BCO Review 1

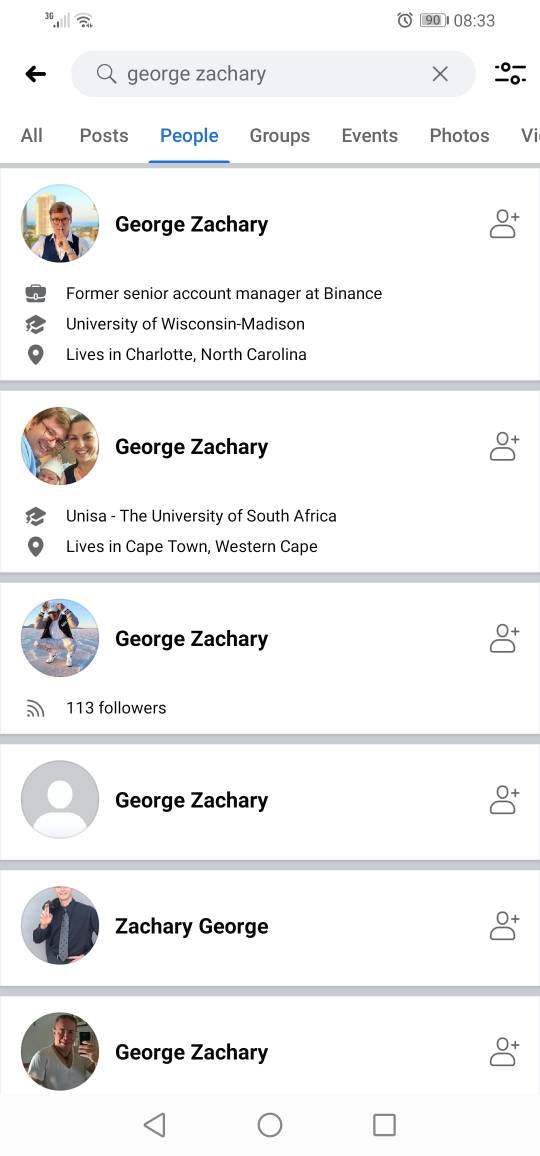

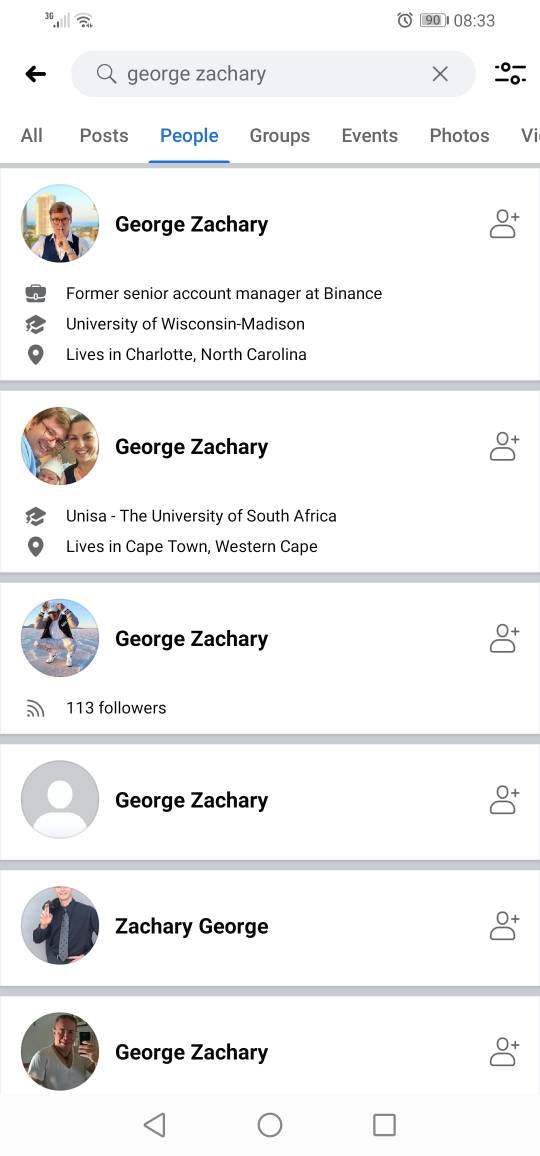

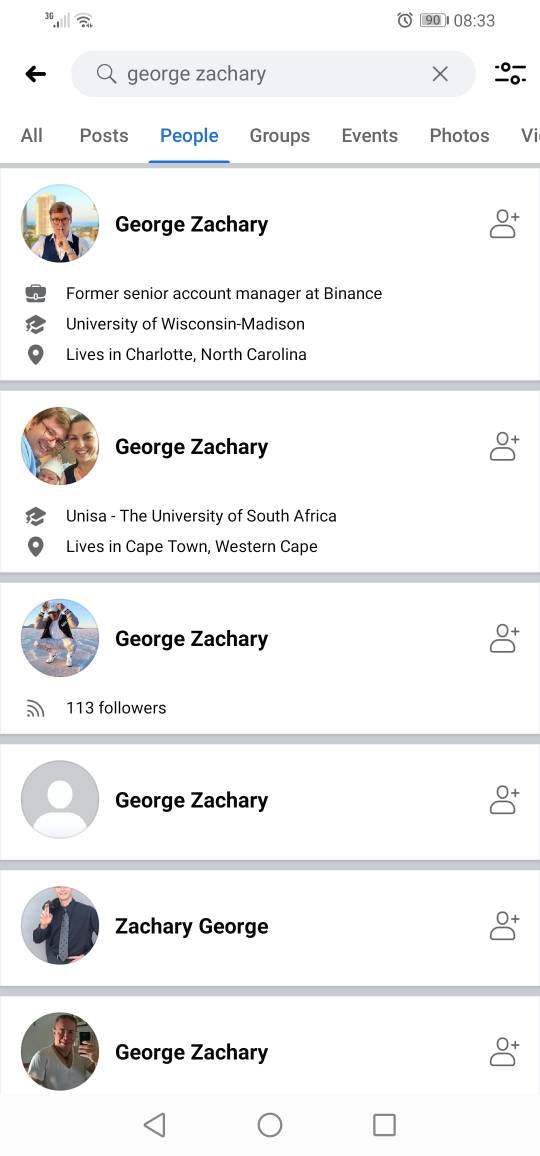

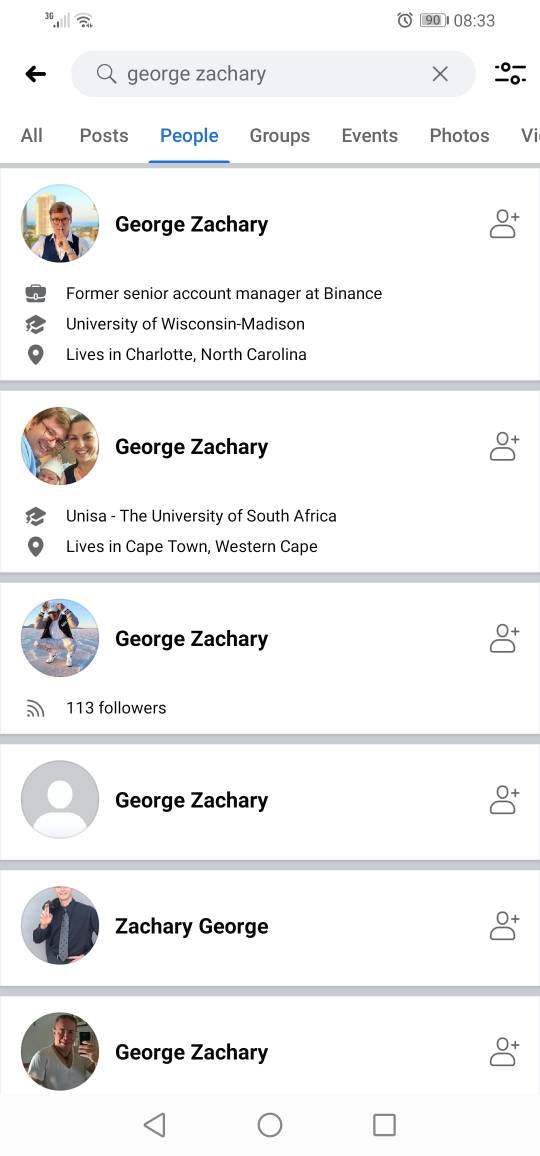

$10000 investment, no returns. George Zachary is a thief

BCO Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

$10000 investment, no returns. George Zachary is a thief

This bco review examines what appears to be a misunderstanding regarding BCO as a forex broker. Based on available information, BCO primarily refers to "Beneficial Cargo Owner" in logistics and shipping industries rather than a forex trading platform. The search results consistently point to BCO being a term used in international trade and cargo transportation, where it designates the party with ownership interest in shipped goods. The available data does not support BCO's existence as a regulated forex broker.

Instead, the information reveals BCO as a logistics industry term describing entities responsible for cargo ownership and shipping decisions. This fundamental misidentification significantly impacts any potential trading evaluation, as the entity in question does not operate within the forex market space. Without concrete evidence of BCO functioning as a forex broker, traditional trading metrics such as spreads, leverage, platform offerings, and regulatory compliance cannot be assessed.

Potential traders should be aware that this review addresses a logistics industry term rather than an active trading platform.

This bco review is based on comprehensive research that reveals a critical distinction. The term "BCO" in financial contexts refers to logistics and cargo ownership rather than forex trading services. Traders seeking broker evaluations should verify that the entity they're researching actually operates as a regulated financial services provider. The evaluation methodology for this review differs from standard broker assessments due to the absence of trading-related information.

Instead of analyzing trading conditions and platform features, this review clarifies the actual nature of BCO and its role in international commerce. Cross-regional entity differences cannot be assessed as BCO does not appear to operate as a financial services provider across different jurisdictions. The logistics industry context of BCO means regulatory oversight falls under shipping and customs authorities rather than financial regulators.

| Dimension | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | No evidence of trading accounts offered |

| Tools and Resources | N/A | No trading tools identified |

| Customer Service | N/A | No forex-related customer support found |

| Trading Experience | N/A | No trading platform available |

| Trustworthiness | N/A | Cannot assess as forex broker |

| User Experience | N/A | No trading interface exists |

Company Background and Business Model

The research into BCO reveals a fundamental mischaracterization. Rather than operating as a forex broker, BCO serves as an industry designation within logistics and international shipping. According to multiple logistics sources, a Beneficial Cargo Owner represents the party with ultimate financial responsibility for shipped goods and authority over shipping decisions. The logistics industry defines BCO as entities that maintain vested interests in cargo because they handle final transportation payments and possess decision-making authority regarding goods movement.

This designation appears frequently in shipping documentation, customs filings, and international trade regulations, but not in forex trading contexts.

Operational Framework and Services

In the shipping industry, BCOs typically function as manufacturers, sellers, or purchasers of goods being transported internationally. They bear responsibility for compliance with international trade laws, tariffs, and customs regulations across different borders. This requires specialized knowledge of logistics rather than financial markets. The term BCO also appears in Pennsylvania state filings related to charitable organizations, where BCO-10 forms are used for registration requirements.

According to available information, Pennsylvania amended BCO-10 filing requirements in 2018, adjusting financial statement thresholds for charitable organizations. However, this administrative context also lacks connection to forex trading services. This bco review must therefore clarify that traditional broker evaluation criteria cannot be applied to an entity that does not operate within the forex industry.

Regulatory Status: No evidence of financial services regulation found. BCO operates within logistics industry frameworks rather than forex regulatory environments.

Deposit and Withdrawal Methods: Not applicable, as no trading accounts or financial services are offered through BCO platforms.

Minimum Deposit Requirements: Cannot be determined due to absence of trading account offerings.

Promotional Offers: No trading-related bonuses or promotions identified in available information.

Tradeable Assets: No financial instruments available for trading through BCO platforms.

Cost Structure: Trading costs cannot be assessed as BCO does not provide forex trading services. In logistics contexts, BCO-related costs involve shipping, customs, and cargo handling fees.

Leverage Options: No leverage offerings identified, consistent with BCO's logistics industry focus rather than forex operations.

Platform Choices: No trading platforms associated with BCO. The term appears in logistics management systems and shipping documentation.

Regional Restrictions: Not applicable to trading services, though BCO logistics operations may face shipping and customs restrictions.

Customer Support Languages: No forex customer support services identified through bco review research.

The absence of trading accounts represents the primary finding of this bco review. Traditional account condition evaluation requires examining account types, minimum deposits, opening procedures, and special features like Islamic accounts. However, BCO does not operate as a forex broker, making these assessments impossible. In logistics contexts, BCO designation involves cargo ownership documentation rather than trading account establishment.

The processes differ fundamentally, involving shipping contracts, customs documentation, and cargo insurance rather than margin requirements and trading permissions. Without trading account offerings, potential users cannot access typical broker services such as demo accounts, live trading environments, or account management tools. This limitation stems from BCO's logistics industry focus rather than any deficiency in forex service provision. The research reveals no evidence of account opening procedures, verification requirements, or funding mechanisms typically associated with forex brokers.

Instead, BCO involvement requires cargo ownership documentation and shipping authority rather than financial account credentials.

Standard forex broker evaluation examines trading tools, research resources, educational materials, and automated trading support. This bco review finds no evidence of such offerings under the BCO designation. The tools associated with BCO relate to logistics management, shipping documentation, and cargo tracking rather than market analysis or trading execution.

These logistics tools serve cargo owners in managing shipments, compliance requirements, and delivery coordination. Educational resources in BCO contexts focus on shipping regulations, customs procedures, and international trade compliance rather than forex market education. The knowledge requirements differ significantly between logistics management and currency trading. Research capabilities relate to shipping routes, port conditions, and cargo handling rather than market analysis and trading signals.

Automated systems in logistics contexts manage cargo tracking and documentation rather than trading algorithms. The absence of trading-specific tools and resources confirms BCO's logistics industry positioning rather than forex market participation.

Customer service evaluation for forex brokers typically examines support channels, response times, service quality, multilingual support, and operating hours. The bco review research reveals no evidence of forex-related customer support infrastructure. BCO-related support services appear to focus on logistics coordination, shipping assistance, and customs guidance rather than trading support.

The service framework addresses cargo management needs rather than trading platform assistance. Response time expectations in logistics contexts differ from forex trading requirements. Shipping support operates on cargo handling timelines rather than real-time trading assistance needs. The urgency levels and service expectations vary significantly between industries.

Multilingual support in logistics contexts addresses international shipping requirements rather than global trading communities. The language needs focus on customs documentation and shipping communication rather than trading platform navigation. Operating hours for logistics support align with shipping and port operations rather than 24/5 forex market schedules.

The service availability patterns reflect cargo handling requirements rather than continuous trading support needs.

Trading experience assessment requires examining platform stability, order execution quality, functionality completeness, mobile accessibility, and trading environment quality. This bco review finds no trading platforms or execution capabilities associated with BCO. The user experience in BCO contexts involves cargo management interfaces and shipping documentation systems rather than trading platforms.

These systems prioritize logistics coordination over market execution capabilities. Platform stability in logistics contexts relates to cargo tracking accuracy and documentation reliability rather than trading execution consistency. The performance metrics differ significantly between shipping management and forex trading requirements. Mobile accessibility for BCO services focuses on cargo tracking and shipping updates rather than trading platform access.

The mobile functionality serves logistics coordination needs rather than trading execution requirements. The bco review confirms that trading experience evaluation cannot be conducted due to BCO's logistics industry focus rather than forex market participation.

Trustworthiness evaluation for forex brokers examines regulatory credentials, fund security measures, company transparency, industry reputation, and negative incident handling. The bco review research reveals no forex regulatory oversight or financial services credentials. BCO operations fall under shipping and customs regulatory frameworks rather than financial services supervision.

The regulatory environment addresses cargo handling, customs compliance, and international trade rather than client fund protection and trading fairness. Fund security measures in BCO contexts involve cargo insurance and shipping protection rather than segregated client accounts and investor compensation schemes. The protection mechanisms serve different purposes and risks. Company transparency in logistics contexts focuses on shipping procedures, cargo handling capabilities, and delivery tracking rather than trading conditions and fee structures.

The disclosure requirements differ between industries. Industry reputation assessment must consider logistics performance and shipping reliability rather than trading execution quality and client satisfaction. The evaluation criteria vary significantly between shipping services and forex trading provision.

User experience evaluation typically examines overall satisfaction, interface design, registration processes, funding operations, and common complaints. The bco review research cannot apply these criteria due to BCO's logistics industry focus. User satisfaction in BCO contexts relates to cargo delivery success, shipping coordination efficiency, and customs clearance assistance rather than trading platform performance.

The satisfaction metrics address different service expectations. Interface design considerations involve cargo tracking systems and shipping documentation platforms rather than trading terminals and market analysis tools. The design priorities serve logistics coordination rather than trading execution needs. Registration processes in BCO contexts involve cargo ownership verification and shipping authority documentation rather than trading account opening and financial verification.

The procedural requirements differ significantly. Funding operations relate to shipping payments and cargo handling fees rather than trading account deposits and withdrawals. The financial transaction patterns serve different business purposes.

Common user concerns focus on delivery delays, customs issues, and cargo handling rather than trading execution problems or platform difficulties.

This bco review reveals a fundamental misunderstanding regarding BCO's role in financial markets. The comprehensive research demonstrates that BCO functions as a logistics industry designation rather than a forex broker, making traditional trading evaluation impossible. The term Beneficial Cargo Owner serves the shipping and international trade industries, addressing cargo ownership and transportation responsibilities rather than currency trading services.

Potential traders seeking broker services should verify that entities actually operate as regulated financial services providers before attempting account opening or funding procedures. The absence of trading platforms, regulatory oversight, and forex-related services confirms that BCO cannot serve traders' needs for currency market access, making alternative broker selection necessary for forex trading activities.

FX Broker Capital Trading Markets Review