Eco Valores S.A. 2025 Review: Everything You Need to Know

Summary

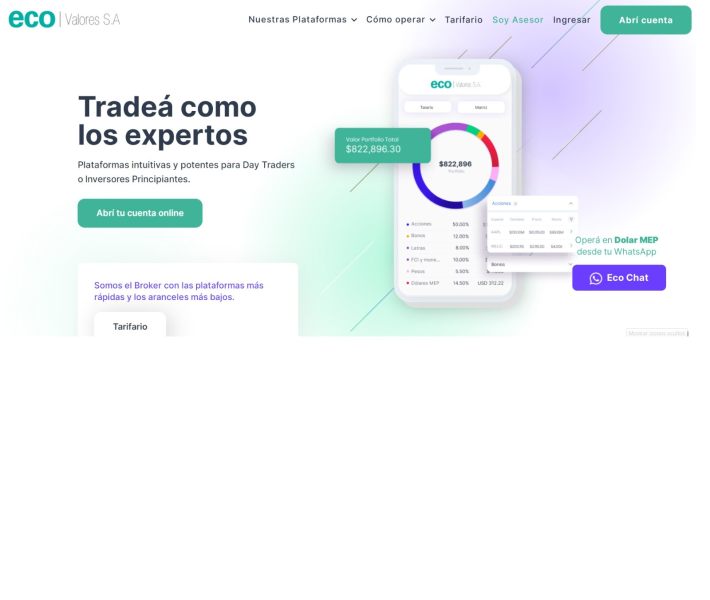

This eco valores s.a. review looks at a new but important player in Argentina's financial services sector. Eco Valores S.A. is an online brokerage firm that has become a leading Argentine Fintech company since starting in 2019. The company has shown great growth and market presence in Argentina's financial world, even though it has been running for just over five years.

The firm works under CNV license #109. This gives it regulatory approval and oversight for its operations. Eco Valores stands out because it focuses on new technology and offers what they say are the fastest trading platforms in the Argentine market.

The company serves two main groups of customers. Day traders need fast execution, and small-to-medium businesses need financing through stock market operations. Eco Valores is located in Ciudad Autónoma de Buenos Aires and has built a good following with 662 followers on professional networks.

The company keeps a small but focused team of 11-50 employees. This size lets them move quickly while keeping the skills needed to serve their special market groups well. Their focus on new technology and market speed has helped them compete against bigger players in Argentina's brokerage sector.

Important Notes

Investors should know that Eco Valores S.A. is registered in Argentina under the CNV. This means its services and protections work mainly in Argentina. This regional focus may have both good and bad points depending on where investors live and what they need.

This review uses public information and industry data. Potential investors should do their own research and think about talking with financial advisors who know Argentine financial rules before making investment choices. The rules and market conditions in Argentina may be very different from other international markets.

Rating Framework

Broker Overview

Eco Valores S.A. started in 2019 as a forward-thinking financial technology company in Argentina's capital markets. The company has made itself a leading Argentine Fintech that focuses on online brokerage services using new technology to give better trading experiences. The firm is based in Ciudad Autónoma de Buenos Aires and works under Argentina's CNV oversight with license number #109, making sure it follows local financial rules and investor protection standards.

The company's business plan focuses on giving technology solutions for two different but related market groups. For day traders, Eco Valores offers high-speed trading platforms made to take advantage of quick market movements and short-term trading chances. At the same time, the firm serves small and medium businesses by giving them access to stock market financing solutions, helping these businesses raise money and manage their finances better.

The firm's promise to technology excellence shows in their claim to offer "the fastest platforms on the Market." This focus on speed and efficiency reflects what modern trading needs, where milliseconds can decide if you make money. With a small but skilled team of 11-50 employees, Eco Valores keeps the ability to adapt quickly to market changes while giving personal service to their clients.

The company's good social media following of 662 followers shows growing market recognition and client engagement in the Argentine financial community.

Regulatory Jurisdiction: Eco Valores S.A. works under Argentine law with CNV license #109. This gives regulatory oversight and investor protections specific to the Argentine market.

Deposit and Withdrawal Methods: Specific information about funding methods and withdrawal processes is not detailed in available public materials. You need to ask the company directly.

Minimum Deposit Requirements: The company has not publicly shared minimum deposit amounts or account opening requirements in available documents.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in current public information about the firm's services.

Tradeable Assets: Based on available information, the company focuses mainly on stock market operations. The complete range of available instruments needs clarification directly from the broker.

Cost Structure: Detailed fee schedules, commission rates, and cost breakdowns are not specified in publicly available materials. This needs direct communication for this eco valores s.a. review.

Leverage Ratios: Information about maximum leverage offerings and margin requirements is not shared in current public documents.

Platform Options: The company emphasizes providing the fastest trading platforms available in the Argentine market. Specific platform names and features need further investigation.

Geographic Restrictions: Service availability appears focused on the Argentine market. International accessibility details are not clearly specified.

Customer Service Languages: Given the Argentine base of operations, Spanish language support is assumed. Multilingual capabilities are not confirmed in available materials.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

The account conditions evaluation for this eco valores s.a. review faces limits because of limited publicly available information about specific account structures and requirements. While Eco Valores S.A. works as a licensed brokerage firm under CNV oversight, the company has not extensively detailed its account offerings in public materials. This lack of openness about account types, minimum deposit requirements, and specific account features makes it hard for potential clients to fully assess whether the firm's offerings match their investment needs and financial abilities.

What is known is that the company serves both individual day traders and SMEs. This suggests that multiple account types likely exist to accommodate these different client groups. Day trading accounts would probably need different features and abilities compared to corporate accounts designed for SME financing needs.

However, without specific information about account opening procedures, verification requirements, or special account features such as Islamic accounts for Muslim investors, potential clients must engage directly with the company to understand available options. The absence of detailed account information in public materials may reflect the company's preference for personal consultation rather than standardized public offerings.

This approach could benefit clients seeking customized solutions but may disadvantage those preferring transparent, upfront information about account conditions and requirements.

Eco Valores S.A.'s emphasis on technology innovation and claims of offering "the fastest platforms on the Market" suggests a strong promise to providing advanced trading tools and resources. The company's positioning as a leading Fintech shows significant investment in technology infrastructure designed to support both day trading activities and SME financing operations. However, specific details about available trading tools, analytical resources, and educational materials are not extensively documented in public information.

The focus on platform speed suggests that the company has invested heavily in execution technology, low-delay connections, and strong infrastructure capable of handling high-frequency trading demands. For day traders, this technology emphasis could translate into competitive advantages through faster order execution, real-time market data, and sophisticated charting abilities.

The company's ability to serve SMEs also implies the availability of tools and resources specifically designed for corporate financial management and capital raising activities. While the technology foundation appears strong based on the company's market positioning and claims, the lack of detailed information about specific tools, research abilities, educational resources, and automated trading support makes it difficult to provide a comprehensive assessment.

Potential clients would need to engage directly with the firm to understand the full scope of available tools and determine whether they meet their specific trading and investment requirements.

Customer Service and Support Analysis (6/10)

The customer service evaluation for Eco Valores S.A. is limited by limited public information about support channels, availability, and service quality metrics. With a team size of 11-50 employees, the company maintains a relatively small staff that could enable more personal customer relationships but might also limit 24/7 support abilities. The firm's focus on serving both day traders and SMEs suggests that customer service needs vary significantly across their client base, requiring different levels of support and expertise.

Given the company's Argentine base of operations, Spanish language support is likely standard. Multilingual abilities for international clients remain unclear. The absence of detailed information about customer service channels such as phone support, live chat, email response times, or dedicated account management services makes it challenging to assess the quality and accessibility of customer support offerings.

For day traders who need immediate help during active trading sessions, customer service responsiveness becomes critically important. Similarly, SMEs seeking financing solutions may need more consultative support and guidance throughout their engagement with the platform.

Without specific information about service level agreements, response time promises, or customer satisfaction metrics, potential clients must rely on direct engagement with the company to evaluate whether customer service abilities meet their expectations and requirements.

Trading Experience Analysis (7/10)

The trading experience assessment for this eco valores s.a. review centers on the company's strong emphasis on technology speed and platform performance. Eco Valores S.A.'s claim to offer "the fastest platforms on the Market" suggests significant investment in trading infrastructure designed to provide superior execution abilities. This focus on speed is particularly relevant for day traders who depend on rapid order execution and minimal delay to take advantage of short-term market movements and maintain competitive advantages.

The company's positioning as a leading Fintech shows adoption of modern technology approaches to trading platform development. This potentially includes advanced order management systems, real-time market data feeds, and sophisticated execution algorithms. However, specific details about platform stability, uptime statistics, order execution quality metrics, and mobile trading abilities are not extensively documented in available public information.

The firm's ability to serve both individual day traders and SMEs suggests that their trading platforms accommodate different trading styles and requirements. Day trading functionality would require features such as advanced charting, rapid order entry, and real-time position monitoring.

SME clients might need different tools focused on capital raising and longer-term investment management. Without detailed user feedback or performance metrics, the actual trading experience quality must be assessed through direct platform evaluation and user testimonials obtained independently.

Trust and Reliability Analysis (8/10)

Eco Valores S.A. shows strong credentials in terms of regulatory compliance and institutional legitimacy through its CNV license #109 and established presence in the Argentine financial services sector. The Comisión Nacional de Valores provides regulatory oversight and investor protection frameworks that enhance the company's credibility and trustworthiness. Since its establishment in 2019, the firm has maintained its regulatory standing and continued operations, showing compliance with ongoing regulatory requirements and financial obligations.

The company's positioning as a leading Argentine Fintech and its ability to attract 662 followers while maintaining steady operations suggests market acceptance and client confidence. The regulatory framework provided by CNV includes investor protection measures, capital adequacy requirements, and operational standards that contribute to overall trust and reliability.

However, specific information about additional safety measures such as segregated client funds, insurance coverage, or third-party auditing is not detailed in available public materials. While no significant negative events or regulatory issues are apparent in public records, the relatively short operational history since 2019 means that the company's long-term stability and crisis management abilities remain to be fully demonstrated.

The regulatory oversight provided by CNV offers important protections, but potential clients should understand that these protections are specific to Argentine jurisdiction and may differ from international regulatory frameworks they might be familiar with in other markets.

User Experience Analysis (6/10)

The user experience evaluation for Eco Valores S.A. is based on limited available feedback and the company's market positioning rather than extensive user testimonials or satisfaction surveys. The firm's growth since 2019 and its ability to maintain operations while serving both day traders and SMEs suggests that users find sufficient value in the services provided. The company's focus on technology innovation and platform speed shows attention to user experience elements that are critical for trading success.

The dual focus on day traders and SMEs implies that the user experience must accommodate significantly different needs and usage patterns. Day traders require intuitive, fast-responding interfaces with advanced functionality.

SME clients may prioritize comprehensive financial management tools and consultative support. The company's compact team size could enable more personalized user experiences but might also limit the availability of extensive self-service resources or 24/7 support abilities.

Without detailed user feedback, interface screenshots, or comprehensive feature descriptions, it's challenging to assess specific aspects of user experience such as platform navigation, account management processes, mobile functionality, or overall satisfaction levels. The company's continued operation and market presence suggest adequate user satisfaction.

Potential clients would benefit from trial periods or demonstrations to evaluate whether the user experience meets their specific requirements and expectations.

Conclusion

This eco valores s.a. review reveals a promising but relatively new player in Argentina's financial services landscape. Eco Valores S.A. has established itself as a technology-focused brokerage firm with strong regulatory credentials through its CNV license #109 and a clear market positioning serving day traders and SMEs. The company's emphasis on providing the fastest trading platforms in the market shows commitment to technology excellence and client success.

The firm appears most suitable for clients seeking cutting-edge trading technology within the Argentine market. This is particularly true for day traders who prioritize execution speed and SMEs requiring stock market financing solutions. However, potential clients should note that limited public information about specific account conditions, fees, and service details makes direct engagement with the company necessary to fully evaluate service offerings.

While the regulatory oversight and market presence provide confidence in the firm's legitimacy, the relatively short operational history and limited user feedback available publicly suggest that thorough due diligence remains important for prospective clients.