Exen Markets 2025 Review: Everything You Need to Know

Executive Summary

Exen Markets is an unregulated financial services company registered in Saint Vincent and the Grenadines. Users should exercise caution when considering this platform due to its lack of proper regulatory oversight. The company was established in 2016 and claims to be operated by EXEN AUSTRALIA PTY LTD, which allegedly holds authorization from the Australian Securities and Investments Commission. However, our comprehensive exen markets review reveals significant concerns about the platform's transparency and regulatory status.

The primary user base consists of investors interested in forex trading. These are particularly those seeking alternative trading conditions outside traditional regulated environments. However, the lack of detailed information about trading conditions, account types, and customer support raises red flags for potential users. According to available sources, including WikiFX and other broker review platforms, Exen Markets operates with limited transparency regarding its actual services and trading infrastructure.

The platform's registration in Saint Vincent and the Grenadines is concerning. This jurisdiction is known for minimal regulatory requirements, combined with unclear operational details, making it a high-risk choice for retail traders. Our analysis suggests that while the company claims Australian regulatory backing, the actual regulatory status remains questionable and requires further verification from potential users.

Important Disclaimer

As an unregulated broker, Exen Markets' legal status may vary significantly across different jurisdictions. Investors must assume full responsibility for any associated risks. The regulatory landscape for offshore brokers continues to evolve, and what may be permissible in one region could face restrictions in another. Users should thoroughly research their local regulations before engaging with this platform.

This review is compiled based on publicly available information from various sources. These include WikiFX, WikiBit, and FXVerify platforms. Potential users should conduct their own due diligence and consider their individual circumstances when making investment decisions. The lack of comprehensive regulatory oversight means that standard investor protections may not apply.

Rating Framework

Broker Overview

Exen Markets was established in 2016 as a financial services company registered in Saint Vincent and the Grenadines. The company claims to operate under EXEN AUSTRALIA PTY LTD, which allegedly holds authorization from the Australian Securities and Investments Commission. However, verification of these regulatory claims remains challenging, as the available documentation does not provide clear evidence of active regulatory supervision.

The broker's business model appears to focus on forex trading services. Specific details about their operational structure, market-making versus STP execution, or institutional partnerships remain undisclosed. According to sources reviewed in this exen markets review, the company maintains a low profile in the industry with minimal marketing presence or industry recognition.

The platform's registration in Saint Vincent and the Grenadines raises concerns about regulatory oversight. This jurisdiction is known for minimal financial services regulation. While the company claims Australian regulatory backing through EXEN AUSTRALIA PTY LTD, independent verification of this authorization status is recommended for potential users. The lack of detailed operational information and limited online presence suggests a broker that operates with minimal transparency standards.

Available information suggests that Exen Markets targets retail forex traders. The specific demographics or geographic focus remain unclear. The absence of detailed marketing materials or comprehensive service descriptions indicates either a very selective client approach or limited operational scope.

Regulatory Status: Exen Markets is registered in Saint Vincent and the Grenadines. It operates as an unregulated financial services provider with questionable regulatory oversight.

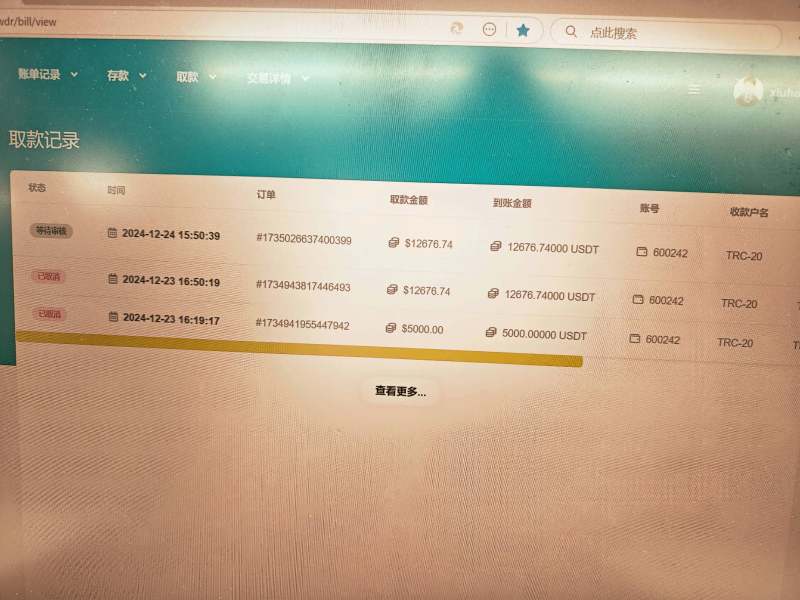

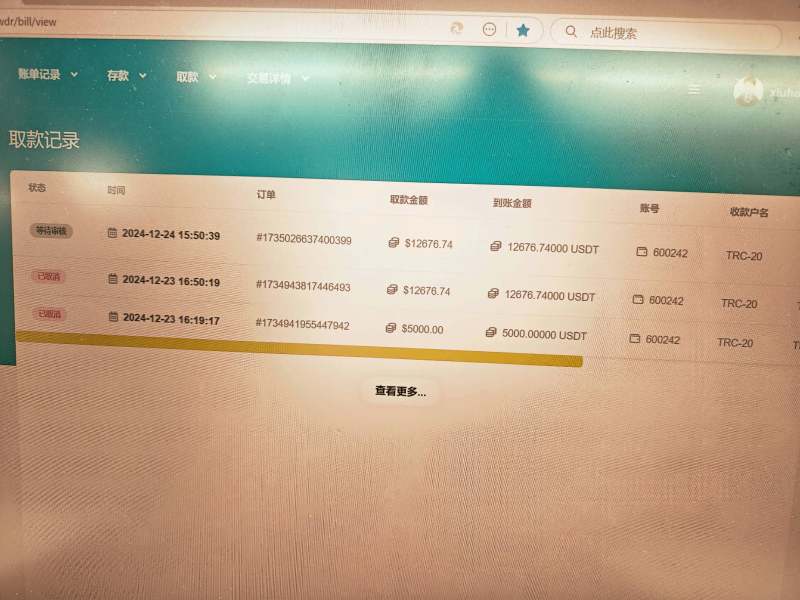

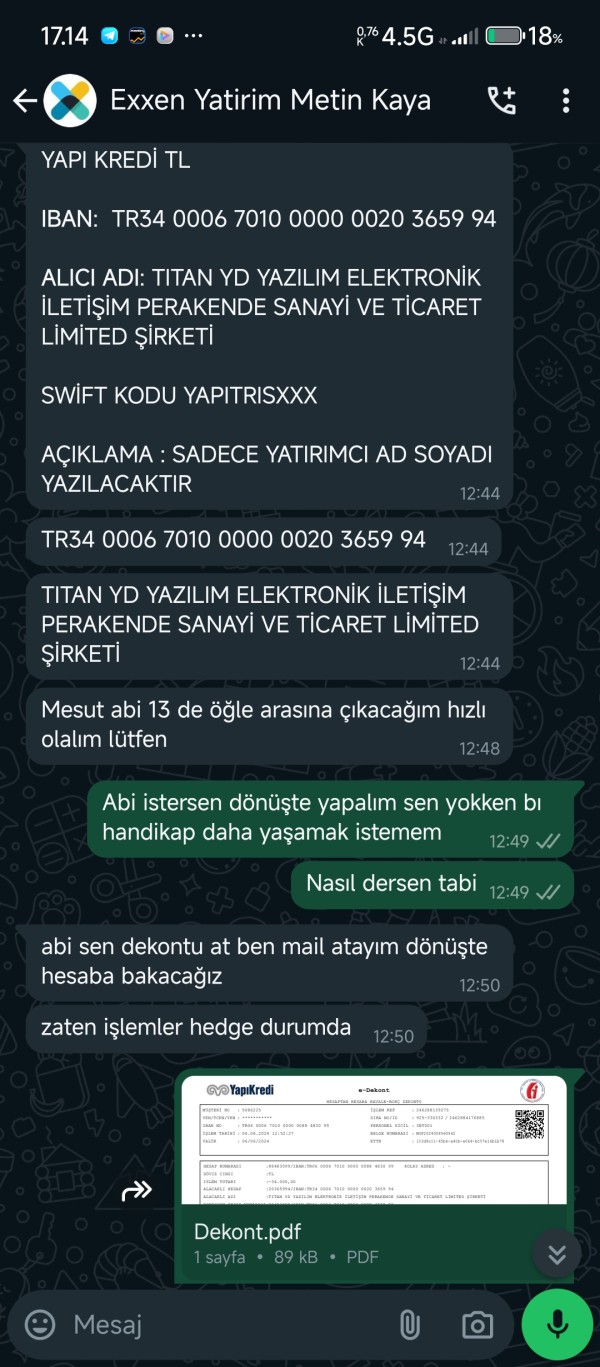

Deposit and Withdrawal Methods: Specific information about payment methods, processing times, and associated fees is not detailed in available sources.

Minimum Deposit Requirements: The minimum deposit amount required to open an account is not specified in available documentation.

Bonus and Promotions: No information about promotional offers, welcome bonuses, or ongoing incentives is available in reviewed sources.

Tradeable Assets: The range of financial instruments available for trading, including forex pairs, commodities, or indices, is not clearly specified.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in available materials. This is concerning for this exen markets review.

Leverage Ratios: Maximum leverage offerings and margin requirements are not disclosed in accessible documentation.

Platform Options: Information about trading platform availability, including MetaTrader support or proprietary platforms, is not specified.

Geographic Restrictions: Details about restricted countries or regional limitations are not clearly outlined.

Customer Support Languages: Available support languages and communication channels are not detailed in reviewed sources.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by Exen Markets remain largely undisclosed. This significantly impacts our assessment in this exen markets review. Available sources do not provide specific information about account types, their distinctive features, or the benefits associated with different tier levels. This lack of transparency is particularly concerning for potential clients who need to understand the trading environment before committing funds.

Minimum deposit requirements are not specified in any of the reviewed sources. This makes it impossible for traders to plan their initial investment or compare costs with other brokers. The absence of clear account opening procedures and requirements suggests either poor marketing communication or a deliberately opaque approach to client onboarding.

According to WikiFX and other review platforms, there is insufficient information about special account features. These include Islamic accounts, professional trader classifications, or institutional services. The lack of detailed account documentation raises questions about the broker's commitment to transparency and regulatory compliance.

User feedback regarding account conditions is notably absent from major review platforms. This could indicate either a very limited client base or restricted access to the platform. This absence of user testimonials makes it difficult to assess the practical experience of working with Exen Markets' account structures.

The trading tools and resources provided by Exen Markets are not adequately documented in available sources. This results in a poor rating for this category. There is no specific information about market analysis tools, economic calendars, or technical analysis capabilities that would typically be expected from a modern forex broker.

Research and analysis resources appear to be either non-existent or not promoted through the broker's available channels. The absence of market commentary, daily analysis, or research reports suggests limited support for traders who rely on fundamental analysis for their trading decisions.

Educational resources, which are crucial for retail trader development, are not mentioned in any of the reviewed sources. The lack of webinars, tutorials, or educational materials indicates that Exen Markets may not prioritize trader education or skill development.

Automated trading support, including Expert Advisor compatibility or API access, is not documented in available materials. This limitation could significantly impact traders who rely on algorithmic trading strategies or require advanced automation features for their trading activities.

Customer Service and Support Analysis (2/10)

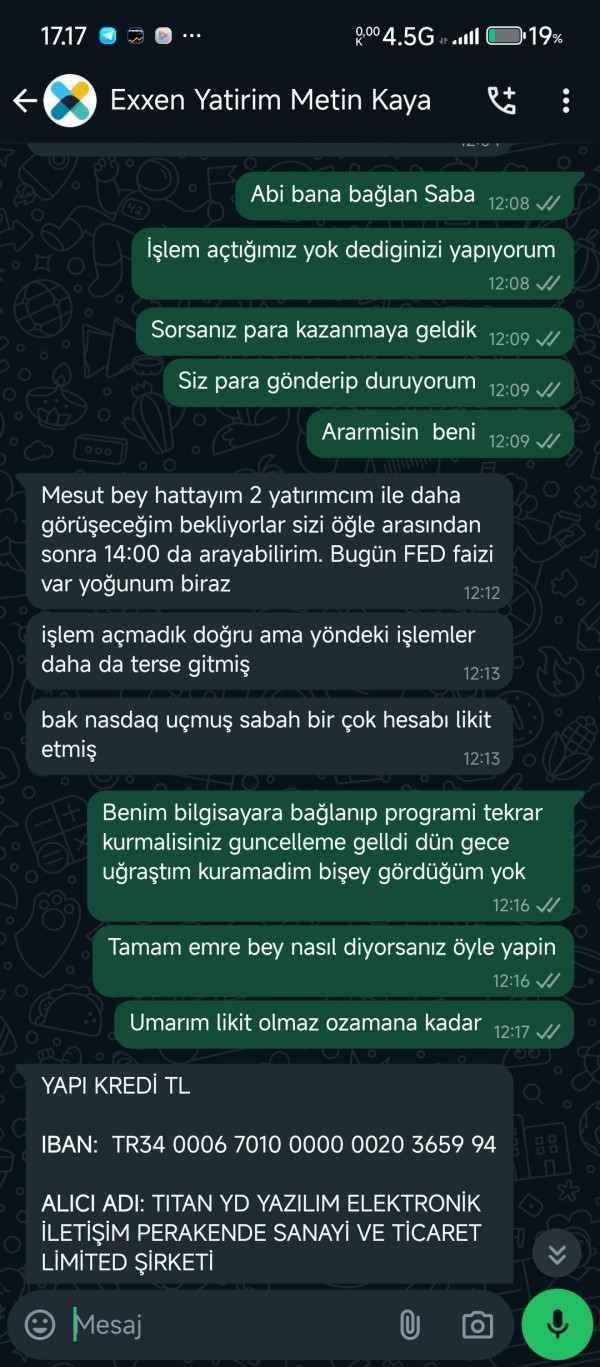

Customer service information for Exen Markets is notably absent from reviewed sources. This raises significant concerns about the quality and availability of client support. There is no documentation of available support channels, whether through phone, email, live chat, or other communication methods.

Response time commitments and service level agreements are not specified. This makes it impossible to assess the broker's dedication to client service. The absence of published support hours or availability windows suggests either limited service offerings or poor communication of support capabilities.

Service quality assessments cannot be made due to the lack of user feedback and testimonials regarding customer service experiences. This absence of client reviews about support interactions is particularly concerning for potential users who may need assistance with account issues or trading problems.

Multi-language support capabilities are not documented. This could limit accessibility for international clients. The lack of clearly defined support procedures and escalation processes raises questions about the broker's ability to handle complex client issues effectively.

Trading Experience Analysis (3/10)

The trading experience offered by Exen Markets cannot be comprehensively evaluated due to insufficient information. Available sources do not provide specific data about platform stability, execution speed, and overall performance metrics that would be essential for this exen markets review.

Platform functionality and feature completeness remain unclear. There is no detailed description of the trading interface, charting capabilities, or order management tools. The absence of platform screenshots or detailed feature lists makes it impossible to assess the user interface quality or trading functionality.

Mobile trading experience is not documented in available sources. This is particularly concerning given the importance of mobile accessibility in modern forex trading. The lack of information about mobile app availability or mobile-optimized platforms suggests potential limitations in trading flexibility.

Trading environment characteristics, such as market depth, price feed quality, or execution model transparency, are not disclosed. This lack of transparency about the actual trading conditions makes it difficult for potential clients to assess whether the platform meets their trading requirements.

User feedback about trading experience is notably absent from major review platforms. This could indicate either limited user adoption or restricted platform access. The absence of performance testimonials or trading experience reviews raises questions about the platform's actual capabilities and user satisfaction levels.

Trust and Safety Analysis (2/10)

The trust and safety profile of Exen Markets presents significant concerns due to its unregulated status and lack of transparent operational information. The company's registration in Saint Vincent and the Grenadines, while legal, provides minimal regulatory protection for client funds and trading activities.

Fund safety measures are not clearly documented in available sources. This raises questions about client money segregation, insurance coverage, or other protective mechanisms typically expected from regulated brokers. The absence of clear fund protection policies is particularly concerning for potential clients considering significant deposits.

Company transparency is limited, with minimal public information about management, operational procedures, or business practices. The lack of detailed company information and operational transparency reduces confidence in the broker's legitimacy and professional standards.

Industry reputation appears minimal based on the limited presence in major broker review platforms and the absence of industry recognition or awards. The lack of established industry relationships or partnerships suggests a broker operating outside mainstream financial services networks.

Regulatory verification of the claimed Australian authorization through EXEN AUSTRALIA PTY LTD requires independent confirmation. The available sources do not provide conclusive evidence of active regulatory supervision or compliance monitoring.

User Experience Analysis (3/10)

User experience assessment for Exen Markets is significantly hampered by the lack of comprehensive user reviews and feedback across major broker evaluation platforms. The absence of detailed user testimonials makes it impossible to gauge overall satisfaction levels or identify common user concerns.

Interface design and usability cannot be properly evaluated due to the lack of available platform demonstrations or detailed feature descriptions. The absence of user interface screenshots or navigation guides suggests either limited platform development or poor marketing communication.

Registration and verification processes are not clearly documented. This makes it difficult for potential users to understand account opening requirements or expected timeline for account activation. The lack of clear onboarding procedures could indicate either simplified processes or inadequate documentation.

Fund operation experience, including deposit and withdrawal procedures, processing times, and associated costs, is not detailed in available sources. This absence of crucial operational information makes it difficult for users to plan their trading activities or assess the practical aspects of account management.

Common user complaints and concerns cannot be identified due to the limited availability of user feedback and review content. This absence of user-generated content raises questions about the platform's actual user base and operational activity levels.

Conclusion

Exen Markets receives a low overall rating due to significant concerns about regulatory oversight, transparency, and operational disclosure. The broker's unregulated status, combined with limited public information about trading conditions and services, makes it suitable only for investors who fully understand and accept the associated risks.

The main advantages include registration convenience in Saint Vincent and the Grenadines. The primary disadvantages encompass lack of regulatory protection, insufficient transparency about trading conditions, limited customer support information, and absence of user feedback. Potential users should exercise extreme caution and conduct thorough due diligence before considering this platform for their trading activities.