FX Daily 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive fx daily review reveals significant concerns about FX Daily as a trading platform. FX Daily operates under Daily FX Markets and is a UK-registered forex broker that has been flagged by the Financial Conduct Authority as a suspected fraudulent operation. The company was established in 2023. This unregulated broker primarily focuses on forex trading while offering limited access to commodities and indices.

The broker's lack of regulatory oversight combined with its designation as a suspicious entity by the FCA raises serious red flags for potential traders. FX Daily may appear to target traders with higher risk tolerance who are willing to trade with unregulated entities, but the significant regulatory warnings make it unsuitable for most trading scenarios. The absence of proper licensing and the FCA's fraud alert suggest that traders should exercise extreme caution. Traders should consider alternative, properly regulated brokers for their trading activities.

Important Notice

This fx daily review is based on publicly available information and regulatory warnings from official sources. FX Daily's regulatory status may vary across different jurisdictions, and traders should verify current regulatory standing in their specific region before considering any engagement. The evaluation presented here reflects the broker's status as of 2025. It incorporates feedback from regulatory bodies and available user reports. Given the dynamic nature of regulatory oversight, potential users should conduct independent verification of all claims and regulatory standings before making any trading decisions.

Rating Framework

Broker Overview

FX Daily was established in 2023. The company operates under the umbrella of Daily FX Markets, a UK-registered company that positions itself as a forex-focused broker. Despite its UK registration, the company operates without proper regulatory authorization from the Financial Conduct Authority. The FCA has subsequently flagged it as a suspicious operation. The broker's business model centers around providing forex trading services, though it lacks the essential regulatory safeguards that legitimate brokers typically maintain.

The company's recent establishment and immediate regulatory concerns suggest a problematic foundation for trading operations. FX Daily attempts to offer trading services across forex markets while also providing limited access to commodities and indices. However, the absence of proper licensing and the explicit warnings from the FCA indicate that the broker operates outside the bounds of legitimate financial services. This regulatory gap creates significant risks for potential clients. There are no investor protection schemes or regulatory oversight to ensure fair trading practices or fund security.

Regulatory Status: The broker falls under FCA jurisdiction but has been specifically marked as suspicious and potentially fraudulent. This indicates severe regulatory compliance failures.

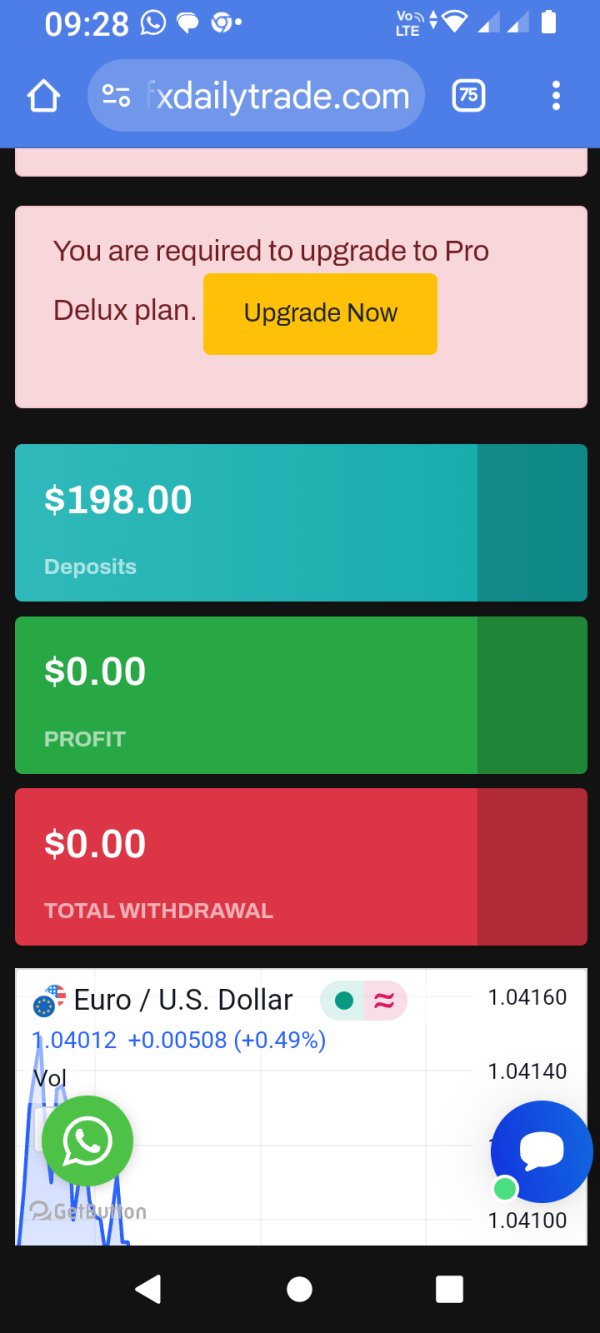

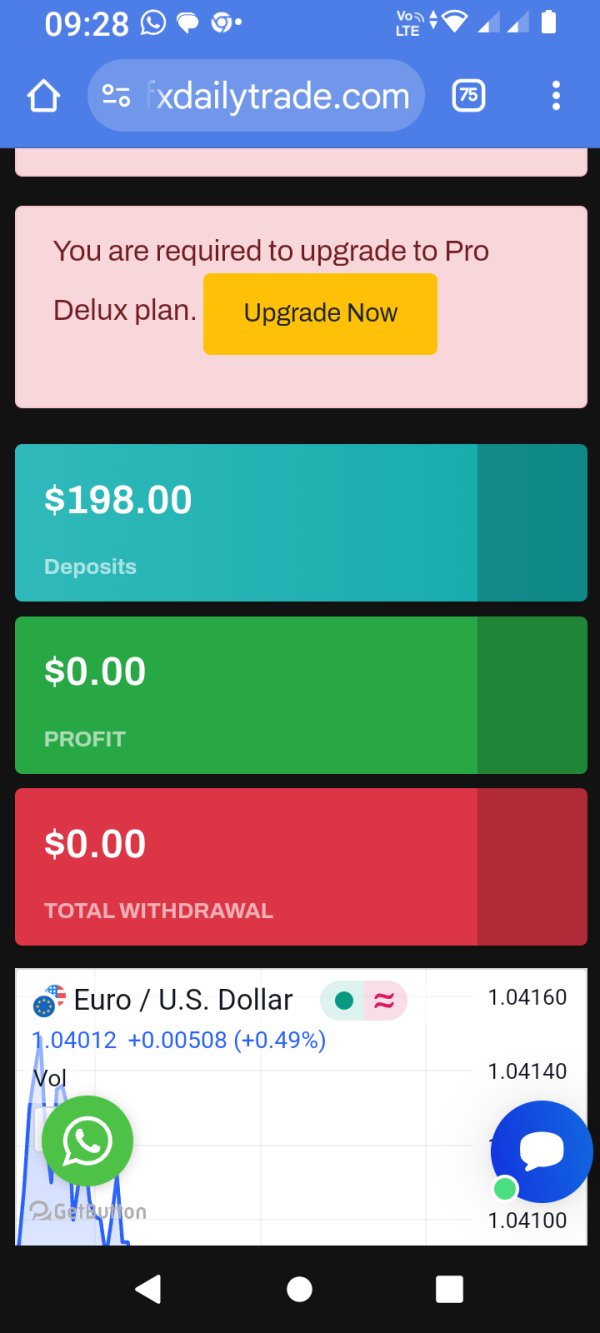

Deposit and Withdrawal Methods: Available information does not specify the deposit and withdrawal options offered by FX Daily. This raises concerns about transparency in financial operations.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit requirements in publicly available sources. This is unusual for legitimate trading platforms.

Bonus and Promotions: No information regarding promotional offers or bonus structures is available from official sources.

Tradeable Assets: FX Daily offers access to forex pairs, commodities, and indices. The extent and quality of these offerings remain unclear due to limited disclosure.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not readily available. This hampers cost comparison with regulated alternatives.

Leverage Options: Specific leverage ratios and margin requirements have not been disclosed in available materials.

Platform Options: The trading platform technology and options are not detailed in accessible sources.

Regional Restrictions: Geographic limitations and availability are not specified in current documentation.

Customer Support Languages: Supported languages for customer service are not indicated in available resources.

Detailed Rating Analysis

Account Conditions Analysis (1/10)

The account conditions evaluation for this fx daily review reveals substantial gaps in available information. FX Daily has not provided comprehensive details about account types, tier structures, or specific features that distinguish different account levels. This lack of transparency is particularly concerning for a financial services provider. Potential clients cannot make informed decisions about account suitability.

The absence of clear minimum deposit requirements further complicates the assessment process. Legitimate brokers typically provide detailed account specifications, including deposit thresholds, account benefits, and any associated fees or charges. The unavailability of such fundamental information suggests either poor communication practices or deliberate opacity in business operations.

Without detailed account opening procedures or verification requirements, potential users cannot adequately prepare for the registration process. This information gap, combined with the regulatory warnings, significantly undermines confidence in the broker's account management capabilities. It also raises concerns about overall operational transparency.

The evaluation of trading tools and resources presents limited positive findings. While there is some association with DailyFX, described as a leading platform for forex trading news, charts, indicators, and analysis, the direct connection and availability of these resources through FX Daily remains unclear. This ambiguity prevents a comprehensive assessment of the actual tools available to traders.

Educational resources, which are crucial for trader development, appear to be either non-existent or poorly documented. Legitimate brokers typically offer comprehensive educational materials, including webinars, tutorials, market analysis, and trading guides. The absence of such resources suggests that FX Daily may not prioritize trader education and development.

Research and analysis capabilities, essential for informed trading decisions, are not adequately described in available materials. Without proper analytical tools, economic calendars, or market research, traders would need to rely on external sources. This diminishes the value proposition of the trading platform.

Customer Service and Support Analysis (2/10)

Customer service evaluation reveals significant concerns due to the complete absence of detailed support information. Professional forex brokers typically provide multiple contact channels, including phone support, live chat, email assistance, and comprehensive FAQ sections. The lack of such information for FX Daily raises questions about the broker's commitment to customer support.

Response times, service quality standards, and support availability hours are not specified in any accessible documentation. This absence of basic customer service information is particularly problematic for a financial services provider. Timely support can be crucial for trading operations and issue resolution.

Multilingual support capabilities, essential for international operations, are not documented. Given the global nature of forex trading, the absence of language support information suggests limited international service capabilities. It may also indicate poor communication of available services.

Trading Experience Analysis (4/10)

The trading experience assessment for this fx daily review is hampered by insufficient information about platform performance, execution quality, and user interface design. Without detailed specifications about trading platform technology, order execution speeds, or system reliability, it's impossible to provide a comprehensive evaluation of the trading environment.

Platform stability and uptime statistics, crucial for active trading, are not documented in available sources. Professional trading platforms typically provide performance metrics and system reliability data to demonstrate their technical capabilities. The absence of such information suggests either poor platform performance or inadequate transparency about system capabilities.

Mobile trading capabilities, increasingly important for modern traders, are not described in accessible materials. The lack of information about mobile apps, responsive web platforms, or mobile-specific features indicates potential limitations in trading accessibility. It also suggests limited convenience for users.

Trust and Security Analysis (1/10)

The trust and security evaluation reveals the most concerning aspects of FX Daily's operations. The FCA's explicit warning about the broker being a suspected fraudulent operation represents a severe red flag that cannot be overlooked. Regulatory authorities issue such warnings only when there is substantial evidence of problematic or potentially illegal activities.

The unregulated status of FX Daily means that clients have no regulatory protection or recourse mechanisms in case of disputes or fund security issues. Legitimate forex brokers operate under strict regulatory frameworks that include client fund segregation, compensation schemes, and regular audits to ensure operational integrity.

Fund security measures, such as segregated client accounts, insurance coverage, or third-party fund custody arrangements, are not documented. This absence of security information, combined with the regulatory warnings, creates significant risks for any potential deposits or trading activities.

User Experience Analysis (2/10)

User experience evaluation is severely limited by the absence of substantial user feedback and testimonials. Established brokers typically have extensive user reviews, community feedback, and third-party evaluations that provide insights into real-world trading experiences. The lack of such feedback for FX Daily may indicate limited user base or suppressed negative reviews.

Interface design and usability assessments cannot be completed without access to detailed platform information or user interface demonstrations. Professional trading platforms typically showcase their design capabilities and user-friendly features to attract potential clients. The absence of such materials suggests potential limitations in platform development or marketing transparency.

Registration and account verification processes are not adequately described, making it difficult for potential users to understand the onboarding experience. Legitimate brokers provide clear guidance on account opening procedures, required documentation, and verification timelines. This ensures smooth user experience.

Conclusion

This comprehensive fx daily review concludes with a strong recommendation to avoid FX Daily as a trading platform. The combination of unregulated status, FCA fraud warnings, and lack of transparency in crucial operational areas creates an unacceptable risk profile for any trader. This applies regardless of their experience level or risk tolerance.

The absence of proper regulatory oversight, combined with insufficient information about basic trading conditions, customer support, and security measures, makes FX Daily unsuitable for serious trading activities. Traders seeking reliable forex trading opportunities should consider properly regulated alternatives that offer transparent operations. These alternatives provide comprehensive customer protection and established track records in the financial services industry.