FinFX-Pro 2025 Review: Everything You Need to Know

In the evolving landscape of forex trading, FinFX-Pro emerges as a broker that has garnered attention for its unique offerings and contentious reputation. This review synthesizes various insights from recent evaluations, highlighting both the advantages and drawbacks of trading with this broker. Key features include a low minimum deposit requirement and a wide range of trading instruments, but the lack of regulation raises significant concerns.

Note: It is crucial to recognize that the operations of FinFX-Pro may vary across regions, and the absence of a reputable regulatory body can affect the safety of your investments. This review aims for fairness and accuracy by collating information from multiple sources.

Ratings Overview

How We Rate Brokers: Our ratings are based on comprehensive analysis, including user experiences, expert opinions, and factual data regarding services and conditions.

Broker Overview

Founded in 2018, FinFX-Pro is a forex and CFD broker registered in the United Kingdom. It operates on popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offering traders access to a diverse range of financial instruments. The broker provides trading opportunities in forex pairs, commodities like gold and silver, and a selection of cryptocurrencies. However, it is essential to note that FinFX-Pro operates without regulation, which significantly impacts its credibility and the safety of client funds.

Detailed Breakdown

Regulatory Landscape

FinFX-Pro is unregulated, which poses a substantial risk to traders. According to multiple sources, including WikiFX, the absence of oversight from established financial authorities means that there are no guarantees for fund safety or operational transparency. Traders are advised to exercise caution and consider this lack of regulation a critical factor before engaging with the broker.

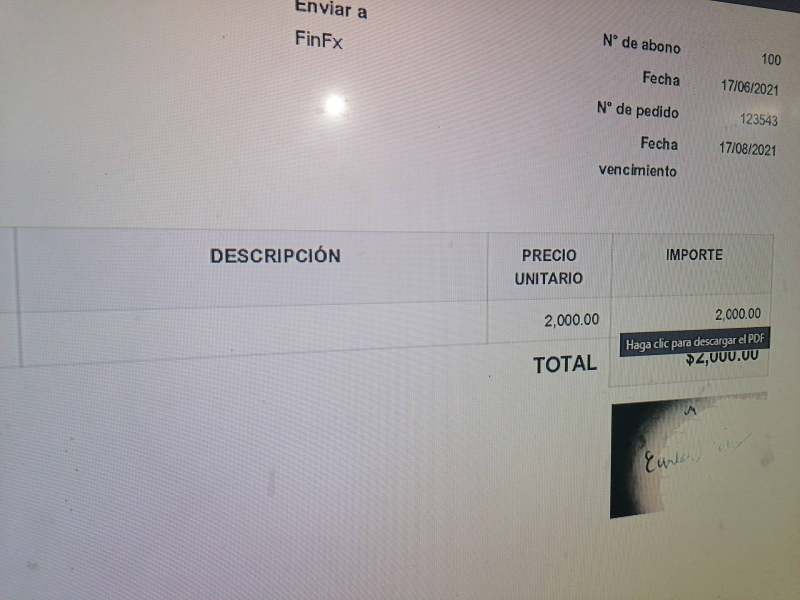

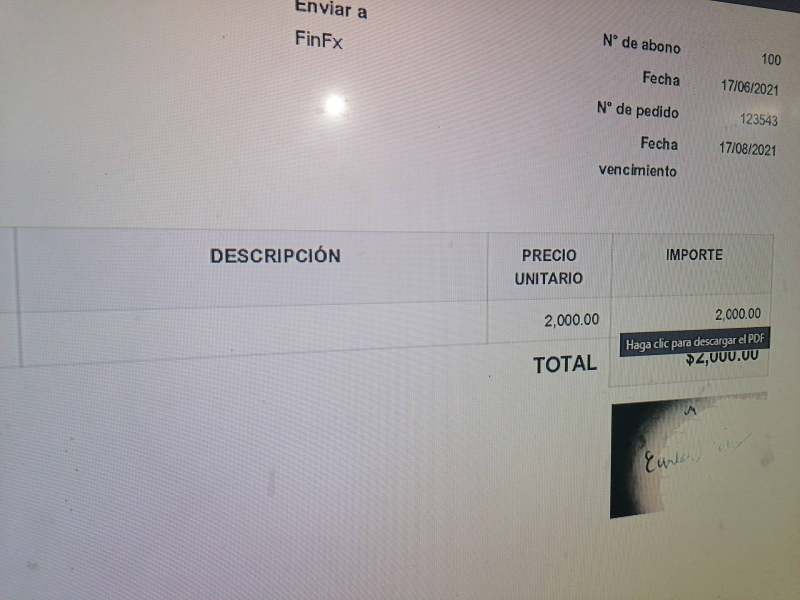

Deposit and Withdrawal Options

FinFX-Pro supports a variety of deposit and withdrawal methods, including traditional options like credit cards and bank transfers, as well as modern solutions such as Bitcoin. The minimum deposit is attractively low, starting at just $5 for the micro account, which is appealing for new traders. However, the broker's lack of regulation raises concerns regarding the security of these transactions.

Minimum Deposit

The broker offers five different account types, with the minimum deposit ranging from $5 for the micro account to $25,000 for the VIP account. While the low entry point is advantageous for beginners, the higher-tier accounts may provide better conditions but require significant capital.

There is limited information regarding bonuses or promotional offers on FinFX-Pro. The absence of attractive incentives may deter some traders, especially when compared to other brokers offering competitive bonuses to attract new clients.

Trading Asset Categories

FinFX-Pro provides access to a wide array of trading instruments, including 36 forex pairs, commodities like gold and silver, and multiple cryptocurrencies. This variety allows traders to diversify their portfolios, but the lack of a regulated environment can limit the effectiveness of these trading strategies.

Cost Structure

The cost of trading with FinFX-Pro varies by account type. Standard STP accounts have spreads starting from 0.7 pips with no commissions, while micro accounts feature spreads from 0.2 pips plus a commission of $4 per standard lot. Pure ECN accounts boast spreads starting from 0 pips but charge commissions, which can increase the overall trading cost. Traders should be aware of these costs, especially when using high leverage.

Leverage Options

FinFX-Pro offers leverage of up to 1:400 for most accounts, which is appealing for traders looking to maximize their trading potential. However, higher leverage also increases risk, and traders should implement robust risk management strategies to protect their capital.

The broker supports both MT4 and MT5, which are widely regarded as industry standards. These platforms offer advanced charting tools, automated trading capabilities, and a user-friendly interface, making them suitable for both novice and experienced traders.

Restricted Regions

While FinFX-Pro is based in the UK, it does not appear to have specific restrictions regarding trading from other regions. However, potential clients should verify their local regulations to ensure compliance before opening an account.

Customer Service Languages

Customer support is available primarily in English, with limited resources for other languages. The effectiveness of customer service has been a point of contention, with reports of slow response times and inadequate support for traders facing issues.

Final Ratings Overview

In conclusion, while FinFX-Pro offers some attractive features such as low minimum deposits and a variety of trading instruments, the significant drawbacks, particularly the lack of regulation and mixed reviews regarding customer service, warrant caution. Traders should thoroughly assess their risk tolerance and consider alternative brokers with stronger regulatory oversight before engaging with FinFX-Pro.