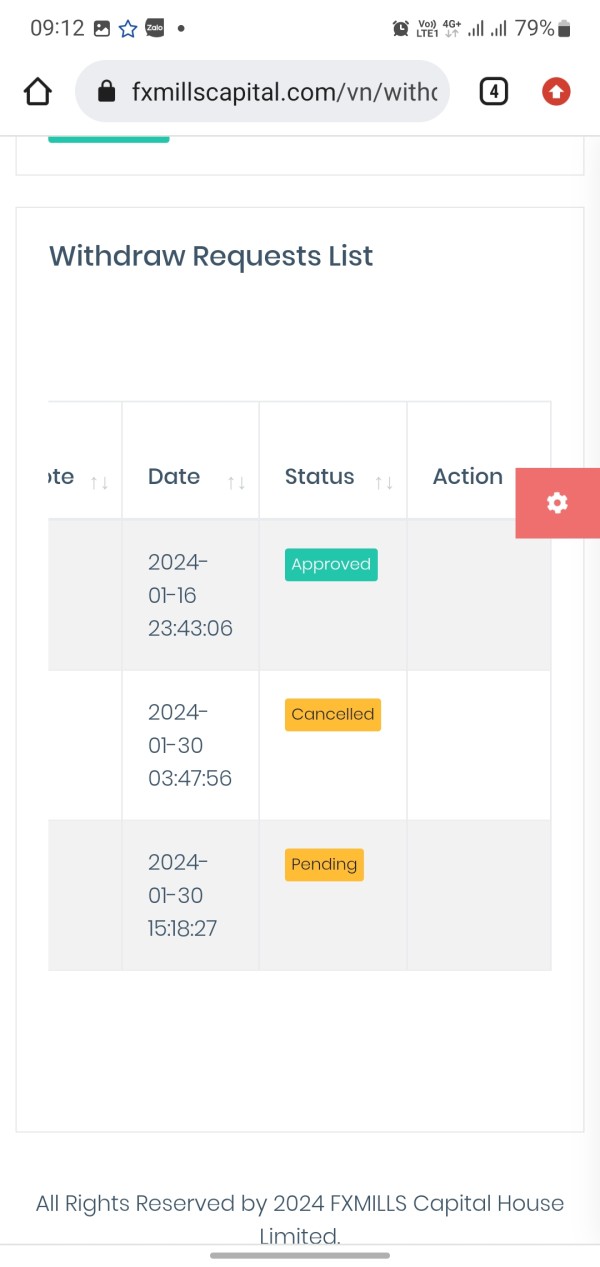

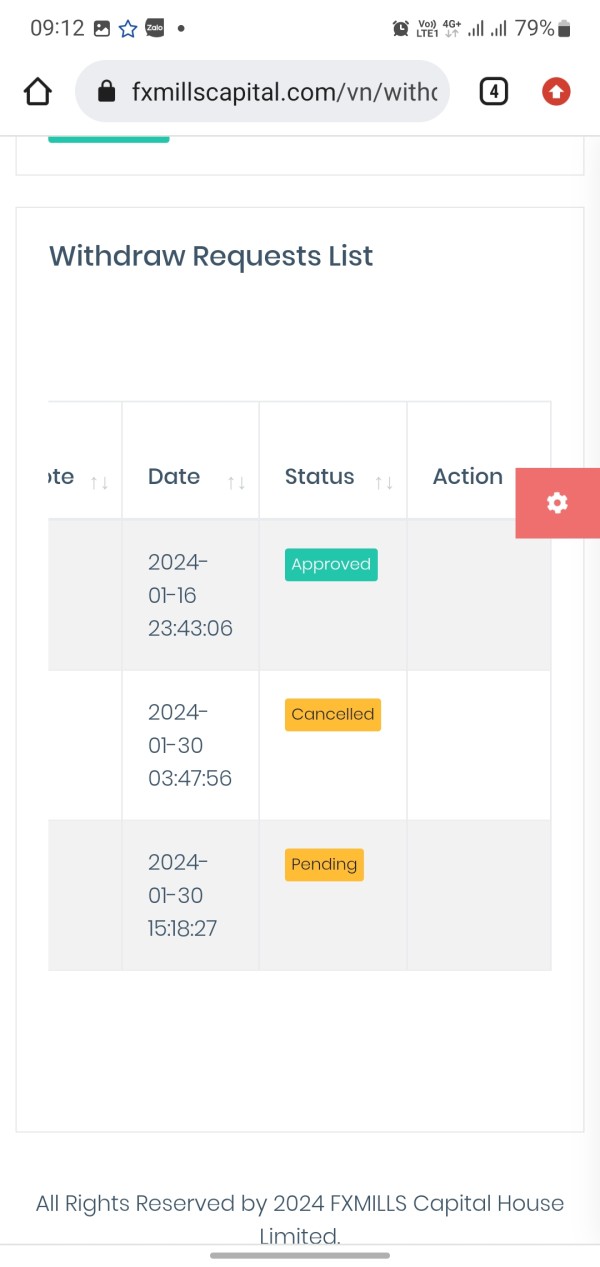

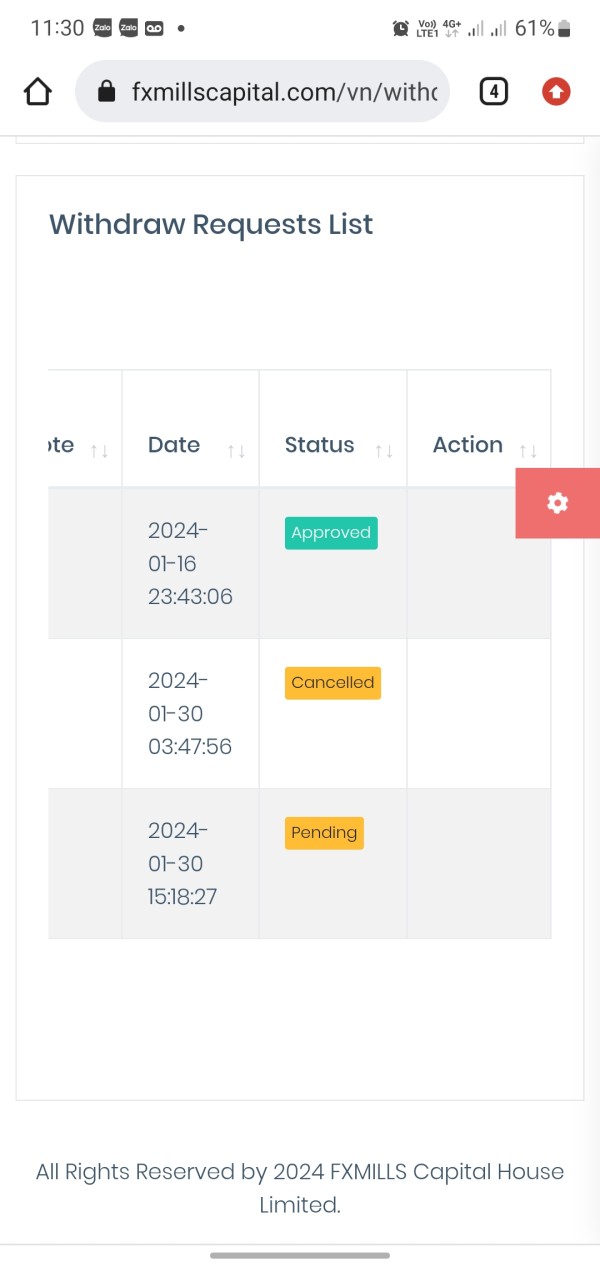

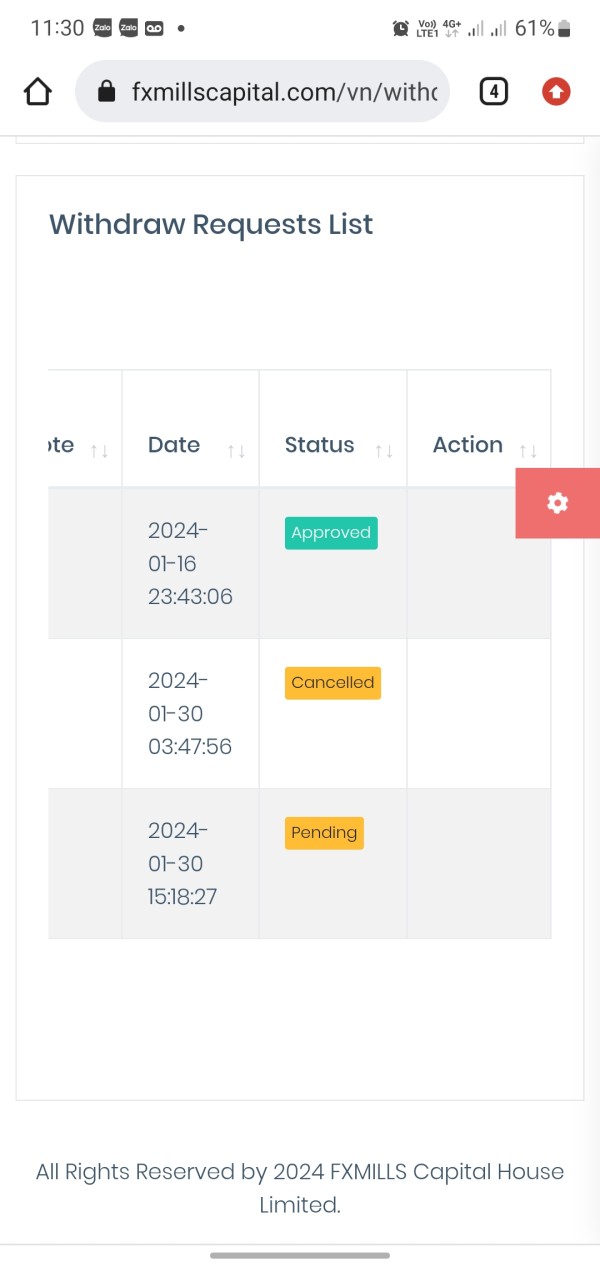

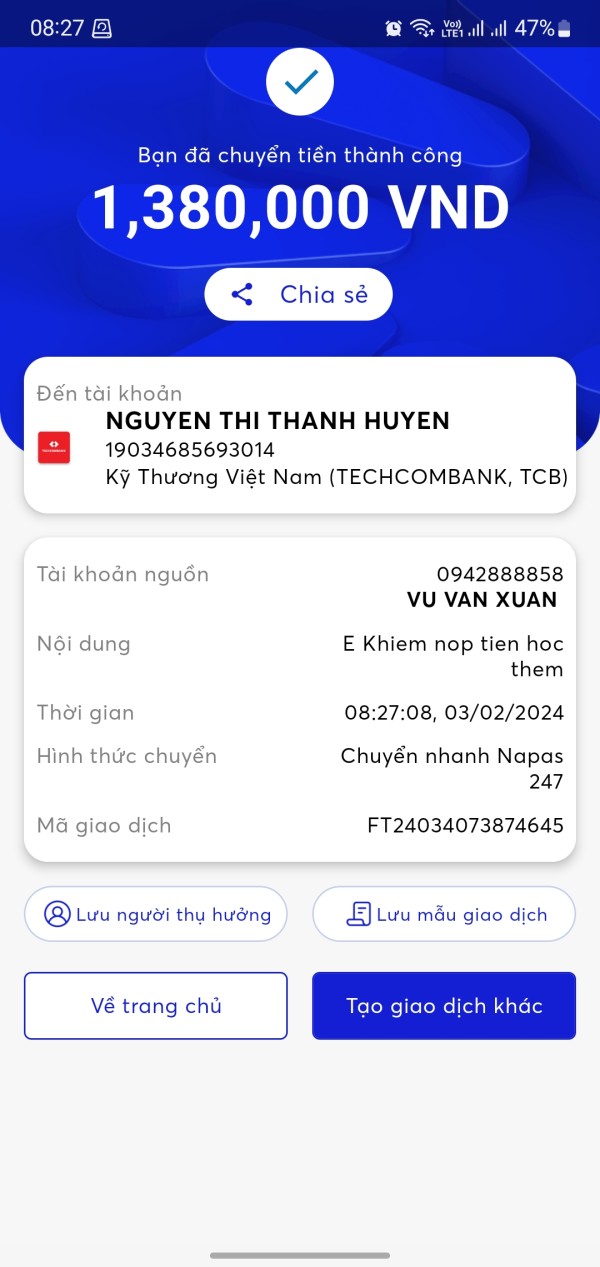

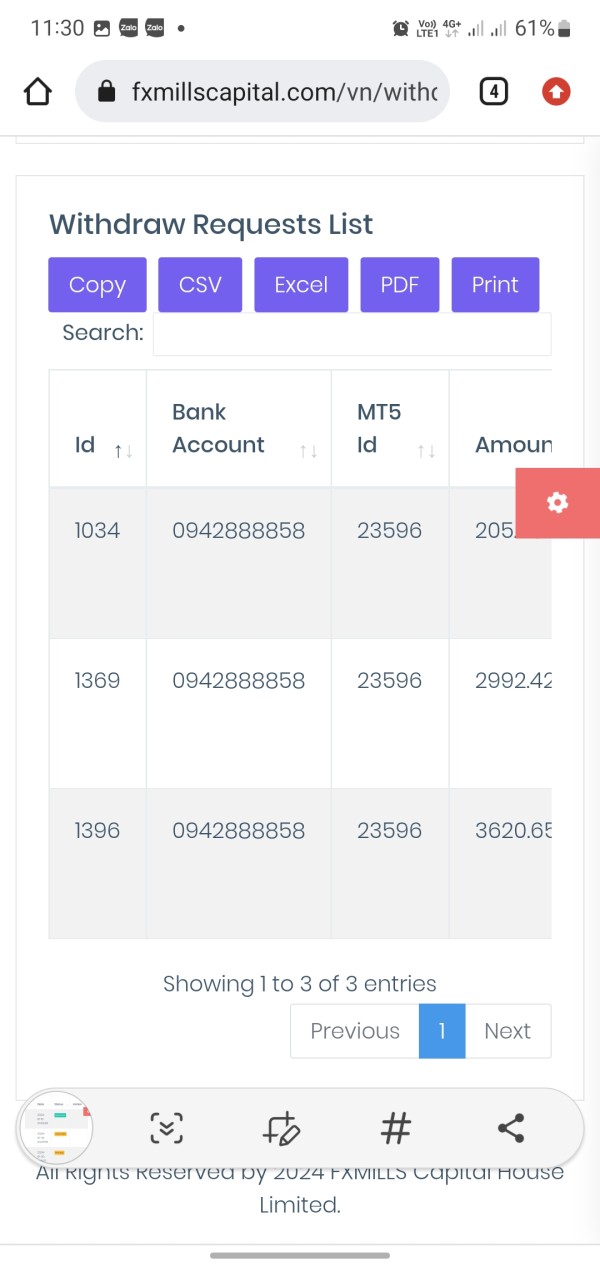

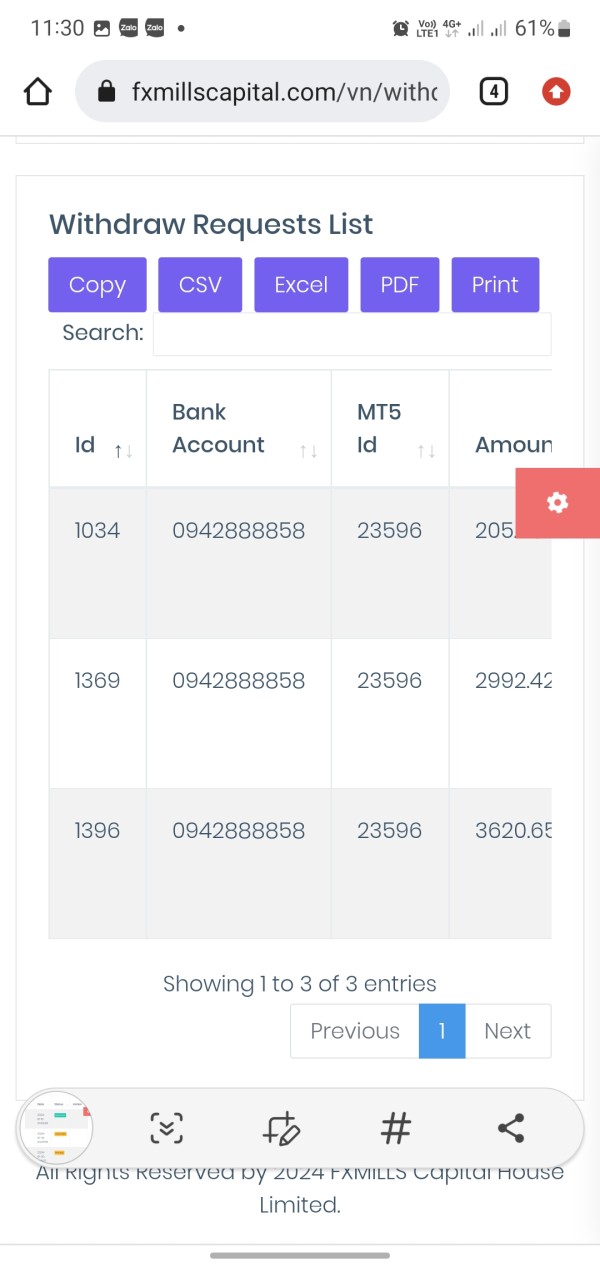

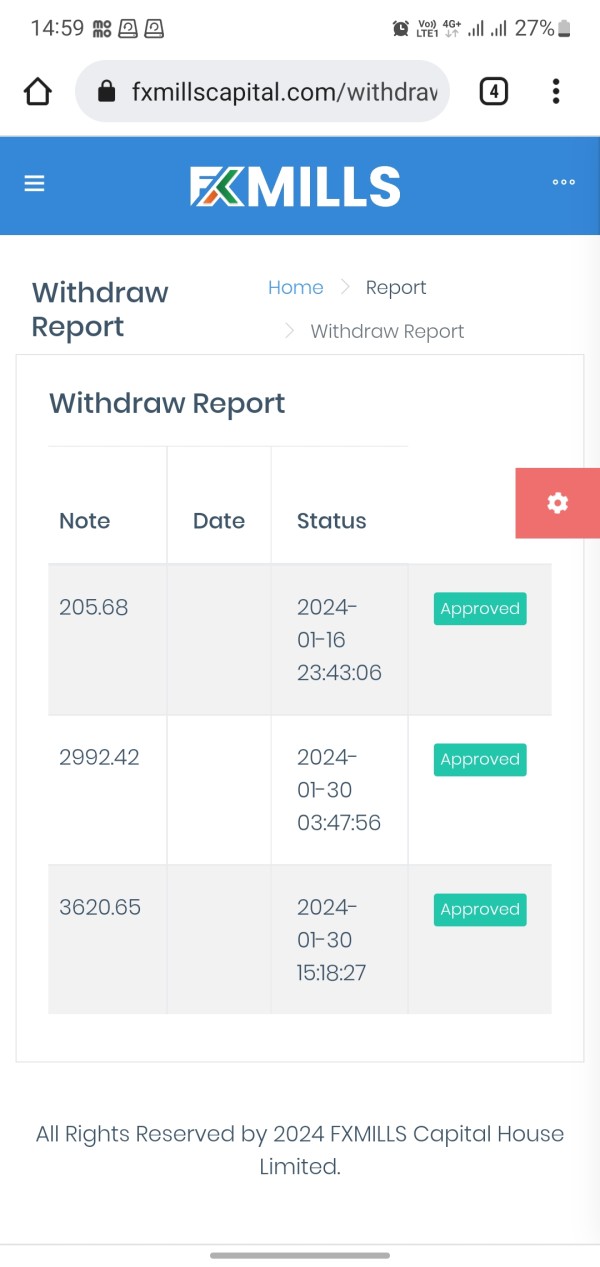

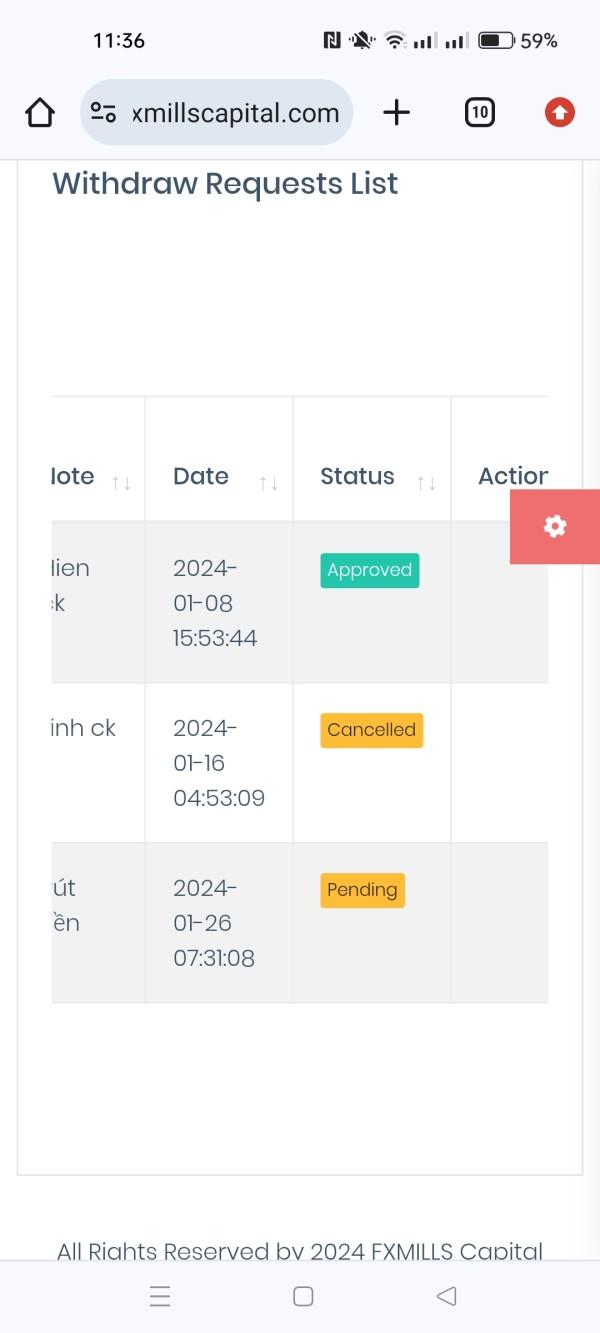

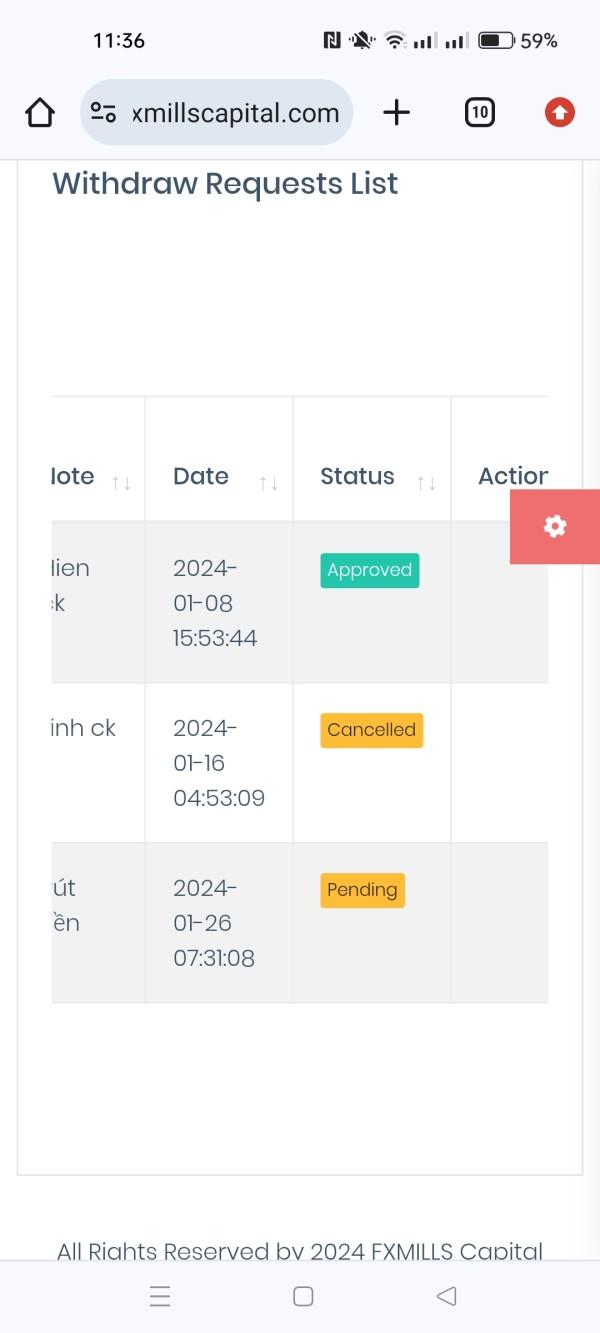

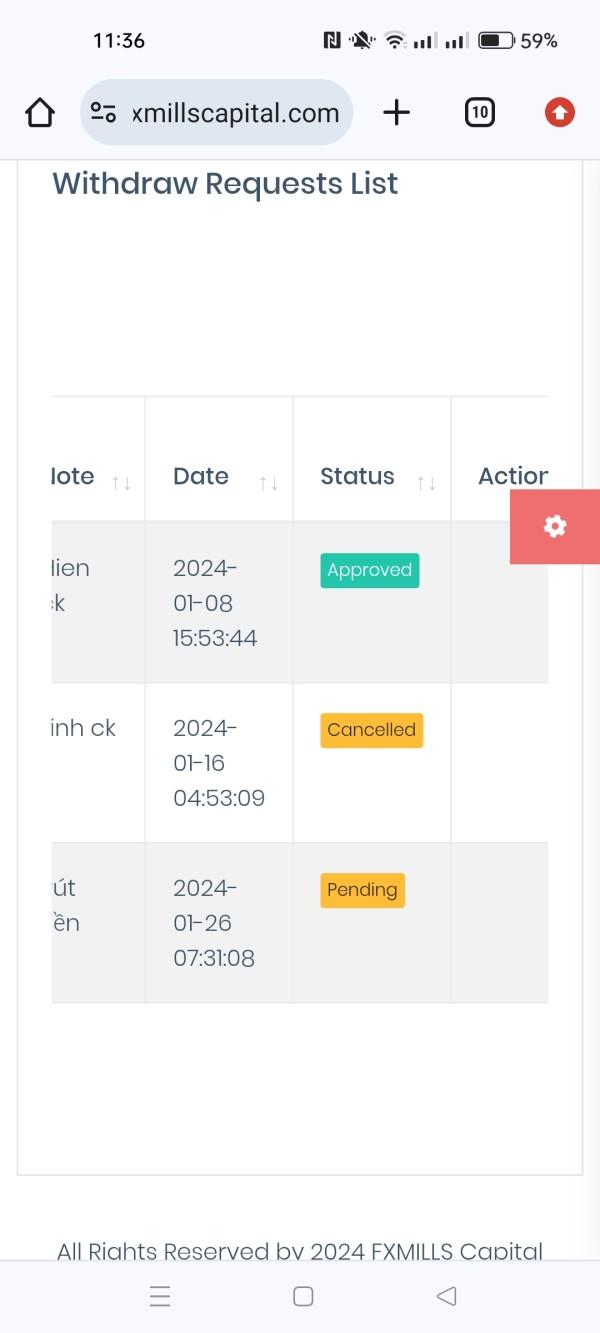

Deposit and Withdrawal Methods:

FXMills supports multiple payment methods, including credit cards, debit cards, and electronic wallets. This flexibility lets clients fund and withdraw money using familiar and convenient platforms, making overall access better.

Minimum Deposit Requirements:

The broker's VIP account requires a minimum deposit of $10,000, making FXMills more suitable for established and serious investors rather than beginners.

Bonus and Promotions:

The available details do not show any specific bonus or promotional offers. Potential clients should look for additional updates directly from the broker's website or customer service representatives.

Tradeable Assets:

FXMills offers a wide range of tradeable assets, including forex, indices, stocks, commodities, and cryptocurrencies. This variety of offerings helps traders diversify their portfolios effectively.

Cost Structure:

A notable feature is the Elite Plus account's attractive spread, as low as 0.5 pips. But more clarity on the spread details for other account types is not given. The cost structure looks competitive for high-volume traders but stays unclear for smaller accounts.

Leverage:

Specific details about leverage ratios were not given in the available information, making it hard to assess this aspect thoroughly.

Platform Options:

FXMills offers the MetaTrader 4 and MetaTrader 5 platforms, meeting the needs of traders who want reliable and strong trading environments. These platforms are known for their analytical tools and user-friendly interfaces.

Regional Limitations:

There is no clear mention of regional restrictions in the available data, leaving it uncertain whether clients in certain areas may face limitations or additional compliance requirements.

Customer Service Languages:

The broker's support information does not detail the languages available for customer service, which could be important for non-English speaking users.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

The analysis of FXMills' account conditions shows several key observations. The broker currently offers limited account types, with its main focus being on VIP and Elite Plus accounts. The VIP account, requiring a minimum deposit of $10,000, is clearly designed for wealthy individuals and professional traders. This high entry requirement can stop beginner and retail traders from using the platform, making it less accessible. The Elite Plus account, with its appealing low spread of 0.5, targets experienced traders who care about cost efficiency in their trading operations. But information about the complete account opening process, such as verification procedures and available additional account types , remains insufficient. User feedback often raises concerns about the restrictive account conditions, particularly the strict financial requirements and the limited flexibility in account options. Other brokers tend to offer a range of accounts tailored to different trading profiles when compared. In light of these issues, the overall assessment of FXMills' account conditions is affected by both its favorable low spread for elite trading and its challenging minimum deposit requirement. This fxmills review shows the critical need for potential users to weigh these factors before committing to the platform.

FXMills gives its traders industry-standard platforms—MetaTrader 4 and MetaTrader 5—which are well-known for their strength and complete functionality. Having these platforms allows access to a wide range of technical analysis tools, automated trading capabilities, and risk management features. Users have given mostly positive feedback about the speed and reliability of these platforms, although some have noted occasional issues with order execution when market volatility increases. Even with the solid set of trading tools, the broker's offering of educational and research resources is notably limited, with little evidence of detailed market analysis reports or dedicated educational materials. This gap in additional resources leaves trading strategy development largely to the individual trader. While the technical tools provided are good and support advanced trading techniques, the lack of informative content for strategy improvement and market insight is a drawback. Also, automated trading support appears standard but not exceptionally enhanced compared to competitors. In summary, FXMills' trading toolset is adequate for a professional trader but may not be enough for users seeking comprehensive market intelligence alongside their trading software.

6.3 Customer Service and Support Analysis

The customer support structure at FXMills presents a mixed picture based on user experiences. While the broker claims to offer strong customer service, there are different opinions about the effectiveness and responsiveness of the support team. Some users have praised the professionalism and problem-solving attitude of the support staff, citing successful and timely resolutions of technical issues. But other users have reported instances of delayed response times and inconsistencies in the quality of service—particularly during periods of high trading activity. Also, although the exact communication channels and the languages supported by the service team have not been clearly detailed, these gaps contribute to uncertainty. The absence of clear operational hours and a fully disclosed support structure further complicates the overall user experience. From the reported feedback, it appears that while customer service can be efficient under favorable circumstances, the variability in performance remains a significant point of contention among traders. Balancing these perspectives, FXMills' customer service and support are evaluated as moderate, with room for improvement, especially in making reliability and transparency better.

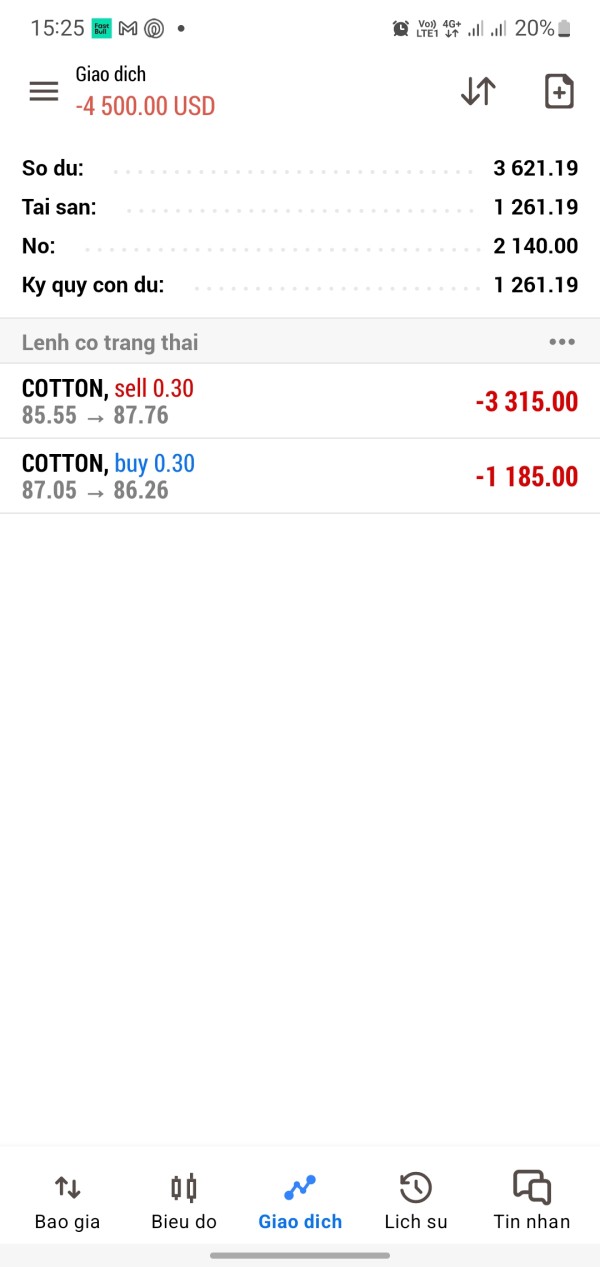

6.4 Trading Experience Analysis

The trading experience at FXMills has both strengths and areas of concern. The strength of the MT4/MT5 platforms generally ensures a stable and reliable trading environment, which is particularly praised during periods of regular market conditions. But some traders have noted that while order execution is typically smooth, there have been occasional complaints about slippage and spread fluctuations—factors that can negatively affect trade outcomes during volatile market conditions. The existence of a low spread option on the Elite Plus account is definitely a positive aspect, contributing to cost-effective trading for those who qualify. On the other hand, the high minimum deposit associated with the VIP account and the lack of additional account options limit accessibility and flexibility. Also, while the platform's user interface is largely familiar to seasoned traders, elements such as the registration and fund management processes have not been described in enough detail, leaving potential users with unanswered questions. Overall, while the trading environment at FXMills meets expectations for many experienced traders, the mixed comments about spread consistency and execution quality moderate the overall rating. This fxmills review highlights that while the platform has many technical strengths, some users remain cautious due to operational inconsistencies and financial entry barriers.

6.5 Trustworthiness Analysis

When evaluating the trustworthiness of FXMills, the absence of clearly disclosed regulatory information emerges as the most significant drawback. In an industry where strong regulatory oversight means operational safety and reliability, FXMills' unclear approach in this regard raises valid concerns among potential clients. Information from various sources indicates that there are ongoing discussions in user forums about the broker's regulatory status and potential security of client funds. This uncertainty is made worse by the minimal disclosure of internal risk management protocols and fund safeguarding measures. While some users have suggested that the broker's competitive trading conditions and appealing cost structure indicate a commitment to their clientele, the lack of external validation from recognized regulatory bodies overshadows these positives. It is essential for high-end traders, particularly those investing significant sums via VIP accounts, to have confidence in the broker's integrity and security measures. As a result, despite other strengths in trading tools and platform functionality, the trust factor remains low. This unresolved element of risk can deter a segment of traders who prioritize regulatory assurance above all else, impacting overall confidence in FXMills.

6.6 User Experience Analysis

The overall user experience at FXMills is defined by a combination of strong technical performance and notable areas for improvement. Traders typically appreciate the operational reliability of the MT4/MT5 platforms, which deliver a familiar, analytical, and efficient trading environment. But the experience is somewhat hurt by the high minimum deposit requirements and inflexibility in account options which exclude a broader range of traders. Also, while the process for depositing and withdrawing funds is helped by multiple payment methods, the lack of detailed information about the ease of these transactions leaves room for uncertainty. Many users have given feedback about delays and unexpected costs associated with fund transfers, while others remain frustrated by the unclear registration and account verification process. Interface design and navigation appear to be standard, yet without comprehensive details on language support and customer service availability, the user experience can feel incomplete for non-native speakers or those seeking more localized assistance. In summary, while FXMills offers a technically sound platform, the friction caused by account requirements and partial support information suggests that the overall user journey could benefit from increased transparency and user-focused improvements.

7. Conclusion

In conclusion, FXMills emerges as a relatively new broker with a mixed profile. On one hand, it offers competitive trading conditions such as low spreads on its Elite Plus account and a selection of convenient deposit options. On the other, the lack of clear regulatory details, high minimum deposit requirements, and inconsistent customer support raise concerns about its overall reliability. As outlined in this fxmills review, the platform is best suited for mid-to-high-end traders who can meet the financial thresholds and are comfortable navigating a less transparent operational framework. Prospective clients should weigh these advantages and limitations carefully before proceeding.